Global Fitness App Market Overview

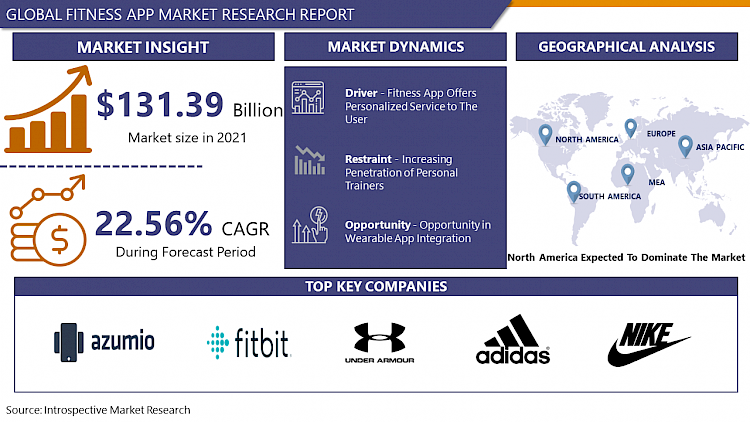

Global Fitness App Market was valued at USD 131.39 billion in 2022 and is predicted to grow at a CAGR of 22.56 % to USD 545.76 billion by 2028.

This fitness app is created especially to help users with exercise, nutrition & diet, and other forms of physical training or other fitness-related topics. A fitness app is an application that can be installed on any mobile device easily such as smartphones, tablets, and PC. The two leading platforms, iPhone operating system (iOS) and Android, consist of several health-related apps, people can download these applications on devices. Apps can perform different functions such as letting users track caloric intake, gathering workout ideas, setting fitness goals, and allow sharing all the things on social media to influence others for healthy behavior change. The goal of these apps is to make the lifestyle healthier. Advancement in technology allows apps to track heart rate, blood pressure, and step tracking which is beneficial for individuals with high-low blood pressure levels. This helps to increase the adoption of fitness apps and generate high revenue. According to Statista, the average revenue per user (ARPU) is expected to amount to USD 24.66.

Market Dynamics And Factors For Fitness App Market

Drivers:

Fitness App Offers Personalized Service to the User

It is the most convenient and cost-effective way to live a healthy, fit and cheerful life. These apps are developed by using advanced technology such as machine learning, artificial intelligence, and other technologies to offer personalized fitness plans to the user. It also offers personalized diet charts, monitors diet, tracks footsteps, and no equipment workout routines for better results. The fitness app provides personalized health and fitness coaches for early results. Such offerings and advantages are expected to increase the growth potential of the fitness app market. For instance, MyFitnessPal offers personalized diet and activity tracking to their users and generated revenue of USD 6.7 million in June 2020 In terms of IAP revenue, MyFitnessPal leads the pack in both 2020 and 2021. This show offering personalized services propels the growth of the fitness app market.

Restraints:

Increasing penetration of personal trainers

A personal trainer is a professional that gives the tools and supports to reach a health and fitness goal. Personal trainers provide support, accountability, education, and a personalized plan that convinces people to hire a personal trainer for working out and hampers the market for a fitness app. The higher income group is more likely to spend on personal trainers for a daily workout sessions, and diet plans which are restraining the growth of the market. But, this segment of people is slowly converting to word fitness apps due to their availability and efficiency that support the growth of the market.

Opportunity:

Opportunity in Wearable App Integration

A Wearable smart device is a technology that individuals can wear on body parts or clothing. These devices are connected to the internet through smartphones, computers, tablets, etc. In this technique, the data is exchanged from the wearable apps to the mobile to perform tasks, monitoring, and analysis of the physical performance of individuals. Wearable apps are smart watches and rings, fitness trackers like FitBit, body sensors, Google Glass, and Others. For instance, The FitLyfe 360 platform integrates with most fitness tracking devices and third-party apps to help population activity in one place. This wearable fitness app helps to increase wellness program participation, make friendly Competition, and informs health coaches to give lifestyle solutions, customized diet, and exercise. All these factors provide opportunities for the growth of the fitness app market.

Segmentation Analysis Of Fitness App Market

By Type, the Android segment is expected to dominate the fitness app market in the forecast period. The Android sector had the largest market share of 45.32 percent, with a market value of USD 159.17 billion for fitness apps. Smartphones running the Android operating system hold an 87% share of the global market. This shows the higher consumer base of android users that suggest the larger population using fitness app operating on an android system developed by Google. Additionally, the open code provides manufacturers the freedom to choose which apps are pre-installed on their devices and also allows the customer to install apps according to their preferences. Android platform offers apps such as MyFitnessPal, Google Fit, Sworkit, Runstastic, and Leap Fitness Workout Apps. This rising number of android users is rapidly growing in the fitness market.

By Application, the health monitoring segment is expected to garner a significant share in the fitness app industry during the forecast period. Owing to the increasing instances of obesity due to changing lifestyles, eating habits and comfy living propel the conditions like obesity, high BP, and lower oxygen levels. A survey from 2021 of people from 30 different countries found that obesity was ranked fifth, behind COVID-19, cancer, mental health, and stress. To overcome from this people are using a fitness app that provides exercise routines, calorie consumption, diet plan, exercise routines, notifications, and check BP, and oxygen level which led to the growth of the market. Moreover, clinicians are advising about the usefulness of mobile apps. Many people have already integrated apps into their attempts to manage weight. However, increasing demands from healthcare institutions for easy and risk-free fitness transformations and an increase in the requirement to monitor a rising variety of healthcare and fitness conditions boost the growth of the fitness app market.

Regional Analysis Of Fitness App Market

The North American region is expected largest market share of the fitness app market during the forecasted period. The coronavirus pandemic boosts the use of fitness applications in this region. People are restricted to go outside of the house, fitness apps provide in-house fitness training which contributes a large share to the growth of the market. People are more concerned about their health and lifestyle in those days, also increasing awareness about exercise, and a healthy diet to improve the immunity system boosts the fitness app market. In 2019, there were 68.7 million smartphone owners in the United States who used at least one health or fitness app at last once per month. In addition to this, the Fitness app provides all the training, dietary plans, and exercise routines to people at a very low cost. It is a very convenient way to be fit while doing work or being at home. The United States accounts for around half of IAP earnings in the fitness section. In 2020, 45 percent increase in users, and interest has remained high in 2021. As a result, the advantage of the application boosts the fitness app market in the North American region.

Asia Pacific region is the second most dominated region in the fitness app market projected period. The rapidly growing online market, increasing adoption of new technology, smartphones, and other mobile devices, and increasing awareness regarding healthy lifestyle help to propel the growth of the fitness app market in the Asia Pacific region. The Asia Pacific especially China accrues the largest share in the global market for fitness app usage. According to Statista in global comparison, most revenue will be generated in China (USD5, 005.00m in 2022). In December 2021, an app named Keep, which provides online fitness programs topped the sports app ranking with about 13.1 million monthly active users in China. Additionally, China and India are densely populated countries in this region which provides a large user base for a fitness app. That promotes the fitness app market in the Asia Pacific region during the forecasted period.

Europe is the region that has the potential to grow in the fitness app market in the upcoming period. The increasing disposable income and high living slandered of people in this region are helping in the growth of the fitness app market in the Europe region. During the first quarter of 2020, health and fitness apps were downloaded 593 million times in the world. That shows the high consumption rate of the fitness app. Moreover, Due to the global coronavirus pandemic has caused the individual to stay at home and restructure their exercise and general lifestyle practices. Results in the high installation rate of fitness applications in this region, propels the growth of the fitness app market in the Europe region

Covid-19 Impact Analysis On Fitness App Market

The Global market struggled due to the sudden hampering of the pandemic. But this works in favor of the fitness app market. Due to lockdown and restrictions, people are in their homes and depend on online services. The increasing use of fitness applications shows a positive impact on the fitness app market. As more gyms and fitness centers continue to collaborate with app developers and roll out advanced, engaging, and fitness-motivating apps, the fitness app market is set to grow at an impressive pace, particularly in 2020 and 2021. The increasing awareness about living a healthy lifestyle and a healthy diet to increase immunity against diseases results in the high adoption of fitness applications in the world. People prefer using a mobile phone application for exercise and training rather than going outside the house and getting infected by the disease. The fitness app helps to maintain distance from Gym equipment, and trainers. As a result, COVID-19 shows positive impact on the fitness app market.

Top Key Players Covered In Fitness App Market

- Azumio(US)

- FitBit (US)

- Jawbone (US)

- FitnessKeeper (US)

- Under Armour (US)

- Adidas (US)

- Fooducate (US)

- Google (US)

- My Diet Coach (US)

- Nike (US)

- Noom (US)

- Polar Electro (Finland)

- Runtastic (Austria)

- Samsung Electronics (South Korea)

- Sports Tracking Technologies (Finland)

- Wahoo Fitness (Atlanta). and Other major players.

Key Industry Development In The Fitness App Market

In April 2020, Samsung Electronics Co. Ltd. collaborated with top fitness brands such as calm, barre3, Echelon, obé Fitness, Fitplan, and Jillian Michaels Fitness and launched wellness apps on Samsung’s smart TV platform.

In January 2021 Vivendi SA, a French media conglomerate, announced signing an agreement with Equinox Media LLC, the world's most influential lifestyle brand, to add its largest music catalog to Equinox's various digital fitness apps. The music industry is increasingly looking for new partners across the fitness industry, social media, and videogames, for revenue beyond streaming.

|

Global Fitness App Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 131.39 Bn |

|

Forecast Period 2022-28 CAGR: |

22.56 % |

Market Size in 2028: |

USD 545.76 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Fitness App Market by Type

5.1 Fitness App Market Overview Snapshot and Growth Engine

5.2 Fitness App Market Overview

5.3 Android

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Android: Grographic Segmentation

5.4 iOS

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 iOS: Grographic Segmentation

Chapter 6: Fitness App Market by Application

6.1 Fitness App Market Overview Snapshot and Growth Engine

6.2 Fitness App Market Overview

6.3 Health Monitoring

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Health Monitoring: Grographic Segmentation

6.4 Lifestyle Monitoring

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Lifestyle Monitoring: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Fitness App Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Fitness App Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Fitness App Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AZUMIO

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 FITBIT

7.4 JAWBONE

7.5 FITNESSKEEPER

7.6 UNDER ARMOUR

7.7 ADIDAS

7.8 FOODUCATE

7.9 GOOGLE

7.10 MY DIET COACH

7.11 NIKE

7.12 NOOM

7.13 POLAR ELECTRO

7.14 RUNTASTIC

7.15 SAMSUNG ELECTRONICS

7.16 SPORTS TRACKING TECHNOLOGIES

7.17 WAHOO FITNESS

7.18 OTHER MAJOR PLAYERS

Chapter 8: Global Fitness App Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Android

8.2.2 iOS

8.3 Historic and Forecasted Market Size By Application

8.3.1 Health Monitoring

8.3.2 Lifestyle Monitoring

Chapter 9: North America Fitness App Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Android

9.4.2 iOS

9.5 Historic and Forecasted Market Size By Application

9.5.1 Health Monitoring

9.5.2 Lifestyle Monitoring

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Fitness App Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Android

10.4.2 iOS

10.5 Historic and Forecasted Market Size By Application

10.5.1 Health Monitoring

10.5.2 Lifestyle Monitoring

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Fitness App Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Android

11.4.2 iOS

11.5 Historic and Forecasted Market Size By Application

11.5.1 Health Monitoring

11.5.2 Lifestyle Monitoring

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Fitness App Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Android

12.4.2 iOS

12.5 Historic and Forecasted Market Size By Application

12.5.1 Health Monitoring

12.5.2 Lifestyle Monitoring

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Fitness App Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Android

13.4.2 iOS

13.5 Historic and Forecasted Market Size By Application

13.5.1 Health Monitoring

13.5.2 Lifestyle Monitoring

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Fitness App Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 131.39 Bn |

|

Forecast Period 2022-28 CAGR: |

22.56 % |

Market Size in 2028: |

USD 545.76 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FITNESS APP MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FITNESS APP MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FITNESS APP MARKET COMPETITIVE RIVALRY

TABLE 005. FITNESS APP MARKET THREAT OF NEW ENTRANTS

TABLE 006. FITNESS APP MARKET THREAT OF SUBSTITUTES

TABLE 007. FITNESS APP MARKET BY TYPE

TABLE 008. ANDROID MARKET OVERVIEW (2016-2028)

TABLE 009. IOS MARKET OVERVIEW (2016-2028)

TABLE 010. FITNESS APP MARKET BY APPLICATION

TABLE 011. HEALTH MONITORING MARKET OVERVIEW (2016-2028)

TABLE 012. LIFESTYLE MONITORING MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA FITNESS APP MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA FITNESS APP MARKET, BY APPLICATION (2016-2028)

TABLE 015. N FITNESS APP MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE FITNESS APP MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE FITNESS APP MARKET, BY APPLICATION (2016-2028)

TABLE 018. FITNESS APP MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC FITNESS APP MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC FITNESS APP MARKET, BY APPLICATION (2016-2028)

TABLE 021. FITNESS APP MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA FITNESS APP MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA FITNESS APP MARKET, BY APPLICATION (2016-2028)

TABLE 024. FITNESS APP MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA FITNESS APP MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA FITNESS APP MARKET, BY APPLICATION (2016-2028)

TABLE 027. FITNESS APP MARKET, BY COUNTRY (2016-2028)

TABLE 028. AZUMIO: SNAPSHOT

TABLE 029. AZUMIO: BUSINESS PERFORMANCE

TABLE 030. AZUMIO: PRODUCT PORTFOLIO

TABLE 031. AZUMIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. FITBIT: SNAPSHOT

TABLE 032. FITBIT: BUSINESS PERFORMANCE

TABLE 033. FITBIT: PRODUCT PORTFOLIO

TABLE 034. FITBIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. JAWBONE: SNAPSHOT

TABLE 035. JAWBONE: BUSINESS PERFORMANCE

TABLE 036. JAWBONE: PRODUCT PORTFOLIO

TABLE 037. JAWBONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. FITNESSKEEPER: SNAPSHOT

TABLE 038. FITNESSKEEPER: BUSINESS PERFORMANCE

TABLE 039. FITNESSKEEPER: PRODUCT PORTFOLIO

TABLE 040. FITNESSKEEPER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. UNDER ARMOUR: SNAPSHOT

TABLE 041. UNDER ARMOUR: BUSINESS PERFORMANCE

TABLE 042. UNDER ARMOUR: PRODUCT PORTFOLIO

TABLE 043. UNDER ARMOUR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ADIDAS: SNAPSHOT

TABLE 044. ADIDAS: BUSINESS PERFORMANCE

TABLE 045. ADIDAS: PRODUCT PORTFOLIO

TABLE 046. ADIDAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. FOODUCATE: SNAPSHOT

TABLE 047. FOODUCATE: BUSINESS PERFORMANCE

TABLE 048. FOODUCATE: PRODUCT PORTFOLIO

TABLE 049. FOODUCATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. GOOGLE: SNAPSHOT

TABLE 050. GOOGLE: BUSINESS PERFORMANCE

TABLE 051. GOOGLE: PRODUCT PORTFOLIO

TABLE 052. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MY DIET COACH: SNAPSHOT

TABLE 053. MY DIET COACH: BUSINESS PERFORMANCE

TABLE 054. MY DIET COACH: PRODUCT PORTFOLIO

TABLE 055. MY DIET COACH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. NIKE: SNAPSHOT

TABLE 056. NIKE: BUSINESS PERFORMANCE

TABLE 057. NIKE: PRODUCT PORTFOLIO

TABLE 058. NIKE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. NOOM: SNAPSHOT

TABLE 059. NOOM: BUSINESS PERFORMANCE

TABLE 060. NOOM: PRODUCT PORTFOLIO

TABLE 061. NOOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. POLAR ELECTRO: SNAPSHOT

TABLE 062. POLAR ELECTRO: BUSINESS PERFORMANCE

TABLE 063. POLAR ELECTRO: PRODUCT PORTFOLIO

TABLE 064. POLAR ELECTRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. RUNTASTIC: SNAPSHOT

TABLE 065. RUNTASTIC: BUSINESS PERFORMANCE

TABLE 066. RUNTASTIC: PRODUCT PORTFOLIO

TABLE 067. RUNTASTIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SAMSUNG ELECTRONICS: SNAPSHOT

TABLE 068. SAMSUNG ELECTRONICS: BUSINESS PERFORMANCE

TABLE 069. SAMSUNG ELECTRONICS: PRODUCT PORTFOLIO

TABLE 070. SAMSUNG ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SPORTS TRACKING TECHNOLOGIES: SNAPSHOT

TABLE 071. SPORTS TRACKING TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 072. SPORTS TRACKING TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 073. SPORTS TRACKING TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. WAHOO FITNESS: SNAPSHOT

TABLE 074. WAHOO FITNESS: BUSINESS PERFORMANCE

TABLE 075. WAHOO FITNESS: PRODUCT PORTFOLIO

TABLE 076. WAHOO FITNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FITNESS APP MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FITNESS APP MARKET OVERVIEW BY TYPE

FIGURE 012. ANDROID MARKET OVERVIEW (2016-2028)

FIGURE 013. IOS MARKET OVERVIEW (2016-2028)

FIGURE 014. FITNESS APP MARKET OVERVIEW BY APPLICATION

FIGURE 015. HEALTH MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 016. LIFESTYLE MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA FITNESS APP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE FITNESS APP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC FITNESS APP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA FITNESS APP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA FITNESS APP MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Fitness App Market research report is 2022-2028.

Azumio (US), FitBit (US), Jawbone (US), FitnessKeeper (US), Under Armour (US), Adidas (US), and Other major players.

The Fitness App Market is segmented into type, application, and region. By Type the market is categorized into Android, & iOS. By Application, the market is categorized into Health Monitoring, Lifestyle Monitoring. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

This fitness app is created specially to help users with exercise, nutrition & diet, and other forms of physical training or other fitness related topics.

Global Fitness App Market was valued at USD 131.39 billion in 2022 and is predicted to grow at a CAGR of 22.56 % to USD 545.76 billion by 2028.