Glyoxal Market Synopsis

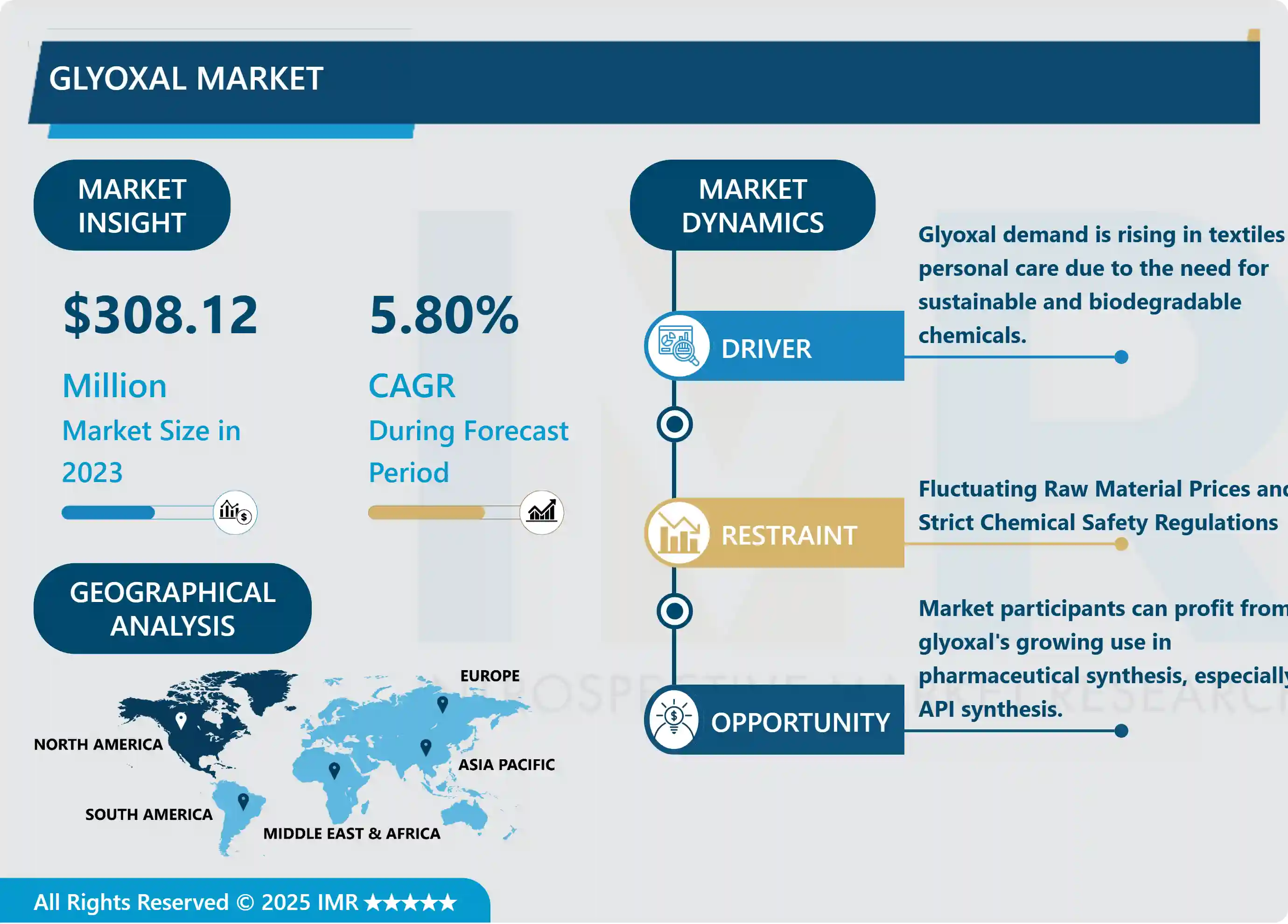

Glyoxal Market Size is Valued at USD 308.12 Million in 2023, and is Projected to Reach USD 483.73 Million by 2032, Growing at a CAGR of 5.8% From 2024-2032.

Their diverse uses in textiles & clothing, leather products, paper, and chemical intermediate for synthesis of products of glyoxal are the reasons for its growing market. FCA, or Reactive aldehyde glyoxal, is cherished explicitly for its cross-linking property that makes it more useful in enhancing water resistance of paper products as well as imparting durability to the textiles. The increasing application of glyoxal as a preservative in the personal care products and resin production is putting further fuel to the stoke the market demand.

Another identified market driver is the growing global need for green chemicals especially in Europe and North America where the push towards sustainable industries is being realised. It must also be noted that Glyoxal is non toxic and highly biodegradable; factors that make it quite suitable for use by industries with an aim of reducing their negative impact on the environment. In addition, the fashion and manufacturing industries in the Asia-Pacific region are continuing to contribute to the higher consumption of glyoxal expanding the leather and textile industry.

However, the market has its share of troubles that include; restrictions in formulation and production due to regulations on safety and stability of chemicals and varying costs of raw materials. However, the occurrence of bio based glyoxal introduces objectives that are in tune with the growing green chemistry concept. It is expected that market growth in the future would be supported by further research and developmental studies carried out in glyoxal prime application areas for its uses for example in the pharma and cosmetic industries.

Glyoxal Market Trend Analysis

Increasing Adoption of Glyoxal in Eco-Friendly Products

- One major trend for the glyoxal market exists in the fact that the usage rate for glyoxal in environmentally friendly products is steadily rising due to the growing level of concern among consumers over the safe disposal of their products and the use of non-degradable materials for manufacturing them. Because of the biodegradable nature of glyoxal, the compound is favored as industries such as textiles, paper and personal care strive to reduce their impact on the environment. The use of glyoxal has grown in formulations because of the ability of the manufacturer to improve the performance of a product and the drive towards the global use of sustainable products. This has led to development of new green chemistry applications as outlined below.

- As they logically extend glyoxal’s benefits it also positions the chemical better in the market while at the same time spurring other industrial uses like bio-based adhesives and coating. Only if regulations regarding the used hazardous chemicals become stricter, and if consumers become more inclined towards environmentally friendly products, will the glyoxal market likely expand significantly. For manufacturers implementing sustainable management strategies, and investing in glyoxal-based products, positioning with superior competitive advantage within the shifting Environmental Consumerism frontier is probable.

Expanding Applications in the Pharmaceutical Sector

- The market of glyoxal is developing fast mainly because of the increase demand for its usage in the production of APIs in the pharmaceuticals. Owing to its complexity the chemical characteristics of glyoxal make it possible for it to engage in a number of reactions as is required in the development of drugs. Glyoxal has become an indispensable chemical for the production of various new drugs, especially for expanding markets due to rising demand for new drugs.

- This is not only in line with the general trend of the industry’s pursuit of environmentally friendly products but also increases the application range of glyoxal. It is seen that manufacturers are also working to find out the application of glyoxal in emerging drugs or as the component of new drugs to make the usage of glyoxal more diversified than it is at present. In the next couple of years, firms in the pharmaceutical industries expect to incorporate increasing amounts of glyoxal since firms are continuously looking for ways to improve manufacturing processes. This will serve to foster the development growth and stability of the glyoxal market.

Glyoxal Market Segment Analysis:

Glyoxal Market Segmented on the basis of By Type, By Application and End-Use Industry

By Type, Pharmaceutical Grade segment is expected to dominate the market during the forecast period

- Therefore, the classification of glyoxal is mainly offered in two categories such as pharmaceutical glyoxal and industrial glyoxal. This is so because pharmaceutical – grade glyoxal has compounding standards of high purity to ensure it meets the pharmaceutical production standards. Organic synthesis is very sensitive especially when producing Active Pharmaceutical Ingredients and in many formulations the level of precision and safety has to be given the utmost importance. Therefore, such a grade is critical. The increase in demand for new medicines and therapies among pharmaceutical companies for optimised and efficient intermediates is fueling the growth of this segment.

- Industrial glyoxal, a different product, has an extensive variety of applications that include the manufacture of chemicals, fabrics, leather, as well as papers. This grade is appreciated for its efficiency and usability factors which include the ability to increase water repellency and product endurance. The demand for glyoxal of industrial standard is high due to increasing demands in industries that require the use of cross linking agents and preservatives etc. Altogether, the various uses of both segments and the increasing focus on responsible activities remain conducive to development.

By End-Use Industry, Flavour and Fragrance segment held the largest share in 2023

- Because glyoxal is used to increase the cross linking in fibers, making those fabrics more durable and resistant to water, it represents a valuable market. It is widely used by several end-use industries especially textiles and leather. Glyoxal is used as a finish for textiles to enhance the color fastness as well as the crease resistance of the textiles; similarly, it is used as a leather finish that greatly enhances the Leather products. In addition, industries such as the resin and polymer use glyoxal because of its ability to bond and react in the production of adhesives and coatings.

- Glyoxal is used mainly for the cosmetic field and the personal care industry as the preservative for the stability and the shelf life of products formulations. It also finds a number of applications in paper packaging, as it increases the barrier properties and the mechanical strength of paper materials. As a chemical, Wolff’s base material for drilling fluids and fracturing agents are also useful for the oil and gas industry. This proves that glycoxal is a very versatile chemical in different fields of industries.

Glyoxal Market Regional Insights:

North America is expected to dominate the market

- North America is likely to continue to lead glyoxal market owing to rapid industrialization, increasing adoption of green chemicals. The United States and Canada lead the way when it comes to becoming environmentally conscious in many industries like beauty accessories and products, synthetic leather, and fabrics. Glyoxal is a preferred choice because its products are biodegradable and glyoxal itself acts as a chemical intermediate, attributes which are gaining significance to manufacturers in their search for eco friendly products. Besides, consumer awareness on sustainable products and more so certain legal requirements which call for the use of green products are also encouraging the search for glyoxal as a core component.

- Continuous investments in research and development all over the North American region pharmaceutical sector also enhances the growth of glyoxal market. It is a key input for pharma companies given the role it plays in evolving synthesis of APIs that enhances the drug production. Our two key drivers, sustainability and innovation, are expected to amplify North America’s pole position in the glyoxal market, demand and market growth in the future years will be driven.

Active Key Players in the Glyoxal Market

- WeylChem International GmbH (Germany)

- Haihang Industry (China)

- Otto Chemie Pvt. Ltd (India)

- BASF SE (Germany)

- Amzole India Pvt. Ltd (India)

- Silver Fern Chemical LLC (U.S.)

- Eastman Chemical Company (U.S.)

- Dow (U.S.)

- Huntsman International LLC (U.S.)

- others

|

Global Glyoxal Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 308.12 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 483.73 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glyoxal Market by Type (2018-2032)

4.1 Glyoxal Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pharmaceutical Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Industrial Grade

Chapter 5: Glyoxal Market by Application (2018-2032)

5.1 Glyoxal Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cross-linking

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Intermediate

5.5 Others

Chapter 6: Glyoxal Market by End-Use Industry (2018-2032)

6.1 Glyoxal Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Textile

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Leather

6.5 Resin & Polymers

6.6 Cosmetics & personal care

6.7 Paper Packaging

6.8 Oil and Gas

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Glyoxal Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 WEYLCHEM INTERNATIONAL GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HAIHANG INDUSTRY (CHINA)

7.4 OTTO CHEMIE PVT. LTD (INDIA)

7.5 BASF SE (GERMANY)

7.6 AMZOLE INDIA PVT. LTD (INDIA)

7.7 SILVER FERN CHEMICAL LLC (U.S.)

7.8 EASTMAN CHEMICAL COMPANY (U.S.)

7.9 DOW (U.S.)

7.10 HUNTSMAN INTERNATIONAL LLC (U.S.)

7.11 OTHERS

7.12

Chapter 8: Global Glyoxal Market By Region

8.1 Overview

8.2. North America Glyoxal Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Pharmaceutical Grade

8.2.4.2 Industrial Grade

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cross-linking

8.2.5.2 Intermediate

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End-Use Industry

8.2.6.1 Textile

8.2.6.2 Leather

8.2.6.3 Resin & Polymers

8.2.6.4 Cosmetics & personal care

8.2.6.5 Paper Packaging

8.2.6.6 Oil and Gas

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Glyoxal Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Pharmaceutical Grade

8.3.4.2 Industrial Grade

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cross-linking

8.3.5.2 Intermediate

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End-Use Industry

8.3.6.1 Textile

8.3.6.2 Leather

8.3.6.3 Resin & Polymers

8.3.6.4 Cosmetics & personal care

8.3.6.5 Paper Packaging

8.3.6.6 Oil and Gas

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Glyoxal Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Pharmaceutical Grade

8.4.4.2 Industrial Grade

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cross-linking

8.4.5.2 Intermediate

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End-Use Industry

8.4.6.1 Textile

8.4.6.2 Leather

8.4.6.3 Resin & Polymers

8.4.6.4 Cosmetics & personal care

8.4.6.5 Paper Packaging

8.4.6.6 Oil and Gas

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Glyoxal Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Pharmaceutical Grade

8.5.4.2 Industrial Grade

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cross-linking

8.5.5.2 Intermediate

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End-Use Industry

8.5.6.1 Textile

8.5.6.2 Leather

8.5.6.3 Resin & Polymers

8.5.6.4 Cosmetics & personal care

8.5.6.5 Paper Packaging

8.5.6.6 Oil and Gas

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Glyoxal Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Pharmaceutical Grade

8.6.4.2 Industrial Grade

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cross-linking

8.6.5.2 Intermediate

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End-Use Industry

8.6.6.1 Textile

8.6.6.2 Leather

8.6.6.3 Resin & Polymers

8.6.6.4 Cosmetics & personal care

8.6.6.5 Paper Packaging

8.6.6.6 Oil and Gas

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Glyoxal Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Pharmaceutical Grade

8.7.4.2 Industrial Grade

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cross-linking

8.7.5.2 Intermediate

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End-Use Industry

8.7.6.1 Textile

8.7.6.2 Leather

8.7.6.3 Resin & Polymers

8.7.6.4 Cosmetics & personal care

8.7.6.5 Paper Packaging

8.7.6.6 Oil and Gas

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Glyoxal Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 308.12 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 483.73 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||