Guacamole Market Synopsis

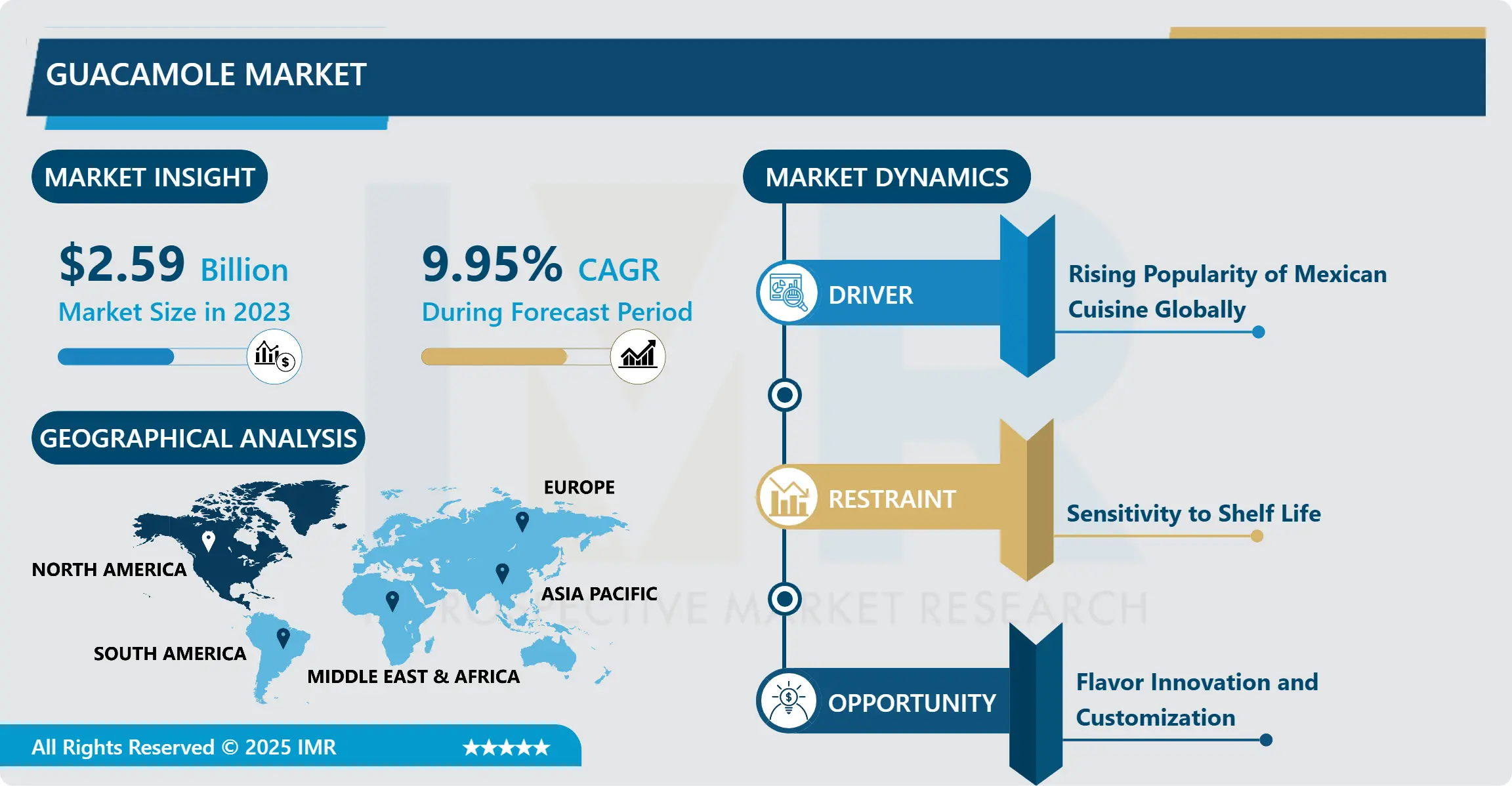

Guacamole Market Size Was Valued at USD 2.59 Billion in 2023 and is Projected to Reach USD 6.07 Billion by 2032, Growing at a CAGR of 9.95% From 2024-2032.

Guacamole is a traditional Mexican table preparation or spreads primarily consisting of mashed mature avocados with salt, lime juice and often other accompaniments which may include; onions, tomatoes, coriander, and chili peppers. This type of salsa is more of a thick liquid with a fresh and slightly sour taste; it is used as seasoning, as a dip for tortilla chips or as a topping for tacos and burritos, and similar dishes. People from all sites of the world have embraced this natural food because the avocado is creamy like butter and combines it with the zesty, savory flavors of spices, tomatoes, onions, etc.>Cheeses In Mexican Cuisine.

The market for guacamole has expanded rapidly within the past several years mainly due to growing interest from the consumers in tasty, healthy, and easy to prepare food products. Guacamole, a Mexican recipe that is produced with major raw materials from avocados, is consumed internationally due to its versatility being served as a dip, spread or garnish. The above increase in demand can be explained by several causes.

Firstly, changes in the customers’ consciousness that has made people more concerned with their health while opting for healthy and natural products including foods. Above all the primary product used in the preparation of guacamole, that is avocados, are considered to be nutrient-dense food rich in healthy fats, vitamins, and minerals. This nutritional makeup has shaped people’s preference of using guacamole as a better option as compared to normal dips and spreads that might contain high levels of unhealthy fats or ingredients such as artificial preservatives.

Secondly, shift in people’s food habits, thereby cultural diversities are one of the key factors that have impacted the growth of the guacamole market. The current trends in sociferization of food offer Mexican cuisine as the classic dish, which people know as guacamole. Incorporation of spicy salsa into a number of specialty meals like taco, burritos, salad, sandwich and other related cuisines of Mexican origin have also put this product on the fast rising cuisine chart as considered today’s favorite.

Also, there is the question of convenience for its market which has boosted by having this product being easily spread. Products such as ready to eat guacamole found in supermarkets and convenience stores targets people with busy schedules as it can easily be used as a snack or added into meals. This has expanded the consumer group and added more occasions when consumers indulge in eating these products, from at home snacking to consumption while on the go.

Besides, an increase in the number of distribution outlets and product differentiation has facilitated market intensity. Guacamole is offered in various types and these are fresh, refrigerated, frozen and shelf stable known to meet consumer needs and usage occasions. Manufacturers have also brought to the market new guacamole’s tastes with herbs, spices and other vegetables so that they can satisfy different palates and gain new customers.

The current market for guacamole across the world has intense competition and well established brands and new brands are also there. Quality, sustainability and ethical sourcing are likely to remain important for key market players in avocados since consumers have become conscious with issues to do with the environment and ethical means of getting the produce. Such focus is consistent with the new generation’s demand for foods that are not only healthy but also made sustainably.

Prospects for future development of the Global Guacamole Market can thus be attributed to shifting customer satisfaction, advanced varieties of products, and distributions channels. Thus, with the constant expansion of the popularity of Mexican cuisine all over the world and the constantly high demand for healthy convenient foods, guacamole has a great potential for becoming an important key player in the world food market.

Guacamole Market Trend Analysis

Guacamole Market Trend Analysis

Health and Wellness Driving Demand

- The guacamole market is experiencing robust growth driven by increasing consumer focus on health and wellness. Guacamole, primarily made from avocados, is perceived as a nutritious food choice due to its high content of healthy fats, vitamins, and minerals. This nutritional profile aligns well with modern dietary trends emphasizing natural, nutrient-dense foods. Moreover, the rising awareness about the health benefits associated with avocado consumption, such as heart health support and weight management, further boosts demand for guacamole products.

- Additionally, the versatility of guacamole as a dip, spread, or ingredient in various dishes appeals to health-conscious consumers seeking flavorful yet nutritious options. Manufacturers are capitalizing on this trend by introducing innovative guacamole products, including organic and all-natural varieties, to cater to the growing demand for healthier snack and meal options. As a result, the health and wellness trend continues to be a significant driver in shaping the expanding guacamole market globally.

Flavor Innovation and Customization

- The increase in different flavors and the option to add them according to the consumers’ preferences in the guacamole market resulted in focusing on those aspects. With changing and more sundry preferences of the consumers, the companies producing guacamole are shifting focus towards the creation of numerous flavors that correspond with the geographical area and actual trends. This is not only observed with the common guacamole flavors but has also spread to fusion types that contain elements of other cooking culture mixed with avocado, which includes mango, chipotle or spicy habanero.

- Customisation takes this a step further where as consumers, you can select additional addons for the guacamole, or the level of spice. Such innovations not only identify new segments of consumers but also create more loyal clients due to the unprecedented and highly unique way of eating. Further, these developments are followed by innovations in technologies in food processing and packaging; these customized flavors of guacamole can effectively reached the consumer after being distributed with suitable freshness and quality, all these factors continue to drive the growth and innovations in guacamole market around the world.

Guacamole Market Segment Analysis:

Guacamole Market Segmented based on Product Type, Distribution Channel, Packaging Type, and End User .

By Product Type , Traditional Guacamole segment is expected to dominate the market during the forecast period

- As for the guacamole product classification, there are the basic and the type of spices, organic, and other options. Novelty guacamole covers innovative recipes ranging from the simple incorporation of chipotle pepper or cilantro to more complex combinations of cheese, fried bananas, corn, and beans etc. : However, traditional guacamole – avocados, onions, tomatoes, and lime juice – still appeals to the minimum of consumers because of the affinity for basic tastes. The distinctive choice of guacamole prepared with the increased level of spiciness due to the usage of jalapenos, chili peppers or other pungent additives will appeal to the clients who are ready to enjoy tangy tastes.

- Guacamole manufactured by using fresh avocados and other ingredients that have been grown organically and certified organic is a great relief to the buying public which prefers natural foods. Apart from these basic types, other types of guacamole could be the fruit added guacamole or different regional guacamole which utilizes some local ingredients that have not been listed above depending with the consumer or tender choice and culinary trends. Such a segmentation shows that the industry which is guacamole is a vibrant one whereby diversification of product combines with the dynamism of consumers’ preferences which triggers change and hence growthwithin the sector.

By Packaging Type, Pouches segment held the largest share in 2023

- Depending on the type of packaging used, the global market for guacamole can be divided into tubs/tubs with lids, pouches, jars, and others. The share of tubs and tubs with lids is also quite large since the customer wants convenience and products that do not deteriorate in terms of freshness once purchased. A notable position is implemented by pouches, which apparently target the audience with an on-the-go consumption concept and single-serve portions.

- The jar packaging is transparent or translucent and has a prestigious appearance, which matches traditional consumer expectations and is preferred when the packaged item’s identification is important, such as in retail stores. The ‘others’ bracket accounts for other concepts that are cropping up to respond to consumers’ multiple needs such as biodegradable packaging and packaging material which give product a differentiation angle especially in stores. All in all, the actual diversity in the packaging types indicates that it is a developing market that balances the consumers’ needs for convenience, sustainability, and appealing packaging in the guacamole market.

Guacamole Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Current and projected development conveys that the current guacamole market in North America is about to escalate its growth and dominance for the following reasons. Due to an increase in consumption of heathily food products and the emergence of preference for Mexican foods in the region led to an increase in request for guacamole products. Higher knowledge and information about avocados as healthy food that as a major component in the preparation of guacamole has also contributed to the market expansion.

- Moreover, increase in sales of at-home consumption and consequential ready-to-eat products have also boosted the market. , North America has been identified as the largest consumer market for guacamole, especially in the United States because it has enough population plus it has good distribution network. There is a strategic emphasis on product development with more organic and low-fat products to meet changing customer preference of healthier guacamole products. In addition, manufacturers and retailers’ partnership and cooperation are also improving the distribution of products and market access. Taking into account these factors, it is believed that North America will continue to lead the guacamole market in the future, during the forecast period.

Active Key Players in the Guacamole Market

- Avo-King (Mexico)

- MegaMex Foods, LLC. (U.S)

- SNOWCREST (Canada)

- SABRA DIPPING CO., LLC, (U.S)

- Westfalia Fruit (Pty) Ltd (U.S)

- Conagra Brands (U.S)

- Calavo Growers, Inc. (U.S)

- B&G Foods, Inc. (U.S)

- Ventura Foods, LLC, (U.S)

- Casa Sanchez SF (U.S)

- Hormel Foods Corporation (U.S.)

- Woolworths Group Limited (U.S.), Other Active Players

|

Global Guacamole Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.95% |

Market Size in 2032: |

USD 6.07 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Packaging Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Guacamole Market by Product Type (2018-2032)

4.1 Guacamole Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Traditional Guacamole

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Spicy Guacamole

4.5 Organic Guacamole

4.6 Others

Chapter 5: Guacamole Market by Distribution Channel (2018-2032)

5.1 Guacamole Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarkets/Hypermarkets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Online Retail

5.6 Specialty Stores

5.7 Others

Chapter 6: Guacamole Market by Packaging Type (2018-2032)

6.1 Guacamole Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Tubs/Tubs with lids

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pouches

6.5 Jars

6.6 Others

Chapter 7: Guacamole Market by End User (2018-2032)

7.1 Guacamole Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Household

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Food Service Industry

7.5 Institutional Buyers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Guacamole Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AVO-KING (MEXICO)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MEGAMEX FOODS

8.4 LLC. (U.S)

8.5 SNOWCREST (CANADA)

8.6 SABRA DIPPING COLLC

8.7 (U.S)

8.8 WESTFALIA FRUIT (PTY) LTD (U.S)

8.9 CONAGRA BRANDS (U.S)

8.10 CALAVO GROWERS INC. (U.S)

8.11 B&G FOODS INC. (U.S)

8.12 VENTURA FOODS

8.13 LLC

8.14 (U.S)

8.15 CASA SANCHEZ SF (U.S)

8.16 HORMEL FOODS CORPORATION (U.S.)

8.17 WOOLWORTHS GROUP LIMITED (U.S.)

8.18

Chapter 9: Global Guacamole Market By Region

9.1 Overview

9.2. North America Guacamole Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Traditional Guacamole

9.2.4.2 Spicy Guacamole

9.2.4.3 Organic Guacamole

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size by Distribution Channel

9.2.5.1 Supermarkets/Hypermarkets

9.2.5.2 Convenience Stores

9.2.5.3 Online Retail

9.2.5.4 Specialty Stores

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Packaging Type

9.2.6.1 Tubs/Tubs with lids

9.2.6.2 Pouches

9.2.6.3 Jars

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Household

9.2.7.2 Food Service Industry

9.2.7.3 Institutional Buyers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Guacamole Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Traditional Guacamole

9.3.4.2 Spicy Guacamole

9.3.4.3 Organic Guacamole

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size by Distribution Channel

9.3.5.1 Supermarkets/Hypermarkets

9.3.5.2 Convenience Stores

9.3.5.3 Online Retail

9.3.5.4 Specialty Stores

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Packaging Type

9.3.6.1 Tubs/Tubs with lids

9.3.6.2 Pouches

9.3.6.3 Jars

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Household

9.3.7.2 Food Service Industry

9.3.7.3 Institutional Buyers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Guacamole Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Traditional Guacamole

9.4.4.2 Spicy Guacamole

9.4.4.3 Organic Guacamole

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size by Distribution Channel

9.4.5.1 Supermarkets/Hypermarkets

9.4.5.2 Convenience Stores

9.4.5.3 Online Retail

9.4.5.4 Specialty Stores

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Packaging Type

9.4.6.1 Tubs/Tubs with lids

9.4.6.2 Pouches

9.4.6.3 Jars

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Household

9.4.7.2 Food Service Industry

9.4.7.3 Institutional Buyers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Guacamole Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Traditional Guacamole

9.5.4.2 Spicy Guacamole

9.5.4.3 Organic Guacamole

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size by Distribution Channel

9.5.5.1 Supermarkets/Hypermarkets

9.5.5.2 Convenience Stores

9.5.5.3 Online Retail

9.5.5.4 Specialty Stores

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Packaging Type

9.5.6.1 Tubs/Tubs with lids

9.5.6.2 Pouches

9.5.6.3 Jars

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Household

9.5.7.2 Food Service Industry

9.5.7.3 Institutional Buyers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Guacamole Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Traditional Guacamole

9.6.4.2 Spicy Guacamole

9.6.4.3 Organic Guacamole

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size by Distribution Channel

9.6.5.1 Supermarkets/Hypermarkets

9.6.5.2 Convenience Stores

9.6.5.3 Online Retail

9.6.5.4 Specialty Stores

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Packaging Type

9.6.6.1 Tubs/Tubs with lids

9.6.6.2 Pouches

9.6.6.3 Jars

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Household

9.6.7.2 Food Service Industry

9.6.7.3 Institutional Buyers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Guacamole Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Traditional Guacamole

9.7.4.2 Spicy Guacamole

9.7.4.3 Organic Guacamole

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size by Distribution Channel

9.7.5.1 Supermarkets/Hypermarkets

9.7.5.2 Convenience Stores

9.7.5.3 Online Retail

9.7.5.4 Specialty Stores

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Packaging Type

9.7.6.1 Tubs/Tubs with lids

9.7.6.2 Pouches

9.7.6.3 Jars

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Household

9.7.7.2 Food Service Industry

9.7.7.3 Institutional Buyers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Guacamole Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.95% |

Market Size in 2032: |

USD 6.07 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Packaging Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||