Wedding Wear Market Synopsis

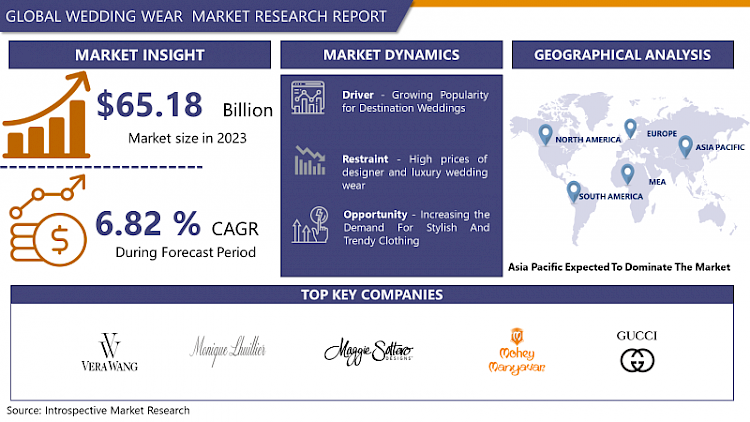

The Global Market for Wedding Wear Estimated at USD 65.18 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 118.03 Billion by 2032, Growing at A CAGR of 6.82 % Over the Forecast Period 2024-2032.

- The wedding wear industry offers a wide variety of products to accommodate various regional, religious, and cultural traditions. Traditional wedding attire can differ greatly from one nation or culture to another, giving customers a wide range of options. A significant portion of the wedding apparel market is made up of bridal gowns. These dresses are frequently the focal point of a wedding, and designers are constantly coming up with new designs, materials, and embellishments to meet the preferences of brides and changing fashion trends.

- The market also includes a variety of options for the groom's attire, ranging from classic tuxedos and suits to more unconventional and personalized choices, depending on the wedding theme and formality. Moreover, in different religious communities, the different wedding dress refers to the outfit that wears in the wedding ceremony. This dress is usually a special dress designed to reflect the style, personality, and taste of the bride and others which is often considered one of the most important elements of the wedding day.

The Wedding Wear Market Trend Analysis

Growing Popularity for Destination Weddings

- The market for wedding apparel is expanding significantly due to the rising demand of destination weddings. Couples who decide to get married abroad, frequently in exotic or beautiful locales, are said to have chosen a destination wedding. The wedding apparel industry has been significantly impacted by this trend, which has grown tremendously in popularity in recent years.

- Destination weddings frequently take place in distinctive locations, like beach resorts, iconic locations, or lush gardens. As a result, couples and their guests frequently choose wedding attire that ties in with the theme and atmosphere of the destination of choice. Destination weddings may call for specialized wedding wear that suits the climate and environment of the location. For example, lightweight and breathable fabrics are favored for beach weddings, while elegant and formal attire may be preferred for destination weddings held in historic venues.

Increasing the Demand for Stylish And Trendy Clothing

- Due to the rising demand for fashionable and trendy clothing, the wedding wear market offers a sizable opportunity. Wedding attire that reflects the newest fashion trends and complements modern couples' and guests' personal styles is sought after. The wedding wear market can respond by providing a wide variety of fashionable options as fashion-conscious consumers embrace modern aesthetics and cutting-edge designs. Designers of bridal gowns can appeal to brides who want chic and fashionable looks by incorporating cutting-edge silhouettes, opulent fabrics, and creative embellishments into their collections. Similar to how brides can have contemporary cuts, unusual color schemes, and opulent details, grooms can do the same.

- The clothing for bridesmaids and groomsmen can also benefit from stylish updates, with styles that strike a balance between traditional elegance and a modern, trendy twist. To design eye-catching and current bridesmaid and groomsmen attire, brands can experiment with a variety of color schemes, distinctive patterns, and modern cuts. The demand for stylish and trendy clothing has an impact on guest attire in addition to wedding party attire. Wedding wear companies can reach a larger audience and establish themselves as a go-to source for all guests by providing a variety of modern and stylish guest attire.

Segmentation Analysis of The Wedding Wear Market

Wedding Wear market segments cover the Product, Gender, and Distribution Channels. By Product, the Gowns segment is anticipated to dominate the Market Over the Forecast period.

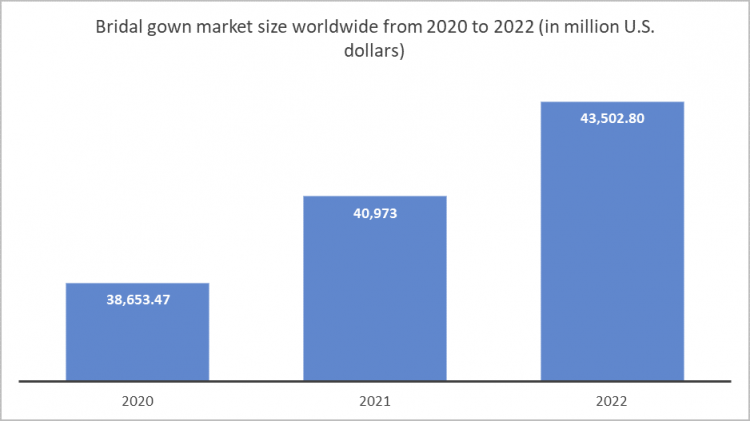

- The gowns segment is excepted to dominate the Wedding Wear Market. One of the key drivers is the advent of different types of fabrics and styles in gowns, which has captured the imagination of modern brides and wedding attendees alike. The availability of a wide variety of fabrics, ranging from traditional to contemporary and eco-friendly options, allows brides to choose gowns that align perfectly with their preferences and wedding themes. As Females accounted for the largest market share in the wedding wear market the demand for gowns is increasing day by day. For instance, according to Statista, the market value of bridal gowns reached 43,502 million in 2022. The increasing market valves for the bridal gown drive growth of the wedding wear market.

- Moreover, in order to increase the aesthetic value and appeal of dresses, retailers and fashion designers have been focusing on elaborate artisanal designs for their embellishments. Gowns are made more elegant and sophisticated by the addition of delicate embellishments, lacework, embroidery, and beadwork, which is why brides who care about fashion are so drawn to them.

- Additionally, to stay relevant and hold onto their market share, manufacturers must constantly update their collections due to the constantly shifting fashion landscape. Due to the frequent and significant changes in fashion trends, brides are constantly looking for fashionable and chic gowns to represent the most recent developments in bridal fashion. The market dominance of this segment is a result of the demand for modern, stylish gowns.

Regional Analysis of The Wedding Wear Market

Asia Pacific is Expected to Dominate the Wedding Wear Market Over the Forecast Period.

- The Asia Pacific region currently holds the leading position in the global wedding wear market, due to a number of factors that support its brisk expansion. The rising demand for royal weddings in the area is one of the main motivators. The enormous diversity of people and cultures throughout the Asia-Pacific region contributes to the market's expansion. Wedding apparel brands can provide a wide range of options to accommodate the diverse preferences and style preferences of couples and guests from various backgrounds because they are surrounded by a rich tapestry of traditions and customs.

- Also, Asia Pacific's expanding millennial population is a key factor in the market's expansion. Millennials frequently follow current fashion trends and look for wedding attire that showcases their distinct personal style. There are many opportunities in this region for designers and brands to develop cutting-edge and fashionable collections as a result of the demand for stylish and fashionable wedding attire.

COVID-19 Impact Analysis On the Wedding Wear Market

- COVID-19 began in China in the year 2019 and then quickly spread to the rest of the world. The worrying coronavirus has affected almost all industries and sectors. The wedding business is also facing uncertainty and recession as couples brace for a pandemic of disappointments. With weddings on hold and cities on lockdown, the coronavirus has affected the wedding industry and put many plans on hold. The government has imposed restrictions across the country and anti-virus precautions are strongly recommended. This in turn has affected the wedding wear market.

- All sectors were affected due to the pandemic, textiles, and bridal fashion were no exception. The pandemic has disrupted global supply chains, causing production delays and shortages of raw materials. This has led to increased production costs and reduced availability of certain fabrics, embellishments, and accessories used in wedding wear.

- Also, the government has imposed restrictions on weeding and functions, which leads to a large decline in the demand for wedding wear, as wedding wear is mainly used for wedding ceremonies and functions. However, E-commerce has played an important role in uplifting the supply chain of bridal wear as it helped to cover a wider range and meet the needs of customers. Customers have also started to switch to online shopping and hesitate and avoid in-store shopping to slow the spread of coronavirus diseases and it somewhat increased the demand for bridal wear.

Top Key Players Covered in The Wedding Wear Market

- Vera Wang(US)

- Monique Lhuillier (US)

- Maggie Sottero Designs (US)

- Alfred Angelo (US)

- David's Bridal (US)

- Mori Lee (US)

- Amsale (US)

- Marchesa (US)

- Reem Acra (US)

- Gucci (Italy)

- Versace (Italy)

- Pronovias Fashion Group (Spain)

- Septwolves (China)

- Mohey-Manyavar (India), and Other Major Players

Key Industry Developments in the Wedding Wear Market

- In April 2024, Gucci’s parent company, Kering, finalized the acquisition of a prominent retail block located on Milan’s renowned Via Monte Napoleone for a staggering €1.3 billion. This transaction stands as Europe’s most substantial property deal in the past two years.

- In July 2023, The Vampire's Wife, renowned for its distinctive and avant-garde designs, launched a mesmerizing capsule collection tailored for unconventional brides seeking a touch of dark romanticism. This stunning collection of wedding gowns deviates from conventional norms, offering an exquisite blend of edgy elegance and ethereal charm.

|

Global Wedding Wear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 68.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 118.03 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WEDDING WEAR MARKET BY PRODUCT (2017-2032)

- WEDDING WEAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GOWNS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUIT/ TUXEDO

- TRADITIONAL WEAR

- WEDDING WEAR MARKET BY GENDER (2017-2032)

- WEDDING WEAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FEMALE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MALE

- WEDDING WEAR MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- WEDDING WEAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OFFLINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ONLINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- WEDDING WEAR Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- Vera Wang (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Monique Lhuillier (US)

- Maggie Sottero Designs (US)

- Alfred Angelo (US)

- Versace (Italy)

- David's Bridal (US)

- Mohey-Manyavar (India)

- Mori Lee (US)

- Gucci (Italy)

- Pronovias Fashion Group (Spain)

- Amsale (US)

- Septwolves (China)

- Marchesa (US)

- Reem Acra (US)

- COMPETITIVE LANDSCAPE

- GLOBAL WEDDING WEAR MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wedding Wear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 68.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 118.03 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WEDDING WEAR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WEDDING WEAR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WEDDING WEAR MARKET COMPETITIVE RIVALRY

TABLE 005. WEDDING WEAR MARKET THREAT OF NEW ENTRANTS

TABLE 006. WEDDING WEAR MARKET THREAT OF SUBSTITUTES

TABLE 007. WEDDING WEAR MARKET BY PRODUCT

TABLE 008. GOWNS MARKET OVERVIEW (2016-2030)

TABLE 009. SUIT/TUXEDO MARKET OVERVIEW (2016-2030)

TABLE 010. TRADITIONAL WEAR MARKET OVERVIEW (2016-2030)

TABLE 011. WEDDING WEAR MARKET BY GENDER

TABLE 012. FEMALE MARKET OVERVIEW (2016-2030)

TABLE 013. MALE MARKET OVERVIEW (2016-2030)

TABLE 014. WEDDING WEAR MARKET BY DISTRIBUTION CHANNEL

TABLE 015. OFFLINE MARKET OVERVIEW (2016-2030)

TABLE 016. ONLINE MARKET OVERVIEW (2016-2030)

TABLE 017. NORTH AMERICA WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 018. NORTH AMERICA WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 019. NORTH AMERICA WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 020. N WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 022. EASTERN EUROPE WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 023. EASTERN EUROPE WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 024. WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 025. WESTERN EUROPE WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 026. WESTERN EUROPE WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 027. WESTERN EUROPE WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 028. WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 029. ASIA PACIFIC WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 030. ASIA PACIFIC WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 031. ASIA PACIFIC WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 033. MIDDLE EAST & AFRICA WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 034. MIDDLE EAST & AFRICA WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 036. WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 037. SOUTH AMERICA WEDDING WEAR MARKET, BY PRODUCT (2016-2030)

TABLE 038. SOUTH AMERICA WEDDING WEAR MARKET, BY GENDER (2016-2030)

TABLE 039. SOUTH AMERICA WEDDING WEAR MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 040. WEDDING WEAR MARKET, BY COUNTRY (2016-2030)

TABLE 041. VERA WANG: SNAPSHOT

TABLE 042. VERA WANG: BUSINESS PERFORMANCE

TABLE 043. VERA WANG: PRODUCT PORTFOLIO

TABLE 044. VERA WANG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MONIQUE LHUILLIER: SNAPSHOT

TABLE 045. MONIQUE LHUILLIER: BUSINESS PERFORMANCE

TABLE 046. MONIQUE LHUILLIER: PRODUCT PORTFOLIO

TABLE 047. MONIQUE LHUILLIER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MAGGIE SOTTERO DESIGNS: SNAPSHOT

TABLE 048. MAGGIE SOTTERO DESIGNS: BUSINESS PERFORMANCE

TABLE 049. MAGGIE SOTTERO DESIGNS: PRODUCT PORTFOLIO

TABLE 050. MAGGIE SOTTERO DESIGNS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ALFRED ANGELO: SNAPSHOT

TABLE 051. ALFRED ANGELO: BUSINESS PERFORMANCE

TABLE 052. ALFRED ANGELO: PRODUCT PORTFOLIO

TABLE 053. ALFRED ANGELO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. VERSACE: SNAPSHOT

TABLE 054. VERSACE: BUSINESS PERFORMANCE

TABLE 055. VERSACE: PRODUCT PORTFOLIO

TABLE 056. VERSACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DAVID'S BRIDAL: SNAPSHOT

TABLE 057. DAVID'S BRIDAL: BUSINESS PERFORMANCE

TABLE 058. DAVID'S BRIDAL: PRODUCT PORTFOLIO

TABLE 059. DAVID'S BRIDAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. MOHEY-MANYAVAR: SNAPSHOT

TABLE 060. MOHEY-MANYAVAR: BUSINESS PERFORMANCE

TABLE 061. MOHEY-MANYAVAR: PRODUCT PORTFOLIO

TABLE 062. MOHEY-MANYAVAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MORI LEE: SNAPSHOT

TABLE 063. MORI LEE: BUSINESS PERFORMANCE

TABLE 064. MORI LEE: PRODUCT PORTFOLIO

TABLE 065. MORI LEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. GUCCI: SNAPSHOT

TABLE 066. GUCCI: BUSINESS PERFORMANCE

TABLE 067. GUCCI: PRODUCT PORTFOLIO

TABLE 068. GUCCI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PRONOVIAS FASHION GROUP: SNAPSHOT

TABLE 069. PRONOVIAS FASHION GROUP: BUSINESS PERFORMANCE

TABLE 070. PRONOVIAS FASHION GROUP: PRODUCT PORTFOLIO

TABLE 071. PRONOVIAS FASHION GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. AMSALE: SNAPSHOT

TABLE 072. AMSALE: BUSINESS PERFORMANCE

TABLE 073. AMSALE: PRODUCT PORTFOLIO

TABLE 074. AMSALE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SEPTWOLVES: SNAPSHOT

TABLE 075. SEPTWOLVES: BUSINESS PERFORMANCE

TABLE 076. SEPTWOLVES: PRODUCT PORTFOLIO

TABLE 077. SEPTWOLVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MARCHESA: SNAPSHOT

TABLE 078. MARCHESA: BUSINESS PERFORMANCE

TABLE 079. MARCHESA: PRODUCT PORTFOLIO

TABLE 080. MARCHESA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. REEM ACRA: SNAPSHOT

TABLE 081. REEM ACRA: BUSINESS PERFORMANCE

TABLE 082. REEM ACRA: PRODUCT PORTFOLIO

TABLE 083. REEM ACRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 084. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 085. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 086. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WEDDING WEAR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WEDDING WEAR MARKET OVERVIEW BY PRODUCT

FIGURE 012. GOWNS MARKET OVERVIEW (2016-2030)

FIGURE 013. SUIT/TUXEDO MARKET OVERVIEW (2016-2030)

FIGURE 014. TRADITIONAL WEAR MARKET OVERVIEW (2016-2030)

FIGURE 015. WEDDING WEAR MARKET OVERVIEW BY GENDER

FIGURE 016. FEMALE MARKET OVERVIEW (2016-2030)

FIGURE 017. MALE MARKET OVERVIEW (2016-2030)

FIGURE 018. WEDDING WEAR MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 019. OFFLINE MARKET OVERVIEW (2016-2030)

FIGURE 020. ONLINE MARKET OVERVIEW (2016-2030)

FIGURE 021. NORTH AMERICA WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. EASTERN EUROPE WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. WESTERN EUROPE WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. ASIA PACIFIC WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. MIDDLE EAST & AFRICA WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. SOUTH AMERICA WEDDING WEAR MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Wedding Wear Market research report is 2024-2032.

Vera Wang (US), Monique Lhuillier (US), Maggie Sottero Designs (US), Alfred Angelo (US), Versace (Italy), David's Bridal (US), Mohey-Manyavar (India), Mori Lee (US), Gucci (Italy), Pronovias Fashion Group (Spain), Amsale (US), Septwolves (China), Marchesa (US), Reem Acra (US), and Other Major Players

The Wedding Wear Market is segmented into Product, Gender, Distribution Channel, and region. By Product, the market is categorized into Gowns, Suit/Tuxedo, and Traditional Wear. By Gender, the market is categorized into Female and Male. By Distribution Channel, the market is categorized into Offline, Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The clothing and accessories that guests to a wedding ceremony choose and wear specifically for the occasion are known as wedding wear. The attire of the bride, groom, bridesmaids, groomsmen, family, and visitors is included in this. The wedding wear industry offers a wide variety of products to accommodate various regional, religious, and cultural traditions. Traditional wedding attire can differ greatly from one nation or culture to another, giving customers a wide range of options.

The Global Market for Wedding Wear Estimated at USD 65.18 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 118.03 Billion by 2032, Growing at A CAGR of 6.82 % Over the Forecast Period 2024-2032.