IoT for Finance Market Synopsis

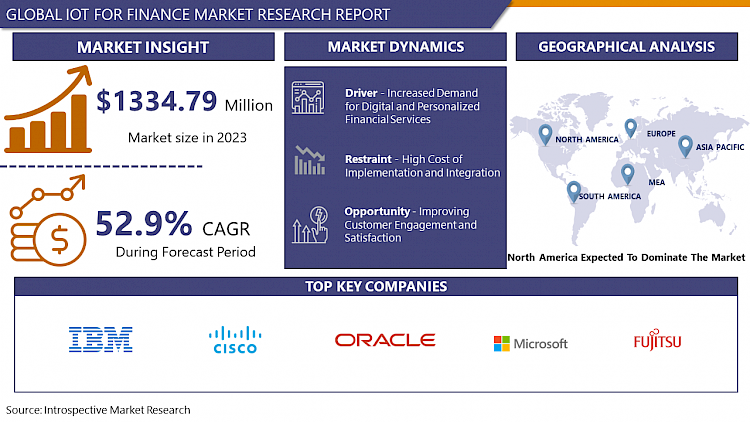

The IoT for Finance Market Size Was Valued at USD 1334.79 Million in 2023 and is Projected to Reach USD 11391.05 Million by 2032, Growing at a CAGR of 52.9% From 2024-2032.

IoT revolutionizes financial operations by seamlessly integrating devices for real-time data gathering, transmission, and analysis. It boosts efficiency across transactions, risk management, and customer service via interconnected sensors, smart devices, and analytics platforms. This transformative technology simplifies workflows, enhances decision-making, and fortifies security in financial operations.

- IoT is pivotal in revolutionizing traditional finance processes, with its application spanning various domains. One critical function is transaction monitoring, wherein IoT devices analyze financial transactions in real time to identify anomalies and potential fraud, bolstering security measures. Asset tracking is another vital area, with IoT sensors monitoring the whereabouts and status of physical assets like inventory and equipment, thereby optimizing resource allocation and reducing operational expenses.

- Improved data collection and analysis capabilities facilitate better risk assessment and decision-making processes. Additionally, automating routine tasks such as inventory management and payment processing streamlines operations, enhancing overall efficiency. This leads to cost reductions and a competitive advantage for financial institutions.

- There is an anticipated surge in demand for IoT solutions in finance as businesses increasingly embrace digital transformation initiatives. With the proliferation of connected devices and advancements in data analytics and artificial intelligence, IoT is poised to continue playing a central role in reshaping the financial landscape, fostering innovation, and delivering value to both businesses and consumers.

IoT for Finance Market Trend Analysis

Increased Demand for Digital and Personalized Financial Services

- The growing desire for digital and personalized financial services is a significant catalyst propelling the expansion of IoT in finance. Financial institutions are leveraging IoT technology to cater to the changing preferences of consumers who demand seamless, convenient, and customized experiences. Actively monitoring consumer behavior through IoT devices enables the provision of personalized financial advice, products, and services in real-time, fostering customer satisfaction and loyalty.

- IoT facilitates the integration of financial services into everyday devices like smartphones, wearables, and smart home appliances, creating a connected ecosystem that enhances accessibility and convenience for users. For instance, IoT-enabled payment systems enable secure and hassle-free transactions, while smart banking apps offer insights into spending habits and financial well-being. This fusion of IoT and finance not only enhances user experience but also extends the reach of financial services to previously underserved populations, promoting financial inclusion and economic empowerment.

- With the continued surge in demand for digital and personalized financial services, the adoption of IoT in finance is set for rapid expansion. Financial institutions are investing in IoT infrastructure and partnerships to innovate and distinguish themselves in a competitive market environment. By harnessing the capabilities of IoT, they can provide value-added services, streamline operational processes, and unlock new revenue opportunities, ultimately driving the evolution of the financial industry towards a more interconnected and customer-centric future.

Improving Customer Engagement and Satisfaction

- Enhancing customer engagement and satisfaction offers a significant opportunity for the expansion of IoT in finance. Through the deployment of IoT devices and sensors, financial institutions can collect real-time data on customer behavior, preferences, and requirements. This data-centric approach enables personalized interactions and customized financial solutions, fostering deeper engagement and improving overall customer satisfaction. For instance, smart banking applications powered by IoT can analyze spending habits and deliver proactive recommendations or alerts to assist customers in managing their finances more efficiently.

- Moreover, IoT facilitates the creation of innovative services that address the changing needs of modern consumers. Wearable devices equipped with biometric sensors, for example, enable seamless and secure authentication for banking transactions, providing a more convenient and user-friendly experience. Similarly, IoT-driven virtual assistants or chatbots offer personalized financial guidance and support, enhancing customer service and relationship management.

- As financial institutions prioritize customer-centric strategies to maintain competitiveness, integrating IoT into their operations becomes increasingly crucial. By harnessing IoT technology to offer personalized, convenient, and proactive services, they can strengthen customer relationships, cultivate loyalty, and set themselves apart in the market. This emphasis on improving customer engagement and satisfaction not only benefits individual institutions but also contributes to the growth and transformation of the financial industry toward a more interconnected and customer-centric future.

IoT for Finance Market Segment Analysis:

IoT for Finance Market Segmented on the basis of Solution Type, Application, and End-User.

By Solution Type, Software segment is expected to dominate the market during the forecast period

- Software solutions are pivotal in enabling the functionality and integration of IoT devices within financial systems. These platforms facilitate data collection, analysis, and interpretation, empowering financial entities to derive actionable insights from the substantial data influx generated by IoT devices. Additionally, software applications are crucial for implementing security measures and ensuring compliance with regulations, addressing key concerns in the finance sector. As financial institutions increasingly embrace digital transformation initiatives, the demand for software solutions facilitating IoT integration is anticipated to soar, further bolstering the dominance of the software segment in the IoT for Finance market.

- Furthermore, software providers consistently innovate to cater to the evolving requirements of the finance industry, offering scalable and adaptable solutions tailored to specific use cases and organizational needs. This flexibility and adaptability render software the preferred option for financial institutions aiming to leverage IoT technology to enhance operational efficiency, elevate customer experiences, and gain a competitive advantage. the software segment is forecasted to maintain its dominance in the IoT for Finance market, shaping the future of financial services through continual innovation and technological progression.

By Application, Banking segment held the largest share of 59.23% in 2023

- The banking sector is expected to command the largest share in the IoT for Finance market, IoT technology across various operations. Financial institutions are actively deploying IoT devices and sensors to optimize customer experiences, streamline processes, and enhance security measures. Through the utilization of IoT solutions, banks can monitor transactions in real time, detect fraudulent activities, and provide personalized services, consequently enhancing overall operational efficiency and customer satisfaction.

- Moreover, the banking industry's substantial investment in IoT infrastructure and partnerships contributes to its dominance in the market. Banks prioritize innovation to maintain a competitive edge, leading to the widespread adoption of IoT-enabled services such as mobile banking, contactless payments, and tailored financial advice. This strategic emphasis on leveraging IoT capabilities positions the banking segment as a significant driver of growth in the IoT for Finance market, with its initiatives shaping the future of digital banking and redefining customer expectations in the financial sector.

IoT for Finance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The region possesses a robust and advanced technological infrastructure, providing a strong basis for the widespread adoption of IoT solutions within the financial sector. Financial institutions in North America are pioneers in innovation, actively investing in IoT technologies to enhance customer experiences, streamline operations, and gain competitive advantages. Additionally, the presence of major IoT technology providers and financial hubs further expedites the integration of IoT solutions in finance across the region.

- Moreover, North America's regulatory environment fosters a conducive atmosphere for IoT adoption in finance, with clear guidelines and frameworks that encourage innovation while ensuring security and compliance. Additionally, the region's sizable market and high consumer demand for digital financial services contribute to North America's dominance in the IoT for finance market. With continual advancements in IoT technology and increasing collaboration between financial institutions and technology firms, North America is poised to uphold its leadership position in the IoT for finance market in the forthcoming years.

IoT for Finance Market Top Key Players:

- IBM (U.S.)

- Cisco Systems (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Intel Corporation (U.S.)

- Dell Technologies (U.S.)

- CGI Inc. (Canada)

- Hewlett Packard Enterprise (U.S.)

- SAP SE (Germany)

- Finastra (UK)

- Capgemini SE (France)

- Atos SE (France)

- Accenture plc (Ireland)

- Fujitsu Limited (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

- NTT Data Corporation (Japan)

- Huawei Technologies Co., Ltd. (China)

- Infosys Limited (India)

- Tata Consultancy Services (India)

- Wipro Limited (India), and Other Major Players

Key Industry Developments in the IoT for Finance Market:

- In April 2024, LTIMindtree revealed its collaboration with Vodafone to deliver connected and smart IoT solutions, leveraging its Insight NXT platform (iNXT) alongside Vodafone's IoT Managed Connectivity. This partnership aimed to facilitate Industry X.0 and digital transformation across various vertical sectors. LTIMindtree's iNXT Business Unit contributed technical and functional components, working in conjunction with Vodafone's IoT managed connectivity solutions to address intricate business challenges. This collaboration sought to harness the strengths of both entities to provide comprehensive solutions for clients seeking to navigate the complexities of the digital landscape and embrace emerging technologies.

- In January 2024, Vodafone inked a 10-year deal with Microsoft worth $1.5 billion, aiming to extend generative AI, digital, enterprise, and cloud services to over 300 million businesses and consumers throughout its European and African markets. This strategic partnership sought to leverage Microsoft's expertise to enhance Vodafone's offerings in AI, cloud computing, and IoT solutions. The collaboration aimed to empower businesses and consumers with innovative technologies, driving digital transformation across various sectors. Through this agreement, Vodafone aimed to strengthen its position as a leading provider of telecommunications and digital services, catering to the evolving needs of its vast customer base.

|

Global IoT for Finance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1334.79 Million. |

|

Forecast Period 2024-32 CAGR: |

52.9% |

Market Size in 2032: |

USD 11391.05 Million. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- IOT FOR FINANCE MARKET BY SOLUTION TYPE (2017-2032)

- IOT FOR FINANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- IOT FOR FINANCE MARKET BY APPLICATION (2017-2032)

- IOT FOR FINANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PAYMENTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FRAUD DETECTION

- RISK MANAGEMENT

- ASSET MANAGEMENT

- IOT FOR FINANCE MARKET BY END-USER (2017-2032)

- IOT FOR FINANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BANKING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSURANCE

- IOT FOR

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- IoT for Finance Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IBM (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CISCO SYSTEMS (U.S.)

- MICROSOFT CORPORATION (U.S.)

- ORACLE CORPORATION (U.S.)

- INTEL CORPORATION (U.S.)

- DELL TECHNOLOGIES (U.S.)

- CGI INC. (CANADA)

- HEWLETT PACKARD ENTERPRISE (U.S.)

- SAP SE (GERMANY)

- FINASTRA (UK)

- CAPGEMINI SE (FRANCE)

- ATOS SE (FRANCE)

- ACCENTURE PLC (IRELAND)

- FUJITSU LIMITED (JAPAN)

- HITACHI, LTD. (JAPAN)

- TOSHIBA CORPORATION (JAPAN)

- NTT DATA CORPORATION (JAPAN)

- HUAWEI TECHNOLOGIES CO., LTD. (CHINA)

- INFOSYS LIMITED (INDIA)

- TATA CONSULTANCY SERVICES (INDIA)

- WIPRO LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL IOT FOR FINANCE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End- User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global IoT for Finance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1334.79 Million. |

|

Forecast Period 2024-32 CAGR: |

52.9% |

Market Size in 2032: |

USD 11391.05 Million. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. IOT FOR FINANCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. IOT FOR FINANCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. IOT FOR FINANCE MARKET COMPETITIVE RIVALRY

TABLE 005. IOT FOR FINANCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. IOT FOR FINANCE MARKET THREAT OF SUBSTITUTES

TABLE 007. IOT FOR FINANCE MARKET BY TYPE

TABLE 008. CONNECTED PLATFORM MARKET OVERVIEW (2016-2028)

TABLE 009. INFORMATION MANAGEMENT SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. IOT FOR FINANCE MARKET BY APPLICATION

TABLE 012. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA IOT FOR FINANCE MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA IOT FOR FINANCE MARKET, BY APPLICATION (2016-2028)

TABLE 017. N IOT FOR FINANCE MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE IOT FOR FINANCE MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE IOT FOR FINANCE MARKET, BY APPLICATION (2016-2028)

TABLE 020. IOT FOR FINANCE MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC IOT FOR FINANCE MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC IOT FOR FINANCE MARKET, BY APPLICATION (2016-2028)

TABLE 023. IOT FOR FINANCE MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA IOT FOR FINANCE MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA IOT FOR FINANCE MARKET, BY APPLICATION (2016-2028)

TABLE 026. IOT FOR FINANCE MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA IOT FOR FINANCE MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA IOT FOR FINANCE MARKET, BY APPLICATION (2016-2028)

TABLE 029. IOT FOR FINANCE MARKET, BY COUNTRY (2016-2028)

TABLE 030. ARM HOLDINGS PLC: SNAPSHOT

TABLE 031. ARM HOLDINGS PLC: BUSINESS PERFORMANCE

TABLE 032. ARM HOLDINGS PLC: PRODUCT PORTFOLIO

TABLE 033. ARM HOLDINGS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. CISCO SYSTEMS: SNAPSHOT

TABLE 034. CISCO SYSTEMS: BUSINESS PERFORMANCE

TABLE 035. CISCO SYSTEMS: PRODUCT PORTFOLIO

TABLE 036. CISCO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 037. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 038. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 039. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. INTEL CORPORATION: SNAPSHOT

TABLE 040. INTEL CORPORATION: BUSINESS PERFORMANCE

TABLE 041. INTEL CORPORATION: PRODUCT PORTFOLIO

TABLE 042. INTEL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ROCKWELL AUTOMATION: SNAPSHOT

TABLE 043. ROCKWELL AUTOMATION: BUSINESS PERFORMANCE

TABLE 044. ROCKWELL AUTOMATION: PRODUCT PORTFOLIO

TABLE 045. ROCKWELL AUTOMATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ABB LTD.: SNAPSHOT

TABLE 046. ABB LTD.: BUSINESS PERFORMANCE

TABLE 047. ABB LTD.: PRODUCT PORTFOLIO

TABLE 048. ABB LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DASSAULT SYSTÈMES SA: SNAPSHOT

TABLE 049. DASSAULT SYSTÈMES SA: BUSINESS PERFORMANCE

TABLE 050. DASSAULT SYSTÈMES SA: PRODUCT PORTFOLIO

TABLE 051. DASSAULT SYSTÈMES SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HONEYWELL INTERNATIONAL: SNAPSHOT

TABLE 052. HONEYWELL INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 053. HONEYWELL INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 054. HONEYWELL INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. HUAWEI TECHNOLOGY: SNAPSHOT

TABLE 055. HUAWEI TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 056. HUAWEI TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 057. HUAWEI TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. IBM: SNAPSHOT

TABLE 058. IBM: BUSINESS PERFORMANCE

TABLE 059. IBM: PRODUCT PORTFOLIO

TABLE 060. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. IOT FOR FINANCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. IOT FOR FINANCE MARKET OVERVIEW BY TYPE

FIGURE 012. CONNECTED PLATFORM MARKET OVERVIEW (2016-2028)

FIGURE 013. INFORMATION MANAGEMENT SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. IOT FOR FINANCE MARKET OVERVIEW BY APPLICATION

FIGURE 016. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA IOT FOR FINANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE IOT FOR FINANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC IOT FOR FINANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA IOT FOR FINANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA IOT FOR FINANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the IoT for Finance Market research report is 2024-2032.

IBM (U.S.), Cisco Systems (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Intel Corporation (U.S.), Dell Technologies (U.S.), CGI Inc. (Canada), Hewlett Packard Enterprise (U.S.), SAP SE (Germany), Finastra (UK), Capgemini SE (France) , Atos SE (France), Accenture plc (Ireland), Fujitsu Limited (Japan), Hitachi, Ltd. (Japan), Toshiba Corporation (Japan), NTT Data Corporation (Japan), Huawei Technologies Co., Ltd. (China), Infosys Limited (India), Tata Consultancy Services (India), Wipro Limited (India), and Other Major Players

The IoT for Finance Market is segmented into Solution Type, Application, End-User, and region. By Solution Type, the market is categorized into Hardware, Software, and Services. By Application, the market is categorized into Payments, Fraud Detection, Risk Management, and Asset Management. By End-User, the market is categorized into Banking and Insurance. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

IoT revolutionizes financial operations by seamlessly integrating devices for real-time data gathering, transmission, and analysis. It boosts efficiency across transactions, risk management, and customer service via interconnected sensors, smart devices, and analytics platforms. This transformative technology simplifies workflows, enhances decision-making, and fortifies security in financial operations.

The IoT for Finance Market Size Was Valued at USD 1334.79 Million in 2023 and is Projected to Reach USD 11391.05 Million by 2032, Growing at a CAGR of 52.9 % From 2024-2032.