Food Enzymes Market Synopsis

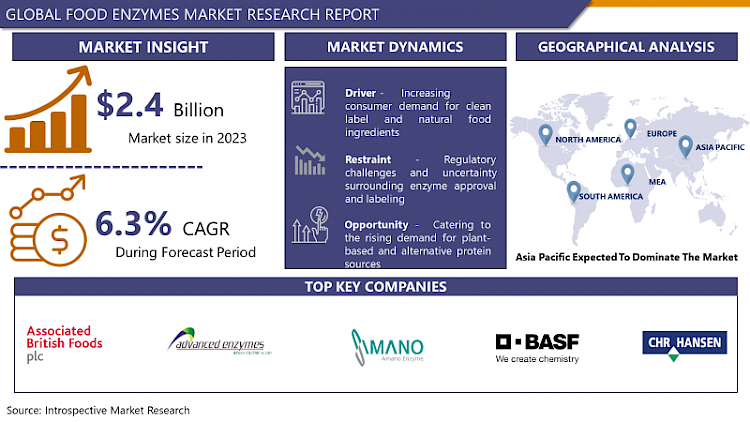

Food Enzymes of Size Was Valued at USD 2.4 Billion in 2023, and is Projected to Reach USD 4.1 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

The term “food enzymes”, refers to a particular class of enzymes that are inherent in different foods and which facilitate digestion of derived nutrients. These enzymes are typically proteins that are generated naturally occurring and isolated from various sources such as plants, animals, and microorganisms. If the topic is apiculture which refers to the management of honey bees, then the food enzymes of most significance are those that support honey production. During the formation of honey, bees move enzymes to nectar which helps to split big sugar chains into smaller chains and also enhances the taste and characteristic features of honey .

- Food enzymes market has been growing over the years due to changing consumer habits and preferences focusing on convenience and processed foods and innovative enzymes application. They act as primary catalysts in the biochemical reactions that occur in food processing industry to improve tastes, textures and nutritional value of various food products. As consumers shift their focus towards healthy food products, they opt for natural and clean-label ingredients in foods; this is where enzymes comes in handy as they act as potent ingredient replacers for chemical counterpart. Moreover, increasing consumer concern on sustainable and green agricultural practices has boosted the uptake of enzymes as most of them bear environmental compatibility since they are biodegradable.

- Some of the segment of the food enzymes market is carbohydrases, proteases, lipases and others are the major segments where carbohydrases are used for modifying the starches, proteins segment include products like papain, bromelain and others are the sector where lipases are common for altering the fats of the food products. The carbohydrases for instance amylases and the cellulases are employed in baking, brewing, and starchy food industries to hydrolyse the complex carbohydrate compound into simpler sugars. These enzymes are used in meat tenderizing, milk treatment, and protein breakdown of meat and fish products respectively while the lipases are employed in cheese preparation, and flavors and fats control.

- Due to the increasing innovative innovation in the food industry, making the food enzymes market to expand as it is backed by the technological advancements, regulation support on the use of enzymes in the manufacturing process, and awareness of the importance of food enzymes.

Food Enzymes Market Trend Analysis

Focus on enzyme customization and optimization for specific food applications

- Initially, the use of enzymes in food processing has been done with lot of emphasis on their activities in general. Yet there is another trend, which explains the desire of the food manufacturers – the market offers food with specific properties and specialized consumers’ demand on enzymes will also grow.

- There is the aspect of efficiency in that customized enzymes exhibit greater efficiency in catalysis as well as better quality products and reduced costs. The biotechnology companies are putting their efforts in the discovery of enzymes which may be developed under controlled conditions containing exact properties like activities, thermal stability and substrate specificity which are ideal for the food processes.

- This trend towards enzyme customization is a natural effect of development of the biotechnology and enzymology, usage of novel techniques in enzyme engineering and in knowledge of enzyme-substrate interactions. Since more enzyme suppliers provide specialized and targeted enzymes, then food manufacturers can be assisted in achieving their desired properties, as well as increase their shelf life and effectiveness in today’s competitive market. Furthermore, customized enzyme is another function of enzymes in food production since it makes it possible for the producers to develop unique products and strategies that capture the market and meet the emerging needs of the market without exerting much pressure on natural resources due to efficiency in food processing.

Catering to the rising demand for plant-based and alternative protein sources

- Since consumers are demanding plant protein from various sources to meet the dietary requirement, health, and social standing, there is a demand for more enzymatic plants to extract protein from vegetable sources such as soy, peas, or pulses. Proteases therefore have enormous potential for enhancing the yields, flavour intensities and nutritional value of plant protein ingredients, and thus help to make plant protein foods more acceptable to consumers in relation to animal food products.

- More specifically, as the plant-based meat and dairy alternatives are getting more popular and diverse, the enzyme manufacturing companies can also work on new technologies for texturization, flavor, and texture improvement of the products. To achieve a similar taste, texture, and mouthfeel as traditional meat or dairy, the enzymes therein serve to enhance acceptance by consumers, a key factor for market growth.

- As the market for plant-based foods continues to expand, firms may seek to gain competitive advantage and ensure future growth by devoting resources to R&D that yields enzyme formulations most relevant and effective for plant-based production applications. Moreover, new business relationships with food makers and enzyme suppliers can help incorporate enzyme solutions into numerous plant-based foods and ingredients, open up profitable markets and diversify potential revenue streams.

Food Enzymes Market Segment Analysis:

Food Enzymes Market is segmented on the basis of type, source, application.

By Type, Carbohydrase segment is expected to dominate the market during the forecast period

- The carbohydrase segment has been determined to dominate the food enzymes market in the given timeframe owing to certain factors that include but are not limited to the following As a result: Carbohydrases are enzymes which are involved in the hydrolysis of carbohydrates such as amylases, cellulases, and hemicellulases that are involved in the breaking of several starch into simpler sugars with applications such as in starchy products like baking, brewing, and fruit juice production.Of the mentioned carbohydrase segment, one of the key factors that have helped boost this segment is the constant need for enzymes in the baking business. Amylases specifically are very important for the breakdown of starch into sugars, which are in turn, turned into carbon dioxide gas by the yeast to help the dough rise and acquire the consistency and taste that is expected. As the global consumption of baked foods and other baked products continues to grow coupled with increased buyers’ expectations with regard to quality, freshness and taste of the products, manufactures have adopted carbohydrases as a functional ingredient in the dough systems to improve production process efficiency and shelf life of their products.

- However, Amylum also has an important role in the production of the number of the other foods like the beer, milk products, confectionery, and other snacks. For instance, in brewing, the enzymes are applied for breaking the starches in the barley during mashing to produce fermentable sugars to enhance the brewing of beer of equal taste and quality as well as different strengths. In the same way, in fruit juice production enzymes facilitate depolymerization of pectin and cell walls which aids in higher yield and clarity of the final product.

- Moreover, the consumer preference has been changing towards natural and clean labelled food products which has more demand for enzymatic solutions than the chemical solvents. Carbohydrases are considered more natural and friendly to the environment than chemical methods that are used in the production of food products, thus making them to meet the desired functions in food formulations, which are preferred in the markets today due to health consciousness.

By Application, Bakery Products segment is expected to held the largest share

- Taking the food enzymes market where it belongs in bakery products, it emerges that the position matches the observation and has factors to support that. Bakery products’re those which are baked and include bread, cakes, pastries, and cookies among others and they are very popular around the world and form a significant part of the food industry. Enzymes are very useful in baking processes as they help enhance the dough’s processing qualities, improve the overall quality of the final product, help in increasing the shelf life of the final products and last but not the least help in increasing the overall technical, economic and operational efficiency of the whole production process.

- In the bakery industry, a number of carbohydrases like amylases, xylanases, and glucose oxidases are incorporated to catalyse the hydrolysis of complex carbohydrates into simpler sugars, or to boost the process of fermentation, and to stabilise and cause expansion and textural qualities in bread and other bakery products. Enzymes can also be used for components in enhancing dough strength, improving the formation of the gluten network, and enhancing resistance to mechanical damage during processing.

- Also, it involves the use of lipases and other enzymes in fats alteration, flavoring of the baked confectionaries, and increase in the shelf life of the baked products. The advancement in enzyme technology has continued, as producers are constantly coming up with new formulations of enzymes more appropriate in the context of bakery and other uses, including clean label products that consumers are demanding more and more today due to the common desire in natural and ecological enzymes.

Food Enzymes Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Certain factors influencing increased market demand of food enzymes for Asia Pacific region in the context of the presented forecast data include:. Firstly, the region is experiencing significant population growth, which is fuelling urbanisation and industrialisation, resulting in shifts in palaeo risk and an emergent focus on processed and convenience foods. Therefore, the trend of applying enzymes in food processing for enhancing the quality, flavor, and nutritional content of such products is increasing.

- Furthermore, the enzyme consumption level is high in the Asia Pacific region’s countries, including China, India, Japan, and South Korea, which carry massive and diversified agricultural sectors, constituting suitable sources of raw materials for enzyme manufacturing. This makes it possible for manufacturers to acquire affordable ingredients to be used in producing enzymes to spur the market.

- Moreover, due to an enhanced focus of consumers on their health and well-being, plus the growth in their disposable income, there is a trend toward the use of natural and clean label food ingredients like enzymes. Changing consumer preferences in Asia Pacific region for products with low number of additive and preservatives have led to the use of enzymes in food processing Naturally occurring enzymes preferred over chemical solutions.

Active Key Players in the Food Enzymes Market

- Associated British Foods Plc. (ABF) (UK)

- Advanced Enzyme Technologies (India)

- Amano Enzyme Co., Ltd (Japan)

- BASF (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DowDuPont (US)

- Kerry Group (Ireland)

- PLC (Denmark)

- Novozymes (Denmark)

- Royal DSM N.V (Netherland)

- Aum Enzymes (India)

- Other key Players

Key Industry Developments in the Food Enzymes Market:

- In March 2021, Enovera 3001, a bakery-specific enzyme, was introduced by IFF in North America. This technology empowers industrial producers to create dough formulations that maintain the dough's strength, texture, and flavor.

- In November 2020, by means of its Food & Beverage platform, DuPont Nutrition & Biosciences has engaged into a new agreement with the Institute for the Future (IFTF), the preeminent futures organization in the world. The collaborative effort seeks to innovate in the food and beverage industry in anticipation of market changes.

|

Global Food Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 4.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FOOD ENZYME MARKET BY TYPE (2017-2032)

- FOOD ENZYME MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CARBOHYDRASE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIPASE

- PROTEASE

- OTHERS

- FOOD ENZYME MARKET BY SOURCE (2017-2032)

- FOOD ENZYME MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MICROORGANISMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMALS

- PLANTS

- FOOD ENZYME MARKET BY APPLICATION (2017-2032)

- FOOD ENZYME MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BAKERY PRODUCTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BEVERAGES

- DAIRY PRODUCTS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ASSOCIATED BRITISH FOODS PLC. (ABF) (UK)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ADVANCED ENZYME TECHNOLOGIES (INDIA)

- AMANO ENZYME CO., LTD (JAPAN)

- BASF (GERMANY)

- CHR. HANSEN HOLDING A/S (DENMARK)

- DOWDUPONT (US)

- KERRY GROUP (IRELAND)

- PLC (DENMARK)

- NOVOZYMES (DENMARK)

- ROYAL DSM N.V (NETHERLAND)

- AUM ENZYMES (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL FOOD ENZYME MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Food Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 4.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001: EXECUTIVE SUMMARY

TABLE 002. FOOD ENZYMES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD ENZYMES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD ENZYMES MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD ENZYMES MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD ENZYMES MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD ENZYMES MARKET BY TYPE

TABLE 008. CARBOHYDRASES MARKET OVERVIEW (2016-2028)

TABLE 009. PROTEASES MARKET OVERVIEW (2016-2028)

TABLE 010. LIPASES MARKET OVERVIEW (2016-2028)

TABLE 011. POLYMERASES MARKET OVERVIEW (2016-2028)

TABLE 012. NUCLEASES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. FOOD ENZYMES MARKET BY APPLICATION

TABLE 015. PROCESSED FOOD MARKET OVERVIEW (2016–2028)

TABLE 016. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 017. BAKERY & CONFECTIONARY MARKET OVERVIEW (2016-2028)

TABLE 018. MEAT PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 019. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA FOOD ENZYMES MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA FOOD ENZYMES MARKET, BY APPLICATION (2016-2028)

TABLE 023. N FOOD ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE FOOD ENZYMES MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE FOOD ENZYMES MARKET, BY APPLICATION (2016-2028)

TABLE 026. FOOD ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC FOOD ENZYMES MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC FOOD ENZYMES MARKET, BY APPLICATION (2016-2028)

TABLE 029. FOOD ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA FOOD ENZYMES MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA FOOD ENZYMES MARKET, BY APPLICATION (2016-2028)

TABLE 032. FOOD ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA FOOD ENZYMES MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA FOOD ENZYMES MARKET, BY APPLICATION (2016-2028)

TABLE 035. FOOD ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 036. DUPONT: SNAPSHOT

TABLE 037. DUPONT: BUSINESS PERFORMANCE

TABLE 038. DUPONT: PRODUCT PORTFOLIO

TABLE 039. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ASSOCIATED BRITISH FOODS PLC: SNAPSHOT

TABLE 040. ASSOCIATED BRITISH FOODS PLC: BUSINESS PERFORMANCE

TABLE 041. ASSOCIATED BRITISH FOODS PLC: PRODUCT PORTFOLIO

TABLE 042. ASSOCIATED BRITISH FOODS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DSM: SNAPSHOT

TABLE 043. DSM: BUSINESS PERFORMANCE

TABLE 044. DSM: PRODUCT PORTFOLIO

TABLE 045. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. NOVOZYMES: SNAPSHOT

TABLE 046. NOVOZYMES: BUSINESS PERFORMANCE

TABLE 047. NOVOZYMES: PRODUCT PORTFOLIO

TABLE 048. NOVOZYMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CHR. HANSEN: SNAPSHOT

TABLE 049. CHR. HANSEN: BUSINESS PERFORMANCE

TABLE 050: CHR. HANSEN: PRODUCT PORTFOLIO

TABLE 051. CHR. HANSEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. KERRY GROUP: SNAPSHOT

TABLE 052. KERRY GROUP: BUSINESS PERFORMANCE

TABLE 053. KERRY GROUP: PRODUCT PORTFOLIO

TABLE 054. KERRY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. JIANGSU BOLI BIOPRODUCTS CO.: SNAPSHOT

TABLE 055. JIANGSU BOLI BIOPRODUCTS CO.: BUSINESS PERFORMANCE

TABLE 056. JIANGSU BOLI BIOPRODUCTS CO.: PRODUCT PORTFOLIO

TABLE 057. JIANGSU BOLI BIOPRODUCTS CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BIOCATALYSTS LTD: SNAPSHOT

TABLE 058. BIOCATALYSTS LTD: BUSINESS PERFORMANCE

TABLE 059. BIOCATALYSTS LTD: PRODUCT PORTFOLIO

TABLE 060. BIOCATALYSTS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. PURATOS GROUP: SNAPSHOT

TABLE 061. PURATOS GROUP: BUSINESS PERFORMANCE

TABLE 062. PURATOS GROUP: PRODUCT PORTFOLIO

TABLE 063. PURATOS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ADVANCED ENZYME TECHNOLOGIES LTD: SNAPSHOT

TABLE 064. ADVANCED ENZYME TECHNOLOGIES LTD: BUSINESS PERFORMANCE

TABLE 065. ADVANCED ENZYME TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 066. ADVANCED ENZYME TECHNOLOGIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AMANO ENZYME INC.: SNAPSHOT

TABLE 067. AMANO ENZYME INC.: BUSINESS PERFORMANCE

TABLE 068. AMANO ENZYME INC.: PRODUCT PORTFOLIO

TABLE 069. AMANO ENZYME INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ENZYME DEVELOPMENT CORPORATION: SNAPSHOT

TABLE 070. ENZYME DEVELOPMENT CORPORATION: BUSINESS PERFORMANCE

TABLE 071. ENZYME DEVELOPMENT CORPORATION: PRODUCT PORTFOLIO

TABLE 072. ENZYME DEVELOPMENT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ENMEX: SNAPSHOT

TABLE 073. ENMEX: BUSINESS PERFORMANCE

TABLE 074. ENMEX: PRODUCT PORTFOLIO

TABLE 075. ENMEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. S.A. DE C.V.: SNAPSHOT

TABLE 076. S.A. DE C.V.: BUSINESS PERFORMANCE

TABLE 077. S.A. DE C.V.: PRODUCT PORTFOLIO

TABLE 078. S.A. DE C.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078: ENZYME BIOSCIENCE PRIVATE LIMITED: SNAPSHOT

TABLE 079. ENZYME BIOSCIENCE PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 080. ENZYME BIOSCIENCE PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 081. ENZYME BIOSCIENCE PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. AUMGENE BIOSCIENCES: SNAPSHOT

TABLE 082. AUMGENE BIOSCIENCES: BUSINESS PERFORMANCE

TABLE 083. AUMGENE BIOSCIENCES: PRODUCT PORTFOLIO

TABLE 084. AUMGENE BIOSCIENCES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. CREATIVE ENZYMES: SNAPSHOT

TABLE 085. CREATIVE ENZYMES: BUSINESS PERFORMANCE

TABLE 086. CREATIVE ENZYMES: PRODUCT PORTFOLIO

TABLE 087. CREATIVE ENZYMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. SUNSON INDUSTRY GROUP CO.: SNAPSHOT

TABLE 088. SUNSON INDUSTRY GROUP CO.: BUSINESS PERFORMANCE

TABLE 089. SUNSON INDUSTRY GROUP CO.: PRODUCT PORTFOLIO

TABLE 090: SUNSON INDUSTRY GROUP CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. AUM ENZYMES: SNAPSHOT

TABLE 091. AUM ENZYMES: BUSINESS PERFORMANCE

TABLE 092. AUM ENZYMES: PRODUCT PORTFOLIO

TABLE 093. AUM ENZYMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. XIKE BIOTECHNOLOGY CO. LTD.: SNAPSHOT

TABLE 094. XIKE BIOTECHNOLOGY CO. LTD.: BUSINESS PERFORMANCE

TABLE 095. XIKE BIOTECHNOLOGY CO. LTD.: PRODUCT PORTFOLIO

TABLE 096. XIKE BIOTECHNOLOGY CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ANTOZYME BIOTECH PVT LTD: SNAPSHOT

TABLE 097. ANTOZYME BIOTECH PVT LTD: BUSINESS PERFORMANCE

TABLE 098. ANTOZYME BIOTECH PVT LTD: PRODUCT PORTFOLIO

TABLE 099. ANTOZYME BIOTECH PVT LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001: YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD ENZYMES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD ENZYMES MARKET OVERVIEW BY TYPE

FIGURE 012. CARBOHYDRASES MARKET OVERVIEW (2016-2028)

FIGURE 013. PROTEASES MARKET OVERVIEW (2016-2028)

FIGURE 014. LIPASES MARKET OVERVIEW (2016-2028)

FIGURE 015. POLYMERASES MARKET OVERVIEW (2016-2028)

FIGURE 016. NUCLEASES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. FOOD ENZYMES MARKET OVERVIEW BY APPLICATION

FIGURE 019. PROCESSED FOOD MARKET OVERVIEW (2016-2028)

FIGURE 020. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 021. BAKERY & CONFECTIONARY MARKET OVERVIEW (2016-2028)

FIGURE 022. MEAT PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 023. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA FOOD ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE FOOD ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC FOOD ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA FOOD ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA FOOD ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Enzymes Market research report is 2024-2032.

Associated British Foods Plc. (ABF) (UK), Advanced Enzyme Technologies (India), Amano Enzyme Co., Ltd (Japan), BASF (Germany), Chr. Hansen Holding A/S (Denmark), and Other Major Players.

The Food Enzymes Market is segmented into Type, Source, Application, and region. By Type, the market is categorized into Carbohydrase, Lipase, Protease and Others. By Source, the market is categorized into Microorganisms, Animals and Plants. By Application, the market is categorized into Bakery Products, Beverages, Dairy Products and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The term “food enzymes”, refers to a particular class of enzymes that are inherent in different foods and which facilitate digestion of derived nutrients. These enzymes are typically proteins that are generated naturally occurring and isolated from various sources such as plants, animals, and microorganisms. If the topic is apiculture which refers to the management of honey bees, then the food enzymes of most significance are those that support honey production. During the formation of honey, bees move enzymes to nectar which helps to split big sugar chains into smaller chains and also enhances the taste and characteristic features of honey .

Food Enzymes Market Size Was Valued at USD 2.4 Billion in 2023, and is Projected to Reach USD 4.1 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.