Gearless Conveyor Drive Market Synopsis

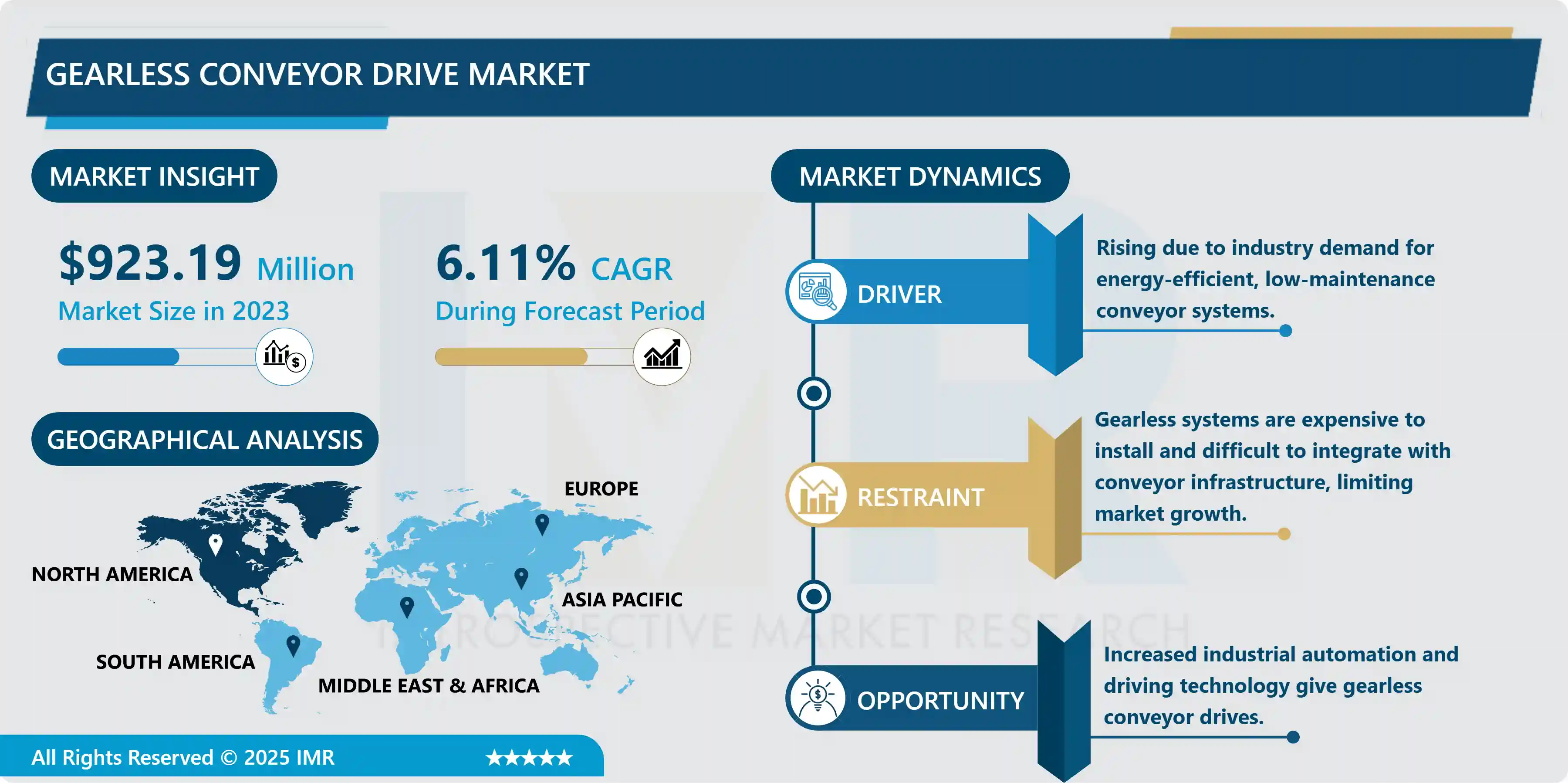

Gearless Conveyor Drive Market Size Was Valued at USD 923.19 Million In 2023 And Is Projected to Reach USD 1574.34 Million By 2032, Growing at A CAGR of 6.11% From 2024-2032.

The gearless conveyor drive market is expanding significantly as a result of the growing demand for reliable and efficient material handling systems in a variety of industries, such as mining, manufacturing, and logistics. Gearless conveyor drives, utilizing direct drive systems without conventional gearboxes, offer numerous benefits. These benefits include increased efficiency, reduced maintenance costs, and more reliable operation. These systems enhance operational performance and reduce energy utilization by providing smooth and precise control of conveyor belts. High-capacity and large-scale operations are increasingly adopting conveyor systems, driving the market along with the need for advanced automation. Businesses are striving to enhance their operational efficiency and optimize their material handling processes, which is further fostering market growth through technological advancements in motor and control systems. The gearless conveyor drive market is on the brink of further growth as industries continue to prioritize sustainability and automation.

The gearless conveyor drive market is undergoing a transformation as industries strive to implement conveyor systems that are more dependable and efficient. Gearless conveyor drives employ direct drive technology, eliminating the need for conventional gearboxes and their associated components. This design improves efficiency by decreasing mechanical losses, maintenance requirements, and overall energy consumption. In industries such as mining, cement, and heavy industry, gearless drives are particularly advantageous in applications that necessitate high power and reliability. Gearless conveyor drives are capable of effectively addressing the market's demand for reduced downtime, increased operational efficiency, and lower maintenance costs.

The market for gearless conveyor drives is expanding as a result of the ongoing development of drive technology and the growing investment in industrial infrastructure and automation. Companies are increasingly implementing gearless systems to capitalize on their advantages, which include improved performance, increased reliability, and reduced pollution levels. Furthermore, the push for sustainable and energy-efficient solutions aligns with the capabilities of gearless conveyor mechanisms, which further encourages their adoption. We anticipate that the gearless conveyor drive market will expand, offering sophisticated solutions to meet the evolving demands of the industrial sector, as industries continue to prioritize environmental sustainability and operational efficiency.

Gearless Conveyor Drive Market Trend Analysis

Integration of IoT and Automation

- The market for gearless conveyor drives is undergoing a significant transformation as a result of the integration of automation technologies and the Internet of Things (IoT). These developments facilitate the real-time monitoring and control of conveyor systems, thereby improving their operational reliability and efficiency. IoT sensors and automation tools provide valuable data on system performance, wear and tear, and maintenance requirements, enabling predictive maintenance and reduced outages.

- This connectivity enables the seamless integration with broader industrial automation systems, thereby optimizing conveyor operations and enhancing overall productivity in the manufacturing, logistics, and distribution sectors.

- The gearless conveyor drive market is experiencing a surge in the adoption of these technologies as the demand for sophisticated and efficient conveyor systems continues to increase.

- In order to enhance performance, reduce maintenance costs, and increase energy efficiency, businesses are investing in gearless drive solutions that integrate IoT and automation capabilities. This trend is consistent with the broader industry's transition to Industry 4.0 and digital transformation, establishing gearless conveyor mechanisms as a critical element in contemporary, automated production environments.

Focus on Energy Efficiency and Sustainability

- The gearless conveyor drive market is currently observing a significant trend toward improved energy efficiency and sustainability. Gearless conveyor drives are an appealing solution for industries that are striving to minimize environmental impacts and operational costs. This is due to their superior efficiency and diminished energy consumption in comparison to conventional gear-driven systems. These motors eliminate the need for gearboxes, increasing the system's overall reliability while reducing mechanical losses and maintenance requirements.

- Numerous industries, including mining, logistics, and manufacturing, prioritize gearless conveyor drives due to stringent regulatory standards and corporate sustainability objectives that emphasize energy efficiency.

- Sustainability is increasingly important in the selection of conveyance systems, in addition to energy efficiency. By optimizing energy consumption and prolonging the longevity of equipment, gearless conveyor drives contribute to a reduced carbon footprint.

- The market is undergoing a transformation as a result of innovations that improve performance and minimize environmental impact, which are consistent with global trends toward more sustainable and environmentally friendly industrial practices. As the demand for environmentally responsible solutions increases, gearless conveyor drives are on the brink of playing a critical role in the advancement of sustainable industrial operations.

Gearless Conveyor Drive Market Segment Analysis:

Gearless Conveyor Drive Market Segmented on the basis of By type, and Application.

By Type, Direct Drive segment is expected to dominate the market during the forecast period

- We divide the gearless conveyor drive market into three types: direct drive, indirect drive, and center drive systems. Each type provides distinct benefits for a variety of industrial applications. By eliminating the necessity for supplementary components such as transmissions, direct drive systems offer exceptional reliability and efficiency, which in turn reduces operational and maintenance expenses.

- Indirect drive systems are capable of accommodating a variety of load conditions and provide design flexibility by utilizing a transmission to transfer power from the motor to the conveyor belt. Applications that require consistent performance and high torque often implement center drive systems. This configuration positions the drive unit centrally, thereby enhancing durability and ensuring balanced load distribution.

- The increasing demand for low-maintenance, efficient conveyor systems in industries like mining, manufacturing, and logistics is driving the gearless conveyor drive market. Businesses are endeavoring to maximize operations and minimize downtime, which is further bolstering market growth as a result of technological advancements and the movement toward energy-efficient solutions. The gearless conveyor drive market is on the verge of continued expansion and innovation as automation and material handling requirements continue to evolve.

By Application, Mining segment held the largest share in 2024

- The efficacy and reliability of the gearless conveyor drive are driving growth in a variety of industries, such as automotive, mining, and food and beverage. The mining sector employs gearless conveyor mechanisms to transport bulk materials, including ore and coal, over long distances and challenging terrains, thereby increasing operational efficiency and reducing maintenance requirements. These systems are highly regarded for their ability to operate seamlessly in challenging environments and manage significant workloads.

- Gearless conveyor mechanisms in the automotive industry achieve improved precision and reduced downtime by facilitating the automation of production lines. They support high-speed production and assembly operations, facilitating the smoother management of materials and the assembly process.

- Gearless conveyor drives benefit the food and beverage industry by ensuring hygienic and efficient product transportation through various processing and packaging phases. Their low maintenance requirements and consistent performance render them an appealing alternative for improving operational efficiency and productivity in a variety of applications.

Gearless Conveyor Drive Market Regional Insights:

Europe also play important roles in global Market

- Europe's commitment to technological innovation and its advanced industrial infrastructure significantly influence the global gearless conveyor drive market. The region's robust manufacturing sector, particularly in industries like automotive, mining, and logistics, fuels the demand for efficient and reliable conveyor systems.

- Gearless conveyor mechanisms, which offer advantages such as improved performance, increased energy efficiency, and reduced maintenance costs, align with Europe's emphasis on operational efficiency and sustainability. Substantial investments in research and development have enabled European companies to be at the forefront of developing and implementing these advanced drive technologies.

- Additionally, the stringent regulations in Europe that govern energy consumption and environmental impact further bolster the adoption of gearless conveyor mechanisms. The advantages of gearless systems are in alignment with the region's emphasis on reducing carbon footprints and enhancing energy efficiency in industrial processes.

- As European industries continue to pursue innovative solutions to enhance productivity and sustainability, we anticipate the gearless conveyor drive market in Europe to remain a significant player in the global landscape, driving advancements and setting industry standards.

Active Key Players in the Gearless Conveyor Drive Market

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- SEW-Eurodrive (Germany)

- Rockwell Automation (United States)

- Danfoss A/S (Denmark)

- Boston Gear (United States)

- Bonfiglioli Group (Italy), and Others Key Players.

|

Gearless Conveyor Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 923.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.11% |

Market Size in 2032: |

USD 1574.34 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gearless Conveyor Drive Market by Type (2018-2032)

4.1 Gearless Conveyor Drive Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Direct Drive

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Indirect Drive

4.5 Center Drive

Chapter 5: Gearless Conveyor Drive Market by Application (2018-2032)

5.1 Gearless Conveyor Drive Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mining

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Automotive

5.5 Food & Beverage

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Gearless Conveyor Drive Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB LTD. (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SIEMENS AG (GERMANY)

6.4 SEW-EURODRIVE (GERMANY)

6.5 ROCKWELL AUTOMATION (UNITED STATES)

6.6 DANFOSS A/S (DENMARK)

6.7 BOSTON GEAR (UNITED STATES)

6.8 BONFIGLIOLI GROUP (ITALY)

6.9 AND OTHERS KEY PLAYERS

Chapter 7: Global Gearless Conveyor Drive Market By Region

7.1 Overview

7.2. North America Gearless Conveyor Drive Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Direct Drive

7.2.4.2 Indirect Drive

7.2.4.3 Center Drive

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Mining

7.2.5.2 Automotive

7.2.5.3 Food & Beverage

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Gearless Conveyor Drive Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Direct Drive

7.3.4.2 Indirect Drive

7.3.4.3 Center Drive

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Mining

7.3.5.2 Automotive

7.3.5.3 Food & Beverage

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Gearless Conveyor Drive Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Direct Drive

7.4.4.2 Indirect Drive

7.4.4.3 Center Drive

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Mining

7.4.5.2 Automotive

7.4.5.3 Food & Beverage

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Gearless Conveyor Drive Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Direct Drive

7.5.4.2 Indirect Drive

7.5.4.3 Center Drive

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Mining

7.5.5.2 Automotive

7.5.5.3 Food & Beverage

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Gearless Conveyor Drive Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Direct Drive

7.6.4.2 Indirect Drive

7.6.4.3 Center Drive

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Mining

7.6.5.2 Automotive

7.6.5.3 Food & Beverage

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Gearless Conveyor Drive Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Direct Drive

7.7.4.2 Indirect Drive

7.7.4.3 Center Drive

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Mining

7.7.5.2 Automotive

7.7.5.3 Food & Beverage

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Gearless Conveyor Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 923.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.11% |

Market Size in 2032: |

USD 1574.34 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||