Last Mile Delivery Market Synopsis

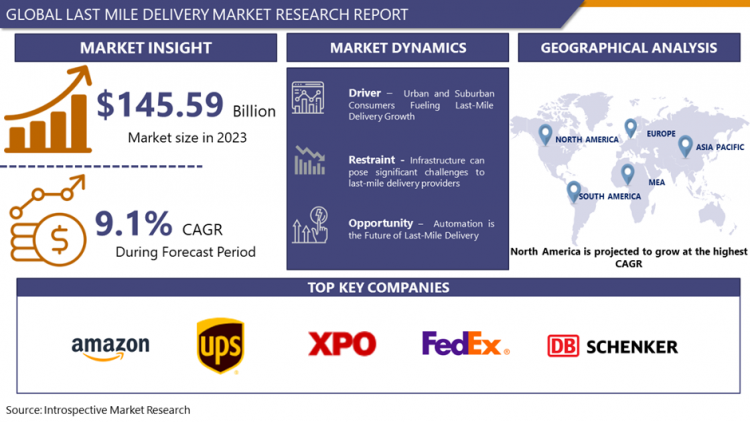

Last Mile Delivery Market Size Was Valued at USD 145.59 Billion in 2023, and is Projected to Reach USD 318.83 Billion by 2032, Growing at a CAGR of 9.1% From 2024-2032.

The last-mile delivery market serves diverse industries such as e-commerce, retail, food and beverage, healthcare, and logistics, driven primarily by the burgeoning demands of online shopping and omnichannel retailing. Businesses rely on these services to streamline supply chain logistics and meet customer expectations for swift and seamless order fulfillment. Simultaneously, consumers benefit from the convenience of doorstep delivery across a wide array of products, including groceries, electronics, and pharmaceuticals.

Advancements in technology, including route optimization algorithms, real-time tracking systems, autonomous vehicles, and drones, are revolutionizing last-mile delivery, enhancing efficiency, reducing costs, and minimizing environmental impact. However, the sector grapples with challenges like urban congestion, regulatory complexities, labor shortages, and escalating operational expenses. Nevertheless, these challenges offer opportunities for market players to innovate, enhance customer service, and forge strategic collaborations to drive sustainable growth and meet evolving consumer needs.

- Last mile delivery is important because it makes customers happy. When companies make sure stuff gets to people's homes or offices quickly and smoothly, it makes them look good and keeps customers coming back. Plus, it lets companies offer cool options like same-day or next-day delivery, which everyone wants these days because they're all about fast shipping.

- Another big deal with last mile delivery is saving money. Companies can figure out the best routes to deliver stuff, use fancy tech like GPS and route planning tools, and just be efficient about getting things where they need to go. This saves them cash, which is a big deal, especially when they're trying to compete in tough markets where every penny counts.

- Efficient last-mile delivery in e-commerce, exemplified by companies like Amazon and Alibaba, plays a crucial role in reducing environmental impact while ensuring timely package delivery. Utilizing eco-friendly vehicles, sustainable packaging, and smart delivery planning, businesses cut down on pollution and contribute to environmental conservation. This process involves coordinating with local carriers, employing specialized services, and leveraging technology like route optimization and delivery drones in urban areas to navigate congested streets, thereby improving delivery times, reducing costs, and enhancing customer satisfaction.

Last Mile Delivery Market Trend Analysis:

Urban and Suburban Consumers Fueling Last-Mile Delivery Growth

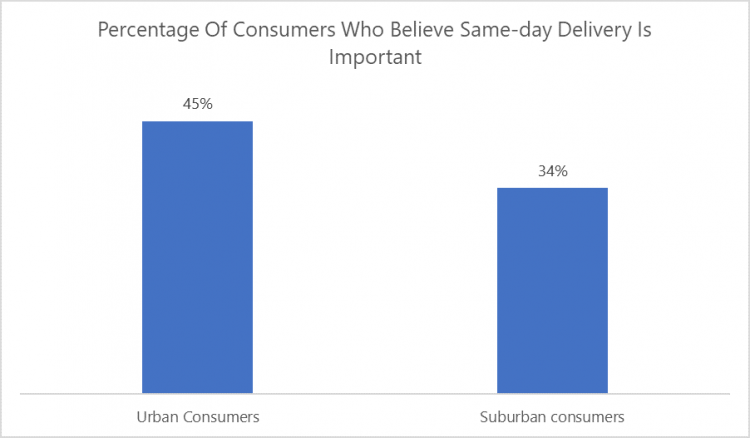

- The need for last-mile delivery services is greatly pushed by both urban and suburban customers, each with their own specific needs and hurdles. Urban consumers, known for their fast-paced lifestyles and desire for convenience, are a significant driver of the global last-mile delivery market. They prefer quick and adaptable delivery options like same-day delivery and easy pick-up locations, prompting delivery companies to innovate. The crowded nature of cities makes traditional delivery methods difficult, leading to the adoption of inventive solutions such as e-cargo bikes and drones to navigate through traffic efficiently. Moreover, urban consumers are tech-savvy and open to trying new technologies, creating a demand for automated and contactless delivery services, which further boosts the development of last-mile delivery in urban areas.

- Suburban customers are also contributing to the growth of the last-mile delivery market. As e-commerce becomes more popular in suburban areas and traditional retail options dwindle, home delivery services become increasingly important. Suburban regions usually cover larger distances and heavily rely on cars, affecting delivery logistics and costs. To address these challenges, solutions like optimizing routes and consolidation hubs are becoming necessary. With suburban populations embracing online shopping more, the demand for efficient last-mile delivery services is expected to rise, driving the expansion of the global last-mile delivery market even further.

Automation is the Future of Last-Mile Delivery

- The combination of drones, self-driving delivery vehicles, and bots represents a significant step forward in improving last-mile delivery services. As technology advances rapidly, these innovations have the potential to completely change how goods are transported, particularly in the logistics sector. Big players like Amazon are heavily investing in companies like Aurora to develop state-of-the-art autonomous systems.

- This move towards automation brings the promise of faster and more efficient delivery services. For example, Amazon's use of drones to deliver pharmacy orders within an hour without extra charges demonstrates the incredible capabilities of these technologies. While still relatively new, the adoption of autonomous vehicles for deliveries is picking up speed, signaling a major shift in how goods are transported. As these technologies mature and become more common, they're expected to have significant growth in the global last-mile delivery market, offering quicker, more dependable, and cost-effective delivery options for both businesses and consumers.

Last Mile Delivery Market Segment Analysis:

Last Mile Delivery Market is Segmented into Delivery Mode, Service Type, Industry Verticals, Vehicle Type, Mode of Operation, and Destination.

By Service Type, the B2C segment holds a 65% share of the global revenue.

- The exponential growth of e-commerce platforms has reshaped consumer behavior, leading to a surge in online purchases across various product categories. This increased demand for home delivery services, driving the dominance of B2C deliveries.

- B2C delivery companies have been at the forefront of embracing technological advancements to streamline their operations and enhance customer experience. Mobile apps, route optimization software, real-time tracking, and other innovations have made B2C deliveries more efficient and convenient, further solidifying their dominance.

- B2C delivery services offer a wide range of delivery options to cater to diverse customer needs and preferences. Whether it's same-day delivery for urgent purchases, express delivery for time-sensitive items, or scheduled deliveries for convenience, B2C delivery companies provide flexible solutions that align with consumer demands.

By Mode of Operation, the non-autonomous segment dominates the global last-mile delivery market, accounting for a significant share of the market revenue.

- Non-autonomous solutions are currently more cost-effective than autonomous technologies. The initial investment and maintenance costs for autonomous vehicles and associated infrastructure are higher, making them less attractive from a financial standpoint.

- The existing infrastructure and workforce for non-autonomous operations allow for easier and faster scaling compared to autonomous alternatives. Non-autonomous solutions can leverage established transportation networks, warehouses, and delivery personnel, facilitating broader deployment.

- Autonomous delivery technologies face significant regulatory challenges and safety concerns. Governments and regulatory bodies are cautious about permitting widespread adoption due to uncertainties surrounding liability, safety standards, and potential impacts on employment.

By Industry Verticals, E-commerce currently dominates the global last-mile delivery market, holding a significant share of 55%.

- E-commerce offers unparalleled convenience to consumers, allowing them to shop from the comfort of their homes or on the go using mobile devices. This convenience factor has significantly contributed to the rapid growth of online shopping.

- E-commerce breaks down geographical barriers, enabling businesses to reach customers worldwide. This global reach opens up new markets and opportunities for businesses, fostering growth and expansion.

- E-commerce platforms leverage data analytics and algorithms to personalize the shopping experience for each customer. By analyzing past purchases, browsing history, and preferences, online retailers can recommend relevant products, promotions, and content tailored to individual interests, enhancing customer satisfaction and loyalty.

Last Mile Delivery Market Regional Insights:

North America Currently holds the largest market share.

- North America boasts one of the highest e-commerce penetration rates globally. The widespread adoption of online shopping among consumers has reshaped retail dynamics, with a significant portion of retail sales now occurring online. Factors contributing to this high adoption include widespread internet access, a tech-savvy population, and a culture of convenience-seeking consumers.

- The surge in e-commerce has propelled the demand for last-mile delivery services. Consumers increasingly expect fast and reliable delivery options, driving companies to optimize their last-mile logistics to meet these expectations. From same-day delivery to flexible delivery windows, businesses are constantly innovating to provide convenient options to consumers.

- North America benefits from a well-developed logistics infrastructure, comprising extensive transportation networks and state-of-the-art warehousing facilities. Major cities are interconnected by highways, railways, and air cargo hubs, facilitating the efficient movement of goods across vast distances. This infrastructure forms the backbone of the region's e-commerce ecosystem, enabling timely and cost-effective deliveries.

Last Mile Delivery Market Top Key Players:

- Amazon.com (United States)

- USA Couriers (United States)

- A1 Express Services Inc. (United States)

- Marble Robot (United States)

- United Parcel Service, Inc. (United States)

- Power Link Expedite (United States)

- Jet Delivery, Inc. (United States)

- XPO Logistics, Inc. (United States)

- Savioke (United States)

- Flirtey (United States)

- Matternet (United States)

- Dropoff, Inc. (United States)

- FedEx (United States)

- Drone Delivery (Canada)

- Deutsche Post AG (Germany)

- DB Schenker (Germany)

- DPD (Germany)

- Geodis (France)

- DSV (Denmark)

- SF Express (China)

- BEST Inc (China)

- YTO Express Group Co. (China)

- Kerry Logistics Network Limited (Hong Kong)

- Flytrex (Israel)

- Aramex (UAE), and Other Major Players.

Key Industry Developments in the Last Mile Delivery Market:

- In March 2024, DroneUp, a prominent autonomous drone delivery firm in the U.S., has announced the launch of its pioneering technology aimed at transforming last-mile logistics. The company introduced its innovative autonomous Ecosystem, which integrates advanced ground, air, and software components into a unified platform. This move signifies a significant step toward achieving scalable and economically viable drone delivery solutions for various industries, including retail, quick-service restaurants, and healthcare. The DroneUp Ecosystem combines automated ground infrastructure, a suite of software operating systems, and an autonomous drone platform in a novel approach, heralding a new era in delivery logistics.

- In September 2024, Oracle and Uber collaborated to introduce "Collect and Receive," a new feature on the Oracle Retail platform aimed at revolutionizing last-mile delivery in retail. Leveraging Oracle Retail Data Store and cloud platform technologies, retailers gained access to Uber Direct, Uber's white-label delivery solution, through pre-integrated APIs. This joint initiative empowered retailers to optimize inventory management while offering customers an array of delivery choices, including same-day and scheduled options, as well as order pickup and returns at nearby retail or postal locations. The service was made available immediately to Oracle Retail customers in the United States and Canada.

|

Global Last Mile Delivery Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 145.59 Bn. |

|

|

CAGR (2024-2032) : |

9.1% |

Market Size in 2032: |

USD 318.83 Bn. |

|

|

Segments Covered: |

By Delivery Mode |

|

|

|

|

By Service Type |

|

|

||

|

By Industry Verticals |

|

|

||

|

By Vehicle Type |

|

|

||

|

By Mode of Operation |

|

|

||

|

By Destination |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LAST MILE DELIVERY MARKET BY DELIVERY MODE (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SAME-DAY DELIVERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NEXT-DAY DELIVERY

- STANDARD DELIVERY

- ECONOMY DELIVERY

- LAST MILE DELIVERY MARKET BY SERVICE TYPE (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BUSINESS-TO-CONSUMER (B2C)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSINESS-TO-BUSINESS (B2B)

- CONSUMER-TO-CONSUMER (C2C)

- LAST MILE DELIVERY MARKET BY INDUSTRY VERTICALS (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- E-COMMERCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD AND GROCERY

- HEALTHCARE

- PARCEL AND COURIER SERVICES

- FURNITURE AND APPLIANCES

- FASHION AND APPAREL

- LAST MILE DELIVERY MARKET BY VEHICLE TYPE (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOTORCYCLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LCV

- HCV

- DRONES

- LAST MILE DELIVERY MARKET BY MODE OF OPERATION (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NON-AUTONOMOUS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTONOMOUS

- LAST MILE DELIVERY MARKET BY DESTINATION (2017-2032)

- LAST MILE DELIVERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DOMESTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INTERNATIONAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- LAST MILE DELIVERY Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMAZON.COM (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- USA COURIERS (UNITED STATES)

- A1 EXPRESS SERVICES INC. (UNITED STATES)

- MARBLE ROBOT (UNITED STATES)

- UNITED PARCEL SERVICE, INC. (UNITED STATES)

- POWER LINK EXPEDITE (UNITED STATES)

- JET DELIVERY, INC. (UNITED STATES)

- XPO LOGISTICS, INC. (UNITED STATES)

- SAVIOKE (UNITED STATES)

- FLIRTEY (UNITED STATES)

- MATTERNET (UNITED STATES)

- DROPOFF, INC. (UNITED STATES)

- FEDEX (UNITED STATES)

- DRONE DELIVERY (CANADA)

- DEUTSCHE POST AG (GERMANY)

- DB SCHENKER (GERMANY)

- DPD (GERMANY)

- GEODIS (FRANCE)

- DSV (DENMARK)

- SF EXPRESS (CHINA)

- BEST INC (CHINA)

- YTO EXPRESS GROUP CO. (CHINA)

- KERRY LOGISTICS NETWORK LIMITED (HONG KONG)

- FLYTREX (ISRAEL)

- ARAMEX (UAE)

- COMPETITIVE LANDSCAPE

- GLOBAL LAST MILE DELIVERY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Delivery Mode

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By Industry Verticals

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Mode of Operation

- Historic And Forecasted Market Size By Destination

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Last Mile Delivery Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 145.59 Bn. |

|

|

CAGR (2024-2032) : |

9.1% |

Market Size in 2032: |

USD 318.83 Bn. |

|

|

Segments Covered: |

By Delivery Mode |

|

|

|

|

By Service Type |

|

|

||

|

By Industry Verticals |

|

|

||

|

By Vehicle Type |

|

|

||

|

By Mode of Operation |

|

|

||

|

By Destination |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Last Mile Delivery Market research report is 2024-2032.

Amazon.com (United States), USA Couriers (United States), A1 Express Services Inc. (United States), Marble Robot (United States), United Parcel Service, Inc. (United States), Power Link Expedite (United States), Jet Delivery, Inc. (United States), XPO Logistics, Inc. (United States), Savioke (United States), Flirtey (United States), Matternet (United States), Dropoff, Inc. (United States), FedEx (United States), Drone Delivery (Canada), Deutsche Post AG (Germany), DB Schenker (Germany), DPD (Germany), Geodis (France), DSV (Denmark), SF Express (China), BEST Inc (China), YTO Express Group Co. (China), Kerry Logistics Network Limited (Hong Kong), Flytrex (Israel), Aramex (UAE), and Other Major Players.

The Last Mile Delivery Market is segmented into Delivery Mode, Service Type, Industry Verticals, Vehicle Type, Mode of Operation, Destination, and Region. By Delivery Mode the market is categorized into (Same-day delivery, Next-day delivery, Standard delivery, Economy delivery), By Service Type the market is categorized into (Business-to-consumer (B2C), Business-to-business (B2B), Consumer-to-consumer (C2C)), By Industry Verticals the market is categorized into (E-Commerce, Food and grocery, Healthcare, Parcel and courier services, Furniture and appliances, Fashion and apparel), By Vehicle Type the market is categorized into (Motorcycle, LCV, HCV, Drones), By Mode of Operation the market is categorized into (Non-Autonomous, Autonomous), By Destination the market is categorized into (Domestic, International). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The final step of delivery, which involves getting packages from warehouses, factories, or shops to customers, covers various destinations like doorsteps, workplaces, other stores, or local carrier centers.

Last Mile Delivery Market Size Was Valued at USD 145.59 Billion in 2023, and is Projected to Reach USD 318.83 Billion by 2032, Growing at a CAGR of 9.1% From 2024-2032.