Lactate Monitoring Devices Market Synopsis:

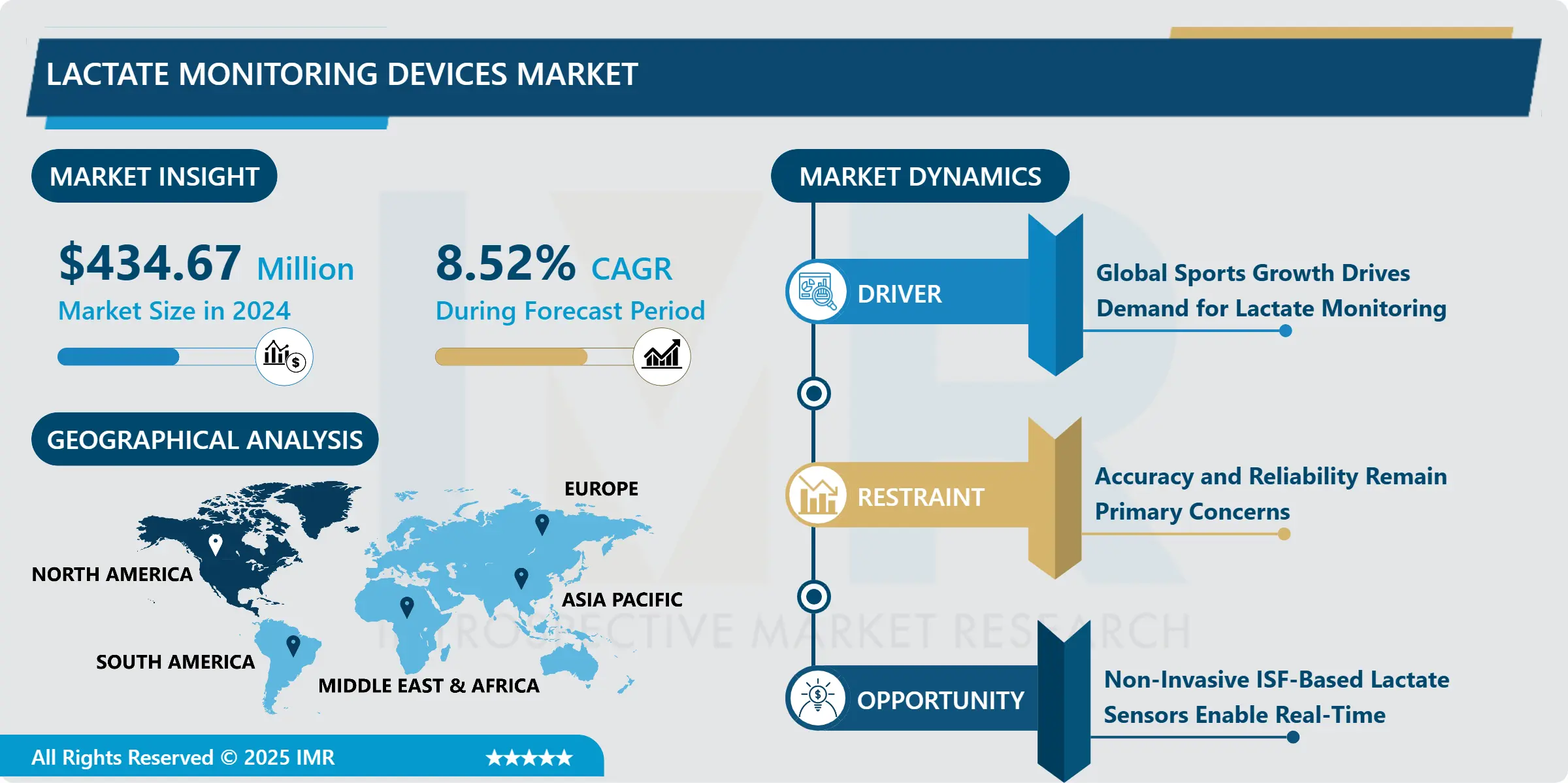

Lactate Monitoring Devices Market Size Was Valued at USD 434.67 Million in 2024 and is Projected to Reach USD 907.29 Million by 2035, Growing at a CAGR of 8.52% From 2025-2035.

A lactate monitor is a wearable sensor that measures lactate concentrations in the body during exercise. This monitor can be implemented in healthcare situations, but this article focuses on the fitness benefits for athletes. Lactate monitors have been around for ages. Athletes prick their finger or earlobe to take a blood sample and analyze it with a lactate strip and a (handheld) lactate monitor. The lactate monitor shows the blood lactate concentration in mmol/L during exercise.

The development of better technological lactate monitoring devices led to user-friendly portable products that increased their market potential. The new generation of devices contains improved algorithms and sensors that deliver significantly accurate lactate level readings inside the body. The enhanced accuracy of lactate monitoring devices serves as a vital tool for both athletes and healthcare professionals who need precise measurements. lactate monitors will revolutionize athletic performance. indeed, have the potential to join fundamental sensors like heart rate monitors and power meters. Contrary to continuous glucose monitors CLMs will be implemented and embraced much faster.

Lactate Monitoring Devices Market Growth and Trend Analysis:

Global Sports Growth Drives Demand for Lactate Monitoring

- Millions worldwide participate in sports such as football, badminton, field hockey, volleyball, basketball, and tennis, driving a growing demand for lactate monitoring devices. The increasing popularity of sports fuels the need for advanced tools to enhance athletic performance and support recovery.

- According to the SportsZtar Survey, Football/Soccer is the most popular sport globally, with 265 million players and over 5 million referees, representing 4% of the world’s population. It is especially popular in Europe, Central and South America, and Africa. Badminton is enjoyed by 220 million people worldwide, particularly in Asia, where it thrives as a popular indoor sport with a low entry barrier. Field hockey, played by 10 outfield players and a goalkeeper, spans over 100 countries across five continents and is more accessible than ice hockey due to its adaptability to warmer climates.

- This data highlights the vast number of individuals engaged in sports globally. With an estimated 3.09 billion potential buyers for lactate monitoring devices, the market is experiencing significant expansion as both professional and amateur athletes increasingly seek data-driven performance enhancement and recovery solutions.

Accuracy and Reliability Remain Primary Concerns

- The widespread implementation of lactate monitoring devices in sports and fitness fields meets various obstacles preventing their general use. The reliability and accuracy of sports monitoring methods stand as primary concerns because non-invasive sweat sensors often face challenges maintaining consistency among individuals and with environmental variables. Lactate monitoring devices face two main challenges standardization and calibration issues since there exists no universal benchmark that causes devices to show variable results and necessitates regular calibration procedures.

Non-Invasive ISF-Based Lactate Sensors Enable Real-Time

- A major opportunity lies in developing non-invasive lactate monitoring using interstitial fluids (ISF), similar to advancements seen in glucose monitoring. ISF-based lactate sensors can extract lactate from skin cells' surrounding fluid, enabling continuous and real-time metabolic tracking with minimal discomfort. Wearable electrochemical biosensors, integrated into patches, smartwatches, and microneedle arrays, provide a promising alternative for seamless lactate detection. These devices enhance user convenience and adherence, offering real-time insights for athletes optimizing training, critically ill patients requiring metabolic monitoring, and individuals with chronic conditions like sepsis or mitochondrial disorders.

Lactate Monitoring Devices Market Segment Analysis:

Lactate Monitoring Devices Market is segmented based on device type, technology, method of measurement, end-users, distribution channel, and region

By Method of Measurement, Non-invasive segment is expected to dominate the market during the forecast period

- The market segment for non-invasive lactate monitoring systems has gained dominance worldwide owing to growing consumer interest in wearable technology with continuous monitoring features. Real-time lactate monitoring became possible through advancements that integrated sweat-based sensors with microfluidics and biosensors and wireless data transmission capabilities better than blood-based measurement methods.

- Non-invasive devices along with physiological parameters such as glucose, pH, and oxygen saturation prove valuable in critical care settings by supporting clinical decision-making. The effectiveness of lactate monitoring is improved by predictive modeling techniques that use embedded machine-learning algorithms within wearable devices.

- These technologies continue to grow mainstream, driving market expansion, and making non-invasive lactate monitoring a fundamental force behind innovation in the worldwide lactate marketplace. The ongoing development of accuracy and affordability in these devices will drive advancements in patient care, enabling preventive action, enhancing customized medical care, and leading to better outcomes.

By End User, Recreational sports held the largest share of 55-65% in the projected period

- Recreational sports dominate the lactate monitoring device market, accounting for 55-65% of its share. Players in team sports like soccer, basketball, and volleyball participate primarily for enjoyment, fitness, and social interaction rather than competition. While the physical demands are lower than in professional settings, monitoring lactate levels helps these athletes optimize their performance, prevent fatigue, and adjust training intensity. This allows them to improve endurance, maintain optimal exertion, and reduce injury risks while enjoying their activities.

- The growing awareness of health benefits, including physical and mental well-being, has led to increased participation in recreational team sports. As more young individuals engage in these activities, the demand for performance-enhancing tools like lactate monitoring devices is rising. These devices offer valuable insights into physiological conditions, helping athletes track their exertion levels, improve recovery, and enhance overall fitness. This shift towards structured training in recreational sports underscores the market's expansion potential.

- With the rise of competitive recreational sports such as marathons and triathlons, athletes are increasingly focused on measuring their physiological metrics. Lactate monitoring devices allow them to track performance, optimize endurance, and prevent fatigue, helping them reach personal milestones like qualifying for elite events. This growing demand for precise performance tracking presents a strong market opportunity, as more recreational athletes seek advanced tools to enhance their training efficiency and overall sporting experience.

Lactate Monitoring Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Given that North America represents the largest share of the global wellness and physical activity spending, with USD 401.3 billion in 2023 and an annual growth rate of 4.2%, it's evident that the region has a strong focus on health and fitness. This region also has the highest per capita expenditure on physical activities, amounting to USD 1,072 in 2023.

- This high level of investment in physical activity is likely to extend to the health tech sector, particularly in areas like lactate monitoring devices, which are key for athletes and individuals focused on optimizing their fitness. As the market for fitness technology, which includes wearables and health tracking devices, grows rapidly (16.6% annual growth from 2019-2023), North America is positioned to continue leading in the adoption and development of advanced fitness monitoring technologies, including lactate monitoring.

- Furthermore, the fitness technology sector in North America has seen consistent recovery and growth, indicating a high demand for health-focused innovations. This trend, combined with the region's emphasis on cutting-edge medical technologies, suggests that North America will dominate the lactate monitoring devices market over the forecast period, contributing significantly to the overall expansion of this sector.

Lactate Monitoring Devices Market Active Players:

- Abbott Laboratories (USA)

- Acon Laboratories (USA)

- ARKRAY, Inc. (Japan)

- Caresyntax (USA)

- Draeger (Germany)

- EKF Diagnostics (UK)

- Eko Devices (USA)

- Glucometer (generic, global)

- HemoCue (Sweden)

- Lactate Plus (USA)

- Medtronic (Ireland)

- Menarini Diagnostics (Italy)

- Nova Biomedical (USA)

- PKvitality (France)

- Roche Diagnostics (Switzerland)

- Sensa Core Medical (USA)

- Siemens Healthineers (Germany)

- TECOM Analytical Systems (USA)

- VivaCheck Biotech (China)

- YSI Life Sciences (USA)

- Other Active Players

Key Industry Developments in the Lactate Monitoring Devices Market:

- In August 2024, EKF Diagnostics Holdings plc, the?AIM-listed global diagnostics business, announced the launch of its new Biosen C-Line, an advanced version of its industry-leading rapid benchtop glucose and lactate analyzer. The new and updated analyzer has been designed to enhance usability with the latest color, touch screen and advanced connectivity, enabling the Biosen C-Line to seamlessly connect with hospital and laboratory IT systems, via EKF Link, to ensure patient results are quickly and securely available to clinicians.

- In January 2023, BOSTON MA 908 Devices Inc., a pioneer of handheld and desktop devices for chemical and biochemical analysis, announced the launch of MAVEN, a device for on-line monitoring and control of glucose and lactate in cell culture and fermentation processes. MAVEN empowers biopharma companies to make timely decisions based on highly sensitive, real-time measurements. Taking measurements as frequently as every two minutes, MAVEN operates without having to manually draw samples out of the bioreactor due to its novel aseptic sampling approach.

|

Lactate Monitoring Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 434.67 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.52 % |

Market Size in 2035: |

USD 907.29 Mn. |

|

Segments Covered: |

By Device Type |

|

|

|

By Technology |

|

||

|

By Method of Measurement |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lactate Monitoring Devices Market by Device Type (2018-2035)

4.1 Lactate Monitoring Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed Lactate Monitoring Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed Lactate Monitoring Devices

Chapter 5: Lactate Monitoring Devices Market by Technology (2018-2035)

5.1 Lactate Monitoring Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Optical and Infrared Spectroscopy Sensor

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electrobiochemical Sensor

Chapter 6: Lactate Monitoring Devices Market by Method of Measurement (2018-2035)

6.1 Lactate Monitoring Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Invasive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-Invasive

Chapter 7: Lactate Monitoring Devices Market by End-User (2018-2035)

7.1 Lactate Monitoring Devices Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Recreational Team Sports Players {Soccer

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Basketball

7.5 Rugby

7.6 Cricket

7.7 Mixed Martial Arts (MMA)

7.8 Pickleball

7.9 Lacrosse

7.10 Others}

7.11 Weekend Individual Warriors {Martial Artists

7.12 Recreational Runners

7.13 Casual Cyclists

7.14 Amateur Swimmers

7.15 Weekend Tennis Players

7.16 Golfers

7.17 Casual Basketball Players

7.18 Amateur Soccer Players

7.19 Weightlifters

7.20 Others}

Chapter 8: Lactate Monitoring Devices Market by Distribution Channel (2018-2035)

8.1 Lactate Monitoring Devices Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Sport Centers

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Centre of Excellence

8.5 Retail Pharmacies

8.6 Sports Equipment Stores

8.7 Online Sales

8.8 Others {Medical Device Distributors

8.9 Specialty Health and Wellness Stores}

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Lactate Monitoring Devices Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ABBOTT LABORATORIES (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ACON LABORATORIES (USA)

9.4 ARKRAY INC. (JAPAN)

9.5 CARESYNTAX (USA)

9.6 DRAEGER (GERMANY)

9.7 EKF DIAGNOSTICS (UK)

9.8 EKO DEVICES (USA)

9.9 GLUCOMETER (GENERIC

9.10 GLOBAL)

9.11 HEMOCUE (SWEDEN)

9.12 LACTATE PLUS (USA)

9.13 MEDTRONIC (IRELAND)

9.14 MENARINI DIAGNOSTICS (ITALY)

9.15 NOVA BIOMEDICAL (USA)

9.16 PKVITALITY (FRANCE)

9.17 ROCHE DIAGNOSTICS (SWITZERLAND)

9.18 SENSA CORE MEDICAL (USA)

9.19 SIEMENS HEALTHINEERS (GERMANY)

9.20 TECOM ANALYTICAL SYSTEMS (USA)

9.21 VIVACHECK BIOTECH (CHINA)

9.22 YSI LIFE SCIENCES (USA)

9.23

Chapter 10: Global Lactate Monitoring Devices Market By Region

10.1 Overview

10.2. North America Lactate Monitoring Devices Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Device Type

10.2.4.1 Processed Lactate Monitoring Devices

10.2.4.2 Unprocessed Lactate Monitoring Devices

10.2.5 Historic and Forecasted Market Size by Technology

10.2.5.1 Optical and Infrared Spectroscopy Sensor

10.2.5.2 Electrobiochemical Sensor

10.2.6 Historic and Forecasted Market Size by Method of Measurement

10.2.6.1 Invasive

10.2.6.2 Non-Invasive

10.2.7 Historic and Forecasted Market Size by End-User

10.2.7.1 Recreational Team Sports Players {Soccer

10.2.7.2 Basketball

10.2.7.3 Rugby

10.2.7.4 Cricket

10.2.7.5 Mixed Martial Arts (MMA)

10.2.7.6 Pickleball

10.2.7.7 Lacrosse

10.2.7.8 Others}

10.2.7.9 Weekend Individual Warriors {Martial Artists

10.2.7.10 Recreational Runners

10.2.7.11 Casual Cyclists

10.2.7.12 Amateur Swimmers

10.2.7.13 Weekend Tennis Players

10.2.7.14 Golfers

10.2.7.15 Casual Basketball Players

10.2.7.16 Amateur Soccer Players

10.2.7.17 Weightlifters

10.2.7.18 Others}

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Sport Centers

10.2.8.2 Centre of Excellence

10.2.8.3 Retail Pharmacies

10.2.8.4 Sports Equipment Stores

10.2.8.5 Online Sales

10.2.8.6 Others {Medical Device Distributors

10.2.8.7 Specialty Health and Wellness Stores}

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Lactate Monitoring Devices Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Device Type

10.3.4.1 Processed Lactate Monitoring Devices

10.3.4.2 Unprocessed Lactate Monitoring Devices

10.3.5 Historic and Forecasted Market Size by Technology

10.3.5.1 Optical and Infrared Spectroscopy Sensor

10.3.5.2 Electrobiochemical Sensor

10.3.6 Historic and Forecasted Market Size by Method of Measurement

10.3.6.1 Invasive

10.3.6.2 Non-Invasive

10.3.7 Historic and Forecasted Market Size by End-User

10.3.7.1 Recreational Team Sports Players {Soccer

10.3.7.2 Basketball

10.3.7.3 Rugby

10.3.7.4 Cricket

10.3.7.5 Mixed Martial Arts (MMA)

10.3.7.6 Pickleball

10.3.7.7 Lacrosse

10.3.7.8 Others}

10.3.7.9 Weekend Individual Warriors {Martial Artists

10.3.7.10 Recreational Runners

10.3.7.11 Casual Cyclists

10.3.7.12 Amateur Swimmers

10.3.7.13 Weekend Tennis Players

10.3.7.14 Golfers

10.3.7.15 Casual Basketball Players

10.3.7.16 Amateur Soccer Players

10.3.7.17 Weightlifters

10.3.7.18 Others}

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Sport Centers

10.3.8.2 Centre of Excellence

10.3.8.3 Retail Pharmacies

10.3.8.4 Sports Equipment Stores

10.3.8.5 Online Sales

10.3.8.6 Others {Medical Device Distributors

10.3.8.7 Specialty Health and Wellness Stores}

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Lactate Monitoring Devices Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Device Type

10.4.4.1 Processed Lactate Monitoring Devices

10.4.4.2 Unprocessed Lactate Monitoring Devices

10.4.5 Historic and Forecasted Market Size by Technology

10.4.5.1 Optical and Infrared Spectroscopy Sensor

10.4.5.2 Electrobiochemical Sensor

10.4.6 Historic and Forecasted Market Size by Method of Measurement

10.4.6.1 Invasive

10.4.6.2 Non-Invasive

10.4.7 Historic and Forecasted Market Size by End-User

10.4.7.1 Recreational Team Sports Players {Soccer

10.4.7.2 Basketball

10.4.7.3 Rugby

10.4.7.4 Cricket

10.4.7.5 Mixed Martial Arts (MMA)

10.4.7.6 Pickleball

10.4.7.7 Lacrosse

10.4.7.8 Others}

10.4.7.9 Weekend Individual Warriors {Martial Artists

10.4.7.10 Recreational Runners

10.4.7.11 Casual Cyclists

10.4.7.12 Amateur Swimmers

10.4.7.13 Weekend Tennis Players

10.4.7.14 Golfers

10.4.7.15 Casual Basketball Players

10.4.7.16 Amateur Soccer Players

10.4.7.17 Weightlifters

10.4.7.18 Others}

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Sport Centers

10.4.8.2 Centre of Excellence

10.4.8.3 Retail Pharmacies

10.4.8.4 Sports Equipment Stores

10.4.8.5 Online Sales

10.4.8.6 Others {Medical Device Distributors

10.4.8.7 Specialty Health and Wellness Stores}

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Lactate Monitoring Devices Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Device Type

10.5.4.1 Processed Lactate Monitoring Devices

10.5.4.2 Unprocessed Lactate Monitoring Devices

10.5.5 Historic and Forecasted Market Size by Technology

10.5.5.1 Optical and Infrared Spectroscopy Sensor

10.5.5.2 Electrobiochemical Sensor

10.5.6 Historic and Forecasted Market Size by Method of Measurement

10.5.6.1 Invasive

10.5.6.2 Non-Invasive

10.5.7 Historic and Forecasted Market Size by End-User

10.5.7.1 Recreational Team Sports Players {Soccer

10.5.7.2 Basketball

10.5.7.3 Rugby

10.5.7.4 Cricket

10.5.7.5 Mixed Martial Arts (MMA)

10.5.7.6 Pickleball

10.5.7.7 Lacrosse

10.5.7.8 Others}

10.5.7.9 Weekend Individual Warriors {Martial Artists

10.5.7.10 Recreational Runners

10.5.7.11 Casual Cyclists

10.5.7.12 Amateur Swimmers

10.5.7.13 Weekend Tennis Players

10.5.7.14 Golfers

10.5.7.15 Casual Basketball Players

10.5.7.16 Amateur Soccer Players

10.5.7.17 Weightlifters

10.5.7.18 Others}

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Sport Centers

10.5.8.2 Centre of Excellence

10.5.8.3 Retail Pharmacies

10.5.8.4 Sports Equipment Stores

10.5.8.5 Online Sales

10.5.8.6 Others {Medical Device Distributors

10.5.8.7 Specialty Health and Wellness Stores}

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Lactate Monitoring Devices Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Device Type

10.6.4.1 Processed Lactate Monitoring Devices

10.6.4.2 Unprocessed Lactate Monitoring Devices

10.6.5 Historic and Forecasted Market Size by Technology

10.6.5.1 Optical and Infrared Spectroscopy Sensor

10.6.5.2 Electrobiochemical Sensor

10.6.6 Historic and Forecasted Market Size by Method of Measurement

10.6.6.1 Invasive

10.6.6.2 Non-Invasive

10.6.7 Historic and Forecasted Market Size by End-User

10.6.7.1 Recreational Team Sports Players {Soccer

10.6.7.2 Basketball

10.6.7.3 Rugby

10.6.7.4 Cricket

10.6.7.5 Mixed Martial Arts (MMA)

10.6.7.6 Pickleball

10.6.7.7 Lacrosse

10.6.7.8 Others}

10.6.7.9 Weekend Individual Warriors {Martial Artists

10.6.7.10 Recreational Runners

10.6.7.11 Casual Cyclists

10.6.7.12 Amateur Swimmers

10.6.7.13 Weekend Tennis Players

10.6.7.14 Golfers

10.6.7.15 Casual Basketball Players

10.6.7.16 Amateur Soccer Players

10.6.7.17 Weightlifters

10.6.7.18 Others}

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Sport Centers

10.6.8.2 Centre of Excellence

10.6.8.3 Retail Pharmacies

10.6.8.4 Sports Equipment Stores

10.6.8.5 Online Sales

10.6.8.6 Others {Medical Device Distributors

10.6.8.7 Specialty Health and Wellness Stores}

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Lactate Monitoring Devices Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Device Type

10.7.4.1 Processed Lactate Monitoring Devices

10.7.4.2 Unprocessed Lactate Monitoring Devices

10.7.5 Historic and Forecasted Market Size by Technology

10.7.5.1 Optical and Infrared Spectroscopy Sensor

10.7.5.2 Electrobiochemical Sensor

10.7.6 Historic and Forecasted Market Size by Method of Measurement

10.7.6.1 Invasive

10.7.6.2 Non-Invasive

10.7.7 Historic and Forecasted Market Size by End-User

10.7.7.1 Recreational Team Sports Players {Soccer

10.7.7.2 Basketball

10.7.7.3 Rugby

10.7.7.4 Cricket

10.7.7.5 Mixed Martial Arts (MMA)

10.7.7.6 Pickleball

10.7.7.7 Lacrosse

10.7.7.8 Others}

10.7.7.9 Weekend Individual Warriors {Martial Artists

10.7.7.10 Recreational Runners

10.7.7.11 Casual Cyclists

10.7.7.12 Amateur Swimmers

10.7.7.13 Weekend Tennis Players

10.7.7.14 Golfers

10.7.7.15 Casual Basketball Players

10.7.7.16 Amateur Soccer Players

10.7.7.17 Weightlifters

10.7.7.18 Others}

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Sport Centers

10.7.8.2 Centre of Excellence

10.7.8.3 Retail Pharmacies

10.7.8.4 Sports Equipment Stores

10.7.8.5 Online Sales

10.7.8.6 Others {Medical Device Distributors

10.7.8.7 Specialty Health and Wellness Stores}

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Lactate Monitoring Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 434.67 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.52 % |

Market Size in 2035: |

USD 907.29 Mn. |

|

Segments Covered: |

By Device Type |

|

|

|

By Technology |

|

||

|

By Method of Measurement |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||