HVAC Services Market Synopsis

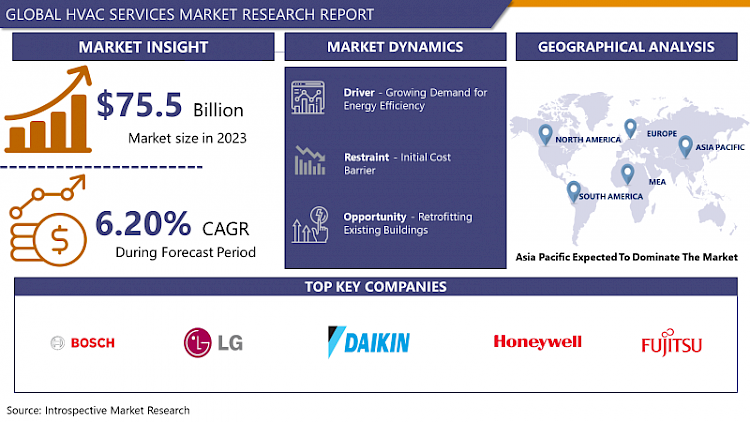

HVAC Services Market Size Was Valued at USD 75.5 Billion in 2023, and is Projected to Reach USD 129.8 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.

The HVAC (Heating, Ventilation, and Air Conditioning) services market therefore embraces a range of services meant for the installation, repair, and maintenance of HVAC systems utilized in different structures for regulation of indoor climate and air quality.

- This market includes all of the design and consultation, installation, maintenance, and even repair of heating, cooling, and ventilation systems when there is an emergency. The market is mainly stimulated by factors such as new construction, energy conservation needs, regulation from authorities, and the replacement or modernization of outdated systems. Market growth is also driven by technological changes such as smart heating, Ventilation, and air conditioning systems that make communication systems better and easier to manage.

- The subsector of the HVAC (Heating, Ventilation, and Air Conditioning) services market remains to be very growing due to drivers such as technological provision, the growing demand for energy-efficient measures, and the expansion of commercial and residential structures worldwide. The market is disturbed by the growth of demand for HVAC systems due to the increased need for quality indoor climate control in residential as well as commercial buildings. Not only this, the strict standards set by governments to curb emissions of polluting elements and encourage energy efficiency are other factors that are helping the growth of HVAC services.

- Another current that is gaining significant momentum in the HVAC services market is digitization and the use of smart technologies and IoT solutions. These developments allow for more effective monitoring of HVAC systems, forecasts on the system failures, and optimization of the systems and thus the consumption by consumers. Also, the focus on proper airing and contests, together with rising concern regarding the quality of the air within the closed spaces and its effects on health, promoted the boom of the demand for HVAC services that provide proper airing and filtering of the indoor spaces.

- The intensity of competition is high due to a large number of entrants actively seeking to expand their market share through new product and service launches, strategic partnerships, and the expansion of the range of services offered. Through meeting the needs of their customers, HVAC service providers are being driven to increase their capabilities by providing solutions encompassing design, installation, maintenance, and repair solutions. On the same note, the developing energy management solutions and the increasing inclusion of renewable energy sources into the main business market offer further opportunities for expansion in the HVAC services industry.

- Regionally, Asia-Pacific holds great promise in the HVAC services industry due to factors such as high growth in population density, urbanization, industrialization, and infrastructure development across the Asia-Pacific countries, especially China, India, and the ASEAN countries. North America and Europe remain other important regions, as they comprise a well-developed HVAC market with a vast focus on energy-saving solutions.

HVAC Services Market Trend Analysis

The Rise of Energy-Efficient HVAC Solutions and Solar Power Integration

- The escalating need for energy efficiency and sustainability solutions in the HVAC services market is the key that propels lots of innovation and changes in the market. In particular, residents and businesses are now increasingly aware of the environmental and cost-saving potentials of optimal HVAC solutions. This change in consumer attitude has called for innovation in HVAC systems through research in the development of high efficiency and sustainability by manufacturers and service providers.

- Among the key outcomes of this trend is a trend to rely on renewable sources of energy such as solar energy for heating and cooling. Generally, Solar HVAC systems utilize the sun's energy to complement or even replace other conventional methods that use fuel or other natural resources to heat and cool buildings. This also helps shift away from non-renewable energy sources and at the same time makes the customer’s bills more manageable in the long run. Moreover, governments and regulatory authorities are now offering incentives like subsidies and tax credits for renewable energy technologies including solar HVAC systems that are widely used in residential and commercial buildings. Therefore, the HVAC industry is gradually adjusting to new technologies that would enhance the sustainability of its products hence creating a green future.

Revolutionizing Comfort and Efficiency Through Technological Advancements

- The use of technology in the HVAC system is now changing with the benefits of complete human control, more efficient and convenient for both homeowners and commercial clients. Thanks to the integration of smart technology, IoT capabilities, and others in HVAC systems, one can remotely control and monitor, do predictive maintenance as well as set personalized comfort value amongst others. One prominent feature of this technological advancement is smart thermostats which enable the user to control and monitor the heating and cooling systems with ease through an application on their phone or any other smart devices. This level of connectivity not only adds convenience but can also enable the accurate monitoring and control of energy consumption, a promising solution to the rising costs and increasing environmental concerns.

- Further, IoT advancements lead to improving HVAC systems to become user-friendly through absorbing more intelligence. Smart HVAC systems are capable of learning the building occupancy schedules, ambient conditions, and indoor air quality and being able to regulate the building environment on their own to enhance the building's comfort with energy efficiency. For instance, automatically generated sensors are enabled to identify a particular room’s occupancy state and hence avoid over-cooling or heating the required room. On the same note, self-learning algorithms that anticipate a catastrophic event help lessen the frequency of repairs and increase the effectiveness and stability of the system. Therefore, smart technology and IoT capabilities are not only changing how HVAC systems are operated and managed but also enhancing the working capabilities and outputs of intelligent heating and cooling systems, making way for the modernized controlled environment and heating and cooling systems.

HVAC Services Market Segment Analysis:

HVAC Services Market is segmented based on Type, Service and Application

By Type, Heating segment is expected to dominate the market during the forecast period

- In the sphere of heating systems, there is a plethora of components that are crucial to comprehend and they all contribute to one type taking a lead position within the heating systems market. First of all, high demand serves as one of the cornerstones, especially in countries where warm winters are not the norm, and where heating can be more than a mere convenience but rather a necessity for people to feel comfortable and even survive the winter season. As the demand becomes consistent and almost indispensable in many homes, it provides a strong support to the control of heating systems. However, heating is not limited to the premises of residence but also commercial and industrial uses, thereby increasing its importance in the global market. For example, companies that manufacture goods sensitive to temperature fluctuations, warehouses that tend to keep produce fresh, or offices aiming at maintaining satisfactory temperatures for their clients are likely to benefit greatly from this technology.

- Another factor that has enhanced the widespread use of heating systems is the consumption level or Widespread adoption. Over the years, arising from advancements in engineering, there have emerged improved methods in heating technologies, specific to being more efficient, cheaper to use, and best of all, eco-friendly. It is therefore for this reason that they are now very prominent in society and well integrated into the current infrastructure. From boiler systems in buildings to floor heating for residential houses to the advancement of heat pump systems, heating devices have ceased to be restricted to just individual spaces but have become integrated with various aspects of life. It not only establishes them in the market but also generates inertia, which is prohibitive for competitors in the form of anti-hegemonic forces to displace the incumbents. Heating systems are thus backed up comprehensively by technological innovations. Heating options have continued to grow smarter, ranging from smart thermostats that optimize energy consumption in the heating process to sources of green energy including the use of geothermal and solar heating. It can be ascertained that such continuous change not only satisfies the market’s current needs but also accommodates sustainable development goals of decomposing carbon footprint and combating climate change, making heating systems relevant for future market demands.

By Service, Consulting segment held the largest share in 2023

- When considering the field of HVAC services, consulting, therefore, stands out as a prominent foundation, advancing significant information and advice to those who choose to engage the service of HVAC system consultants. The reliance on consulting is thus seen as the primary reason for its large share as it is considered to be the key factor in determining outcomes of HVAC projects across various industries. Professional advice is a type of strategic partnership based on industry expertise and specific mastery in delivering tips and insights to clients seeking to achieve goals and objectives by accumulating the knowledge needed to come to these decisions. Consultation ranges from general studies on the first customized concepts and approaches for comprehensive avoidable system design and all aspects of efficiency, comfort, and success as well as sustainability with the current and future state of the rules and laws.

- However, as will be discussed below, it means that consulting services are much more than practical advice for the organization’s operational processes; it is about providing foresight and avoiding potential problems altogether. In today’s world with all the developing technology and emerging markets and increasing need for environmental sustainability, consulting firms offer insights to clients regarding certain strategies that will help them to prepare for the future and avoid any setbacks in their HVAC investments. Through needs assessments, feasibility studies, and lifecycle costing approaches, consulting professionals assist clients in their quest to understand the current and future state of HVAC technologies, leading to greater opportunities for change, energy efficiency, and overall system performance. In addition, it reveals that consultants are also involved in managing cooperation between the involved agents, as well as providing communication as well as decision-making procedures, to narrow down the time taken by the project as well as to improve the results. Hence, the greatest proportion goes to consulting, which creates a compelling argument for the importance of hiring a reliable consulting service to support heating, ventilation, and air conditioning projects in residential, commercial, and industrial applications.

HVAC Services Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The HVAC services market in Asia-Pacific is considered the largest and most influential market because of several factors that have been instrumental in the region’s growth. A look at many Asia-Pacific cities today shows that with increasing urbanization and population growth, construction activities are on the rise. This building construction expansion involves residential, commercial, industrial, multi-story apartments, office buildings, and factories. As such areas develop, so does the need for HVAC systems due to the necessity of maintaining a comfortable indoor environment and stability in temperatures in the various climates of the region.

- Furthermore, the Asia-Pacific region has a constantly growing disposable income per capita leading to the population raising the standards of living and adopting more comfortable HVAC services. In addition to the latter, the global market has also displayed a clear trend towards providing energy-saving and environmentally friendly HVAC systems. This is due to government policies that seek to reduce air pollution or address climate change concerns and promote the use of sustainable HVAC solutions like heat pumps, solar-powered systems, and smart thermostats. This increasing popularity of environmentally friendly products not only meets global environmental concerns but also social trends and changes in consumer behavior. Therefore, the future landscape of the HVAC industry is dominated by the Asia-Pacific market, which becomes the main driver of innovation, sustainability, and economic development.

Active Key Players in the HVAC Services Market

- Daikin Industries Ltd.

- Dr. Energy Saver, Inc

- Dwyer Franchising, LLC

- Electrolux AB

- Fujitsu General Ltd.

- Honeywell International Inc.

- Johnson Controls International PLC

- Lennox International Inc.

- LG Electronics Inc.

- Nortek Global HVAC

- One Hour Heating & Air Conditioning Franchising SPE LLC

- Robert Bosch GmbH

- Siemens AG

- The Home Depot

- Watsco, Other Key Players

Key Industry Developments in the HVAC Services Market:

- October 2023: Panasonic Corporation, an innovator and global provider of sustainable solution solutions for homes, has released news of an improvement in residential heat pumps that would transform the way Canadians manage the cost of heating and cooling their homes. INTERIORS is a new system introduced in Panasonic’s Breathe Well series that helps enhance the quality of indoor air; it is a multi-functional, floor-standing central heat pump system that is capable of providing heating and cooling solutions to residential spaces.

- September 2023: KOVA Comfort Intelligent HVAC, the new advanced technological heating, ventilation, and air conditioning product line was unveiled by building material solutions provider, KOVA. Penetrating building projects, this AI-controlled HVAC is an exceptional adaptation, offering more comfortable and healthy environments with several features, including human daily activities schedules. KOVA Comfort Intelligent HVAC system is a new-age system that relies on behavioral information, environmental data, and system-specific data to offer comfort and energy efficiency.

|

Global HVAC Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 75.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.20 % |

Market Size in 2032: |

USD 129.8 Bn. |

|

Segments Covered: |

By Type: |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Daikin Industries Ltd., Dr. Energy Saver, Inc., Dwyer Franchising, LLC, Electrolux AB, Fujitsu General Ltd., Honeywell International Inc., and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HVAC SERVICES MARKET BY TYPE (2017-2032)

- HVAC SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HEATING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VENTILATION

- COOLING

- HVAC SERVICES MARKET BY SERVICE (2017-2032)

- HVAC SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSULTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSTALLATION

- MAINTENANCE & REPAIR

- UPGRADE/REPLACEMENT

- HVAC SERVICES MARKET BY APPLICATION (2017-2032)

- HVAC SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HVAC SERVICES Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DAIKIN INDUSTRIES LTD.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DR. ENERGY SAVER, INC

- DWYER FRANCHISING, LLC

- ELECTROLUX AB

- FUJITSU GENERAL LTD.

- HONEYWELL INTERNATIONAL INC.

- JOHNSON CONTROLS INTERNATIONAL PLC

- LENNOX INTERNATIONAL INC.

- LG ELECTRONICS INC.

- NORTEK GLOBAL HVAC

- ONE-HOUR HEATING & AIR CONDITIONING FRANCHISING SPE LLC

- ROBERT BOSCH GMBH

- SIEMENS AG

- THE HOME DEPOT

- WATSCO

- COMPETITIVE LANDSCAPE

- GLOBAL HVAC SERVICES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global HVAC Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 75.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.20 % |

Market Size in 2032: |

USD 129.8 Bn. |

|

Segments Covered: |

By Type: |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Daikin Industries Ltd., Dr. Energy Saver, Inc., Dwyer Franchising, LLC, Electrolux AB, Fujitsu General Ltd., Honeywell International Inc., and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HVAC SERVICES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HVAC SERVICES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HVAC SERVICES MARKET COMPETITIVE RIVALRY

TABLE 005. HVAC SERVICES MARKET THREAT OF NEW ENTRANTS

TABLE 006. HVAC SERVICES MARKET THREAT OF SUBSTITUTES

TABLE 007. HVAC SERVICES MARKET BY TYPE

TABLE 008. HEATING MARKET OVERVIEW (2016-2028)

TABLE 009. VENTILATION MARKET OVERVIEW (2016-2028)

TABLE 010. COOLING MARKET OVERVIEW (2016-2028)

TABLE 011. HVAC SERVICES MARKET BY APPLICATION

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 014. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA HVAC SERVICES MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA HVAC SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 017. N HVAC SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE HVAC SERVICES MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE HVAC SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 020. HVAC SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC HVAC SERVICES MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC HVAC SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 023. HVAC SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA HVAC SERVICES MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA HVAC SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 026. HVAC SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA HVAC SERVICES MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA HVAC SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 029. HVAC SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 030. CARRIER CORPORATION: SNAPSHOT

TABLE 031. CARRIER CORPORATION: BUSINESS PERFORMANCE

TABLE 032. CARRIER CORPORATION: PRODUCT PORTFOLIO

TABLE 033. CARRIER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. DAIKIN INDUSTRIES: SNAPSHOT

TABLE 034. DAIKIN INDUSTRIES: BUSINESS PERFORMANCE

TABLE 035. DAIKIN INDUSTRIES: PRODUCT PORTFOLIO

TABLE 036. DAIKIN INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. INGERSOLL RAND: SNAPSHOT

TABLE 037. INGERSOLL RAND: BUSINESS PERFORMANCE

TABLE 038. INGERSOLL RAND: PRODUCT PORTFOLIO

TABLE 039. INGERSOLL RAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. JOHNSON CONTROLS INTERNATIONAL: SNAPSHOT

TABLE 040. JOHNSON CONTROLS INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 041. JOHNSON CONTROLS INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 042. JOHNSON CONTROLS INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. MITSUBISHI ELECTRIC CORP: SNAPSHOT

TABLE 043. MITSUBISHI ELECTRIC CORP: BUSINESS PERFORMANCE

TABLE 044. MITSUBISHI ELECTRIC CORP: PRODUCT PORTFOLIO

TABLE 045. MITSUBISHI ELECTRIC CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. LENNOX INTERNATIONAL INC.: SNAPSHOT

TABLE 046. LENNOX INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 047. LENNOX INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 048. LENNOX INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LG CORPORATION: SNAPSHOT

TABLE 049. LG CORPORATION: BUSINESS PERFORMANCE

TABLE 050. LG CORPORATION: PRODUCT PORTFOLIO

TABLE 051. LG CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SAMSUNG ELECTRONICS: SNAPSHOT

TABLE 052. SAMSUNG ELECTRONICS: BUSINESS PERFORMANCE

TABLE 053. SAMSUNG ELECTRONICS: PRODUCT PORTFOLIO

TABLE 054. SAMSUNG ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 055. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 056. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 057. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HVAC SERVICES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HVAC SERVICES MARKET OVERVIEW BY TYPE

FIGURE 012. HEATING MARKET OVERVIEW (2016-2028)

FIGURE 013. VENTILATION MARKET OVERVIEW (2016-2028)

FIGURE 014. COOLING MARKET OVERVIEW (2016-2028)

FIGURE 015. HVAC SERVICES MARKET OVERVIEW BY APPLICATION

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 018. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA HVAC SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE HVAC SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC HVAC SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA HVAC SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA HVAC SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the HVAC Services Market research report is 2024-2032.

Daikin Industries Ltd., Dr. Energy Saver, Inc, Dwyer Franchising, LLC, Electrolux AB, Fujitsu General Ltd., Honeywell International Inc., Johnson Controls International PLC, Lennox International Inc, LG Electronics Inc., Nortek Global HVAC, One Hour Heating & Air Conditioning Franchising SPE LLC, Robert Bosch GmbH, Siemens AG, The Home Depot, Watsco and Other Major Players.

The HVAC Services Market is segmented into By Type, By Service, By Application, and region. By Type, the market is categorized into Heating, Ventilation, and Cooling. By Service, the market is categorized into Consulting, Installation, Maintenance & Repair, and Upgrade/Replacement. By Application, the market is categorized into Residential, Commercial, and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The HVAC services market refers to products and services that include installation, repair, and maintenance of heating, ventilating, and air conditioning systems, through which temperature regulation and indoor air quality are maintained for residences, businesses, and industries. This market involves all from the design and consultation up to maintenance and emergency services for any heating, cooling as well as ventilating system. New constructions, energy conservation needs, legal issues as well as old systems installation or upgrade are some of the main factors that trigger demand in HVAC systems. Another aspect that marks growth in the HVAC market is innovations as a result of technology, for instance, smart systems in HVAC.

HVAC Services Market Size Was Valued at USD 75.5 Billion in 2023, and is Projected to Reach USD 129.8 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.