Ibuprofen API Market Synopsis

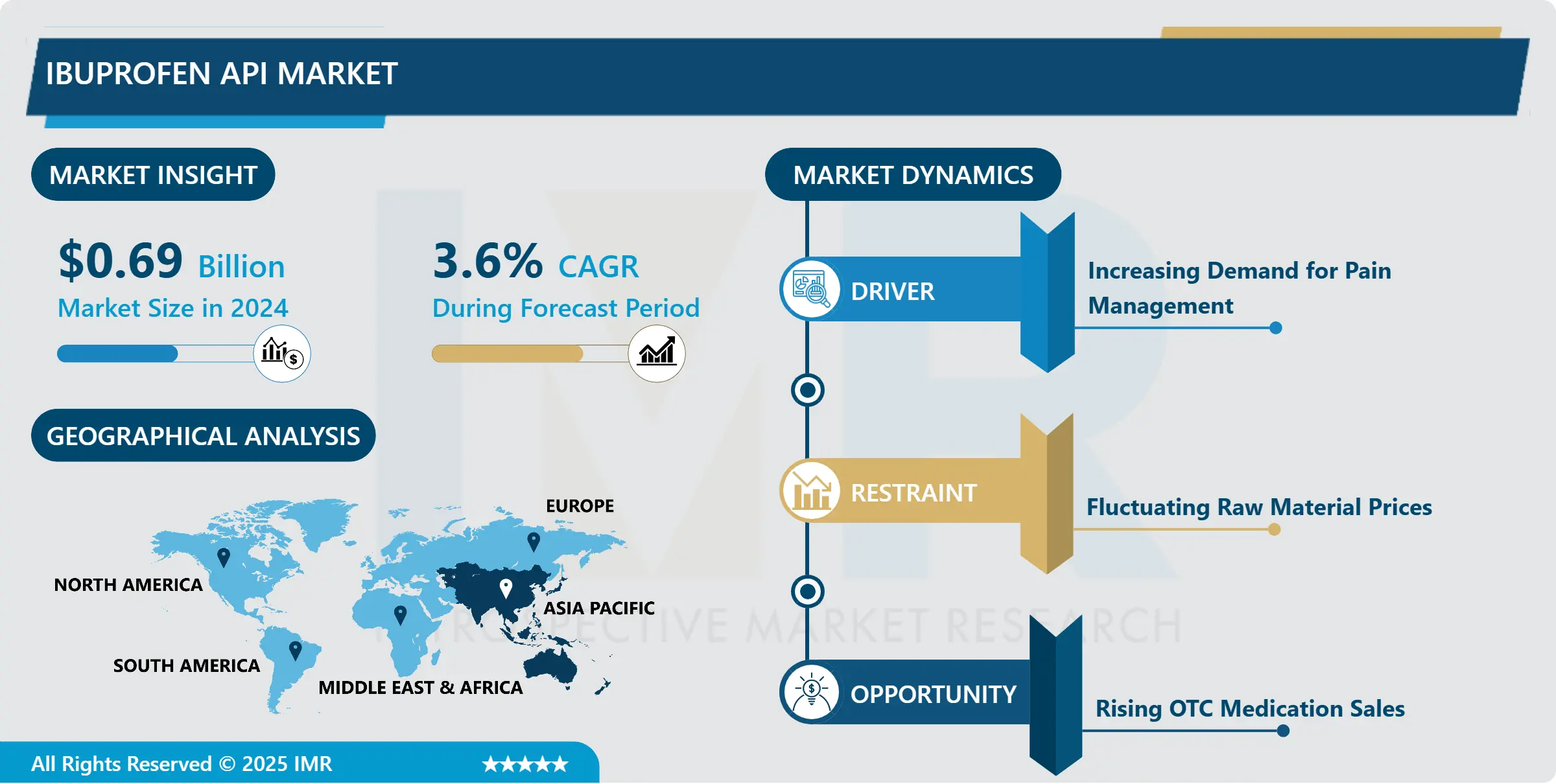

Ibuprofen API Market Size Was Valued at USD 0.69 Billion in 2024, and is Projected to Reach USD 1.02 Billion by 2035, Growing at a CAGR of 3.6% From 2025-2035.

Ibuprofen API is the actual substance, that is in its pure form, used in compounding formulate for manufacturing any medicine that contains ibuprofen. Ibuprofen refers to the group of non-prescription drugs that help in eradicating fever, pain and inflammation. The API is the component of therapeutic value of ibuprofen when it is incorporated in table, capsule or other dosage form.

The global market for the ibuprofen API is realizing robust growth due in part to the soaring global population’s need for pain relief medication. Ibuprofen is a common non-steroidal anti-inflammatory painkiller and anti-fever medication indicated for muscular and skeletal pain. Neither of these markets is expected to decrease in the foreseeable future given that chronic pain conditions continue to increase, and people looking for over the counter medication to get a quick relief with the help of affordable preparations offer a steady demand for ibuprofen formulations. Also, the increasing understanding of the cases of self-treatment, especially in the developing countries, ultimately accelerates the market growth. This sector also has intense product rivalry among market players in the industry particularly for API ibuprofen since they invest heavily in research to produce better and safer products. Producers are putting resources into enhanced production processes and methodologies to enhance recoveries and decrease costs of manufacturing. In addition, government regulations on the quality and safety of the drug products have also forced firms to manufacturers their products to the set standards. This not only increases product reliability but also improves the status of consumer confidence and forms a good market condition.

Regionally, Asia-Pacific countries are gradually becoming major suppliers of ibuprofen API due to the existence of large pharmaceutical manufacturing plants, and increasing market demand. Industrialisation is continuing at fast pace in the Asian countries such as China and India and this has put the region in a position of strengths in the global ibuprofen market. North America also remains a big market with tremendous consumer expenditure on health care and backed up by a robust pharmaceutical industry as is the case with Europe region. In all, the ibuprofen API market is expected to grow significantly because of growing consumer demand together with new technologies, and collaboration between market players.

Ibuprofen API Market Trend Analysis

Chronic Diseases and Self-Medication

- Chronic diseases rampantly affecting people today and rheumatic diseases and other musculoskeletal diseases in particular, prompt many patrons to find the best painkiller and anti-inflammatory drug – Ibuprofen. These factors present lifestyle factors namely, reduced physical activity levels, and the prevalence of poor diets, which result from such illnesses. Also, the worldwide population of geriatric people is rising with growing age people are more sensitive to pain and inflammation arising from age-related diseases. Hence, health care providers prescribe radio antecedent Ibuprofen for pain management and its increased consumption in the prescription and over the counter segments.

- Also, the incidence of people’s self-medication has been gradually growing, including the regular use of OTC medications, such as Ibuprofen. Thus, modern consumers have discussed their priority to handle the pains and inflammation on their own, and without a doctor’s visit at that. This change in the trend has created an opportunity for Ibuprofen because of its availability in treating numerous ailments by a single solution. The fact that consumers can easily and freely purchase Ibuprofen in the chemist, from the counter, over the internet, among other places, has also contributed to continued use, thus offering empirical credence to what is increasingly becoming a phenomenon of empowered consumerist health management. This state of affairs has fostered favourable market conditions for Ibuprofen and constant chances for expansion.

Innovations and Challenges in Ibuprofen API Manufacturing

- Over the last years, numerous innovations in the field of manufacturing technologies and green chemistry have improved the efficiency of Ibuprofen APIs manufacturing. They have made it possible for manufacturers to improve their efficiency, minimize wastage and prove friendly to the environment. Moreover, there has been increased regulation of the industry and effort to produce quality API hence increasing the standards set within the API manufacturing industry. This has, in turn, led to the expansion of investment in development, so that modes of producing products meet both safety and efficiency standards. In addition, the various fast moving, convenient convenience stores has meant that Ibuprofen is easy to access for consumers through online pharmacies and electronic commerce platforms thus contributing to the growth of its market share. However, the overall situation seems to be improving and with some few challenges such as; increased competition and the products being fake or Counterfeit Ibuprofen API. These factors make it possible to establish that quality control mechanism must be enhanced so as to enhance consumer protection as well as to maintain the image of the brands in the market. Consequently, to avoid or at least minimize counterfeiting risks, more firms are putting their efforts and money into improving security measures and verifications. In the future, the demand for Ibuprofen API is projected to increase owing to increasing health consciousness and the ever-continuing need for efficient analgesic products.

Ibuprofen API Market Segment Analysis:

Ibuprofen API Market Segmented based on By Type, By Application and By End User

By Type, Standard Ibuprofen segment is expected to dominate the market during the forecast period

- Standard Ibuprofen is one of the most popular formulations within the family of Nonsteroidal Anti-Inflammatory Drugs, NSAID, which is effective in the management of pain, inflammation and fever. Being an accessible counter medication for pain, consumers who experience slight to moderate pain for instance headache, muscle aches and dental discomfort can use it. It is very cheap to produce, and it can also be obtained easily; hence it has become a staple product in most households. The formulation is not only used by people for over the counter medication, but also prescribed by doctors and other health care practitioners across different types of illness.

- In addition to relieving pain, standard ibuprofen also features flexibility in usage with regard to fever control in adults and children. On its pharmacological activity, Mechanism of action is based on the inhibition of cyclooxygenase enzymes (COX-1 and COX-2) is involved in the synthesis prostaglandin which acts as mediator of pain and inflammation. Hence, standard ibuprofen is usually prescribed for various conditions because the side effects of this drug are known to be mild when taken according to the recommended dosage. That is why, the availability of the broad range of applications and arising awareness of effective self-treatment practices could always maintain an active demand for the standard ibuprofen in the sphere of pharmaceuticals.

By End User, CROs and CMOs segment held the largest share in 2023

- CROs and CMOs occupy a central position in the monographs entitled pharmaceutical supply and represent important outsourcing partners for the pharmaceutical firms. These organisations provide misc services of drug development,personalised clinical trial solutions and manufacturing processes that act as crucial steps in delivering new medication to the public. In this context, ibuprofen has a very important role, that is often selected in clinical trials to evaluate the efficacy and safety of a new compound. The therapeutic application of ibuprofen as an analgesic and anti-inflammatory drug, in combination therapies and as part of multimodal analgesia are typically investigated by using ibuprofen as a reference.

- Having established steady sales with CROs and CMOs, the demand for ibuprofen continues to remain strong due to continued active research on new formulation and therapeutic indication. It also explores new delivery systems whereby the drug can be formulated to have longer duration of action and improved pain relief by using targeted drug delivery systems. While the independent research organizations are looking for new ways and means of pain management, the usage of reference samples as ibuprofen is progressively high. Alongside such factors as the constant focus on the quality of treating the patients and introduction of individual approach to their treatment, further investigations of numerous possibilities of using ibuprofen for the treatment of various diseases become more important; this fact underlines the perspectives of this drug as one of the most significant values on the modern stage of pharmaceutical developments.

Ibuprofen API Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Within the Asia-Pacific region, there exist great opportunities for the development of the Ibuprofen API market: population growth, advancing urbanization, and the increasing rates of chronic diseases. Pain is a major issue with population growth and increasing city size, which means that there is more and more demand for effective pain management. Developed countries are leading this growth with China and India being major beneficiaries of increased investment in health care as well as improved health care access. Further, increased disposable income is translating into increased spending on health care, and overall, over the counter medicines such as Ibuprofen also contribute to enhanced market demand.

- Another important fact contributing to the boost in this market is raising the usage of generic drugs including Ibuprofen API in this region. Another factor is that due to improvement of the awareness of people and the medical personnel about the efficiency of these generic drugs and the reduction of their price they find their way to different sections, thus broadening the market size. In addition, the Asia-Pacific countries have experienced significant enhancements in terms of pharmaceutical manufacturing capacities and domestic producers’ capabilities to increase production of Ibuprofen APIs. This increase in availability along with the favourable regulatory policies in various countries is anticipated boost the demand for the Ibuprofen API market in the Asia-Pacific region in the future years.

Active Key Players in the Ibuprofen API Market

- BASF SE (Germany)

- SI Group, Inc. (U.S.)

- BIOCAUSE Inc. (U.S.)

- IOL Chemicals and Pharmaceuticals Limited (India)

- Zibo Xinhua-Perrigo Pharmaceutical Co., Ltd. (China)

- Granules India Limited (India)

- LGM Pharma (U.S.)

- Salvavidas (India)

- Taj Pharmaceuticals Limited (India)

- Other Key Players

Key Industry Developments in the Ibuprofen API Market:

- In November 2022, Solara Active Pharma Sciences Limited's state-of-the-art, multipurpose API manufacturing facility in Vishakhapatnam, Andhra Pradesh, obtained Certificate of Suitability (CEP) approval from the European Directorate for the Quality of Medicine (EDQM) for ibuprofen API production.

|

Global Ibuprofen API Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.69 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.6% |

Market Size in 2035: |

USD 1.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ibuprofen API Market by Type (2018-2035)

4.1 Ibuprofen API Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Standard Ibuprofen

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 High Potency Ibuprofen

Chapter 5: Ibuprofen API Market by Application (2018-2035)

5.1 Ibuprofen API Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Headache

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Arthritis

5.5 Others

Chapter 6: Ibuprofen API Market by End User (2018-2035)

6.1 Ibuprofen API Market Snapshot and Growth Engine

6.2 Market Overview

6.3 CROs and CMOs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceutical and Biopharmaceutical Companies

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ibuprofen API Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF SE (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SI GROUP INC. (U.S.)

7.4 BIOCAUSE INC. (U.S.)

7.5 IOL CHEMICALS AND PHARMACEUTICALS LIMITED (INDIA)

7.6 ZIBO XINHUA-PERRIGO PHARMACEUTICAL COLTD. (CHINA)

7.7 GRANULES INDIA LIMITED (INDIA)

7.8 LGM PHARMA (U.S.)

7.9 SALVAVIDAS (INDIA)

7.10 TAJ PHARMACEUTICALS LIMITED (INDIA)

7.11 OTHER KEY PLAYERS

Chapter 8: Global Ibuprofen API Market By Region

8.1 Overview

8.2. North America Ibuprofen API Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Standard Ibuprofen

8.2.4.2 High Potency Ibuprofen

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Headache

8.2.5.2 Arthritis

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 CROs and CMOs

8.2.6.2 Pharmaceutical and Biopharmaceutical Companies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ibuprofen API Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Standard Ibuprofen

8.3.4.2 High Potency Ibuprofen

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Headache

8.3.5.2 Arthritis

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 CROs and CMOs

8.3.6.2 Pharmaceutical and Biopharmaceutical Companies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ibuprofen API Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Standard Ibuprofen

8.4.4.2 High Potency Ibuprofen

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Headache

8.4.5.2 Arthritis

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 CROs and CMOs

8.4.6.2 Pharmaceutical and Biopharmaceutical Companies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ibuprofen API Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Standard Ibuprofen

8.5.4.2 High Potency Ibuprofen

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Headache

8.5.5.2 Arthritis

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 CROs and CMOs

8.5.6.2 Pharmaceutical and Biopharmaceutical Companies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ibuprofen API Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Standard Ibuprofen

8.6.4.2 High Potency Ibuprofen

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Headache

8.6.5.2 Arthritis

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 CROs and CMOs

8.6.6.2 Pharmaceutical and Biopharmaceutical Companies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ibuprofen API Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Standard Ibuprofen

8.7.4.2 High Potency Ibuprofen

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Headache

8.7.5.2 Arthritis

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 CROs and CMOs

8.7.6.2 Pharmaceutical and Biopharmaceutical Companies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Ibuprofen API Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.69 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.6% |

Market Size in 2035: |

USD 1.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||