Global Fungicides Market Overview

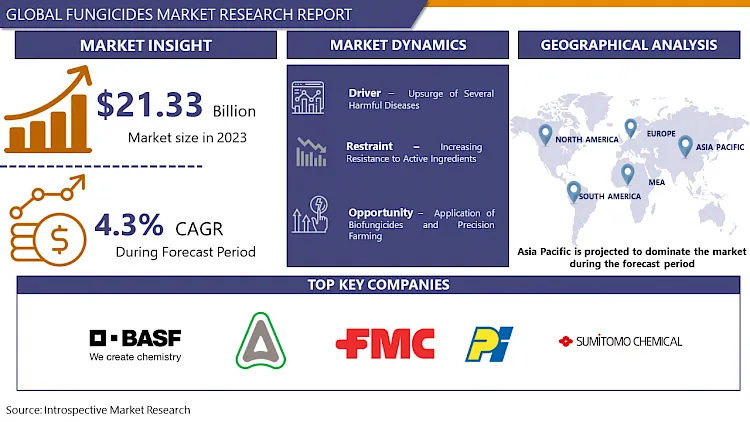

The Global Fungicides Market size is expected to grow from USD 21.33 billion in 2023 to USD 31.16 billion by 2032, at a CAGR of 4.3% during the forecast period (2024-2032).

The global fungicide market has been experiencing steady growth, driven by increasing food demand, the need for higher crop yields, and the rising prevalence of crop diseases worldwide. Fungicides play a crucial role in modern agriculture by protecting crops from fungal infections, which can significantly reduce crop yields and quality. The market is characterized by ongoing innovation in active ingredients and formulations, aiming to provide more effective and environmentally friendly solutions.

Key market players include multinational agrochemical companies such as Syngenta, Bayer, BASF, Corteva Agriscience, and FMC Corporation. These companies invest heavily in research and development to introduce new products and expand their market share. The market is also seeing increased participation from regional players, particularly in emerging economies, who often focus on specific crops or local market needs.

There's a growing trend towards sustainable agriculture and integrated pest management, which has led to increased demand for bio-based fungicides. These products, derived from natural sources, are gaining popularity due to their lower environmental impact and reduced risk of pest resistance. However, synthetic fungicides still dominate the market due to their broader spectrum of activity and often lower cost.

Market Dynamics And Factors For Fungicides Market

Drivers:

Upsurge of Several Harmful Diseases

Climate change is a severe concern for any agricultural production all around the world. Any sudden changes in the climatic condition may adversely affect the crop production and give rise to various pests and diseases. Owing to such changes in temperature and a rise in atmospheric moisture content, crops are susceptible to growth of harmful fungal diseases and fungi on the plant. In order to avoid any crop losses due to fungi, farmers are inclined towards the adequate utilization of fungicides. Various types of products such as biofungicides, dithiocarbamate, benzimidazoles, triazoles and diazoles are widely used to prevent crop against fungal infections and to boost crop yield. Thus, the upsurge of many harmful diseases due to fungi growth and climatic changes are driving the fungicide market growth over the forecast period.

Restraints:

Increasing Resistance to Active Ingredients

Among all the fungicides and pesticides that are used, chemical pesticides are widely used for preventing crop losses as they are easy to handle and use, and are comparatively cheaper. The random and inappropriate usage of such fungicides cause several negative effects on the crop health. Additionally, using such fungicides or pesticides on the crop continuously, may cause the fungus on the plant to develop resistance against the products. For instance, Botrytis cinera, a grey mold present in vegetable and fruit crops have eventually developed resistance against fungicide products. Therefore, inadequate or continuous usage of fungicide products may cause the crop to become resistant, further hampering the growth of fungicides market in the upcoming years.

Opportunity:

Application of Biofungicides and Precision Farming

In past few years, the demand for organic products have increased widely, and to meet the growing demand, growers and manufacturers are inclined towards organic and precision farming techniques as well as maximum utilization of biofungicides for the crop growth. In addition, the rapid urbanization is prevailing the usage of biological fungicides to gain maximum revenue from the crop, to avoid losses from fungi attack, and to cultivate natural and chemical free products. Such a rise in demand for biofungicides and practicing precision farming methods for better crop quality and yield is most likely to provide lucrative opportunities for fungicides market over the estimated years.

Segmentation Analysis Of Fungicides Market

By type, the biological fungicides segment holds the largest market share and is expected to continue its dominance over the projected period. Biofungicides contain various beneficial microorganisms to control the growth of fungi, and many such microorganisms are found naturally in the soil. Biofungicides are commonly used before the occurrence of disease, and are more efficient when combined with good agricultural practices. Additionally, the extensive usage of chemical fungicides causes harmful effects on the crop, thus, the market growth of biological fungicides segment is expected to continue its dominance.

By crop type, the cereals and grains segment is anticipated to lead the development of the fungicide market over the analysis period. The rapid growth in population and demand for food material have propelled the need for crop protection, and thereby increasing the use of fungicides on cereals and grains. This segment is estimated to continue its dominance as the crops grown are in abundance and on a wide- scale across many regions of the world.

By mode of application, the post- harvest segment is estimated to dominate the market growth over the forecast period owing to the prevention of post-harvest losses of various seasonal and nonseasonal crops. Post-harvest segment is formulated to reduce the amount of fungicides being used and to solve the wastewater disposal related problems. Growers utilize fungicides widely during the post-harvest time period to avoid growth of fungi and fungi spores during storing, handling, transporting or distributing; further leading to rapid growth of this segment.

Regional Analysis Of Fungicides Market

The Asia Pacific region currently holds the largest share of the global fungicide market. This dominance is primarily driven by the region's vast agricultural sector, increasing population, rising food demand, and growing awareness about crop protection techniques among farmers.

China and India are the key players in the Asia Pacific fungicide market, owing to their large agricultural economies and high crop production volumes. These countries face significant challenges related to crop diseases, particularly in rice, wheat, and vegetables, which has led to increased fungicide adoption. Additionally, government initiatives promoting modern farming practices and supporting farmer education have contributed to market growth.

Climate change and unpredictable weather patterns have also played a role in boosting fungicide demand in the Asia Pacific. Increased humidity and temperature fluctuations have created favorable conditions for fungal growth, necessitating more frequent and effective fungicide applications. The market is characterized by the presence of both global agrochemical giants and local manufacturers. While multinational companies often lead in terms of innovation and product development, local players have a strong foothold due to their understanding of regional crops and farming practices.

Top Key Players Covered in Fungicides Market

- Sumitomo Chemical Co. Ltd (Japan)

- PI Industries (India)

- FMC Corporation (USA)

- ADAMA Ltd. (Israel)

- BASF SE(Germany)

- UPL(India)

- Bayer AG (Germany)

- Syngenta AG(Switzerland)

- The Dow Chemical Company (US)

- Cheminova A/S(Denmark)

- Chemtura Corporation (US)

- Bioworks Inc (United States)

- American Vanguard Corporation (US) and other major players.

Key Industry Development In The Fungicides Market

- October 2023:Bayer, a prominent agricultural products company headquartered in the UK, secured approval from the Chemicals Regulation Division (CRD) for isoflucypram, a novel active ingredient for fungicide use. This substance will be utilized in their new product, Vimoy.

- February 2023, Corteva Agriscience introduced Univoq, a novel fungicide specifically developed for grain crops. Utilizing Inatreq's unique mode of action, Univoq offers superior preventative, curative, and long-lasting protection against major cereal diseases compared to existing solutions.

- February 2023, ADAMA inaugurated a new multi-functional production facility in Brazil. This plant enables the company to manufacture its entire range of Prothioconazole-based products for global distribution and supports its strategy to launch several innovative offerings in the Brazilian market in the coming years.

- February 2023, Syngenta reaffirmed its commitment to maintaining market leadership in the tomato sector by unveiling Orondis Ultra, a significant innovation in mildew prevention technology.

|

Global Fungicides Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 31.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Crop type |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fungicides Market by Type (2018-2032)

4.1 Fungicides Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chemical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biological

Chapter 5: Fungicides Market by Crop type (2018-2032)

5.1 Fungicides Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cereals and Grains

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oilseeds and Pulses

5.5 Fruits and Vegetables

Chapter 6: Fungicides Market by Mode of Application (2018-2032)

6.1 Fungicides Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Seed treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Foliar spray

6.5 Soil treatment

6.6 Post-harvest

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fungicides Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANCHOR (AUCKLAND

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NEW ZEALAND)

7.4 ABBOTT NUTRITION (US)

7.5 ADVANCED FOOD PRODUCTS (PA)

7.6 AGRI- MARK INC. (US)

7.7 AGROPUR INGREDIENTS (US)

7.8 ALL AMERICAN FOODS INC. (US)

7.9 FRIESLAND CAMPINA (NETHERLANDS)

7.10 CARGILL(US)

7.11 BAKELS EDIBLE OILS (NEW ZEALAND)

7.12 LACTOPUR (CANADA)

7.13 PACIFICBLENDS (CANADA)

7.14 GALLOWAY COMPANY (US)

7.15 DOHLER (GERMANY)

7.16 KERRY FOODS (IRELAND)

7.17 FONTERRA CO-OPERATIVE GROUP (NEW ZEALAND)

Chapter 8: Global Fungicides Market By Region

8.1 Overview

8.2. North America Fungicides Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Chemical

8.2.4.2 Biological

8.2.5 Historic and Forecasted Market Size by Crop type

8.2.5.1 Cereals and Grains

8.2.5.2 Oilseeds and Pulses

8.2.5.3 Fruits and Vegetables

8.2.6 Historic and Forecasted Market Size by Mode of Application

8.2.6.1 Seed treatment

8.2.6.2 Foliar spray

8.2.6.3 Soil treatment

8.2.6.4 Post-harvest

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fungicides Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Chemical

8.3.4.2 Biological

8.3.5 Historic and Forecasted Market Size by Crop type

8.3.5.1 Cereals and Grains

8.3.5.2 Oilseeds and Pulses

8.3.5.3 Fruits and Vegetables

8.3.6 Historic and Forecasted Market Size by Mode of Application

8.3.6.1 Seed treatment

8.3.6.2 Foliar spray

8.3.6.3 Soil treatment

8.3.6.4 Post-harvest

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fungicides Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Chemical

8.4.4.2 Biological

8.4.5 Historic and Forecasted Market Size by Crop type

8.4.5.1 Cereals and Grains

8.4.5.2 Oilseeds and Pulses

8.4.5.3 Fruits and Vegetables

8.4.6 Historic and Forecasted Market Size by Mode of Application

8.4.6.1 Seed treatment

8.4.6.2 Foliar spray

8.4.6.3 Soil treatment

8.4.6.4 Post-harvest

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fungicides Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Chemical

8.5.4.2 Biological

8.5.5 Historic and Forecasted Market Size by Crop type

8.5.5.1 Cereals and Grains

8.5.5.2 Oilseeds and Pulses

8.5.5.3 Fruits and Vegetables

8.5.6 Historic and Forecasted Market Size by Mode of Application

8.5.6.1 Seed treatment

8.5.6.2 Foliar spray

8.5.6.3 Soil treatment

8.5.6.4 Post-harvest

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fungicides Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Chemical

8.6.4.2 Biological

8.6.5 Historic and Forecasted Market Size by Crop type

8.6.5.1 Cereals and Grains

8.6.5.2 Oilseeds and Pulses

8.6.5.3 Fruits and Vegetables

8.6.6 Historic and Forecasted Market Size by Mode of Application

8.6.6.1 Seed treatment

8.6.6.2 Foliar spray

8.6.6.3 Soil treatment

8.6.6.4 Post-harvest

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fungicides Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Chemical

8.7.4.2 Biological

8.7.5 Historic and Forecasted Market Size by Crop type

8.7.5.1 Cereals and Grains

8.7.5.2 Oilseeds and Pulses

8.7.5.3 Fruits and Vegetables

8.7.6 Historic and Forecasted Market Size by Mode of Application

8.7.6.1 Seed treatment

8.7.6.2 Foliar spray

8.7.6.3 Soil treatment

8.7.6.4 Post-harvest

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Fungicides Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 31.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Crop type |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fungicide Market research report is 2024-2032.

Sumitomo Chemical Co., Ltd (Japan), PI Industries (India), FMC Corporation (USA), ADAMA Ltd. (Israel), BASF SE(Germany), and other major players.

The Fungicide Market is segmented into type, crop type, mode of application and region. By Type, the market is categorized into Chemical and Biological. By Crop Type, the market is categorized into cereals & grains, oilseeds & pulses, fruits & vegetables. By Mode of Application, the market is categorized into Foliar Spray, Post- harvest, Soil Treatment, And Seed Treatment. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fungicides are the type of pesticides that are widely used to kill fungi and fungi spores, control rust, mildews and blights and to prevent crop against any fungal infection that further drives the market growth.

The Global Fungicides Market size is expected to grow from USD 21.33 billion in 2023 to USD 31.16 billion by 2032, at a CAGR of 4.3% during the forecast period (2024-2032).