Formic Acid Market Synopsis

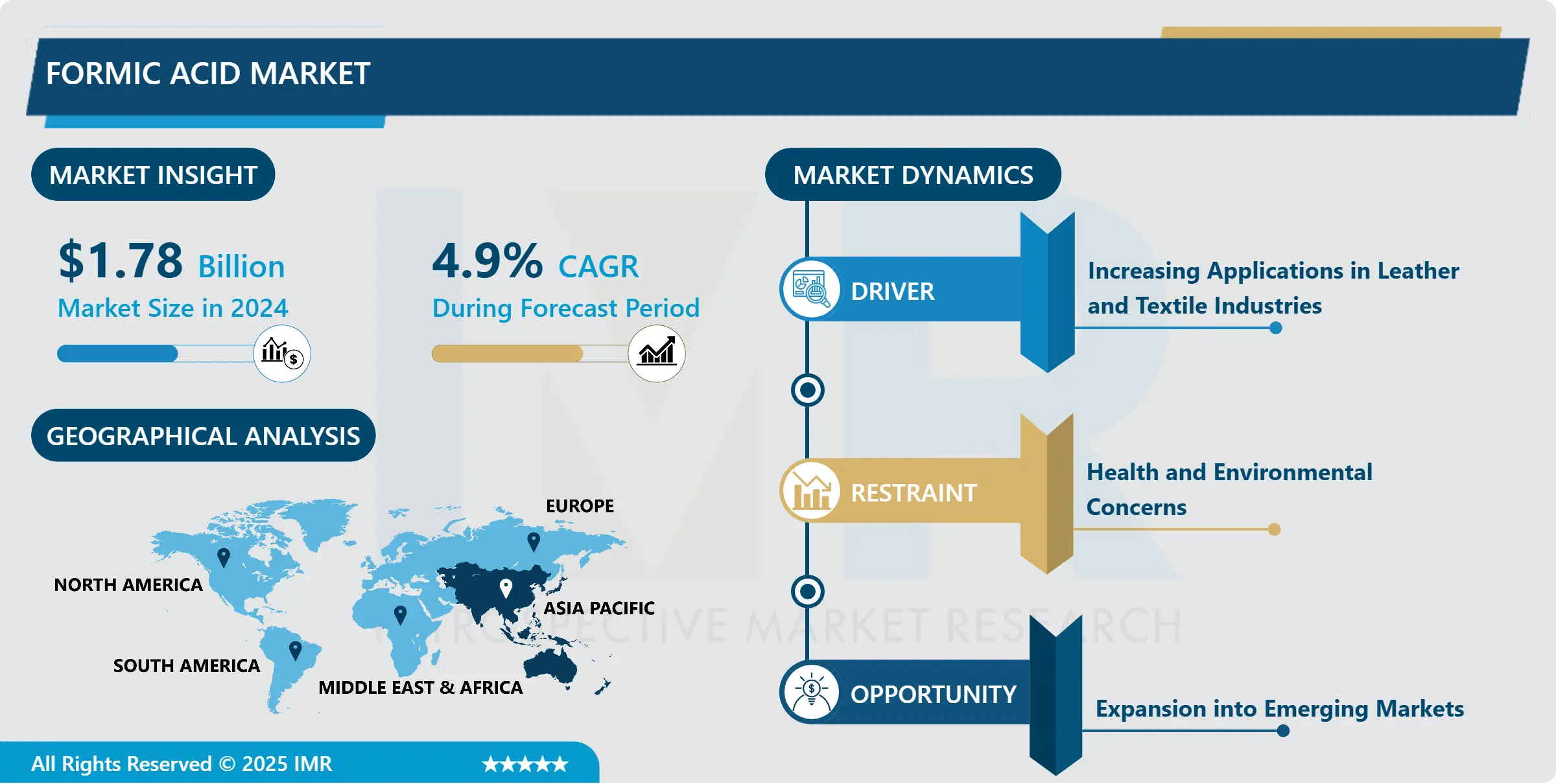

Formic Acid Market Size is Valued at USD 1.78 Billion in 2024 and is Projected to Reach USD 3.01 Billion by 2035, Growing at a CAGR of 4.9% From 2025-2035.

The formic acid market refers to the global trade and production of formic acid, a colourless, pungent liquid with the chemical formula HCOOH. It is primarily used in various industrial applications, including leather tanning, textile dyeing, and as a preservative and antibacterial agent in livestock feed. The market encompasses a range of activities, from the extraction and synthesis of formic acid to its distribution and utilization across multiple sectors, driven by its effectiveness as a preservative, reducing agent, and intermediary in chemical synthesis.

The global formic acid market is experiencing notable growth, driven by its extensive application across various industries such as agriculture, textiles, leather, rubber, and chemicals. Formic acid, recognized for its antibacterial and preservative properties, is particularly vital in the animal feed industry, where it is used to prevent spoilage and enhance the shelf life of silage and animal feed. The rising demand for animal-derived products, coupled with the need for sustainable agricultural practices, is fueling the growth of formic acid in this sector.

In addition to agriculture, the textile and leather industries are significant consumers of formic acid, utilizing it in dyeing and tanning processes. The rubber industry also benefits from formic acid as a coagulating agent for rubber latex. With increasing industrialization and the expansion of these end-use sectors, the demand for formic acid is expected to continue its upward trajectory.

Geographically, the Asia-Pacific region dominates the formic acid market, driven by robust growth in its agriculture and textile industries. China, in particular, is a major producer and consumer of formic acid, benefiting from its extensive industrial base and agricultural activities. Europe and North America also represent significant markets, with a focus on eco-friendly and sustainable products contributing to the demand for formic acid in these regions.

However, the market faces challenges such as fluctuating raw material prices and environmental concerns associated with the production of formic acid. Nevertheless, advancements in production technologies and the development of bio-based formic acid are expected to mitigate these challenges, providing new growth opportunities for market players.

Overall, the global formic acid market is poised for steady growth, supported by its diverse applications and the increasing demand for sustainable solutions across various industries.

Formic Acid Market Trend Analysis

Growing Agricultural Use and Industrial Applications Propel Formic Acid Market Expansion

- The agricultural sector is a key driver of the formic acid market, with its application as a silage preservative and animal feed additive gaining considerable traction. Formic acid's ability to inhibit bacterial growth and mold formation in silage is crucial for preserving the nutritional quality of animal feed, which in turn supports better livestock health and productivity. The growing global emphasis on food security and sustainable agriculture has further boosted the adoption of formic acid in farming practices. In addition to preserving feed, formic acid's role in promoting feed efficiency and reducing the need for antibiotics in animal husbandry aligns with the broader trend toward more natural and eco-friendly farming solutions. This trend is particularly strong in regions with large agricultural bases, such as Europe and Asia-Pacific, where there is a heightened focus on enhancing livestock performance while minimizing environmental impact.

- In the leather and textile industries, formic acid's eco-friendly characteristics have made it a preferred choice for tanning and dyeing processes. Unlike traditional chemicals, formic acid is less harmful to the environment, which is becoming increasingly important as industries face stricter environmental regulations and consumer demand for sustainable products. The use of formic acid in leather tanning not only helps in achieving high-quality finished products but also reduces the environmental footprint of the production process. Similarly, in the textile industry, formic acid is valued for its effectiveness in dyeing processes, ensuring vibrant and long-lasting colors while minimizing the use of harsh chemicals. The expansion of the automotive and construction sectors has also spurred the demand for rubber, where formic acid plays a crucial role as a coagulant in latex processing. The growth in these industries, particularly in emerging economies, is expected to further propel the demand for formic acid, underscoring its importance across diverse industrial applications.

Formic Acid's Vital Role in Sustainable Leather, Textile, and Rubber Industries

- In the leather industry, formic acid has emerged as a crucial component in tanning processes, owing to its ability to facilitate the efficient removal of impurities from hides and skins. This not only enhances the quality of the leather but also contributes to a more sustainable production process by reducing the reliance on more toxic chemicals traditionally used in tanning. The environmental benefits of formic acid are particularly significant as the leather industry faces increasing pressure to adopt greener practices. By using formic acid, manufacturers can lower their environmental footprint, comply with stringent regulations, and appeal to eco-conscious consumers who are demanding products that are produced with minimal environmental impact. Furthermore, formic acid's efficiency in leather processing leads to improved yields and higher-quality leather, which is essential in meeting the demands of luxury brands and high-end markets where quality and sustainability are paramount.

- In the textile industry, formic acid's role in dyeing processes is equally important, particularly as the industry shifts toward more sustainable practices. Formic acid is highly effective in fixing dyes to fabrics, ensuring that colors remain vibrant and resistant to fading over time. This is especially valuable in the production of textiles for fashion and home furnishings, where color fastness is a critical quality attribute. The use of formic acid in dyeing also aligns with the growing trend of reducing the environmental impact of textile production, as it minimizes the need for harsher chemicals that can be harmful to both the environment and workers. The global expansion of the automotive and construction sectors has further bolstered the demand for rubber, where formic acid is integral in latex coagulation. This process is essential for producing the high-quality rubber required in a wide range of applications, from automotive tires to construction materials. As emerging economies continue to industrialize, the demand for formic acid in these sectors is expected to rise, reinforcing its importance as a versatile and environmentally friendly chemical in various industrial applications.

Formic Acid Market Segment Analysis:

Market Name Market Segmented based on By Grade and By Application.

By Grade, 99% segment is expected to dominate the market during the forecast period

- The 90% to 99% grades, particularly the 94% and 99% concentrations, play a critical role in industries where high purity is paramount. These grades are often chosen for applications that demand stringent quality controls and precision, such as in rubber processing and specialized intermediate chemical production. In rubber processing, the purity of these grades ensures that the chemical reactions occurring during vulcanization and other manufacturing processes are consistent and free from contaminants. This is especially important in producing high-performance rubber products, such as automotive tires, seals, and gaskets, where even minor impurities can lead to significant variations in product quality, durability, and performance. The consistent quality afforded by these high-purity grades helps manufacturers meet stringent industry standards and deliver products that perform reliably under stress, heat, and other demanding conditions.

- In addition to rubber processing, these high-grade concentrations are essential in the production of specialized chemical intermediates. These intermediates often serve as the building blocks for pharmaceuticals, agrochemicals, and other fine chemicals. The use of 94% and 99% grades ensures that the resulting intermediates are of the highest quality, with minimal impurities that could otherwise affect subsequent reactions or the efficacy of the final products. In industries like pharmaceuticals, where even trace impurities can have significant implications for safety and efficacy, the reliance on these high-purity grades is crucial. The demand for these grades is therefore driven by industries that prioritize quality, precision, and reliability, particularly in regions with advanced manufacturing capabilities and stringent regulatory environments, such as North America, Europe, and parts of Asia.

By Application, Leather & textile processing segment held the largest share in 2023

- The leather and textile processing sector is a significant consumer of mid to high-grade products, particularly those ranging from 75% to 85% purity. These grades are essential in various stages of leather tanning and textile finishing, where the chemical processes require consistent and reliable inputs to achieve the desired quality in the final products. In leather processing, for instance, high-purity grades are crucial for ensuring uniform penetration of chemicals during tanning, which directly affects the texture, durability, and appearance of the leather. Similarly, in textile processing, these grades are used in bleaching, dyeing, and finishing processes to ensure that fabrics retain their color, strength, and feel. The use of high-purity grades minimizes the risk of defects, such as uneven coloration or weakening of the material, which can result from impurities in the chemical agents used.

- The demand for these grades is particularly robust in countries like India and China, which are global hubs for leather and textile manufacturing. These countries have large, established industries that cater to both domestic and international markets, supplying everything from luxury leather goods to mass-produced textiles. The emphasis on high-purity grades in these regions is driven by the need to meet international quality standards and maintain competitiveness in the global market. Additionally, as these industries increasingly adopt more advanced and sustainable processing techniques, the demand for high-grade products that offer greater efficiency and environmental benefits is also growing. This focus on quality and sustainability reinforces the importance of mid to high-grade products in the leather and textile processing sectors, ensuring that manufacturers can consistently produce high-quality goods that meet the expectations of discerning consumers worldwide.

Formic Acid Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region's dominance in the global formic acid market is underpinned by several key factors. Agriculture plays a pivotal role, with formic acid being widely used as a preservative in silage and animal feed, crucial for the region's large-scale livestock farming. China and India, two of the largest agricultural economies in the world, are at the forefront of this demand. These countries have vast agricultural operations that require efficient preservation methods, making formic acid an essential component. Additionally, the growing emphasis on improving agricultural productivity and ensuring food security has further increased the demand for formic acid as a cost-effective and efficient preservative.

- Beyond agriculture, the region's thriving textile, leather, and rubber industries are significant contributors to the market's growth. China, with its robust industrial base, is the largest consumer of formic acid, using it extensively in leather tanning and rubber processing. The leather industry, particularly in China and India, benefits from formic acid's ability to improve the quality and durability of leather products. Moreover, the rapid industrialization and urbanization across the Asia-Pacific have led to an increase in infrastructure projects, further driving the demand for rubber, where formic acid is used in coagulation processes. This multifaceted demand across various industries positions the Asia-Pacific region as a critical player in the global formic acid market.

Active Key Players in the Formic Acid Market

- BASF SE

- Eastman Chemical Company

- Perstorp, Feicheng Acid Chemicals Co., Ltd.,

- Chongqing Chuandong Chemical (Group) Co., Ltd.,

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC),

- LUXI GROUP, Other Active Players

Key Industry Developments in the Formic Acid Market:

- In March 2021, BASF SE announced an increase in formic acid prices in North America for all grades, which would be USD 0.05 per pound.

|

Global Formic Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.7 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.9% |

Market Size in 2035: |

USD 2.59 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Formic Acid Market by Grade (2018-2035)

4.1 Formic Acid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 20%

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 25%

4.5 40%

4.6 60%

4.7 70%

4.8 75%

4.9 85%

4.10 90%

4.11 94%

4.12 99%

Chapter 5: Formic Acid Market by Application (2018-2035)

5.1 Formic Acid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Leather & textile processing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Agriculture

5.5 Animal Feed

5.6 Poultry

5.7 Swine

5.8 Ruminants

5.9 Aquatic

5.10 Cleaning

5.11 Coating

5.12 Rubber

5.13 Intermediate

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Formic Acid Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BASF SE

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EASTMAN CHEMICAL COMPANY

6.4 PERSTORP

6.5 FEICHENG ACID CHEMICALS COLTD.

6.6 CHONGQING CHUANDONG CHEMICAL (GROUP) COLTD. GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED (GNFC)

6.7 LUXI GROUP

6.8

Chapter 7: Global Formic Acid Market By Region

7.1 Overview

7.2. North America Formic Acid Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Grade

7.2.4.1 20%

7.2.4.2 25%

7.2.4.3 40%

7.2.4.4 60%

7.2.4.5 70%

7.2.4.6 75%

7.2.4.7 85%

7.2.4.8 90%

7.2.4.9 94%

7.2.4.10 99%

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Leather & textile processing

7.2.5.2 Agriculture

7.2.5.3 Animal Feed

7.2.5.4 Poultry

7.2.5.5 Swine

7.2.5.6 Ruminants

7.2.5.7 Aquatic

7.2.5.8 Cleaning

7.2.5.9 Coating

7.2.5.10 Rubber

7.2.5.11 Intermediate

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Formic Acid Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Grade

7.3.4.1 20%

7.3.4.2 25%

7.3.4.3 40%

7.3.4.4 60%

7.3.4.5 70%

7.3.4.6 75%

7.3.4.7 85%

7.3.4.8 90%

7.3.4.9 94%

7.3.4.10 99%

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Leather & textile processing

7.3.5.2 Agriculture

7.3.5.3 Animal Feed

7.3.5.4 Poultry

7.3.5.5 Swine

7.3.5.6 Ruminants

7.3.5.7 Aquatic

7.3.5.8 Cleaning

7.3.5.9 Coating

7.3.5.10 Rubber

7.3.5.11 Intermediate

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Formic Acid Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Grade

7.4.4.1 20%

7.4.4.2 25%

7.4.4.3 40%

7.4.4.4 60%

7.4.4.5 70%

7.4.4.6 75%

7.4.4.7 85%

7.4.4.8 90%

7.4.4.9 94%

7.4.4.10 99%

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Leather & textile processing

7.4.5.2 Agriculture

7.4.5.3 Animal Feed

7.4.5.4 Poultry

7.4.5.5 Swine

7.4.5.6 Ruminants

7.4.5.7 Aquatic

7.4.5.8 Cleaning

7.4.5.9 Coating

7.4.5.10 Rubber

7.4.5.11 Intermediate

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Formic Acid Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Grade

7.5.4.1 20%

7.5.4.2 25%

7.5.4.3 40%

7.5.4.4 60%

7.5.4.5 70%

7.5.4.6 75%

7.5.4.7 85%

7.5.4.8 90%

7.5.4.9 94%

7.5.4.10 99%

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Leather & textile processing

7.5.5.2 Agriculture

7.5.5.3 Animal Feed

7.5.5.4 Poultry

7.5.5.5 Swine

7.5.5.6 Ruminants

7.5.5.7 Aquatic

7.5.5.8 Cleaning

7.5.5.9 Coating

7.5.5.10 Rubber

7.5.5.11 Intermediate

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Formic Acid Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Grade

7.6.4.1 20%

7.6.4.2 25%

7.6.4.3 40%

7.6.4.4 60%

7.6.4.5 70%

7.6.4.6 75%

7.6.4.7 85%

7.6.4.8 90%

7.6.4.9 94%

7.6.4.10 99%

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Leather & textile processing

7.6.5.2 Agriculture

7.6.5.3 Animal Feed

7.6.5.4 Poultry

7.6.5.5 Swine

7.6.5.6 Ruminants

7.6.5.7 Aquatic

7.6.5.8 Cleaning

7.6.5.9 Coating

7.6.5.10 Rubber

7.6.5.11 Intermediate

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Formic Acid Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Grade

7.7.4.1 20%

7.7.4.2 25%

7.7.4.3 40%

7.7.4.4 60%

7.7.4.5 70%

7.7.4.6 75%

7.7.4.7 85%

7.7.4.8 90%

7.7.4.9 94%

7.7.4.10 99%

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Leather & textile processing

7.7.5.2 Agriculture

7.7.5.3 Animal Feed

7.7.5.4 Poultry

7.7.5.5 Swine

7.7.5.6 Ruminants

7.7.5.7 Aquatic

7.7.5.8 Cleaning

7.7.5.9 Coating

7.7.5.10 Rubber

7.7.5.11 Intermediate

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Formic Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.7 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.9% |

Market Size in 2035: |

USD 2.59 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||