Industrial Bakeware Market Synopsis

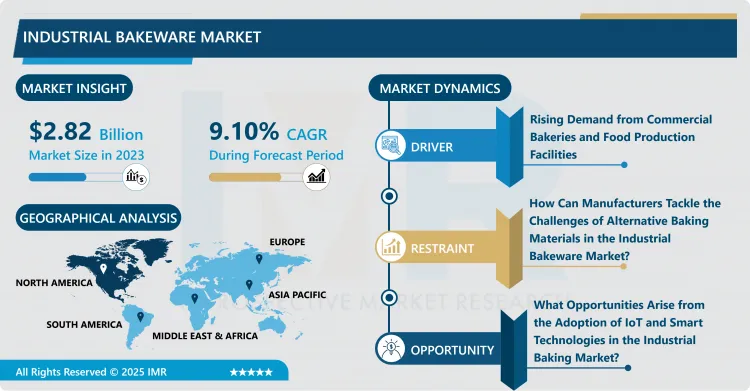

Industrial Bakeware Market Size is Valued at USD 2.82 Billion in 2023 and is Projected to Reach USD 6.18 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

Commercial and retail consumption of baked food items is influencing the expansion of the industrial bakeware market considerably. This has created a growing demand for high quality bakeware so that industries like the food service industry, the hospitality industry and the retail industry are coming up with products and services to fill this niche of a high demand of artisanal baking and other specialty baked items. In addition, the growth in healthier and organic baked products is resulting from the introduction of bakeware products that offer faster as well as homogenous cooking. This is also backed by technology innovations to enhance the production of new products aimed at increasing durability in culinary.

- Currently, consumers are presented with a great choice of goods, including, but not limited to, baking trays, pans, molds, and a number of utensils made of silicone, stainless steel, and aluminum. The kinds of materials affect the efficiency of bakeware because each type has its benefits in terms of cleanup and heat transfer. Non-stick coatings are also becoming more popular as a result of the ease of using and the process of removal any sort of food the two being admired by both home makers and commercial bakers. Besides, due to availability and convenience being key factors that influence consumer purchase decisions, the e-commerce platforms that exist are enhancing the consumer reach to these products hence creating market elasticity through sales.

- However, there are factors which affect market growth of the products, including; competition from other potential baking solutions for customers and variations of prices of raw materials. To establish competitive advantage and meet the customers’ new demands, the focus is made on sustainable development and new product differentiation. There are even opportunities in terms of adding new lines in products, including multipurpose and the environmentally friendly bakeware to meet the growing consumer interest in green items for use in the kitchen. Overall the industrial bakeware market can be seen poised on the threshold of rapid growth as it modifies itself with the changing food industry and the modern consumer demands.

Industrial Bakeware Market Trend Analysis

Shift Towards Sustainable Bakeware

- The industrial bakeware has experienced significant changes within the transition to the usage of the environmentally friendly and sustainable material with growing awareness of the public. The consumers’ need for green bakeware has therefore been met through the development of bakeware products made out of degradable materials as well as through less hazardous manufacturing processes. This trend not only attracts the glance of the eco-minded buyer but also aligns with other trends demonstrated by the industry towards sustainability. Therefore, extending value through sustainable practices helps organizations capable of creating competitive advantage and improve organizational brand image amongst the elites consumers.

- Increasing tendencies of sustainable bakery solutions are observed in the industrial bakery market and this fact may be considered as the sign of further changes in the preference of consumers to purchase environmentally friendly products.Companies are every year more conscious of the environmental situation and therefore manufacturers have started to produce bakeware with eco friendly material such as silicone and aluminum that can be recycled. This movement not only appeals populace that is increasingly environmentally sensitive but is also in compliance with the legal requirements of industry and conservation programs proposed to minimize waste.

Adoption of Smart Baking Technologies

- As much as kitchen technologies and automation dominates the industrial bakeware market, smart baking technologies are adopted. Intelligent bakeware is bake wear products with sensors and connectivity that allow adjustments during the baking process to be made on real-time basis. This innovation can meet the expectations of professional bakers because of the improvement of specifics of baking through the use of this tool. Bakeware solution adopted smart technologies as a result of the rise in the adoption of automation by manufacturers. This modern approach is very appealing to commercial and domestic bakers who desire different overall results and efficiency.

- Even some highly developed characteristics like connectivity and building in sensors make modern bakery product, allowing the bakers to control the parameters, that are hardly noticeable by them before, such as temperature and moisture content. Aside from enhancing the quality as well as homogeneity of baked foods, this innovation repairs fundamental production processes, contributing to commercial bakeries and restaurants that focus on effectiveness. Moreover, there are smart bakeware solutions that allow bakers improve their performance and improve their skills by providing tools aimed at data gathering and analysis.

Industrial Bakeware Market Segment Analysis:

Industrial Bakeware Market Segmented on the basis of By Product Type, By Material and By End User

By Product Type, Baking Trays segment is expected to dominate the market during the forecast period

- This market is characterized by product type segmentation to suit the needs of commercial bakeries and Food service operators. As for a number of specialties, including bread, cakes, and biscuits, baking trays and baking pans cannot be done without. These products have been designed and developed by manufacturers with the help of different materials ranging from aluminum and non-stick coatings in order to provide best heat transfer feature and easy to use. Others include the perforated trays which make even baking possible due to better heat circulation are also on the rise, highlighting customer desire for better quality baked goods.

- So, molds, utensils and tools further support the market, though they add a certain measure of flexibility in approach towards the presentation and preparation of cuisine. Food manufacturers can easily create appealing shapes and forms for many of their products through the use of various molds, necessary for the constant growth of specialty and artisanal products in baking. In the meantime, such objects as implements and tools as dough scrapers or spatulas are essential when expecting a great level of accuracy in the baking process. Future trends regarding the industrial bakeware market are sure to integrate these product categories as pivotal assets to encouraging the ability of professional bakers to explore with their concoctions.

By End User, Commercial Bakeries segment held the largest share in 2024

- End users divide the industrial bakeware market into four categories. These categories include commercial bakeries, restaurants and cafés, retail bakeries, and household use. Each category represents distinct demand drivers. The demand for high-capacity production of a variety of baked products is the primary factor driving the growth of commercial bakeries, which are the largest segment. To achieve high volumes and consistency, professional baking facilities require durable and efficient bakeware. In the same vein, the demand for versatile bakeware that can accommodate a variety of recipes and styles is on the rise as restaurants and cafés concentrate more on providing specialized baked goods.

- Conversely, retail bakeries offer artisanal products to local communities, necessitating bakeware that improves the quality and presentation of their products. Meanwhile, health trends and cooking programs are driving the expansion of the household use segment due to the growing popularity of baking at home. This segment is a proponent of user-friendly, innovative bakeware, which is a factor in the overall expansion of the industrial bakeware market as it adjusts to the diverse preferences and requirements of consumers.

Industrial Bakeware Market Regional Insights:

North America is fastest growing in the Industrial Bakeware market

- Driven by the expansion of the food service industry and the increasing consumption of baked products, North America is becoming the fastest-growing region in the industrial bakeware market. The region's robust bakery sector, encompassing a wide variety of products such as specialty pastries and artisan breads, fuels the demand for high-quality bakeware solutions. Health-conscious consumers, seeking fresh and organic alternatives, are driving the growing popularity of home cooking, further bolstering the market. North American consumers are actively looking for innovative bakeware products that improve their baking experience, with a strong emphasis on quality and convenience.

- Additionally, the presence of established distribution networks and key participants in North America facilitates the rapid expansion of the industrial bakeware market. In order to accommodate the changing preferences of consumers, manufacturers are emphasizing product innovation, including the introduction of sustainable options and advanced materials. North America is a global leader in the industrial bakeware market due to the convergence of technological advancements, increasing disposable incomes, and a growing preference for premium culinary products.

Active Key Players in the Industrial Bakeware Market

- Nordic Ware (U.S.)

- Wilton Brands LLC (U.S.)

- USA Pan (U.S.)

- Silikomart (Italy)

- Paderno (Canada)

- Others

|

Global Industrial Bakeware Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 6.18 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Bakeware Market by Product Type (2018-2032)

4.1 Industrial Bakeware Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Baking Trays

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Baking Pans

4.5 Molds

4.6 Utensils and Tools

Chapter 5: Industrial Bakeware Market by Material (2018-2032)

5.1 Industrial Bakeware Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aluminum

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Stainless Steel

5.5 Silicone

5.6 Non-Stick Coatings

5.7 Others

Chapter 6: Industrial Bakeware Market by End User (2018-2032)

6.1 Industrial Bakeware Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial Bakeries

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Restaurants and Cafés

6.5 Retail Bakeries

6.6 Household Use

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industrial Bakeware Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NORDIC WARE (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WILTON BRANDS LLC (U.S.)

7.4 USA PAN (U.S.)

7.5 SILIKOMART (ITALY)

7.6 PADERNO (CANADA)

7.7 OTHERS

7.8

Chapter 8: Global Industrial Bakeware Market By Region

8.1 Overview

8.2. North America Industrial Bakeware Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Baking Trays

8.2.4.2 Baking Pans

8.2.4.3 Molds

8.2.4.4 Utensils and Tools

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Aluminum

8.2.5.2 Stainless Steel

8.2.5.3 Silicone

8.2.5.4 Non-Stick Coatings

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Commercial Bakeries

8.2.6.2 Restaurants and Cafés

8.2.6.3 Retail Bakeries

8.2.6.4 Household Use

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industrial Bakeware Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Baking Trays

8.3.4.2 Baking Pans

8.3.4.3 Molds

8.3.4.4 Utensils and Tools

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Aluminum

8.3.5.2 Stainless Steel

8.3.5.3 Silicone

8.3.5.4 Non-Stick Coatings

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Commercial Bakeries

8.3.6.2 Restaurants and Cafés

8.3.6.3 Retail Bakeries

8.3.6.4 Household Use

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industrial Bakeware Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Baking Trays

8.4.4.2 Baking Pans

8.4.4.3 Molds

8.4.4.4 Utensils and Tools

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Aluminum

8.4.5.2 Stainless Steel

8.4.5.3 Silicone

8.4.5.4 Non-Stick Coatings

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Commercial Bakeries

8.4.6.2 Restaurants and Cafés

8.4.6.3 Retail Bakeries

8.4.6.4 Household Use

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industrial Bakeware Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Baking Trays

8.5.4.2 Baking Pans

8.5.4.3 Molds

8.5.4.4 Utensils and Tools

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Aluminum

8.5.5.2 Stainless Steel

8.5.5.3 Silicone

8.5.5.4 Non-Stick Coatings

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Commercial Bakeries

8.5.6.2 Restaurants and Cafés

8.5.6.3 Retail Bakeries

8.5.6.4 Household Use

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industrial Bakeware Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Baking Trays

8.6.4.2 Baking Pans

8.6.4.3 Molds

8.6.4.4 Utensils and Tools

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Aluminum

8.6.5.2 Stainless Steel

8.6.5.3 Silicone

8.6.5.4 Non-Stick Coatings

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Commercial Bakeries

8.6.6.2 Restaurants and Cafés

8.6.6.3 Retail Bakeries

8.6.6.4 Household Use

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industrial Bakeware Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Baking Trays

8.7.4.2 Baking Pans

8.7.4.3 Molds

8.7.4.4 Utensils and Tools

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Aluminum

8.7.5.2 Stainless Steel

8.7.5.3 Silicone

8.7.5.4 Non-Stick Coatings

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Commercial Bakeries

8.7.6.2 Restaurants and Cafés

8.7.6.3 Retail Bakeries

8.7.6.4 Household Use

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Industrial Bakeware Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 6.18 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Industrial Bakeware Market research report is 2024-2032.

Nordic Ware (U.S.), Wilton Brands LLC (U.S.), USA Pan (U.S.), Silikomart (Italy), Paderno (Canada), Others

The Industrial Bakeware Market is segmented into By Product Type(Baking Trays, Baking Pans, Molds, Utensils and Tools), By Material(Aluminum, Stainless Steel, Silicone,Non-Stick Coatings, Others), By End User(Commercial Bakeries, Restaurants and Cafés, Retail Bakeries, Household Use).By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Commercial settings such as bakeries, restaurants, and food manufacturing facilities typically employ industrial bakeware, a term that denotes specialized baking tools and apparatus specifically designed for high-volume baking operations. This category encompasses a diverse array of products such as baking trays, pans, molds, and implements. Durable materials such as silicone, stainless steel, and aluminum construct these products. Designed to withstand rigorous use, industrial bakeware simultaneously ensures optimal heat distribution, easy food release, and efficient cleanup. It is essential to the baking process, as it enables the production of a diverse array of baked products, including bread, pastries, cakes, and cookies, with consistent and high-quality results. The continually growing demand for baked goods and the advancements in materials and technologies are driving innovation in the industrial bakeware market.

Industrial Bakeware Market Size is Valued at USD 2.82 Billion in 2023 and is Projected to Reach USD 6.18 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.