Ferrocene Market Synopsis

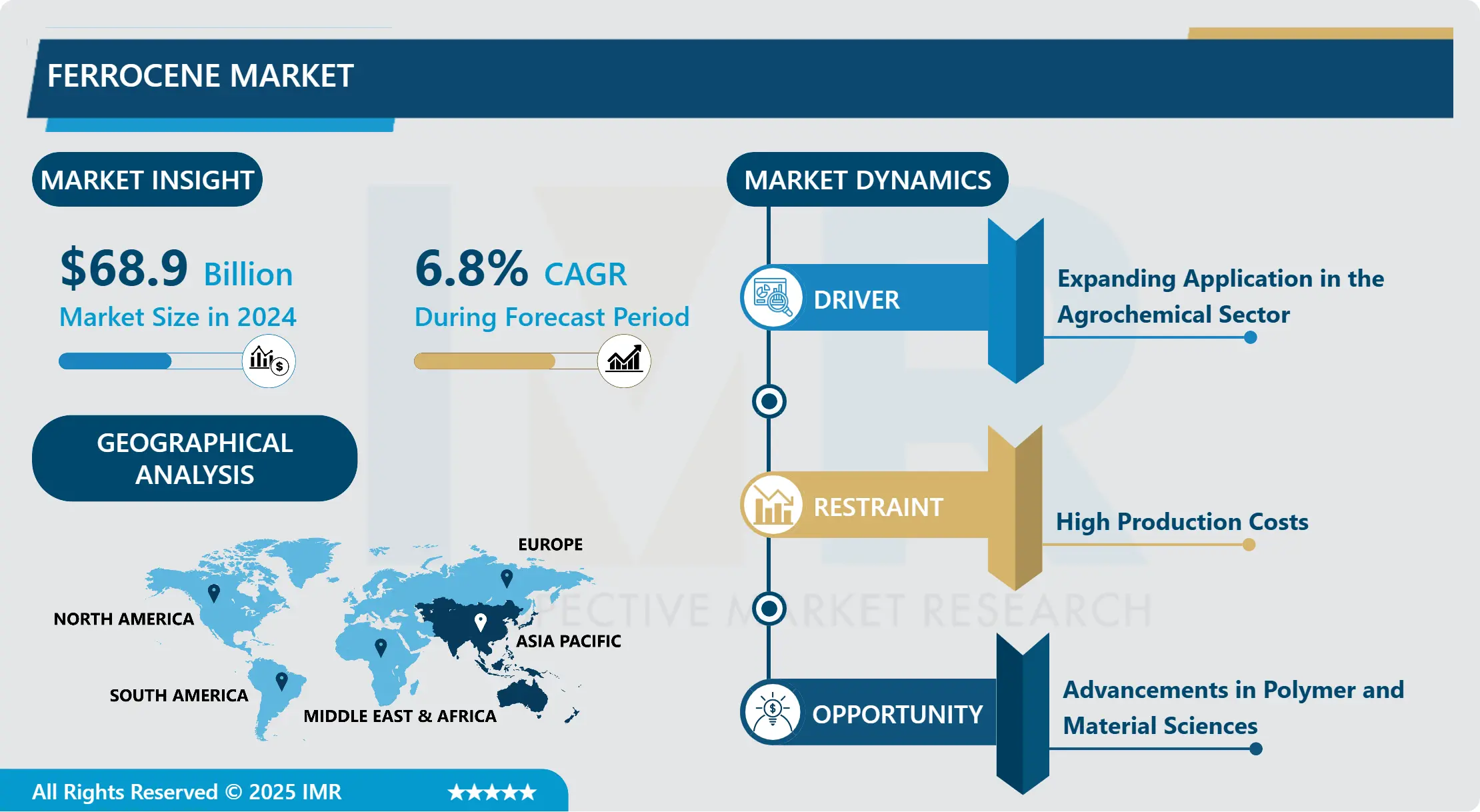

Ferrocene Market Size Was Valued at USD 68.9 Billion in 2024 and is Projected to Reach USD 142.07 Billion by 2035, Growing at a CAGR of 6.80% From 2025-2035.

Ferrocene is one of the organometallic compounds formed by two cyclopentadienyl anions (C5H5-) co-ordinated to Fe. Its formula is Fe(C5H5)2. This compound was first synthesized in the early 1950’s and takes a “sandwich” structure where the iron atom is in the middle of and covalently bonded to two identical, flat, paralleled cyclopentadienyl rings. Ferrocene itself is relatively inert and displays most of the characteristics of an aromatic compound. Because of its stability and peculiar structure of bonds it can be used in organic synthesis, catalysis and materials science.

Ferrocene market is on a rapid growth path owing to the varied uses in the markets it has tapped into. The compound ferrocene which has the chemical formula (C5H5)2Fe is remarkably stable aromatic compound which find a wide application. The major application that currently fuels this market is the ability to be used as a fuel additive in aerospace as well as automotive industries. Ferrocene improves the combustion of fuels since it reduces soot formation hence extending the life of fuel and improving the performance of engines and at the same time reducing environmental pollution. The alternative fuelling options have hence stimulated the use of ferrocene due to its non-toxic characteristic and environmental policies in North America and Europe.

Thus, ferrocene is used as a catalyst in the chemical industry, in the production of polymers and as a component of drugs and fuel additives. These include its use in carrying out polymerization and hydrogenation processes as well as the generally pivotal part that it plays in a number of chemical reactions in the manufacturing industry. Besides, ferrocene derivatives are also widely used in the pharmaceutical industry because of its characteristics that can improve the performance of drugs and their stability. The enhanced efforts to produce new molecules and materials to improve therapeutic activity in the pharmaceutical industry will help contribute more to the demand of ferrocene.

Regionally, the Asia-Pacific market is emerging to be at the forefront, due to increasing automotive and chemical industries across the Asian giants like China and India. There is a steady rise in industrialization in these countries and government support towards industrialization hence the consumption of ferrocene has also improved. However, other factors which may keep the ferrocene market rout in the future include the continued urbanization and industrialization processes in the concerned region.

Nevertheless, the market of ferrocene has some peculiarities that may pose a threat to its development. Ferrocene is produced through several steps and processes which makes it to be expensive, hence constraints its use. Moreover, it can be seen that the fluctuation in price of raw material is a major issue for the manufactures due to which one can witness an impact on the profit margin and market forces. To combat these problems, firms are directing capital towards research to invent ways to produce in the cheapest manner possible; the supply chain issue is also prompting companies to look out for substitutes that can offer a stable source.

Overall, it can be stated that the future of the ferrocene market is rather promising due to the variety of its uses and the growing need for the effective fuel additives, catalysts, and pharmaceuticals. Hindrances like cost of production and fluctuating prices of raw materials are unavoidable but as technology and research go on, then the issue are expected to be sorted hence giving the market a positive outlook. Another factor that incites growth in the ferrocene industry is the exports and industrialization of regional markets especially in the Asia-Pacific, which are likely to avail the necessary economic conditions.

Ferrocene Market Trend Analysis

Rising Demand in Pharmaceutical Applications

- The increased demand of ferrocene in the pharmaceutical application field is substantially influencing the ferrocene market. The molecule called ferrocene, the structure of which is an iron sandwiched between two cyclopentadienyl groups, is gradually attracting attention owing to its characteristics such as heat stability, chemical activity, and possibility of synthesizing compounds that vary in functionality. Such properties make ferrocene important in the search and synthesis of new drugs for pharmaceutical applications. It is currently being considered for incorporation into drug delivery applications because of features that help in the delivery process and the increased stability and reactivity in the process.

- Furthermore, ferrocene derivatives have proven to have notable impact in the pharmaceutical industries, since they are being explored in therapeutic uses for malaria, cancer and microbial infections studies and have went through pre-clinical successes. The variations that can be done with ferrocene are equally applicable when forming molecules with organic compounds, which also allows for the synthesis of new pharmaceutical produce with enhanced therapeutic characteristics. Today the pharmaceutical industry persists in development of new solutions to meet complicated disease-related tasks that will positively influence the necessity of ferrocene and thus, market expansion. This growth further coupled with rising research and development spending and partnerships between the pharmaceutical companies and research organizations in order to harness the possibilities of ferrocene in devising the advanced forms of drug and therapies.

Advancements in Polymer and Material Sciences

- The market for Ferrocene has indicated a number of changes in terms of polymer and material sciences which in turn has further contributed towards it expansion and growth. Ferrocene can be described as a species of organometallic compound that is characterized by rather extraordinary features for use in a wide range of some application areas, such as polymer science. In particular, the topic of the current work is the application of organometallic compound ferrocene into the polymer matrices to increase thermal stability, electrical conducting ability, and mechanical properties of polymers. This has enhanced the existence of superior ferrocene based polymers which are used in high performance materials such as conductive polymers, nanocomposites and intelligent materials.

- Moreover, the progress in material sciences has enabled the synthesis of ferrocene compounds possessing the needed characteristics for the particular application; ferrocene compounds have found their uses in the areas like catalysis, energy storage and molecular electronics. Also, the use of ferrocene in polymeric materials is enhancing research related to biomedical application, which includes the biocompatibility of the material and redox properties for drug delivery and diagnose. The ferrocene market will therefore remain on an upward growth trend and witness new techniques and application methodologies as the material scientists work round the clock to engage new mechanisms to capture the market.

Ferrocene Market Segment Analysis:

Ferrocene Market Segmented based on Form, Application and End User.

By Form, Liquid segment is expected to dominate the market with around 38.37% share during the forecast period.

- The ferrocene can be categorize in to liquid ferrocene powder and others form depend on its property and usage. The molten form of ferrocene as a rule is used in fuel supplements whereby the combustion efficacy of vehicles as well as Industrial engines are improved and the emission reduced. The material should be able to mix with fuels in equal amounts and be highly reactive which is why it finds use in these. Powdered ferrocene, however, has large application in preparation of ferrocene catalysts and as a reagent in syntheses. This stability in solid form can be used directly in chemical reactions and can also easily be incorporated into a wide variety of uses.

- Thus, other varieties of ferrocene, including complexes and derivatives, are used in specific cases, for example, in materials science and the development of new drugs. The type of form mainly depends on the solubility, reactivity and intended chemical processes of the end use application. This segmentation proves the fact that ferrocene acts as a versatile compound that finds its application in the automotive, industrial, as well as advance research fields.

By Application, Surfactants segment is likely to command almost 27.32% share during the upcoming years.

- The market distribution of ferrocene based on the application is found to be quite wide in the different sectors. Ferrocene is another member of the anti-cancer group and has a significant position in present and future pharmaceuticals research works concerning the potential use of this compound, to help destroy cancer cells safely. This compound and it derivatives are used in the catalyst sector to increase rates of reactions in several industries such as polymerization and petroleum industries. Applied as a co-shear it improves service characteristics of materials, for example, increase stability and quality of fuels and lubricants.

- Strongly connected with the effective cleaning agents and emulsifiers in the surfactants market, ferrocene compounds are involved in the formation of products with lower surface tension. Furthermore, the applications of the ‘others’ category may include organic electronics and magnetic materials and other future applications in environment and energy technologies. These examples collectively provide an outline of a vast area of applications of ferrocene and in turn reveal how important this compound is in various fields.

Ferrocene Market Regional Insights:

By Region, Asia Pacific is anticipated to remain the leading regional market with close to 32.76% share during the upcoming years.

- The global market for ferrocene is expected to show steady growth in the near future, out of which the Asia-Pacific region is likely to hold the maximum market share for various reasons. The region is leading consumers due to growth of the industrial sector, high rate urbanization, and many large automobile and aerospace industries that use ferrocene. Moreover, the Asia-Pacific regions like China, India and Japan are the largest producers and consumers of ferrocene as they have large manufacturing industries owing to the increasing use of these complex materials in applications like catalysts or chemical syntheses.

- The increasing use of ferrocene in the formulation of efficient high performance lubricants and the shifting preference towards technology and innovation in the aspects of this region also establishes a solid market for it. The Asia-Pacific region stands as the significant person in the ferrocene market due to the support of the government policies and better business environment of the region till 2021 impacting the global market trend.

Active Key Players in the Ferrocene Market

- Sisco Research Laboratories Pvt. Ltd. (India)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Yixing Weite Petrochemical (China)

- Spectrum Chemical Mfg. Corp. (USA)

- Yixing Lianyang Chemical (China)

- TCI Chemicals India Pvt. Ltd. (India), Others Active Players

Key Industry Developments in the Cargo Bike Market:

- In 2024, Patent filings and technical disclosures from companies and labs indicate ongoing R&D into ferrocene-based additive formulations and production processes suggesting near-term product innovations and licensing opportunities. Patent databases show filings for ferrocene formulations and production technologies (historic + recent continuations).

(Source: https://patents.google.com/)

Ferrocene Market Scope:

|

Global Ferrocene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 68.9 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.80% |

Market Size in 2035: |

USD 142.07 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By End USer |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ferrocene Market by Form (2018-2032)

4.1 Ferrocene Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Powder

4.5 Others

Chapter 5: Ferrocene Market by Application (2018-2032)

5.1 Ferrocene Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anti-Cancer Agent

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Catalyst

5.5 Additive

5.6 Surfactants

5.7 Others

Chapter 6: Ferrocene Market by End USer (2018-2032)

6.1 Ferrocene Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Agriculture

6.5 Aerospace

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ferrocene Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SISCO RESEARCH LABORATORIES PVT. LTD. (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HEFEI TNJ CHEMICAL INDUSTRY COLTD. (CHINA)

7.4 YIXING WEITE PETROCHEMICAL (CHINA)

7.5 SPECTRUM CHEMICAL MFG. CORP. (USA)

7.6 YIXING LIANYANG CHEMICAL (CHINA)

7.7 TCI CHEMICALS INDIA PVT. LTD. (INDIA)

7.8 OTHERS ACTIVE PLAYERS

7.9

Chapter 8: Global Ferrocene Market By Region

8.1 Overview

8.2. North America Ferrocene Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Liquid

8.2.4.2 Powder

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Anti-Cancer Agent

8.2.5.2 Catalyst

8.2.5.3 Additive

8.2.5.4 Surfactants

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End USer

8.2.6.1 Pharmaceutical

8.2.6.2 Agriculture

8.2.6.3 Aerospace

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ferrocene Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Liquid

8.3.4.2 Powder

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Anti-Cancer Agent

8.3.5.2 Catalyst

8.3.5.3 Additive

8.3.5.4 Surfactants

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End USer

8.3.6.1 Pharmaceutical

8.3.6.2 Agriculture

8.3.6.3 Aerospace

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ferrocene Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Liquid

8.4.4.2 Powder

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Anti-Cancer Agent

8.4.5.2 Catalyst

8.4.5.3 Additive

8.4.5.4 Surfactants

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End USer

8.4.6.1 Pharmaceutical

8.4.6.2 Agriculture

8.4.6.3 Aerospace

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ferrocene Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Liquid

8.5.4.2 Powder

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Anti-Cancer Agent

8.5.5.2 Catalyst

8.5.5.3 Additive

8.5.5.4 Surfactants

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End USer

8.5.6.1 Pharmaceutical

8.5.6.2 Agriculture

8.5.6.3 Aerospace

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ferrocene Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Liquid

8.6.4.2 Powder

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Anti-Cancer Agent

8.6.5.2 Catalyst

8.6.5.3 Additive

8.6.5.4 Surfactants

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End USer

8.6.6.1 Pharmaceutical

8.6.6.2 Agriculture

8.6.6.3 Aerospace

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ferrocene Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Liquid

8.7.4.2 Powder

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Anti-Cancer Agent

8.7.5.2 Catalyst

8.7.5.3 Additive

8.7.5.4 Surfactants

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End USer

8.7.6.1 Pharmaceutical

8.7.6.2 Agriculture

8.7.6.3 Aerospace

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Ferrocene Market Scope:

|

Global Ferrocene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 68.9 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.80% |

Market Size in 2035: |

USD 142.07 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By End USer |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||