Instant Payment Market Synopsis

The global Instant Payment Market was valued at USD 116.6 billion in 2023 and is expected to reach USD 1138.27 Billion by the year 2032, at a CAGR of 28.81%.

Instant payment (sometimes called real-time payment or faster payment) is a way to exchange money and process payments that allows money to be transferred between bank accounts almost instantly, instead of the usual one to three business days.

- Many countries have adopted instant payment systems and many instant payment systems and platforms are currently being developed worldwide as the need for faster and more reliable transactions has grown. Widespread penetration of smartphones, high-speed internet, and cloud-based solutions that improve the payment experience across multiple industries such as BFSI, Retail, Manufacturing Healthcare, etc. drives the growth of the instant payment market.

- The government invests huge capital in instant payments, which makes the payment process easier for end users. Financial institutions and research and development programs have helped reform the industry and accelerate the growth of the instant payment market.

- Due to the growing need for faster and more reliable transactions, many countries have established instant payment systems, and many instant payment systems and platforms are currently being developed around the world. In some countries, it is possible to pay instantly with a mobile phone, offering the same speed and convenience as cash.

The Instant Payment Market Trend Analysis

Increasing Demand For Quick Money Transfers In Consumers And Businesses

- The increasing demand for fast money transfers has been a major driver for the growth of the instant payment market. Both consumers and businesses have realized the benefits of instant payments, resulting in adoption and market acceleration. Instant payment solutions offer a quick and easy way to transfer money. Traditional methods such as bank transfers or checks can be time-consuming and cause delays. Instant payments enable near real-time transfers, allowing individuals and businesses to receive money instantly, improving overall convenience and liquidity.

- Furthermore, instant payment solutions, often integrated with mobile wallets or peer-to-peer payment apps, allow people to easily send money to friends, family, or acquaintances. This ease of use and convenience has led to the widespread use of instant payments for everyday things such as splitting bills, repaying loans, or making informal payments. Also, the ability to make instant payments is very useful for businesses, especially in industries where speed and efficiency are critical. Express payments speed up payments, improve cash flow management and reduce the need for credit or late payments. It can simplify supply chains, improve business relationships and improve overall operational efficiency.

The Massive Technological Revolution

- The technological revolution has led to the development of innovative payment technologies, including real-time payment systems, mobile payment applications, digital wallets, and blockchain solutions. These advances enable fast and seamless payment transactions, providing convenience and efficiency to businesses and consumers.

- The widespread use of smartphones and internet connections has accelerated the growth of mobile and digital payments. Instant payment solutions use mobile devices and digital platforms to enable real-time money transfers, eliminating the need for traditional payment methods such as checks or cash. This has changed the way people make payments and created new opportunities for instant payment service providers. Additionally, consumers, today expect fast, convenient, and secure payment options. The technological revolution has influenced consumer behavior and there is a growing preference for instant gratification and instant transactions. Instant payment solutions meet changing consumer expectations and offer a seamless payment experience.

- The growth of e-commerce and online shopping has also increased the demand for instant payment solutions. Consumers expect fast and hassle-free payment processes for their online purchases. Instant payment options enable instant authorizations and payment transactions, reducing the friction of the e-shopping experience.

Segmentation Analysis Of The Instant Payment Market

The Instant Payment market segments cover the Nature of Payment, Deployment Mode, Enterprise Size, and End-User. By Nature of Payment, the Person-to-Business (P2B) segment is Anticipated to Dominate the Market Over the Forecast period.

- P2B payments refer to financial transactions between businesses and customers (such as recipient or source). A key factor in the development of the segment is the constant growth of mobile phone transactions and online shopping. Continued growth in e-commerce and e-commerce is expected to support the development of the segment. P2B payments allow businesses to improve customer satisfaction.

- The P2B structure accelerated with changes in regulatory reforms. Paying bills online and in stores promises the next huge wave of volume needed to keep real-time costs cheaper than cards. The growing trend of cloud-based real-time payment solutions is due to their flexibility to provide real-time payment information to retailers. The growing adoption of digital payment methods in major retail stores across the globe is expected to drive the market during the forecast period.

Regional Analysis of The Instant Payment Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- The market growth in this region is driven by the huge population of the region, which affects the number of transactions, and domestic and international companies investing in the region. In the APAC region, the rate of growth can be attributed to several different factors such as the adoption of advanced technology, economic development, increased digitization, and heavy investment in real-time payment solutions and service providers.

- APAC countries, particularly China, South Korea, and Singapore, have been at the forefront of technological development and digital innovation. They have developed robust digital payment ecosystems, including real-time payment infrastructures and mobile payment platforms, which have accelerated the adoption of instant payment solutions.

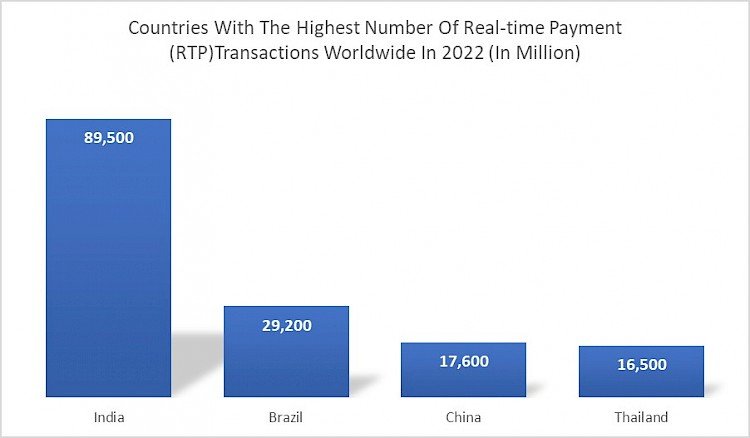

- Additionally, mobile adoption and usage have grown rapidly in APAC. This has created a favorable environment for the adoption of mobile instant payment solutions. Mobile wallets and payment apps have gained significant popularity in China and India, among others, which has boosted the growth of instant payment services. Real-time payments were commonly used in Asia-Pacific in 2022, with transactions in India being almost five times higher than in China. For instance, according to Statista, India is the highest number of real-time payment transactions in 2022 which drives the growth of the market in this region.

Covid-19 Impact Analysis On Instant Payment Market

- Due to market restrictions and logistics bans imposed by governments, Covid-19 has affected several global markets, reorganizing supply chains. However, some markets benefited from the course of the pandemic. Covid-19 contributed to the growth of the instant payment market by expanding competition and introducing free payments. Covid-19 has accelerated the process of change, including the transition from a cash economy to a cashless economy. At the height of Covid-19, e-commerce and digital payment platforms have also expanded their space to viral areas. The rapid digitization of many companies, industries, and retail outlets is also behind the widespread adoption of instant payment options, which increases sales in the instant payment market.

- In addition, the COVID-19 epidemic forced banks and customers to react quickly to the limitations of physical user interfaces. As a result, the adoption of instant payments by bank customers has accelerated. Although significant, the shift to instant digital payments has been far less dramatic than most anticipated. Banks have kept at least some of their branches open and reduced office staff and opening hours and limited the number of customers they can accept. As a result, digital acceleration due to the pandemic will help banks and other financial institutions lower costs and provide a better customer experience, which improves Net Promoter Score and increases customer lifetime value.

Top Key Players Covered in The Instant Payment Market

- ACI Worldwide (US)

- FIS (US)

- Mastercard (US)

- Temenos (Switzerland)

- Worldline (France)

- PayPal(US)

- Fiserv (US)

- Visa (US)

- FSS (India)

- Montran (US)

- REPAY (US)

- Icon Solutions (UK)

- Apple (US)

- Ant Financial (China), and Other Major Players

Key Industry Developments in the Instant Payment Market

- In April 2023, Visa announced a strategic collaboration with PayPal and Venmo to initiate the pilot of Visa+, an innovative service designed to facilitate swift and secure money transfers between various person-to-person (P2P) digital payment applications. Later in the same year, users of Venmo and PayPal in the United States will have the capability to seamlessly transfer funds between the two platforms.

- In April 2023, CRED unveiled its UPI-based P2P payments, presenting a new payment option for its users. This feature allows CRED members to utilize the 'pay anyone' functionality through their contact list, phone numbers, or UPI IDs

- In April 2023, The Federal Reserve announced the launch of FedNow, a new real-time payments service that will enable faster and more secure financial payments for consumers and businesses. This system has the potential to revolutionize how people make payments in the US by providing instantaneous transfer of funds between banks in a matter of seconds, available 24 hours a day, 365 days a year.

- In January 2023, ACI Worldwide announced the launch of ACI Instant Pay, a new real-time payments solution that enables merchants in the U.S. to accept online, mobile and in-store payments instantly. The expansion of ACI's real-time payments software solutions to merchants reinforces ACI’s global leadership in powering domestic and pan-regional real-time schemes reaching billions worldwide.

- In March 2022, the Reserve Bank of India (RBI) launched an instant payment system "UPI 123PAY" for feature phone users. The new Unified Payments Interface (UPI) will allow India's 40 crore feature phone users to access the payment service in a more secure manner.

|

Global Instant Payment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 - 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 116.6 Billion |

|

Forecast Period 2024-32 CAGR: |

28.81 % |

Market Size in 2032: |

USD 1138.27 Billion |

|

|

By Nature of Payment |

|

|

|

By Deployment Mode |

|

||

|

By Enterprise Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By By Nature of Payment

3.2 By Deployment Mode

3.3 By Enterprise Size

3.4 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Instant Payment Market by By Nature of Payment

5.1 Instant Payment Market Overview Snapshot and Growth Engine

5.2 Instant Payment Market Overview

5.3 Person-to-Person (P2P)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Person-to-Person (P2P): Geographic Segmentation

5.4 Person-to-Business (P2B)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Person-to-Business (P2B): Geographic Segmentation

5.5 Business-To-Person (B2P)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Business-To-Person (B2P): Geographic Segmentation

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Geographic Segmentation

Chapter 6: Instant Payment Market by Deployment Mode

6.1 Instant Payment Market Overview Snapshot and Growth Engine

6.2 Instant Payment Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cloud: Geographic Segmentation

6.4 On-Premises

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 On-Premises: Geographic Segmentation

Chapter 7: Instant Payment Market by Enterprise Size

7.1 Instant Payment Market Overview Snapshot and Growth Engine

7.2 Instant Payment Market Overview

7.3 Small And Medium-Sized Enterprises (SMEs)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Small And Medium-Sized Enterprises (SMEs): Geographic Segmentation

7.4 Large Enterprises

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Large Enterprises: Geographic Segmentation

Chapter 8: Instant Payment Market by End-User

8.1 Instant Payment Market Overview Snapshot and Growth Engine

8.2 Instant Payment Market Overview

8.3 BFSI

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 BFSI: Geographic Segmentation

8.4 Retail And E-Commerce

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Retail And E-Commerce: Geographic Segmentation

8.5 Government

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Government: Geographic Segmentation

8.6 IT

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 IT: Geographic Segmentation

8.7 And Telecommunications

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 And Telecommunications: Geographic Segmentation

8.8 Energy

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size (2017-2032F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Energy: Geographic Segmentation

8.9 And Utilities

8.9.1 Introduction and Market Overview

8.9.2 Historic and Forecasted Market Size (2017-2032F)

8.9.3 Key Market Trends, Growth Factors and Opportunities

8.9.4 And Utilities: Geographic Segmentation

8.10 Others

8.10.1 Introduction and Market Overview

8.10.2 Historic and Forecasted Market Size (2017-2032F)

8.10.3 Key Market Trends, Growth Factors and Opportunities

8.10.4 Others: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Instant Payment Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Instant Payment Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Instant Payment Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ACI WORLDWIDE (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 FIS (US)

9.4 MASTERCARD (US)

9.5 TEMENOS (SWITZERLAND)

9.6 WORLDLINE (FRANCE)

9.7 PAYPAL (US)

9.8 FISERV (US)

9.9 VISA (US)

9.10 FSS (INDIA)

9.11 MONTRAN (US)

9.12 REPAY (US)

9.13 ICON SOLUTIONS (UK)

9.14 APPLE (US)

9.15 ANT FINANCIAL (CHINA)

9.16 OTHER MAJOR PLAYERS

Chapter 10: Global Instant Payment Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By By Nature of Payment

10.2.1 Person-to-Person (P2P)

10.2.2 Person-to-Business (P2B)

10.2.3 Business-To-Person (B2P)

10.2.4 Other

10.3 Historic and Forecasted Market Size By Deployment Mode

10.3.1 Cloud

10.3.2 On-Premises

10.4 Historic and Forecasted Market Size By Enterprise Size

10.4.1 Small And Medium-Sized Enterprises (SMEs)

10.4.2 Large Enterprises

10.5 Historic and Forecasted Market Size By End-User

10.5.1 BFSI

10.5.2 Retail And E-Commerce

10.5.3 Government

10.5.4 IT

10.5.5 And Telecommunications

10.5.6 Energy

10.5.7 And Utilities

10.5.8 Others

Chapter 11: North America Instant Payment Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By By Nature of Payment

11.4.1 Person-to-Person (P2P)

11.4.2 Person-to-Business (P2B)

11.4.3 Business-To-Person (B2P)

11.4.4 Other

11.5 Historic and Forecasted Market Size By Deployment Mode

11.5.1 Cloud

11.5.2 On-Premises

11.6 Historic and Forecasted Market Size By Enterprise Size

11.6.1 Small And Medium-Sized Enterprises (SMEs)

11.6.2 Large Enterprises

11.7 Historic and Forecasted Market Size By End-User

11.7.1 BFSI

11.7.2 Retail And E-Commerce

11.7.3 Government

11.7.4 IT

11.7.5 And Telecommunications

11.7.6 Energy

11.7.7 And Utilities

11.7.8 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 US

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Eastern Europe Instant Payment Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By By Nature of Payment

12.4.1 Person-to-Person (P2P)

12.4.2 Person-to-Business (P2B)

12.4.3 Business-To-Person (B2P)

12.4.4 Other

12.5 Historic and Forecasted Market Size By Deployment Mode

12.5.1 Cloud

12.5.2 On-Premises

12.6 Historic and Forecasted Market Size By Enterprise Size

12.6.1 Small And Medium-Sized Enterprises (SMEs)

12.6.2 Large Enterprises

12.7 Historic and Forecasted Market Size By End-User

12.7.1 BFSI

12.7.2 Retail And E-Commerce

12.7.3 Government

12.7.4 IT

12.7.5 And Telecommunications

12.7.6 Energy

12.7.7 And Utilities

12.7.8 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Bulgaria

12.8.2 The Czech Republic

12.8.3 Hungary

12.8.4 Poland

12.8.5 Romania

12.8.6 Rest of Eastern Europe

Chapter 13: Western Europe Instant Payment Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By By Nature of Payment

13.4.1 Person-to-Person (P2P)

13.4.2 Person-to-Business (P2B)

13.4.3 Business-To-Person (B2P)

13.4.4 Other

13.5 Historic and Forecasted Market Size By Deployment Mode

13.5.1 Cloud

13.5.2 On-Premises

13.6 Historic and Forecasted Market Size By Enterprise Size

13.6.1 Small And Medium-Sized Enterprises (SMEs)

13.6.2 Large Enterprises

13.7 Historic and Forecasted Market Size By End-User

13.7.1 BFSI

13.7.2 Retail And E-Commerce

13.7.3 Government

13.7.4 IT

13.7.5 And Telecommunications

13.7.6 Energy

13.7.7 And Utilities

13.7.8 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Germany

13.8.2 UK

13.8.3 France

13.8.4 Netherlands

13.8.5 Italy

13.8.6 Russia

13.8.7 Spain

13.8.8 Rest of Western Europe

Chapter 14: Asia Pacific Instant Payment Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By By Nature of Payment

14.4.1 Person-to-Person (P2P)

14.4.2 Person-to-Business (P2B)

14.4.3 Business-To-Person (B2P)

14.4.4 Other

14.5 Historic and Forecasted Market Size By Deployment Mode

14.5.1 Cloud

14.5.2 On-Premises

14.6 Historic and Forecasted Market Size By Enterprise Size

14.6.1 Small And Medium-Sized Enterprises (SMEs)

14.6.2 Large Enterprises

14.7 Historic and Forecasted Market Size By End-User

14.7.1 BFSI

14.7.2 Retail And E-Commerce

14.7.3 Government

14.7.4 IT

14.7.5 And Telecommunications

14.7.6 Energy

14.7.7 And Utilities

14.7.8 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 China

14.8.2 India

14.8.3 Japan

14.8.4 South Korea

14.8.5 Malaysia

14.8.6 Thailand

14.8.7 Vietnam

14.8.8 The Philippines

14.8.9 Australia

14.8.10 New Zealand

14.8.11 Rest of APAC

Chapter 15: Middle East & Africa Instant Payment Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By By Nature of Payment

15.4.1 Person-to-Person (P2P)

15.4.2 Person-to-Business (P2B)

15.4.3 Business-To-Person (B2P)

15.4.4 Other

15.5 Historic and Forecasted Market Size By Deployment Mode

15.5.1 Cloud

15.5.2 On-Premises

15.6 Historic and Forecasted Market Size By Enterprise Size

15.6.1 Small And Medium-Sized Enterprises (SMEs)

15.6.2 Large Enterprises

15.7 Historic and Forecasted Market Size By End-User

15.7.1 BFSI

15.7.2 Retail And E-Commerce

15.7.3 Government

15.7.4 IT

15.7.5 And Telecommunications

15.7.6 Energy

15.7.7 And Utilities

15.7.8 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Turkey

15.8.2 Bahrain

15.8.3 Kuwait

15.8.4 Saudi Arabia

15.8.5 Qatar

15.8.6 UAE

15.8.7 Israel

15.8.8 South Africa

Chapter 16: South America Instant Payment Market Analysis, Insights and Forecast, 2017-2032

16.1 Key Market Trends, Growth Factors and Opportunities

16.2 Impact of Covid-19

16.3 Key Players

16.4 Key Market Trends, Growth Factors and Opportunities

16.4 Historic and Forecasted Market Size By By Nature of Payment

16.4.1 Person-to-Person (P2P)

16.4.2 Person-to-Business (P2B)

16.4.3 Business-To-Person (B2P)

16.4.4 Other

16.5 Historic and Forecasted Market Size By Deployment Mode

16.5.1 Cloud

16.5.2 On-Premises

16.6 Historic and Forecasted Market Size By Enterprise Size

16.6.1 Small And Medium-Sized Enterprises (SMEs)

16.6.2 Large Enterprises

16.7 Historic and Forecasted Market Size By End-User

16.7.1 BFSI

16.7.2 Retail And E-Commerce

16.7.3 Government

16.7.4 IT

16.7.5 And Telecommunications

16.7.6 Energy

16.7.7 And Utilities

16.7.8 Others

16.8 Historic and Forecast Market Size by Country

16.8.1 Brazil

16.8.2 Argentina

16.8.3 Rest of SA

Chapter 17 Investment Analysis

Chapter 18 Analyst Viewpoint and Conclusion

|

Global Instant Payment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 - 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 116.6 Billion |

|

Forecast Period 2024-32 CAGR: |

28.81 % |

Market Size in 2032: |

USD 1138.27 Billion |

|

|

By Nature of Payment |

|

|

|

By Deployment Mode |

|

||

|

By Enterprise Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INSTANT PAYMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INSTANT PAYMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INSTANT PAYMENT MARKET COMPETITIVE RIVALRY

TABLE 005. INSTANT PAYMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. INSTANT PAYMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. INSTANT PAYMENT MARKET BY BY NATURE OF PAYMENT

TABLE 008. PERSON-TO-PERSON (P2P) MARKET OVERVIEW (2016-2030)

TABLE 009. PERSON-TO-BUSINESS (P2B) MARKET OVERVIEW (2016-2030)

TABLE 010. BUSINESS-TO-PERSON (B2P) MARKET OVERVIEW (2016-2030)

TABLE 011. OTHER MARKET OVERVIEW (2016-2030)

TABLE 012. INSTANT PAYMENT MARKET BY DEPLOYMENT MODE

TABLE 013. CLOUD MARKET OVERVIEW (2016-2030)

TABLE 014. ON-PREMISES MARKET OVERVIEW (2016-2030)

TABLE 015. INSTANT PAYMENT MARKET BY ENTERPRISE SIZE

TABLE 016. SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2030)

TABLE 017. LARGE ENTERPRISES MARKET OVERVIEW (2016-2030)

TABLE 018. INSTANT PAYMENT MARKET BY END-USER

TABLE 019. BFSI MARKET OVERVIEW (2016-2030)

TABLE 020. RETAIL AND E-COMMERCE MARKET OVERVIEW (2016-2030)

TABLE 021. GOVERNMENT MARKET OVERVIEW (2016-2030)

TABLE 022. IT MARKET OVERVIEW (2016-2030)

TABLE 023. AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2030)

TABLE 024. ENERGY MARKET OVERVIEW (2016-2030)

TABLE 025. AND UTILITIES MARKET OVERVIEW (2016-2030)

TABLE 026. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 027. NORTH AMERICA INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 028. NORTH AMERICA INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 029. NORTH AMERICA INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 030. NORTH AMERICA INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 031. N INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 032. EASTERN EUROPE INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 033. EASTERN EUROPE INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 034. EASTERN EUROPE INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 035. EASTERN EUROPE INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 036. INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 037. WESTERN EUROPE INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 038. WESTERN EUROPE INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 039. WESTERN EUROPE INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 040. WESTERN EUROPE INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 041. INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 042. ASIA PACIFIC INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 043. ASIA PACIFIC INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 044. ASIA PACIFIC INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 045. ASIA PACIFIC INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 046. INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 051. INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 052. SOUTH AMERICA INSTANT PAYMENT MARKET, BY BY NATURE OF PAYMENT (2016-2030)

TABLE 053. SOUTH AMERICA INSTANT PAYMENT MARKET, BY DEPLOYMENT MODE (2016-2030)

TABLE 054. SOUTH AMERICA INSTANT PAYMENT MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 055. SOUTH AMERICA INSTANT PAYMENT MARKET, BY END-USER (2016-2030)

TABLE 056. INSTANT PAYMENT MARKET, BY COUNTRY (2016-2030)

TABLE 057. ACI WORLDWIDE (US): SNAPSHOT

TABLE 058. ACI WORLDWIDE (US): BUSINESS PERFORMANCE

TABLE 059. ACI WORLDWIDE (US): PRODUCT PORTFOLIO

TABLE 060. ACI WORLDWIDE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FIS (US): SNAPSHOT

TABLE 061. FIS (US): BUSINESS PERFORMANCE

TABLE 062. FIS (US): PRODUCT PORTFOLIO

TABLE 063. FIS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MASTERCARD (US): SNAPSHOT

TABLE 064. MASTERCARD (US): BUSINESS PERFORMANCE

TABLE 065. MASTERCARD (US): PRODUCT PORTFOLIO

TABLE 066. MASTERCARD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TEMENOS (SWITZERLAND): SNAPSHOT

TABLE 067. TEMENOS (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 068. TEMENOS (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 069. TEMENOS (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. WORLDLINE (FRANCE): SNAPSHOT

TABLE 070. WORLDLINE (FRANCE): BUSINESS PERFORMANCE

TABLE 071. WORLDLINE (FRANCE): PRODUCT PORTFOLIO

TABLE 072. WORLDLINE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. PAYPAL (US): SNAPSHOT

TABLE 073. PAYPAL (US): BUSINESS PERFORMANCE

TABLE 074. PAYPAL (US): PRODUCT PORTFOLIO

TABLE 075. PAYPAL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. FISERV (US): SNAPSHOT

TABLE 076. FISERV (US): BUSINESS PERFORMANCE

TABLE 077. FISERV (US): PRODUCT PORTFOLIO

TABLE 078. FISERV (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. VISA (US): SNAPSHOT

TABLE 079. VISA (US): BUSINESS PERFORMANCE

TABLE 080. VISA (US): PRODUCT PORTFOLIO

TABLE 081. VISA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. FSS (INDIA): SNAPSHOT

TABLE 082. FSS (INDIA): BUSINESS PERFORMANCE

TABLE 083. FSS (INDIA): PRODUCT PORTFOLIO

TABLE 084. FSS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. MONTRAN (US): SNAPSHOT

TABLE 085. MONTRAN (US): BUSINESS PERFORMANCE

TABLE 086. MONTRAN (US): PRODUCT PORTFOLIO

TABLE 087. MONTRAN (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. REPAY (US): SNAPSHOT

TABLE 088. REPAY (US): BUSINESS PERFORMANCE

TABLE 089. REPAY (US): PRODUCT PORTFOLIO

TABLE 090. REPAY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. ICON SOLUTIONS (UK): SNAPSHOT

TABLE 091. ICON SOLUTIONS (UK): BUSINESS PERFORMANCE

TABLE 092. ICON SOLUTIONS (UK): PRODUCT PORTFOLIO

TABLE 093. ICON SOLUTIONS (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. APPLE (US): SNAPSHOT

TABLE 094. APPLE (US): BUSINESS PERFORMANCE

TABLE 095. APPLE (US): PRODUCT PORTFOLIO

TABLE 096. APPLE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ANT FINANCIAL (CHINA): SNAPSHOT

TABLE 097. ANT FINANCIAL (CHINA): BUSINESS PERFORMANCE

TABLE 098. ANT FINANCIAL (CHINA): PRODUCT PORTFOLIO

TABLE 099. ANT FINANCIAL (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INSTANT PAYMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INSTANT PAYMENT MARKET OVERVIEW BY BY NATURE OF PAYMENT

FIGURE 012. PERSON-TO-PERSON (P2P) MARKET OVERVIEW (2016-2030)

FIGURE 013. PERSON-TO-BUSINESS (P2B) MARKET OVERVIEW (2016-2030)

FIGURE 014. BUSINESS-TO-PERSON (B2P) MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 016. INSTANT PAYMENT MARKET OVERVIEW BY DEPLOYMENT MODE

FIGURE 017. CLOUD MARKET OVERVIEW (2016-2030)

FIGURE 018. ON-PREMISES MARKET OVERVIEW (2016-2030)

FIGURE 019. INSTANT PAYMENT MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 020. SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2030)

FIGURE 021. LARGE ENTERPRISES MARKET OVERVIEW (2016-2030)

FIGURE 022. INSTANT PAYMENT MARKET OVERVIEW BY END-USER

FIGURE 023. BFSI MARKET OVERVIEW (2016-2030)

FIGURE 024. RETAIL AND E-COMMERCE MARKET OVERVIEW (2016-2030)

FIGURE 025. GOVERNMENT MARKET OVERVIEW (2016-2030)

FIGURE 026. IT MARKET OVERVIEW (2016-2030)

FIGURE 027. AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2030)

FIGURE 028. ENERGY MARKET OVERVIEW (2016-2030)

FIGURE 029. AND UTILITIES MARKET OVERVIEW (2016-2030)

FIGURE 030. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 031. NORTH AMERICA INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. EASTERN EUROPE INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. WESTERN EUROPE INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. ASIA PACIFIC INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. MIDDLE EAST & AFRICA INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. SOUTH AMERICA INSTANT PAYMENT MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Instant Payment Market research report is 2024 - 2032.

ACI Worldwide (US), FIS (US), Mastercard (US), Temenos (Switzerland), Worldline (France), PayPal (US), Fiserv (US), Visa (US), FSS (India), Montran (US), REPAY (US), Icon Solutions (UK), Apple (US), Ant Financial (China), and Other Major Players

The Instant Payment Market is segmented into Nature of Payment, Deployment Mode, Enterprise Size, End User, and Region. By Nature of Payment, the market is categorized into Person-to-Person (P2P), Person-to-Business (P2B), Business-To-Person (B2P), and Other. By Deployment Mode, the market is categorized into Cloud and On-Premises. By Enterprise Size, the market is categorized into Small and Medium-Sized Enterprises (SMEs), Large Enterprises. By End User, the market is categorized into BFSI, Retail and E-Commerce, Government, IT and Telecommunications, Energy and Utilities, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Instant payment (sometimes called real-time payment or faster payment) is a way to exchange money and process payments that allows money to be transferred between bank accounts almost instantly, instead of the usual one to three business days. Many countries have adopted instant payment systems and many instant payment systems and platforms are currently being developed worldwide as the need for faster and more reliable transactions has grown.

The global Instant Payment Market was valued at USD 116.6 billion in 2023 and is expected to reach USD 1138.27 Billion by the year 2032, at a CAGR of 28.81%.