Healthy Snacks Market Synopsis

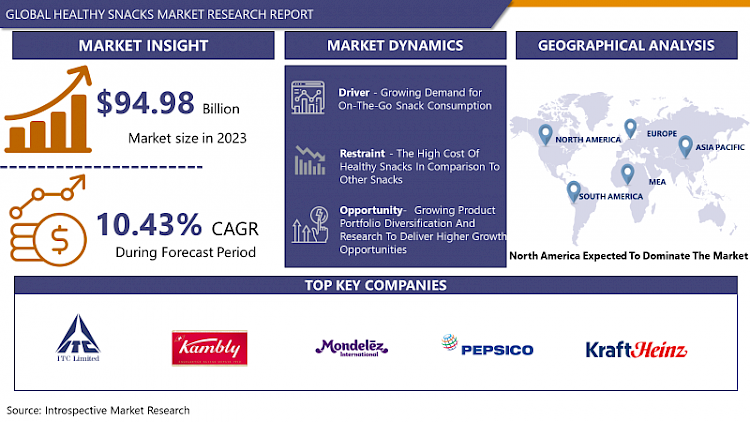

Healthy Snacks Market Size Was Valued at USD 94.98 Billion in 2023, and is Projected to Reach USD 231.96 Billion by 2032, Growing at a CAGR of 10.43% From 2024-2032.

Currently, the global market for healthy snacks is evolving due to consumers’ desire to include healthier products in their diets and the growing knowledge about the need for healthy snacks. Several factors that have been attributed to this growth include health awareness and consciousness, coupled with increased activities and leading a busy schedule, and the new and attractive better-for-you products available in an expanded and diverse number of channels. Furthermore, the increase in the number of health-conscious customers, especially in developing countries, looking for plant-based and organic snacks, and the progression in food technology are acting as the drivers of market growth. However, the competition that has resulted from the presence of established players and regulatory constraints dealing with labeling and health claims present real challenges to market players seeking to benefit from developments in this growing market segment.

- Snacks refer to small portions of food or beverages that cannot be categorized under meals or which are taken in between the regularly organized meals. Healthy snacks are sacks that have low sodium content, are not sweetened contain vitamins and nutrients, and low content of saturated fats. Products to eat between meals should be rich in fiber as well as proteins to ensure that one is well-fed all day or at least not hungry to snack again. Some of the recommended snack foods are eggs, whole grains such as lentils and rice, seeds and nuts, vegetables, fruits, and low-fat dairy products.

- To be more precise, healthy snacks are food items that are believed to be superior and safer for human consumption than other snacking products. Snacks are employer foods that are taken in small or limited quantities, during between-meal intervals, and are often highly pressurized. They are available in numerous forms including packaging materials. But they can also be produced at home using simple staple foods in every household.

- However, they can also be prepared at home using common household items, being made out of ordinary foodstuffs. Common examples of snacks include baked products like cookies, cake pieces or chocolates, sandwiches, nuts, and fruits. Some of them are healthier in terms of their processing as compared to other refined or ultra-processed foods. Pre-daintified snacks are becoming trendy as they proved to be useful in enhancing health standards and maintaining a healthier lifestyle by offering the required portion of the necessary nutrients.

- In addition, they also include very little or are free from other poisonous elements like sugar and fats. Definitions about which foods, or which kinds of foods, can be considered healthy snacks may vary in geographical location, as well as geographic tendencies and preferences. For instance, peanut is a healthy snacking food greatly consumed in the US while countries that have a variety of spices in their palates may want to use different spices for healthy snacks. The present market structure is highly saturated with established brands dealing with healthy snacks and new entrants are being witnessed adding to the list of brands and products.

Healthy Snacks Market Trend Analysis

Plant-Based Snacks

- Plant-based snacks have started to dominate the market primarily because of health and eco-consciousness effects. Savory snacks are those munched between meals and the most preferred snacks are healthy snacks made from fruits, vegetables, nuts, seeds, and legumes as compared to unhealthy snacks made from processed ingredients with added additives.

- This trend is driven by the increasing population of vegetarians and vegans, those on flexitarian diets, or those who simply prefer to purchase good quality, ‘clean label’ food products. Manufacturers are thus trying to upgrade and diversify their plant-based snacks like veggie chips, fruit bars, nut clusters, and pulse-based snacks such as chickpeas & lentils-based protein-packed snacks.

Functional Snacks

- Functional snacks are becoming progressively popular because people are looking for snacks that not only have taste appeal but are also functional to meet certain nutritional requirements or serve some precise purpose. These snacks can boast of such additives as vitamins, minerals, antioxidants, probiotics, or other valuable additives that are known for their beneficial effect on the body.

- These include Vitamin and Mineral enhanced energy bars, Probiotic yogurts, antioxidant-rich fruit bars, and protein bars for health-conscious exercised persons. However, with the increasing focus of people on the idea of having a personalized diet, there is a surge in the consumption of functional snacks that better fit the target consumer demographic needs. Thus, a rise in awareness among consumers of their health status will actuate the demand for snack foods with supplementary benefits.

Healthy Snacks Market Segment Analysis:

Healthy Snacks Market is segmented based on Product, Claim, Distribution Channel and Packaging

By Product, the Dried Fruit segment is expected to dominate the market during the forecast period

- Segment three contains the biggest market share attributed to the fact that they are portable foods that are rich in both protein and healthy fats. Consumers are striving to have pecans like almonds, walnuts, and chia seeds as they seek to have an added nutritive value on their diets.

- A quintessential category in the healthy snacks, this segment brings the elements of convenience, and nutritional density in terms of providing fiber in intakes like whole grains, nuts, and dried fruits. Food processors are also constantly coming up with new types and varieties of products due to the increase in different types of requirements.

- The natural source of sweetness and fiber dried fruits are the dietary requirement and much better than consuming candy and sweets. Some of the more familiar nuts to use are dried raisins, cranberries, and mangoes.

- The ingredients of trail mix are nuts, seeds, and dried fruits; it is an equally healthy and tasty advancement in food technology. This category takes advantage of the fact that both, nuts and dried fruits are popular among consumers, and one provides something that the other does not; namely a taste and a texture.

- In this segment, the company faces great growth due to the increased need for the consumption of protein-based, convenient snacks. Popular fowled products include jerky and meat bars produced from lean cuts suitable for the conscious health-savvy consumer base.

By Claim, Gluten-free segment held the largest share in 2023

- Consciously or unconsciously, people have shifted from taking big meals to taking several small meals which is why there is a good market for healthy snacks. Today’s consumer requires products that are easy to consume, portable have great taste, and conveniently packaged, and are compliant with their particular diet.

- This segment has felt a positive impact in recent years, especially the celiac disease or gluten intolerance one. Some people have diseases such as celiac disease that call for them to avoid gluten and countless others prefer such products assuming that they are healthier for them. Some of the commonly taken snacks include rice cakes, nut mix, fruit bars, and veggie chips.

- Though the effective crusade against the consumption of fatty meals has not been eradicated from the market, there is still a great market pull for low-fat snacks. It targets anyone eager to drop some weight or anyone who has heart-related issues. Try to envisage a yogurt parfait, low-fat cheddar cheese sticks with raw vegetables, and perhaps popcorn.

- A multitude of people focus on the limitation of sugar consumption; therefore, the consumption of sugarless products is on the rise. However, one should not continue with the thought process that sugar-free products are healthy products as well. Choose products that are made with natural sweeteners such as stevia or berries and other natural fruits. Some examples include sugar-free yogurt, non-sugar-sweetened dryer fruits, and artificially sweetened protein bars.

Healthy Snacks Market Regional Insights:

North America is expected to dominate the market for healthy snacks.

- It would be safe to say that there is a gradual expansion in the healthy snacks market, particularly with North America being a prominent contributor to this growth. Some of the drivers that are attributed to the growth of healthy snacks include; a shift in lifestyle among consumers with more emphasis on their health, more concern being placed on health by people leading to more consumption of healthy products, convenience or snacking habits; the snacking trends are shifting towards healthier foods.

- The demand for healthy snack products in North America has been especially strong for several reasons, including the well-entrenched nutrition-conscious mindset of consumers, greater levels of disposable income available to consumers to spend on healthy niche products, and the proliferation of new snack products that address specific dietary needs or preferences like gluten-free, vegan, organic, etc.

- Moreover, the COVID-19 healthy snacking effect has continued to gain momentum since consumers require foods that strengthen their immune system, avoiding conventional snacks that are typically less healthy. As a result, there has been heightened focus and aggressive insistence on the creation of fresh healthy snacks throughout the region.

- All summed, owing to the favorable market dynamics and increasing customer consciousness, better nutrition habits, and the regional market maturity in NA is expected to retain its leadership in the healthy snacks market development and further advancement in the niche.

Active Key Players in the Healthy Snacks Market

- I.T.C. Limited (India)

- Kambly SA (Switzerland)

- vMondelez International (U.S.)

- PepsiCo (U.S.)

- The Kraft Heinz Company (U.S.)

- Annie's Homegrown, Inc. (U.S.)

- Parle Products Pvt. Ltd. (India)

- Patanjali Ayurved (India)

- Britannia (India)

- Kellogg Co (U.S.)

- pladis global (U.K.)

- Walkers Shortbread Ltd (U.K.)

- Lotus Bakeries NV (Belgium)

- Nestle SA (Switzerland)

- Burton’s Foods Ltd. (U.K.)

- Others

Key Industry Developments in the Healthy Snacks Market:

- In May 2022, HUNGRY, an all-encompassing food and events platform for corporate America, acquired the nutrient-dense refreshment provider NatureBox. Through this acquisition, Hungry enhances its healthier product offerings and fortifies its standing within the corporate food-tech industry.

Global Healthy Snacks Market Scope:

|

Global Healthy Snacks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 94.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.43% |

Market Size in 2032: |

USD 231.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Claim |

|

||

|

By Distribution Channel |

|

||

|

By Packaging |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HEALTHY SNACKS MARKET BY PRODUCT (2017-2032)

- HEALTHY SNACKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRIED FRUIT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREAL

- GRANOLA BARS

- NUTS AND SEEDS

- MEAT

- TRAIL MIX

- HEALTHY SNACKS MARKET BY CLAIM (2017-2032)

- HEALTHY SNACKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GLUTEN-FREE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LOW-FAT

- SUGAR-FREE

- OTHERS

- HEALTHY SNACKS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- HEALTHY SNACKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HYPERMARKET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKET

- FOOD SPECIALITY STORES

- CONVENIENCE STORES

- ONLINE

- OTHERS

- HEALTHY SNACKS MARKET BY PACKAGING 2017-2032)

- HEALTHY SNACKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- JARS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOXES

- POUCHES

- CANS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Healthy Snacks Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- I.T.C. LIMITED (INDIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KAMBLY SA (SWITZERLAND)

- VMONDELEZ INTERNATIONAL (U.S.)

- PEPSICO (U.S.)

- THE KRAFT HEINZ COMPANY (U.S.)

- ANNIE'S HOMEGROWN, INC. (U.S.)

- PARLE PRODUCTS PVT. LTD. (INDIA)

- PATANJALI AYURVED (INDIA)

- BRITANNIA (INDIA)

- KELLOGG CO (U.S.)

- PLADIS GLOBAL (U.K.)

- WALKERS SHORTBREAD LTD (U.K.)

- LOTUS BAKERIES NV (BELGIUM)

- NESTLE SA (SWITZERLAND)

- BURTON’S FOODS LTD. (U.K.)

- COMPETITIVE LANDSCAPE

- GLOBAL HEALTHY SNACKS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Claim

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Healthy Snacks Market Scope:

|

Global Healthy Snacks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 94.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.43% |

Market Size in 2032: |

USD 231.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Claim |

|

||

|

By Distribution Channel |

|

||

|

By Packaging |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEALTHY SNACKS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEALTHY SNACKS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEALTHY SNACKS MARKET COMPETITIVE RIVALRY

TABLE 005. HEALTHY SNACKS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEALTHY SNACKS MARKET THREAT OF SUBSTITUTES

TABLE 007. HEALTHY SNACKS MARKET BY PRODUCT TYPE

TABLE 008. SUGAR-FREE MARKET OVERVIEW (2016-2028)

TABLE 009. GLUTEN FREE MARKET OVERVIEW (2016-2028)

TABLE 010. LOW FAT PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 011. DRIED FRUIT MARKET OVERVIEW (2016-2028)

TABLE 012. CEREALS & OAT BARS MARKET OVERVIEW (2016-2028)

TABLE 013. NUTS & SEEDS MARKET OVERVIEW (2016-2028)

TABLE 014. MEAT PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 015. HEALTHY COOKIES MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. HEALTHY SNACKS MARKET BY PACKAGING TYPE

TABLE 018. POUCHES MARKET OVERVIEW (2016-2028)

TABLE 019. JARS MARKET OVERVIEW (2016-2028)

TABLE 020. BOXES MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. HEALTHY SNACKS MARKET BY DISTRIBUTION CHANNELS

TABLE 023. HYPERMARKETS/SUPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 024. ONLINE CHANNELS MARKET OVERVIEW (2016-2028)

TABLE 025. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 026. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA HEALTHY SNACKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 028. NORTH AMERICA HEALTHY SNACKS MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 029. NORTH AMERICA HEALTHY SNACKS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 030. N HEALTHY SNACKS MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE HEALTHY SNACKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 032. EUROPE HEALTHY SNACKS MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 033. EUROPE HEALTHY SNACKS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 034. HEALTHY SNACKS MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC HEALTHY SNACKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. ASIA PACIFIC HEALTHY SNACKS MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 037. ASIA PACIFIC HEALTHY SNACKS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 038. HEALTHY SNACKS MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA HEALTHY SNACKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA HEALTHY SNACKS MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA HEALTHY SNACKS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 042. HEALTHY SNACKS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA HEALTHY SNACKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 044. SOUTH AMERICA HEALTHY SNACKS MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 045. SOUTH AMERICA HEALTHY SNACKS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 046. HEALTHY SNACKS MARKET, BY COUNTRY (2016-2028)

TABLE 047. NESTLE S.A.: SNAPSHOT

TABLE 048. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 049. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 050. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. TYSON FOOD INC.: SNAPSHOT

TABLE 051. TYSON FOOD INC.: BUSINESS PERFORMANCE

TABLE 052. TYSON FOOD INC.: PRODUCT PORTFOLIO

TABLE 053. TYSON FOOD INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. B&G FOODS INC.: SNAPSHOT

TABLE 054. B&G FOODS INC.: BUSINESS PERFORMANCE

TABLE 055. B&G FOODS INC.: PRODUCT PORTFOLIO

TABLE 056. B&G FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. PEPSICO INC.: SNAPSHOT

TABLE 057. PEPSICO INC.: BUSINESS PERFORMANCE

TABLE 058. PEPSICO INC.: PRODUCT PORTFOLIO

TABLE 059. PEPSICO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CALBEE INC.: SNAPSHOT

TABLE 060. CALBEE INC.: BUSINESS PERFORMANCE

TABLE 061. CALBEE INC.: PRODUCT PORTFOLIO

TABLE 062. CALBEE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. UNILEVER PLC: SNAPSHOT

TABLE 063. UNILEVER PLC: BUSINESS PERFORMANCE

TABLE 064. UNILEVER PLC: PRODUCT PORTFOLIO

TABLE 065. UNILEVER PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. KELLOGG COMPANY: SNAPSHOT

TABLE 066. KELLOGG COMPANY: BUSINESS PERFORMANCE

TABLE 067. KELLOGG COMPANY: PRODUCT PORTFOLIO

TABLE 068. KELLOGG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MONDELEZ INTERNATIONAL: SNAPSHOT

TABLE 069. MONDELEZ INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 070. MONDELEZ INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 071. MONDELEZ INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEALTHY SNACKS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEALTHY SNACKS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. SUGAR-FREE MARKET OVERVIEW (2016-2028)

FIGURE 013. GLUTEN FREE MARKET OVERVIEW (2016-2028)

FIGURE 014. LOW FAT PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 015. DRIED FRUIT MARKET OVERVIEW (2016-2028)

FIGURE 016. CEREALS & OAT BARS MARKET OVERVIEW (2016-2028)

FIGURE 017. NUTS & SEEDS MARKET OVERVIEW (2016-2028)

FIGURE 018. MEAT PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 019. HEALTHY COOKIES MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. HEALTHY SNACKS MARKET OVERVIEW BY PACKAGING TYPE

FIGURE 022. POUCHES MARKET OVERVIEW (2016-2028)

FIGURE 023. JARS MARKET OVERVIEW (2016-2028)

FIGURE 024. BOXES MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. HEALTHY SNACKS MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 027. HYPERMARKETS/SUPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 028. ONLINE CHANNELS MARKET OVERVIEW (2016-2028)

FIGURE 029. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 030. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA HEALTHY SNACKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE HEALTHY SNACKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC HEALTHY SNACKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA HEALTHY SNACKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA HEALTHY SNACKS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Healthy Snacks Market research report is 2024-2032.

I.T.C. Limited (India), Kambly SA (Switzerland), vMondelez International (U.S.), PepsiCo (U.S.), The Kraft Heinz Company (U.S.), Annie's Homegrown, Inc. (U.S.), Parle Products Pvt. Ltd. (India), Patanjali Ayurved (India), Britannia (India), Kellogg Co (U.S.),pladis global (U.K.), Walkers Shortbread Ltd (U.K.), Lotus Bakeries NV (Belgium), Nestle SA (Switzerland), Burton’s Foods Ltd. (U.K.) and Others

The By Product (Dried Fruit, Cereal and Granola Bars, Nuts and Seeds, Meat, Trail Mix), Claim (Gluten-free, Low-Fat, Sugar-Free, Others), Distribution Channel (Hypermarket and Supermarket, Food Speciality Stores, Convenience Stores, Online, Others), Packaging (Jars, Boxes, Pouches, Cans, Others) and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Healthy snacks can be defined as food items that offer nutritional benefits while also being convenient and satisfying for consumption between meals. These snacks typically contain a balance of essential nutrients such as vitamins, minerals, fiber, and protein, and are often lower in added sugars, saturated fats, and artificial ingredients compared to traditional snack options. Healthy snacks encompass a wide range of products, including fruits, vegetables, nuts, seeds, whole grains, yogurt, and protein bars, among others. They are designed to support overall health and wellness goals by providing sustained energy, promoting satiety, and contributing to the intake of vital nutrients essential for optimal functioning of the body.

Healthy Snacks Market Size Was Valued at USD 94.98 Billion in 2023, and is Projected to Reach USD 231.96 Billion by 2032, Growing at a CAGR of 10.43% From 2024-2032.