Market Overview of the Global Laboratory Chemicals Market

The Global Market for Laboratory Chemicals Estimated at USD 28838.47 Million In the Year 2022, Is Projected to Reach A Revised Size of USD 40140.31 Million by 2030, Growing at A CAGR of 4.22 % Over the Forecast Period 2022-2030.

Laboratory chemicals are chemicals that are used in laboratory testing and experiments of distinct kinds. Laboratory chemicals include substances of sufficient purity and content to be used in chemical analysis, chemical reactions and testing. Such Chemical reagents may be either organic or inorganic compounds that are generally used for analytical. Laboratory chemical reagents or simple chemicals are responsible for production of more complex chemicals which are further to be used for diagnostic purposes, such as in the preparation of drugs or in laboratory experiments. For instance, Laboratories use a Serial dilution test in analyzing ICP–AES and AA of new and unknown parameters in order to determine if nonlinear physical and chemical interferences might be hiding the analytes.

The vast use of lab chemicals makes it to hold great importance in the field of Chemistry. Chemistry as a whole can be explained as an experimental and practical science that relies heavily on laboratory testing to arrive at experimental conclusions. May it be a student performing simple titration practices or a chemist researching a new medicine, Laboratory chemicals are the primary component need to be used while conducting the experiments. Chemicals are used in laboratories all around the world with the purpose of consummating experimental and investigative procedures in chemistry, biochemistry, cellular biology, and molecular biology. Lab chemicals are wide variety of chemicals include Acids and Bases (Corrosive), Reagents, Adhesives, Solutions, Buffers, Flammable Liquids, Compressed Gases, Oxidizers and many more. These chemicals may vary in concentration, or consistency which eventually depends upon their intended applications.

Market Dynamics and Factors of the Global Laboratory Chemicals Market:

Drivers:

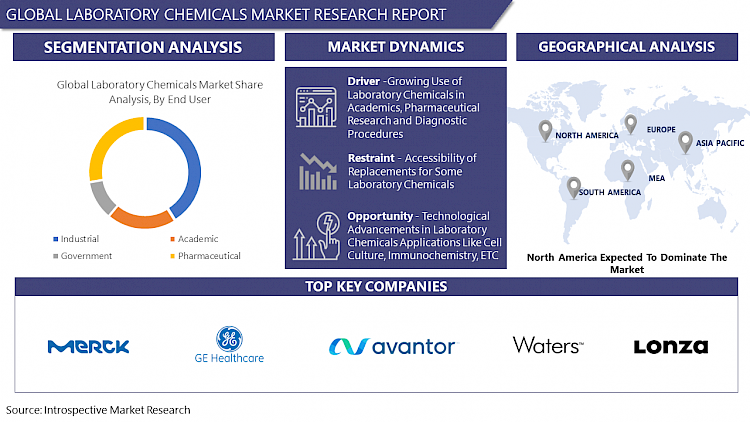

- Growing Use of Laboratory Chemicals in Academics, Pharmaceutical Research and Diagnostic Procedures

Restraints:

- Accessibility of Replacements for Some Laboratory Chemicals

Opportunities:

- Technological Advancements in Laboratory Chemicals Applications Like Cell Culture, Immunochemistry Recombination DNA, Environmental Testing and Others

Regional Analysis Of Laboratory Chemicals Market:

North America covers a majority of share in Global Laboratory Chemicals Market revenue. The major reason behind the dominance of North America in the sales of Laboratory Chemicals is attributed to the newly emerging pharmaceutical research, nucleic acid testing processes, environment testing processes and other inventions wherein Laboratory Chemicals are used.

Furthermore, the North American Countries are home for many Laboratory Chemical producing companies and these countries have been witnessing large scale consumptions both by domestic as well as export means. Other factors such as industrial improvements, improvements in Biochemistry and enhancements in cell and tissue culture technology are going to be the growth driving factors pushing the Laboratory Chemicals Sales even further.

COVID-19 Impact on the Global Laboratory Chemicals Market:

The COVID-19 restrictions like lockdown that were imposed first in 2020 by the government authorities across the globe to prevent the spreading of COVID-19 highly impacted the market sales and distribution by disrupting the functionality of supply chain houses eventually limiting the operations of certain end-users like medicine, industries, acedimiea, pharmaceuticals, etc. The experimental work in these sectors which are done to investigate or to conduct research for new products before their launch and to make improvements in other related products were also at halt due to shutting down of sites, Schools and education Centres, research labs, etc.

The Global Market of Laboratory Chemicals also experienced a downfall in R&D Investments and investments on production activities. The pandemic caused the sudden stop in manufacturing of Lab Chemicals due to availability of less workforce and reinforced lockdowns. Also, the demand for these chemicals were negatively impacted and therefore, the counter reaction of the companies was an evident discontinue in production. For example, United Nations Office on Drugs and Crimes reported that, due to lockdown restrictions, there was reduction in the production of opium medicine in Myanmar due to decrease in its sales. Hence, the decrease in Investments and production due to decrease in demand owning to slower testing and experimental work inhibited the growth of Laboratory Chemicals market during the pandemic.

Top Key Players Covered In the Global Laboratory Chemicals Market:

- Merck Group (Germany)

- Waters Corp (USA)

- Toronto Research Chemicals, Inc (Canada)

- FUJIFILM Wako Chemicals (USA)

- Avantor, Inc(USA)

- Lonza (Switzerland)

- Argus Chemicals (China)

- Beckman Coulter (USA)

- GE Healthcare (USA)

- Honeywell International(USA)

- CSC Scientific Company, Inc. (USA)

- Thomas Scientific (USA)

- Molecular BioProducts Inc (USA)

- Cole-Parmer (USA)

- Spectrum Chemical Mfg. Corp. (USA)

- GFS Chemicals, Inc (USA) and Other Key Players

Key Industry Developments in the Global Laboratory Chemicals Market:

- In February 2023, Thermo Fisher Scientific, a leading life sciences company, acquired PeproTech, a prominent developer and manufacturer of recombinant proteins and antibodies, for $1.35 billion. This acquisition strengthens Thermo Fisher's protein portfolio and expands its reach in the biologics research market.

- In April 2023, Avantor, a global provider of high-performance materials and laboratory equipment, partnered with Brookfield Business Partners to form a new joint venture focused on the specialty chemicals market. The joint venture, valued at $6 billion, will combine Avantor's expertise in specialty chemicals with Brookfield's financial resources and operational capabilities.

|

Global Laboratory Chemicals Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 28838.47 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.22% |

Market Size in 2030: |

USD 40140.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Laboratory Chemicals Market by Type

5.1 Laboratory Chemicals Market Overview Snapshot and Growth Engine

5.2 Laboratory Chemicals Market Overview

5.3 Acids & Bases

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Acids & Bases: Geographic Segmentation

5.4 Reagents

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Reagents: Geographic Segmentation

5.5 Solvents

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Solvents: Geographic Segmentation

5.6 Compressed Gas

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Compressed Gas: Geographic Segmentation

5.7 Flammable Liquids

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Flammable Liquids: Geographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation

Chapter 6: Laboratory Chemicals Market by Application

6.1 Laboratory Chemicals Market Overview Snapshot and Growth Engine

6.2 Laboratory Chemicals Market Overview

6.3 Biochemistry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Biochemistry: Geographic Segmentation

6.4 Cellular Biology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cellular Biology: Geographic Segmentation

6.5 Molecular Biology

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Molecular Biology: Geographic Segmentation

Chapter 7: Laboratory Chemicals Market by End User

7.1 Laboratory Chemicals Market Overview Snapshot and Growth Engine

7.2 Laboratory Chemicals Market Overview

7.3 Industrial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Industrial: Geographic Segmentation

7.4 Academic

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Academic: Geographic Segmentation

7.5 Government

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Government: Geographic Segmentation

7.6 Pharmaceutical

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Pharmaceutical : Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Laboratory Chemicals Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Laboratory Chemicals Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Laboratory Chemicals Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 MERCK GROUP (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 WATERS CORP (USA)

8.4 TORONTO RESEARCH CHEMICALS INC (CANADA)

8.5 FUJIFILM WAKO CHEMICALS (USA)

8.6 AVANTOR INC (USA)

8.7 LONZA (SWITZERLAND)

8.8 ARGUS CHEMICALS (CHINA)

8.9 BECKMAN COULTER (USA)

8.10 GE HEALTHCARE (USA)

8.11 HONEYWELL INTERNATIONAL (USA)

8.12 CSC SCIENTIFIC COMPANY INC. (USA)

8.13 THOMAS SCIENTIFIC (USA)

8.14 MOLECULAR BIOPRODUCTS INC (USA)

8.15 COLE-PARMER (USA)

8.16 SPECTRUM CHEMICAL MFG. CORP. (USA)

8.17 GFS CHEMICALS INC (USA)

8.18 OTHER MAJOR PLAYERS

Chapter 9: Global Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Acids & Bases

9.2.2 Reagents

9.2.3 Solvents

9.2.4 Compressed Gas

9.2.5 Flammable Liquids

9.2.6 Others

9.3 Historic and Forecasted Market Size By Application

9.3.1 Biochemistry

9.3.2 Cellular Biology

9.3.3 Molecular Biology

9.4 Historic and Forecasted Market Size By End User

9.4.1 Industrial

9.4.2 Academic

9.4.3 Government

9.4.4 Pharmaceutical

Chapter 10: North America Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Acids & Bases

10.4.2 Reagents

10.4.3 Solvents

10.4.4 Compressed Gas

10.4.5 Flammable Liquids

10.4.6 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Biochemistry

10.5.2 Cellular Biology

10.5.3 Molecular Biology

10.6 Historic and Forecasted Market Size By End User

10.6.1 Industrial

10.6.2 Academic

10.6.3 Government

10.6.4 Pharmaceutical

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Acids & Bases

11.4.2 Reagents

11.4.3 Solvents

11.4.4 Compressed Gas

11.4.5 Flammable Liquids

11.4.6 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Biochemistry

11.5.2 Cellular Biology

11.5.3 Molecular Biology

11.6 Historic and Forecasted Market Size By End User

11.6.1 Industrial

11.6.2 Academic

11.6.3 Government

11.6.4 Pharmaceutical

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Acids & Bases

12.4.2 Reagents

12.4.3 Solvents

12.4.4 Compressed Gas

12.4.5 Flammable Liquids

12.4.6 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Biochemistry

12.5.2 Cellular Biology

12.5.3 Molecular Biology

12.6 Historic and Forecasted Market Size By End User

12.6.1 Industrial

12.6.2 Academic

12.6.3 Government

12.6.4 Pharmaceutical

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Acids & Bases

13.4.2 Reagents

13.4.3 Solvents

13.4.4 Compressed Gas

13.4.5 Flammable Liquids

13.4.6 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Biochemistry

13.5.2 Cellular Biology

13.5.3 Molecular Biology

13.6 Historic and Forecasted Market Size By End User

13.6.1 Industrial

13.6.2 Academic

13.6.3 Government

13.6.4 Pharmaceutical

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Laboratory Chemicals Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Acids & Bases

14.4.2 Reagents

14.4.3 Solvents

14.4.4 Compressed Gas

14.4.5 Flammable Liquids

14.4.6 Others

14.5 Historic and Forecasted Market Size By Application

14.5.1 Biochemistry

14.5.2 Cellular Biology

14.5.3 Molecular Biology

14.6 Historic and Forecasted Market Size By End User

14.6.1 Industrial

14.6.2 Academic

14.6.3 Government

14.6.4 Pharmaceutical

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Laboratory Chemicals Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 28838.47 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.22% |

Market Size in 2030: |

USD 40140.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LABORATORY CHEMICALS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LABORATORY CHEMICALS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LABORATORY CHEMICALS MARKET COMPETITIVE RIVALRY

TABLE 005. LABORATORY CHEMICALS MARKET THREAT OF NEW ENTRANTS

TABLE 006. LABORATORY CHEMICALS MARKET THREAT OF SUBSTITUTES

TABLE 007. LABORATORY CHEMICALS MARKET BY TYPE

TABLE 008. ACIDS & BASES MARKET OVERVIEW (2016-2028)

TABLE 009. REAGENTS MARKET OVERVIEW (2016-2028)

TABLE 010. SOLVENTS MARKET OVERVIEW (2016-2028)

TABLE 011. COMPRESSED GAS MARKET OVERVIEW (2016-2028)

TABLE 012. FLAMMABLE LIQUIDS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. LABORATORY CHEMICALS MARKET BY APPLICATION

TABLE 015. BIOCHEMISTRY MARKET OVERVIEW (2016-2028)

TABLE 016. CELLULAR BIOLOGY MARKET OVERVIEW (2016-2028)

TABLE 017. MOLECULAR BIOLOGY MARKET OVERVIEW (2016-2028)

TABLE 018. LABORATORY CHEMICALS MARKET BY END USER

TABLE 019. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 020. ACADEMIC MARKET OVERVIEW (2016-2028)

TABLE 021. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 022. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA LABORATORY CHEMICALS MARKET, BY TYPE (2016-2028)

TABLE 024. NORTH AMERICA LABORATORY CHEMICALS MARKET, BY APPLICATION (2016-2028)

TABLE 025. NORTH AMERICA LABORATORY CHEMICALS MARKET, BY END USER (2016-2028)

TABLE 026. N LABORATORY CHEMICALS MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE LABORATORY CHEMICALS MARKET, BY TYPE (2016-2028)

TABLE 028. EUROPE LABORATORY CHEMICALS MARKET, BY APPLICATION (2016-2028)

TABLE 029. EUROPE LABORATORY CHEMICALS MARKET, BY END USER (2016-2028)

TABLE 030. LABORATORY CHEMICALS MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC LABORATORY CHEMICALS MARKET, BY TYPE (2016-2028)

TABLE 032. ASIA PACIFIC LABORATORY CHEMICALS MARKET, BY APPLICATION (2016-2028)

TABLE 033. ASIA PACIFIC LABORATORY CHEMICALS MARKET, BY END USER (2016-2028)

TABLE 034. LABORATORY CHEMICALS MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA LABORATORY CHEMICALS MARKET, BY TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA LABORATORY CHEMICALS MARKET, BY APPLICATION (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA LABORATORY CHEMICALS MARKET, BY END USER (2016-2028)

TABLE 038. LABORATORY CHEMICALS MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA LABORATORY CHEMICALS MARKET, BY TYPE (2016-2028)

TABLE 040. SOUTH AMERICA LABORATORY CHEMICALS MARKET, BY APPLICATION (2016-2028)

TABLE 041. SOUTH AMERICA LABORATORY CHEMICALS MARKET, BY END USER (2016-2028)

TABLE 042. LABORATORY CHEMICALS MARKET, BY COUNTRY (2016-2028)

TABLE 043. MERCK GROUP (GERMANY): SNAPSHOT

TABLE 044. MERCK GROUP (GERMANY): BUSINESS PERFORMANCE

TABLE 045. MERCK GROUP (GERMANY): PRODUCT PORTFOLIO

TABLE 046. MERCK GROUP (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. WATERS CORP (USA): SNAPSHOT

TABLE 047. WATERS CORP (USA): BUSINESS PERFORMANCE

TABLE 048. WATERS CORP (USA): PRODUCT PORTFOLIO

TABLE 049. WATERS CORP (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. TORONTO RESEARCH CHEMICALS INC (CANADA): SNAPSHOT

TABLE 050. TORONTO RESEARCH CHEMICALS INC (CANADA): BUSINESS PERFORMANCE

TABLE 051. TORONTO RESEARCH CHEMICALS INC (CANADA): PRODUCT PORTFOLIO

TABLE 052. TORONTO RESEARCH CHEMICALS INC (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. FUJIFILM WAKO CHEMICALS (USA): SNAPSHOT

TABLE 053. FUJIFILM WAKO CHEMICALS (USA): BUSINESS PERFORMANCE

TABLE 054. FUJIFILM WAKO CHEMICALS (USA): PRODUCT PORTFOLIO

TABLE 055. FUJIFILM WAKO CHEMICALS (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. AVANTOR INC (USA): SNAPSHOT

TABLE 056. AVANTOR INC (USA): BUSINESS PERFORMANCE

TABLE 057. AVANTOR INC (USA): PRODUCT PORTFOLIO

TABLE 058. AVANTOR INC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LONZA (SWITZERLAND): SNAPSHOT

TABLE 059. LONZA (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 060. LONZA (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 061. LONZA (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ARGUS CHEMICALS (CHINA): SNAPSHOT

TABLE 062. ARGUS CHEMICALS (CHINA): BUSINESS PERFORMANCE

TABLE 063. ARGUS CHEMICALS (CHINA): PRODUCT PORTFOLIO

TABLE 064. ARGUS CHEMICALS (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BECKMAN COULTER (USA): SNAPSHOT

TABLE 065. BECKMAN COULTER (USA): BUSINESS PERFORMANCE

TABLE 066. BECKMAN COULTER (USA): PRODUCT PORTFOLIO

TABLE 067. BECKMAN COULTER (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. GE HEALTHCARE (USA): SNAPSHOT

TABLE 068. GE HEALTHCARE (USA): BUSINESS PERFORMANCE

TABLE 069. GE HEALTHCARE (USA): PRODUCT PORTFOLIO

TABLE 070. GE HEALTHCARE (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. HONEYWELL INTERNATIONAL (USA): SNAPSHOT

TABLE 071. HONEYWELL INTERNATIONAL (USA): BUSINESS PERFORMANCE

TABLE 072. HONEYWELL INTERNATIONAL (USA): PRODUCT PORTFOLIO

TABLE 073. HONEYWELL INTERNATIONAL (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CSC SCIENTIFIC COMPANY INC. (USA): SNAPSHOT

TABLE 074. CSC SCIENTIFIC COMPANY INC. (USA): BUSINESS PERFORMANCE

TABLE 075. CSC SCIENTIFIC COMPANY INC. (USA): PRODUCT PORTFOLIO

TABLE 076. CSC SCIENTIFIC COMPANY INC. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. THOMAS SCIENTIFIC (USA): SNAPSHOT

TABLE 077. THOMAS SCIENTIFIC (USA): BUSINESS PERFORMANCE

TABLE 078. THOMAS SCIENTIFIC (USA): PRODUCT PORTFOLIO

TABLE 079. THOMAS SCIENTIFIC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. MOLECULAR BIOPRODUCTS INC (USA): SNAPSHOT

TABLE 080. MOLECULAR BIOPRODUCTS INC (USA): BUSINESS PERFORMANCE

TABLE 081. MOLECULAR BIOPRODUCTS INC (USA): PRODUCT PORTFOLIO

TABLE 082. MOLECULAR BIOPRODUCTS INC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. COLE-PARMER (USA): SNAPSHOT

TABLE 083. COLE-PARMER (USA): BUSINESS PERFORMANCE

TABLE 084. COLE-PARMER (USA): PRODUCT PORTFOLIO

TABLE 085. COLE-PARMER (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SPECTRUM CHEMICAL MFG. CORP. (USA): SNAPSHOT

TABLE 086. SPECTRUM CHEMICAL MFG. CORP. (USA): BUSINESS PERFORMANCE

TABLE 087. SPECTRUM CHEMICAL MFG. CORP. (USA): PRODUCT PORTFOLIO

TABLE 088. SPECTRUM CHEMICAL MFG. CORP. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. GFS CHEMICALS INC (USA): SNAPSHOT

TABLE 089. GFS CHEMICALS INC (USA): BUSINESS PERFORMANCE

TABLE 090. GFS CHEMICALS INC (USA): PRODUCT PORTFOLIO

TABLE 091. GFS CHEMICALS INC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LABORATORY CHEMICALS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LABORATORY CHEMICALS MARKET OVERVIEW BY TYPE

FIGURE 012. ACIDS & BASES MARKET OVERVIEW (2016-2028)

FIGURE 013. REAGENTS MARKET OVERVIEW (2016-2028)

FIGURE 014. SOLVENTS MARKET OVERVIEW (2016-2028)

FIGURE 015. COMPRESSED GAS MARKET OVERVIEW (2016-2028)

FIGURE 016. FLAMMABLE LIQUIDS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. LABORATORY CHEMICALS MARKET OVERVIEW BY APPLICATION

FIGURE 019. BIOCHEMISTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. CELLULAR BIOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 021. MOLECULAR BIOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 022. LABORATORY CHEMICALS MARKET OVERVIEW BY END USER

FIGURE 023. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 024. ACADEMIC MARKET OVERVIEW (2016-2028)

FIGURE 025. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 026. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA LABORATORY CHEMICALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE LABORATORY CHEMICALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC LABORATORY CHEMICALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA LABORATORY CHEMICALS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA LABORATORY CHEMICALS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Laboratory Chemicals Market research report is 2022-2028.

Merck Group (Germany), Waters Corp (USA), Toronto Research Chemicals, Inc (Canada), FUJIFILM Wako Chemicals (USA), Avantor, Inc (USA), Lonza (Switzerland), Argus Chemicals (China), Beckman Coulter (USA), GE Healthcare (USA), Honeywell International (USA), CSC Scientific Company, Inc. (USA), Thomas Scientific (USA), Molecular BioProducts Inc (USA), Cole-Parmer (USA), Spectrum Chemical Mfg. Corp. (USA), GFS Chemicals, Inc (USA) and Other Key Players.

The Global Laboratory Chemicals Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Acids and Bases, Reagents, Solvents, Compressed Gas, Flammable Liquids and Others. By Application, the market is categorized Biochemistry, Cellular Biology and Molecular Biology, By End User, the market is categorized Industrial, Academic, Government and Pharmaceutical. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Laboratory chemicals are chemicals that are used in laboratory testing and experiments of distinct kinds. Laboratory chemicals include substances of sufficient purity and content to be used in chemical analysis, chemical reactions and testing. Such Chemical reagents may be either organic or inorganic compounds that are generally used for analytical. Laboratory chemical reagents or simple chemicals are responsible for production of more complex chemicals which are further to be used for diagnostic purposes, such as in the preparation of drugs or in laboratory experiments.

The Global Market for Laboratory Chemicals Estimated at USD 28838.47 Million In the Year 2022, Is Projected to Reach A Revised Size of USD 40140.31 Million by 2030, Growing at A CAGR of 4.22 % Over the Forecast Period 2022-2030.