Food Robotics Market Synopsis

Food Robotics Market Size Was Valued at USD 2.44 billion in 2022, and is Projected to Reach USD 6.53 billion by 2030, Growing at a CAGR of 13.1 % From 2023-2030.

Food robotics refers to the application of robotic technology in various aspects of the food industry, from production and processing to packaging and distribution. This innovative field aims to improve efficiency, precision, and safety in food-related tasks, addressing challenges such as labor shortages and the need for increased productivity. In food production, robots can be utilized for tasks such as harvesting, sorting, and handling raw ingredients, while in processing, they can assist with cutting, cooking, and assembling food items.

- Additionally, robotic systems can enhance the packaging and labeling processes, ensuring accuracy and consistency. By incorporating robotics into the food industry, businesses can optimize their operations, reduce costs, and maintain high-quality standards throughout the production and distribution chain.

- The integration of food robotics also contributes to advancements in food safety and hygiene. Robots can be designed to meet strict sanitation standards, minimizing the risk of contamination and ensuring compliance with regulatory requirements. Automation in food handling reduces the need for human intervention, mitigating the potential for errors and improving overall hygiene in the production environment. Furthermore, the use of robotics allows for enhanced traceability, as each step of the food production process can be accurately monitored and recorded.

- The Food Robotics market has witnessed substantial growth and transformation, driven by the increasing demand for automation and efficiency in the food industry. As the global population continues to grow, there is a heightened need for enhanced productivity, cost-effectiveness, and improved food safety standards. Food robotics technologies, including robotic arms, automated processing systems, and smart machinery, are being increasingly adopted by food manufacturers to streamline production processes, reduce labor costs, and ensure consistent product quality.

Food Robotics Market Trend Analysis

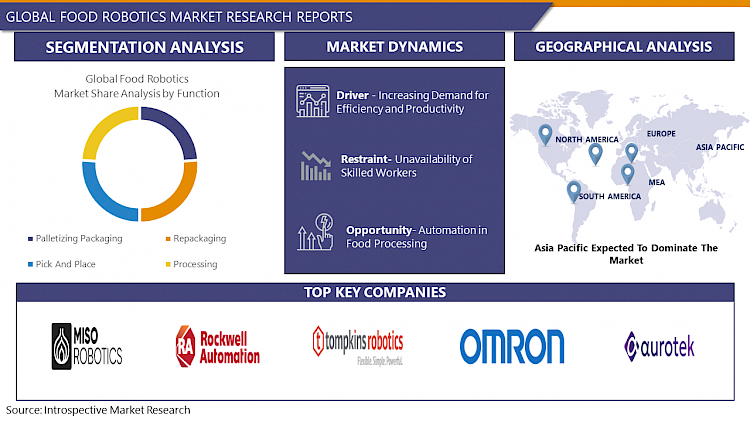

Increasing Demand for Efficiency and Productivity

- The Food Robotics market is experiencing a surge in demand driven by the increasing emphasis on efficiency and productivity in the food industry. As global population continues to grow, so does the demand for food products, placing greater pressure on the food supply chain to enhance its capabilities. In this context, the integration of robotics in various aspects of food production and processing has emerged as a key solution to meet the rising demand while ensuring cost-effectiveness and sustainability.

- Efficiency stands out as a primary driving factor for the adoption of robotics in the food industry. Automation through robotics enables streamlined processes, reducing manual labor requirements and minimizing the risk of human errors. This is particularly crucial in tasks such as sorting, packaging, and quality control, where precision and speed are paramount. By incorporating robotic systems, food manufacturers can achieve higher production rates, lower operational costs, and ultimately deliver products to market more efficiently.

- Productivity gains are another compelling reason for the growing prominence of food robotics. Robots can work continuously without the need for breaks, leading to a significant increase in overall output. Moreover, they can handle repetitive and labour-intensive tasks, allowing human workers to focus on more complex and value-added aspects of production, such as innovation and quality control. The result is a more productive and agile food manufacturing process that can adapt to changing market demands.

Automation in Food Processing create an Opportunity for Food Robotics Market

- Automation in food processing presents significant opportunities for the Food Robotics market. The integration of robotics into the food industry is driven by the need for increased efficiency, improved quality, and enhanced safety. As consumer demands evolve, manufacturers are turning to automation to meet these expectations and stay competitive in the market.

- One key opportunity lies in the improvement of operational efficiency. Food robotics can streamline various processes in food production, including sorting, packaging, and handling. With precision and speed, robots can perform repetitive tasks more efficiently than human workers, leading to increased productivity and reduced operational costs. This efficiency is particularly crucial in the food industry, where tight profit margins and high demand necessitate streamlined processes.

- Quality assurance is another area where food robotics can make a significant impact. Robots equipped with advanced sensors and vision systems can detect defects, ensure consistent product quality, and minimize errors in the production line. This not only enhances the overall quality of the products but also reduces waste, contributing to sustainability goals.

- Food safety is a top priority in the industry, and robotics can play a crucial role in ensuring compliance with strict regulations. Automation minimizes the risk of contamination by reducing human intervention in critical processes. Robots can operate in controlled environments, minimizing the chances of microbial contamination and ensuring that food products meet stringent safety standards.

Food Robotics Market Segment Analysis:

Food Robotics Market Segmented on the basis of type, payload, function, application.

By Type, collaborative robot segment is expected to dominate the market during the forecast period

- The collaborative robot (cobot) segment stands out as the dominant force in the rapidly evolving landscape of the Food Robotics market. Collaborative robots are designed to work alongside humans seamlessly, fostering a synergistic environment that combines the strengths of both man and machine. In the food industry, cobots have gained significant traction due to their ability to enhance operational efficiency, ensure food safety, and adapt to dynamic production requirements.

- Unlike traditional industrial robots, cobots in the food sector prioritize safety, with advanced sensors and built-in intelligence enabling them to collaborate with human workers without posing a threat. Their versatility allows for a wide range of applications in food processing, packaging, and assembly, contributing to streamlined workflows and increased productivity. With the ability to handle repetitive tasks and intricate processes, cobots reduce the risk of human errors and enhance overall production quality.

- Moreover, the collaborative nature of these robots facilitates a flexible and adaptive manufacturing environment, crucial in the ever-changing landscape of the food industry. As the demand for automation in food production continues to rise, the collaborative robot segment is poised to maintain its dominance, driving innovation and efficiency across the Food Robotics market.

By Application, Meat segment held the largest share of 39% in 2022

- Meat segment's dominance is the intricate nature of meat processing, where precision and efficiency are paramount. Robotics in this sector not only enhance the speed and accuracy of tasks but also address labor-intensive challenges, ensuring consistent product quality. Automated systems excel in handling complex operations such as deboning, trimming, and portioning, thereby optimizing production processes.

- Moreover, the Meat segment has witnessed a surge in demand due to increasing consumer preferences for processed and packaged meat products. Robotics play a pivotal role in meeting this demand by streamlining operations, minimizing waste, and adhering to stringent safety standards. The integration of smart technologies and robotics further enables traceability and transparency in the meat supply chain, bolstering consumer confidence.

Food Robotics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the Food Robotics market, fueled by a convergence of factors that underscore the region's economic prowess and technological advancements. As the global demand for automated solutions in the food industry continues to escalate, Asia Pacific is positioned to lead this transformative wave.

- Rapid industrialization, burgeoning population, and a burgeoning middle class with changing consumption patterns are propelling the need for enhanced efficiency in food production and processing. The adoption of robotics in the food sector is seen as a key solution to address these challenges, offering benefits such as increased productivity, precision, and cost-effectiveness.

- Countries like China, Japan, South Korea, and India are at the forefront of integrating robotics into their food production and processing facilities. Robust investments in research and development, coupled with a growing focus on innovation, are driving the region's leadership in the food robotics domain. Additionally, supportive government initiatives and a proactive approach toward embracing automation further contribute to the region's dominance.

Food Robotics Market Top Key Players:

- Miso Robotics (USA)

- Bastian Solutions LLC (USA)

- Ellison Technologies Inc. (USA)

- Tompkins Robotics (USA)

- Rockwell Automation Inc. (USA)

- Flexetail by Soft Robotics (USA)

- Staubli International AG (Switzerland)

- Festo AG & Co. KG (Germany)

- KUKA AG (Germany)

- Asic Robotics AG (Switzerland)

- ABB Group(Switzerland)

- Fanuc Corporation (Japan)

- Kawasaki Heavy Industries Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Denso Corporation (Japan)

- Nachi-Fujikoshi Corporation (Japan)

- OMRON Corporation (Japan)

- Mayekawa Mfg. Co. Ltd. (Japan)

- Aurotek Corporation (Taiwan)

- Techman Robot Inc. (Taiwan)

- Robot First (China)

- Universal Robots A/S (Denmark)

- Apex Automation & Robotics (Australia)

Key Industry Developments in the Food Robotics Market:

- In October 2023: ABB Launched the IRB 6790, a high-payload robot designed for palletizing and packaging applications in the food and beverage industry. The IRB 6790 has a payload capacity of 180 kg and a reach of 3.3 meters, making it ideal for handling heavy cases and boxes.

- In October 2023: Fanuc Launched the CRX-10iA/L cobot, a collaborative robot designed for food processing tasks such as picking, packing, and assembly. The CRX-10iA/L is lightweight and easy to program, making it suitable for small and medium-sized businesses.

|

Global Food Robotics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.1% |

Market Size in 2030: |

USD 6.53Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Payload |

|

||

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FOOD ROBOTICS MARKET BY TYPE (2016-2030)

- FOOD ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ARTICULATED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CARTESIAN

- SCARA

- PARALLEL

- CYLINDRICAL

- COLLABORATIVE

- FOOD ROBOTICS MARKET BY PAYLOAD (2016-2030)

- FOOD ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM

- HIGH

- FOOD ROBOTICS MARKET BY FUNCTION (2016-2030)

- FOOD ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PALLETIZING PACKAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REPACKAGING

- PICK AND PLACE

- PROCESSING

- FOOD ROBOTICS MARKET BY APPLICATION (2016-2030)

- FOOD ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEAT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POULTRY

- SEAFOOD

- DAIRY PRODUCTS

- FRUITS & VEGETABLES

- BEVERAGE

- BAKERY & CONFECTIONERY PRODUCTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Food Robotics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MISO ROBOTICS (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BASTIAN SOLUTIONS LLC (USA)

- ELLISON TECHNOLOGIES INC. (USA)

- TOMPKINS ROBOTICS (USA)

- ROCKWELL AUTOMATION INC. (USA)

- FLEXETAIL BY SOFT ROBOTICS (USA)

- STAUBLI INTERNATIONAL AG (SWITZERLAND)

- FESTO AG & CO. KG (GERMANY)

- KUKA AG (GERMANY)

- ASIC ROBOTICS AG (SWITZERLAND)

- ABB GROUP (SWITZERLAND)

- FANUC CORPORATION (JAPAN)

- KAWASAKI HEAVY INDUSTRIES LTD. (JAPAN)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- YASKAWA ELECTRIC CORPORATION (JAPAN)

- DENSO CORPORATION (JAPAN)

- NACHI-FUJIKOSHI CORPORATION (JAPAN)

- OMRON CORPORATION (JAPAN)

- MAYEKAWA MFG. CO. LTD. (JAPAN)

- AUROTEK CORPORATION (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL FOOD ROBOTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Payload

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Food Robotics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.1% |

Market Size in 2030: |

USD 6.53Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Payload |

|

||

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD ROBOTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD ROBOTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD ROBOTICS MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD ROBOTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD ROBOTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD ROBOTICS MARKET BY TYPE

TABLE 008. ARTICULATED MARKET OVERVIEW (2016-2028)

TABLE 009. CARTESIAN MARKET OVERVIEW (2016-2028)

TABLE 010. SCARA MARKET OVERVIEW (2016-2028)

TABLE 011. PARALLEL MARKET OVERVIEW (2016-2028)

TABLE 012. CYLINDRICAL MARKET OVERVIEW (2016-2028)

TABLE 013. COLLABORATIVE MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER TYPES MARKET OVERVIEW (2016-2028)

TABLE 015. FOOD ROBOTICS MARKET BY PAYLOAD

TABLE 016. HIGH MARKET OVERVIEW (2016-2028)

TABLE 017. MEDIUM MARKET OVERVIEW (2016-2028)

TABLE 018. LOW MARKET OVERVIEW (2016-2028)

TABLE 019. FOOD ROBOTICS MARKET BY FUNCTION

TABLE 020. PALLETIZING MARKET OVERVIEW (2016-2028)

TABLE 021. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 022. REPACKAGING MARKET OVERVIEW (2016-2028)

TABLE 023. PICKING MARKET OVERVIEW (2016-2028)

TABLE 024. PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 025. OTHER FUNCTIONS MARKET OVERVIEW (2016-2028)

TABLE 026. FOOD ROBOTICS MARKET BY APPLICATION

TABLE 027. MEAT MARKET OVERVIEW (2016-2028)

TABLE 028. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 029. AND SEAFOOD MARKET OVERVIEW (2016-2028)

TABLE 030. PROCESSED FOOD MARKET OVERVIEW (2016-2028)

TABLE 031. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 032. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 033. BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 034. BAKERY & CONFECTIONERY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 035. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 036. NORTH AMERICA FOOD ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 037. NORTH AMERICA FOOD ROBOTICS MARKET, BY PAYLOAD (2016-2028)

TABLE 038. NORTH AMERICA FOOD ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 039. NORTH AMERICA FOOD ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 040. N FOOD ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 041. EUROPE FOOD ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 042. EUROPE FOOD ROBOTICS MARKET, BY PAYLOAD (2016-2028)

TABLE 043. EUROPE FOOD ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 044. EUROPE FOOD ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 045. FOOD ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 046. ASIA PACIFIC FOOD ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 047. ASIA PACIFIC FOOD ROBOTICS MARKET, BY PAYLOAD (2016-2028)

TABLE 048. ASIA PACIFIC FOOD ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 049. ASIA PACIFIC FOOD ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 050. FOOD ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 051. MIDDLE EAST & AFRICA FOOD ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 052. MIDDLE EAST & AFRICA FOOD ROBOTICS MARKET, BY PAYLOAD (2016-2028)

TABLE 053. MIDDLE EAST & AFRICA FOOD ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 054. MIDDLE EAST & AFRICA FOOD ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 055. FOOD ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 056. SOUTH AMERICA FOOD ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 057. SOUTH AMERICA FOOD ROBOTICS MARKET, BY PAYLOAD (2016-2028)

TABLE 058. SOUTH AMERICA FOOD ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 059. SOUTH AMERICA FOOD ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 060. FOOD ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 061. ABB: SNAPSHOT

TABLE 062. ABB: BUSINESS PERFORMANCE

TABLE 063. ABB: PRODUCT PORTFOLIO

TABLE 064. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. KAWASAKI HEAVY INDUSTRIES: SNAPSHOT

TABLE 065. KAWASAKI HEAVY INDUSTRIES: BUSINESS PERFORMANCE

TABLE 066. KAWASAKI HEAVY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 067. KAWASAKI HEAVY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ROCKWELL AUTOMATION: SNAPSHOT

TABLE 068. ROCKWELL AUTOMATION: BUSINESS PERFORMANCE

TABLE 069. ROCKWELL AUTOMATION: PRODUCT PORTFOLIO

TABLE 070. ROCKWELL AUTOMATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FANUC: SNAPSHOT

TABLE 071. FANUC: BUSINESS PERFORMANCE

TABLE 072. FANUC: PRODUCT PORTFOLIO

TABLE 073. FANUC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KUKA: SNAPSHOT

TABLE 074. KUKA: BUSINESS PERFORMANCE

TABLE 075. KUKA: PRODUCT PORTFOLIO

TABLE 076. KUKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SEIKO EPSON: SNAPSHOT

TABLE 077. SEIKO EPSON: BUSINESS PERFORMANCE

TABLE 078. SEIKO EPSON: PRODUCT PORTFOLIO

TABLE 079. SEIKO EPSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. YASKAWA ELECTRIC: SNAPSHOT

TABLE 080. YASKAWA ELECTRIC: BUSINESS PERFORMANCE

TABLE 081. YASKAWA ELECTRIC: PRODUCT PORTFOLIO

TABLE 082. YASKAWA ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. STAUBLI INTERNATIONAL: SNAPSHOT

TABLE 083. STAUBLI INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 084. STAUBLI INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 085. STAUBLI INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. MAYEKAWA MFG: SNAPSHOT

TABLE 086. MAYEKAWA MFG: BUSINESS PERFORMANCE

TABLE 087. MAYEKAWA MFG: PRODUCT PORTFOLIO

TABLE 088. MAYEKAWA MFG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. UNIVERSAL ROBOTICS: SNAPSHOT

TABLE 089. UNIVERSAL ROBOTICS: BUSINESS PERFORMANCE

TABLE 090. UNIVERSAL ROBOTICS: PRODUCT PORTFOLIO

TABLE 091. UNIVERSAL ROBOTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. BASTIAN SOLUTIONS: SNAPSHOT

TABLE 092. BASTIAN SOLUTIONS: BUSINESS PERFORMANCE

TABLE 093. BASTIAN SOLUTIONS: PRODUCT PORTFOLIO

TABLE 094. BASTIAN SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD ROBOTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD ROBOTICS MARKET OVERVIEW BY TYPE

FIGURE 012. ARTICULATED MARKET OVERVIEW (2016-2028)

FIGURE 013. CARTESIAN MARKET OVERVIEW (2016-2028)

FIGURE 014. SCARA MARKET OVERVIEW (2016-2028)

FIGURE 015. PARALLEL MARKET OVERVIEW (2016-2028)

FIGURE 016. CYLINDRICAL MARKET OVERVIEW (2016-2028)

FIGURE 017. COLLABORATIVE MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER TYPES MARKET OVERVIEW (2016-2028)

FIGURE 019. FOOD ROBOTICS MARKET OVERVIEW BY PAYLOAD

FIGURE 020. HIGH MARKET OVERVIEW (2016-2028)

FIGURE 021. MEDIUM MARKET OVERVIEW (2016-2028)

FIGURE 022. LOW MARKET OVERVIEW (2016-2028)

FIGURE 023. FOOD ROBOTICS MARKET OVERVIEW BY FUNCTION

FIGURE 024. PALLETIZING MARKET OVERVIEW (2016-2028)

FIGURE 025. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 026. REPACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 027. PICKING MARKET OVERVIEW (2016-2028)

FIGURE 028. PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHER FUNCTIONS MARKET OVERVIEW (2016-2028)

FIGURE 030. FOOD ROBOTICS MARKET OVERVIEW BY APPLICATION

FIGURE 031. MEAT MARKET OVERVIEW (2016-2028)

FIGURE 032. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 033. AND SEAFOOD MARKET OVERVIEW (2016-2028)

FIGURE 034. PROCESSED FOOD MARKET OVERVIEW (2016-2028)

FIGURE 035. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 036. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 037. BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 038. BAKERY & CONFECTIONERY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 039. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 040. NORTH AMERICA FOOD ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 041. EUROPE FOOD ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 042. ASIA PACIFIC FOOD ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 043. MIDDLE EAST & AFRICA FOOD ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 044. SOUTH AMERICA FOOD ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Robotics Market research report is 2023-2030.

Miso Robotics (USA), Bastian Solutions LLC (USA), Ellison Technologies Inc. (USA), Tompkins Robotics (USA), Rockwell Automation Inc. (USA), Flexetail by Soft Robotics (USA), Staubli International AG (Switzerland),Festo AG & Co. KG (Germany),KUKA AG (Germany),Asic Robotics AG (Switzerland), ABB Group (Switzerland), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Mitsubishi Electric Corporation (Japan),Yaskawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Mayekawa Mfg. Co. Ltd. (Japan), Aurotek Corporation (Taiwan), Techman Robot Inc. (Taiwan), Robot First (China), Universal Robots A/S (Denmark), Apex Automation & Robotics (Australia) and Other Major Players.

Food Robotics is segmented into Type, Payload, Function, Application and region. By Type, the market is categorized into Articulated, Cartesian, Scara, Parallel, Cylindrical, Collaborative. By Payload, the market is categorized into Low, Medium, and High. By Function, the market is categorized into Palletizing Packaging, Repackaging, Pick & Place, Processing. By Application, the market is categorized into Meat, poultry, seafood, Dairy products, Fruits & vegetables, Beverage, Bakery & confectionery products. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Food robotics refers to the application of robotic technology in various aspects of the food industry, from production and processing to packaging and distribution. This innovative field aims to improve efficiency, precision, and safety in food-related tasks, addressing challenges such as labor shortages and the need for increased productivity. In food production, robots can be utilized for tasks such as harvesting, sorting, and handling raw ingredients, while in processing, they can assist with cutting, cooking, and assembling food items.

Food Robotics Market Size Was Valued at USD 2.44 billion in 2022, and is Projected to Reach USD 6.53 billion by 2030, Growing at a CAGR of 13.1 % From 2023-2030.