Inertial Navigation System Market Synopsis

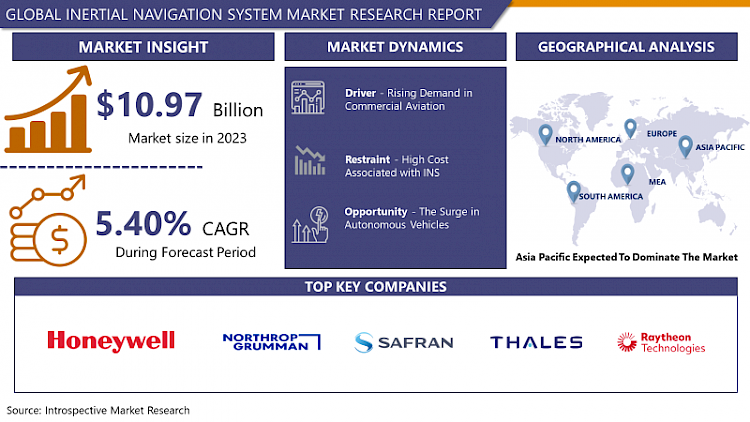

Inertial Navigation System Market Size Was Valued at USD 10.97 Billion in 2023 and is Projected to Reach USD 17.61 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

An Inertial Navigation System (INS) is a navigation technology used in vehicles, aircraft, and ships to ascertain their position, orientation, and velocity without external references such as GPS. It relies on a combination of accelerometers and gyroscopes to continuously measure changes in velocity and orientation. By integrating these measurements over time, INS calculate the object's current position and movement relative to its starting point.

- The applications of INS are vast, ranging from guiding missiles, aircraft, and submarines to aiding in the navigation of autonomous vehicles and spacecraft. In scenarios where GPS signals are unreliable or unavailable, such as underwater or in remote locations, INS serve as a crucial backup or primary navigation system. It's employed in aviation for precise aircraft positioning, especially during moments of GPS signal loss, and in the military for its robustness against signal jamming or spoofing.

- The advantages of INS lie in its autonomy and reliability. It operates independently of external signals, making it highly resilient in GPS-denied environments or areas where signals may be intentionally disrupted. Additionally, INS provide real-time, continuous navigation data, crucial for time-sensitive applications where accuracy and consistency are paramount, such as in defense, transportation, and exploration. Despite its strengths, INS systems require periodic recalibration to maintain accuracy over extended durations.

Inertial Navigation System Market Trend Analysis

Rising Demand in Commercial Aviation

- The burgeoning demand for inertial navigation systems (INS) in commercial aviation stands as a pivotal driver propelling market growth. In this industry, INS serve as a critical component for navigation and guidance, complementing GPS systems and offering robust redundancy in scenarios where GPS signals might falter or become unavailable.

- The surge in air travel worldwide has led to an increased need for precise and reliable navigation solutions. INS play a vital role in ensuring the safety and efficiency of flights, especially during adverse weather conditions, in remote areas with limited GPS coverage, or in instances of intentional GPS signal disruption.

- Moreover, stringent safety regulations in the aviation sector mandate redundancy in navigation systems to mitigate risks. INS serve as a dependable backup, providing continuous and accurate positioning data independent of external signals, thereby reinforcing the safety measures in place.

- As airlines strive for improved operational efficiency and reliability, the demand for advanced INS technology continues to soar. The integration of INS not only enhances navigation capabilities but also contributes to optimizing flight routes, reducing operational costs, and bolstering overall flight safety, making it an indispensable component in the modern aviation landscape.

The Surge in Autonomous Vehicles

- The surge in autonomous vehicles represents a significant opportunity for the inertial navigation systems (INS) market. Autonomous vehicles, including self-driving cars, drones, and unmanned aerial vehicles (UAVs), heavily rely on sophisticated navigation systems for precise localization, mapping, and obstacle detection, making INS a crucial component in their development and operation.

- INS technology provides autonomous vehicles with real-time, high-precision navigation capabilities independent of external infrastructure, such as GPS. This autonomy is crucial, especially in scenarios where GPS signals might be unreliable or unavailable, such as in urban canyons, tunnels, or areas with signal interference. INS fill this gap by offering continuous and accurate positioning data using inertial sensors like accelerometers and gyroscopes.

- The increasing demand for safe, efficient, and reliable autonomous transportation fuels the need for advanced INS solutions. These systems play a fundamental role in ensuring the safety and effectiveness of autonomous vehicles by providing constant and accurate positional awareness, enabling them to navigate complex environments with precision.

- Moreover, as the autonomous vehicle industry continues to evolve, there's a growing need for compact, cost-effective, and robust INS solutions that can seamlessly integrate into various vehicle platforms, presenting an immense opportunity for innovation and market growth within the INS sector. As technology advances and autonomous vehicle deployment expands across industries, the demand for advanced INS technology is poised to rise, driving the market forward and creating new avenues for development and application.

Inertial Navigation System Market Segment Analysis:

Inertial Navigation System Market Segmented on the basis of component, technology, grade and applications.

By Component, Gyroscope segment is expected to dominate the market during the forecast period

- The gyroscope segment is anticipated to maintain dominance within the inertial navigation systems (INS) market during the forecast period. Gyroscopes, a crucial component of INS, play a pivotal role in measuring angular velocity and orientation changes accurately. Their ability to sense and maintain orientation without external references contributes significantly to the reliability and precision of navigation systems.

- Technological advancements in gyroscope manufacturing, particularly the development of micro-electromechanical systems (MEMS) gyroscopes, have led to more compact, cost-effective, and high-performance solutions. These advancements enhance the efficiency and applicability of INS across various industries, including aerospace, defense, automotive, and robotics.

- As demand grows for more sophisticated navigation systems that can function autonomously and accurately in diverse environments, the gyroscope segment continues to see substantial investment and innovation. Its pivotal role in determining an INS's accuracy and reliability solidifies its position as a dominant component driving the growth and evolution of inertial navigation systems.

By Application, Aerospace and Defense segment held the largest market share of 43.6% in 2022

- The Aerospace and Defense segment have consistently held the largest market share within the inertial navigation systems (INS) market owing to its critical role in ensuring precision navigation, guidance, and control in various aerospace and defense applications. INS technology is integral in aircraft, missiles, drones, spacecraft, and military vehicles, where precise and reliable navigation is paramount.

- In the aerospace industry, INS is indispensable for commercial and military aircraft, providing continuous and accurate positioning data, especially in scenarios where GPS signals might be disrupted or inaccessible. It serves as a crucial backup system, ensuring flight safety and reliability.

- Furthermore, the defense sector heavily relies on INS for applications like missile guidance, reconnaissance, unmanned aerial vehicles (UAVs), and military vehicles, where operational success depends on accurate navigation and positioning, even in GPS-denied environments.

- The constant evolution of military technology, coupled with the need for sophisticated navigation systems in both civil and military aviation, sustains the dominance of the Aerospace and Defense segment, making it the primary contributor to the inertial navigation systems market's significant market share.

Inertial Navigation System Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is anticipated to emerge as the dominant region in the inertial navigation systems (INS) market over the forecast period. The region's market leadership is attributed to several factors contributing to the rapid growth and adoption of INS technology.

- Rapid industrialization, technological advancements, and the increasing adoption of autonomous vehicles across countries like China, India, Japan, and South Korea are driving the demand for advanced navigation systems. These nations are witnessing significant investments in defense, aerospace, and automotive sectors, bolstering the need for precise and reliable navigation solutions.

- Moreover, expanding defense budgets, coupled with ongoing modernization efforts in defense equipment, contribute to the increased deployment of INS technology in military applications. Additionally, the region's thriving aerospace industry, including commercial aircraft manufacturing and space exploration initiatives, further propels the demand for high-performance INS systems.

- The presence of prominent INS manufacturers and ongoing research and development activities focused on enhancing navigation technologies solidify Asia Pacific's position as the leading market for inertial navigation systems in the foreseeable future.

Inertial Navigation System Market Top Key Players:

- Honeywell International Inc.(U.S.)

- Northrop Grumman Corporation (U.S.)

- Safran (France)

- Thales Group (France)

- Raytheon Technologies Corporation (U.S.)

- General Electric Company (U.S.)

- Teledyne Technologies, Inc. (U.S.)

- Vectornav Technologies, Llc (U.S.)

- Parker-Hannifin Corporation (U.S.)

- Trimble Navigation Ltd. (U.S.)

- Gladiator Technologies, Inc. (U.S.)

- Ixblue Sas (France)

- L3harris Technologies, Inc. (U.S.)

- Memsic Inc. (U.S.)

- Advanced Navigation (Australia)

- Collins Aerospace (U.S.)

- Kvh Industries, Inc. (U.S.) and Other Major Players

Key Industry Developments in the Inertial Navigation System Market:

- In November 2023, Trimble announced a collaboration with the Indian Institute of Technology in Kanpur (IIT Kanpur) to support a new program in uncrewed aerial vehicles (UAV) to be offered by the Department of Aerospace Engineering.

- In November 2023, Point One Navigation has introduced the Atlas Inertial Navigation System (INS), a product that offers high accuracy and affordability for autonomous vehicles, mapping and other applications.

- In May 2023, ANELLO Photonics, The Creator of the SiPhOG™, announced the availability of the ANELLO GNSS INS - The World's Smallest Optical Gyro Inertial Navigation System - for robust and reliable long-term GPS-Denied Navigation and Localization.

|

Global Inertial Navigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 10.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 17.61 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Grade |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INERTIAL NAVIGATION SYSTEM MARKET BY COMPONENT (2016-2030)

- INERTIAL NAVIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACCELEROMETERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GYROSCOPES

- ALGORITHMS & PROCESSORS

- WIRELESS

- INERTIAL NAVIGATION SYSTEM MARKET BY TECHNOLOGY (2016-2030)

- INERTIAL NAVIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MECHANICAL GYRO

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RING LASER GYRO

- FIBRE OPTICS GYRO

- MEMS

- INERTIAL NAVIGATION SYSTEM MARKET BY GRADE (2016-2030)

- INERTIAL NAVIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MARINE GRADE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NAVIGATION GRADE

- TACTICAL GRADE

- SPACE-GRADE

- COMMERCIAL-GRADE

- INERTIAL NAVIGATION SYSTEM MARKET BY APPLICATION (2016-2030)

- INERTIAL NAVIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AEROSPACE & DEFENSE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MARINE

- AUTOMOTIVE

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- INERTIAL NAVIGATION SYSTEM Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NORTHROP GRUMMAN CORPORATION (U.S.)

- SAFRAN (FRANCE)

- THALES GROUP (FRANCE)

- RAYTHEON TECHNOLOGIES CORPORATION (U.S.)

- GENERAL ELECTRIC COMPANY (U.S.)

- TELEDYNE TECHNOLOGIES, INC. (U.S.)

- VECTORNAV TECHNOLOGIES, LLC (U.S.)

- PARKER-HANNIFIN CORPORATION (U.S.)

- TRIMBLE NAVIGATION LTD. (U.S.)

- GLADIATOR TECHNOLOGIES, INC. (U.S.)

- IXBLUE SAS (FRANCE)

- L3HARRIS TECHNOLOGIES, INC. (U.S.)

- MEMSIC INC. (U.S.)

- ADVANCED NAVIGATION (AUSTRALIA)

- COLLINS AEROSPACE (U.S.)

- KVH INDUSTRIES, INC. (U.S.) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL INERTIAL NAVIGATION SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By COMPONENT

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By GRADE

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Inertial Navigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 10.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 17.61 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Grade |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INERTIAL NAVIGATION SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INERTIAL NAVIGATION SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INERTIAL NAVIGATION SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. INERTIAL NAVIGATION SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. INERTIAL NAVIGATION SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. INERTIAL NAVIGATION SYSTEM MARKET BY COMPONENT

TABLE 008. ACCELEROMETERS MARKET OVERVIEW (2016-2028)

TABLE 009. GYROSCOPES MARKET OVERVIEW (2016-2028)

TABLE 010. ALGORITHMS & PROCESSORS MARKET OVERVIEW (2016-2028)

TABLE 011. WIRELESS MARKET OVERVIEW (2016-2028)

TABLE 012. INERTIAL NAVIGATION SYSTEM MARKET BY TECHNOLOGY

TABLE 013. MECHANICAL GYRO MARKET OVERVIEW (2016-2028)

TABLE 014. RING LASER GYRO MARKET OVERVIEW (2016-2028)

TABLE 015. FIBER OPTICS GYRO MARKET OVERVIEW (2016-2028)

TABLE 016. MEMS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. INERTIAL NAVIGATION SYSTEM MARKET BY GRADE

TABLE 019. MARINE GRADE MARKET OVERVIEW (2016-2028)

TABLE 020. NAVIGATION GRADE MARKET OVERVIEW (2016-2028)

TABLE 021. TACTICAL GRADE MARKET OVERVIEW (2016-2028)

TABLE 022. SPACE-GRADE MARKET OVERVIEW (2016-2028)

TABLE 023. COMMERCIAL-GRADE MARKET OVERVIEW (2016-2028)

TABLE 024. INERTIAL NAVIGATION SYSTEM MARKET BY APPLICATION

TABLE 025. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 026. MARINE MARKET OVERVIEW (2016-2028)

TABLE 027. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 028. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 029. NORTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 030. NORTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY TECHNOLOGY (2016-2028)

TABLE 031. NORTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY GRADE (2016-2028)

TABLE 032. NORTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 033. N INERTIAL NAVIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE INERTIAL NAVIGATION SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 035. EUROPE INERTIAL NAVIGATION SYSTEM MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. EUROPE INERTIAL NAVIGATION SYSTEM MARKET, BY GRADE (2016-2028)

TABLE 037. EUROPE INERTIAL NAVIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 038. INERTIAL NAVIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 039. ASIA PACIFIC INERTIAL NAVIGATION SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 040. ASIA PACIFIC INERTIAL NAVIGATION SYSTEM MARKET, BY TECHNOLOGY (2016-2028)

TABLE 041. ASIA PACIFIC INERTIAL NAVIGATION SYSTEM MARKET, BY GRADE (2016-2028)

TABLE 042. ASIA PACIFIC INERTIAL NAVIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 043. INERTIAL NAVIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA INERTIAL NAVIGATION SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA INERTIAL NAVIGATION SYSTEM MARKET, BY TECHNOLOGY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA INERTIAL NAVIGATION SYSTEM MARKET, BY GRADE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA INERTIAL NAVIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 048. INERTIAL NAVIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 049. SOUTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 050. SOUTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY TECHNOLOGY (2016-2028)

TABLE 051. SOUTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY GRADE (2016-2028)

TABLE 052. SOUTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 053. INERTIAL NAVIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 054. HONEYWELL INTERNATIONAL INC: SNAPSHOT

TABLE 055. HONEYWELL INTERNATIONAL INC: BUSINESS PERFORMANCE

TABLE 056. HONEYWELL INTERNATIONAL INC: PRODUCT PORTFOLIO

TABLE 057. HONEYWELL INTERNATIONAL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. NORTHROP GRUMMAN CORPORATION: SNAPSHOT

TABLE 058. NORTHROP GRUMMAN CORPORATION: BUSINESS PERFORMANCE

TABLE 059. NORTHROP GRUMMAN CORPORATION: PRODUCT PORTFOLIO

TABLE 060. NORTHROP GRUMMAN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SAFRAN ELECTRONICS & DEFENSE: SNAPSHOT

TABLE 061. SAFRAN ELECTRONICS & DEFENSE: BUSINESS PERFORMANCE

TABLE 062. SAFRAN ELECTRONICS & DEFENSE: PRODUCT PORTFOLIO

TABLE 063. SAFRAN ELECTRONICS & DEFENSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. THALES GROUP: SNAPSHOT

TABLE 064. THALES GROUP: BUSINESS PERFORMANCE

TABLE 065. THALES GROUP: PRODUCT PORTFOLIO

TABLE 066. THALES GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. THE RAYTHEON COMPANY: SNAPSHOT

TABLE 067. THE RAYTHEON COMPANY: BUSINESS PERFORMANCE

TABLE 068. THE RAYTHEON COMPANY: PRODUCT PORTFOLIO

TABLE 069. THE RAYTHEON COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 070. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 071. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 072. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ROCKWELL COLLINS INC: SNAPSHOT

TABLE 073. ROCKWELL COLLINS INC: BUSINESS PERFORMANCE

TABLE 074. ROCKWELL COLLINS INC: PRODUCT PORTFOLIO

TABLE 075. ROCKWELL COLLINS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. TELEDYNE TECHNOLOGIES INC: SNAPSHOT

TABLE 076. TELEDYNE TECHNOLOGIES INC: BUSINESS PERFORMANCE

TABLE 077. TELEDYNE TECHNOLOGIES INC: PRODUCT PORTFOLIO

TABLE 078. TELEDYNE TECHNOLOGIES INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. KVH INDUSTRIES: SNAPSHOT

TABLE 079. KVH INDUSTRIES: BUSINESS PERFORMANCE

TABLE 080. KVH INDUSTRIES: PRODUCT PORTFOLIO

TABLE 081. KVH INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. VECTRONAV TECHNOLOGIES LLC: SNAPSHOT

TABLE 082. VECTRONAV TECHNOLOGIES LLC: BUSINESS PERFORMANCE

TABLE 083. VECTRONAV TECHNOLOGIES LLC: PRODUCT PORTFOLIO

TABLE 084. VECTRONAV TECHNOLOGIES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. LORD MICROSTRAIN: SNAPSHOT

TABLE 085. LORD MICROSTRAIN: BUSINESS PERFORMANCE

TABLE 086. LORD MICROSTRAIN: PRODUCT PORTFOLIO

TABLE 087. LORD MICROSTRAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. TRIMBLE NAVIGATION LTD.: SNAPSHOT

TABLE 088. TRIMBLE NAVIGATION LTD.: BUSINESS PERFORMANCE

TABLE 089. TRIMBLE NAVIGATION LTD.: PRODUCT PORTFOLIO

TABLE 090. TRIMBLE NAVIGATION LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COMPONENT

FIGURE 012. ACCELEROMETERS MARKET OVERVIEW (2016-2028)

FIGURE 013. GYROSCOPES MARKET OVERVIEW (2016-2028)

FIGURE 014. ALGORITHMS & PROCESSORS MARKET OVERVIEW (2016-2028)

FIGURE 015. WIRELESS MARKET OVERVIEW (2016-2028)

FIGURE 016. INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY TECHNOLOGY

FIGURE 017. MECHANICAL GYRO MARKET OVERVIEW (2016-2028)

FIGURE 018. RING LASER GYRO MARKET OVERVIEW (2016-2028)

FIGURE 019. FIBER OPTICS GYRO MARKET OVERVIEW (2016-2028)

FIGURE 020. MEMS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY GRADE

FIGURE 023. MARINE GRADE MARKET OVERVIEW (2016-2028)

FIGURE 024. NAVIGATION GRADE MARKET OVERVIEW (2016-2028)

FIGURE 025. TACTICAL GRADE MARKET OVERVIEW (2016-2028)

FIGURE 026. SPACE-GRADE MARKET OVERVIEW (2016-2028)

FIGURE 027. COMMERCIAL-GRADE MARKET OVERVIEW (2016-2028)

FIGURE 028. INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 029. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 030. MARINE MARKET OVERVIEW (2016-2028)

FIGURE 031. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 032. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 033. NORTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. EUROPE INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. ASIA PACIFIC INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. MIDDLE EAST & AFRICA INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. SOUTH AMERICA INERTIAL NAVIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Inertial Navigation System Market research report is 2024-2032.

Honeywell International Inc. (U.S.), Northrop Grumman Corporation (U.S.), Safran (France), Thales Group (France), Raytheon Technologies Corporation (U.S.), General Electric Company (U.S.), Teledyne Technologies, Inc. (U.S.), VectorNav Technologies, LLC (U.S.), Parker-Hannifin Corporation (U.S.), Trimble Navigation Ltd. (U.S.), Gladiator Technologies, Inc. (U.S.), iXblue SAS (France), L3Harris Technologies, Inc. (U.S.), MEMSIC Inc. (U.S.), Advanced Navigation (Australia), Collins Aerospace (U.S.), KVH Industries, Inc. (U.S.) and Other Major Players.

The Inertial Navigation System Market is segmented into Component, Technology, Grade, Application, and region. By Component, the market is categorized into Accelerometers, Gyroscopes, Algorithms & Processors, and Wireless. By Technology, the market is categorized into Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, Mems, and Others. By Grade, the market is categorized into Marine Grade, Navigation Grade, Tactical Grade, Space-Grade, and Commercial-Grade. By Application, the market is categorized into Aerospace & Defense, Marine, Automotive, and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An Inertial Navigation System (INS) is a navigation technology used in vehicles, aircraft, and ships to ascertain their position, orientation, and velocity without external references such as GPS. It relies on a combination of accelerometers and gyroscopes to continuously measure changes in velocity and orientation. By integrating these measurements over time, INS calculate the object's current position and movement relative to its starting point.

Inertial Navigation System Market Size Was Valued at USD 10.97 Billion in 2023 and is Projected to Reach USD 17.61 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.