Global Food Stabilizer Market Overview

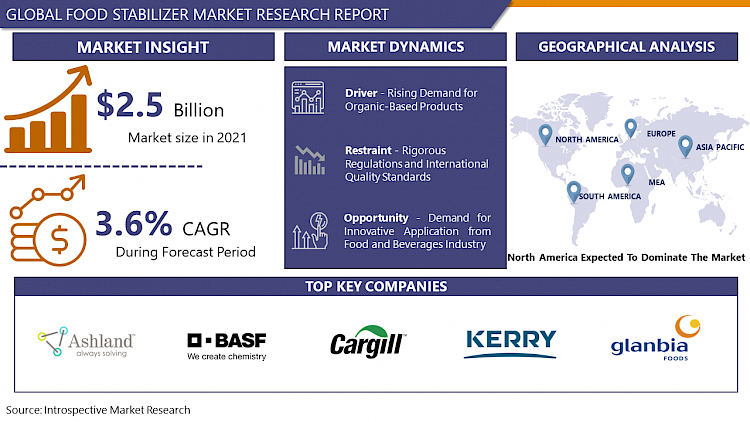

Global Food Stabilizer Market size was valued at USD 2.61 Billion in 2022, and is projected to reach USD 3.63 Billion by 2030, growing at a CAGR of 4.2% from 2023 to 2030.

Food Stabilizer are substances that help in increasing stability and thickness by helping foods retain their physical characteristics and remain in an emulsion. Substances that normally do not mix, such as water and oil, need stabilizer. Many low-fat foods are dependent on stabilizer. Food stabilizer are substances mostly produced from naturally occurring raw materials and they maintain the food's physiochemical state. Growing consumer awareness towards safe and healthy food products is an important factor enhancing the market growth effectively. Furthermore, rise in alcoholic beverage consumption in North America and APAC and rise in choices of consumption of processed and convenience foods in this region are contributing to the rising market growth. However various key factors such as increasing disposable wastes income, increasing adoption of food stabilizer in a wide range of food products such as beverages, sauces and bakery among others and rising demand for food stabilizer in the confectionery and dairy are thereby projected to boost the growth of food stabilizer market. Additionally, increasing modernization and rising research and development activities in the new products offered in the food stabilizer market will create new opportunities and expand the growth in the forecasted period.

Market Dynamics And Factors For Food Stabilizer Market

Drivers:

Rising Demand for Organic-Based Products

Expanding global population, the growing harm to the safety of food supplies and usage, and the intense growth of the middle-class population in different developing nations, are the major driving producers and factors of food and beverages. These factors help focus on developing creative and innovative solutions to meet the emerging trends and challenges. For instance, xanthan is mostly used in bakery products as it helps in the retention of water in baking food and thus increases the shelf life of the food products. Another effective trend driving market growth and expansion is the increasing consumer fondness for food and beverage products that are highly processed. Moreover, changing lifestyles, trends, and improvement in the economic scenario has added to an increase in the number of customers eating in hotels and restaurants, which often use various additional ingredients to improve food aesthetics. Also, the increasing demand for stabilizer in bakery food products convenience food and beverages is expected to enhance the market growth in various developed countries.

Restraints:

Rigorous Regulations and International Quality Standards

International bodies like the World Health Organization (WHO), National Food Safety and Quality Service (SENASA), U.S. Food and Drug Administration (FDA), Canadian Food Inspection Agency (CFIA), and Committee on the Environment, Food Safety (EU), and Public Health are associated with food safety rules and regulations. These International Bodies have control over the application of different materials and chemicals used in food processing, indirectly or directly. With strict international regulations, regulatory and complete approval of a food ingredient is important. Without approval of the suitable government bodies, the food additive has function or market in food. Obtaining statutory approval for a new food ingredient is becoming comparatively expensive and a stagnant process.

Opportunity:

Demand for Innovative Application from Food and Beverages Industry

Food ingredients and food additives are crucial for manufacturing of processed products, which drives the markets. The growing market demand for food products is driven by the economic development and increasing population. The ever-widening global population enforces pressure on obtainability of scarce resources. Rising raw material costs and High energy prices impact food prices directly or indirectly, thus influencing low-income consumers. The increasing market for food products such as meat products, bakery, beverages, and convenience food are estimated to offer tremendous growth opportunities for the stabilizer blends and systems market. Consumers in developing nations are characterized by emerging change in lifestyles and higher income, which helps in driving the market for processed food products.

Challenges:

Rise in Raw Material Prices

Hydrocolloids are the raw materials for blends and systems. The prices in such type of raw materials have been varying again and again, resulting in instability in the market. A natural raw source for Hydrocolloid namely Seaweed is available in the market which is further used in food & beverages for various processes like gelling, stabilizing, thickening, and others. The rates of hydrocolloid raw materials impact the price of the hydrocolloids, which directly or indirectly affects the price of the end food product. Gum sources like the agar, alginates, carrageenan, etc. are also obtained from seaweed. When preferring gum sources for such usages as ice cream and tortillas, formulators mainly consider price factor. This increase in prices of raw material will give rise to the operational and product costs of food stabilizer manufacturers.

Segmentation Analysis Of Food Stabilizer Market

By Source, the plant segment is estimated to dominate the market and be the fastest-growing during the forecasted period. The plant segment is rapidly growing due to the increasing demand for various natural ingredients as well as increase in trend for varied vegan food. Consumer’s attitude and perception towards the nutritional factors of plant-sourced food stabilizer have also been enhancing the adoption rate of such naturally sourced stabilizer. Food & beverage producers and manufacturers prefer plant-sourced food stabilizer in order to fulfil the consumer's rising demand for natural food additives. Thus, the plant segment is expected to continue its dominance in the upcoming years.

By Application, the food stabilizer market was expected to dominate by the dairy & dairy products segment. There has been an enormous increase in the application of food stabilizer in many dairy products such as frozen desserts and ice-creams, and flavoured milk. Food Stabilizer such as carrageenan and guar gum are the most used ingredients for dairy applications, and with the growing innovations in dairy products industry, the market for dairy products and dairy is expected to dominate in the forecasted time. In the food and the food stabilizer industry, the demand for dairy & dairy products is rapidly growing due to the changing trends, lifestyles and eating habits thereby fuelling the growth of food stabilizer market.

By Function, the texturizing segment is predicted to dominate the market to account for the highest share in the food stabilizer market. In the food industry, the usage of food stabilizer is helping widely for the improvement of the appearance of the product, which, in turn, boosts the buying nature of consumers to purchase their products. The texturizing segment also finds an opportunity in many food and confectionary industries, which thereby boosts the food stabilizer market growth. Thus, the demand for such texturizing segment and the stabilizer in the food industry is increasing rapidly.

Regional Analysis Of Food Stabilizer Market

North America is estimated to dominate the food stabilizer market in the upcoming year. Developed economies in the North America is projected to dominate the market growth due to the increasing demand for convenience and packaged foods and the growing awareness among people for the healthy food. The food processing industries which are very well-established and the presence of innumerable large-scale food companies in the United States remain a significant driving force for the food stabilizer market. This US region is witnessing secured increase in demand for natural food stabilizer, because of the growing awareness about natural and healthy foods among consumers.

Asia Pacific expected to grow significantly in the Food Stabilizer Market during forecasted period. China being the world`s second largest economic country, is projected to grow rapidly through the forecasted period. China, with the development of emerging technologies, holds more than 40 pectin authorized manufacturers and producers. The resources for extracting pectin are apple pomace and citrus. Although, being the developing country, China still can’t meet the rising demands of the market due to the low utilization rate of materials. The improved infrastructure on Research & Development sector to develop new, flavors, textures, products, tastes is slowly improvising in the country. The domestic pectin output is expected to grow rapidly in the next few years which is impactful in driving the growth of the Food Stabilizer Market. Kappa is the majorly utilized carrageenan in China, as it acts as a natural Food stabilizer, bodying agent and emulsifier in ice cream, cheese, chocolate, and puddings.

Europe region is anticipated to grow rapidly in the forecasted years due to the increasing consumption of ready-to-drink and ready-to-eat beverages has extended the application of various food stabilizer in the European market. The market is further uplifted by the increasing demand for organic food and convenience food across this region. In the European Union, pectin is entirely approved for usage in accordance with Regulation (EC) 1333/2008 on all the food stabilizer and food additives which in turn is leading to gain consumer trust in the final products. It is especially used in the production of jellies and jams, as a stabilizing agent. European consumers are preferring natural ingredients rather than the artificial ingredients in food products. Thus, driving the rising demand in the region. Various Technological advancements have led to the overall development of various stabilizer blends in the European market, which are multi-functional as well as cost-effective at the same time. Continuous innovations and developments in the food stabilizer market are estimated to offer potential opportunities to the producers and manufacturers operating in the Europe region.

Covid-19 Impact Analysis On Food Stabilizer Market

The effects of Covid-19 continue to present many worldwide challenges. The International Food Additives Council then reminded the consumers that the quality and safety of the global food supply remain strong and that food stabilizer and food additives continue to play a vital role in nurturing the quality of foods in the pantry. During the pandemic, when consumers are urged to minimize their time in the store, packaged foods containing food additives and food stabilizer are an excellent option. While there have been various reports of shortages of certain food products at retail, which are primarily due to transportation and restocking issues, it is also important to note that coronavirus has not made an impact on food safety. In Accordance with the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), there was no evidence of Coronavirus transmission through food packaging or in the food substances, including imported goods as well. However, despite the momentary disruption, the Food Stabilizer market is predicted to grow at a gradual rate during the forecasted period.

Top Key Players Covered In Food Stabilizer Market

- AshlandInc. (US)

- BASF SE(Germany)

- Cargill Inc. (US)

- CP Kelco (US)

- DowDuPont Inc. (US)

- Hydrosol GmbH & Co. KG(Germany)

- Ingredion Inc. (US)

- Kerry Group PLC (Ireland)

- NEXIRA (Normandie)

- Palsgaard A/S (Denmark)

- Tate & Lyle PLC (UK)

- Glanbiaplc (Ireland)

- Advanced Food Systems Inc (New Jersey)

- Chemelco (Netherlands)

- Associated British Foods plc (UK), and other major players.

Key Industry Development In The Food Stabilizer Market

In February 2022, KERRY GROUP announces significant strategic biotechnology acquisitions. Kerry Group, the global nutrition, and taste company announce that it has reached an agreement to acquire 92% of the share capital of c-LEcta GmbH (‘c-LEcta‘) for particular consideration of 137 Million Euros, with management to retain the balance.

In November 2021, the independent family-owned company Nexira, a world leader in acacia fiber and natural plant-based ingredients for the food, health, and nutrients industries, announced its acquisition of the UNIPEKTIN Ingredients AG, a Swiss Company a leader and specialist in premium ingredients and natural hydrocolloids.

|

Global Food Stabilizer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.61 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.2% |

Market Size in 2030: |

USD 3.63 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Source

3.2 By Application

3.3 By Function

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Food Stabilizers Market by Source

5.1 Food Stabilizers Market Overview Snapshot and Growth Engine

5.2 Food Stabilizers Market Overview

5.3 Plant

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Plant: Grographic Segmentation

5.4 Microbial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Microbial: Grographic Segmentation

5.5 Seaweed

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Seaweed: Grographic Segmentation

5.6 Synthetic

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Synthetic: Grographic Segmentation

5.7 Animal

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Animal: Grographic Segmentation

Chapter 6: Food Stabilizers Market by Application

6.1 Food Stabilizers Market Overview Snapshot and Growth Engine

6.2 Food Stabilizers Market Overview

6.3 Dairy & Dairy Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Dairy & Dairy Products: Grographic Segmentation

6.4 Bakery

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Bakery: Grographic Segmentation

6.5 Confectionery

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Confectionery: Grographic Segmentation

6.6 Beverages

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Beverages: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Food Stabilizers Market by Function

7.1 Food Stabilizers Market Overview Snapshot and Growth Engine

7.2 Food Stabilizers Market Overview

7.3 Stability

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Stability: Grographic Segmentation

7.4 Texture

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Texture: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Food Stabilizers Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Food Stabilizers Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Food Stabilizers Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ASHLAND INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 BASF SE(GERMANY)

8.4 CARGILL INC. (US)

8.5 CP KELCO (US)

8.6 DOWDUPONT INC. (US)

8.7 HYDROSOL GMBH & CO. KG(GERMANY)

8.8 INGREDION INC. (US)

8.9 KERRY GROUP PLC (IRELAND)

8.10 NEXIRA (NORMANDIE)

8.11 PALSGAARD A/S (DENMARK)

8.12 TATE & LYLE PLC (UK)

8.13 GLANBIA PLC (IRELAND)

8.14 ADVANCED FOOD SYSTEMS INC (NEW JERSEY)

8.15 CHEMELCO (NETHERLANDS)

8.16 ASSOCIATED BRITISH FOODS PLC (UK)

8.17 OTHER MAJOR PLAYERS

Chapter 9: Global Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Source

9.2.1 Plant

9.2.2 Microbial

9.2.3 Seaweed

9.2.4 Synthetic

9.2.5 Animal

9.3 Historic and Forecasted Market Size By Application

9.3.1 Dairy & Dairy Products

9.3.2 Bakery

9.3.3 Confectionery

9.3.4 Beverages

9.3.5 Others

9.4 Historic and Forecasted Market Size By Function

9.4.1 Stability

9.4.2 Texture

Chapter 10: North America Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Source

10.4.1 Plant

10.4.2 Microbial

10.4.3 Seaweed

10.4.4 Synthetic

10.4.5 Animal

10.5 Historic and Forecasted Market Size By Application

10.5.1 Dairy & Dairy Products

10.5.2 Bakery

10.5.3 Confectionery

10.5.4 Beverages

10.5.5 Others

10.6 Historic and Forecasted Market Size By Function

10.6.1 Stability

10.6.2 Texture

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Source

11.4.1 Plant

11.4.2 Microbial

11.4.3 Seaweed

11.4.4 Synthetic

11.4.5 Animal

11.5 Historic and Forecasted Market Size By Application

11.5.1 Dairy & Dairy Products

11.5.2 Bakery

11.5.3 Confectionery

11.5.4 Beverages

11.5.5 Others

11.6 Historic and Forecasted Market Size By Function

11.6.1 Stability

11.6.2 Texture

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Source

12.4.1 Plant

12.4.2 Microbial

12.4.3 Seaweed

12.4.4 Synthetic

12.4.5 Animal

12.5 Historic and Forecasted Market Size By Application

12.5.1 Dairy & Dairy Products

12.5.2 Bakery

12.5.3 Confectionery

12.5.4 Beverages

12.5.5 Others

12.6 Historic and Forecasted Market Size By Function

12.6.1 Stability

12.6.2 Texture

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Source

13.4.1 Plant

13.4.2 Microbial

13.4.3 Seaweed

13.4.4 Synthetic

13.4.5 Animal

13.5 Historic and Forecasted Market Size By Application

13.5.1 Dairy & Dairy Products

13.5.2 Bakery

13.5.3 Confectionery

13.5.4 Beverages

13.5.5 Others

13.6 Historic and Forecasted Market Size By Function

13.6.1 Stability

13.6.2 Texture

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Food Stabilizers Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Source

14.4.1 Plant

14.4.2 Microbial

14.4.3 Seaweed

14.4.4 Synthetic

14.4.5 Animal

14.5 Historic and Forecasted Market Size By Application

14.5.1 Dairy & Dairy Products

14.5.2 Bakery

14.5.3 Confectionery

14.5.4 Beverages

14.5.5 Others

14.6 Historic and Forecasted Market Size By Function

14.6.1 Stability

14.6.2 Texture

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Food Stabilizer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.61 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.2% |

Market Size in 2030: |

USD 3.63 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD STABILIZERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD STABILIZERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD STABILIZERS MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD STABILIZERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD STABILIZERS MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD STABILIZERS MARKET BY SOURCE

TABLE 008. PLANT MARKET OVERVIEW (2016-2028)

TABLE 009. MICROBIAL MARKET OVERVIEW (2016-2028)

TABLE 010. SEAWEED MARKET OVERVIEW (2016-2028)

TABLE 011. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 012. ANIMAL MARKET OVERVIEW (2016-2028)

TABLE 013. FOOD STABILIZERS MARKET BY APPLICATION

TABLE 014. DAIRY & DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 015. BAKERY MARKET OVERVIEW (2016-2028)

TABLE 016. CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 017. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. FOOD STABILIZERS MARKET BY FUNCTION

TABLE 020. STABILITY MARKET OVERVIEW (2016-2028)

TABLE 021. TEXTURE MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA FOOD STABILIZERS MARKET, BY SOURCE (2016-2028)

TABLE 023. NORTH AMERICA FOOD STABILIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA FOOD STABILIZERS MARKET, BY FUNCTION (2016-2028)

TABLE 025. N FOOD STABILIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE FOOD STABILIZERS MARKET, BY SOURCE (2016-2028)

TABLE 027. EUROPE FOOD STABILIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE FOOD STABILIZERS MARKET, BY FUNCTION (2016-2028)

TABLE 029. FOOD STABILIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC FOOD STABILIZERS MARKET, BY SOURCE (2016-2028)

TABLE 031. ASIA PACIFIC FOOD STABILIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC FOOD STABILIZERS MARKET, BY FUNCTION (2016-2028)

TABLE 033. FOOD STABILIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA FOOD STABILIZERS MARKET, BY SOURCE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA FOOD STABILIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA FOOD STABILIZERS MARKET, BY FUNCTION (2016-2028)

TABLE 037. FOOD STABILIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA FOOD STABILIZERS MARKET, BY SOURCE (2016-2028)

TABLE 039. SOUTH AMERICA FOOD STABILIZERS MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA FOOD STABILIZERS MARKET, BY FUNCTION (2016-2028)

TABLE 041. FOOD STABILIZERS MARKET, BY COUNTRY (2016-2028)

TABLE 042. ASHLAND INC. (US): SNAPSHOT

TABLE 043. ASHLAND INC. (US): BUSINESS PERFORMANCE

TABLE 044. ASHLAND INC. (US): PRODUCT PORTFOLIO

TABLE 045. ASHLAND INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BASF SE(GERMANY): SNAPSHOT

TABLE 046. BASF SE(GERMANY): BUSINESS PERFORMANCE

TABLE 047. BASF SE(GERMANY): PRODUCT PORTFOLIO

TABLE 048. BASF SE(GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CARGILL INC. (US): SNAPSHOT

TABLE 049. CARGILL INC. (US): BUSINESS PERFORMANCE

TABLE 050. CARGILL INC. (US): PRODUCT PORTFOLIO

TABLE 051. CARGILL INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CP KELCO (US): SNAPSHOT

TABLE 052. CP KELCO (US): BUSINESS PERFORMANCE

TABLE 053. CP KELCO (US): PRODUCT PORTFOLIO

TABLE 054. CP KELCO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. DOWDUPONT INC. (US): SNAPSHOT

TABLE 055. DOWDUPONT INC. (US): BUSINESS PERFORMANCE

TABLE 056. DOWDUPONT INC. (US): PRODUCT PORTFOLIO

TABLE 057. DOWDUPONT INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. HYDROSOL GMBH & CO. KG(GERMANY): SNAPSHOT

TABLE 058. HYDROSOL GMBH & CO. KG(GERMANY): BUSINESS PERFORMANCE

TABLE 059. HYDROSOL GMBH & CO. KG(GERMANY): PRODUCT PORTFOLIO

TABLE 060. HYDROSOL GMBH & CO. KG(GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. INGREDION INC. (US): SNAPSHOT

TABLE 061. INGREDION INC. (US): BUSINESS PERFORMANCE

TABLE 062. INGREDION INC. (US): PRODUCT PORTFOLIO

TABLE 063. INGREDION INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. KERRY GROUP PLC (IRELAND): SNAPSHOT

TABLE 064. KERRY GROUP PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 065. KERRY GROUP PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 066. KERRY GROUP PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NEXIRA (NORMANDIE): SNAPSHOT

TABLE 067. NEXIRA (NORMANDIE): BUSINESS PERFORMANCE

TABLE 068. NEXIRA (NORMANDIE): PRODUCT PORTFOLIO

TABLE 069. NEXIRA (NORMANDIE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. PALSGAARD A/S (DENMARK): SNAPSHOT

TABLE 070. PALSGAARD A/S (DENMARK): BUSINESS PERFORMANCE

TABLE 071. PALSGAARD A/S (DENMARK): PRODUCT PORTFOLIO

TABLE 072. PALSGAARD A/S (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. TATE & LYLE PLC (UK): SNAPSHOT

TABLE 073. TATE & LYLE PLC (UK): BUSINESS PERFORMANCE

TABLE 074. TATE & LYLE PLC (UK): PRODUCT PORTFOLIO

TABLE 075. TATE & LYLE PLC (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GLANBIA PLC (IRELAND): SNAPSHOT

TABLE 076. GLANBIA PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 077. GLANBIA PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 078. GLANBIA PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ADVANCED FOOD SYSTEMS INC (NEW JERSEY): SNAPSHOT

TABLE 079. ADVANCED FOOD SYSTEMS INC (NEW JERSEY): BUSINESS PERFORMANCE

TABLE 080. ADVANCED FOOD SYSTEMS INC (NEW JERSEY): PRODUCT PORTFOLIO

TABLE 081. ADVANCED FOOD SYSTEMS INC (NEW JERSEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. CHEMELCO (NETHERLANDS): SNAPSHOT

TABLE 082. CHEMELCO (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 083. CHEMELCO (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 084. CHEMELCO (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. ASSOCIATED BRITISH FOODS PLC (UK): SNAPSHOT

TABLE 085. ASSOCIATED BRITISH FOODS PLC (UK): BUSINESS PERFORMANCE

TABLE 086. ASSOCIATED BRITISH FOODS PLC (UK): PRODUCT PORTFOLIO

TABLE 087. ASSOCIATED BRITISH FOODS PLC (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 088. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 089. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 090. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD STABILIZERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD STABILIZERS MARKET OVERVIEW BY SOURCE

FIGURE 012. PLANT MARKET OVERVIEW (2016-2028)

FIGURE 013. MICROBIAL MARKET OVERVIEW (2016-2028)

FIGURE 014. SEAWEED MARKET OVERVIEW (2016-2028)

FIGURE 015. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 016. ANIMAL MARKET OVERVIEW (2016-2028)

FIGURE 017. FOOD STABILIZERS MARKET OVERVIEW BY APPLICATION

FIGURE 018. DAIRY & DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 019. BAKERY MARKET OVERVIEW (2016-2028)

FIGURE 020. CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 021. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. FOOD STABILIZERS MARKET OVERVIEW BY FUNCTION

FIGURE 024. STABILITY MARKET OVERVIEW (2016-2028)

FIGURE 025. TEXTURE MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA FOOD STABILIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE FOOD STABILIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC FOOD STABILIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA FOOD STABILIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA FOOD STABILIZERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Stabilizer Market research report is 2023-2030.

Ashland Inc. (US), BASF SE(Germany), Cargill Inc. (US), CP Kelco (US), DowDuPont Inc. (US), Hydrosol GmbH & Co. KG(Germany), Ingredion Inc. (US), Kerry Group PLC (Ireland), NEXIRA (Normandie), Palsgaard A/S (Denmark), Tate & Lyle PLC (UK), Glanbia plc (Ireland), Advanced Food Systems Inc (New Jersey), Chemelco (Netherlands), Associated British Foods plc (UK), and other major players.

The Food Stabilizer Market is segmented into source, application, function and region. By Source, the market is categorized into Plant, microbial, Seaweed, Synthetic and Animal. By Application, the market is categorized Dairy & Dairy Products, Bakery, Confectionary, Beverages, Others. By Function, the market is categorized into Stability, texture, moisture retention. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food Stabilizer are substances that help in increasing stability and thickness by helping foods retain their physical characteristics and remain in an emulsion. Substances that normally do not mix, such as water and oil, need stabilizer.

Global Food Stabilizer Market size was valued at USD 2.61 Billion in 2022, and is projected to reach USD 3.63 Billion by 2030, growing at a CAGR of 4.2% from 2023 to 2030.