Light Aircraft Market Synopsis

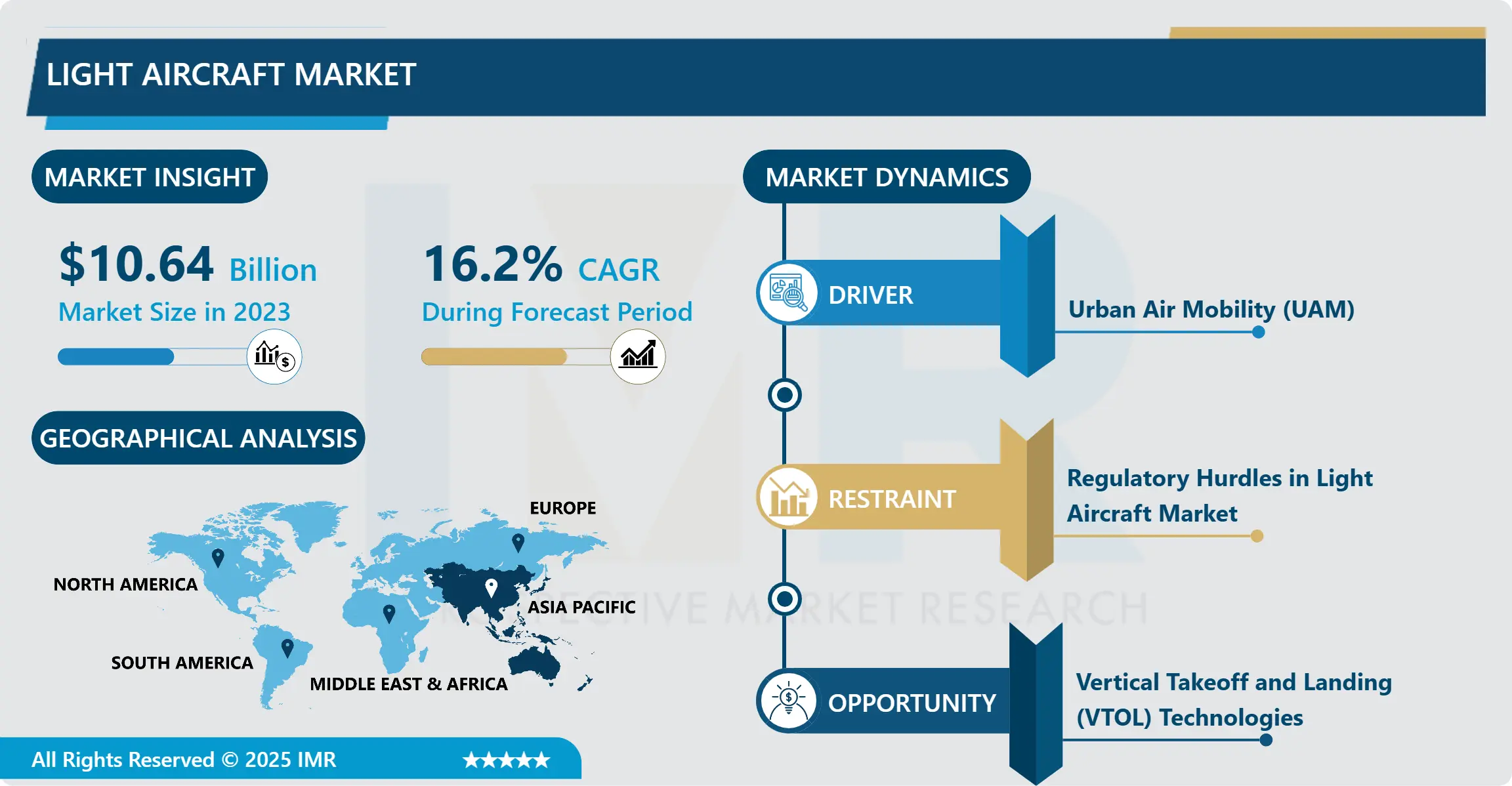

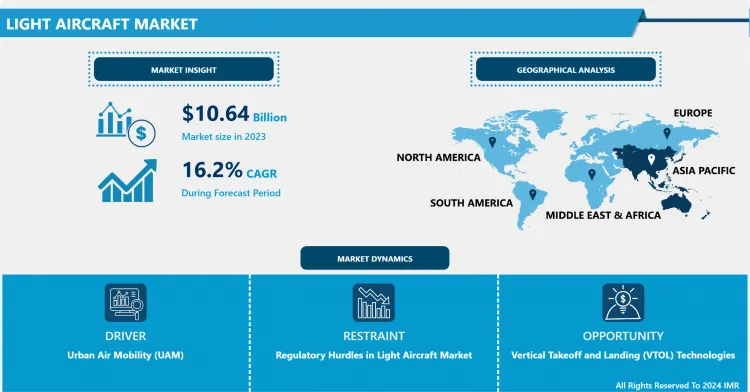

Light Aircraft Market Size Was Valued at USD 10.64 Billion in 2023 and is Projected to Reach USD 41.1 Billion by 2032, Growing at a CAGR of 16.2 % From 2024-2032.

The light aircraft market refers to the sector of the aviation industry primarily focused on the manufacturing, sales, and operation of small, single, or twin-engine airplanes designed for personal, recreational, training, and limited commercial purposes. These aircraft typically have a maximum takeoff weight of under 12,500 pounds and are characterized by their relatively lower cost, simpler construction, and ease of operation compared to larger commercial or military aircraft. Light aircraft serve a variety of roles, including private transportation for individuals and businesses, flight training for aspiring pilots, aerial photography, agricultural spraying, and sightseeing tours, contributing to the accessibility and diversity of aviation activities worldwide.

Regulation changes, changing consumer needs, and technical improvements are causing a dynamic transition in the light aircraft sector. Manufacturers are making investments in cutting-edge designs and materials to improve performance and lessen their environmental effect as efficiency, safety, and sustainability become increasingly important.

While avionics and automation advances are improving safety and convenience of operation, electric and hybrid propulsion systems are gaining favor due to their promise of lower operating costs and emissions.

Urban air mobility (UAM) concepts are also changing the environment by providing new prospects for aerial services and short-distance transportation. But there are still issues, such as infrastructure constraints, regulatory barriers, and unstable economic conditions.

Notwithstanding these challenges, the market for light aircraft is still strong because of its wide range of uses, which include aerial surveillance, travel, flight training, and leisure travel. Unlocking the full potential of this dynamic sector will require coordination between manufacturers, regulators, and other stakeholders as the industry continues to expand.

Light Aircraft Market Trend Analysis

Enhancing Safety and Efficiency in Light Aircraft

- Aviation technology has improved significantly with the incorporation of automation and modern avionics in light aircraft. Glass cockpits, which are distinguished by enormous electronic displays in place of more conventional analog instrumentation, give pilots better situational awareness by presenting a wealth of flight data in a logical and organized manner. These systems, which are equipped with capabilities like traffic alerts, terrain awareness, and synthetic vision, let pilots make more informed judgments and have a greater understanding of their surroundings, particularly in inclement weather or unfamiliar airspace.

- Another essential element of contemporary avionics suites, autopilot systems, are vital in lowering pilot workload and weariness. Autopilots free up pilots' attention for higher-level duties like navigation, communication, and flight system monitoring by automatically regulating the aircraft's heading, altitude, and speed. This reduces the possibility of human error, which increases safety. It also increases overall flight efficiency and passenger comfort, especially on long-haul flights.

- Light aircraft avionics are further enhanced by advanced navigation aids including multi-function displays (MFDs) and GPS-based navigation systems. These systems enable pilots to fly more precisely and effectively by giving them access to real-time weather updates, route planning tools, and precise positioning data. Furthermore, functions like obstacle avoidance and terrain mapping lessen the dangers of flying at low altitudes, especially in crowded or hilly regions. Overall, the way pilots interact with their aircraft is changing dramatically as a result of the growing use of modern avionics and automation systems in light aircraft. This improves flying enjoyment, safety, and efficiency.

The Rise of Electric and Hybrid-Electric Propulsion in Light Aircraft

- The increased interest in light aircraft electric and hybrid-electric propulsion systems is indicative of a larger worldwide trend in transportation toward environmental sustainability and energy efficiency. Because aviation contributes significantly to carbon emissions, especially from smaller piston-engine aircraft, producers and operators are looking for more environmentally friendly power sources. In addition to lowering the carbon footprint of small aircraft operations and addressing concerns about air quality and climate change, electric propulsion systems promise zero-emission flight.

- Electric propulsion in light aircraft is also becoming more and more popular due to the possibility of decreased operating expenses. Since electric motors are by nature more efficient than conventional internal combustion engines, an aircraft's fuel consumption and maintenance costs will be reduced over its lifetime. Furthermore, the economic feasibility of electric flying is further improved by the availability of renewable energy sources like solar and wind power, which may lessen or completely eliminate the need for fossil fuels. Electric propulsion is a desirable alternative for manufacturers and operators who want to lower operating costs while still adhering to sustainability objectives because of its financial incentive and environmental benefits.

- But even with all of the advantages of electric propulsion, there are still major issues that need to be resolved before widespread adoption takes place. The creation of energy-dense, lightweight batteries that can deliver the power and endurance needed for realistic light aircraft operations is the most significant of these issues. The limits of current battery technology, including as energy density, weight, and the infrastructure needed for charging, limit the range and cargo capacity of electric aircraft in comparison to their piston-engine competitor. In order to overcome these technological obstacles, further work needs to be done in the fields of materials science, energy storage systems, battery design, and charging infrastructure at airports and other aviation facilities.

Light Aircraft Market Segment Analysis:

Light Aircraft Market Segmented based on By Aircraft Type, By Engine Type and By Price Range.

By Aircraft Type, Fixed-wing segment is expected to dominate the market during the forecast period

- Unquestionably, fixed-wing aircraft dominate the aviation sector and hold the majority of the market share worldwide. Several factors contribute to their domination, the most important being their exceptional effectiveness over long distances. Fixed-wing aircraft have unparalleled speed and endurance, whether traveling across continents or short distances between nearby cities. For commercial airlines, where timely and dependable passenger and freight transit is critical, this efficiency is essential. Furthermore, fixed-wing aircraft's ability to carry big passenger or cargo cargoes reinforces their status as the favored option for both airlines and logistics providers.

- Fixed-wing aircraft have a broader range of applications outside of commercial flying, which contributes to their dominance in a number of industries. Business leaders use fixed-wing aircraft's speed and convenience to meet deadlines and conduct international business, which is why they rely on private jets for accelerated travel. In a similar vein, medical evacuation operations mostly depend on fixed-wing aircraft to quickly carry seriously injured or critically ill patients—often over great distances—to specialist medical institutions. Fixed-wing aircraft are essential to military operations; their roles in reconnaissance, transport, and aerial combat demonstrate their versatility and usefulness in a range of situations and missions.

- Moreover, their market dominance is reinforced by the ongoing technological breakthroughs in fixed-wing aircraft. Modern avionics systems and fuel-efficient engines are only two examples of how constant innovation keeps fixed-wing aircraft at the forefront of aviation. These developments open the door for the creation of next-generation platforms that will be more effective, safe, and sustainable in addition to improving the performance and capabilities of current aircraft. As a result, fixed-wing aircraft are still firmly established as the leading force in the dynamic aviation industry, influencing air travel globally in the years to come.

By Engine Type, Piston Engine segment held the largest share in 2023

- When it comes to aircraft propulsion, jet engines are the clear market leader, holding the highest share globally. Their superior performance and adaptability, which make them the preferred propulsion system for a wide range of aircraft, particularly in commercial aviation, are the fundamental causes of their dominance. Their superior thrust-to-weight ratios—a critical parameter that establishes an engine's capacity to move an aircraft through the air quickly and effectively—are the secret to their dominance. This feature makes it possible for jet-powered aircraft to soar to breathtaking heights and reach astounding speeds, allowing for swift travel over great distances with unmatched efficiency.

- Jet engines are widely used, as demonstrated by the commercial aviation industry. Jet propulsion powers almost all contemporary commercial aircraft, enabling them to transport people and goods across continents and oceans at previously unheard-of speeds. Jet engines power a diversified fleet of airliners that crisscross the skies, connecting towns and cultures in a global web of air travel, from sleek narrow-body planes to magnificent wide-body giants. Jet engines have been at the vanguard of the aviation industry's unwavering demands for speed, efficiency, and dependability, solidifying their position as the engine powering the global air transportation infrastructure.

- Furthermore, jet engines are widely used in military, corporate, and even some high-performance general aviation aircraft in addition to commercial aircraft. They are invaluable in a wide range of missions and applications, from executive transport and aerial surveillance to air superiority and strategic bombing. This is due to their agility and adaptability. As a result, jet engines not only dominate the market in terms of sheer numbers but also wield unrivaled influence and impact throughout many areas of the aviation industry, defining the path of aviation history and pushing innovation in propulsion technology for years to come.

Light Aircraft Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, particularly in countries like China and India, the light aircraft market is poised for substantial growth, driven by several factors. One key driver is the rapidly expanding middle and affluent class with increasing disposable incomes. As individuals in these demographics seek personalized travel experiences and recreational activities, there's a growing demand for light aircraft for leisure flying, sightseeing tours, and short-distance travel. This trend is further fueled by changing lifestyles and preferences, where owning or chartering a light aircraft represents a symbol of luxury and status.

- Moreover, the continual expansion of aviation infrastructure in the region plays a pivotal role in fostering the growth of the light aircraft market. The development of new airports, airstrips, and aviation-related facilities enhances accessibility and convenience for enthusiasts and potential buyers. Improved connectivity and accessibility to remote areas also contribute to the attractiveness of light aircraft for various purposes, including tourism, aerial photography, and medical evacuation services.

- Despite the presence of regulatory challenges in some Asian countries, such as complex certification processes and restrictive airspace regulations, governments are increasingly recognizing the economic potential of general aviation and are taking steps to address these barriers. Policies aimed at streamlining regulatory processes, promoting investment in aviation infrastructure, and incentivizing private ownership and operation of light aircraft are being implemented. These initiatives not only facilitate market entry and expansion for manufacturers but also stimulate demand by creating a conducive environment for the growth of the light aircraft industry.

Active Key Players in the Light Aircraft Market

- Cessna Aircraft Company

- Piper Aircraft, Inc

- Beechcraft Corporation

- Diamond Aircraft Industries

- Cirrus Aircraft

- Flight Design General Aviation GmbH

- Tecnam

- Van's Aircraft Inc

- Zenith Aircraft Company

- Maule Air Inc. and Other Active Players

Key Industry Development:

- In July 2024, Falko Regional Aircraft acquired two Embraer E190 aircraft previously leased to South African regional carrier Airlink. The aircraft, identified as MSN 19000202 and MSN 19000265, were purchased from Nordic Aviation Capital (NAC) as part of a previously announced acquisition of a twenty-four E-Jet portfolio. This purchase was made for the Falko-managed fund, Falko Regional Aircraft Opportunities Fund II (Fund II). Falko, an asset manager and aircraft lessor specializing in regional aircraft, completed the acquisition to expand its portfolio of regional jets.

- In May 2024, India's leading airline, IndiGo, had been negotiating with three aircraft manufacturers—ATR, Embraer, and Airbus—for the purchase of at least 100 smaller planes. This decision was part of the airline's strategy to expand its regional network. At that time, IndiGo was operating 45 ATR-72 aircraft, each with a seating capacity of 78, and was set to receive an additional five ATR-72 aircraft within the year.

|

Global Light Aircraft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.2% |

Market Size in 2032: |

USD 41.1 Bn. |

|

Segments Covered: |

By Aircraft Type |

|

|

|

By Engine Type |

|

||

|

By Price Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Light Aircraft Market by Aircraft Type (2018-2032)

4.1 Light Aircraft Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed-wing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Rotary-wing

Chapter 5: Light Aircraft Market by Engine Type (2018-2032)

5.1 Light Aircraft Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Piston Engine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Turboprop

5.5 Jet Engine

Chapter 6: Light Aircraft Market by Price Range (2018-2032)

6.1 Light Aircraft Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Budget/Entry-level

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mid-range

6.5 Premium/Luxury

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Light Aircraft Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CESSNA AIRCRAFT COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PIPER AIRCRAFT INC

7.4 BEECHCRAFT CORPORATION

7.5 DIAMOND AIRCRAFT INDUSTRIES

7.6 CIRRUS AIRCRAFT

7.7 FLIGHT DESIGN GENERAL AVIATION GMBH

7.8 TECNAM

7.9 VAN'S AIRCRAFT INC

7.10 ZENITH AIRCRAFT COMPANY

7.11 MAULE AIR INC.

Chapter 8: Global Light Aircraft Market By Region

8.1 Overview

8.2. North America Light Aircraft Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Aircraft Type

8.2.4.1 Fixed-wing

8.2.4.2 Rotary-wing

8.2.5 Historic and Forecasted Market Size by Engine Type

8.2.5.1 Piston Engine

8.2.5.2 Turboprop

8.2.5.3 Jet Engine

8.2.6 Historic and Forecasted Market Size by Price Range

8.2.6.1 Budget/Entry-level

8.2.6.2 Mid-range

8.2.6.3 Premium/Luxury

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Light Aircraft Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Aircraft Type

8.3.4.1 Fixed-wing

8.3.4.2 Rotary-wing

8.3.5 Historic and Forecasted Market Size by Engine Type

8.3.5.1 Piston Engine

8.3.5.2 Turboprop

8.3.5.3 Jet Engine

8.3.6 Historic and Forecasted Market Size by Price Range

8.3.6.1 Budget/Entry-level

8.3.6.2 Mid-range

8.3.6.3 Premium/Luxury

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Light Aircraft Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Aircraft Type

8.4.4.1 Fixed-wing

8.4.4.2 Rotary-wing

8.4.5 Historic and Forecasted Market Size by Engine Type

8.4.5.1 Piston Engine

8.4.5.2 Turboprop

8.4.5.3 Jet Engine

8.4.6 Historic and Forecasted Market Size by Price Range

8.4.6.1 Budget/Entry-level

8.4.6.2 Mid-range

8.4.6.3 Premium/Luxury

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Light Aircraft Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Aircraft Type

8.5.4.1 Fixed-wing

8.5.4.2 Rotary-wing

8.5.5 Historic and Forecasted Market Size by Engine Type

8.5.5.1 Piston Engine

8.5.5.2 Turboprop

8.5.5.3 Jet Engine

8.5.6 Historic and Forecasted Market Size by Price Range

8.5.6.1 Budget/Entry-level

8.5.6.2 Mid-range

8.5.6.3 Premium/Luxury

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Light Aircraft Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Aircraft Type

8.6.4.1 Fixed-wing

8.6.4.2 Rotary-wing

8.6.5 Historic and Forecasted Market Size by Engine Type

8.6.5.1 Piston Engine

8.6.5.2 Turboprop

8.6.5.3 Jet Engine

8.6.6 Historic and Forecasted Market Size by Price Range

8.6.6.1 Budget/Entry-level

8.6.6.2 Mid-range

8.6.6.3 Premium/Luxury

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Light Aircraft Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Aircraft Type

8.7.4.1 Fixed-wing

8.7.4.2 Rotary-wing

8.7.5 Historic and Forecasted Market Size by Engine Type

8.7.5.1 Piston Engine

8.7.5.2 Turboprop

8.7.5.3 Jet Engine

8.7.6 Historic and Forecasted Market Size by Price Range

8.7.6.1 Budget/Entry-level

8.7.6.2 Mid-range

8.7.6.3 Premium/Luxury

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Light Aircraft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.2% |

Market Size in 2032: |

USD 41.1 Bn. |

|

Segments Covered: |

By Aircraft Type |

|

|

|

By Engine Type |

|

||

|

By Price Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||