Lid Applicator Machine Market Synopsis

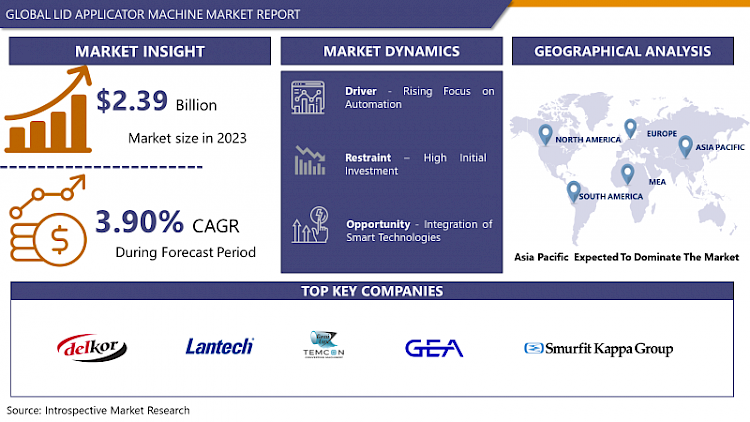

Global Lid Applicator Machine Market Size Was Valued at USD 2.39 Billion in 2023 and is Projected to Reach USD 3.37 Billion by 2032, Growing at a CAGR of 3.90% From 2024-2032

A Lid Applicator Machineactively secures lids onto containers, ensuring precise sealing in diverse industries. This device streamlines packaging, automates lid application, reduces manual labor, and maintains consistent container sealing quality, enhancing overall productivity.

- The Lid Applicator Machine automates the lid-sealing process for containers, benefiting sectors like food, pharmaceuticals, and cosmetics. It ensures airtight seals in food, preserving freshness and shelf life, and secures medication containers in pharmaceuticals, enhancing product integrity, regulatory compliance, and consumer safety. Its applications extend to food, pharmaceuticals, and cosmetics.

- Lid Applicator Machines are a cost-effective packaging solution, as they automate the lid application process, reducing production time and enhancing sealing accuracy. They also contribute to long-term cost savings by reducing workforce involvement and product wastage. These machines are designed to accommodate various lid types and sizes, making them adaptable to different packaging requirements, thereby enhancing efficiency and reducing the risk of packaging errors.

- The future market demand for Lid Applicator Machines is expected to increase due to industries prioritizing efficiency, quality, and cost-effectiveness. Advancements in technology, including smart features and improved user interfaces, are expected to make these machines more attractive to businesses. The trend towards sustainability and eco-friendly packaging is also expected to drive the adoption of these machines, supporting environmentally conscious practices in the packaging industry.

Lid Applicator Machine Market Trend Analysis:

Rising Focus on Automation

- The Lid Applicator Machine Market is witnessing significant growth due to the growing emphasis on automating packaging processes. Industries worldwide are striving to improve operational efficiency, making automation a key factor in adopting Lid Applicator Machines. These machines automate the lid-sealing process, streamlining production lines, reducing reliance on manual labor, and enhancing productivity and cost-effectiveness. Automation's increasing focus is particularly notable in precision-critical sectors like food and pharmaceuticals.

- Additionally, the demand for Lid Applicator Machines stems from the need for faster and more reliable packaging solutions. Automation not only speeds up lid application but also minimizes human errors, ensuring consistent, high-quality packaging. Industries optimizing manufacturing processes are increasingly incorporating Lid Applicator Machines into automated packaging lines. This trend is expected to drive market growth as businesses recognize automation's strategic importance in staying competitive and meeting dynamic market demands.

- Moreover, the Lid Applicator Machine Market is set to benefit from technological advancements that enhance automation capabilities. Integration with smart technologies, such as sensors and connectivity features, enables real-time monitoring and control, contributing to predictive maintenance and reducing downtime. As the global industrial landscape evolves toward greater automation, Lid Applicator Machines are becoming indispensable tools for achieving efficiency, precision, and cost savings in packaging operations.

Integration of Smart Technologies

- The Lid Applicator Machine Market is presented with a significant opportunity through the integration of smart technologies. This incorporation enhances Lid Applicator Machines, making them more efficient and adaptable to changing industry requirements. Equipped with advanced sensors and connectivity features, these machines allow real-time monitoring and control of the lid-sealing process, improving operational efficiency and ensuring consistent, precise lid application.

- Smart technology adoption in Lid Applicator Machines opens the door to predictive maintenance. Sensors providing machine performance data enable proactive issue identification, minimizing downtime and disruptions to production. This predictive maintenance approach boosts the reliability of Lid Applicator Machines, making them dependable assets for manufacturers. The ability to optimize performance and reduce unplanned downtime is compelling for industries aiming to maximize efficiency in their packaging processes.

- Furthermore, the integration of smart technologies aligns with the broader Industry 4.0 trend, emphasizing connectivity and data-driven decision-making. Lid Applicator Machines leveraging these technologies not only streamline operations but also contribute to a more intelligent and interconnected manufacturing ecosystem. As industries increasingly undergo digital transformation, the opportunity for Lid Applicator Machines to be integral to smart, connected production lines positions them as essential components for achieving enhanced efficiency and competitiveness in the evolving market landscape.

Lid Applicator Machine Market Segment Analysis:

Lid Applicator Machine Market Segmented on the basis of Type Application, and End-User

By Type, Food & Beverage segment is expected to dominate the market during the forecast period

- The Food & Beverage segment holds a prominent position in the Lid Applicator Machine market due to the industry's strict packaging requirements. With consumer preferences emphasizing convenience and freshness, there is a critical need for efficient and precise lid-sealing processes in this sector. Lid Applicator Machines address these demands by automating lid application, ensuring airtight seals that preserve the quality and safety of food and beverage products. As the Food & Beverage industry continues to grow and diversify, the demand for Lid Applicator Machines is expected to steadily increase, driven by the growing need for streamlined packaging processes.

- Moreover, the Food & Beverage sector's responsiveness to emerging packaging trends, such as sustainable and eco-friendly practices, further reinforces the dominance of this segment. Lid Applicator Machines aligning with these evolving preferences become essential tools for businesses aiming to meet consumer expectations and regulatory standards, solidifying the Food & Beverage segment's key role in propelling the Lid Applicator Machine market's growth.

By Application, Liquid Products segment held the largest share of 42.19% in 2022

- The dominance of the Lid Applicator Machine market is led by the Liquid Products segment, Lid Applicator Machines addresses the intricate needs of liquid packaging by providing airtight seals, preventing leakage, and ensuring product integrity. Industries dealing with beverages, pharmaceutical liquids, and chemical products heavily rely on these machines to uphold the quality and safety of their liquid contents. The demand for Lid Applicator Machines in the Liquid Products segment arises from the critical need for precision and consistency in lid application, reducing the risk of spillage during transportation and storage.

- Furthermore, the adaptability of Lid Applicator Machines in handling various lid types and sizes makes them well-suited for the diverse packaging requirements within the Liquid Products sector. As industries continually innovate and introduce new liquid formulations, the Lid Applicator Machine's capacity to adjust to evolving packaging needs establishes it as a cornerstone in the market's growth, securing a significant share in the dynamic landscape of liquid product packaging.

Lid Applicator Machine Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to dominate the Lid Applicator Machine market due to the region's burgeoning industrial and manufacturing activities. The increasing demand for consumer goods, especially in populous countries like China and India, is driving the need for efficient and automated packaging solutions. Lid Applicator Machines offers a streamlined approach to packaging processes, aligning with the region's focus on enhancing productivity and meeting rising consumer expectations for quality products.

- Furthermore, the proactive adoption of advanced technologies in manufacturing and packaging industries in the Asia Pacific contributes to the dominance of the region in the Lid Applicator Machine market. As businesses in countries like China, Japan, and India seek to optimize their production lines, the incorporation of Lid Applicator Machines for precise and automated lid application becomes instrumental in achieving operational efficiency. The dynamic economic growth, coupled with a strong emphasis on industrial automation, positions Asia Pacific as a key driver for the expansion of the Lid Applicator Machine market.

Lid Applicator Machine Market Top Key Players:

- Delkor Systems Inc. (U.S.)

- Precision PMD (U.S.)

- LanTech (U.S.)

- Temcon Machinery (U.S.)

- Qcomp Technologies (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- Smurfit Kappa Group (Ireland)

- ATP-Engineering & Packaging S.L (Spain)

- Budé Group bv (Netherlands)

- Tp Engineering & Packaging (India)

- Dase-Sing Packaging Technology Co. Ltd. (Taiwan)

- Xu Yuan Packaging Technology Co. Ltd. (Taiwan)

- Eversleeve Enterprise Co. Ltd. (Taiwan)

- Pack Leader Machinery Inc. (Taiwan)

- King Hong Industrial Co. Ltd. (Taiwan)

- Delmax Machinery Co. Ltd. (Taiwan)

- Benison & Co. Ltd. (Taiwan)

- Kansan Makina Kagit San. Ve Tic. A.S. (Turkey), and Other Major Players.

Key Industry Developments.

In November 2023, Chadwicks and Tekplas launched an innovative spoon-in-lid solution for infant formula packaging. This development features a plastic spoon sealed within an over-lid, coupled with a transparent die-cut lid by Chadwicks. The components, including the aluminum can, over-lid, scoop, and lid, are fully recyclable. Tekplas General Manager Scott Laurence emphasized the convenience of the design, preventing the scoop from submerging in the formula. John Harrison, Chadwick's General Sales Manager, highlighted the importance of combining functionality and user-friendliness through collaboration and innovation in packaging.

|

Global Lid Applicator Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.90 % |

Market Size in 2032: |

USD 3.37 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LID APPLICATOR MACHINE MARKET BY TYPE (2017-2032)

- LID APPLICATOR MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUAL MACHINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEMI-AUTOMATIC MACHINE

- AUTOMATIC MACHINE

- LID APPLICATOR MACHINE MARKET BY APPLICATION (2017-2032)

- LID APPLICATOR MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWDERED ITEMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GRANULAR PRODUCTS

- LIQUID PRODUCTS

- LID APPLICATOR MACHINE MARKET BY END-USER (2017-2032)

- LID APPLICATOR MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COSMETIC & PERSONAL CARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD & BEVERAGE

- HEALTH CARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Lid Applicator Machine Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DELKOR SYSTEMS INC.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PRECISION PMD (U.S.)

- LANTECH (U.S.)

- TEMCON MACHINERY (U.S.)

- QCOMP TECHNOLOGIES (U.S.)

- GEA GROUP AKTIENGESELLSCHAFT (GERMANY)

- SMURFIT KAPPA GROUP (IRELAND)

- ATP-ENGINEERING & PACKAGING S.L (SPAIN)

- BUDÉ GROUP BV (NETHERLANDS)

- TP ENGINEERING & PACKAGING (INDIA)

- DASE-SING PACKAGING TECHNOLOGY CO. LTD. (TAIWAN)

- XU YUAN PACKAGING TECHNOLOGY CO. LTD. (TAIWAN)

- EVERSLEEVE ENTERPRISE CO. LTD. (TAIWAN)

- PACK LEADER MACHINERY INC. (TAIWAN)

- KING HONG INDUSTRIAL CO. LTD. (TAIWAN)

- DELMAX MACHINERY CO. LTD. (TAIWAN)

- BENISON & CO. LTD. (TAIWAN)

- KANSAN MAKINA KAGIT SAN. VE TIC. A.S. (TURKEY)

- COMPETITIVE LANDSCAPE

- GLOBAL LID APPLICATOR MACHINE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

2. Potential Market Strategies

|

Global Lid Applicator Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.90 % |

Market Size in 2032: |

USD 3.37 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LID APPLICATOR MACHINE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LID APPLICATOR MACHINE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LID APPLICATOR MACHINE MARKET COMPETITIVE RIVALRY

TABLE 005. LID APPLICATOR MACHINE MARKET THREAT OF NEW ENTRANTS

TABLE 006. LID APPLICATOR MACHINE MARKET THREAT OF SUBSTITUTES

TABLE 007. LID APPLICATOR MACHINE MARKET BY TYPE

TABLE 008. MANUAL MACHINE MARKET OVERVIEW (2016-2028)

TABLE 009. SEMI-AUTOMATIC MACHINE MARKET OVERVIEW (2016-2028)

TABLE 010. AUTOMATIC MACHINE MARKET OVERVIEW (2016-2028)

TABLE 011. LID APPLICATOR MACHINE MARKET BY APPLICATION

TABLE 012. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 013. COSMETIC & PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 014. HEALTH CARE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA LID APPLICATOR MACHINE MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA LID APPLICATOR MACHINE MARKET, BY APPLICATION (2016-2028)

TABLE 018. N LID APPLICATOR MACHINE MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE LID APPLICATOR MACHINE MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE LID APPLICATOR MACHINE MARKET, BY APPLICATION (2016-2028)

TABLE 021. LID APPLICATOR MACHINE MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC LID APPLICATOR MACHINE MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC LID APPLICATOR MACHINE MARKET, BY APPLICATION (2016-2028)

TABLE 024. LID APPLICATOR MACHINE MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA LID APPLICATOR MACHINE MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA LID APPLICATOR MACHINE MARKET, BY APPLICATION (2016-2028)

TABLE 027. LID APPLICATOR MACHINE MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA LID APPLICATOR MACHINE MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA LID APPLICATOR MACHINE MARKET, BY APPLICATION (2016-2028)

TABLE 030. LID APPLICATOR MACHINE MARKET, BY COUNTRY (2016-2028)

TABLE 031. TP ENGINEERING & PACKAGING: SNAPSHOT

TABLE 032. TP ENGINEERING & PACKAGING: BUSINESS PERFORMANCE

TABLE 033. TP ENGINEERING & PACKAGING: PRODUCT PORTFOLIO

TABLE 034. TP ENGINEERING & PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. DELKOR SYSTEMS: SNAPSHOT

TABLE 035. DELKOR SYSTEMS: BUSINESS PERFORMANCE

TABLE 036. DELKOR SYSTEMS: PRODUCT PORTFOLIO

TABLE 037. DELKOR SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. INC.: SNAPSHOT

TABLE 038. INC.: BUSINESS PERFORMANCE

TABLE 039. INC.: PRODUCT PORTFOLIO

TABLE 040. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. PRECISION PMD: SNAPSHOT

TABLE 041. PRECISION PMD: BUSINESS PERFORMANCE

TABLE 042. PRECISION PMD: PRODUCT PORTFOLIO

TABLE 043. PRECISION PMD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. LANTECH: SNAPSHOT

TABLE 044. LANTECH: BUSINESS PERFORMANCE

TABLE 045. LANTECH: PRODUCT PORTFOLIO

TABLE 046. LANTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BUDE GROUP: SNAPSHOT

TABLE 047. BUDE GROUP: BUSINESS PERFORMANCE

TABLE 048. BUDE GROUP: PRODUCT PORTFOLIO

TABLE 049. BUDE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SMURFIT KAPPA GROUP: SNAPSHOT

TABLE 050. SMURFIT KAPPA GROUP: BUSINESS PERFORMANCE

TABLE 051. SMURFIT KAPPA GROUP: PRODUCT PORTFOLIO

TABLE 052. SMURFIT KAPPA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. GEA GROUP AKTIENGESELLSCHAFT: SNAPSHOT

TABLE 053. GEA GROUP AKTIENGESELLSCHAFT: BUSINESS PERFORMANCE

TABLE 054. GEA GROUP AKTIENGESELLSCHAFT: PRODUCT PORTFOLIO

TABLE 055. GEA GROUP AKTIENGESELLSCHAFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TEMCON MACHINERY: SNAPSHOT

TABLE 056. TEMCON MACHINERY: BUSINESS PERFORMANCE

TABLE 057. TEMCON MACHINERY: PRODUCT PORTFOLIO

TABLE 058. TEMCON MACHINERY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. QCOMP TECHNOLOGIES: SNAPSHOT

TABLE 059. QCOMP TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 060. QCOMP TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 061. QCOMP TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LID APPLICATOR MACHINE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LID APPLICATOR MACHINE MARKET OVERVIEW BY TYPE

FIGURE 012. MANUAL MACHINE MARKET OVERVIEW (2016-2028)

FIGURE 013. SEMI-AUTOMATIC MACHINE MARKET OVERVIEW (2016-2028)

FIGURE 014. AUTOMATIC MACHINE MARKET OVERVIEW (2016-2028)

FIGURE 015. LID APPLICATOR MACHINE MARKET OVERVIEW BY APPLICATION

FIGURE 016. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 017. COSMETIC & PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 018. HEALTH CARE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA LID APPLICATOR MACHINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE LID APPLICATOR MACHINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC LID APPLICATOR MACHINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA LID APPLICATOR MACHINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA LID APPLICATOR MACHINE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Lid Applicator Machine Market research report is 2024-2032.

Delkor Systems Inc. (U.S.), Precision PMD (U.S.), LanTech (U.S.), Temcon Machinery (U.S.), Qcomp Technologies (U.S.), GEA Group Aktiengesellschaft (Germany), Smurfit Kappa Group (Ireland), ATP-Engineering & Packaging S.L (Spain), Budé Group Bv (Netherlands), TP Engineering & Packaging (India), DASE-SING Packaging Technology Co. LTD. (Taiwan), XU YUAN PACKAGING TECHNOLOGY CO. LTD. (Taiwan), Eversleeve Enterprise Co. Ltd. (Taiwan), Pack Leader Machinery Inc. (Taiwan), KING HONG Industrial Co. Ltd. (Taiwan), DELMAX MACHINERY Co. Ltd. (Taiwan), Benison & Co. Ltd. (Taiwan), Kansan Makina Kagit San. VE TIC. A.S. (Turkey), And Other Major Players.

The Lid Applicator Machine Market is segmented into Type, Application, End-User and region. By Type, the market is categorized into Manual Machine, Semi-Automatic Machine and Automatic Machine. By Application, the market is categorized into Powdered Items, Granular Products, and Liquid Products. By End-User, the market is categorized into Cosmetic & Personal Care, Food & Beverage, and Health Care. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Lid Applicator Machine actively secures lids onto containers, ensuring precise sealing in diverse industries. This device streamlines packaging, automates lid application, reduces manual labor, and maintains consistent container sealing quality, enhancing overall productivity.

Global Lid Applicator Machine Market Size Was Valued at USD 2.39 Billion in 2023 and is Projected to Reach USD 3.37 Billion by 2032, Growing at a CAGR of 3.90% From 2024-2032