Gelatin Market Synopsis

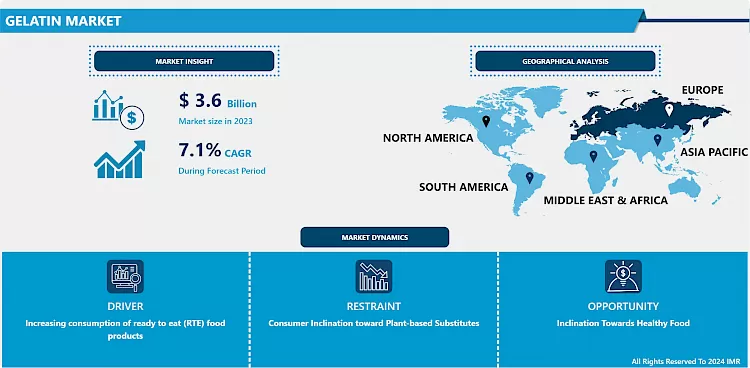

Gelatin Market Size Was Valued at USD 3.6 Billion in 2023, and is Projected to Reach USD 6.7 Billion by 2032, Growing at a CAGR of 7.1% From 2024-2032.

Gelatin or gelatine is a hydrolyzed form of collagen which is applied as gelling material in many areas for example in food products, in paper, cosmetics and in medicine treatment. It is a blend of proteins and peptides that are produced from collagen got from animals skins, bones as well as animal tissues conditioned by partial hydrolysis

- Consumer demand has shifted greatly still towards convenience due to their two busy lifestyle and their constantly changing purchase behaviour for the several food and drinks products. While the meal is increasingly turning into functional food, individuals are receiving more social-awareness concerning the quality and the prospective fitness perks attached to diverse nutrients. This has come about due to peoples increased desire to consume healthy food products, which engulf in the growth of the gelatin market. It has specifically gained wide acceptance in the food and beverage sector as a means of improving the characteristics of food products such as flavoúr, taste, texture and nutritional profiles. Furthermore, due to the growing health consciousness and required nutritional intake for overall immunity, the market sales also benefits.

- The ongoing trends of having people become more conscious of their health is one of the leading causes of the high demands for gelatin all over the world. Gelatin is typically high in amino acids that are the structural components of proteins and which are easily assimilated. A frequent nutrient is collagen and this is because it is the most plentiful and versatile protein in the body. It is also affecting joints, which can support the joints’ recovery, skin, hair, and nails.

- Industry factors like BCG matrix, market concentration, total market size in the format of concentration of key players, positioning of players, winning strategies, competitive dashboard, and the assessment of companies quadrant has been outlined in the report. Furthermore, more refined corporate records of all key entities have equally been compiled. They include the following Strategies of the competitors: The market is highly competitive with top six players. This is due to the fact that the total number of manufacturers in the gelatin industry is six, and as such there are low numbers of new entrants.

- Most of the consumers take collagen in their diets than having it injected, a factor that is expected to reach more clients in the food and drink related industries. For instance, different manufacturers such as JBS and Jiangxi Cosen Biology Co have used different types of chemical solvents as highlighted below. , LTD. specialise in the production of bovine grade collagen for primarily for the food and beverages industries. Rising consumption of the referred products in confectionery companies and desserts are likely to drive the market growth.

Gelatin Market Trend Analysis

Growth in Food and Cosmetics Industries

- In the food and beverages industry, there is a requirement of gelatin for making candies, syrups, aspics, pâtés and others. Another factor that contributes to the rising demand for gelatin is its contribution f to the product taste since it ensures the structure of the product and also keeps the other components intact. This lipid phase in healthy food categories such as low-fat yogurt and salad dressings replaces natural fats by giving gelatin to the customary feel or mouthfeel generally associated with high-fat products.

- Hence, there has been tremendous consumer needs for functional foods in the recent past, and gellatin is used as one of the components in such foods. The use and benefits of gelatin are in digestion, heart diseases, etc Gelatin fused with collagen is used in beauty products and beauty treatments which help in skin ageing and youthful appearance by decreasing wrinkles on the skin. The market is expected to boost in future since most people are embracing gelatinated products in food industries and in production of cosmetics.

Expanding Use in the Pharmaceutical and Healthcare Sectors

- Increase in the incidences of chronic as well as lifestyle illnesses, increase in the elderly people, and increase in health awareness are some of the factors that have led to increased use of Gelatin in the pharmaceutical field. Market increase results from growing focus on healthcare due to increasing healthcare costs. Moreover, the utilization of the product has always been associated withweight reduction and management of brittle bones, rheumatoid joint pain, and osteoarthritis. In humans, collagen production also reduces with age, and this leads to the skin losing its elasticity and developing wrinkles. However, the product’s protein and amino acid help to support the body’s manufacture of collagen – a protein vitally important to skin health. As a result, a large number of dermatology businesses are focusing on developing sophisticated products to cater to the needs of the market.

- Also, increased awareness of clean label products contributes to the consumers’ trend to shift towards products that do not contain additives and preservatives. One of the major factors that govern the nutraceuticals industry today is being driven by the need for clean label products which has seen manufacturers being keen on ensuring that their food supplements meet ethical standards.

Gelatin Market Segment Analysis:

Gelatin Market Segmented based on Source, and Application.

By Source, Porcine segment is expected to dominate the market during the forecast period

- The Porcine segment is expected to remain the largest in the gelatin market by the end of the forecast period for the following reasons. Porcine Gelatin is preferred in terms of functional properties such as high gel strength, clarity and stability and therefore has wide application in food and beverages, pharmaceuticals and cosmetics industry. Besides, its ready availability and relatively lower price compared to other sources such as bovine or marine only adds to its allure. Also, porcine gelatin is consumed in numerous applications such as confectionery, dairy products, and medicinal capsules, which has helped to boost the demand. These characteristics and ability to meet the various needs of the industry thus plays a role to the growing demand of porcine based gelatin in the market.

By Application, food & beverages segment held the largest share in 2023

- The application segment is further divided into food & beverages, healthcare & pharmaceutical, cosmetics, others. The food & beverages segment has a bigger share due to rising demand of the product in food industry to manufacture snacks, candies, gummy bears, desserts, etc.

- In addition, increased intake of nutritional supplements and clean-label trends boost the consumption of the ingredient in food & beverages. The healthcare &pharmaceutical segment is expected to exhibit significant growth at a robust CAGR during the forecast period. Thus, the product can be used in the pharmaceutical industries and medicine – as one of the components of production of capsules and tablets, as well as being part of dressings for wounds, hemostatic sponges, and blood volume substitutes. These are sort of what you can categorize as the absorbable medical dressings that are used in stopping the bleeding on any given surface. Road traffic accidents account for the most common cause of fatal bone injuries in patients.

- The Food & Beverages segment accounted for the largest market share in terms of gelatin used in 2023. Gelatin has numerous application in foods due to its functional properties like gelling, stabilization and emulsifying, where it is used in confectioneries, in dairy products, desserts, and in products made from meat. Thus, its application in the area of increasing texture, increasing shelf life and being a natural source of protein complies with the trends of providing clean label and better quality of foods that are required by the consumers. Furthermore, the shift towards the consumption of convenience foods, ready to eat products and changing eating habits in terms of a concern for health and nutrition has also contributed towards the growth of gelatin in the food and beverages segment. This broad use and versatility contributes substantially towards the general consumption of gelatin in the market.

Gelatin Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is the largest region providing the largest revenue proportion to the overall global market which was at USD 1. 26 billion in 2023. Further, the rising rate of bone related ailments will be instrumental in the growth of Europe market.

- An increase in the incidence of sports related injuries is therefore projected to provide significant opportunities for companies in the industry. The increased acceptability of the product in various European countries but most especially in Germany has also lead to the growth in regional sales. The main driving force for the German cosmetics market is consumers’ predilection for increased spending on cosmetics and body care products. In addition, its incorporation in hair care products prevents hair fall while encouraging the development of hair. Increasing consumer interest towards hair care products is expected to fuel the market growth in the region for the mentioned period.

Active Key Players in the Gelatin Market

- Gelita AG (Germany)

- Darling Ingredients Inc. (U.S.)

- Nitta Gelatin, Inc. (Japan)

- Tessenderlo Group (Belgium)

- Weishardt (France)

- Trobas Gelatine B.V. (Netherlands)

- Lapi Gelatine S.p.a. (Italy)

- Juncà Gelatines SL (Spain)

- Italgel S.r.l (Italy)

- Sterling Biotech Ltd. (India)

- Gelnex (Brazil)

- Other Key Players

Key Industry Developments in the Gelatin Market:

- In December 2023, Gelatin, which is a key ingredient in a variety of foods and pharmaceuticals, is a product that has been the subject of patents by various manufacturers, for instance; Darling Ingredients Inc filed for a patent for its gelatin called StabiCaps. This one has the advantage of enhancing the stability of soft gel capsules and is versatile in the production of various pharmaceutical products.

- In May 2023, GELITA, a gelatin maker, has developed the application of fast setting gelatin for creating high quality fortified gummies.

|

Gelatin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.1 % |

Market Size in 2032: |

USD 6.7 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gelatin Market by Source (2018-2032)

4.1 Gelatin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Porcine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bovine

4.5 Others

Chapter 5: Gelatin Market by Application (2018-2032)

5.1 Gelatin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food & Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Healthcare & Pharmaceuticals

5.5 Cosmetics

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Gelatin Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GELITA AG (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DARLING INGREDIENTS INC. (U.S.)

6.4 NITTA GELATIN INC. (JAPAN)

6.5 TESSENDERLO GROUP (BELGIUM)

6.6 WEISHARDT (FRANCE)

6.7 TROBAS GELATINE B.V. (NETHERLANDS)

6.8 LAPI GELATINE S.P.A. (ITALY)

6.9 JUNCÀ GELATINES SL (SPAIN)

6.10 ITALGEL S.R.L (ITALY)

6.11 STERLING BIOTECH LTD. (INDIA)

6.12 GELNEX (BRAZIL)

6.13 OTHER KEY PLAYERS

Chapter 7: Global Gelatin Market By Region

7.1 Overview

7.2. North America Gelatin Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Source

7.2.4.1 Porcine

7.2.4.2 Bovine

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food & Beverages

7.2.5.2 Healthcare & Pharmaceuticals

7.2.5.3 Cosmetics

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Gelatin Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Source

7.3.4.1 Porcine

7.3.4.2 Bovine

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food & Beverages

7.3.5.2 Healthcare & Pharmaceuticals

7.3.5.3 Cosmetics

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Gelatin Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Source

7.4.4.1 Porcine

7.4.4.2 Bovine

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food & Beverages

7.4.5.2 Healthcare & Pharmaceuticals

7.4.5.3 Cosmetics

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Gelatin Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Source

7.5.4.1 Porcine

7.5.4.2 Bovine

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food & Beverages

7.5.5.2 Healthcare & Pharmaceuticals

7.5.5.3 Cosmetics

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Gelatin Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Source

7.6.4.1 Porcine

7.6.4.2 Bovine

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food & Beverages

7.6.5.2 Healthcare & Pharmaceuticals

7.6.5.3 Cosmetics

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Gelatin Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Source

7.7.4.1 Porcine

7.7.4.2 Bovine

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food & Beverages

7.7.5.2 Healthcare & Pharmaceuticals

7.7.5.3 Cosmetics

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Gelatin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.1 % |

Market Size in 2032: |

USD 6.7 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gelatin Market research report is 2024-2032.

Gelita AG (Germany) Darling Ingredients Inc. (U.S.) Nitta Gelatin, Inc. (Japan) Tessenderlo Group (Belgium) Weishardt (France) Trobas Gelatine B.V. (Netherlands) Lapi Gelatine S.p.a. (Italy) Juncà Gelatines SL (Spain) Italgel S.r.l (Italy) Sterling Biotech Ltd. (India) Gelnex (Brazil), and Other Major Players.

The Gelatin Market is segmented into source, application, and region. By source, the market is categorized into porcine, bovine, and others. By application, the market is categorized into food & beverages, healthcare & pharmaceutical, cosmetics, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Gelatin is a tasteless and odorless animal protein that dissolves in water and is produced from collagen, which is structural protein, found in animal connective tissue such as bovine, porcine and fish. It is prepared from collagen containing tissues like skin, bones and tendons, after putting them in hot water and then filtering out all other components thereby leaving behind a protein material which congeals on cooling. It is also a good source of protein, vitamins, minerals, calcium, magnesium potassium and other nutrients. .It is useful in the improvement of gut health, lowering inflammation and enhancing skin, bone health and also the reduction of wrinkle formation. It provides crystallisation control, water retention, film former, bodying agent, and emulsifying properties.

Gelatin Market Size Was Valued at USD 3.6 Billion in 2023, and is Projected to Reach USD 6.7 Billion by 2032, Growing at a CAGR of 7.1% From 2024-2032.