Fitness Equipment Market Synopsis

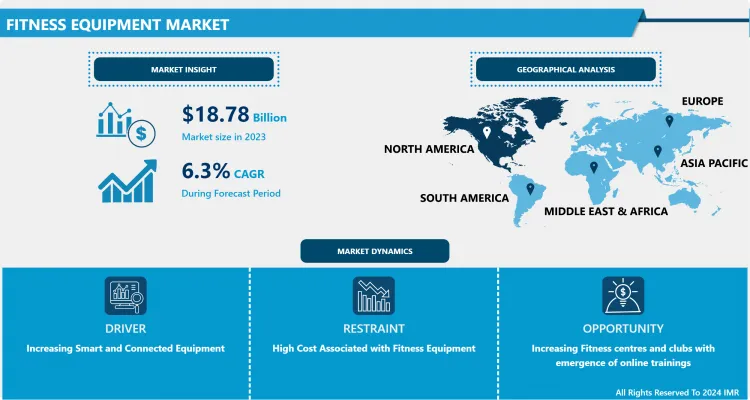

Fitness Equipment Market Size Was Valued at 19.96 Billion in 2024, and is Projected to Reach USD 32.54 Billion by 2032, Growing at a CAGR of 6.3% From 2025-2032.

People are becoming more sensitive of their health, which has raised awareness of the need of regular exercise for general wellbeing. This pattern has encouraged more money to be spent on workout equipment, along with increased disposable incomes.

Exercise equipment is necessary for a variety of activities that target improving physical health, controlling weight, and increasing muscle mass and endurance. Increased health concerns, an increasing youth population, and the high prevalence of obesity are all factors driving market expansion. This market includes a wide range of goods made for home and business usage, such as equipment for gyms, sports teams, fitness centres, and individual users.

The fitness sector offers a wide range of products to meet the demands and tastes of its customers, from weight machines and free weights to stationary bikes and treadmills. It is anticipated that as the market for fitness solutions expands, new products and technologies that improve efficacy and user experience will emerge. Fitness equipment is now more widely available because to the development of e-commerce platforms, which let users compare products, read reviews, and make purchases. A noteworthy factor bolstering the market expansion is the heightened emphasis on corporate wellness initiatives.

Corporate wellness initiatives are being implemented by numerous businesses as a result of their recognition of the value of promoting the health and well-being of their workforce. Businesses are investing in on-site workout facilities within their office buildings to promote corporate wellness initiatives. Exercise equipment like weight machines, yoga mats, treadmills, and exercise bikes are frequently available in these facilities. The market is growing because of the demand for exercise equipment in these settings.

Fitness Equipment Market Trend Analysis

Fitness Equipment Market Growth Driver- Increasing Smart and Connected Equipment

- A notable trend in the fitness equipment market is the rise of smart and connected equipment, which is reshaping the landscape of the sector in a number of ways. Technological developments and the rising desire for a customised, practical, and enjoyable workout experience are the driving forces behind this trend. In order to add value to their equipment, businesses are providing virtual lessons, training courses, and wellness material via subscription services.

- Rising demand for home fitness solutions has led to the development of space-saving and versatile equipment, such as foldable treadmills and all-in-one gym systems. Growth of online workout programs and virtual personal training sessions that can be accessed via home fitness equipment. Increased use of sustainable and recyclable materials in the manufacturing of fitness equipment. Development of self-powered machines, like treadmills and ellipticals that generate power as they are used.

- Equipment that can tailor workouts to an individual's fitness level, goals, and preferences, often through AI and machine learning algorithms. Machines that allow users to customize resistance and settings easily, catering to a range of fitness levels. Growing popularity of equipment designed for recovery and rehabilitation, such as foam rollers, massage guns, and stretching machines. Expansion of product lines to include items that support overall wellness, including yoga mats, meditation cushions, and balance trainers.

Fitness Equipment Market Expansion Opportunity- Increasing Fitness centres and clubs with emergence of online trainings

- Many peoples are engaging in online training programs, there is a higher demand for home fitness equipment. Peoples are investing in treadmills, stationary bikes, dumbbells, resistance bands, and other portable fitness gear to facilitate their at-home workouts.so the demand for home fitness equipment’s are rising. The convergence of technology and fitness has led to the development of smart fitness equipment. These devices often integrate with fitness apps, providing real-time feedback, virtual coaching, and community engagement, enhancing the overall workout experience.

- Many Corporates arrange the health training programs, companies are increasingly recognizing the importance of employee wellness, leading to the implementation of corporate wellness programs that include fitness equipment for offices or subsidized memberships to fitness centres. This trend can drive bulk purchases of fitness equipment by organizations looking to support their employees' health and productivity.

- Rising of online training and a more customization approach to fitness, there is a growing market for customized fitness equipment. Consumers are demanding for equipment that fits their specific needs, preferences, and space constraints. This opens up opportunities for companies to offer bespoke solutions, such as adjustable dumbbells, foldable exercise bikes, and modular home gym systems.

Fitness Equipment Market Segment Analysis:

Fitness Equipment Market is Segmented on The Basis of Product Type, Application, Gender, Buyer Type, Gender, End-User, Type, Distribution Channel and Region.

By Type, Cardiovascular Training Equipment segment is expected to dominate the market during the forecast period

- Cardiovascular training equipment dominates the fitness equipment market, driven by the increasing focus on cardiovascular health, weight management, and overall fitness. The health benefits of cardiovascular exercise are well-known, and they include enhancing lung capacity, lowering the risk of chronic diseases like hypertension, diabetes, and obesity, as well as assisting in weight loss. This type advantages make cardio hardware interesting to an expansive crowd.

- Cardio gear like treadmills, exercise bikes, circular machines, and paddling machines take care of different wellness levels and inclinations. They provide a variety of workout options, ranging from high-intensity interval training to more interactive and engaging cardio equipment. The user experience has been enhanced by built-in screens, virtual coaching, online classes, and performance tracking, making workouts more enjoyable and motivating.

- A greater understanding of the significance of cardiovascular health has led people to purchase cardiac equipment. Fitness gurus and public health initiatives frequently highlight the importance of physical activity in preserving general health and wellness. Cardio equipment is often an excellent investment for both individuals and fitness centres since it provides a nice balance between cost and functionality. Its commercial appeal keeps it at the top of the market.

By End-Users, Home Consumer segment held the Largest Share in 2024

- Many home consumers facing the space problem so compact and foldable fitness equipment is in high demand. Folding treadmills, portable exercise cycles, and mini elliptical trainers are examples of products that are made to fit into smaller living spaces without sacrificing functionality. Users can quickly put up and store their training equipment thanks to these space-saving alternatives.

- The need for portable exercise equipment that is convenient to use in different parts of the house is growing. Products like kettlebells, resistance bands, adjustable dumbbells, and small rowing machines are convenient and versatile for individuals who require a variety of training options and demanding this type of products. With rising popularity of online fitness classes has surged, allowing home consumers to participate in live or on-demand workout sessions led by professional trainers.

- Platforms like Peloton, iFit, and Echelon provide interactive classes for various fitness levels and interests, and helps to consumer stay engaged and motivated. The home consumer market is becoming more and more concerned with overall wellbeing and health. As a result, there is a growing need for gear that promotes both mental and physical health. Incorporating yoga mats, mindfulness equipment, and meditation applications into home workout regimens is becoming more typical.

Fitness Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America there is rising awareness of health and fitness among the people. Many people are increasingly realizing the importance of regular exercise and leading a healthy lifestyle, which drives the demand for fitness equipment. In this region, particularly the United States, has been facing an obesity epidemic for several years. This has led to a heightened focus on weight management, physical activity, and overall wellness, resulting in a robust demand for fitness equipment.

- North America has a relative population with high disposable income to spend on fitness and wellness products. This purchasing power drives the market for high-quality fitness equipment, including advanced cardiovascular machines, strength training equipment, and home gym setups. The region is a hub for innovation and technological advancements in the fitness industry. North American companies continuously develop cutting-edge fitness equipment with features like connectivity, virtual training, and personalized workout programs, catering to the evolving needs and preferences of consumers.

- Strong fitness culture in this region, with a significant emphasis on physical appearance, health, and wellness. This cultural mindset fosters a continuous demand for fitness equipment and services, supporting the market's dominance in the region.

- From this graph, it is shown that the wholesale sales data for fitness equipment in the U.S. from 2020 to 2023 indicates a fluctuating trend. In 2020, wholesale sales of fitness equipment in the U.S. amounted to $5.59 billion. This figure increased to $6.42 billion in 2021, reflecting a significant rise in demand for fitness equipment. However, in 2022, there was a slight decrease in wholesale sales, dropping to $6.08 billion. By 2023, the wholesale sales of fitness equipment rebounded, reaching $6.56 billion. That the fitness equipment market experienced overall growth during this period, albeit with some fluctuations. In 2022, the market demonstrated resilience and recovered swiftly, achieving a higher sales figure in 2023 compared to the previous years.

Fitness Equipment Market Top Key Players:

- Life Fitness (USA)

- Technogym (Italy)

- Nautilus, Inc. (USA)

- Precor (USA)

- Johnson Health Tech (Taiwan)

- Peloton Interactive (USA)

- ICON Health & Fitness (USA)

- TRUE Fitness (USA)

- Cybex International (USA)

- Matrix Fitness (USA)

- Keiser Corporation (USA)

- Spirit Fitness (USA)

- Star Trac (USA)

- Torque Fitness (USA)

- Dyaco International (Taiwan)

- Body-Solid, Inc. (USA)

- Hoist Fitness (USA)

- Hammer Strength (USA)

- Panatta (Italy)

- SportsArt (Taiwan)

- Core Health & Fitness (USA)

- Woodway USA (USA)

- Rogue Fitness (USA)

- Atlantis Strength (Canada)

- BH Fitness (Spain)

- Impulse Group (China)

- Jerai Fitness Ltd (India)

- Gym80 International GmbH (Germany)

- Other Active players.

Key Industry Developments in the Fitness Equipment Market:

- In Jan 2024, EGYM, the global fitness technology and corporate health innovation leader, and Life Fitness, the global leader in commercial fitness equipment, are thrilled to announce the expansion of t

|

Fitness Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.96 million |

|

Forecast Period 2025-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 32.54 million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Gender |

|

||

|

By Buyer Type |

|

||

|

By Usage |

|

||

|

By Type |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fitness Equipment Market by Product Type (2018-2032)

4.1 Fitness Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Strength Training Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cardiovascular Training Equipment

4.5 Body Composition Analyser

4.6 Fitness Monitoring Equipment and Others

Chapter 5: Fitness Equipment Market by Application (2018-2032)

5.1 Fitness Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Weight Loss

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Body Building

5.5 Physical Fitness

5.6 Mental Fitness and Others

Chapter 6: Fitness Equipment Market by Gender (2018-2032)

6.1 Fitness Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Male

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Female

Chapter 7: Fitness Equipment Market by Buyer Type (2018-2032)

7.1 Fitness Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Individual

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Institution

Chapter 8: Fitness Equipment Market by Usage (2018-2032)

8.1 Fitness Equipment Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Residential

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

Chapter 9: Fitness Equipment Market by Type (2018-2032)

9.1 Fitness Equipment Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Outdoor

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Indoor

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Fitness Equipment Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 LIFE FITNESS (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 TECHNOGYM (ITALY)

10.4 NAUTILUS INC. (USA)

10.5 PRECOR (USA)

10.6 JOHNSON HEALTH TECH (TAIWAN)

10.7 PELOTON INTERACTIVE (USA)

10.8 ICON HEALTH & FITNESS (USA)

10.9 TRUE FITNESS (USA)

10.10 CYBEX INTERNATIONAL (USA)

10.11 MATRIX FITNESS (USA)

10.12 KEISER CORPORATION (USA)

10.13 SPIRIT FITNESS (USA)

10.14 STAR TRAC (USA)

10.15 TORQUE FITNESS (USA)

10.16 DYACO INTERNATIONAL (TAIWAN)

10.17 BODY-SOLID INC. (USA)

10.18 HOIST FITNESS (USA)

10.19 HAMMER STRENGTH (USA)

10.20 PANATTA (ITALY)

10.21 SPORTSART (TAIWAN)

10.22 CORE HEALTH & FITNESS (USA)

10.23 WOODWAY USA (USA)

10.24 ROGUE FITNESS (USA)

10.25 ATLANTIS STRENGTH (CANADA)

10.26 BH FITNESS (SPAIN)

10.27 IMPULSE GROUP (CHINA)

10.28 JERAI FITNESS LTD (INDIA)

10.29 GYM80 INTERNATIONAL GMBH (GERMANY)

Chapter 11: Global Fitness Equipment Market By Region

11.1 Overview

11.2. North America Fitness Equipment Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Product Type

11.2.4.1 Strength Training Equipment

11.2.4.2 Cardiovascular Training Equipment

11.2.4.3 Body Composition Analyser

11.2.4.4 Fitness Monitoring Equipment and Others

11.2.5 Historic and Forecasted Market Size by Application

11.2.5.1 Weight Loss

11.2.5.2 Body Building

11.2.5.3 Physical Fitness

11.2.5.4 Mental Fitness and Others

11.2.6 Historic and Forecasted Market Size by Gender

11.2.6.1 Male

11.2.6.2 Female

11.2.7 Historic and Forecasted Market Size by Buyer Type

11.2.7.1 Individual

11.2.7.2 Institution

11.2.8 Historic and Forecasted Market Size by Usage

11.2.8.1 Residential

11.2.8.2 Commercial

11.2.9 Historic and Forecasted Market Size by Type

11.2.9.1 Outdoor

11.2.9.2 Indoor

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Fitness Equipment Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Product Type

11.3.4.1 Strength Training Equipment

11.3.4.2 Cardiovascular Training Equipment

11.3.4.3 Body Composition Analyser

11.3.4.4 Fitness Monitoring Equipment and Others

11.3.5 Historic and Forecasted Market Size by Application

11.3.5.1 Weight Loss

11.3.5.2 Body Building

11.3.5.3 Physical Fitness

11.3.5.4 Mental Fitness and Others

11.3.6 Historic and Forecasted Market Size by Gender

11.3.6.1 Male

11.3.6.2 Female

11.3.7 Historic and Forecasted Market Size by Buyer Type

11.3.7.1 Individual

11.3.7.2 Institution

11.3.8 Historic and Forecasted Market Size by Usage

11.3.8.1 Residential

11.3.8.2 Commercial

11.3.9 Historic and Forecasted Market Size by Type

11.3.9.1 Outdoor

11.3.9.2 Indoor

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Fitness Equipment Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Product Type

11.4.4.1 Strength Training Equipment

11.4.4.2 Cardiovascular Training Equipment

11.4.4.3 Body Composition Analyser

11.4.4.4 Fitness Monitoring Equipment and Others

11.4.5 Historic and Forecasted Market Size by Application

11.4.5.1 Weight Loss

11.4.5.2 Body Building

11.4.5.3 Physical Fitness

11.4.5.4 Mental Fitness and Others

11.4.6 Historic and Forecasted Market Size by Gender

11.4.6.1 Male

11.4.6.2 Female

11.4.7 Historic and Forecasted Market Size by Buyer Type

11.4.7.1 Individual

11.4.7.2 Institution

11.4.8 Historic and Forecasted Market Size by Usage

11.4.8.1 Residential

11.4.8.2 Commercial

11.4.9 Historic and Forecasted Market Size by Type

11.4.9.1 Outdoor

11.4.9.2 Indoor

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Fitness Equipment Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Product Type

11.5.4.1 Strength Training Equipment

11.5.4.2 Cardiovascular Training Equipment

11.5.4.3 Body Composition Analyser

11.5.4.4 Fitness Monitoring Equipment and Others

11.5.5 Historic and Forecasted Market Size by Application

11.5.5.1 Weight Loss

11.5.5.2 Body Building

11.5.5.3 Physical Fitness

11.5.5.4 Mental Fitness and Others

11.5.6 Historic and Forecasted Market Size by Gender

11.5.6.1 Male

11.5.6.2 Female

11.5.7 Historic and Forecasted Market Size by Buyer Type

11.5.7.1 Individual

11.5.7.2 Institution

11.5.8 Historic and Forecasted Market Size by Usage

11.5.8.1 Residential

11.5.8.2 Commercial

11.5.9 Historic and Forecasted Market Size by Type

11.5.9.1 Outdoor

11.5.9.2 Indoor

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Fitness Equipment Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Product Type

11.6.4.1 Strength Training Equipment

11.6.4.2 Cardiovascular Training Equipment

11.6.4.3 Body Composition Analyser

11.6.4.4 Fitness Monitoring Equipment and Others

11.6.5 Historic and Forecasted Market Size by Application

11.6.5.1 Weight Loss

11.6.5.2 Body Building

11.6.5.3 Physical Fitness

11.6.5.4 Mental Fitness and Others

11.6.6 Historic and Forecasted Market Size by Gender

11.6.6.1 Male

11.6.6.2 Female

11.6.7 Historic and Forecasted Market Size by Buyer Type

11.6.7.1 Individual

11.6.7.2 Institution

11.6.8 Historic and Forecasted Market Size by Usage

11.6.8.1 Residential

11.6.8.2 Commercial

11.6.9 Historic and Forecasted Market Size by Type

11.6.9.1 Outdoor

11.6.9.2 Indoor

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Fitness Equipment Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Product Type

11.7.4.1 Strength Training Equipment

11.7.4.2 Cardiovascular Training Equipment

11.7.4.3 Body Composition Analyser

11.7.4.4 Fitness Monitoring Equipment and Others

11.7.5 Historic and Forecasted Market Size by Application

11.7.5.1 Weight Loss

11.7.5.2 Body Building

11.7.5.3 Physical Fitness

11.7.5.4 Mental Fitness and Others

11.7.6 Historic and Forecasted Market Size by Gender

11.7.6.1 Male

11.7.6.2 Female

11.7.7 Historic and Forecasted Market Size by Buyer Type

11.7.7.1 Individual

11.7.7.2 Institution

11.7.8 Historic and Forecasted Market Size by Usage

11.7.8.1 Residential

11.7.8.2 Commercial

11.7.9 Historic and Forecasted Market Size by Type

11.7.9.1 Outdoor

11.7.9.2 Indoor

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Fitness Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.96 million |

|

Forecast Period 2025-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 32.54 million |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Gender |

|

||

|

By Buyer Type |

|

||

|

By Usage |

|

||

|

By Type |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

.webp)