Food Colors Market Synopsis

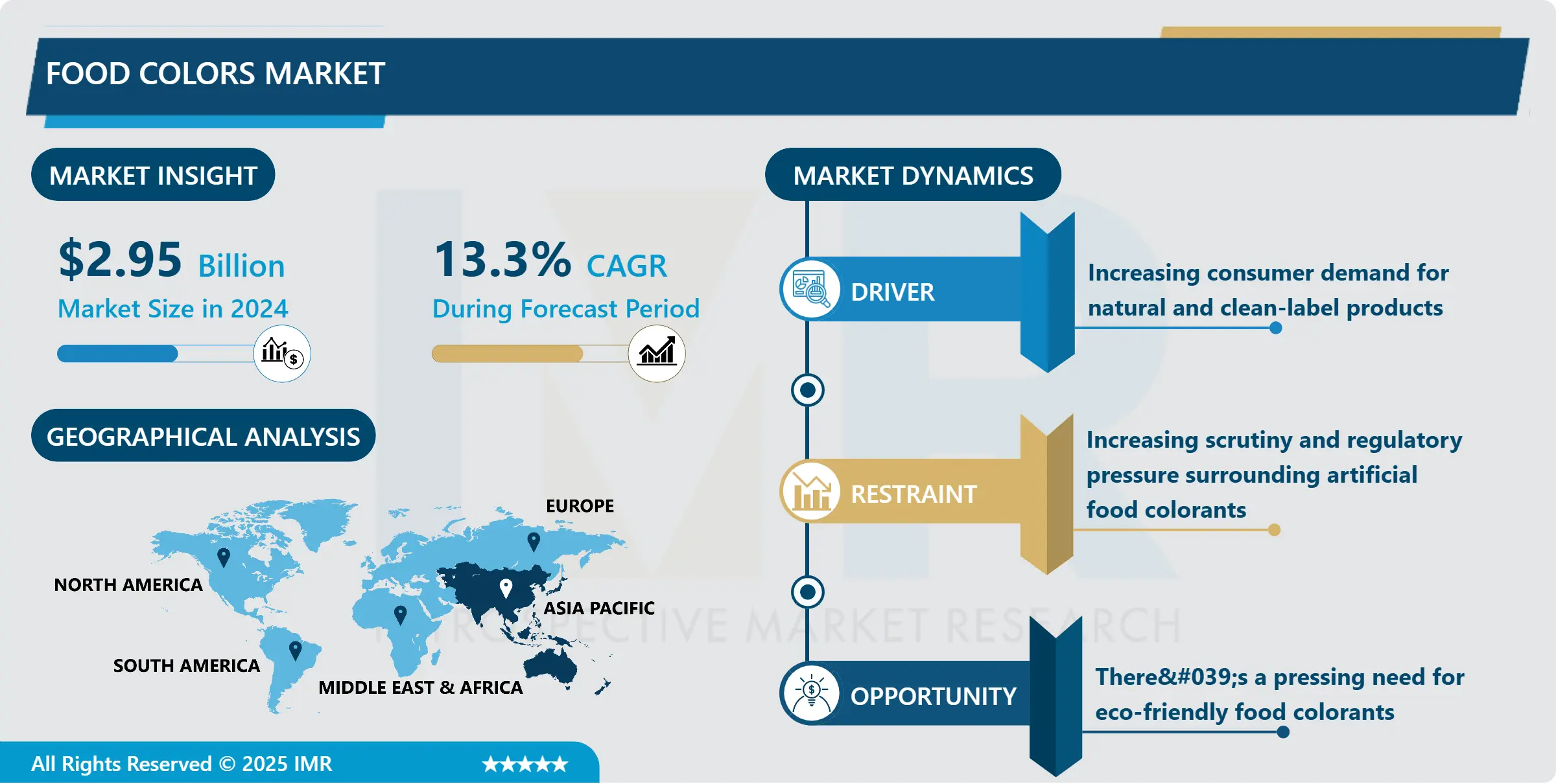

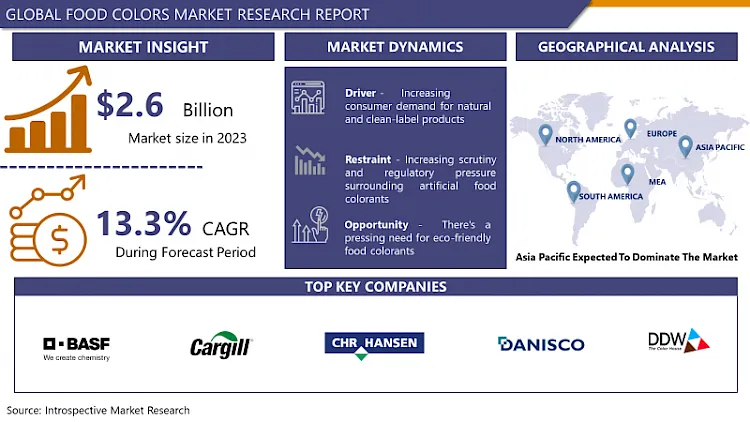

Food Colors Market Size Was Valued at USD 2.95 Billion in 2024, and is Projected to Reach USD 8.01 Billion by 2032, Growing at a CAGR of 13.3% From 2025-2032.

Food colors market can be defined as a market that includes production, sale, and usage of products which add colors to food products, and also used in beverages. These additives perform different functions;Initially, these additives can be used to improve the color of the food and, secondly, they are used to replace the natural colors of the food that may be lost during the processing period. This has explained why the stakes in natural, synthetic, and nature-identical colors remain on the rise considering the fact that consumers are paying more attention to the appearance of food products. Some of the factors that affect the dynamic nature of this market include trends, legal requirements as well as improved processes in food industry. Also, special considerations including impacts on the users’ health and the environment influence the demand for natural and plant-extracted colorants in the food colors industry.

The market of food colors is continuing to expand based on the growing need from the food and beverage industry as well as the pharmaceutical, cosmetic, and textile industries. The demands of consumers especially in industries such as food and beverages are also a factor owing to the appeal for nowadays products in terms of color and that many people are becoming more conscious with what they eat which include natural food colors. North America and Europe are witnessing a shift towards natural food colours from fruits, vegetables and other plant sources owing to the perceived health benefits and with the trend of clean label Food colours though synthetic have larger market and usage in some specific application, particularly confectionery and bakery. In addition, rigid regulatory polices on the aspect of food safety and quality assurance have led to increase in the development of research on approaches to offering foods with natural colours which are meeting customers’ expectation as well as global acceptable standards.

While the market continues to grow, the food colors come with some challenges some of which include; the unpredictable nature of raw materials particularly food colors derived from natural sources can compromise cost rules for producers. Moreover, questions regarding the safety of synthetic food colors that led to the restriction of of their usage in some part of the world present the market players with some challenges. Nevertheless, there are several challenges associated with food colors; these include high production costs, potential toxicity, instability of colorants, and fewer approvals by regulatory bodies. But modern technology like microencapsulation techniques and nanotechnology for food color production present great potential for addressing some of the challenges and expanding the market. In summary, the food colors market is expected to grow steadily in the future due to these factors such as the custom preferences, innovative products, and enhanced rules on regulations that are running the food colors industry.

Food Colors Market Trend Analysis

Growing demand for natural and clean-label ingredients

- Customers are becoming more demanding regarding the elements in the food they consume, and therefore, there is demand for natural colors obtained from fruits, vegetables, and other plant products. This change is due to the interests in the health and wellbeing of consumers together with the adoption of a healthier lifestyle by people and the confidence for authenticity of food products. Consequently, the food manufacturers are transitioning from synthetically-produced colors to these natural colors, resulting in a new usage of ingredients such as turmeric, beetroot, and spirulina as colors.

- Also, the Food Color Market 2017 is witnessing huge movements in terms of innovation especially in the formulations of bright and long-lasting colors for distinct Food products. Newer and highly developed food technological and the aspect of ingredients used in coloration enable manufacturers to come up with food colors that have high stability, better solubility, coupled with long shelf-life to meet several types of food and beverage products in the market. Processional food colors that range from high intensity for confectionery goods to pastel shades for dairy products: Advancements in delivering the aesthetic appeal in the food products while addressing the consumer preferences towards natural and spirited food products are brought about by the evolution of such new colors.

There's a pressing need for eco-friendly food colorants

- Based on the number of potential factors that can be associated with the Food Colors Market, the industry can be described as promising and full of opportunities to incorporate catchy colors into products. With the shift in consumer trends towards natural organic products, it is crucial to develop natural and natural-sourced provenance food colorants in domestic and international markets that are safe to consumed and meet the requirements of standards and legal requirements of various countries. This puts companies in a position to value improve research to discover new plant based products and clean-label approaches that finder better reception among health conscious consumers. To take advantage of this market trend, and have a positive impact on the future of the food industry and environmental sustainability, businesses must realize more ways that it can cater for the market.

- Moreover, the advancement of the global food industry also signifies; opportunities for the various forms of application of food colors across the unlimited segments such as, beverage, confectionery, bakery and savory products. Through technology and the analysis of the market, corporate giants can widen the offering of their products and services to reflect different needs through alteration of shade and other preferences.

- Additionally, the formation of long-term close collaborations with the suppliers and distributors can enhance the sector’s impact, driving a thriving culture of innovation. Rising popularity of Instagram-worthy dishes, colors and captions is merely the tip of the iceberg of what can be achieved at the Food Colors Market at the moment, not to mention the potential for lucrative returns as an investor.

Food Colors Market Segment Analysis:

Food Colors Market is segmented on the basis of type, application and region

By Type, Natural Colors segment is expected to dominate the market during the forecast period

- New entrants can also influence the segmentation patterns of the Food Colors Market, while its Natural Colors segment is expected to dominate the market throughout the forecast period. There are some trends since the pandemic that is natural with the idea of health-consciousness and consumer preference for natural and clean-label products. Natural food colorants derived from plant, fruit, and vegetable sources constitute a tangible and appealing substitute for synthetic ones, which is consistent with increasing food consumers’ pursuit of genuine and sustainable products. This segment not only targets the more health conscious consumer but also ensures that products complied with legal provisions as a result is a model that many producers desire to associate their products to improve its marketability.

- With the development of the population’s consciousness regarding the effects of eco-friendly natural colors added to food and beverages, businesses that invest in this segment gain a tremendous share of it and contribute to the creation of a unique focus on healthy and natural food.

By Application, Meat Products segment is expected to held the largest share in 2024

- While analyzing the Food Colors Market from a global perspective, the distinctive opportunities arise from the Meat Products vertical, set to grow exponentially as they dominate the share. This comes in light with the increasing demand on processed end packaged meat on the international market, there is clearly need for these products to have that appealing aspect to look at. The use of food colors is significant since it increases the appeal of mutton products in terms of appearance which in return is appealing to human eye sight and appeal when displayed on supermarkets and while cooking. At the same time, consumers are getting more health-conscious and are increasingly drawn to natural and organic solutions, making clean-label food colorants in meat products a segment with potential for innovation.

- In addition, all categories mentioned under the Meat Products segment are applicable across various categories such as marination and paired with cured or smoked items which are completely different concerns altogether where color solutions are concerned. With the market moving forward, it is possible to successfully conclude that today this segment can not only satisfy the increased demand in wrapped and sealed product but also create personalized offers that would answer to the specific requests of consumers, their religion, or other geographical peculiarities.

- Thus, there is a vast and untapped potential for market growth, particularly in sectors such as the meat industry where visuals play a critical role, to capitalize on which, key niche players could secure significant market ground and emerge as leaders in the Foods Colors Market.

Food Colors Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The fact that the Food Colors Market is predicted to grow more dominantly in the Asia Pacific region in the coming forecast period, pave the way for a progressive era ahead. Due to high population growth rates, shift in preferences with regards to diet, and the general inclination towards higher expenditure on food in areas such as China, India, and Japan, there is incoming demand for as visually appealing food products. In addition, the increased awareness and implementation of legal requirements for food quality and safety necessitate the use of superior quality food colorants, thus providing the desired openings for market growth.

- Additionally, the people of the Asia Pacific region have their unique gastronomic culture which means there is much variety to explore. This cultural diversity has promoted the development of new and more effective food coloring, especially those targeting natural and traditional products familiar with cultures of diverse regions. Businesses that unlock this market by committing to research, production, and distribution networks will be all set for big bucks in this prosperous environment. With the focus on Global food colors moving towards Asia Pacific region in the near future, business entities still have the opportunity and flexibility to shade their specialty field and come out as pioneers in the culinary culture of Food Colors.

Active Key Players in the Food Colors Market

- BASF (Germany)

- Cargill (US)

- CHR Hansen (Denmark)

- Danisco (Denmark)

- DD Williamson (US)

- DSM (Netherlands)

- GNT Group (Netherlands)

- Lycored Ltd. (Israel)

- Naturex (France)

- SAN-EI GEN F.F.I. INC (Japan)

- Other Active Players

Key Industry Developments in the Food Colors Market:

- In April 2023, for pet foods, Sensient Colors, a division of Sensient Technologies, has created a new natural green hue. Vertafine, a novel natural green color alternative for pet foods created by Sensient Colors, empowers pet food manufacturers to cater to the growing consumer preference for natural pigments. This cost-effective solution features vibrant green hues, rendering it well-suited for use in high-temperature pet food applications.

- In December 2022, Givaudan acquired the United States-based natural color company DDW. By means of the acquisition, Givaudan endeavors to furnish clients with an appealing product line and participate in cooperative undertakings to create immersive and multisensory gastronomic encounters.

|

Global Food Colors Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.3 % |

Market Size in 2032: |

USD 8.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Colors Market by Type (2018-2032)

4.1 Food Colors Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural Colors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Artificial Colors

Chapter 5: Food Colors Market by Application (2018-2032)

5.1 Food Colors Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Meat Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverages

5.5 Dairy

5.6 Bakery and Confectionary

5.7 Processed Food and Vegetables

5.8 Oils and Fats

5.9 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Food Colors Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MASTER LOCK

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ONITY

6.4 SALTO SYSTEMS

6.5 ALLEGION

6.6 CANSEC SYSTEMS

6.7 ASSA ABLOY AB

6.8 HONEYWELL

6.9 HAVEN LOCK

6.10 SPECTRUM BRANDS

6.11 YALE

6.12 MASTER LOCK (USA)

6.13 ONITY (USA)

6.14 SALTO SYSTEMS (SPAIN)

6.15 ALLEGION (IRELAND)

6.16 CANSEC SYSTEMS (CANADA)

6.17 ASSA ABLOY AB (SWEDEN)

6.18 HONEYWELL (USA)

6.19 HAVEN LOCK (USA)

6.20 SPECTRUM BRANDS (USA)

6.21 YALE (PART OF ASSA ABLOY GROUP) (USA)

6.22 KWIKSET (SPECTRUM BRANDS) (USA)

6.23 SCHLAGE (ALLEGION) (USA)

6.24 BRINK’S HOME SECURITY (USA)

6.25 AUGUST HOME (ASSA ABLOY GROUP) (USA)

Chapter 7: Global Food Colors Market By Region

7.1 Overview

7.2. North America Food Colors Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Natural Colors

7.2.4.2 Artificial Colors

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Meat Products

7.2.5.2 Beverages

7.2.5.3 Dairy

7.2.5.4 Bakery and Confectionary

7.2.5.5 Processed Food and Vegetables

7.2.5.6 Oils and Fats

7.2.5.7 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Food Colors Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Natural Colors

7.3.4.2 Artificial Colors

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Meat Products

7.3.5.2 Beverages

7.3.5.3 Dairy

7.3.5.4 Bakery and Confectionary

7.3.5.5 Processed Food and Vegetables

7.3.5.6 Oils and Fats

7.3.5.7 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Food Colors Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Natural Colors

7.4.4.2 Artificial Colors

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Meat Products

7.4.5.2 Beverages

7.4.5.3 Dairy

7.4.5.4 Bakery and Confectionary

7.4.5.5 Processed Food and Vegetables

7.4.5.6 Oils and Fats

7.4.5.7 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Food Colors Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Natural Colors

7.5.4.2 Artificial Colors

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Meat Products

7.5.5.2 Beverages

7.5.5.3 Dairy

7.5.5.4 Bakery and Confectionary

7.5.5.5 Processed Food and Vegetables

7.5.5.6 Oils and Fats

7.5.5.7 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Food Colors Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Natural Colors

7.6.4.2 Artificial Colors

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Meat Products

7.6.5.2 Beverages

7.6.5.3 Dairy

7.6.5.4 Bakery and Confectionary

7.6.5.5 Processed Food and Vegetables

7.6.5.6 Oils and Fats

7.6.5.7 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Food Colors Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Natural Colors

7.7.4.2 Artificial Colors

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Meat Products

7.7.5.2 Beverages

7.7.5.3 Dairy

7.7.5.4 Bakery and Confectionary

7.7.5.5 Processed Food and Vegetables

7.7.5.6 Oils and Fats

7.7.5.7 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Food Colors Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.3 % |

Market Size in 2032: |

USD 8.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||