Global Heat Exchanger Market Overview

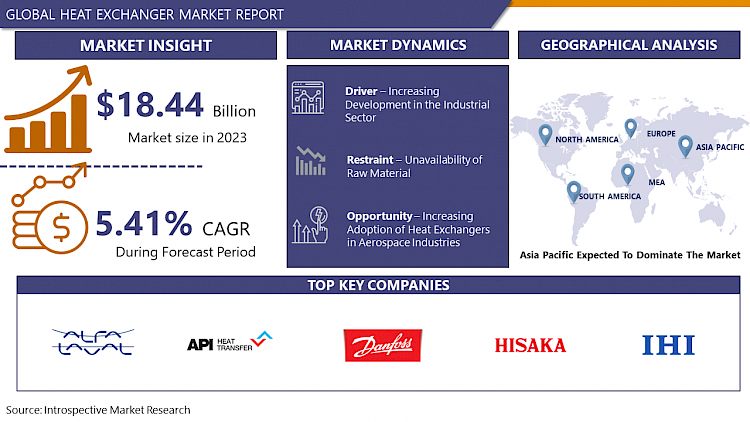

The global Heat Exchanger Market was valued at USD 18.44 Billion in 2023 and is expected to reach USD 29.62 Billion by the year 2032, at a CAGR of 5.41%

A heat exchanger is a device in a system that is used to exchange the heat between two or more fluids. Heat exchange between two fluids has different temperatures. Heat exchanger devices are used in different systems depending on the application of that system. It is used for different applications in many engineering devices, such as space heating, air-conditioning systems, refrigeration, and food processing systems, automobile radiators, chemical processing systems, power plants, and waste heat recovery units. Economizers, air preheaters, evaporators, super-heaters, condensers, and cooling towers used in a power plant are a few examples of heat exchangers. Finned Tube Heat Exchanger or Air Cooled Heat Exchanger, Shell and Tube Heat Exchanger, or Heat Exchanger is some types of the heat exchanger. According to the type of heat exchanger used, the heat transfer process is carried out between liquid to gas, gas to gas, or liquid to liquid. By using a solid wall of high thermal conductivity, these two fluids are separated in the system which prevents the mixing of fluids, and direct contact fluids.

Market Dynamics And Factors For Heat Exchanger Market

Drivers:

Increasing Development in the Industrial Sector

Increasing development in the industrial sector leads to the growth of the heat exchanger market during the forecast period. In developing countries growth rate of the industrial sector is very high. To develop the economy industrialization is important it brings employment and money to the country which is expected to boost the demand for heat exchangers. Commercial and industrial projects in the region have also contributed to the growth heat exchangers market globally. Increased demand for petrochemical products is expected to have a positive impact on the heat exchangers market.

Restraints:

Unavailability of Raw Material

The unavailability of raw materials restrains the growth of the heat exchanger market in the forecasting period. The raw material used for the manufacturing of heat exchangers, like aluminium, steel, copper, and other metals. Manufacturers required raw materials on time and in the required quantity and quality for the production of otherwise it affects the production of the product. The availability of raw material is depending on various factors such as supply conditions, economic conditions, and exchange rates, which create an adverse effect on production. Unavailability of raw material leads to resulting in delay or cancelation of the projects, which hamper the overall market growth of heat exchangers.

Opportunity:

Increasing Adoption of Heat Exchangers in Aerospace Industries

Increasing adoption of heat exchangers in aerospace industries giving boost to the heat exchangers market during the forecasted period. Heat exchangers play an important part in aerospace sector. Aircraft of all sizes, shapes, fixed wings, and rotary wings all have heat exchangers in their system. In aviation, they used heat exchangers for reducing the increased temperatures of the fuel which helps to increase the efficiency of the aircraft engines. Aircraft heat exchangers are used in cooling and heating both but are commonly used to cool RAM air, hydraulics, gearboxes, auxiliary power units, etc. The flat tube and the plate-fin heat exchangers are the most common use heat exchanges in aviation due to this Aerospace Industries can boost the market share of heat exchanger in the upcoming time.

Segmentation Analysis Of Heat Exchanger Market

By Type, Shell & Tube Heat Exchanger is dominating the growth of the heat exchanger market during the forecast period. Shell and Tube Heat Exchangers are one of the most famous types of the heat exchanger; it is used on large scale compared to others due to the flexibility this system allows for a use of a wide range of pressures and temperatures. It is beneficial in the exchange of heat between gases that are dangerous to the body or health and mandated to keep away from release into the environment. Shell and Tube Heat Exchangers are used in two different industries petrochemical industry, the power industry as a power plant condensers, and feed-water heaters. It consists of a cylindrical shell and several tubes mounted inside the shell. Two fluids flow in a system to exchange the heat without getting into direct contact. This segment is likely to dominate the heat exchanger market during the forecast period.

By Material, Stainless Steel segment is anticipated to grab the maximum market share in the heat exchanger market over the projected period. Various materials are used to make a heat exchanger but the correct choice of material is required for the good quality product formation, material affects the function and service life of the product. The heat exchanger is used in many industries like gas, oil, and food. They operate outdoors, or in a processing plant, then there is a high risk of corrosion and high corrosion resistance material is required due to this stainless steel is having high demand. Stainless steel is corrosion resistant which makes it an ideal choice. Critical substances are passing through a heat exchanger in chemical industries; stainless steel is a great material that keeps the chemical in pure form. It has optimum thermal properties, they tolerate heat loads over 800 kW this stainless steel is a highly preferred material which expected to lead the heat exchanger market in upcoming years.

Regional Analysis Of Heat Exchanger Market

The Asia Pacific is the region that is dominating the heat exchanger market during the forecast period. The Asia Pacific is a region that includes many developing countries. The countries like China and India are in their developing phase, and the government of these countries is supporting and working on industrialization which helps to boost the economy of the country. Industrial development brings employment, money, and advancement to the system due to this the market for the heat exchanger is increasing and is growing fast in this region. The requirement of heat exchangers is in many areas that help to increase the share of heat exchangers in the market. The Asia Pacific is the region that enhances the heat exchanger market during the forecast period.

North America is expected to grow with a significant growth rate in heat exchanger market during the forecast period. North America is the developed region the countries like USA, Mexico, and Canada are in this region. These are the countries that are technically and economically advanced. Adoption of new techniques in industries is constantly carried out by government and industrialists, due to this, there are a very high consumer base for heat exchangers. The heat exchanger is used in many industries like food, gas, oil, and petroleum, and these are the prime customers that are used heat exchangers to carry out different industrial activities, due to all this the demand for the heat exchanger is increased that’s boost the heat exchanger market in North America region in the forecast period.

The European region is expected to lead the heat exchanger market during the forecast period. It is a developed region there are many industries, companies are established in this region so it is the prime market place for heat exchanger devices. Also many uses of this device are useful in so many commercial and residential activities. This is the safest way to exchange heat, without releasing toxic gases in the atmosphere and it does not cause harm to the environment. There are some government policies in the European region that support this environment friendly system which is not causing any harm to the environment and help to overcome the problems like global warming. Due to this, the demand for heat exchangers in the European region is increasing which gives growth to the heat exchanger market in the forecast period.

Covid-19 Impact Analysis On Heat Exchanger Market

COVID-19 had done adverse impact on the Heat Exchanger Market. The market witnessed a slow growth in 2020 as compared to 2019. The slow growth in 2020 was due to supply chain disruptions across the world. Due to COVID-19, the entire world is shouting downed, in lockdown all the industries have to stop there work in all over the world. Only essential needs like agricultural industry and healthcare, Pharma industry is working with all force rest have to follow the rules for the safety living thing. Heat exchanger is used in many industries according to the requirement there are many application it like heating, air-conditioning systems, refrigeration, and food processing systems, automobile radiators, chemical processing systems, power plants, and waste heat recovery units. Economizers, air preheaters, evaporators, super-heaters, condensers, and cooling towers and all these industries are suffered in the pandemic. Labor are not available during this time, less manpower affect the total production. Also the heat exchanger manufacturing companies are affected by this COVID-19 situation less availability of raw material, high cost, disturbed supply chain everything is suffering because of COVID-19 which shows the huge impact on the market. After the lockdown government changes its policies and now the market is showing growth in this jewelry market.

Top Key Players Covered In Heat Exchanger Market

- Alfa Laval AB (Sweden)

- API Heat Transfer Inc. (US)

- Danfoss(Denmark)

- General Electric Company (US)

- Hisaka Works Ltd. (Japan)

- IHI Corporation (Japan)

- Johnson Controls International PLC (US)

- Kelvion Holding GmbH (Germany)

- Koch Industries Inc. (US)

- Boyd Corporation (US)

- Mersen SA (France) Modine Manufacturing Company (US)

- Royal Hydraulics Inc. (US)

- Xylem Inc. (US)

- Aero Engineers (India)

- BMR HVAC (India)

- Exchanger Industries Limited (Canada) and Other Major Players.

Key Industry Development In Heat Exchanger Market

- In April 2023, Kelvion launched a dedicated air cooler series for natural refrigerants. The CDF & CDH ranges are dual discharge air coolers highlighting a similar proficient tube system.

- In May 2023, Alfa Laval is enhancing its brazed plate heat exchanger capacity to bolster the global energy transition. The establishment of new facilities in Italy, China, Sweden, and the U.S. signifies significant progress in their initiative to advance manufacturing intelligence and efficiency throughout the entire supply chain.

|

Global Heat Exchanger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.41% |

Market Size in 2032: |

USD 29.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Material

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Heat Exchanger Market by Type

5.1 Heat Exchanger Market Overview Snapshot and Growth Engine

5.2 Heat Exchanger Market Overview

5.3 Shell & Tube Heat Exchanger

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Shell & Tube Heat Exchanger: Grographic Segmentation

5.4 Finned Tube Heat Exchanger

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Finned Tube Heat Exchanger: Grographic Segmentation

5.5 Plate Heat Exchanger

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Plate Heat Exchanger: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Heat Exchanger Market by Material

6.1 Heat Exchanger Market Overview Snapshot and Growth Engine

6.2 Heat Exchanger Market Overview

6.3 Stainless Steel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Stainless Steel: Grographic Segmentation

6.4 Aluminium

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aluminium: Grographic Segmentation

6.5 Copper

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Copper: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Heat Exchanger Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Heat Exchanger Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Heat Exchanger Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ALFA LAVAL AB

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 API HEAT TRANSFER INC.

7.4 DANFOSS

7.5 GENERAL ELECTRIC COMPANY

7.6 HISAKA WORKS LTD.

7.7 IHI CORPORATION

7.8 JOHNSON CONTROLS INTERNATIONAL PLC

7.9 KELVION HOLDING GMBH

7.10 KOCH INDUSTRIES INC.

7.11 BOYD CORPORATION

7.12 MERSEN SA

7.13 MODINE MANUFACTURING COMPANY

7.14 ROYAL HYDRAULICS INC.

7.15 XYLEM INC.

7.16 AERO ENGINEERS

7.17 BMR HVAC

7.18 EXCHANGER INDUSTRIES LIMITED

7.19 OTHER MAJOR PLAYERS

Chapter 8: Global Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Shell & Tube Heat Exchanger

8.2.2 Finned Tube Heat Exchanger

8.2.3 Plate Heat Exchanger

8.2.4 Others

8.3 Historic and Forecasted Market Size By Material

8.3.1 Stainless Steel

8.3.2 Aluminium

8.3.3 Copper

8.3.4 Others

Chapter 9: North America Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Shell & Tube Heat Exchanger

9.4.2 Finned Tube Heat Exchanger

9.4.3 Plate Heat Exchanger

9.4.4 Others

9.5 Historic and Forecasted Market Size By Material

9.5.1 Stainless Steel

9.5.2 Aluminium

9.5.3 Copper

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Shell & Tube Heat Exchanger

10.4.2 Finned Tube Heat Exchanger

10.4.3 Plate Heat Exchanger

10.4.4 Others

10.5 Historic and Forecasted Market Size By Material

10.5.1 Stainless Steel

10.5.2 Aluminium

10.5.3 Copper

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Shell & Tube Heat Exchanger

11.4.2 Finned Tube Heat Exchanger

11.4.3 Plate Heat Exchanger

11.4.4 Others

11.5 Historic and Forecasted Market Size By Material

11.5.1 Stainless Steel

11.5.2 Aluminium

11.5.3 Copper

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Shell & Tube Heat Exchanger

12.4.2 Finned Tube Heat Exchanger

12.4.3 Plate Heat Exchanger

12.4.4 Others

12.5 Historic and Forecasted Market Size By Material

12.5.1 Stainless Steel

12.5.2 Aluminium

12.5.3 Copper

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Heat Exchanger Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Shell & Tube Heat Exchanger

13.4.2 Finned Tube Heat Exchanger

13.4.3 Plate Heat Exchanger

13.4.4 Others

13.5 Historic and Forecasted Market Size By Material

13.5.1 Stainless Steel

13.5.2 Aluminium

13.5.3 Copper

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Heat Exchanger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.41% |

Market Size in 2032: |

USD 29.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEAT EXCHANGER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEAT EXCHANGER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEAT EXCHANGER MARKET COMPETITIVE RIVALRY

TABLE 005. HEAT EXCHANGER MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEAT EXCHANGER MARKET THREAT OF SUBSTITUTES

TABLE 007. HEAT EXCHANGER MARKET BY TYPE

TABLE 008. SHELL & TUBE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

TABLE 009. FINNED TUBE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

TABLE 010. PLATE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. HEAT EXCHANGER MARKET BY MATERIAL

TABLE 013. STAINLESS STEEL MARKET OVERVIEW (2016-2028)

TABLE 014. ALUMINIUM MARKET OVERVIEW (2016-2028)

TABLE 015. COPPER MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA HEAT EXCHANGER MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA HEAT EXCHANGER MARKET, BY MATERIAL (2016-2028)

TABLE 019. N HEAT EXCHANGER MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE HEAT EXCHANGER MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE HEAT EXCHANGER MARKET, BY MATERIAL (2016-2028)

TABLE 022. HEAT EXCHANGER MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC HEAT EXCHANGER MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC HEAT EXCHANGER MARKET, BY MATERIAL (2016-2028)

TABLE 025. HEAT EXCHANGER MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA HEAT EXCHANGER MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA HEAT EXCHANGER MARKET, BY MATERIAL (2016-2028)

TABLE 028. HEAT EXCHANGER MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA HEAT EXCHANGER MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA HEAT EXCHANGER MARKET, BY MATERIAL (2016-2028)

TABLE 031. HEAT EXCHANGER MARKET, BY COUNTRY (2016-2028)

TABLE 032. ALFA LAVAL AB: SNAPSHOT

TABLE 033. ALFA LAVAL AB: BUSINESS PERFORMANCE

TABLE 034. ALFA LAVAL AB: PRODUCT PORTFOLIO

TABLE 035. ALFA LAVAL AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. API HEAT TRANSFER INC.: SNAPSHOT

TABLE 036. API HEAT TRANSFER INC.: BUSINESS PERFORMANCE

TABLE 037. API HEAT TRANSFER INC.: PRODUCT PORTFOLIO

TABLE 038. API HEAT TRANSFER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. DANFOSS: SNAPSHOT

TABLE 039. DANFOSS: BUSINESS PERFORMANCE

TABLE 040. DANFOSS: PRODUCT PORTFOLIO

TABLE 041. DANFOSS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 042. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 043. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 044. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HISAKA WORKS LTD.: SNAPSHOT

TABLE 045. HISAKA WORKS LTD.: BUSINESS PERFORMANCE

TABLE 046. HISAKA WORKS LTD.: PRODUCT PORTFOLIO

TABLE 047. HISAKA WORKS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. IHI CORPORATION: SNAPSHOT

TABLE 048. IHI CORPORATION: BUSINESS PERFORMANCE

TABLE 049. IHI CORPORATION: PRODUCT PORTFOLIO

TABLE 050. IHI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. JOHNSON CONTROLS INTERNATIONAL PLC: SNAPSHOT

TABLE 051. JOHNSON CONTROLS INTERNATIONAL PLC: BUSINESS PERFORMANCE

TABLE 052. JOHNSON CONTROLS INTERNATIONAL PLC: PRODUCT PORTFOLIO

TABLE 053. JOHNSON CONTROLS INTERNATIONAL PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. KELVION HOLDING GMBH: SNAPSHOT

TABLE 054. KELVION HOLDING GMBH: BUSINESS PERFORMANCE

TABLE 055. KELVION HOLDING GMBH: PRODUCT PORTFOLIO

TABLE 056. KELVION HOLDING GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KOCH INDUSTRIES INC.: SNAPSHOT

TABLE 057. KOCH INDUSTRIES INC.: BUSINESS PERFORMANCE

TABLE 058. KOCH INDUSTRIES INC.: PRODUCT PORTFOLIO

TABLE 059. KOCH INDUSTRIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BOYD CORPORATION: SNAPSHOT

TABLE 060. BOYD CORPORATION: BUSINESS PERFORMANCE

TABLE 061. BOYD CORPORATION: PRODUCT PORTFOLIO

TABLE 062. BOYD CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MERSEN SA: SNAPSHOT

TABLE 063. MERSEN SA: BUSINESS PERFORMANCE

TABLE 064. MERSEN SA: PRODUCT PORTFOLIO

TABLE 065. MERSEN SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MODINE MANUFACTURING COMPANY: SNAPSHOT

TABLE 066. MODINE MANUFACTURING COMPANY: BUSINESS PERFORMANCE

TABLE 067. MODINE MANUFACTURING COMPANY: PRODUCT PORTFOLIO

TABLE 068. MODINE MANUFACTURING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ROYAL HYDRAULICS INC.: SNAPSHOT

TABLE 069. ROYAL HYDRAULICS INC.: BUSINESS PERFORMANCE

TABLE 070. ROYAL HYDRAULICS INC.: PRODUCT PORTFOLIO

TABLE 071. ROYAL HYDRAULICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. XYLEM INC.: SNAPSHOT

TABLE 072. XYLEM INC.: BUSINESS PERFORMANCE

TABLE 073. XYLEM INC.: PRODUCT PORTFOLIO

TABLE 074. XYLEM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. AERO ENGINEERS: SNAPSHOT

TABLE 075. AERO ENGINEERS: BUSINESS PERFORMANCE

TABLE 076. AERO ENGINEERS: PRODUCT PORTFOLIO

TABLE 077. AERO ENGINEERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BMR HVAC: SNAPSHOT

TABLE 078. BMR HVAC: BUSINESS PERFORMANCE

TABLE 079. BMR HVAC: PRODUCT PORTFOLIO

TABLE 080. BMR HVAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. EXCHANGER INDUSTRIES LIMITED: SNAPSHOT

TABLE 081. EXCHANGER INDUSTRIES LIMITED: BUSINESS PERFORMANCE

TABLE 082. EXCHANGER INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 083. EXCHANGER INDUSTRIES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 084. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 085. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 086. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEAT EXCHANGER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEAT EXCHANGER MARKET OVERVIEW BY TYPE

FIGURE 012. SHELL & TUBE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

FIGURE 013. FINNED TUBE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

FIGURE 014. PLATE HEAT EXCHANGER MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. HEAT EXCHANGER MARKET OVERVIEW BY MATERIAL

FIGURE 017. STAINLESS STEEL MARKET OVERVIEW (2016-2028)

FIGURE 018. ALUMINIUM MARKET OVERVIEW (2016-2028)

FIGURE 019. COPPER MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA HEAT EXCHANGER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE HEAT EXCHANGER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC HEAT EXCHANGER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA HEAT EXCHANGER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA HEAT EXCHANGER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Heat Exchanger Market research report is 2024-2032.

Alfa Laval AB (Sweden), API Heat Transfer, Inc. (US), Danfoss (Denmark), General Electric Company (US), Hisaka Works Ltd. (Japan), IHI Corporation (Japan), Johnson Controls International PLC (US), Kelvion Holding GmbH (Germany), Koch Industries Inc. (US), Boyd Corporation (US), Mersen SA (France) Modine Manufacturing Company (US), Royal Hydraulics Inc. (US), Xylem Inc. (US) Aero Engineers (India), BMR HVAC (India), Exchanger Industries Limited (Canada), and Other Major Players.

Heat Exchanger Market is segmented into Type, Material, and region. By Type, the market is categorized into Shell & Tube Heat Exchanger, Finned Tube Heat Exchanger, Plate Heat Exchanger, Others. By Material, the market is categorized into Stainless Steel, Aluminium, Copper, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A heat exchanger is a device in a system that is used to exchange the heat between two or more fluids. Heat exchange between two fluids has different temperatures. Heat exchanger devices are used in different systems depending on the application of that system.

The global Heat Exchanger Market was valued at USD 18.44 Billion in 2023 and is expected to reach USD 29.62 Billion by the year 2032, at a CAGR of 5.41%