Gas Furnace Market Synopsis

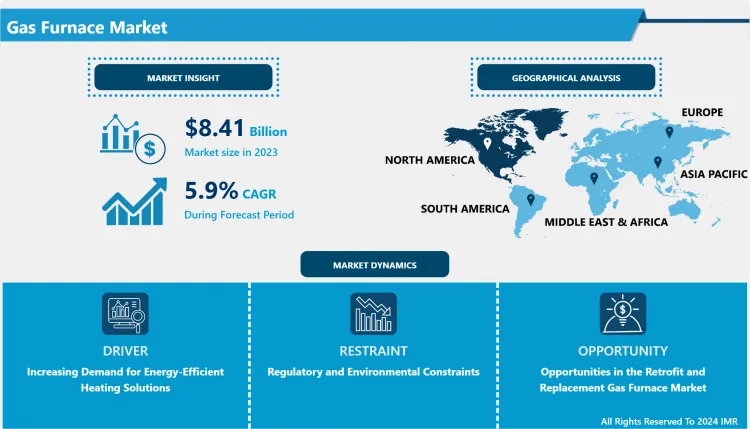

Gas Furnace Market Size is Valued at USD 8.41 Billion in 2023, and is Projected to Reach USD 13.31 Billion by 2032, Growing at a CAGR of 5.90% From 2024-2032.

The Gas Furnace market relates to the creation and supply of heat devices for residential, commercial and industrial uses via utilization of natural gas or propane. These furnaces are classified by the stage of the control, the fuel used, installation type, and efficiency classes. It is available in many outlets including direct selling, agents, and over internet. Market is affected by parameters like technology, energy conservation standards for equipments, geographical shifts in demand. These are the residential users, business and offices, and industrial users with a major emphasis being placed on energy management and home automation systems.

- The market of gas furnals is always compelled by the increasing energy efficiency and environmental standards. As the public becomes more knowledgeable about energy saving and the rates of utilities continue go up, consumer and industries are opting for high efficient Gas Furnaces that have better features and operating efficiency. Energy efficiency standards deployed by governments of countries are becoming stricter and this factor is encouraging technology development in furnaces that should meet new standards. The market is equally being driven by such advancements as modulating and the two-stage Gas Furnaces which operate at an improved heat control and less fuel consumption.

- Also, the technological advancement in the home automation and smart home technologies has called for smart Gas Furnaces with smart thermostats and connectivity. With an increase in the adoption of smart home systems in homes and business premises the incorporation of Gas Furnaces with these systems makes it easier to control convenience and energy use. The growing construction of new homes and business structures as well as construction of home renovations also contributes to the need for better and smarter forms of heating. Each of these play a role in the growing market of Gas Furnaces.

Gas Furnace Market Trend Analysis

From Standard to Smart, The Transformation of the Gas Furnace Market

- Due to rising energy conservation concerns among clients and firms, the global market for Gas Furnaces is gradually inclining toward higher efficiency and incorporation of better technologies. Higher costs of energy and high standards of environmental compliance push up the standards of efficiency of Gas Furnaces and the need for high performance and less operational expenses. New models include modulating and two stage furnaces that are more comfortable than the single staged but less common than they were several years ago. Moreover, the enhancement of connectivity features like smart thermostat and smart connectivity is on the rise, which are also a part of home automation and Energy management systems.

- Regionally, North America is still a large market primarily due to the well-developed supply infrastructure and high consumption of home and office heating systems. However, the Asia Pacific region is on a relatively steeper rise primarily due to aspects such as urbanization, increase in disposable income levels, and construction activities in developing countries. The switching of the global populace towards a more sustainable and environmentally friendly source of heating is a factor that continues to drive changes in the market to date, through the diversification or increase in consumer interest in products that would allow the achievement of environmental objectives in the most cost effective means possible.

Future Trends and Opportunities in the Gas Furnace Industry

- The global Gas Furnace market still has a vast potential for growth as the population faced with energy-saving heating needs and as home network continue to develop. The public and commercial users’ awareness of the need to conserve energy and use less energy results in high bills will push the uptake of high energy efficient modulating Gas Furnaces. The ability of some of the new generation Gas Furnaces to integrate other smart technologies and compatibility of other advanced home automation systems also add onto the growth prospects for these furnaces within the residential and commercial market segments.

- Also, the growing construction and remodelling businesses across the world help in the growth of the market. With new construction of homes and offices, as well as, alteration of old structures there is always need to provide efficient and most importantly cheap source of heating. This trend is especially observed in emerging markets, where either there is a big leap in urbanization or the general living standards are improving and require advanced solutions concerning heating systems. However, new technologies including the Internet of Things as well as increasing concerns for environmental conservation can bail the Gas Furnace in conquering these opportunities and thus, grow its market share.

Gas Furnace Market Segment Analysis:

Gas Furnace Market Segmented on the basis of type, Fuel Type and End User.

By Type, Single-Stage Gas Furnace segment is expected to dominate the market during the forecast period

- The Gas Furnace market is segmented by type into three main categories: Single stage Gas Furnaces, two-stage Gas Furnaces, and modulating Gas Furnaces. Single-Stage Gas Furnaces are designed to work at a constant output; hence, they provide reliable heat, but one cannot vary their performance much to meet different heating requirements. Two-Stage Gas Furnaces are considered more effective and comfortable because they can work in two stages to help achieve better and more cost-efficient warmth. Modulating Gas Furnaces are at the top end of the efficiency scale and their operation can be fine-tuned to deliver that exact amount of heat that is needed and not a watt more.

By Fuel Type, Natural Gas segment held the largest share in 2023

- There is differentiation of the Gas Furnace market by the kind of the fuels used, which includes Natural Gas and Propane. Natural Gas is the most common used type of gas for furnaces due to its relatively cheap price and its availability almost in all big and developed urban and suburban areas where there are established natural gas distribution networks. It is commonly used because it is relatively cheaper as compared to other fuels and is also widely known for effective heating. However, Propane is used in regions where natural gas is unavailable like in the rural or remote-control settings. Despite being generally more costly than natural gas propane is a diverse, effective fire alternative. It replaces the natural gas-based heating systems in areas where the pipelines have not been developed and the performance and efficiency are almost the same. There are needs and preferences for both fuel types, these define the market related to the availability in regions as well as customers’ demands.

Gas Furnace Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America for instance, the market for Gas Furnace is highly dominant based on the high usage of gas heating in the region especially in residential and commercial buildings. This is due to the colder climate experienced in the area thus whenever there is a necessity for heating then the system that will be used must be effective. The market is characterized by a strong base of incumbents and new market entrants, primary trends which include shift towards the high-efficiency models with the integration with smart thermostat and frequency-variable blower.

- The competition intensity in North America is maintained with the help of strict distribution channels and increased investments in the development of new products with improved performance and efficiency of energy consumption. Another a critical factor that influences the functioning of the market is the government regulations and incentives related to energy efficiency. The interest in such heating systems rises as the consumers and businesses look for ways to contain their energy consumption and costs, which serves to underpin the market’s role in the regional heating solutions space.

Active Key Players in the Gas Furnace Market

- Carrier Corporation (United States)

- Trane Technologies (United States)

- Lennox International Inc. (United States)

- Rheem Manufacturing Company (United States)

- Goodman Manufacturing Company (United States)

- York International Corporation (United States)

- American Standard (United States)

- Bryant Heating & Cooling Systems (United States)

- Amana (United States)

- Ruud (United States)

- Daikin Industries, Ltd. (Japan)

- Nordyne (United States)

- Arcoaire (United States)

- Comfortmaker (United States)

- Heil (United States), Other Active Players

|

Global Gas Furnace Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90% |

Market Size in 2032: |

USD 13.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gas Furnace Market by Type (2018-2032)

4.1 Gas Furnace Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Single-Stage Gas Furnace

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Two-Stage Gas Furnace

4.5 Modulating Gas Furnace

Chapter 5: Gas Furnace Market by Fuel Type (2018-2032)

5.1 Gas Furnace Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural Gas

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Propane

Chapter 6: Gas Furnace Market by End User (2018-2032)

6.1 Gas Furnace Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Homeowners

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Builders/Contractors

6.5 Industrial Facilities

6.6 Commercial Establishments

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Gas Furnace Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARRIER CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TRANE TECHNOLOGIES (UNITED STATES)

7.4 LENNOX INTERNATIONAL INC. (UNITED STATES)

7.5 RHEEM MANUFACTURING COMPANY (UNITED STATES)

7.6 GOODMAN MANUFACTURING COMPANY (UNITED STATES)

7.7 YORK INTERNATIONAL CORPORATION (UNITED STATES)

7.8 AMERICAN STANDARD (UNITED STATES)

7.9 BRYANT HEATING & COOLING SYSTEMS (UNITED STATES)

7.10 AMANA (UNITED STATES)

7.11 RUUD (UNITED STATES)

7.12 DAIKIN INDUSTRIES LTD. (JAPAN)

7.13 NORDYNE (UNITED STATES)

7.14 ARCOAIRE (UNITED STATES)

7.15 COMFORTMAKER (UNITED STATES)

7.16 HEIL (UNITED STATES)

7.17

Chapter 8: Global Gas Furnace Market By Region

8.1 Overview

8.2. North America Gas Furnace Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Single-Stage Gas Furnace

8.2.4.2 Two-Stage Gas Furnace

8.2.4.3 Modulating Gas Furnace

8.2.5 Historic and Forecasted Market Size by Fuel Type

8.2.5.1 Natural Gas

8.2.5.2 Propane

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Homeowners

8.2.6.2 Builders/Contractors

8.2.6.3 Industrial Facilities

8.2.6.4 Commercial Establishments

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Gas Furnace Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Single-Stage Gas Furnace

8.3.4.2 Two-Stage Gas Furnace

8.3.4.3 Modulating Gas Furnace

8.3.5 Historic and Forecasted Market Size by Fuel Type

8.3.5.1 Natural Gas

8.3.5.2 Propane

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Homeowners

8.3.6.2 Builders/Contractors

8.3.6.3 Industrial Facilities

8.3.6.4 Commercial Establishments

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Gas Furnace Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Single-Stage Gas Furnace

8.4.4.2 Two-Stage Gas Furnace

8.4.4.3 Modulating Gas Furnace

8.4.5 Historic and Forecasted Market Size by Fuel Type

8.4.5.1 Natural Gas

8.4.5.2 Propane

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Homeowners

8.4.6.2 Builders/Contractors

8.4.6.3 Industrial Facilities

8.4.6.4 Commercial Establishments

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Gas Furnace Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Single-Stage Gas Furnace

8.5.4.2 Two-Stage Gas Furnace

8.5.4.3 Modulating Gas Furnace

8.5.5 Historic and Forecasted Market Size by Fuel Type

8.5.5.1 Natural Gas

8.5.5.2 Propane

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Homeowners

8.5.6.2 Builders/Contractors

8.5.6.3 Industrial Facilities

8.5.6.4 Commercial Establishments

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Gas Furnace Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Single-Stage Gas Furnace

8.6.4.2 Two-Stage Gas Furnace

8.6.4.3 Modulating Gas Furnace

8.6.5 Historic and Forecasted Market Size by Fuel Type

8.6.5.1 Natural Gas

8.6.5.2 Propane

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Homeowners

8.6.6.2 Builders/Contractors

8.6.6.3 Industrial Facilities

8.6.6.4 Commercial Establishments

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Gas Furnace Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Single-Stage Gas Furnace

8.7.4.2 Two-Stage Gas Furnace

8.7.4.3 Modulating Gas Furnace

8.7.5 Historic and Forecasted Market Size by Fuel Type

8.7.5.1 Natural Gas

8.7.5.2 Propane

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Homeowners

8.7.6.2 Builders/Contractors

8.7.6.3 Industrial Facilities

8.7.6.4 Commercial Establishments

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Gas Furnace Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90% |

Market Size in 2032: |

USD 13.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gas Furnace Market research report is 2024-2032.

Carrier Corporation (United States), Trane Technologies (United States), Lennox International Inc. (United States), Rheem Manufacturing Company (United States), Goodman Manufacturing Company (United States), York International Corporation (United States), American Standard (United States), Bryant Heating & Cooling Systems (United States), Amana (United States), Ruud (United States), Daikin Industries, Ltd. (Japan), Nordyne (United States), Arcoaire (United States), Comfortmaker (United States), Heil (United States) and Other Major Players.

The Gas Furnace Market is segmented into by Type (Single-Stage Gas Furnace, Two-Stage Gas Furnace, Modulating Gas Furnace), By Fuel Type (Natural Gas, Propane), End-User (Homeowners, Builders/Contractors, Industrial Facilities, Commercial Establishments). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Gas Furnace market relates to the creation and supply of heat devices for residential, commercial and industrial uses via utilization of natural gas or propane. These furnaces are classified by the stage of the control, the fuel used, installation type, and efficiency classes. It is available in many outlets including direct selling, agents, and over internet. Market is affected by parameters like technology, energy conservation standards for equipments, geographical shifts in demand. These are the residential users, business and offices, and industrial users with a major emphasis being placed on energy management and home automation systems.

Gas Furnace Market Size is Valued at USD 8.41 Billion in 2023, and is Projected to Reach USD 13.31 Billion by 2032, Growing at a CAGR of 5.90% From 2024-2032.