High Purity Isobutylene Market Synopsis

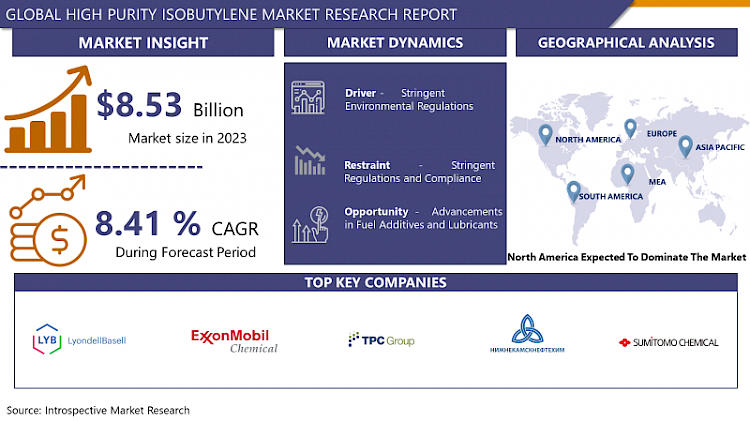

High Purity Isobutylene Market Size Was Valued at USD 8.53 Billion in 2023, and is Projected to Reach USD 17.64 Billion by 2032, Growing at a CAGR of 8.41 % From 2024-2032.

Super purity isobutylene identifies a highly purified kind of isobutylene compound that is concentration higher than 99%. However 5%, isobutylene by itself is a colorless, highly scalable gas that is widely used in the manufacture of many products, such as fuel additives, and synthetic rubber, due to its versatility, with different applications. The significant share of the high purity variant is desirable in industries where high performance and security of end products are certainly given that the purity of products is considered imposing. Having a very stringent purification system removes - contaminants, moisture, and other undesirable components - so that clients in the industrial field will surely receive the best quality isobutylene they wanted. More than half of the world’s yearly production of high purity isobutylene is used in the tire industry, with nearly all of that demand generated from the automotive sector, leading to a sustained growth trend for the overall market. Now that the automotive sector is much concerned with fuel-efficient and sustainable tires, the usage and, as a result, the performance of butyl rubber is expected to elevate drastically in the next few years.

- Isobutylene takes on a role of the major intermediate in synthesizing of the range of the chemicals, including tert-butyl methyl ether (TMME), polyisobutylene (PIB), and alkylate. MTBE, which comes from isobutylene, is assigned a crucial role in increasing the octane rating of gasoline providing also better performances. This in turn leads to reduced emissions. environmental issues concerning the issue of groundwater contamination have been uncovered in some places because of that, the use of MTBE has been decreasing, which influences the isobutylene demand.

- Polyisobutylene is another well known isobutylene derivative used in manufacture of anti-wearing, adhesive and sealing agents which have a high viscosity and stickiness. Expanding need for lubricants in vehicles and industries is one of the main factors that will directly impact the output of high purity isobutylene which might, in turn, affect the market for this compound.

- Expanding adaption of isobutylene as feedstock to manufacture alkylate, a vital gasoline blending agent contributing to the octane rating, is seen supporting the market growth. Due to its high-octane number, low pollution levels, and stable chemical composition, Alkylate goes well with gasoline, especially in regions where environmental regulations are tightened.

- The market of high purity isobutylene has to handle an instability on the supply side due to fluctuating raw material prices, increasingly strict regulations connected to emissions, and rivalry of some non-isobutylene compounds. as impacts the market growth to some extent, connected with the lockdowns, as well as their fluctuating demands caused by the COVID-19 pandemic.

High Purity Isobutylene Market Trend Analysis

Growing Demand for High-Purity Isobutylene in Polymer Manufacturing

- The currently prevailing trend in the isobutylene market can be stated as massive increase of the demand, which is caused by high application value of the substance in the polymer production. Isobutylene, a strong substance for production of polymers, is being used more and more in the automotive, packaging and construction industries as well. The rising interest in lightweight materials as well as the greening production in a sustainable manner also create a considerable demand for high-purity isobutylene since it is used as the main building block to prepare exceptional polymer blends. strict emissions control standards and customer quality specifications for products are thrusting manufacturers to engineer products involving high-purity isobutylene consumption to express compliance and meet the ever-changing market needs.

- Besides its prime opening in well-established domains like polymer production, good quality isobutylene is now being used in healthcare and technology due to their versatile nature. A functionality rich in terms of the role it plays in the multiplicity of polymers as well as its ability to improve the end products properties is what make it widely sought-after by manufacturers of specialty polymers in products like medical devices, electronic components and specialty coatings.

- Growing automotive industry, devoted primarily to development of fuel effective cars and electric mobility vehicular solutions, requires high quality polymers containing isobutylene derivatives applied for such functions as fuel system management, tires and automotive glues. This enhanced demand for ultra-pure isobutylene gives proof of the larger push towards high-function materials in manufacturing and sustainable operations which may be indicative of the market behaving favorably in the coming future. Tapping these opportunities turn out to be the market players' focus as they are joining forces with capacity expansions, partnering strategies and technology development to satisfy the changing needs of their customers and to move ahead of competition in the global market space.

Advancements in Fuel Additives and Lubricants

- Fuel additives and lubricants advancement has been significant, this is as a result of the fact that these technologies are being innovated and also because environmental sustainability is on an increase. The company has particularly given significant attention to producing high purity isobutylene which is key in making that most strategic raw materials which are input to fuel additives and lubricants manufacturing.

- Isobutylene is the best possible solution to the given question. It significantly contributes to performance and longevity of fuels and lubricants by raising the octane ratings, reducing emissions and minimizing the wear and tear of engines. As a consequence, the field of high quality isobutylene has attracted strong market participants, with producers expending on R&D and manufacturing to meet the growing consumer needs.

- Two methods that have accelerated the production of isobutylene at high purity is via advanced refining and purifying processes. Some innovations that are already being used include catalytically refining and molecular sieves. As concern for the environment has grown, catalyst and reactor engineering has also improved, increasingly leading to isobutylene production being more efficient and cheaper, thereby stimulating market development.

- The development of green-based isobutylene from sources like biomass and bio-based products offers a natural alternative to the petrochemical raw materials that are harmful to the environment. This movement towards clean sources of energy is an alignment with a broader trend in the industry to commit for the grudging carbon emissions and promotion of environmental footprint.

High Purity Isobutylene Market Segment Analysis:

High Purity Isobutylene Market is segmented based on Type and Application.

By Type, Isobutane Dehydrogenation Method segment is expected to dominate the market during the forecast period

- The pure isobutylene production market is categorized according to the methods utilized for its production, majorly including C4 fraction separation, MTBE decomposition and liquid isobutane dehydrogenation.

- · The method of MTBE disintegration involves the process of splitting of methyl tert-butyl ether (MTBE). Its break-down largely produces isobutylene (IB). This is usually picked because isobutylene extraction from ethylene produces high purity high quality isobutylene product.

- The issue of selective separation of IB out from C4 hydrocarbons blend employs the C4 fraction separation method. Most of the impurities and byproducts are removed using the distillation and fractions so as to obtain the purest form of isobutylene.

- The Isobutane dehydrogenation catalytic method is the conversion of isobutane into isobutylene by the elimination of hydrogen. This procedure lets us get a straight way to producing the required isobutylene, what makes it unique and very efficient.

By Application , Butyl Rubber segment held the largest share in 2023

- The isobutylene that is given from high purity is segmented in regard to application comprising mainly butyl rubber, polyisobutylene, and few others. Butyl rubber is owing this extend of the market share, thanks to the broad uptake in tire manufacture, automotive components, and other core products used by different industries. Due to its superior factors that include extremely low permeability to gases, good resistant to weathering and excellent water absorption, the demand for butyl rubber is being matched with the best application hence the increased sales. Polyisobutylene , another the large range application segment, is widely been employed in owing to the low gas permeability and excellent viscous properties.

- Wide-ranging, high purity isobutylene is not only used in transport fuels, pharmaceuticals, and chemicals, but is also a major driver of market development. The rising use of high purity isobutylene across these multifaceted industries can be explained mainly through its superior advantages and high utility value, thus, resulting in the dedicated supply to the global market.

High Purity Isobutylene Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- On the one hand, the US and is called Canada foresee becoming leading producers of high purity isobutylene during the coming years and the reason of this relates to the presence of the following factors: The region enjoys prominent infrastructural and technological qualifications, which enable the production and distribution of the product in high-purity isobutylene using an efficient approach. However, high purity isobutylene for petrochemical and chemical industries which are the largest consumers of isobutylene for the manufacture of rubber, plastics, and lubricants is also sourced extensively in North America, contributing to the diversified spectrum of the industry.

- It is the rigid regulatory environment in the area requiring the application of a high percentage of isobutylene to achieve the desired target in emissions usually yearly that explains the increment in demand. the North American high sustainable and green circle consciousness drives broader use of the cleaner and more effienent production technology where the per high purity isobutylene is of a great importance.

Active Key Players in the High Purity Isobutylene Market

- Lyondell Basell (Netherlands)

- ExxonMobil Chemical (U.S.)

- TPC Group (U.S.)

- Nizhnekamskneftekhim (Russia)

- Sumitomo Chemical (Japan)

- Evonik (Germany)

- Yeochun NCC (South Korea)

- TASCO Group (Taiwan)

- Sinopec (China)

- Shandong Chambroad Petrochemical (China)

- Qixiang Tengda Chemical (China)

- Zhejiang Cenway New Materials (China)

- Ningbo Haoda Chemical (China)

- Shandong Chengtai New Material (China) Other Key Players

|

Global High Purity Isobutylene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.53 Bn. |

|

Forecast Period 2023-32 CAGR: |

8.41 % |

Market Size in 2032: |

USD 17.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HIGH PURITY ISOBUTYLENE MARKET BY TYPE (2017-2032)

- HIGH PURITY ISOBUTYLENE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MTBE DECOMPOSITION METHOD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- C4 FRACTION SEPARATION METHOD

- ISOBUTANE DEHYDROGENATION METHOD

- OTHERS

- HIGH PURITY ISOBUTYLENE MARKET BY APPLICATION (2017-2032)

- HIGH PURITY ISOBUTYLENE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BUTYL RUBBER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYISOBUTYLENE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LYONDELL BASELL (NETHERLANDS)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- EXXONMOBIL CHEMICAL (U.S.)

- TPC GROUP (U.S.)

- NIZHNEKAMSKNEFTEKHIM (RUSSIA)

- SUMITOMO CHEMICAL (JAPAN)

- EVONIK (GERMANY)

- YEOCHUN NCC (SOUTH KOREA)

- TASCO GROUP (TAIWAN)

- SINOPEC (CHINA)

- SHANDONG CHAMBROAD PETROCHEMICAL (CHINA)

- QIXIANG TENGDA CHEMICAL (CHINA)

- ZHEJIANG CENWAY NEW MATERIALS (CHINA)

- NINGBO HAODA CHEMICAL (CHINA)

- SHANDONG CHENGTAI NEW MATERIAL (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL HIGH PURITY ISOBUTYLENE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global High Purity Isobutylene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.53 Bn. |

|

Forecast Period 2023-32 CAGR: |

8.41 % |

Market Size in 2032: |

USD 17.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HIGH PURITY ISOBUTYLENE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HIGH PURITY ISOBUTYLENE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HIGH PURITY ISOBUTYLENE MARKET COMPETITIVE RIVALRY

TABLE 005. HIGH PURITY ISOBUTYLENE MARKET THREAT OF NEW ENTRANTS

TABLE 006. HIGH PURITY ISOBUTYLENE MARKET THREAT OF SUBSTITUTES

TABLE 007. HIGH PURITY ISOBUTYLENE MARKET BY TYPE

TABLE 008. MTBE DECOMPOSITION METHOD MARKET OVERVIEW (2016-2028)

TABLE 009. C4 FRACTION SEPARATION METHOD MARKET OVERVIEW (2016-2028)

TABLE 010. ISOBUTANE DEHYDROGENATION METHOD MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. HIGH PURITY ISOBUTYLENE MARKET BY APPLICATION

TABLE 013. BUTYL RUBBER MARKET OVERVIEW (2016-2028)

TABLE 014. POLYISOBUTYLENE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA HIGH PURITY ISOBUTYLENE MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA HIGH PURITY ISOBUTYLENE MARKET, BY APPLICATION (2016-2028)

TABLE 018. N HIGH PURITY ISOBUTYLENE MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE HIGH PURITY ISOBUTYLENE MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE HIGH PURITY ISOBUTYLENE MARKET, BY APPLICATION (2016-2028)

TABLE 021. HIGH PURITY ISOBUTYLENE MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC HIGH PURITY ISOBUTYLENE MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC HIGH PURITY ISOBUTYLENE MARKET, BY APPLICATION (2016-2028)

TABLE 024. HIGH PURITY ISOBUTYLENE MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA HIGH PURITY ISOBUTYLENE MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA HIGH PURITY ISOBUTYLENE MARKET, BY APPLICATION (2016-2028)

TABLE 027. HIGH PURITY ISOBUTYLENE MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA HIGH PURITY ISOBUTYLENE MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA HIGH PURITY ISOBUTYLENE MARKET, BY APPLICATION (2016-2028)

TABLE 030. HIGH PURITY ISOBUTYLENE MARKET, BY COUNTRY (2016-2028)

TABLE 031. LYONDELL BASELL: SNAPSHOT

TABLE 032. LYONDELL BASELL: BUSINESS PERFORMANCE

TABLE 033. LYONDELL BASELL: PRODUCT PORTFOLIO

TABLE 034. LYONDELL BASELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. EXXONMOBIL CHEMICAL: SNAPSHOT

TABLE 035. EXXONMOBIL CHEMICAL: BUSINESS PERFORMANCE

TABLE 036. EXXONMOBIL CHEMICAL: PRODUCT PORTFOLIO

TABLE 037. EXXONMOBIL CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. NKNK: SNAPSHOT

TABLE 038. NKNK: BUSINESS PERFORMANCE

TABLE 039. NKNK: PRODUCT PORTFOLIO

TABLE 040. NKNK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SUMITOMO CHEMICAL: SNAPSHOT

TABLE 041. SUMITOMO CHEMICAL: BUSINESS PERFORMANCE

TABLE 042. SUMITOMO CHEMICAL: PRODUCT PORTFOLIO

TABLE 043. SUMITOMO CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. EVONIK: SNAPSHOT

TABLE 044. EVONIK: BUSINESS PERFORMANCE

TABLE 045. EVONIK: PRODUCT PORTFOLIO

TABLE 046. EVONIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HONEYWELL: SNAPSHOT

TABLE 047. HONEYWELL: BUSINESS PERFORMANCE

TABLE 048. HONEYWELL: PRODUCT PORTFOLIO

TABLE 049. HONEYWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SONGWON: SNAPSHOT

TABLE 050. SONGWON: BUSINESS PERFORMANCE

TABLE 051. SONGWON: PRODUCT PORTFOLIO

TABLE 052. SONGWON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TASCO: SNAPSHOT

TABLE 053. TASCO: BUSINESS PERFORMANCE

TABLE 054. TASCO: PRODUCT PORTFOLIO

TABLE 055. TASCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. BEIJING YANSHAN PETROCHEMICAL: SNAPSHOT

TABLE 056. BEIJING YANSHAN PETROCHEMICAL: BUSINESS PERFORMANCE

TABLE 057. BEIJING YANSHAN PETROCHEMICAL: PRODUCT PORTFOLIO

TABLE 058. BEIJING YANSHAN PETROCHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. TPC GROUP: SNAPSHOT

TABLE 059. TPC GROUP: BUSINESS PERFORMANCE

TABLE 060. TPC GROUP: PRODUCT PORTFOLIO

TABLE 061. TPC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. JINZHOU PETROCHEMICAL: SNAPSHOT

TABLE 062. JINZHOU PETROCHEMICAL: BUSINESS PERFORMANCE

TABLE 063. JINZHOU PETROCHEMICAL: PRODUCT PORTFOLIO

TABLE 064. JINZHOU PETROCHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ZHEJIANG SHUNDA NEW MATERIAL: SNAPSHOT

TABLE 065. ZHEJIANG SHUNDA NEW MATERIAL: BUSINESS PERFORMANCE

TABLE 066. ZHEJIANG SHUNDA NEW MATERIAL: PRODUCT PORTFOLIO

TABLE 067. ZHEJIANG SHUNDA NEW MATERIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SHANGDONG CHAMBROAD PETROCHEMICAL: SNAPSHOT

TABLE 068. SHANGDONG CHAMBROAD PETROCHEMICAL: BUSINESS PERFORMANCE

TABLE 069. SHANGDONG CHAMBROAD PETROCHEMICAL: PRODUCT PORTFOLIO

TABLE 070. SHANGDONG CHAMBROAD PETROCHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY TYPE

FIGURE 012. MTBE DECOMPOSITION METHOD MARKET OVERVIEW (2016-2028)

FIGURE 013. C4 FRACTION SEPARATION METHOD MARKET OVERVIEW (2016-2028)

FIGURE 014. ISOBUTANE DEHYDROGENATION METHOD MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY APPLICATION

FIGURE 017. BUTYL RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 018. POLYISOBUTYLENE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA HIGH PURITY ISOBUTYLENE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the High Purity Isobutylene Market research report is 2024-2032.

Lyondell Basell (Netherlands), ExxonMobil Chemical (US), NKNK (Russia), Sumitomo Chemical (Japan), Evonik (Germany), Honeywell (US), and Other Major Players

The High Purity Isobutylene Market is segmented into Type, Application and Region. By Type,the market is categorized into MTBE Decomposition Method, C4 Fraction Separation Method, Isobutane Dehydrogenation Method, and Others. By Application, the market is categorized into Butyl Rubber, Polyisobutylene, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

High purity isobutylene refers to a refined form of the compound isobutylene, typically with a concentration exceeding 99.5%. Isobutylene itself is a colorless, flammable gas used extensively in the production of various chemicals, including fuel additives and synthetic rubber. The high purity variant is crucial in industries where precise composition and minimal impurities are paramount, ensuring optimal performance and safety in end products. This stringent purification process removes contaminants, moisture, and other undesirable components, guaranteeing the highest quality isobutylene for industrial applications. The increasing demand for high-performance tires, particularly in the automotive sector, is a key driver propelling the growth of the high purity isobutylene market. With the automotive industry's focus shifting towards more fuel-efficient and durable tires, the demand for butyl rubber, and consequently high purity isobutylene, is expected to rise substantially.

High Purity Isobutylene Market Size Was Valued at USD 8.53 Billion in 2023, and is Projected to Reach USD 17.64 Billion by 2032, Growing at a CAGR of 8.41 % From 2024-2032.