Ketones Market Synopsis

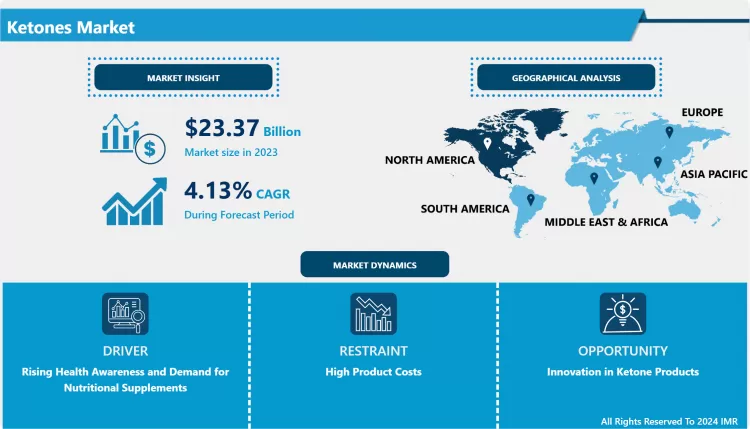

Ketones Market Size Was Valued at USD 23.37 Billion in 2023, and is Projected to Reach USD 33.64 Billion by 2032, Growing at a CAGR of 4.13% From 2024-2032.

Ketone is a functional group formed by RC(=O)R ‘, where R and R ‘ are different types of carbon. Let us discuss some of the main compounds which contain the carbonyl group: ketones and aldehydes. Ketones in general are not very complex because they contain no other functional groups such as -Cl or -OH to the carbonyl group; and they are mostly simple compounds. The most common examples of ketones are chemical solvents namely acetone and sugar (ketos). Some methods of ketones processing have been brought to the industry-oriented educational laboratories and in some extent produced by organisms. The related consumption, health consciousness, convenience food to enhance the functionality of ketones in the Ketones industry are expected to rise.

- In addition, the demand for the global ketones market has raised considerably because people pay more attention to their health and fitness these days especially in developed nations of North America and Europe. B ketones, which are related to energy metabolism and weight loss, are widely incorporated into functional foods, dietary supplements and sports nutrition. As more and more consumers turn to the ketogenic diet which focuses on high uptake of fats and low uptake of carbs to favour the state of ketosis, demand for ketone based products has increased. Furthermore, it can be noted that the constant demand from athletes and the active popularization of new slimming products in the form of ketone preparations are also expanding the market.

- Some other factors that affect the market trends include technological enhancements in ketone production and increasing popularity of sustainability among niche nutrition market segments. It must be noted that the manufacturers are working on increased product differentiation, and numerous ketone ester as well as salts are being developed to meet the market needs. Since the growth holds a secure place in the market, some barriers like high costs linked with products and low consciousness in the developing countries may affect its growth. Still, expanding research and development expenditures coupled with the expanded use of ketones in treatment of neurological disorders offer the potential for future market expansion. All in all, the future seems to hold a good level of growth for the ketones market, due to changing customer bases and improvement of products on the market.

Ketones Market Trend Analysis

Rising Popularity of Ketone Supplements Driven by Health and Fitness Trends

- The awareness of healthy living and weight loss/management has seen consumers flock to look for ketone supplements. These products are geared towards promoting ketosis and increasing energy that has become part of the regular dietary programs of people including sportsmen and anyone on a ketogenic diet. Ketones help the body to metabolize fat faster and thus those who need to shed some weight and improve their metabolism turn to ketones. Increased consumption of health-products, coupled with the consumption of low-carbohydrate diets is increasing the demand for the ketones market.

- Furthermore, ketones are quickly becoming popular in the sports nutrition market as athletes use them to boost stamina time, recovery time and performance. Given that ketones do not cause a surge to blood sugars levels as carbohydrates do but provide a steady energy supply to the muscles, they have become the supplement of choice for athletes that desire to maximize their functions. Further, an increase in the conscious use of ketones to boost cognitive function, burn fats, and improve metabolic rates will create more demands pushing ketones as a strategic player in the total health and wellness market.

Expanding Pharmaceutical and Cosmetic Applications Drive Ketones Market Growth

- The pharmaceutical industry has recently on a regular basis identified ketones as prospective molecules to influence neurological state and disorder including Alzheimer’s disease and epilepsy. Research has indicated that ketones can be used to bring an additional energy supply to the brain, of so much importance especially in neurodegenerative disorders characterized by a decline in glucose oxidation. They have derived new market impetus from the emerging literature, which is finding applications for ketone-based body treatments for mind control and diseases. Since more clinical trials provide evidence of effective performance for ketone bodies in drug production, the application of ketones as the main component of the finished product is gradually increasing, which stimulates the development of the market.

- Aside from being used in health related products, ketones are slowly gaining ground in the cosmetics and personal care products sectors. They described about using its anti-aging and skin nourishing characteristic in skincare products where it assists in firming, moisturizing and revitalizing the skin. This multifunctional appeal is extending the market for ketones because manufacturers are using them in goods aimed at fulfilling a range of consumer requirements. The ketones market continues to develop as research and development progresses in various industries such as pharmaceuticals and personal care, and expansion of its application fields firmly establishes its market.

Ketones Market Segment Analysis:

Ketones Market Segmented based on By Application,By Supplement Type and By Form.

By Application, food & beverages segment is expected to dominate the market during the forecast period

- The food and beverages segment is the most creditworthy for the development of the ketones market, while its growth is mainly due to the increase in the consumption of ketogenic diets and low carbohydrate nutrients. Demand for the exogenous ketones can be attributed to a growing interest seeking ways through which consumer can raise energy levels, lose weight and maintain good metabolism. Consequently, various products that can be consumed if you are administering keto, keto snack foods, keto meal replacement products, and ketone-fortified beverages, among others, are rising in popularity among health enthusiasts. This shift is supported more by the increasing need for the development of new forms, including ketone drinks in a shaker, bread containing ketone ethers or Ketone Boosting Powder. It’s [PepsiCo]’s way of fulfilling the needs of new consumers who are in the keto phase – ready products that they can purchase which can easily fit in their diet plan.

- In addition, increase in the consciousness about wellness and ketones, along with consumer inclination towards clean and natural products is other drivers that contribute to the segment’s growth. More and more, brands take steps to disclose the list of ingredients they use and the methods they employ in the sourcing, processing and production of their products, to cater to the growing market for foods with improved nutritional values and shorter supply-chain footprints. This approach also serves to improve the attractiveness of the products containing ketones in food and beverages as well as boost the tendency to choose and try out other products. The scholarly nature of advance within this area, along with the changing consumer base towards healthy and nutritional products, is likely to fuel the growth of food and beverages segment of ketones market even further in future years.

By Form, Solid segment held the largest share in 2023

- People looking for exogenous ketones have found ketone salts to be the most popular products in the ketones market. These are made combining beta-hydroxybutyrate (BHB) an electrolyte mineral with either sodium, potassium, or calcium. A major argument made for ketone salts is that they raise blood ketone concentrations quite rapidly and thus give users quick energy and mental boosts while not necessitating the careful compliance with a ketogenic diet. This characteristic makes them especially attractive to such clients as athletes and clubs’ trainees, who look for means to enhance the outcome of training sessions through the use of performance-boosting products. Normally in the form of powdered mixtures, ketone salts can be easily dissolved in drinks or shakes to conform to active life’s busy consumer diets.

- With the discovery of the effects of ketone salts, there will be more prospects of using the product since the health benefits of ketone salts and other products made from it will increase. They also know how most of these supplements can improve physical and mental performance, thus the boost in demand. Thus, ketone salts as applicable across various uses and creating an environment of energy and enhanced cognition are a valuable segment in the overall ketones market. Due to the continuous studies and advancements in the relations to ketone salts, they may become even more featured ketone body that people who are seeking to enhance their dietary supplements for boosting up their health and performance.

Ketones Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- One of the most important ketones markets is NA, which can be explained by growing trends towards using keto-diet, primarily in the US. Cautious consumers are moving towards products with low carbohydrates, high fats to assist in weight loss, training and general wellbeing. Such a trend has been boosted by the increasing rates of the lifestyle diseases’ such as obesity and diabetes boosting the market of exogenous ketones used in dietary supplements and functional food products. Another factor contributed by social networking and word of mouth endorsement from health gurus, the ketone-based diets such as the ketogenic diet has also increased consumer uptake of these products.

- Other factors that have been leverages for huge demand in North America include the dietary trend and a robust industrial strength in pharma and F&B segment. There are increasing volumes of Ketones demanded in pharmaceutical industry for its application in treatment of neurological disorders including Alzheimer’s and epilepsy. Also, ketones are being infused into ‘energy’ foods and beverages by the food and beverages industry and targeted to fit and continuously exercising people who want to improve their health. As such, North America remains as a profitable market for the ketones market with the U.S being most innovative and advanced with distribution channels in place and rising consumer disposable income.

Active Key Players in the Ketones Market

- Stern Industries Inc.

- Prototype & Plastic Mold Company, Inc

- Parkway Products, LLC.

- Tri-Mack Plastics Manufacturing Corporation.

- Caledonian Industries Ltd.

- Victrex plc.

- MCAM Surlon India Ltd.

- Darter Plastics Inc.

- Panjin Zhongrun High Performance Polymers Co. Ltd

- Zyex Ltd.

- Other Key Players

|

Global Ketones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.37 Bn. |

|

Forecast Period 2023-34 CAGR: |

4.13% |

Market Size in 2032: |

USD 33.64 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Supplement Type |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ketones Market by Application (2018-2032)

4.1 Ketones Market Snapshot and Growth Engine

4.2 Market Overview

4.3 food & beverages

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 cosmetics & personal care products

Chapter 5: Ketones Market by Supplement Type (2018-2032)

5.1 Ketones Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ketone Salts

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ketone Esters

5.5 Ketone Oils

5.6 Raspberry Ketones

Chapter 6: Ketones Market by Form (2018-2032)

6.1 Ketones Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Solid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

6.5 Semi-liquid

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ketones Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 STERN INDUSTRIES INCPROTOTYPE & PLASTIC MOLD COMPANY INC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PARKWAY PRODUCTS

7.4 LLCTRI-MACK PLASTICS MANUFACTURING CORPORATIONCALEDONIAN INDUSTRIES LTDVICTREX PLCMCAM SURLON INDIA LTDDARTER PLASTICS INCPANJIN ZHONGRUN HIGH PERFORMANCE POLYMERS CO. LTD

7.5 ZYEX LTDOTHER KEY PLAYERS

7.6

Chapter 8: Global Ketones Market By Region

8.1 Overview

8.2. North America Ketones Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Application

8.2.4.1 food & beverages

8.2.4.2 cosmetics & personal care products

8.2.5 Historic and Forecasted Market Size by Supplement Type

8.2.5.1 Ketone Salts

8.2.5.2 Ketone Esters

8.2.5.3 Ketone Oils

8.2.5.4 Raspberry Ketones

8.2.6 Historic and Forecasted Market Size by Form

8.2.6.1 Solid

8.2.6.2 Liquid

8.2.6.3 Semi-liquid

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ketones Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Application

8.3.4.1 food & beverages

8.3.4.2 cosmetics & personal care products

8.3.5 Historic and Forecasted Market Size by Supplement Type

8.3.5.1 Ketone Salts

8.3.5.2 Ketone Esters

8.3.5.3 Ketone Oils

8.3.5.4 Raspberry Ketones

8.3.6 Historic and Forecasted Market Size by Form

8.3.6.1 Solid

8.3.6.2 Liquid

8.3.6.3 Semi-liquid

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ketones Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Application

8.4.4.1 food & beverages

8.4.4.2 cosmetics & personal care products

8.4.5 Historic and Forecasted Market Size by Supplement Type

8.4.5.1 Ketone Salts

8.4.5.2 Ketone Esters

8.4.5.3 Ketone Oils

8.4.5.4 Raspberry Ketones

8.4.6 Historic and Forecasted Market Size by Form

8.4.6.1 Solid

8.4.6.2 Liquid

8.4.6.3 Semi-liquid

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ketones Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Application

8.5.4.1 food & beverages

8.5.4.2 cosmetics & personal care products

8.5.5 Historic and Forecasted Market Size by Supplement Type

8.5.5.1 Ketone Salts

8.5.5.2 Ketone Esters

8.5.5.3 Ketone Oils

8.5.5.4 Raspberry Ketones

8.5.6 Historic and Forecasted Market Size by Form

8.5.6.1 Solid

8.5.6.2 Liquid

8.5.6.3 Semi-liquid

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ketones Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Application

8.6.4.1 food & beverages

8.6.4.2 cosmetics & personal care products

8.6.5 Historic and Forecasted Market Size by Supplement Type

8.6.5.1 Ketone Salts

8.6.5.2 Ketone Esters

8.6.5.3 Ketone Oils

8.6.5.4 Raspberry Ketones

8.6.6 Historic and Forecasted Market Size by Form

8.6.6.1 Solid

8.6.6.2 Liquid

8.6.6.3 Semi-liquid

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ketones Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Application

8.7.4.1 food & beverages

8.7.4.2 cosmetics & personal care products

8.7.5 Historic and Forecasted Market Size by Supplement Type

8.7.5.1 Ketone Salts

8.7.5.2 Ketone Esters

8.7.5.3 Ketone Oils

8.7.5.4 Raspberry Ketones

8.7.6 Historic and Forecasted Market Size by Form

8.7.6.1 Solid

8.7.6.2 Liquid

8.7.6.3 Semi-liquid

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Ketones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.37 Bn. |

|

Forecast Period 2023-34 CAGR: |

4.13% |

Market Size in 2032: |

USD 33.64 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Supplement Type |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

Stern Industries Inc., Prototype & Plastic Mold Company, Inc, Parkway Products, LLC., Tri-Mack Plastics Manufacturing Corporation., Caledonian Industries Ltd., Victrex plc., MCAM Surlon India Ltd. , Darter Plastics Inc., Panjin Zhongrun High Performance Polymers Co. Ltd, Zyex Ltd., and among others

The Ketones Market is segmented into By Application,By Supplement Type, By Form and region. By Application, the market is categorized into Food & Beverages and Cosmetics & Personal Care Products.By Supplement types, the market is categorized into Ketone Salts, Ketone Esters, Ketone Oils and Raspberry Ketones.By Form, the market is categorized into Solid, Liquid and Semi-Liquid.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ketone is a functional group that can be represented as RC(=O)R ‘, and the letters R and R ‘represent several types of carbon. There are many examples of compounds containing the carbonyl group; ketones and aldehydes for example. Ketones are usually non complex since they do not have reactive group such as -OH or -CL which normally are simple compounds with the carbonyl group. The most used ketone solvent is the chemical solvents acetone and sugar (ketos). Different methods for the processing of ketones have been presented to the industrial level laboratory companies and in some extent synthesized by organisms. The Ketones industry should rise its consumption, health concern levels, and convenience food to heighten the versatility of ketones

Ketones Market Size Was Valued at USD 23.37 Billion in 2023, and is Projected to Reach USD 33.64 Billion by 2032, Growing at a CAGR of 4.13% From 2024-2032.