Levulinic Acid Market Synopsis

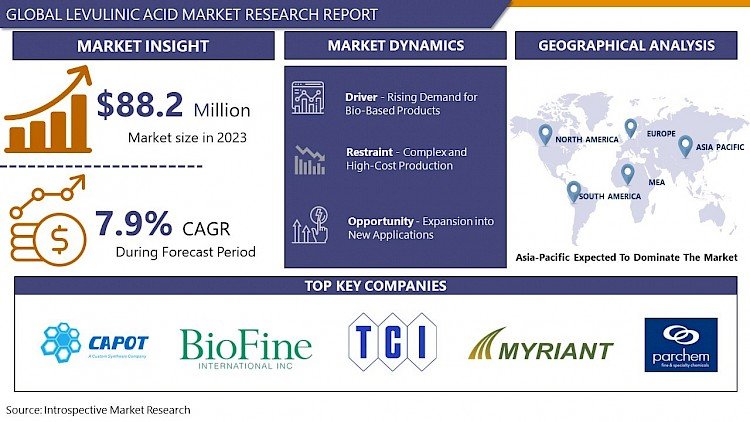

Levulinic Acid Market Size Was Valued at USD 88.2 Million in 2023 and is Projected to Reach USD 174.85 Million by 2032, Growing at a CAGR of 7.9% From 2024-2032.

The production, trading, and consumption of levulinic acid and its derivatives take place on the global market known as the "levulinic acid market." Levulinic acid is an organic chemical that occurs naturally and is obtained from biomass sources including sugars and lignocellulosic materials. It finds extensive use in a variety of industries. The market is divided into several important categories, such as chemicals, medicines, cosmetics, agriculture, and others, where levulinic acid is used as an intermediary, additive, or precursor in the manufacturing of different goods. Levulinic acid is an organic chemical that can be used in many different industries due to its versatility. Its main function is to act as a precursor in the synthesis of many compounds that are utilized as additives, plasticizers, medicines, and other products.

- Levulinic acid and its derivatives are essential to the cosmetics business, especially when it comes to formulating skincare, haircare, and scent products. Levulinic acid's derivative ethyl levulinate is widely utilized in perfumes and aromas, giving them their unique smells and compositions. The fact that levulinic acid is used in cosmetics emphasizes how useful it is as a flexible component that raises the attractiveness and efficacy of personal hygiene products.

- Levulinic acid is also an important component in pharmaceutical applications. It is used as a precursor for many pharmacological substances, such as the previously mentioned aminolevulinic acid. Levulinic acid's function in improving healthcare solutions is demonstrated by the pharmaceutical applications of aminolevulinic acid in photodynamic therapy for specific cancer kinds and other medical therapies.

- Levulinic acid is an essential raw material for the synthesis of other useful molecules including 2-methyltetrahydrofuran (2-MTHF) and γ-valerolactone. These compounds demonstrate the versatility of levulinic acid as a chemical building block for the creation of novel materials and substances. They are used as solvents, biofuels, and in a variety of chemical processes.

Levulinic Acid Market Trend Analysis

Rising Demand for Bio-Based Products

- The market for levulinic acid is expanding due in large part to the growing demand for bio-based goods. There has been an apparent movement toward substitutes made from renewable biomass sources as consumer awareness of the ecological impact of the products they use grows and environmental sustainability concerns continue to mount. This change is motivated by the need to lessen reliance on finite fossil fuels and counteract the harm that conventional chemical processes do to the environment.

- Levulinic acid is produced from biomass feedstocks, which include sugars and lignocellulosic materials. This makes it an ideal match for the increasing need for bio-based substitutes. Because of its renewable nature and environmentally beneficial qualities, it is a desirable choice for businesses looking to cut back on their carbon emissions and abide by stricter environmental laws.

- Overall, the growing market for bio-based products is indicative of a larger cultural movement towards more environmentally friendly consumer habits. Levulinic acid is well-positioned to benefit from this trend, propelling market growth and innovation in the bio-based chemicals industry, thanks to its many uses and renewable sources.

Expansion into New Applications

- Levulinic acid market expansion into new applications offers options for growth and diversification, indicating a significant market opportunity. Levulinic acid's special qualities make it a flexible substance with potential uses in a range of industries as they look for creative ways to meet changing customer wants and tackle new problems.

- Levulinic acid can be used as a precursor to create new therapeutic molecules, which presents a potential for the pharmaceutical sector. Levulinic acid has the potential to contribute to the creation of next-generation medications as the pharmaceutical industry is always looking for novel therapeutic agents and drug delivery techniques. Because of its biodegradable nature and compatibility with pharmaceutical formulations, it is a prospective candidate for drug delivery applications, especially in targeted therapy.

- In short, the levulinic acid market exhibits great potential for growth as a result of its adaptability to changing customer preferences, renewable source, and distinctive qualities. Through utilizing its adaptability and investigating novel approaches for application advancement, the levulinic acid sector can seize expansion prospects and position itself as a crucial participant in the shift towards a more ecologically conscious and sustainable economy.

Levulinic Acid Market Segment Analysis:

Levulinic Acid Market Segmented on the basis of Technology, Application and End-Use.

By Technology, Biofine segment is expected to dominate the market during the forecast period

- The levulinic acid market's Biofine segment is expected to dominate throughout the forecast period due to the development of bio-based technologies and the growing focus on environmentally friendly manufacturing techniques. A cutting-edge method for producing levulinic acid from sustainable biomass sources, such as forestry waste, agricultural wastes, and other biomass feedstocks, is biofine technology.

- Utilizing a variety of thermochemical and catalytic techniques, biomass is transformed into levulinic acid in the biofine technology process. Typically, these procedures involve hydrolysis, dehydration, and further conversion stages, with levulinic acid being produced as the main product. The technology is the method of choice for producing levulinic acid because it has many benefits, such as excellent selectivity, efficiency, and versatility in using different biomass feedstocks.

- The scalability and commercial viability of biofine technology are important factors contributing to the biofine segment's supremacy. Large-scale, effective biomass conversion into levulinic acid has been made possible by developments in reactor design, catalyst development, and process optimization. This has made it easier to commercialize fine-based manufacturing facilities.

By Application, Pharmaceuticals segment held the largest share in 2023

- Due to levulinic acid's vital role as a precursor for the manufacture of pharmaceutical compounds, such as aminolevulinic acid (ALA) and other active pharmaceutical ingredients (APIs), the pharmaceutical industry has the biggest market share in levulinic acid. Because of its adaptability to a wide range of pharmaceutical formulations, levulinic acid is indispensable for the creation of different therapeutic agents and drug delivery systems.

- The synthesis of ALA, which is widely used in photodynamic therapy (PDT) to treat various cancers and other illnesses, is one of the primary uses propelling the Pharmaceuticals segment's domination. In ALA-based photodynamic therapy (PDT), patients are given ALA and then exposed to particular wavelengths of light, which causes aberrant cells like malignant cells to be selectively destroyed.

- In conclusion, the levulinic acid market is dominated by the Pharmaceuticals segment because of the compound's critical function in the production of pharmaceutical chemicals, including ALA, and its usage in drug delivery systems. Levulinic acid is anticipated to maintain its dominance in this market as long as the pharmaceutical industry keeps innovating and evolving. It is likely to play a crucial role in the development of next-generation therapies.

Levulinic Acid Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Due to several important variables that support the industry's expansion and development in the area, Asia Pacific is expected to lead the levulinic acid market during the projected period. One of the main causes is the Asia-Pacific region's rapid industrialization and economic growth, which is especially evident in developing nations like China, India, and Southeast Asia. The need for chemicals and specialty ingredients, such as levulinic acid, is rising in tandem with this industrial growth in a variety of sectors, including chemicals, medicines, cosmetics, and agriculture.

- A substantial agricultural industry exists in Asia Pacific, offering a wealth of biomass resources suitable for levulinic acid production. Agricultural residues, sugarcane bagasse, corn stover, and other biomass feedstocks are readily available in the area, providing a favorable environment for the construction of biorefineries and related facilities. This supports investments in bio-refining technology and increases levulinic acid production capacity in the Asia Pacific. It also corresponds with the increased emphasis on sustainable and bio-based manufacturing practices.

Levulinic Acid Market Top Key Players:

- Capot Chemical Co. Ltd. (China)

- Tokyo Chemical Industry Co. Ltd. (Japan)

- Shanghai Worldyang Chemical Co. Limited (China)

- Parchem fine & specialty chemicals (US)

- Anhui Herman Impex Co. Ltd. (China)

- Haihang Industry Co. Ltd. (China)

- Sigma-Aldrich (US)

- Emerald Performance Materials (US)

- Myriant Corporation (US)

- Simagchem Corporation (China)

- Godavari Biorefineries Ltd (India)

- Biofine International Inc. (US)

- Segetis Inc. (US)

- Iogen Corporation (Canada)

- Hangzhou Dayangchem Co. Ltd. (China)

- Anhui Sunhere Pharmaceutical Excipients Co. Ltd. (China)

- Hebei Langfang Triple Well Chemicals Co. Ltd. (China)

- Anhui Jin'ao Chemical Co. Ltd. (China)

- Anhui Sunhere Pharmaceutical Excipients Co. Ltd. (China)

- Tractus (Canada)

- Muby Chemicals (India)

- GF Biochemicals Ltd. (Italy)

- Biofine Technology LLC (US)

- Avantium (Netherlands)

- Heroy Chemical Industry Co. Ltd. (China), and Other Major Players.

Key Industry Developments in the Levulinic Acid Market:

- In June 2023, Myriant, a management consulting firm affiliated with United Minds, has announced a strategic alliance with S&P worldwide Market Intelligence, a leading supplier of worldwide market intelligence services and solutions. By utilizing S&P Global Market Intelligence's unique capital markets insights, our partnership seeks to improve Myriant's capital markets advising services.

|

Global Levulinic Acid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 174.85 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LEVULINIC ACID MARKET BY TECHNOLOGY (2017-2032)

- LEVULINIC ACID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BIOFINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ACID HYDROLYSIS

- LEVULINIC ACID MARKET BY APPLICATION (2017-2032)

- LEVULINIC ACID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHARMACEUTICALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETICS

- FLAVOURS & FRAGRANCES

- RESINS & COATINGS

- AGROCHEMICALS

- POLYMERS & PLASTICIZERS

- LEVULINIC ACID MARKET BY END-USE (2017-2032)

- LEVULINIC ACID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AGRICULTURAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDICAL AND HEALTHCARE

- PERSONAL CARE

- PETROCHEMICAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Levulinic Acid Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CAPOT CHEMICAL CO. LTD. (CHINA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TOKYO CHEMICAL INDUSTRY CO. LTD. (JAPAN)

- SHANGHAI WORLDYANG CHEMICAL CO. LIMITED (CHINA)

- PARCHEM FINE & SPECIALTY CHEMICALS (US)

- ANHUI HERMAN IMPEX CO. LTD. (CHINA)

- HAIHANG INDUSTRY CO. LTD. (CHINA)

- SIGMA-ALDRICH (US)

- EMERALD PERFORMANCE MATERIALS (US)

- MYRIANT CORPORATION (US)

- SIMAGCHEM CORPORATION (CHINA)

- GODAVARI BIOREFINERIES LTD (INDIA)

- BIOFINE INTERNATIONAL INC. (US)

- SEGETIS INC. (US)

- IOGEN CORPORATION (CANADA)

- HANGZHOU DAYANGCHEM CO. LTD. (CHINA)

- ANHUI SUNHERE PHARMACEUTICAL EXCIPIENTS CO. LTD. (CHINA)

- HEBEI LANGFANG TRIPLE WELL CHEMICALS CO. LTD. (CHINA)

- ANHUI JIN'AO CHEMICAL CO. LTD. (CHINA)

- ANHUI SUNHERE PHARMACEUTICAL EXCIPIENTS CO. LTD. (CHINA)

- TRACTUS (CANADA)

- MUBY CHEMICALS (INDIA)

- GF BIOCHEMICALS LTD. (ITALY)

- BIOFINE TECHNOLOGY LLC (US)

- AVANTIUM (NETHERLANDS)

- HEROY CHEMICAL INDUSTRY CO. LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL LEVULINIC ACID MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-Use

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Levulinic Acid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 174.85 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LEVULINIC ACID MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LEVULINIC ACID MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LEVULINIC ACID MARKET COMPETITIVE RIVALRY

TABLE 005. LEVULINIC ACID MARKET THREAT OF NEW ENTRANTS

TABLE 006. LEVULINIC ACID MARKET THREAT OF SUBSTITUTES

TABLE 007. LEVULINIC ACID MARKET BY TYPE

TABLE 008. INDUSTRIAL GRADE MARKET OVERVIEW (2016-2028)

TABLE 009. PHARMA GRADE MARKET OVERVIEW (2016-2028)

TABLE 010. LEVULINIC ACID MARKET BY APPLICATION

TABLE 011. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 012. COSMETICS & PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 013. PLASTICIZERS MARKET OVERVIEW (2016-2028)

TABLE 014. FOOD AND FLAVORS MARKET OVERVIEW (2016-2028)

TABLE 015. AGROCHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 016. BIOFUELS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA LEVULINIC ACID MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA LEVULINIC ACID MARKET, BY APPLICATION (2016-2028)

TABLE 019. N LEVULINIC ACID MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE LEVULINIC ACID MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE LEVULINIC ACID MARKET, BY APPLICATION (2016-2028)

TABLE 022. LEVULINIC ACID MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC LEVULINIC ACID MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC LEVULINIC ACID MARKET, BY APPLICATION (2016-2028)

TABLE 025. LEVULINIC ACID MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA LEVULINIC ACID MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA LEVULINIC ACID MARKET, BY APPLICATION (2016-2028)

TABLE 028. LEVULINIC ACID MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA LEVULINIC ACID MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA LEVULINIC ACID MARKET, BY APPLICATION (2016-2028)

TABLE 031. LEVULINIC ACID MARKET, BY COUNTRY (2016-2028)

TABLE 032. GFBIOCHEMICALS: SNAPSHOT

TABLE 033. GFBIOCHEMICALS: BUSINESS PERFORMANCE

TABLE 034. GFBIOCHEMICALS: PRODUCT PORTFOLIO

TABLE 035. GFBIOCHEMICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ZIBO CHANGLIN CHEMICAL: SNAPSHOT

TABLE 036. ZIBO CHANGLIN CHEMICAL: BUSINESS PERFORMANCE

TABLE 037. ZIBO CHANGLIN CHEMICAL: PRODUCT PORTFOLIO

TABLE 038. ZIBO CHANGLIN CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. HEROY CHEMICAL INDUSTRY: SNAPSHOT

TABLE 039. HEROY CHEMICAL INDUSTRY: BUSINESS PERFORMANCE

TABLE 040. HEROY CHEMICAL INDUSTRY: PRODUCT PORTFOLIO

TABLE 041. HEROY CHEMICAL INDUSTRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. LANGFANG TRIPLE WELL CHEMICALS: SNAPSHOT

TABLE 042. LANGFANG TRIPLE WELL CHEMICALS: BUSINESS PERFORMANCE

TABLE 043. LANGFANG TRIPLE WELL CHEMICALS: PRODUCT PORTFOLIO

TABLE 044. LANGFANG TRIPLE WELL CHEMICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HEFEI TNJ CHEMICAL: SNAPSHOT

TABLE 045. HEFEI TNJ CHEMICAL: BUSINESS PERFORMANCE

TABLE 046. HEFEI TNJ CHEMICAL: PRODUCT PORTFOLIO

TABLE 047. HEFEI TNJ CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. GUANNAN EAST CHEMICAL: SNAPSHOT

TABLE 048. GUANNAN EAST CHEMICAL: BUSINESS PERFORMANCE

TABLE 049. GUANNAN EAST CHEMICAL: PRODUCT PORTFOLIO

TABLE 050. GUANNAN EAST CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ZIBO SHUANGYU: SNAPSHOT

TABLE 051. ZIBO SHUANGYU: BUSINESS PERFORMANCE

TABLE 052. ZIBO SHUANGYU: PRODUCT PORTFOLIO

TABLE 053. ZIBO SHUANGYU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. LANGFANG HAWK: SNAPSHOT

TABLE 054. LANGFANG HAWK: BUSINESS PERFORMANCE

TABLE 055. LANGFANG HAWK: PRODUCT PORTFOLIO

TABLE 056. LANGFANG HAWK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. HEBEI YANUO: SNAPSHOT

TABLE 057. HEBEI YANUO: BUSINESS PERFORMANCE

TABLE 058. HEBEI YANUO: PRODUCT PORTFOLIO

TABLE 059. HEBEI YANUO: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LEVULINIC ACID MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LEVULINIC ACID MARKET OVERVIEW BY TYPE

FIGURE 012. INDUSTRIAL GRADE MARKET OVERVIEW (2016-2028)

FIGURE 013. PHARMA GRADE MARKET OVERVIEW (2016-2028)

FIGURE 014. LEVULINIC ACID MARKET OVERVIEW BY APPLICATION

FIGURE 015. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 016. COSMETICS & PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 017. PLASTICIZERS MARKET OVERVIEW (2016-2028)

FIGURE 018. FOOD AND FLAVORS MARKET OVERVIEW (2016-2028)

FIGURE 019. AGROCHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 020. BIOFUELS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA LEVULINIC ACID MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE LEVULINIC ACID MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC LEVULINIC ACID MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA LEVULINIC ACID MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA LEVULINIC ACID MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Levulinic Acid Market research report is 2024-2032.

Capot Chemical Co. Ltd. (China), Tokyo Chemical Industry Co. Ltd. (Japan), Shanghai Worldyang Chemical Co. Limited (China), Parchem fine & specialty chemicals (US), Anhui Herman Impex Co. Ltd. (China), Haihang Industry Co. Ltd. (China), MilliporeSigma (US), Emerald Performance Materials (US), Myriant Corporation (US), Simagchem Corporation (China), Godavari Biorefineries Ltd (India), Biofine International Inc. (US), Segetis, Inc. (US), Iogen Corporation (Canada), Hangzhou Dayangchem Co. Ltd. (China), Anhui Sunhere Pharmaceutical Excipients Co. Ltd. (China), Hebei Langfang Triple Well Chemicals Co. Ltd. (China), Anhui Jin'ao Chemical Co. Ltd. (China), Anhui Sunhere Pharmaceutical Excipients Co. Ltd. (China), Tractus (Canada), Muby Chemicals (India), GF Biochemicals Ltd. (Italy), Biofine Technology LLC (US), Avantium (Netherlands), Heroy Chemical Industry Co. Ltd. (China) and Other Major Players.

The Levulinic Acid Market is segmented Technology, Application, End-Use, and region. By Technology, the market is categorized into Biofine and Acid Hydrolysis. By Application, the market is categorized into Pharmaceuticals, Cosmetics, Flavours & Fragrances, Resins & Coatings, Agrochemicals, and Polymers & Plasticizers. By End-Use, the market is categorized into Agricultural, Medical and Healthcare, Personal Care, and Petrochemical. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The production, trading, and consumption of levulinic acid and its derivatives take place on the global market known as the "levulinic acid market." Levulinic acid is an organic chemical that occurs naturally and is obtained from biomass sources including sugars and lignocellulosic materials. It finds extensive use in a variety of industries. The market is divided into several important categories, such as chemicals, medicines, cosmetics, agriculture, and others, where levulinic acid is used as an intermediary, additive, or precursor in the manufacturing of different goods.

Levulinic Acid Market Size Was Valued at USD 88.2 Million in 2023 and is Projected to Reach USD 174.85 Million by 2032, Growing at a CAGR of 7.9% From 2024-2032.