Freediving Respiratory Systems Market Synopsis

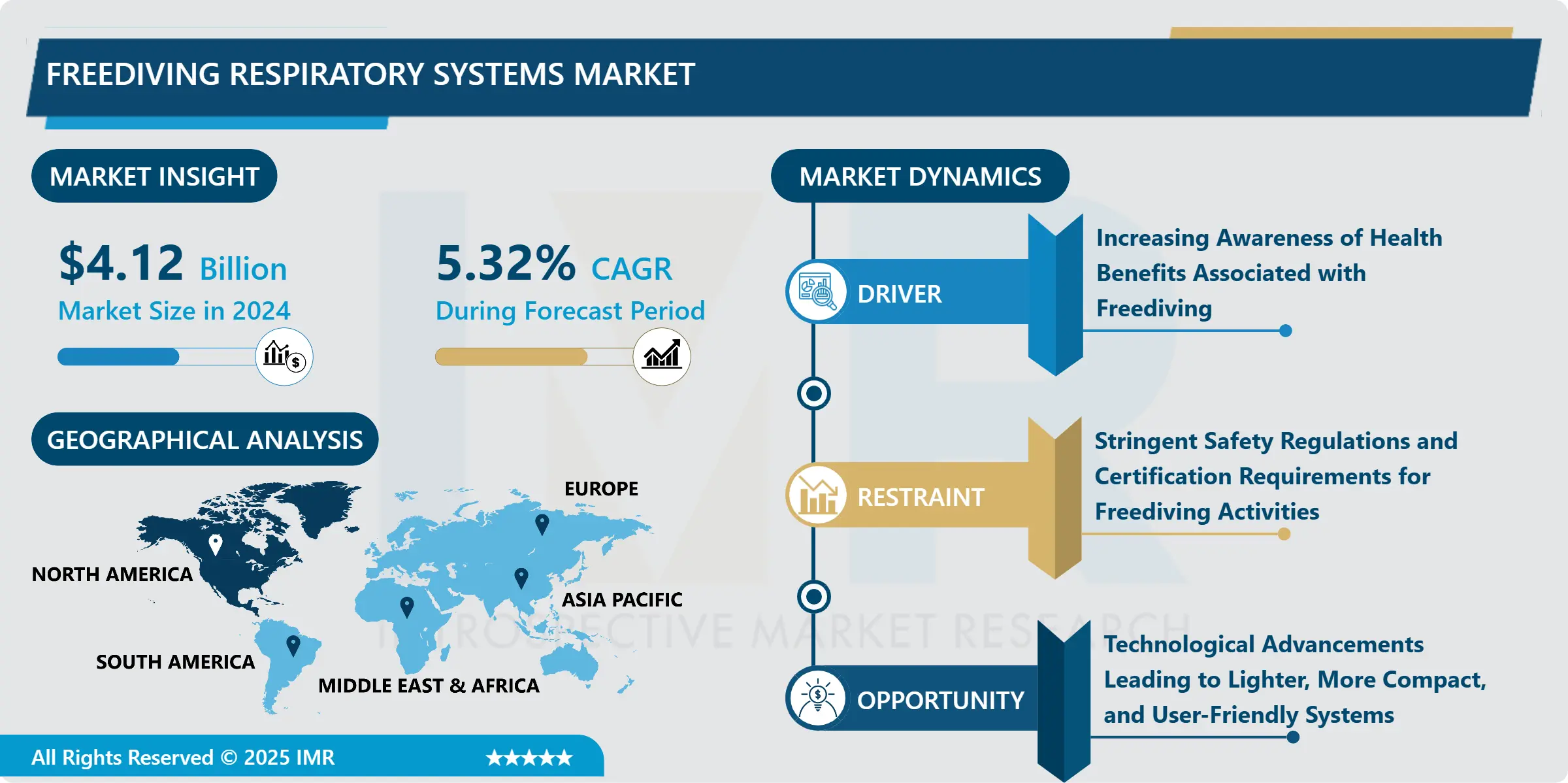

Freediving Respiratory Systems Market Size Was Valued at USD 4.12 Billion in 2024 and is Projected to Reach USD 7.29 Billion by 2035, Growing at a CAGR of 5.32% From 2025-2035.

Freediving respiratory systems are equipment designed for individuals engaging in breath-hold diving, providing a means to breathe underwater without scuba gear. These systems, including open-circuit, closed-circuit (rebreathers), and semi-closed-circuit variants, enable freedivers to explore underwater environments by supplying and managing air intake and exhalation during dives.

Freediving respiratory systems find application in various underwater activities, catering to recreational, competitive, and professional freedivers. These systems enable users to explore underwater environments without the bulk and constraints of traditional scuba gear, enhancing mobility and freedom during dives. The applications range from leisurely exploration and underwater photography to competitive freediving events and scientific research expeditions, where precise control of breathing and extended dive times is crucial.

In their ability to support breath-hold diving with efficient air supply and gas management. Closed-circuit systems, for instance, recycle exhaled air, allowing for longer dives and reduced gas consumption, thus enhancing safety and extending underwater exploration opportunities. Moreover, advancements in technology have led to lighter, more compact designs with improved functionalities, making these systems more accessible and user-friendly for divers of all skill levels.

The future demand growth for freediving respiratory systems is expected to rise steadily, driven by growing interest in water sports and adventure activities globally. As awareness about the benefits of freediving, such as physical fitness, mental relaxation, and environmental consciousness, increases, more individuals are likely to seek quality respiratory systems for their underwater adventures. Additionally, advancements in materials, safety features, and sustainability practices are anticipated to further fuel market expansion, offering innovative solutions to meet the evolving needs of the freediving community.

Freediving Respiratory Systems Market Trend Analysis:

Increasing Awareness of Health Benefits Associated with Freediving

- The growth of the Freediving Respiratory Systems Market is significantly driven by the increasing awareness of the health benefits associated with freediving. As more individuals recognize the physical and mental advantages of this water-based activity, there is a growing demand for high-quality respiratory systems that support safe and enjoyable freediving experiences. Freediving is often praised for its positive impact on cardiovascular fitness, respiratory health, and overall well-being, attracting enthusiasts seeking alternative ways to stay active and connected with nature.

- Moreover, the relaxation and stress-relief benefits of freediving contribute to its popularity among wellness enthusiasts and individuals looking for mindful activities. Freediving allows divers to immerse themselves in the underwater world, experiencing a sense of calmness and tranquility that can improve mental clarity and reduce anxiety. This aspect of freediving aligns with the broader trend of people prioritizing holistic approaches to health and seeking activities that promote mindfulness and relaxation.

- The awareness of environmental conservation and sustainable practices further drives the demand for freediving respiratory systems. As more divers become environmentally conscious, there is a preference for eco-friendly equipment that minimizes impact on marine ecosystems. Manufacturers responding to this demand by developing sustainable materials and technologies contribute to the overall growth of the Freediving Respiratory Systems Market, creating a synergy between health-conscious consumers and environmentally responsible practices.

Technological Advancements Leading to Lighter, More Compact, and User-Friendly Systems

- Technological advancements play a pivotal role in driving the growth of the Freediving Respiratory Systems Market by offering lighter, more compact, and user-friendly systems. These innovations not only enhance the overall diving experience but also attract a wider range of enthusiasts to the sport. The development of lightweight materials and advanced engineering techniques has led to the creation of respiratory systems that are more comfortable to wear, reducing fatigue during extended dives and improving overall maneuverability underwater.

- The trend towards compact designs is particularly advantageous as it allows divers to move more freely and explore underwater environments with greater ease. Compact systems also facilitate easier transport and storage, appealing to divers who value convenience and portability. Additionally, user-friendly features such as intuitive controls, quick-release mechanisms, and easy maintenance contribute to a positive diving experience, encouraging both beginners and experienced free divers to invest in quality respiratory equipment.

- With ongoing research and development focusing on improving efficiency, safety, and functionality. Manufacturers are exploring innovative solutions such as integrated communication systems, real-time data monitoring, and smart sensors to enhance the capabilities of freediving respiratory systems. As these advancements make diving more accessible and enjoyable, the market is poised to expand further, attracting new participants and driving demand for cutting-edge equipment tailored to the evolving needs of the freediving community.

Freediving Respiratory Systems Market Segment Analysis:

Freediving Respiratory Systems Market Segmented based on Type and Application

By Type, Closed Circuit segment is expected to dominate the market during the forecast period

- The closed-circuit segment is poised to dominate the growth of the Freediving Respiratory Systems Market. This segment offers significant advantages, such as extended dive times and reduced gas consumption, making it highly attractive to both professional divers and enthusiasts seeking longer underwater exploration experiences. Closed-circuit systems recycle exhaled air by removing carbon dioxide and replenishing oxygen, allowing divers to stay submerged for extended periods without the need for frequent resurfacing or gas refills.

- The dominance of the closed-circuit segment is further fueled by advancements in technology, leading to more efficient and reliable systems. These technological innovations include improved gas management algorithms, enhanced safety features, and streamlined designs that optimize performance without compromising comfort. As the demand for prolonged and safe freediving experiences continues to grow, the closed-circuit segment is well-positioned to meet these needs, driving market expansion and establishing itself as a preferred choice among freedivers worldwide.

By Application, the Recreational segment held the largest share of 57.25% in 2024

- The recreational segment has emerged as the leader, holding the largest share in the growth of the Freediving Respiratory Systems Market. This segment caters to individuals engaging in freediving as a leisure activity or hobby, driving significant demand for respiratory systems that offer both performance and ease of use. The popularity of recreational freediving is attributed to its accessibility, allowing people of various skill levels to experience underwater exploration and enjoy the tranquility of the marine environment.

- The increasing interest in water sports and adventure activities worldwide. As more people seek recreational activities that combine physical activity with relaxation and connection to nature, the demand for quality respiratory systems tailored to recreational freediving rises. Manufacturers focusing on designing user-friendly, durable, and affordable solutions for recreational divers are poised to capitalize on this growing segment, contributing to the overall expansion of the Freediving Respiratory Systems Market.

Freediving Respiratory Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is projected to take the lead as the dominant region for the growth of the Freediving Respiratory Systems Market. This expectation arises from several key factors, including the region's robust infrastructure for water sports and diving activities, coupled with a strong culture of adventure and exploration. Additionally, North America boasts a significant number of professional divers, enthusiasts, and training facilities, contributing to the growing demand for advanced and innovative respiratory systems tailored to diverse diving needs.

- Furthermore, the presence of leading manufacturers and suppliers in countries like the United States and Canada adds momentum to the market's growth in North America. These companies focus on developing cutting-edge technologies, enhancing safety features, and improving overall performance to meet the evolving requirements of the freediving community in the region. With a combination of favorable market conditions, technological advancements, and a thriving diving ecosystem, North America is poised to maintain its dominance and drive significant growth in the Freediving Respiratory Systems Market.

Freediving Respiratory Systems Market Top Key Players:

- Aqualung (U.S.)

- Oceanic Worldwide (U.S.)

- Atomic Aquatics (U.S.)

- Zeagle Systems (U.S.)

- Ocean Reef Inc. (U.S.)

- Aquatec (U.S.)

- Hollis Rebreathers (U.S.)

- Dive Rite (U.S.)

- Poseidon Diving Systems (Canada)

- Xdeep (Poland)

- Mares (Italy), and Other Major Players

Key Industry Development:

-

In June 3, 2023, Atomic Aquatics launched its latest innovation, the TFX Titanium Front Exhaust Regulator. Available now, the TFX regulator is engineered to provide the most natural and effortless breathing experience for divers, regardless of their attitude or position in the water. This groundbreaking product marks a significant advancement in diving technology.

- In September 2023, Aquatech Systems Asia Pvt. Ltd. of Pune, India, and Data Volt Information Technology Company of Riyadh, Saudi Arabia, signed an MOU for collaboration on water cooling and recycling technology. This post-G20 Summit agreement aims to design sustainable data centers with efficient cooling systems to reduce CO2 emissions.

|

Global Freediving Respiratory Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 4.12 Bn. |

|

Forecast Period 2025-35,CAGR: |

5.32% |

Market Size in 2035 : |

USD 7.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Freediving Respiratory Systems Market by Type (2018-2032)

4.1 Freediving Respiratory Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Open Circuit

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Closed Circuit

Chapter 5: Freediving Respiratory Systems Market by Application (2018-2032)

5.1 Freediving Respiratory Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Recreational

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Competition

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Freediving Respiratory Systems Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 APTARGROUP INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALBEA S.A. (FRANCE)

6.4 HCP PACKAGING (CHINA)

6.5 SILGAN DISPENSING SYSTEMS CORPORATION (USA)

6.6 LUMSON S.P.A. (ITALY)

6.7 FUSIONPKG (USA)

6.8 QUADPACK INDUSTRIES

6.9 S.A. (SPAIN)

6.10 LIBO COSMETICS COMPANY LTD. (CHINA)

6.11 RAEPAK LTD. (UNITED KINGDOM)

6.12 YONWOO COLTD. (SOUTH KOREA)

6.13 CCL INDUSTRIES INC. (CANADA)

6.14 RPC GROUP PLC (UNITED KINGDOM)

6.15 ABC PACKAGING LTD. (UNITED KINGDOM)

6.16 GRAHAM PACKAGING COMPANY (USA)

6.17 TAKEMOTO PACKAGING INC. (JAPAN)

6.18 3C INC. (USA)

6.19 APC PACKAGING (USA)

6.20 GERRESHEIMER AG (GERMANY)

6.21 STÖLZLE-OBERGLAS GMBH (AUSTRIA)

6.22 PLASTOHM (FRANCE)

6.23 INOTECH (SWITZERLAND)

6.24 MITANI VALVE COLTD. (JAPAN)

6.25 PKG GROUP

6.26 LLC (USA)

6.27 LANZHOU HELI TECHNOLOGY COLTD. (CHINA)

6.28 NINGBO VISION PLASTIC COLTD. (CHINA)

6.29 LUMSON USA (USA)

6.30 MEGA AIRLESS (FRANCE)

Chapter 7: Global Freediving Respiratory Systems Market By Region

7.1 Overview

7.2. North America Freediving Respiratory Systems Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Open Circuit

7.2.4.2 Closed Circuit

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Recreational

7.2.5.2 Competition

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Freediving Respiratory Systems Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Open Circuit

7.3.4.2 Closed Circuit

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Recreational

7.3.5.2 Competition

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Freediving Respiratory Systems Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Open Circuit

7.4.4.2 Closed Circuit

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Recreational

7.4.5.2 Competition

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Freediving Respiratory Systems Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Open Circuit

7.5.4.2 Closed Circuit

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Recreational

7.5.5.2 Competition

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Freediving Respiratory Systems Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Open Circuit

7.6.4.2 Closed Circuit

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Recreational

7.6.5.2 Competition

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Freediving Respiratory Systems Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Open Circuit

7.7.4.2 Closed Circuit

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Recreational

7.7.5.2 Competition

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Freediving Respiratory Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 4.12 Bn. |

|

Forecast Period 2025-35,CAGR: |

5.32% |

Market Size in 2035 : |

USD 7.29 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||