Forensic Swab Market Synopsis:

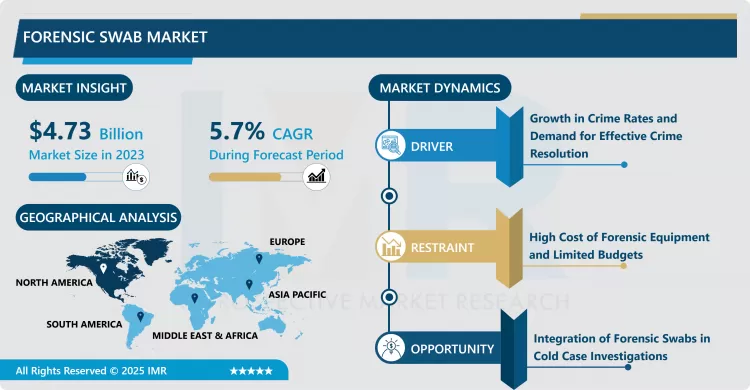

Forensic Swab Market Size Was Valued at USD 4.73 Billion in 2023, and is Projected to Reach USD 7.79 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

The products considered under the scope of the Forensic Swab Market include tools deployed to in forensic services specifically for the collection and preservation of biological samples including DNA, blood and other elements from several crime scenes. These swabs are meant to preserve the samples collected to allow forensic analysis to be accurate and come out as expected. Common in police work and in criminal investigation, forensic swabs play an inestimable role in crime solving in that they help to pinpoint suspects, and provide tangible proof in law.

The market for the forensic swab has been rapidly expanding in the last few years due to the development of DNA analysis technology, the growth in the crime rate and crime solving, and new attention to both solved old and new cases. These specialized swabs are part of the whole forensic procedure, because they make sure that sample material is collected in the most appropriate way, that would not contaminate the biological material and would allow for better analysis of the material collected. Forensic swabs are made in a way that reduces the chance of contamination, something that is very vital in order to ensure that evidence will be admissible in any court of law.

Forensic swabs are in different varieties which may be sterile type and non-sterile ones depending on the for use in the forensic procedure. For instance, sterile swabs are mostly used when it comes to DNA collection in order to reduce contamination factors always associated with such samples, while non-sterile swabs may be used in cases where the samples collected will not affect other subtleties of similar nature. The usage embraces crime scene traces sampling, some of the swabs which are left specially for use in samples such as skin scrapings or body fluids, as well as the forensic laboratory analysis and DNA profiling. The market has continued gowing due to the advancement in technology that sees a realization of new types of forensic swabs in order to meet the market need for improved sample collection and preservation. Moreover, as law enforcement departments in different countries employ progressively diversified methods of forensic analysis, there will be a great need in highly efficient forensic swabs.

Forensic Swab Market Trend Analysis:

Rising Demand for DNA Analysis in Forensics

- In forensic swab market, it has been observed a rising tendency of replacing traditional methods by DNA analysis in criminal trials. With DNA profiling slowly making its way into the mainstream, law enforcement agencies pointed to what can be described as increased need for specialized forensic swabs designed specifically for DNA sample collection. F actually DNA is very useful in a way that enables police accurately identify suspects, support witnesses and ensure that suspects are booked by linking them to a particular scene due to evidence. This has forced manufacturers to come up with swabs that not only accumulate the DNA in the best way but also avoid degradation of the DNA sample, contamination by other matter or any interference from other materials.

- It has also provided impetus to undertake research and development undertake on DNA friendly swabs which can pick up even the slightest deposit of biological matter. Consequently, forensic swabs have been developed to meet the requirements of the crime laboratory, thus containing pre-coated, non-portable, and aseptic designs that help maintain samples. A status of DNA profiling is expected to further increase the driving force of the forensic swab market, with significant emphasis on better accuracy in swab samples.

Integration of Forensic Swabs in Cold Case Investigations

- A great trend in the forensic swab market is the increasing open and review of old cases with the new and improved science of forensic science. Since the kinds of DNA tests have enhanced over the years, the police can now reopen previously unsolved crimes from several years back and analyze the samples afresh by states of the art technology. Forensic swabs have essentially become instrumental in the process in that they enable investigators to access cells that previously may have been brushed over or contaminated by CSI.

- As people’s focus on justice increases, more and more ministries and private enterprises have set up funds and personnel to work for cold cases. This change has led to the need to use forensic swabs that are capable of storing samples for long times perhaps in harsh environments. Forced swab manufacturers are well suited for developing this emerging market and assist justice initiatives around the world by offering easily assemblable, highly reliable and contaminant free sample acquisition.

Forensic Swab Market Segment Analysis:

Forensic Swab Market is Segmented on the basis of type, application, end user, and region

By Type, Sterile Swabs segment is expected to dominate the market during the forecast period

- Sterile and non-sterile swabs are the two broad categories of forensic swabs depending with the kind of forensic use. There are sterile swabs that are useful for DNA and other biological evidence since cases may drag for long, and the swabs help minimize interferences that may tend to lower the evidential value of collected samples. Such swabs are used in crime scenes and for lab purposes, where any object of interest is swabbed to avoid interference of the actual results by unwanted artifacts.

- Sterile swab on the other hand are slightly more expensive than the non-sterile swabs but are useful where contamination is likely to cause a significant compromise to the outcome of any analysis that may be carried out…this may for instance be a case where a initial search for trace evidence is being conducted. The variety of swab means that the forensic teams can make their choices depending on the type of the evidence and the kind of test that needs to be conducted while at the same time being flexible in terms of cost and usage.

By Application, Crime Scene Investigation segment expected to held the largest share

- Such uses of forensic swabs involve crime scene swabbing, forensic swab sample, swab DNA collection, swab trace evidence, and swab purposes in connection with other forensic work. One major use with the swabs is in a crime scene, as the swabs are ideal for taking samples directly at the scene so that an item of evidence such as blood or saliva is not contaminated.

- In the forensic laboratory, these swabs are employed in transferring samples to delicate tests which include DNA profiling that has to be done on samples that have not been contaminated. Other applications such as collection, of trace evidence also reveal the variety of uses of forensic swabs making it suitable for use at different stages of examination.

Forensic Swab Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The forensic swab market is presently most focused in North America due in part to better funding for the police force, technological germane to forensic products, and a solid network of forensic systems in the region. For instance, the U.S is a key player when it comes to forensic science especially in its crime fighting strategies and it more so budgets hugely on DNA and crucial crime scene investigation. It guarantees that police forces from across North America are equipped with state of the art forensic swabs and equipment that aids comprehensive crime fighting.

- The above factors are complemented by positive regulatory environment that supports the development of forensic science and collaborations with forensic related bodies which enable the application advanced forensic solutions. The well-developed infrastructure and R&D focus to remain unchanged, the industry expects North America to lead in the development of the forensic swab market.

Active Key Players in the Forensic Swab Market

- 3M (USA)

- Becton, Dickinson, and Company (USA)

- Thermo Fisher Scientific, Inc. (USA)

- Copan Diagnostics, Inc. (USA)

- MWE (UK)

- Puritan Medical Products (USA)

- Sirchie (USA)

- Lynn Peavey Company (USA)

- FL Medical (Italy)

- Mediclone Biotech (India)

- Dynarex Corporation (USA)

- Super Brush LLC (USA)

- Other Active Players

Key Industry Developments in the Forensic Swab Market:

- On May 14, 2024, the state forensic laboratory's utilization of advanced DNA technology has resulted in the resolution of two cold cases in Hampton Roads, as DNA evidence played a pivotal role in cracking these formerly unsolved crimes

- In April 2024, according to published article Recent advancements in DNA technologies have made it possible to collect touch DNA from evidence previously inaccessible. Collaboration between investigators and medical examiner and coroner (MEC) personnel is vital in identifying areas on a victim's body where a suspect may have left DNA traces. Standardizing the proactive collection of body swabs for touch DNA in all suspicious deaths and homicides can greatly enhance forensic investigations and increase the chances of resolving violent crimes.

|

Forensic Swab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.73 Billion |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 7.79 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Forensic Swab Market by Type (2018-2032)

4.1 Forensic Swab Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sterile Swabs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Sterile Swabs

Chapter 5: Forensic Swab Market by Material (2018-2032)

5.1 Forensic Swab Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cotton

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Foam

5.5 Synthetic

5.6 Other

Chapter 6: Forensic Swab Market by Application (2018-2032)

6.1 Forensic Swab Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Crime Scene Investigation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Forensic Laboratory Analysis

6.5 DNA Collection

6.6 Trace Evidence Collection

6.7 Other

Chapter 7: Forensic Swab Market by End User (2018-2032)

7.1 Forensic Swab Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Law Enforcement Agencies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Forensic Laboratories

7.5 Hospitals & Clinics

7.6 Research Institutions

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Forensic Swab Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 3M (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BECTON

8.4 DICKINSON

8.5 AND COMPANY (USA)

8.6 THERMO FISHER SCIENTIFIC INC. (USA)

8.7 COPAN DIAGNOSTICS INC. (USA)

8.8 MWE (UK)

8.9 PURITAN MEDICAL PRODUCTS (USA)

8.10 SIRCHIE (USA)

8.11 LYNN PEAVEY COMPANY (USA)

8.12 FL MEDICAL (ITALY)

8.13 MEDICLONE BIOTECH (INDIA)

8.14 DYNAREX CORPORATION (USA)

8.15 SUPER BRUSH LLC (USA)

8.16 OTHER ACTIVE PLAYERS

Chapter 9: Global Forensic Swab Market By Region

9.1 Overview

9.2. North America Forensic Swab Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Sterile Swabs

9.2.4.2 Non-Sterile Swabs

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Cotton

9.2.5.2 Foam

9.2.5.3 Synthetic

9.2.5.4 Other

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Crime Scene Investigation

9.2.6.2 Forensic Laboratory Analysis

9.2.6.3 DNA Collection

9.2.6.4 Trace Evidence Collection

9.2.6.5 Other

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Law Enforcement Agencies

9.2.7.2 Forensic Laboratories

9.2.7.3 Hospitals & Clinics

9.2.7.4 Research Institutions

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Forensic Swab Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Sterile Swabs

9.3.4.2 Non-Sterile Swabs

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Cotton

9.3.5.2 Foam

9.3.5.3 Synthetic

9.3.5.4 Other

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Crime Scene Investigation

9.3.6.2 Forensic Laboratory Analysis

9.3.6.3 DNA Collection

9.3.6.4 Trace Evidence Collection

9.3.6.5 Other

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Law Enforcement Agencies

9.3.7.2 Forensic Laboratories

9.3.7.3 Hospitals & Clinics

9.3.7.4 Research Institutions

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Forensic Swab Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Sterile Swabs

9.4.4.2 Non-Sterile Swabs

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Cotton

9.4.5.2 Foam

9.4.5.3 Synthetic

9.4.5.4 Other

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Crime Scene Investigation

9.4.6.2 Forensic Laboratory Analysis

9.4.6.3 DNA Collection

9.4.6.4 Trace Evidence Collection

9.4.6.5 Other

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Law Enforcement Agencies

9.4.7.2 Forensic Laboratories

9.4.7.3 Hospitals & Clinics

9.4.7.4 Research Institutions

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Forensic Swab Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Sterile Swabs

9.5.4.2 Non-Sterile Swabs

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Cotton

9.5.5.2 Foam

9.5.5.3 Synthetic

9.5.5.4 Other

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Crime Scene Investigation

9.5.6.2 Forensic Laboratory Analysis

9.5.6.3 DNA Collection

9.5.6.4 Trace Evidence Collection

9.5.6.5 Other

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Law Enforcement Agencies

9.5.7.2 Forensic Laboratories

9.5.7.3 Hospitals & Clinics

9.5.7.4 Research Institutions

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Forensic Swab Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Sterile Swabs

9.6.4.2 Non-Sterile Swabs

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Cotton

9.6.5.2 Foam

9.6.5.3 Synthetic

9.6.5.4 Other

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Crime Scene Investigation

9.6.6.2 Forensic Laboratory Analysis

9.6.6.3 DNA Collection

9.6.6.4 Trace Evidence Collection

9.6.6.5 Other

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Law Enforcement Agencies

9.6.7.2 Forensic Laboratories

9.6.7.3 Hospitals & Clinics

9.6.7.4 Research Institutions

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Forensic Swab Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Sterile Swabs

9.7.4.2 Non-Sterile Swabs

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Cotton

9.7.5.2 Foam

9.7.5.3 Synthetic

9.7.5.4 Other

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Crime Scene Investigation

9.7.6.2 Forensic Laboratory Analysis

9.7.6.3 DNA Collection

9.7.6.4 Trace Evidence Collection

9.7.6.5 Other

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Law Enforcement Agencies

9.7.7.2 Forensic Laboratories

9.7.7.3 Hospitals & Clinics

9.7.7.4 Research Institutions

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Forensic Swab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.73 Billion |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 7.79 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||