Hotel Mattress Market Synopsis

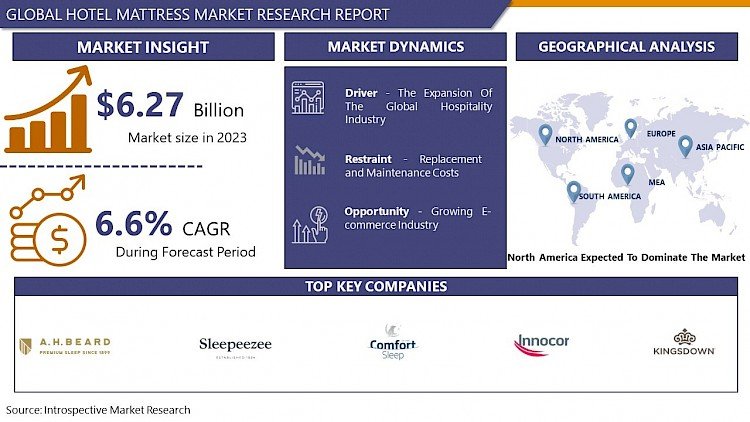

Global Hotel Mattress Market Size Was Valued at USD 6.27 Billion in 2023 And Is Projected to Reach USD 11.15 Billion By 2032, Growing at a CAGR of 6.6% From 2024 To 2032.

A hotel mattress is a crucial component of a comfortable and restful stay for guests in the hospitality industry. It is more than just a piece of furniture; it plays a pivotal role in ensuring the overall satisfaction and quality of sleep experienced by hotel guests. A hotel mattress is specially designed to meet the unique needs and demands of the hotel industry.

- Hotel mattresses are engineered for durability and longevity, as they need to withstand the wear and tear of constant use by various guests. They are constructed using high-quality materials and advanced manufacturing techniques to ensure they maintain their shape and support over time. These mattresses are also designed to be easy to clean and maintain, with features such as removable and washable covers to uphold stringent hygiene standards.

- The primary goal of the Hotel Mattress Market is to provide comfortable and restful sleep experiences for hotel guests. Comfortable bedding, including high-quality mattresses, is essential for ensuring that guests wake up refreshed and rejuvenated, leading to positive reviews, repeat bookings, and brand loyalty for hotels.

The Hotel Mattress Market Trend Analysis

Expansion of the Global Hospitality Industry

- The expansion of the global hospitality industry stands as a paramount driver propelling the growth and vitality of the hotel mattress market. This symbiotic relationship between hospitality and bedding is underpinned by several compelling factors.

- The global hospitality industry has witnessed remarkable growth in recent years, driven by an increasing appetite for travel, changing consumer preferences, and the emergence of new markets. As more hotels, resorts, and accommodation options emerge across the world, there is a concurrent surge in the demand for high-quality mattresses to equip these establishments. Hoteliers recognize that a comfortable and restful night's sleep is a cornerstone of guest satisfaction, which, in turn, directly impacts occupancy rates, repeat business and brand reputation. Consequently, they are compelled to invest in superior mattresses that meet the discerning expectations of their clientele.

- The globalization of tourism and business travel has ushered in an era of heightened competition among hospitality providers. In this competitive landscape, hotels are constantly seeking ways to differentiate themselves and create memorable guest experiences. An integral element of this strategy is the selection of premium mattresses that ensure guests wake up refreshed and rejuvenated. This focus on sleep quality has led to a growing demand for innovative and ergonomic mattresses that cater to diverse guest preferences, from plush to firm.

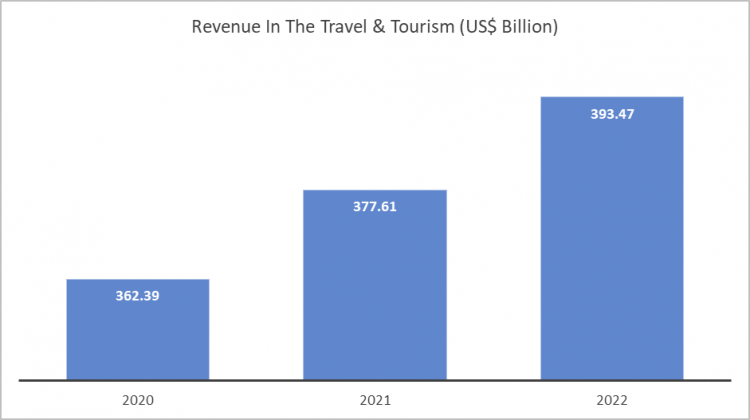

The above graph shows that there is an increase in revenue in the travel & and tourism market in 2022 as compared to the previous year.

Growing E-commerce Industry

- The growing E-commerce industry creates a significant opportunity for the hotel mattress market, nurturing new avenues for growth and market expansion. This synergy between E-commerce and mattress sales is underpinned by a multitude of compelling factors.

- The rise of E-commerce has revolutionized the way consumers shop for a wide range of products, including mattresses. The convenience and accessibility offered by online platforms have democratized the purchasing process, enabling consumers to research, compare, and order mattresses from the comfort of their homes. As a result, hotels and hospitality establishments looking to procure mattresses now have an expanded array of options at their fingertips, transcending geographical limitations. This increased accessibility empowers hotels to explore a wider selection of suppliers and manufacturers, promoting healthy competition and price transparency in the market.

- The customization and personalization features integral in many E-commerce platforms align seamlessly with the hotel industry's evolving needs. Hotels, especially those who want to distinguish themselves, can now collaborate with mattress companies to create bespoke bedding solutions tailored to their specific requirements. Whether it's crafting mattresses with unique firmness levels or incorporating cutting-edge sleep technology, E-commerce allows for a more agile and responsive approach to catering to the diverse needs of hotels and their guests.

Hotel Mattress Market Segmentation Analysis:

Hotel Mattress market segments cover Mattress sizes, Mattress Comfort Level, and Mattress Support Systems. By Mattress sizes, the King and Super King segment is Anticipated to Dominate the Market Over the Forecast period.

- King and Super King mattress sizes are indeed dominant segments in the hotel mattress market, particularly in regions where larger bed sizes are preferred.

- King and Super King mattresses provide more space for guests to stretch out and get a good night's sleep. This extra space can contribute to a more comfortable and relaxing stay. Larger beds are often associated with luxury and upscale accommodations. Hotels that offer King and Super King mattresses can attract guests looking for a more premium experience. Providing spacious and comfortable sleeping arrangements can enhance the overall guest experience. Satisfied guests are more likely to leave positive reviews and return for future stays.

Hotel Mattress Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period.

- North America has emerged as a dominant segment in the Hotel Mattress Market, wielding considerable influence and impact on the industry's dynamics. Several factors contribute to North America's prominence in this market segment.

- North America boasts a robust and thriving hospitality industry that spans across the United States, Canada, and Mexico. With a diverse array of hotels, resorts, and accommodation options catering to a vast and discerning clientele, the demand for hotel mattresses in this region is consistently high. As tourism and business travel continue to flourish, hoteliers are prompted to invest in high-quality mattresses to ensure guest comfort and satisfaction.

The above graph shows that there is an increase in North America's Revenue In The Hotels Market in 2022 as compared to the previous year this growing factor helped to accelerate the hotel mattress market.

- Moreover, North America places a strong emphasis on innovation and technological advancement, and this ethos extends to the hotel mattress market. Mattress manufacturers in the region are at the forefront of developing cutting-edge sleep technology and materials. This commitment to innovation aligns seamlessly with the evolving needs of the hospitality sector, where guests increasingly seek personalized and technologically enhanced sleep experiences.

COVID-19 Impact Analysis On Hotel Mattress Market

The COVID-19 pandemic has had a profound impact on the Hotel Mattress Market, reshaping the dynamics and priorities within the industry. The pandemic disrupted global supply chains, causing delays in the production and delivery of hotel mattresses. Lockdowns, factory closures, and restrictions on international trade hampered the timely availability of mattresses, impacting hotels' ability to replace aging bedding or open new properties.

The dramatic decrease in travel and tourism during the pandemic led to a sharp decline in hotel occupancy rates. Many hotels temporarily closed or operated at minimal capacity, resulting in reduced demand for mattresses. As a result, hotels were less inclined to invest in new bedding during this period. The hotel and tourism industry typically account for about 10% of the worldwide GDP. However, in 2020, when the COVID-19 pandemic hit, the hotel industry made up just 5.5% of global GDP.

Hotel Mattress Market Key Players:

- AH Beard (England)

- Sealy (India)

- Comfort Sleep Bedding (Ireland)

- Sleepeezee (England)

- Casper Sleep Inc (United States)

- Corsicana Bedding Inc (United States)

- Innocor Inc (United States)

- King Koil (United States)

- Kingsdown Inc (United States)

- Paramount Bed Co. Ltd (Japan)

- Relyon Limited (United Kingdom)

- Restonic Mattress Corporation (United States)

- Serta Simmons Bedding LLC (United States)

- Silentnight Group Ltd (United Kingdom)

- Sleep Number Corporation (United States)

- Spring Air International (United States)

- Tempur Sealy International Inc (United States)

- Slumbercorp (Australia )and Other Major Players.

Key Industry Developments in the Hotel Mattress Market

- In April 2023, Serta Simmons Bedding Unveils the Perfect Sleeper Hotel Collection Serta Simmons Bedding, a leading name in sleep technology, proudly introduced the Perfect Sleeper Hotel Collection, a line of state-of-the-art hybrid mattresses meticulously crafted to redefine comfort in the hotel industry. This collection marks a revolutionary advancement in sleep technology, featuring hybrid mattresses that seamlessly blend individually wrapped coils with cutting-edge cooling technology.

- In March 2023, Saatva, a renowned name in luxury mattresses and sleep technology, unveiled its latest innovation in March 2023. This unveiling marked the introduction of the Saatva Smart Base, a cutting-edge adjustable foundation that redefines personalization and comfort in the realm of sleep. The Saatva Smart Base represents a pinnacle of technological advancement and comfort engineering, offering guests an unprecedented level of control over their sleep environment. Designed with state-of-the-art features, this smart base empowers users to tailor their sleep experience according to their preferences, setting a new standard for customizable comfort.

- In May 2024, Serta Simmons Bedding (SSB), a leading global sleep company, announced the launch of its new Serta® iComfort® Collection. Designed to ensure all-night comfort, the new all-foam collection featured 5 support zones for full-body alignment. The new Serta iComfort mattress collection began hitting retail floors for Memorial Day and was also set to be showcased at the Summer Las Vegas Market from July 28 to August 1, 2024.

|

Hotel Mattress Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 6.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 11.15 Bn. |

|

Segments Covered: |

By Mattress Size |

|

|

|

By Mattress Comfort Level |

|

||

|

By Mattress Support System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HOTEL MATTRESS MARKET BY MATTRESS SIZE (2017-2032)

- HOTEL MATTRESS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- KING AND SUPER KING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- QUEEN

- DOUBLE

- SINGLE

- HOTEL MATTRESS MARKET BY MATTRESS COMFORT LEVEL (2017-2032)

- HOTEL MATTRESS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDIUM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FIRM

- PLUSH

- HOTEL MATTRESS MARKET BY MATTRESS SUPPORT SYSTEM (2017-2032)

- HOTEL MATTRESS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SPRING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOAM

- LATEX

- HYBRID

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HOTEL MATTRESS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AH BEARD (ENGLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SEALY (INDIA)

- COMFORT SLEEP BEDDING (IRELAND)

- SLEEPEEZEE (ENGLAND)

- CASPER SLEEP INC (UNITED STATES)

- CORSICANA BEDDING INC (UNITED STATES)

- INNOCOR INC (UNITED STATES)

- KING KOIL (UNITED STATES)

- KINGSDOWN INC (UNITED STATES)

- PARAMOUNT BED CO. LTD (JAPAN)

- RELYON LIMITED (UNITED KINGDOM)

- RESTONIC MATTRESS CORPORATION (UNITED STATES)

- SERTA SIMMONS BEDDING LLC (UNITED STATES)

- SILENTNIGHT GROUP LTD (UNITED KINGDOM)

- SLEEP NUMBER CORPORATION (UNITED STATES)

- SPRING AIR INTERNATIONAL (UNITED STATES)

- TEMPUR SEALY INTERNATIONAL INC (UNITED STATES)

- SLUMBERCORP (AUSTRALIA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL HOTEL MATTRESS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Mattress Size

- Historic And Forecasted Market Size By Mattress Comfort Level

- Historic And Forecasted Market Size By Mattress Support System

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Hotel Mattress Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 6.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 11.15 Bn. |

|

Segments Covered: |

By Mattress Size |

|

|

|

By Mattress Comfort Level |

|

||

|

By Mattress Support System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HOTEL MATTRESS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HOTEL MATTRESS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HOTEL MATTRESS MARKET COMPETITIVE RIVALRY

TABLE 005. HOTEL MATTRESS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HOTEL MATTRESS MARKET THREAT OF SUBSTITUTES

TABLE 007. HOTEL MATTRESS MARKET BY MATTRESS SIZE

TABLE 008. KING AND SUPER KING MARKET OVERVIEW (2016-2030)

TABLE 009. QUEEN MARKET OVERVIEW (2016-2030)

TABLE 010. DOUBLE MARKET OVERVIEW (2016-2030)

TABLE 011. SINGLE MARKET OVERVIEW (2016-2030)

TABLE 012. HOTEL MATTRESS MARKET BY MATTRESS COMFORT LEVEL

TABLE 013. MEDIUM MARKET OVERVIEW (2016-2030)

TABLE 014. FIRM MARKET OVERVIEW (2016-2030)

TABLE 015. PLUSH MARKET OVERVIEW (2016-2030)

TABLE 016. HOTEL MATTRESS MARKET BY MATTRESS SUPPORT SYSTEM

TABLE 017. SPRING MARKET OVERVIEW (2016-2030)

TABLE 018. FOAM MARKET OVERVIEW (2016-2030)

TABLE 019. LATEX MARKET OVERVIEW (2016-2030)

TABLE 020. HYBRID MARKET OVERVIEW (2016-2030)

TABLE 021. NORTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 022. NORTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 023. NORTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 024. N HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 025. EASTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 026. EASTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 027. EASTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 028. HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 029. WESTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 030. WESTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 031. WESTERN EUROPE HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 032. HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 033. ASIA PACIFIC HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 034. ASIA PACIFIC HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 035. ASIA PACIFIC HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 036. HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 038. MIDDLE EAST & AFRICA HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 039. MIDDLE EAST & AFRICA HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 040. HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 041. SOUTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS SIZE (2016-2030)

TABLE 042. SOUTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS COMFORT LEVEL (2016-2030)

TABLE 043. SOUTH AMERICA HOTEL MATTRESS MARKET, BY MATTRESS SUPPORT SYSTEM (2016-2030)

TABLE 044. HOTEL MATTRESS MARKET, BY COUNTRY (2016-2030)

TABLE 045. PLAYCORE INC.: SNAPSHOT

TABLE 046. PLAYCORE INC.: BUSINESS PERFORMANCE

TABLE 047. PLAYCORE INC.: PRODUCT PORTFOLIO

TABLE 048. PLAYCORE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ACQUAPOLE S.A.S.: SNAPSHOT

TABLE 049. ACQUAPOLE S.A.S.: BUSINESS PERFORMANCE

TABLE 050. ACQUAPOLE S.A.S.: PRODUCT PORTFOLIO

TABLE 051. ACQUAPOLE S.A.S.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HYDRO-FIT: SNAPSHOT

TABLE 052. HYDRO-FIT: BUSINESS PERFORMANCE

TABLE 053. HYDRO-FIT: PRODUCT PORTFOLIO

TABLE 054. HYDRO-FIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TECHNOGYM S.P.A.: SNAPSHOT

TABLE 055. TECHNOGYM S.P.A.: BUSINESS PERFORMANCE

TABLE 056. TECHNOGYM S.P.A.: PRODUCT PORTFOLIO

TABLE 057. TECHNOGYM S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. JOHNSON FITNESS: SNAPSHOT

TABLE 058. JOHNSON FITNESS: BUSINESS PERFORMANCE

TABLE 059. JOHNSON FITNESS: PRODUCT PORTFOLIO

TABLE 060. JOHNSON FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. PRECOR INCORPORATED: SNAPSHOT

TABLE 061. PRECOR INCORPORATED: BUSINESS PERFORMANCE

TABLE 062. PRECOR INCORPORATED: PRODUCT PORTFOLIO

TABLE 063. PRECOR INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CYBEX INTERNATIONAL INC.: SNAPSHOT

TABLE 064. CYBEX INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 065. CYBEX INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 066. CYBEX INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AMER SPORTS: SNAPSHOT

TABLE 067. AMER SPORTS: BUSINESS PERFORMANCE

TABLE 068. AMER SPORTS: PRODUCT PORTFOLIO

TABLE 069. AMER SPORTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. KEISER: SNAPSHOT

TABLE 070. KEISER: BUSINESS PERFORMANCE

TABLE 071. KEISER: PRODUCT PORTFOLIO

TABLE 072. KEISER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. MATRIX FITNESS: SNAPSHOT

TABLE 073. MATRIX FITNESS: BUSINESS PERFORMANCE

TABLE 074. MATRIX FITNESS: PRODUCT PORTFOLIO

TABLE 075. MATRIX FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. LIFE FITNESS: SNAPSHOT

TABLE 076. LIFE FITNESS: BUSINESS PERFORMANCE

TABLE 077. LIFE FITNESS: PRODUCT PORTFOLIO

TABLE 078. LIFE FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. YANRE FITNESS: SNAPSHOT

TABLE 079. YANRE FITNESS: BUSINESS PERFORMANCE

TABLE 080. YANRE FITNESS: PRODUCT PORTFOLIO

TABLE 081. YANRE FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TRINITY INTERFACE SYSTEMS PVT LTD.: SNAPSHOT

TABLE 082. TRINITY INTERFACE SYSTEMS PVT LTD.: BUSINESS PERFORMANCE

TABLE 083. TRINITY INTERFACE SYSTEMS PVT LTD.: PRODUCT PORTFOLIO

TABLE 084. TRINITY INTERFACE SYSTEMS PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. COSCO (INDIA) LIMITED: SNAPSHOT

TABLE 085. COSCO (INDIA) LIMITED: BUSINESS PERFORMANCE

TABLE 086. COSCO (INDIA) LIMITED: PRODUCT PORTFOLIO

TABLE 087. COSCO (INDIA) LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. UNITED FITNESS: SNAPSHOT

TABLE 088. UNITED FITNESS: BUSINESS PERFORMANCE

TABLE 089. UNITED FITNESS: PRODUCT PORTFOLIO

TABLE 090. UNITED FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. AEROFIT: SNAPSHOT

TABLE 091. AEROFIT: BUSINESS PERFORMANCE

TABLE 092. AEROFIT: PRODUCT PORTFOLIO

TABLE 093. AEROFIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. NAUTILUS INC.: SNAPSHOT

TABLE 094. NAUTILUS INC.: BUSINESS PERFORMANCE

TABLE 095. NAUTILUS INC.: PRODUCT PORTFOLIO

TABLE 096. NAUTILUS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. TRUE FITNESS TECHNOLOGY INC.: SNAPSHOT

TABLE 097. TRUE FITNESS TECHNOLOGY INC.: BUSINESS PERFORMANCE

TABLE 098. TRUE FITNESS TECHNOLOGY INC.: PRODUCT PORTFOLIO

TABLE 099. TRUE FITNESS TECHNOLOGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. TORQUE FITNESS: SNAPSHOT

TABLE 100. TORQUE FITNESS: BUSINESS PERFORMANCE

TABLE 101. TORQUE FITNESS: PRODUCT PORTFOLIO

TABLE 102. TORQUE FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. ICON HEALTH & FITNESS: SNAPSHOT

TABLE 103. ICON HEALTH & FITNESS: BUSINESS PERFORMANCE

TABLE 104. ICON HEALTH & FITNESS: PRODUCT PORTFOLIO

TABLE 105. ICON HEALTH & FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. INC.: SNAPSHOT

TABLE 106. INC.: BUSINESS PERFORMANCE

TABLE 107. INC.: PRODUCT PORTFOLIO

TABLE 108. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 109. OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 110. OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 111. OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HOTEL MATTRESS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HOTEL MATTRESS MARKET OVERVIEW BY MATTRESS SIZE

FIGURE 012. KING AND SUPER KING MARKET OVERVIEW (2016-2030)

FIGURE 013. QUEEN MARKET OVERVIEW (2016-2030)

FIGURE 014. DOUBLE MARKET OVERVIEW (2016-2030)

FIGURE 015. SINGLE MARKET OVERVIEW (2016-2030)

FIGURE 016. HOTEL MATTRESS MARKET OVERVIEW BY MATTRESS COMFORT LEVEL

FIGURE 017. MEDIUM MARKET OVERVIEW (2016-2030)

FIGURE 018. FIRM MARKET OVERVIEW (2016-2030)

FIGURE 019. PLUSH MARKET OVERVIEW (2016-2030)

FIGURE 020. HOTEL MATTRESS MARKET OVERVIEW BY MATTRESS SUPPORT SYSTEM

FIGURE 021. SPRING MARKET OVERVIEW (2016-2030)

FIGURE 022. FOAM MARKET OVERVIEW (2016-2030)

FIGURE 023. LATEX MARKET OVERVIEW (2016-2030)

FIGURE 024. HYBRID MARKET OVERVIEW (2016-2030)

FIGURE 025. NORTH AMERICA HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. EASTERN EUROPE HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. WESTERN EUROPE HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. ASIA PACIFIC HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. MIDDLE EAST & AFRICA HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. SOUTH AMERICA HOTEL MATTRESS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Hotel Mattress Market research report is 2024-2032.

AH Beard (England), Sealy (India), Comfort Sleep Bedding (Ireland), Sleepeezee (England), Casper Sleep Inc (United States), Corsicana Bedding Inc (United States), Innocor Inc (United States), King Koil (United States), Kingsdown Inc (United States), Paramount Bed Co. Ltd (Japan), Relyon Limited (United Kingdom), Restonic Mattress Corporation (United States), Serta Simmons Bedding LLC (United States), Silentnight Group Ltd (United Kingdom), Sleep Number Corporation (United States), Spring Air International (United States), Tempur Sealy International Inc (United States), Slumbercorp (Australia), and other major players.

The Hotel Mattress Market is segmented into Mattress Size, Mattress Comfort Level, Mattress Support System, and region. By Mattress Size, the market is categorized into King and Super King, Queen, Double, and Single. By Mattress Comfort Level, the market is categorized into Medium, Firm, and Plush. By Mattress Support System, the market is categorized into Spring, Foam, Latex, and Hybrid. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A hotel mattress is a crucial component of a comfortable and restful stay for guests in the hospitality industry. It is more than just a piece of furniture; it plays a pivotal role in ensuring the overall satisfaction and quality of sleep experienced by hotel guests. A hotel mattress is specially designed to meet the unique needs and demands of the hotel industry.

Global Hotel Mattress Market Size Was Valued at USD 6.27 Billion in 2023 And Is Projected to Reach USD 11.15 Billion By 2032, Growing at a CAGR of 6.6% From 2024 To 2032.