Global Industrial Refrigeration System Market Overview

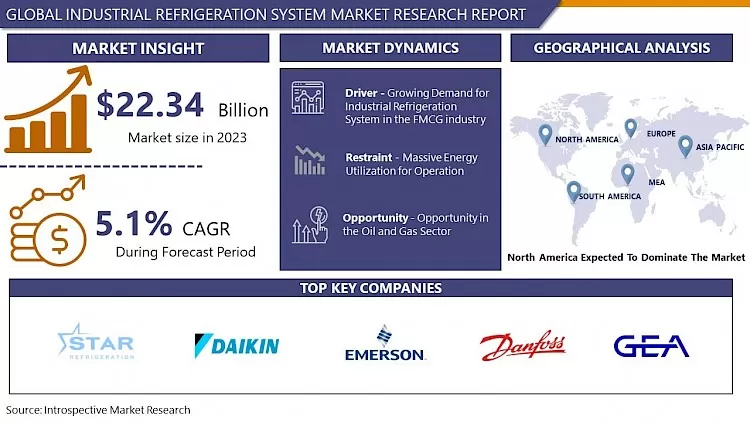

Industrial Refrigeration System Market Size Was Valued at USD 22.34 Billion in 2023, and is Projected to Reach USD 29.17 Billion by 2032, Growing at a CAGR of 5.1% From 2024-2032.

Refrigeration is utilized to remove excess heat from a substance. The modern industrial processes in the various end-use sectors such as food and chemicals are managed by accurate process conditions and temperature is an important parameter in any process. The industrial refrigeration system has a prominent role in maintaining the stability of the overall industrial process and directly influence the quality of the end product. Additionally, refrigeration act as a major role in industry and society. As freezing inhibits microbiological growth, decreasing chemical reactions and delaying physical transformations, it is possible to preserve food, maintaining its quality without wasting, during long storage periods. This capacity is essential for the increasingly demanding modern society. Furthermore, energy can neither be created nor be destroyed and it is transformable from one form to another. Heat is a form of energy that travels owing to the difference in temperature. It transfers from the warmer to the cooler object. There are different refrigerants which are chemicals that are precipitated into the liquid form. They extend into vapor and extract the heat from the surrounding area. The required thing is that the system should be closed. Once the heat is eliminated then the temperature falls. In the case of an industrial system, it can be thought of as a system utilize to eliminate the heat from any Process or Substance.

Moreover, regarding the technological exposure, and contrarily to the heating, ventilation, and air conditioning (HVAC) systems where thermal plants are usually factory-assembled packages, industrial refrigeration systems are commonly built-up, owing to the enormous variety of installations and their operating conditions, offering diverse technical challenges to the mechanical engineer. It will also be an opportunity to deepen the knowledge on utilized thermodynamics, for cycles, which will certainly lead to a proficient lecturing and/or vocational training performance. Amidst the COVID-19 pandemic, the global market for Industrial Refrigeration Systems projected at US$19.4 Billion in the year 2020, is estimated to gain a revised size of US$25.9 Billion by 2027, during the analysis period.

COVID-19 Impact on Industrial Refrigeration System Market

The market has been poorly affected due to the COVID-19 crisis. The majority of industrial operations were shut down over various parts of the world to contain the spread of the virus. Further, consumers' preferences for home-cooked products have led to a significant fall in the demand for processed food. Additionally, interruptions in the supply chain further restrained the industrial refrigeration system market growth. The industrial refrigeration system components produced by some companies' companies are purchased by different stakeholders for various end-use. Furthermore, COVID-19 has influenced the operations of the various industrial refrigeration manufacturers companies, along with businesses of their suppliers and distributors. The fall in export shipments, slow down in projects, and decline domestic demand industrial refrigeration system in comparison to pre COVID-19 levels is also anticipated to negatively impact and slightly stagnate the demand for the industrial refrigeration system market in short term. Nevertheless, the demand for essential items continued to grow during the pandemic. Panic buying of food products has positively influenced the market growth initially. In addition, the requirement for refrigeration systems has observed a surge from the pharmaceutical industry. This trend is expected to continue due to ongoing clinical trials and increased demand for medicine.

Market Dynamics and Factors for the Industrial Refrigeration System Market:

Drivers:

The development in demand for industrial refrigeration systems in the FMCG industry majorly drives the growth of the market, due to increased usage of packaged & processed food & beverages in the emerging economies and prevention of spoilage of semi-processed food & drinks. The government of India has been significant in the growth and development of the food processing industry which accounts for 32% of the country's total food market. In addition, the Ministry of Food Processing Industries (MoFPI) is making all efforts to motivate investments in the business also it has approved proposals for joint ventures (JV), foreign collaborations, industrial licenses, and 100% export-oriented units. According to IBEF (India Brand Equity Foundation) 2019 report, Amazon, a global e-commerce giant, is planning to penetrate the Indian food retailing sector by investing USD 515 million in the next five years.

Furthermore, the growing trend of innovations in cold storage infrastructures across emerging countries drives the growth of the industrial refrigeration system market. In developing economies, food wastage is one of the major reasons for the scarcity of food. India is among the top manufacturer of food products and other perishable goods, including fruits, milk products, and vegetables. Thus, the inadequate cold chain infrastructure is the primary cause of food wastage and food loss. The shelf life of fruits, vegetables, fish, and dairy products declines adequately owing to factors such as insufficient infrastructure, improper handling, no access to cold chains, a dearth of energy resources to power these cold chain facilities, and so on. Hence, some emerging economies, such as China and India, have started adopting developed refrigeration systems across cold storage and cold chain infrastructure to ensure uninterrupted temperature-controlled transport and storage of perishable food products, medicines, and pharmaceuticals, beverages, chemicals, among others.

Restraints:

Massive energy utilization for operation and high investment in maintenance of industrial refrigeration systems restraint the growth of the industrial refrigeration system market over the forecast period. Industrial refrigeration system typically has a high installation cost due to the huge cost of their components, including compressors, condensers, and evaporators. In addition, the control systems used in these refrigeration systems are expensive, which increases the installation cost. Furthermore, during the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly impacted. Manufacturing activities were also terminated or restricted to a massive extent. Construction and transportation activities, along with their supply chains hindered on a global level. This led to a decline in the manufacturing of refrigeration systems, which directly hampers the industrial refrigeration system market.

Opportunities:

Growth Opportunity in the Oil and Gas Sector

The refrigerating systems are crucial elements of the gas and oil manufacturing industry. There are utilized in several processes starting from the extraction of natural gas and oil from the reservoir rocks in the form of crude oil and natural gas to the transportation to end consumers. Refrigeration plants can be very profitable pieces of equipment that cool natural gas to approximately -162 F and change it to a liquid form (natural gas liquids) that can be easily stored and transported through pipelines. According to the International Association of Oil & Gas Producers (IOGP's) Global Production report 2019, demand for oil and gas is at its peak, higher than ever before, with dramatic growth in Africa, Asia Pacific, the Middle East, and the Americas. This has triggered the investment in the exploration and production of oil to accomplish the demand and supply. For instance, in 2019, Ecopetrol and Occidental Petroleum Corp accepted to form a joint venture for the development of unconventional reservoirs in approximately 97,000 acres of the Permian Basin in the State of Texas.

Market Segmentation

Segmentation Analysis of Industrial Refrigeration System Market:

Based on the Component, the compressor segment is expected to register the maximum industrial refrigeration system market share during the forecast period. The development of the compressors segment is attributed to features such as cost-effectiveness and heavy-duty design that supports longevity and durability. Furthermore, compressors offer multiple forces, including consistent and efficient motive force, for smoother operations in production. These forces work as the backbone of most of the operations, such as the push in stamping, air spent in the performance of the machine, and others. Moreover, technological developments and R&D investments have helped to the development of energy-efficient compressors that significantly overcome the energy utilization of industrial refrigerators. The ability of compressors to consistently maintain a low temperature in industrial refrigerators is also contributing to their growing market penetration

Based on the Refrigerant Type, the carbon dioxide segment is anticipating to dominate the industrial refrigeration system market during the forecast period. The increased utilization of natural refrigerants, such as Carbon dioxide (CO2), Ammonia (NH3), and others, have helped to overcome the emission of harmful gases that contribute to global warming. The major factor for the market's growth is the increasing popularity of carbon dioxide cascade refrigeration systems in various applications. Carbon dioxide is huge and stays in the atmosphere for a longer time. Large carbon dioxide-based industrial refrigeration systems are cheaper cost to build than their glycol counterparts; therefore, the initial and life cycle costs of carbon dioxide-based industrial refrigeration systems are comparatively low. Additionally, carbon dioxide has other beneficial characteristics, such as no toxicity, no flammability, high heat transfer, high refrigeration volumetric capacity, and negligible GWP.

Based on Application, the food and beverages segment is projected to dominate the industrial refrigeration system market over the estimated period. The growing utilization of packaged food and expansion of retail food chains globally are anticipated to drive the growth of this segment. Meanwhile, the refrigerated warehouse segment is expected to face considerable growth over the forecast period owing to the increasing population and rising demand for frozen food. Moreover, the adoption of industrial refrigeration cabinets, counters, and vertical freezers is rising rapidly in hypermarkets, supermarkets, and convenience stores, aiding the market statistics. In addition, rising import and export activities in the food & beverage industry are offering a positive outlook to the industry. The high demand for storage and preservation of food items to be exported over international borders is driving the industrial refrigeration system market development.

Regional Analysis of Industrial Refrigeration System Market:

The North American region is expected to dominate the industrial refrigeration system market over the forecast period. Growing demand for fresh food, beverages, and medicines is a key factor anticipated to accelerate the growth of the market in the region over the forecast period. Additionally, technological advancement, convenience, and aggressive marketing of frozen foods in several varieties, including skillet and oven meal kits, restaurant-quality pizza, bowl meals by food manufacturers which will turn the demand in the coming years. Stimulating research and clinical testing to halt the spread of COVID-19 over North America is also turning the growth of the industrial refrigeration system market in the pharmaceutical industry. Furthermore, companies are introducing the latest models of energy-efficient compressors. For instance, in January 2020, Emerson introduced its latest product line of fixed-speed scroll compressors, Copeland, for commercial and industrial refrigeration applications. The Copeland range of scroll compressors is optimized for low GWP refrigerants that help the company to accomplish energy efficiency standards and regulations built up by the Department of Energy (DOE) and California Air Resources Board. Emerson plans to introduce the full lineup of its 6–40-ton compressors by 2022.

Asia Pacific Region is projected to register the significant growth of the industrial refrigeration system market throughout the period. Due to the huge population density and the rising income level with the growing demand for packaged foods this region has the highest market share. In addition, governments of various countries in APAC support the Montreal Protocol initiative to phase out environmentally harmful refrigerants, thereby offering lucrative opportunities for the players providing natural refrigerant-based refrigeration systems. Therefore, government initiatives to further strengthen cold chain management systems are anticipated to be the major driver for the growth of industrial refrigeration systems in the APAC region.

Demand for frozen food items is provoking the adoption of the industrial refrigeration system. In addition, the growing number of large stores has compelled small restaurants and unorganized grocery retail stores to upgrade with the latest electronic appliances including refrigeration equipment. These features are boosting the growth of the Latin American industrial refrigeration system market. Further, the trend of ready-to-eat food is providing huge demand from food outlets and new restaurants in the region. This, in turn, will help the development of the Latin American industrial refrigeration system market in near future.

Players Covered in Industrial Refrigeration System market are :

- Star Refrigeration (Scotland)

- Daikin Industries Ltd. (Japan)

- Emerson Electric Co. (US)

- Danfoss A/S (Denmark)

- GEA Group Aktiengesellschaft (Germany)

- Danfoss (Denmark)

- Mayekawa (Japan)

- Daikin (Japan)

- Ingersoll Rand (Ireland)

- EVAPCO

- Inc. (the US)

- Johnson Controls (Ireland)

- LU-VE Group (Italy)

- MTA S.p.A. (Italy)

- Frascold (Italy)

- HITEMA INTERNATIONAL (Italy)

- Güntner GmbH & Co. KG (Germany)

- KOBELCO (Japan)

- Innovative Refrigeration Systems (US)

- Parker Hannifin (US)

- Lennox International (US)

- Clauger (France)

- Rivacold (Italy)

- Dorin S.p.A. (Italy)

- Industrial Frigo (Lombardy)

- BITZER Kuhlmaschinenbau GmbH (Germany)

- Carnot Refrigeration (Canada)

- SRM Italy (Italy)

- Mayekawa Mfg. Co. Ltd. (Japan)

- Baltimore Aircoil Company (US) and others major key players.

Key Industry Developments In Industrial Refrigeration System Market

- In July 2024, Panasonic Corporation announced that its Cold Chain Solutions Company (hereinafter referred to as Panasonic) has agreed with Cooling Solutions S.L. to purchase all the shares of its subsidiary Area Cooling Solutions Sp. z o.o., a Polish refrigeration equipment manufacturer (hereinafter referred to as Area Cooling).

|

Global Industrial Refrigeration System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.34 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.1% |

Market Size in 2032: |

USD 29.17 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Refrigerant Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Refrigeration System Market by Component (2018-2032)

4.1 Industrial Refrigeration System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compressor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Condenser

4.5 Evaporator

4.6 Expansion Valves

4.7 Others

Chapter 5: Industrial Refrigeration System Market by Application (2018-2032)

5.1 Industrial Refrigeration System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food & Beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Petrochemicals & Pharmaceuticals

5.5 Electricity Production

5.6 Refrigerated Warehouse

5.7 Refrigerated Transportation

5.8 Others

Chapter 6: Industrial Refrigeration System Market by Refrigerant Type (2018-2032)

6.1 Industrial Refrigeration System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Ammonia

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hydrofluorocarbon (HFC)

6.5 Carbon Dioxide

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industrial Refrigeration System Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADM (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUPONT (US)

7.4 CARGILL (US)

7.5 INGREDION (US)

7.6 ARLA FOODS (UK)

7.7 ROQUETTE (FRANCE)

7.8 BASF (GERMANY)

7.9 GLANBIA (IRELAND)

7.10 FONTERRA (NEW ZEALAND)

7.11 DSM (NETHERLANDS)

7.12 FRIESLANDCAMPINA (NETHERLANDS)

7.13 ESSENTIA PROTEIN SOLUTIONS (UK)

7.14 AMAI PROTEINS (ISRAEL)

7.15 MYCORENA (SWEDEN)

7.16 MERIT FUNCTIONAL FOODS (CANADA)

7.17 PLANTIBLE FOODS (US)

7.18 BENEO (GERMANY)

7.19 PROTIFARM (GELDERLAND)

7.20 OMEGA PROTEIN (US)

Chapter 8: Global Industrial Refrigeration System Market By Region

8.1 Overview

8.2. North America Industrial Refrigeration System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Compressor

8.2.4.2 Condenser

8.2.4.3 Evaporator

8.2.4.4 Expansion Valves

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Food & Beverage

8.2.5.2 Petrochemicals & Pharmaceuticals

8.2.5.3 Electricity Production

8.2.5.4 Refrigerated Warehouse

8.2.5.5 Refrigerated Transportation

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Refrigerant Type

8.2.6.1 Ammonia

8.2.6.2 Hydrofluorocarbon (HFC)

8.2.6.3 Carbon Dioxide

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industrial Refrigeration System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Compressor

8.3.4.2 Condenser

8.3.4.3 Evaporator

8.3.4.4 Expansion Valves

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Food & Beverage

8.3.5.2 Petrochemicals & Pharmaceuticals

8.3.5.3 Electricity Production

8.3.5.4 Refrigerated Warehouse

8.3.5.5 Refrigerated Transportation

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Refrigerant Type

8.3.6.1 Ammonia

8.3.6.2 Hydrofluorocarbon (HFC)

8.3.6.3 Carbon Dioxide

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industrial Refrigeration System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Compressor

8.4.4.2 Condenser

8.4.4.3 Evaporator

8.4.4.4 Expansion Valves

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Food & Beverage

8.4.5.2 Petrochemicals & Pharmaceuticals

8.4.5.3 Electricity Production

8.4.5.4 Refrigerated Warehouse

8.4.5.5 Refrigerated Transportation

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Refrigerant Type

8.4.6.1 Ammonia

8.4.6.2 Hydrofluorocarbon (HFC)

8.4.6.3 Carbon Dioxide

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industrial Refrigeration System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Compressor

8.5.4.2 Condenser

8.5.4.3 Evaporator

8.5.4.4 Expansion Valves

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Food & Beverage

8.5.5.2 Petrochemicals & Pharmaceuticals

8.5.5.3 Electricity Production

8.5.5.4 Refrigerated Warehouse

8.5.5.5 Refrigerated Transportation

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Refrigerant Type

8.5.6.1 Ammonia

8.5.6.2 Hydrofluorocarbon (HFC)

8.5.6.3 Carbon Dioxide

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industrial Refrigeration System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Compressor

8.6.4.2 Condenser

8.6.4.3 Evaporator

8.6.4.4 Expansion Valves

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Food & Beverage

8.6.5.2 Petrochemicals & Pharmaceuticals

8.6.5.3 Electricity Production

8.6.5.4 Refrigerated Warehouse

8.6.5.5 Refrigerated Transportation

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Refrigerant Type

8.6.6.1 Ammonia

8.6.6.2 Hydrofluorocarbon (HFC)

8.6.6.3 Carbon Dioxide

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industrial Refrigeration System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Compressor

8.7.4.2 Condenser

8.7.4.3 Evaporator

8.7.4.4 Expansion Valves

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Food & Beverage

8.7.5.2 Petrochemicals & Pharmaceuticals

8.7.5.3 Electricity Production

8.7.5.4 Refrigerated Warehouse

8.7.5.5 Refrigerated Transportation

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Refrigerant Type

8.7.6.1 Ammonia

8.7.6.2 Hydrofluorocarbon (HFC)

8.7.6.3 Carbon Dioxide

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Industrial Refrigeration System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.34 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.1% |

Market Size in 2032: |

USD 29.17 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Refrigerant Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Industrial Refrigeration System Market research report is 2024-2032.

Star Refrigeration (Scotland), Daikin Industries Ltd. (Japan), Emerson Electric Co. (US), Danfoss A/S (Denmark), GEA Group Aktiengesellschaft (Germany), Danfoss (Denmark), Mayekawa (Japan), Daikin (Japan), Ingersoll Rand (Ireland), EVAPCO, Inc. (the US), Johnson Controls (Ireland), LU-VE Group (Italy), MTA S.p.A. (Italy), Frascold (Italy), HITEMA INTERNATIONAL (Italy), Güntner GmbH & Co. KG (Germany), KOBELCO (Japan), Innovative Refrigeration Systems (US), Parker Hannifin (US), Lennox International (US), Clauger (France), Rivacold (Italy), Dorin S.p.A. (Italy), Industrial Frigo (Lombardy), BITZER Kuhlmaschinenbau GmbH (Germany), Carnot Refrigeration (Canada), SRM Italy (Italy), Mayekawa Mfg. Co. Ltd. (Japan), Baltimore Aircoil Company (US), and Other Major Players.

Industrial Refrigeration System Market is segmented into Component, Application, Refrigerant Type and region. By Component, the market is categorized into Hot Cast Elastomer, Cold Cast Elastomer. By Application, the market is categorized into Automotive & Transportation, Agriculture, Industrial, Oil & Gas, Other. By Refrigerant Type, the market is categorized into Online, Offline, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Industrial Refrigeration System is referred to as thermosetting, akin to natural and synthetic rubbers. These elastomers are based on either polyether and/or polyesters. Industrial Refrigeration System possess significant physical properties, incorporating abrasion resistance and load-bearing

Industrial Refrigeration System Market Size Was Valued at USD 22.34 Billion in 2023, and is Projected to Reach USD 29.17 Billion by 2032, Growing at a CAGR of 5.1% From 2024-2032.