Gaming Accessories Market Synopsis

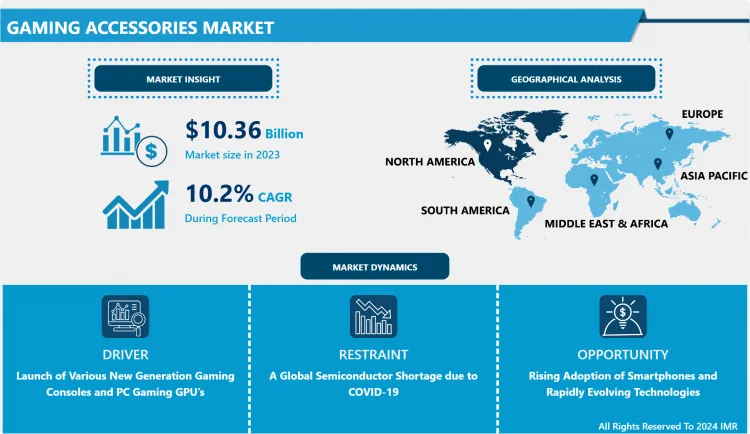

Gaming Accessories Market Size Was Valued at USD 10.36 Billion In 2024 And Is Projected to Reach USD 24.83 Billion By 2032, Growing at A CAGR of 10.2% From 2025-2032.

A game accessory can be referred to as an individual piece of hardware required to use a game console or one that enriches the gaming experience. Gaming accessories are packed with all other devices other than hardware and software that are used in a gaming system. Gaming involves a lot of movements, clicking, scrolling, etc., which lasts for many stretching hours hence, gaming accessories such as gaming mice are developed for prolonged use and are built to improve gaming sessions.

The gaming market is experiencing substantial growth for several interconnected reasons, making it a dynamic and lucrative industry. Technological advancements have played a pivotal role in enhancing the gaming experience. The evolution of graphics, processing power, and virtual reality has led to more immersive and realistic games, attracting a broader audience. The accessibility of gaming platforms, including consoles, PCs, and mobile devices, has further democratized the industry, allowing people of all ages and backgrounds to engage with games easily.

Moreover, the rise of online gaming has transformed the landscape, fostering a sense of community and competition. Multiplayer games, live streaming, and esports have gained immense popularity, creating a social dimension to gaming. The global connectivity facilitated by the internet has allowed gamers to connect and compete with others worldwide, transcending geographical boundaries.

The gaming industry's expansion can also be attributed to its diversification beyond traditional gaming formats. Mobile gaming, in particular, has become a significant market segment, with millions of users playing games on smartphones and tablets. This accessibility has attracted casual gamers who may not have invested in dedicated gaming hardware.

Gaming Accessories Market Trend Analysis

Launch of Various New Generation Gaming Consoles and PC Gaming GPU’s

- The gaming accessories market has witnessed a dynamic shift with the launch of various new-generation gaming consoles and PC gaming GPUs, marking a significant trend in the industry. The past few years have seen a flurry of releases from major players, each striving to redefine the gaming experience and push technological boundaries.

- Industry giants such as Sony and Microsoft have unveiled their respective PlayStation 5 and Xbox Series X/S, setting new benchmarks for console gaming. These consoles feature cutting-edge hardware, including powerful CPUs, advanced GPUs, and high-speed SSDs, delivering unparalleled graphics, faster load times, and seamless gaming experiences. The competitive landscape has spurred innovation, with a focus on immersive technologies like ray tracing and support for high-refresh-rate displays.

- Simultaneously, the PC gaming market has seen a surge in the release of new GPUs, with companies like NVIDIA and AMD leading the charge. These graphics cards, such as the NVIDIA GeForce RTX 30 series and AMD Radeon RX 6000 series, boast impressive performance gains, catering to the demands of modern gaming. Ray tracing capabilities, AI-driven features, and increased VRAM capacities have become standard offerings, enabling gamers to enjoy visually stunning and realistic environments.

- The trend of launching new gaming consoles and GPUs has created a ripple effect in the gaming accessories market. Peripheral manufacturers are aligning their products to complement these powerful systems, offering enhanced gaming experiences. From high-refresh-rate monitors and mechanical keyboards to advanced gaming mice and surround sound headsets, accessories are evolving to leverage the capabilities of the latest gaming hardware.

Rising Adoption of Smartphones and Rapidly Evolving Technologies

- The rising adoption of smartphones and the rapidly evolving technologies present a significant opportunity for the gaming accessories industry. As smartphones become an integral part of our daily lives, they have also emerged as powerful gaming platforms, creating a massive market for accessories that enhance the gaming experience.

- Smartphones, with their advanced processors, high-quality displays, and sophisticated graphics capabilities, have become portable gaming consoles for millions of users. This shift has led to an increased demand for gaming accessories that complement and augment the gaming experience on these devices. This presents an opportunity for companies to develop innovative accessories that cater to the specific needs of mobile gamers.

- As smartphones continue to push the boundaries of processing power and graphics capabilities, gamers seek accessories that enhance their ability to interact with virtual worlds. This has given rise to accessories such as advanced controllers, haptic feedback devices, and augmented reality (AR) attachments that provide a more engaging and immersive gaming environment.

Gaming Accessories Market Segment Analysis:

Gaming Accessories Market Segmented on the basis of type, device type.

By Type, Gamepads/Joysticks segment is expected to dominate the market during the forecast period

- The increasing popularity of multiplayer and cooperative gaming has elevated the demand for versatile and ergonomic controllers. Gamepads and joysticks offer a more immersive and tactile gaming experience compared to traditional keyboard and mouse setups, attracting a broader audience, including casual gamers. Additionally, the rise of gaming platforms like consoles, PCs, and mobile devices has fueled the need for compatible controllers, further boosting sales in this segment. The continuous advancements in technology, such as haptic feedback and adaptive triggers, enhance the overall gaming experience, driving gamers to invest in high-quality controllers.

By Application, PC (Desktop and Laptop) segment held the largest share in 2024

- Gaming accessory segment goes with the PCs which is a favorite choice among gaming fans along with the Gaming consoles which have witnessed a steady rise in demand, due to the rise in the number of gamers and technological advancements over the last few years. Smartphones are also a part of this segment which are now considered as handheld gaming devices along with some additional accessories. Smartphone gaming increased in the past couple of years. Throughout the globe, there was a development of an average of 1.5 million mobile game players in 2020 globally.

Gaming Accessories Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The increasing popularity of gaming as a form of entertainment has driven a surge in demand for high-quality accessories to enhance the gaming experience. The region has a large and growing population of avid gamers who are willing to invest in advanced peripherals such as gaming mice, keyboards, headsets, and controllers.

- Moreover, technological advancements and innovation in gaming accessories have been prominent in North America, with companies consistently introducing cutting-edge products that cater to the evolving needs of gamers. The region is home to many leading gaming accessory manufacturers and developers, contributing to a competitive market that fosters innovation.

Gaming Accessories Market Top Key Players:

- Alienware (Dell) (USA)

- Logitech International SA (Switzerland)

- Razer Inc. (USA)

- Mad Catz Global Limited (Hong Kong)

- Turtle Beach Corporation (USA)

- Corsair Gaming Inc. (USA)

- Cooler Master Co. Ltd (Taiwan)

- Sennheiser electronic GmbH & Co. KG (Germany)

- HyperX (USA)

- Anker (China)

- Redragon (Eastern Times Technology Co. Ltd) (China)

- Nintendo Co. Ltd (Japan)

- Sony Corporation (Japan)

- SteelSeries – (USA)

- Microsoft Corporation (USA)

- Other Active Player

Key Industry Developments in the Gaming Accessories Market:

- In September 2023, Logitech G launched the Aurora Collection, a line of gaming accessories specifically designed for women and non-binary gamers. This announcement indicates recognition of a growing demographic and a strategic move to expand market share.

- In August 2023, Razer launched the Naga Pro V2 wireless MMO mouse, Logitech unveiled the G502 X LIGHTSPEED wireless mouse, and HyperX introduced the Cloud Flight S wireless headset. These announcements highlight the ongoing innovation and competition in the market.

|

Gaming Accessories Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 24.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gaming Accessories Market by Type (2018-2032)

4.1 Gaming Accessories Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gamepads/Joysticks

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gaming Keyboards

4.5 Gaming Mice

4.6 Gaming Headsets

4.7 Virtual Reality Devices

Chapter 5: Gaming Accessories Market by Device Type (2018-2032)

5.1 Gaming Accessories Market Snapshot and Growth Engine

5.2 Market Overview

5.3 PC (Desktop and Laptop)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gaming Consoles

5.5 Smartphones

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Gaming Accessories Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 OLYMPUS CORPORATION (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ETHICON ENDO-SURGERY LLC. (USA)

6.4 FUJIFILM HOLDINGS CORPORATION (JAPAN)

6.5 STRYKER CORPORATION (USA)

6.6 BOSTON SCIENTIFIC CORPORATION (USA)

6.7 KARL STORZ GMBH & CO. KG. (GERMANY)

6.8 SMITH & NEPHEW INC. (USA)

6.9 RICHARD WOLF GMBH (GERMANY)

6.10 MEDTRONIC PLC (COVIDIEN) (IRELAND)

6.11 PENTAX MEDICAL (JAPAN)

6.12 MACHIDA ENDOSCOPE COLTD. (JAPAN)

6.13 OTHER KEY PLAYERS

Chapter 7: Global Gaming Accessories Market By Region

7.1 Overview

7.2. North America Gaming Accessories Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Gamepads/Joysticks

7.2.4.2 Gaming Keyboards

7.2.4.3 Gaming Mice

7.2.4.4 Gaming Headsets

7.2.4.5 Virtual Reality Devices

7.2.5 Historic and Forecasted Market Size by Device Type

7.2.5.1 PC (Desktop and Laptop)

7.2.5.2 Gaming Consoles

7.2.5.3 Smartphones

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Gaming Accessories Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Gamepads/Joysticks

7.3.4.2 Gaming Keyboards

7.3.4.3 Gaming Mice

7.3.4.4 Gaming Headsets

7.3.4.5 Virtual Reality Devices

7.3.5 Historic and Forecasted Market Size by Device Type

7.3.5.1 PC (Desktop and Laptop)

7.3.5.2 Gaming Consoles

7.3.5.3 Smartphones

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Gaming Accessories Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Gamepads/Joysticks

7.4.4.2 Gaming Keyboards

7.4.4.3 Gaming Mice

7.4.4.4 Gaming Headsets

7.4.4.5 Virtual Reality Devices

7.4.5 Historic and Forecasted Market Size by Device Type

7.4.5.1 PC (Desktop and Laptop)

7.4.5.2 Gaming Consoles

7.4.5.3 Smartphones

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Gaming Accessories Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Gamepads/Joysticks

7.5.4.2 Gaming Keyboards

7.5.4.3 Gaming Mice

7.5.4.4 Gaming Headsets

7.5.4.5 Virtual Reality Devices

7.5.5 Historic and Forecasted Market Size by Device Type

7.5.5.1 PC (Desktop and Laptop)

7.5.5.2 Gaming Consoles

7.5.5.3 Smartphones

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Gaming Accessories Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Gamepads/Joysticks

7.6.4.2 Gaming Keyboards

7.6.4.3 Gaming Mice

7.6.4.4 Gaming Headsets

7.6.4.5 Virtual Reality Devices

7.6.5 Historic and Forecasted Market Size by Device Type

7.6.5.1 PC (Desktop and Laptop)

7.6.5.2 Gaming Consoles

7.6.5.3 Smartphones

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Gaming Accessories Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Gamepads/Joysticks

7.7.4.2 Gaming Keyboards

7.7.4.3 Gaming Mice

7.7.4.4 Gaming Headsets

7.7.4.5 Virtual Reality Devices

7.7.5 Historic and Forecasted Market Size by Device Type

7.7.5.1 PC (Desktop and Laptop)

7.7.5.2 Gaming Consoles

7.7.5.3 Smartphones

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Gaming Accessories Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 24.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||