Life Insurance Market Synopsis

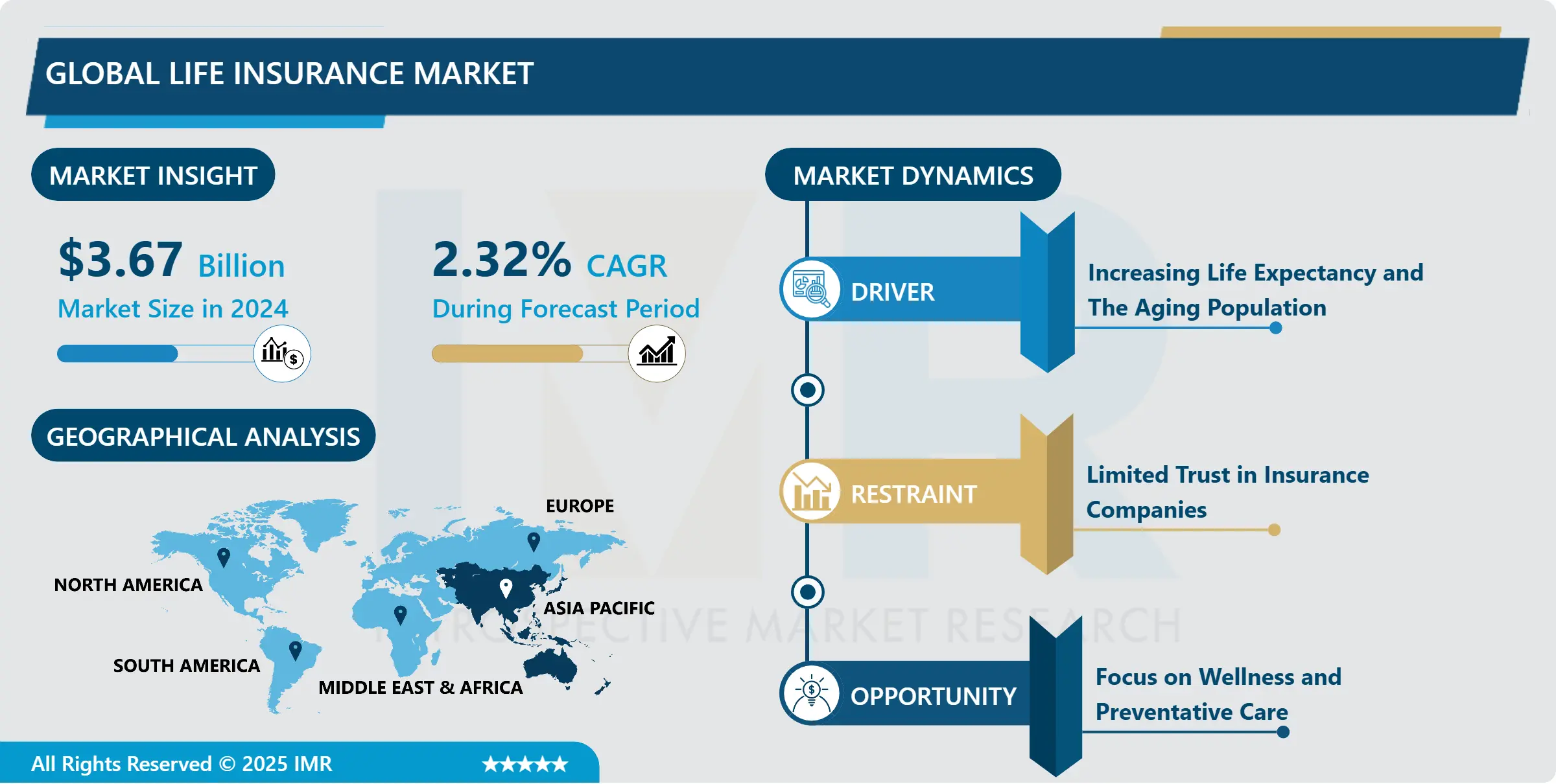

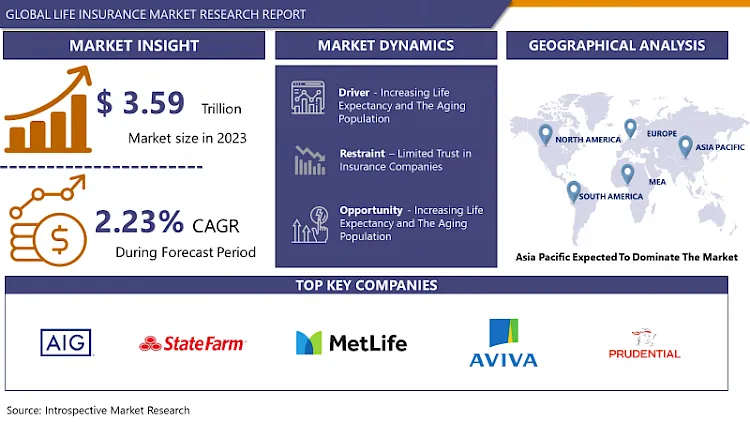

Life Insurance Market Size Was Valued at USD 3.67 Trillion in 2024 and is Projected to Reach USD 4.41 Trillion by 2032, Growing at a CAGR of 2.32% From 2025-2032.

Life insurance offers financial protection to individuals and their families in case of death or disability. Policyholders pay premiums to an insurance company, which provides a lump sum payment or regular income to beneficiaries upon the insured's death or disability. It covers mortgage payments, education costs, and living expenses in case of the policyholder's death. Life insurance provides financial security and well-being to individuals and families, offering protection against death and covering expenses like mortgage payments, outstanding debts, education costs, and daily living expenses. It also serves as an investment vehicle, offering cash value accumulation over time. The demand for life insurance is driven by factors such as financial security, estate planning, and wealth transfer. Life insurance finds applications across different life stages and financial goals, with young families purchasing term life insurance to protect against premature death and provide for their children's future needs, while individuals advance in their careers and accumulate wealth to protect assets and transfer wealth tax-efficiently.

The life insurance industry is shaped by trends such as the adoption of digital technologies, personalized insurance solutions, and environmental, social, and governance (ESG) considerations. Digitalization enhances accessibility, convenience, and efficiency, appealing to tech-savvy consumers. Insurers are leveraging data analytics and predictive modeling to assess risk more accurately, offer customized coverage options, and streamline underwriting processes. ESG criteria are also being incorporated into investment strategies and product offerings, reflecting broader societal trends towards ethical and environmentally conscious practices. Life insurance is a vital part of retirement planning, providing income replacement and financial stability. With the aging population and the shift towards self-funded retirement, it's becoming increasingly important to supplement retirement savings and cover long-term care expenses. Advancements in medical technology and healthcare have extended life expectancy, increasing demand for life insurance products catering to seniors and retirees. Insurers are innovating with guaranteed income annuities and hybrid life insurance policies to cater to these needs.

Life Insurance Market Trend Analysis

Increasing Life Expectancy and The Aging Population

- The rising life expectancy and aging demographic serve as pivotal drivers within the life insurance sector. As medical advancements and healthier lifestyles prolong lifespans, individuals confront the imperative of securing financial stability throughout extended retirement periods. With more years in retirement, there arises an escalating demand for life insurance products that ensure income protection, asset accumulation, and comprehensive coverage for long-term care needs.

- The aging populace presents both opportunities and challenges for the life insurance market. While prolonged life expectancy translates to extended premium payments and investment opportunities for insurers, it also necessitates the development of insurance solutions tailored to the specific requirements of seniors, such as retirement income plans and annuities.

- The burgeoning elderly demographic underscores the necessity for insurance products addressing healthcare expenses, long-term care provisions, and estate planning, thereby prompting innovation and diversification in life insurance offerings. In essence, the demographic shift towards an aging population emphasizes the critical role of life insurance in safeguarding financial security and tranquility across generations.

Focus on Wellness and Preventative Care

- The growing emphasis on wellness and preventative healthcare offers a notable opportunity for the life insurance sector. With individuals increasingly prioritizing healthy living and disease prevention, there's a heightened awareness of insurance's potential to encourage and reward proactive health behaviors.

- Life insurance companies can seize this opportunity by aligning their products and services with the wellness trend. This may involve offering incentives to policyholders who maintain healthy lifestyles, such as discounts on premiums, monetary rewards, or enhanced coverage for participating in wellness initiatives, undergoing health screenings, or achieving fitness milestones.

- Advocating for preventative care and early intervention, insurers can assist policyholders in managing chronic conditions, reducing healthcare expenses, and enhancing overall well-being. This proactive approach not only benefits policyholders' health but also mitigates the financial risks associated with future medical costs and disability claims.

- leveraging technology like wearable devices and telemedicine platforms enables insurers to gather real-time health data and deliver tailored wellness solutions. This data-driven approach fosters greater engagement, transparency, and trust between insurers and policyholders, ultimately enhancing customer satisfaction and fostering long-term relationships.

Life Insurance Market Segment Analysis:

Life Insurance Market Segmented on the basis of Type, Demographics, and Distribution Channel.

By Type, Term Life Insurance segment is expected to dominate the market during the forecast period

- The Term Life Insurance segment is poised to lead the life insurance market for several compelling reasons. Term life insurance offers clear-cut coverage for a designated period, often at a more affordable premium compared to permanent life insurance policies. This cost-effectiveness appeals to individuals seeking basic protection without the added intricacies and expenses associated with cash value accumulation.

- Term life insurance affords flexibility in coverage duration, allowing policyholders to tailor coverage to their specific needs and financial objectives. This adaptability makes it an attractive option for those facing temporary financial commitments, such as mortgage payments, educational costs, or income replacement during their working years.

- The straightforward and transparent nature of term life insurance policies resonates with consumers seeking uncomplicated solutions to their insurance needs. This simplicity makes it easier for consumers to comprehend and compare different policy options, leading to increased adoption and market dominance.

- Demographic shifts such as the emergence of younger, cost-conscious consumers and the growing prevalence of online insurance platforms further bolster the dominance of the term life insurance segment. In summary, the blend of affordability, flexibility, and simplicity positions term life insurance as the preferred choice for many consumers seeking essential life coverage.

By Distribution Channel, Insurance Agents/Brokers segment is expected to dominate the market during the forecast period

- The dominance of the Insurance Agents/Brokers segment in the distribution channel of the life insurance industry is expected for several reasons. Insurance agents and brokers play a pivotal role by offering personalized advice, recommendations, and tailored solutions to clients. Their expertise and knowledge of the market enable them to assess individual needs effectively, instilling trust and confidence among customers.

- Insurance agents and brokers serve as intermediaries between insurance companies and clients, streamlining the purchasing process and handling administrative tasks such as policy issuance and claims processing. This intermediary role enhances the overall customer experience and satisfaction.

- Their extensive network and established relationships with clients, businesses, and community organizations provide them with a broad reach and access to potential customers. Their ability to nurture long-term relationships and generate referrals further solidifies their dominance within the distribution channel.

Life Insurance Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is anticipated to lead the life insurance market due to several pivotal factors. Rapid economic expansion, urbanization, and the emergence of a prosperous middle class have resulted in heightened disposable incomes and financial literacy among consumers. Consequently, there exists a rising demand for financial security, retirement preparations, and wealth accumulation products, propelling the growth of the life insurance sector.

- Demographic shifts such as population increases, aging demographics, and evolving family structures contribute to the escalating insurance requirements within the region. With longer lifespans and changing familial dynamics, individuals seek life insurance options that offer income safeguarding, savings, and long-term care provisions for themselves and their families.

- Supportive regulatory frameworks, technological advancements, and evolving distribution channels facilitate market expansion and innovation across the Asia Pacific region. Insurance providers leverage digital platforms, data analytics, and strategic alliances to extend their reach, tailor products, and enhance customer satisfaction, further solidifying the region's prominence in the global life insurance landscape. In summary, the Asia Pacific region's amalgamation of favorable demographics, economic growth, and industry dynamism positions it as a frontrunner in the life insurance arena.

Life Insurance Market Top Key Players:

- American International Group (AIG) (US)

- State Farm Insurance (US)

- MetLife (US)

- Aviva (UK)

- Prudential (UK)

- Standard Life Assurance (UK)

- Munich Re Group (Germany)

- Allianz (Germany)

- Assicurazioni Generali (Italy)

- CNP Assurances (France)

- AXA (France)

- Swiss Reinsurance (Switzerland)

- Zurich Financial Services (Switzerland)

- ACE Group (Switzerland)

- Aegon (Netherlands)

- Nippon Life Insurance (Japan)

- Asahi Mutual Life Insurance (Japan)

- Sumitomo Life Insurance (Japan)

- Dai-ichi Mutual Life Insurance (Japan)

- Meiji Yasuda Life Insurance Company (Japan)

- Asian Life Insurance Company (Nepal)

- WanaArtha Life (Indonesia)

- AIA Group Limited (China)

- China Life Insurance Company Limited (China)

- China Ping An Life Insurance Company Limited (China)

- IndiaFirst Life (India)

- Other Active Players.

Key Industry Developments in the Life Insurance Market:

- In August 2023, IndiaFirst, a life insurance firm, unveiled the Guarantee of Life Dreams (G.O.L.D.) The plan is an insurance product that is non-linked and non-participating. This plan ensures policyholders with a steady long-term income. Policyholders have the flexibility to select premium payment terms lasting 6, 8, or 10 years for policy durations of either 30 or 40 years.

-

In February 2024, Bajaj Allianz Life and Satin Creditcare announced a partnership aimed at enhancing life insurance accessibility in rural areas, in collaboration with Coverfox. Through this strategic alliance, customers of Satin Creditcare were able to secure their loans with insurance plans from Bajaj Allianz Life across its 1,386 branches nationwide. This initiative provided customers with peace of mind and ensured their family's financial security in case of any unfortunate incidents.

In February 2024, ESAF Small Finance Bank partnered with Edelweiss Tokio Life Insurance to offer life insurance products, significantly enhancing the range of financial solutions for customers. The bancassurance collaboration was officially announced, marking a substantial step in ESAF Small Finance Bank's efforts to broaden its offerings. This partnership played a crucial role in the bank's strategy to expand its range of services, showcasing its dedication to providing financial security to a broader segment of the unbanked and under-banked population.

|

Global Life Insurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.67 Tn. |

|

Forecast Period 2024-32 CAGR: |

2.32 % |

Market Size in 2032: |

USD 4.41 Tn. |

|

Segments Covered: |

By Type |

|

|

|

By Demographics |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Life Insurance Market by Type (2018-2032)

4.1 Life Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Term Life Insurance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Whole Life Insurance

4.5 Universal Life Insurance

4.6 Endowment Policies

4.7 Retirement Plans

Chapter 5: Life Insurance Market by Demographics (2018-2032)

5.1 Life Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Age

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Income Level

5.5 Occupation

Chapter 6: Life Insurance Market by Distribution Channel (2018-2032)

6.1 Life Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Insurance Agents/Brokers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Direct Sales

6.5 Bancassurance

6.6 Employer-Sponsored Plans

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Life Insurance Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LIVECHAT INC. (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTERCOM (U.S.)

7.4 ZENDESK (U.S.)

7.5 FRESHWORKS INC. (U.S.)

7.6 DRIFT (U.S.)

7.7 HELPCRUNCH (U.S.)

7.8 LIVEPERSON INC. (U.S.)

7.9 OLARK (U.S.)

7.10 HAPPYFOX INC. (U.S.)

7.11 CHATRA (U.S.)

7.12 TAWK.TO (U.S.)

7.13 SNAPENGAGE (U.S.)

7.14 PURE CHAT (U.S.)

7.15 COMM100 NETWORK CORPORATION (U.S.)

7.16 USERLIKE (U.S.)

7.17 REVE CHAT (U.S.)

7.18 JIVOSITE INC. (U.S.)

7.19 KAYAKO LTD. (U.K.)

7.20 CHAT.IO (POLAND)

7.21 HUBSPOT INC. (U.S.)

7.22 ACQUIRE (U.S.)

7.23 LIVEAGENT (SLOVAKIA)

7.24 CHATGRAPE (AUSTRIA)

7.25 LIVEZILLA GMBH (GERMANY)

7.26 SMARTSUPP (CZECH REPUBLIC)

Chapter 8: Global Life Insurance Market By Region

8.1 Overview

8.2. North America Life Insurance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Term Life Insurance

8.2.4.2 Whole Life Insurance

8.2.4.3 Universal Life Insurance

8.2.4.4 Endowment Policies

8.2.4.5 Retirement Plans

8.2.5 Historic and Forecasted Market Size by Demographics

8.2.5.1 Age

8.2.5.2 Income Level

8.2.5.3 Occupation

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Insurance Agents/Brokers

8.2.6.2 Direct Sales

8.2.6.3 Bancassurance

8.2.6.4 Employer-Sponsored Plans

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Life Insurance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Term Life Insurance

8.3.4.2 Whole Life Insurance

8.3.4.3 Universal Life Insurance

8.3.4.4 Endowment Policies

8.3.4.5 Retirement Plans

8.3.5 Historic and Forecasted Market Size by Demographics

8.3.5.1 Age

8.3.5.2 Income Level

8.3.5.3 Occupation

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Insurance Agents/Brokers

8.3.6.2 Direct Sales

8.3.6.3 Bancassurance

8.3.6.4 Employer-Sponsored Plans

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Life Insurance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Term Life Insurance

8.4.4.2 Whole Life Insurance

8.4.4.3 Universal Life Insurance

8.4.4.4 Endowment Policies

8.4.4.5 Retirement Plans

8.4.5 Historic and Forecasted Market Size by Demographics

8.4.5.1 Age

8.4.5.2 Income Level

8.4.5.3 Occupation

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Insurance Agents/Brokers

8.4.6.2 Direct Sales

8.4.6.3 Bancassurance

8.4.6.4 Employer-Sponsored Plans

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Life Insurance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Term Life Insurance

8.5.4.2 Whole Life Insurance

8.5.4.3 Universal Life Insurance

8.5.4.4 Endowment Policies

8.5.4.5 Retirement Plans

8.5.5 Historic and Forecasted Market Size by Demographics

8.5.5.1 Age

8.5.5.2 Income Level

8.5.5.3 Occupation

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Insurance Agents/Brokers

8.5.6.2 Direct Sales

8.5.6.3 Bancassurance

8.5.6.4 Employer-Sponsored Plans

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Life Insurance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Term Life Insurance

8.6.4.2 Whole Life Insurance

8.6.4.3 Universal Life Insurance

8.6.4.4 Endowment Policies

8.6.4.5 Retirement Plans

8.6.5 Historic and Forecasted Market Size by Demographics

8.6.5.1 Age

8.6.5.2 Income Level

8.6.5.3 Occupation

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Insurance Agents/Brokers

8.6.6.2 Direct Sales

8.6.6.3 Bancassurance

8.6.6.4 Employer-Sponsored Plans

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Life Insurance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Term Life Insurance

8.7.4.2 Whole Life Insurance

8.7.4.3 Universal Life Insurance

8.7.4.4 Endowment Policies

8.7.4.5 Retirement Plans

8.7.5 Historic and Forecasted Market Size by Demographics

8.7.5.1 Age

8.7.5.2 Income Level

8.7.5.3 Occupation

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Insurance Agents/Brokers

8.7.6.2 Direct Sales

8.7.6.3 Bancassurance

8.7.6.4 Employer-Sponsored Plans

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Life Insurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.67 Tn. |

|

Forecast Period 2024-32 CAGR: |

2.32 % |

Market Size in 2032: |

USD 4.41 Tn. |

|

Segments Covered: |

By Type |

|

|

|

By Demographics |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||