Global Fumigation Products Market Overview

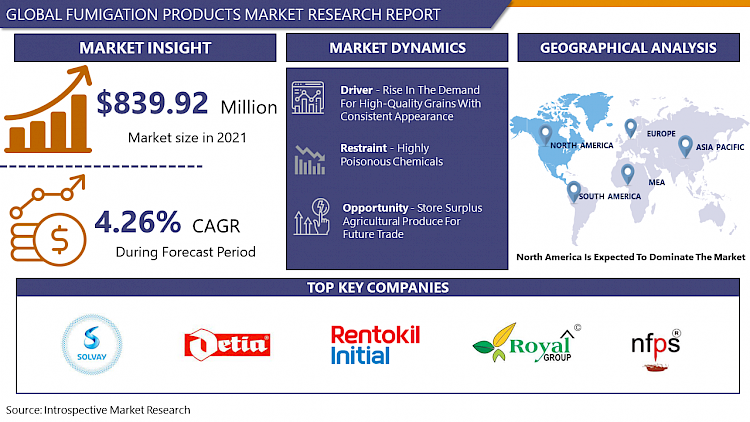

Fumigation Products Market size is projected to reach USD 1,124.77 Million by 2028 from an estimated USD 839.92 Million in 2021, growing at a CAGR of 4.26% globally.

The fumigation method is generally utilized for the operation of pest control. The fumigation process includes the removal of pests by using the fumes of numerous chemicals. It removes pests such as bacteria, weeds, nematodes, fungi, and other hard-to-remove pests. Fumigation products are highly poisonous. They produce noxious gases when exposed to air and moisture. The chemicals used for fumigation such as carbon dioxide sulfuryl fluoride, aluminum phosphide, and magnesium phosphide. There are three types of fumigations which are solid, liquid, and gas. Additionally, the Fumigation products can remove pests at all stages of their lifecycles, from eggs to full-grown adults. It is usually done by devices such as ultra-low volume ULV foggers, aerosol disinfector, mini fogging machines, medical fogger machines, and others. Furthermore, fumigation products are mostly used in the agricultural sector, the food & beverage industry, and grain storage applications. These products also find usage in newly constructed residential spaces and warehouses.

COVID-19 Impact on the Fumigation Products Market

The initial phase of the COVID-19 scenario in 2020 influenced the development of the fumigation products market. While the interest from consumers is relied upon to decline due to the lockdowns and social distancing standards, primarily in developed economies such as U.S., Canada, UK, China, Norway, Australia, and Japan are more probably to stay constant. This is not only influenced the scale of production but also growth of the industries. Furthermore, diminished demand from food & beverages, agricultural industries, and residential purposes changed industrial outputs and negatively influenced the market. In addition, the result of COVID-19 on the agricultural market is anticipated to be significant, as the current pandemic has highlighted the significance of hygiene, healthy, and nutritious eating. Amidst the COVID-19 pandemic, crop protection companies are experiencing remarkable challenges to address the increased demand for food production which is free from pests and insects. The lockdown of various infrastructures has given an increase to the spreading of various rodents, insects, and pests, which creates a major demand for agricultural fumigants. A rapid and unexpected stake in demand for foods during the pandemic resulted in producers, suppliers, and retailers fighting to ensure a continued supply of agricultural fumigants in the market. In addition to this, it is expected that industrial output will resurrect its previous size by the third quarter of 2021.

Market Dynamics and Factors of Fumigation Products Market

Drivers:

The demand for fumigation products generally comes from agricultural produce and grain storage applications. Growth in the infestation of insects in stored food grains such as rice weevil (Sitophilus Oryzae), granary weevil (Sitophilus Granaries), lesser grain borer (Rhyzopertha Dominica), and Angoumois grain moth (Sitotroga Cerealella) poses a significant threat to warehouse operators. A rise in the demand for high-quality grains with consistent appearance is expected to drive the demand for fumigation products for food grain storage/warehouses.

Globalization is driving the global trade of agricultural produce. Containers that hold food items and storage units at ports need frequent pest control to prevent damage that could be caused by insects.

The rise in the urban population over the world is turning the demand for residential construction, primarily in emerging economies such as China, India, Brazil, and Mexico. Growth in the number of residential spaces and transformation of rural areas into urban areas is projected to pose a threat of infestation in the latest constructed residential areas soon, thus accelerating the demand for fumigation products from the residential industry.

Restraints:

Fumigation products are highly poisonous chemicals. These generate harmful gases when exposed to air and moisture, which can be serious not only for the technician applying fumigation products but also for the people around the treated spaces. Hence, the application of fumigation products needs maximum care and must be carried out by certified professionals only.

Emerging nations such as South Africa, India, and Mexico lack the skilled professionals required for fumigation. This hinders the growth of the global fumigation products market in these economies.

Opportunities:

International trade of agricultural produce is anticipated to act as a prominent role in contributing toward food security in different supply-deficit countries. Economies that are facing extreme climate events rely on international trade to accomplish their domestic demand, resulting in a growing need for storage. Stored agricultural goods are always susceptible to infestation. If not treated professionally, this infestation can damage stored goods, which can result in huge losses to storage companies.

The global production of food grains has raised, and international trade has increased significantly in the past few years with the exposure of new exporters and importers of agricultural produce. Changes in the production of agricultural products owing to seasonal changes in emerging countries such as India, Indonesia, Brazil, China, and Russia have been a major development in the global agriculture industry.

Fumigation is the most popular method of pest control waged in agricultural produce storage facilities over the globe. The global demand to store surplus agricultural produce for future trade is expected to lead to the high demand for fumigation products over the world during the forecast period.

Market Segmentation

Segmentation Analysis of Fumigation Products Market:

Based on Form, the liquid segment carries the maximum market share in the course of the forecast period. The factors that can be attributed to growing application in the liquid form in the agricultural sector to prevent damage caused by insects are turning the demand for this segment.

Based on the Treatment Method, the methyl bromide segment is dominating the market during the forecast period. The factors that can be assigned as it can readily penetrate various materials and is used extensively for structural space fumigation. Aluminum phosphide is utilized generally to fumigate grain storage facilities.

Based on the End-Users, the residential fumigation product segment continues to be the largest market share over the forecast period. The factors that can be attributed to the rising incidences associated with the damage of electric wirings and walls in residential constructions improve the demand for this segment.

Based on the Product Type, 1,3-dichloropropene is an essential fumigant and is reviewed as a feasible alternative to Bromomethane (MeBr). 1,3-dichloropropene contains less vapor pressure and kH as well as higher degradation rates and a high level of sorption volume as compared to bromomethane. A higher sorption coefficient eventually allows the compound to be more persistent in soil.

Regional Analysis of Fumigation Products Market:

North America region dominates the market over the forecast period. The presence of principal crop protection chemical producers, expanding the need for sustainable agriculture and the greater efficiency of fumigants in terms of application, and the presence of some of the most protective farming regulations will accelerate the market in the North American region.

The Asia Pacific is anticipated to be the fastest increasing regional segment during the forecast period on account of various macro-economic factors, such as rising accessibility and consciousness about the usage of these products as a crop protection technique. The rising number of producers due to low-cost labor is expected to drive the regional market in the upcoming years.

Europe is one of the significant consumers of pesticides and counterparts on account of its rising agriculture industry, aided by land availability and favorable weather conditions that helps to the vast production of multiple crops. In addition, multiple agencies are creating regulations about the huge utilization of soil protection chemicals in the region. This, in turn, has covered the way for organic farming practices over Europe.

Players Covered in Fumigation Products Market are:

- Rentokil Initial plc

- Solvay S.A.

- Detia Degesch GmbH

- Industrial Fumigant Company LLC

- Royal Agro Organic Pvt. Ltd.

- UPI-USA

- National Fumigants

- Corteva Agriscience

- JAFFER Group of Companies

- AMVAC Chemical Corporation and other major players.

Key Industry Development of the Fumigation Products Market

- In January 2021, Indian company UPL signed a strategic partnership with TeleSense to release monitoring solutions for post-harvest commodity transport and storage. This will ease progress toward food wastage by monitoring and mitigating potential issues such as hotspots, high moisture, gas monitoring, and pests. This will accompaniment the company's robust range of safety, and detection devices as well as fumigants.

- In November 2020, Canadian-based company MustGrow gained an exclusive patent licensing from the University of Idaho for the fumigation of stored vegetables and grains.

- In December 2019, Switzerland-based company SGS SA inclined of its pest management and fumigation operations in Belgium and the Netherlands to Anticimex for a total purchase price of CHF 68 million, creating a gain on the disposal of CHF 63 million.

|

Global Fumigation Products Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 839.92 Mn. |

|

Forecast Period 2022-28 CAGR: |

4.26% |

Market Size in 2028: |

USD 1,124.77 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Treatment Method |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Form

3.3 By Treatment Method

3.4 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Fumigation Products Market by Product Type

4.1 Fumigation Products Market Overview Snapshot and Growth Engine

4.2 Fumigation Products Market Overview

4.3 Phosphine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Phosphine: Grographic Segmentation

4.4 Chloropicrin

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Chloropicrin: Grographic Segmentation

4.5 Telone

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Telone: Grographic Segmentation

4.6 Metam Sodium

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Metam Sodium: Grographic Segmentation

4.7 Dimethyl Disulfide

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Dimethyl Disulfide: Grographic Segmentation

4.8 1

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size (2016-2028F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 1: Grographic Segmentation

4.9 3-Dichloropropene

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size (2016-2028F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 3-Dichloropropene: Grographic Segmentation

4.10 Others

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size (2016-2028F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others: Grographic Segmentation

Chapter 5: Fumigation Products Market by Form

5.1 Fumigation Products Market Overview Snapshot and Growth Engine

5.2 Fumigation Products Market Overview

5.3 Solid Fumigation Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Solid Fumigation Products: Grographic Segmentation

5.4 Liquid Fumigation Products

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Liquid Fumigation Products: Grographic Segmentation

5.5 Gas Fumigation Products

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Gas Fumigation Products: Grographic Segmentation

Chapter 6: Fumigation Products Market by Treatment Method

6.1 Fumigation Products Market Overview Snapshot and Growth Engine

6.2 Fumigation Products Market Overview

6.3 Magnesium Phosphide Fumigation Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Magnesium Phosphide Fumigation Products: Grographic Segmentation

6.4 Aluminum Phosphide Fumigation Products

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aluminum Phosphide Fumigation Products: Grographic Segmentation

6.5 Sulfuryl Fluoride Fumigation Products

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Sulfuryl Fluoride Fumigation Products: Grographic Segmentation

6.6 Carbon Dioxide (Co2) Fumigation Products

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Carbon Dioxide (Co2) Fumigation Products: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Fumigation Products Market by End-User

7.1 Fumigation Products Market Overview Snapshot and Growth Engine

7.2 Fumigation Products Market Overview

7.3 Residential Fumigation Products

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Residential Fumigation Products: Grographic Segmentation

7.4 Agricultural Fumigation Products

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Agricultural Fumigation Products: Grographic Segmentation

7.5 Warehouses/ Storage Fumigation Products

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Warehouses/ Storage Fumigation Products: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Fumigation Products Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Fumigation Products Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Fumigation Products Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 RENTOKIL INITIAL PLC

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 SOLVAY S.A.

8.4 DETIA DEGESCH GMBH

8.5 INDUSTRIAL FUMIGANT COMPANY LLC

8.6 ROYAL AGRO ORGANIC PVT. LTD.

8.7 UPI-USA

8.8 NATIONAL FUMIGANTS

8.9 CORTEVA AGRISCIENCE

8.10 JAFFER GROUP OF COMPANIES

8.11 AMVAC CHEMICAL CORPORATION

Chapter 9: Global Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Product Type

9.2.1 Phosphine

9.2.2 Chloropicrin

9.2.3 Telone

9.2.4 Metam Sodium

9.2.5 Dimethyl Disulfide

9.2.6 1

9.2.7 3-Dichloropropene

9.2.8 Others

9.3 Historic and Forecasted Market Size By Form

9.3.1 Solid Fumigation Products

9.3.2 Liquid Fumigation Products

9.3.3 Gas Fumigation Products

9.4 Historic and Forecasted Market Size By Treatment Method

9.4.1 Magnesium Phosphide Fumigation Products

9.4.2 Aluminum Phosphide Fumigation Products

9.4.3 Sulfuryl Fluoride Fumigation Products

9.4.4 Carbon Dioxide (Co2) Fumigation Products

9.4.5 Others

9.5 Historic and Forecasted Market Size By End-User

9.5.1 Residential Fumigation Products

9.5.2 Agricultural Fumigation Products

9.5.3 Warehouses/ Storage Fumigation Products

9.5.4 Others

Chapter 10: North America Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Phosphine

10.4.2 Chloropicrin

10.4.3 Telone

10.4.4 Metam Sodium

10.4.5 Dimethyl Disulfide

10.4.6 1

10.4.7 3-Dichloropropene

10.4.8 Others

10.5 Historic and Forecasted Market Size By Form

10.5.1 Solid Fumigation Products

10.5.2 Liquid Fumigation Products

10.5.3 Gas Fumigation Products

10.6 Historic and Forecasted Market Size By Treatment Method

10.6.1 Magnesium Phosphide Fumigation Products

10.6.2 Aluminum Phosphide Fumigation Products

10.6.3 Sulfuryl Fluoride Fumigation Products

10.6.4 Carbon Dioxide (Co2) Fumigation Products

10.6.5 Others

10.7 Historic and Forecasted Market Size By End-User

10.7.1 Residential Fumigation Products

10.7.2 Agricultural Fumigation Products

10.7.3 Warehouses/ Storage Fumigation Products

10.7.4 Others

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Phosphine

11.4.2 Chloropicrin

11.4.3 Telone

11.4.4 Metam Sodium

11.4.5 Dimethyl Disulfide

11.4.6 1

11.4.7 3-Dichloropropene

11.4.8 Others

11.5 Historic and Forecasted Market Size By Form

11.5.1 Solid Fumigation Products

11.5.2 Liquid Fumigation Products

11.5.3 Gas Fumigation Products

11.6 Historic and Forecasted Market Size By Treatment Method

11.6.1 Magnesium Phosphide Fumigation Products

11.6.2 Aluminum Phosphide Fumigation Products

11.6.3 Sulfuryl Fluoride Fumigation Products

11.6.4 Carbon Dioxide (Co2) Fumigation Products

11.6.5 Others

11.7 Historic and Forecasted Market Size By End-User

11.7.1 Residential Fumigation Products

11.7.2 Agricultural Fumigation Products

11.7.3 Warehouses/ Storage Fumigation Products

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Phosphine

12.4.2 Chloropicrin

12.4.3 Telone

12.4.4 Metam Sodium

12.4.5 Dimethyl Disulfide

12.4.6 1

12.4.7 3-Dichloropropene

12.4.8 Others

12.5 Historic and Forecasted Market Size By Form

12.5.1 Solid Fumigation Products

12.5.2 Liquid Fumigation Products

12.5.3 Gas Fumigation Products

12.6 Historic and Forecasted Market Size By Treatment Method

12.6.1 Magnesium Phosphide Fumigation Products

12.6.2 Aluminum Phosphide Fumigation Products

12.6.3 Sulfuryl Fluoride Fumigation Products

12.6.4 Carbon Dioxide (Co2) Fumigation Products

12.6.5 Others

12.7 Historic and Forecasted Market Size By End-User

12.7.1 Residential Fumigation Products

12.7.2 Agricultural Fumigation Products

12.7.3 Warehouses/ Storage Fumigation Products

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Phosphine

13.4.2 Chloropicrin

13.4.3 Telone

13.4.4 Metam Sodium

13.4.5 Dimethyl Disulfide

13.4.6 1

13.4.7 3-Dichloropropene

13.4.8 Others

13.5 Historic and Forecasted Market Size By Form

13.5.1 Solid Fumigation Products

13.5.2 Liquid Fumigation Products

13.5.3 Gas Fumigation Products

13.6 Historic and Forecasted Market Size By Treatment Method

13.6.1 Magnesium Phosphide Fumigation Products

13.6.2 Aluminum Phosphide Fumigation Products

13.6.3 Sulfuryl Fluoride Fumigation Products

13.6.4 Carbon Dioxide (Co2) Fumigation Products

13.6.5 Others

13.7 Historic and Forecasted Market Size By End-User

13.7.1 Residential Fumigation Products

13.7.2 Agricultural Fumigation Products

13.7.3 Warehouses/ Storage Fumigation Products

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Fumigation Products Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Phosphine

14.4.2 Chloropicrin

14.4.3 Telone

14.4.4 Metam Sodium

14.4.5 Dimethyl Disulfide

14.4.6 1

14.4.7 3-Dichloropropene

14.4.8 Others

14.5 Historic and Forecasted Market Size By Form

14.5.1 Solid Fumigation Products

14.5.2 Liquid Fumigation Products

14.5.3 Gas Fumigation Products

14.6 Historic and Forecasted Market Size By Treatment Method

14.6.1 Magnesium Phosphide Fumigation Products

14.6.2 Aluminum Phosphide Fumigation Products

14.6.3 Sulfuryl Fluoride Fumigation Products

14.6.4 Carbon Dioxide (Co2) Fumigation Products

14.6.5 Others

14.7 Historic and Forecasted Market Size By End-User

14.7.1 Residential Fumigation Products

14.7.2 Agricultural Fumigation Products

14.7.3 Warehouses/ Storage Fumigation Products

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Fumigation Products Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 839.92 Mn. |

|

Forecast Period 2022-28 CAGR: |

4.26% |

Market Size in 2028: |

USD 1,124.77 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Treatment Method |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FUMIGATION PRODUCTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FUMIGATION PRODUCTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FUMIGATION PRODUCTS MARKET COMPETITIVE RIVALRY

TABLE 005. FUMIGATION PRODUCTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FUMIGATION PRODUCTS MARKET THREAT OF SUBSTITUTES

TABLE 007. FUMIGATION PRODUCTS MARKET BY PRODUCT TYPE

TABLE 008. PHOSPHINE MARKET OVERVIEW (2016-2028)

TABLE 009. CHLOROPICRIN MARKET OVERVIEW (2016-2028)

TABLE 010. TELONE MARKET OVERVIEW (2016-2028)

TABLE 011. METAM SODIUM MARKET OVERVIEW (2016-2028)

TABLE 012. DIMETHYL DISULFIDE MARKET OVERVIEW (2016-2028)

TABLE 013. 1 MARKET OVERVIEW (2016-2028)

TABLE 014. 3-DICHLOROPROPENE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. FUMIGATION PRODUCTS MARKET BY FORM

TABLE 017. SOLID FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 018. LIQUID FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 019. GAS FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 020. FUMIGATION PRODUCTS MARKET BY TREATMENT METHOD

TABLE 021. MAGNESIUM PHOSPHIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 022. ALUMINUM PHOSPHIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 023. SULFURYL FLUORIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 024. CARBON DIOXIDE (CO2) FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. FUMIGATION PRODUCTS MARKET BY END-USER

TABLE 027. RESIDENTIAL FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 028. AGRICULTURAL FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 029. WAREHOUSES/ STORAGE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 030. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 031. NORTH AMERICA FUMIGATION PRODUCTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 032. NORTH AMERICA FUMIGATION PRODUCTS MARKET, BY FORM (2016-2028)

TABLE 033. NORTH AMERICA FUMIGATION PRODUCTS MARKET, BY TREATMENT METHOD (2016-2028)

TABLE 034. NORTH AMERICA FUMIGATION PRODUCTS MARKET, BY END-USER (2016-2028)

TABLE 035. N FUMIGATION PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 036. EUROPE FUMIGATION PRODUCTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. EUROPE FUMIGATION PRODUCTS MARKET, BY FORM (2016-2028)

TABLE 038. EUROPE FUMIGATION PRODUCTS MARKET, BY TREATMENT METHOD (2016-2028)

TABLE 039. EUROPE FUMIGATION PRODUCTS MARKET, BY END-USER (2016-2028)

TABLE 040. FUMIGATION PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 041. ASIA PACIFIC FUMIGATION PRODUCTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 042. ASIA PACIFIC FUMIGATION PRODUCTS MARKET, BY FORM (2016-2028)

TABLE 043. ASIA PACIFIC FUMIGATION PRODUCTS MARKET, BY TREATMENT METHOD (2016-2028)

TABLE 044. ASIA PACIFIC FUMIGATION PRODUCTS MARKET, BY END-USER (2016-2028)

TABLE 045. FUMIGATION PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA FUMIGATION PRODUCTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA FUMIGATION PRODUCTS MARKET, BY FORM (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA FUMIGATION PRODUCTS MARKET, BY TREATMENT METHOD (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA FUMIGATION PRODUCTS MARKET, BY END-USER (2016-2028)

TABLE 050. FUMIGATION PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 051. SOUTH AMERICA FUMIGATION PRODUCTS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 052. SOUTH AMERICA FUMIGATION PRODUCTS MARKET, BY FORM (2016-2028)

TABLE 053. SOUTH AMERICA FUMIGATION PRODUCTS MARKET, BY TREATMENT METHOD (2016-2028)

TABLE 054. SOUTH AMERICA FUMIGATION PRODUCTS MARKET, BY END-USER (2016-2028)

TABLE 055. FUMIGATION PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 056. RENTOKIL INITIAL PLC: SNAPSHOT

TABLE 057. RENTOKIL INITIAL PLC: BUSINESS PERFORMANCE

TABLE 058. RENTOKIL INITIAL PLC: PRODUCT PORTFOLIO

TABLE 059. RENTOKIL INITIAL PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SOLVAY S.A.: SNAPSHOT

TABLE 060. SOLVAY S.A.: BUSINESS PERFORMANCE

TABLE 061. SOLVAY S.A.: PRODUCT PORTFOLIO

TABLE 062. SOLVAY S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DETIA DEGESCH GMBH: SNAPSHOT

TABLE 063. DETIA DEGESCH GMBH: BUSINESS PERFORMANCE

TABLE 064. DETIA DEGESCH GMBH: PRODUCT PORTFOLIO

TABLE 065. DETIA DEGESCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. INDUSTRIAL FUMIGANT COMPANY LLC: SNAPSHOT

TABLE 066. INDUSTRIAL FUMIGANT COMPANY LLC: BUSINESS PERFORMANCE

TABLE 067. INDUSTRIAL FUMIGANT COMPANY LLC: PRODUCT PORTFOLIO

TABLE 068. INDUSTRIAL FUMIGANT COMPANY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ROYAL AGRO ORGANIC PVT. LTD.: SNAPSHOT

TABLE 069. ROYAL AGRO ORGANIC PVT. LTD.: BUSINESS PERFORMANCE

TABLE 070. ROYAL AGRO ORGANIC PVT. LTD.: PRODUCT PORTFOLIO

TABLE 071. ROYAL AGRO ORGANIC PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. UPI-USA: SNAPSHOT

TABLE 072. UPI-USA: BUSINESS PERFORMANCE

TABLE 073. UPI-USA: PRODUCT PORTFOLIO

TABLE 074. UPI-USA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. NATIONAL FUMIGANTS: SNAPSHOT

TABLE 075. NATIONAL FUMIGANTS: BUSINESS PERFORMANCE

TABLE 076. NATIONAL FUMIGANTS: PRODUCT PORTFOLIO

TABLE 077. NATIONAL FUMIGANTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. CORTEVA AGRISCIENCE: SNAPSHOT

TABLE 078. CORTEVA AGRISCIENCE: BUSINESS PERFORMANCE

TABLE 079. CORTEVA AGRISCIENCE: PRODUCT PORTFOLIO

TABLE 080. CORTEVA AGRISCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. JAFFER GROUP OF COMPANIES: SNAPSHOT

TABLE 081. JAFFER GROUP OF COMPANIES: BUSINESS PERFORMANCE

TABLE 082. JAFFER GROUP OF COMPANIES: PRODUCT PORTFOLIO

TABLE 083. JAFFER GROUP OF COMPANIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. AMVAC CHEMICAL CORPORATION: SNAPSHOT

TABLE 084. AMVAC CHEMICAL CORPORATION: BUSINESS PERFORMANCE

TABLE 085. AMVAC CHEMICAL CORPORATION: PRODUCT PORTFOLIO

TABLE 086. AMVAC CHEMICAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FUMIGATION PRODUCTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FUMIGATION PRODUCTS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. PHOSPHINE MARKET OVERVIEW (2016-2028)

FIGURE 013. CHLOROPICRIN MARKET OVERVIEW (2016-2028)

FIGURE 014. TELONE MARKET OVERVIEW (2016-2028)

FIGURE 015. METAM SODIUM MARKET OVERVIEW (2016-2028)

FIGURE 016. DIMETHYL DISULFIDE MARKET OVERVIEW (2016-2028)

FIGURE 017. 1 MARKET OVERVIEW (2016-2028)

FIGURE 018. 3-DICHLOROPROPENE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. FUMIGATION PRODUCTS MARKET OVERVIEW BY FORM

FIGURE 021. SOLID FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 022. LIQUID FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 023. GAS FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 024. FUMIGATION PRODUCTS MARKET OVERVIEW BY TREATMENT METHOD

FIGURE 025. MAGNESIUM PHOSPHIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 026. ALUMINUM PHOSPHIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 027. SULFURYL FLUORIDE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 028. CARBON DIOXIDE (CO2) FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. FUMIGATION PRODUCTS MARKET OVERVIEW BY END-USER

FIGURE 031. RESIDENTIAL FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 032. AGRICULTURAL FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 033. WAREHOUSES/ STORAGE FUMIGATION PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 034. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 035. NORTH AMERICA FUMIGATION PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. EUROPE FUMIGATION PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. ASIA PACIFIC FUMIGATION PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. MIDDLE EAST & AFRICA FUMIGATION PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 039. SOUTH AMERICA FUMIGATION PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2021-2028.

The key players mentioned are Rentokil Initial plc, Solvay S.A., Detia Degesch GmbH, Industrial Fumigant Company LLC, Royal Agro Organic Pvt. Ltd., UPI-USA, National Fumigants, Corteva Agriscience, JAFFER Group of Companies, AMVAC Chemical Corporation.

The Fumigation Products market is segmented into application type, product type and region. By Application type, the market is categorized into Residential Fumigation Products, Agricultural Fumigation Products, Warehouses/ Storage Fumigation Products, Others. By product type, it is classified into Solid Fumigation Products, Liquid Fumigation Products, Gas Fumigation Products and others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

The fumigation method is generally utilized for the operation of pest control. The fumigation process includes the removal of pests by using the fumes of numerous chemicals. It removes pests such as bacteria, weeds, nematodes, fungi, and other hard-to-remove pests. Fumigation products are highly poisonous. They produce noxious gases when exposed to air and moisture.

Fumigation Products Market size is projected to reach USD 1,124.77 Million by 2028 from an estimated USD 839.92 Million in 2021, growing at a CAGR of 4.26% globally.