Fermented Drinks Market Overview:

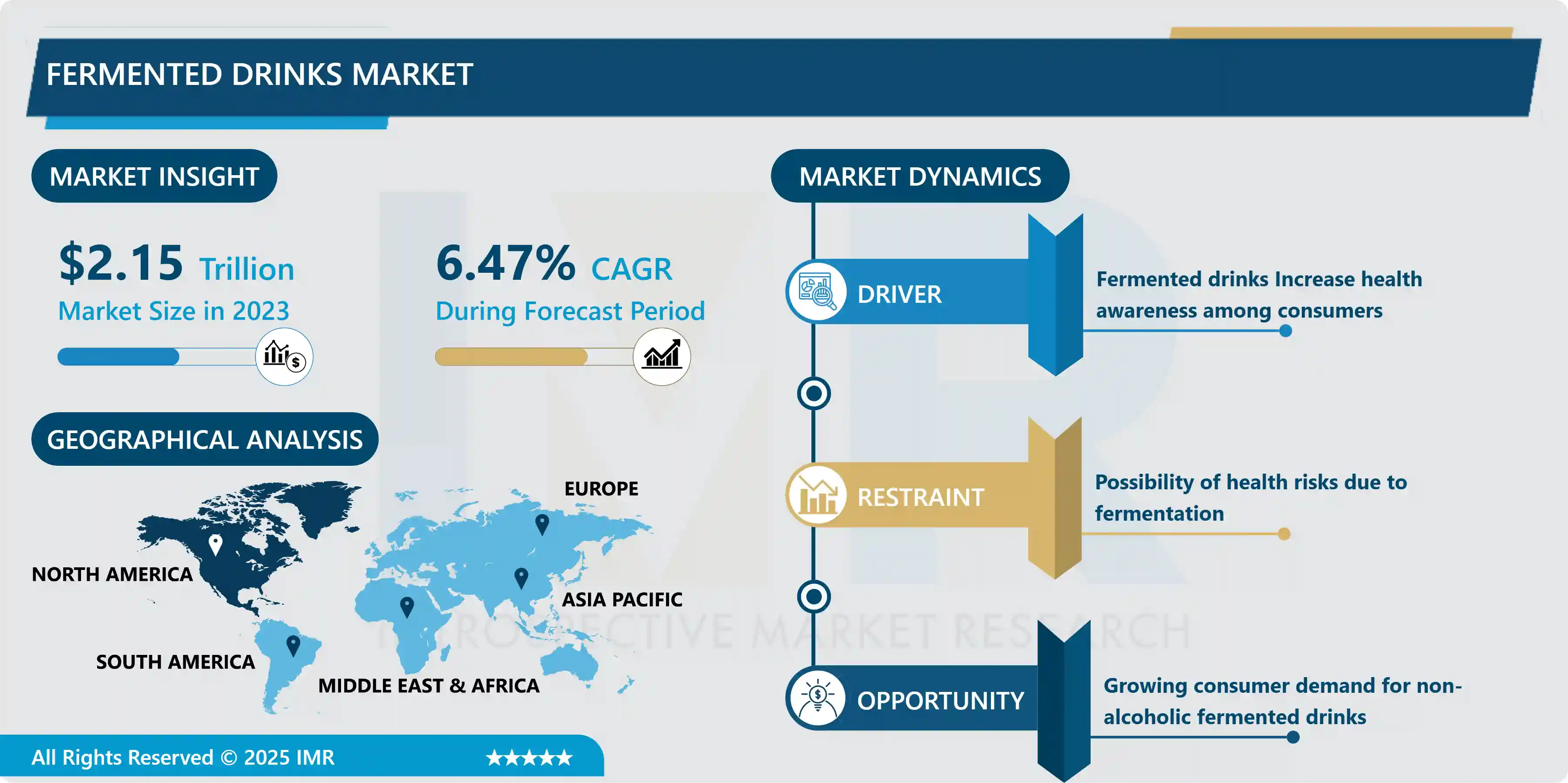

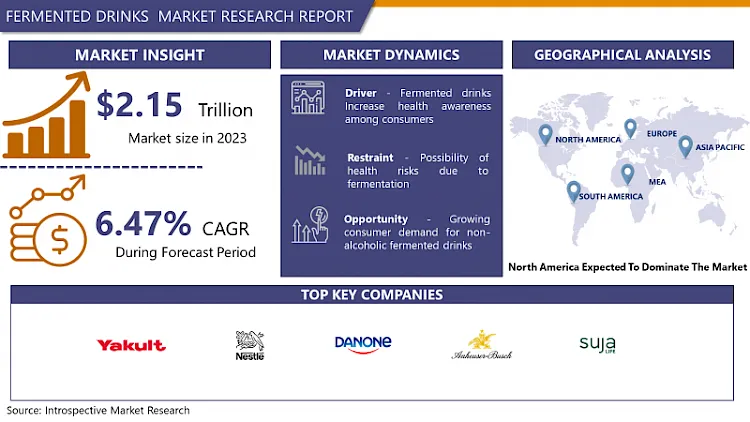

Fermented Drinks Market size was valued at USD 2.15 trillion in 2023 and is projected to reach USD 3.78 trillion by 2032, growing at a CAGR of 6.47% from 2024 to 2032.

The fermented drinks market, rooted in the early era of human history, comprises a diverse array of beverages created through the age-old process of fermentation, where microorganisms like yeasts and bacteria convert sugars into alcohol and organic acids. This ancient practice gave rise to iconic drinks such as wine, beer, and mead, with each culture contributing its unique methods and ingredients. now health-conscious and flavor-seeking society, fermented drinks have undergone a revival, offering probiotic benefits and distinct tastes that cater to modern preferences.

The fermented drinks market has witnessed substantial growth due to increasing consumer interest in health-conscious choices and unique flavors. This diverse market encompasses a wide range of beverages, including kombucha, kefir, kvass, and traditional fermented teas. Fermented drinks offer numerous advantages, such as enhanced gut health through probiotics, improved digestion, and increased nutrient absorption. these beverages often boast natural effervescence and complex flavors, appealing to those seeking alternatives to sugary or artificially flavored options. the fermented drinks market is composed to further expand its reach and offer innovative choices that to a variety of tastes and health goals.

Fermented drinks have emerged as a dynamic and rapidly expanding market segment, contributing significantly to the beverage industry's growth. This trend is driven by consumer preferences for healthier and more diverse options, coupled with the rising awareness of gut health benefits associated with fermentation. Factors such as the increasing demand for probiotics, the appeal of unique flavors, and a surge in craft production methods have driven the market's upward trend. As consumers seek innovative and functional beverages, the fermented drinks market presents a prime opportunity for further expansion, fostering a space where creative recipes, sustainable practices, and health-conscious choices intersect.

The Fermented Drinks Market Trend Analysis

Fermented drinks Increase health awareness among consumers

- Fermented beverages have the potential to impact digestion through their ability to break down food and stimulate the production of digestive enzymes. This could help relief from issues like indigestion and bloating. Scientific investigations have indicated a link between the gastrointestinal system and the brain. probiotics help in managing mood and mental well-being by modulating the production and signaling of neurotransmitters. ?

- Probiotics can help maintain a healthy balance of good bacteria and the gut is crucial for digestion, absorbing nutrients, and overall gut well-being. a part of our immune system is in the gut, having a healthy mix of gut bacteria supported by probiotics can assist in managing immune responses and enhancing the body’s immunity and health. ?

- Reduced Risk of Chronic Diseases studies have indicated that a balanced gut microbiome, supported by probiotics, could contribute to a lower risk of certain chronic diseases, including obesity, type 2 diabetes, and even some forms of cancer. ?

- Consumers are becoming more health-conscious and are looking for natural ways to improve their health. Fermented drinks are a good source of probiotics, they are live microorganisms that have been shown to have several health benefits in the healthy life.

Growing consumer demand for non-alcoholic fermented drinks

- One of the primary concerns with many beverages is their high sugar content. Non-alcoholic fermented drinks like kombucha and water kefir are naturally low in sugar, making them appealing to consumers looking to reduce their sugar intake in their daily lives.

- Non-alcoholic fermented drinks are marketed for their potential functional benefits, such as improved digestion, increased energy, and enhanced immune function. These potential benefits are driving consumer interest in these beverages.

- The market for non-alcoholic fermented drinks has expanded to a wide range of flavors and options, and aware them alternatives to traditional soft drinks and juices. This variety changes consumers' looking for interest in flavourful alternative drinks.

- Increased marketing efforts and educational campaigns about the benefits of non-alcoholic fermented drinks have contributed to their rising popularity. Consumers are more informed about these beverages. non-alcoholic fermented drinks offer many health benefits.

The Fermented Drinks Market Segmentation Analysis

Fermented Drinks Market segments cover the Type, application, and Distribution channel. By application beverages segment is Anticipated to Dominate the Market Over the Forecast period.

- Non-alcoholic beverages like kombucha, kefir, and yogurt drinks are made by fermenting milk, fruits, or vegetables. They don't have any alcohol, which makes them a healthier choice compared to alcoholic drinks Consumers want to eat and drink things that are good for them and full of nutrients.

- Functional beverages like energy drinks, sports drinks, and weight loss drinks are made with added vitamins, minerals, and good ingredients. And that is helpful, like giving more energy or helping to perform better in sports or lose weight. Consumers have busy lives and hectic lives, and they like easy ways to stay refreshed. Fermented drinks are becoming an easy option because they are convenient and can give you energy while keeping you hydrated.

- Alcoholic beverages include beer, wine, and spirits. Alcoholic beverages are fermented from sugars derived from grains, fruits, or vegetables. They contain alcohol, which is a psychoactive drug that can cause intoxication.

- The alcoholic beverages segment is the largest segment of the fermented drinks market, accounting for the majority of the market share. This is due to the popularity of beer, wine, and spirits in many parts of the world.

Fermented Drinks Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast Period.

- North America dominates the fermented drinks market within the United States and Canada. It exerts influence, especially in alcoholic beverages such as beer and wine. the region plays a significant role in the fermented drinks sector, and this presence extends to the incorporation of probiotic bacteria known for their beneficial impacts on gut health. This trend is increasingly favored by individuals.

- North America is a major consumer of alcoholic beverages, especially beer and wine. global beer consumption is high compared to global wine consumption. This high demand for alcoholic beverages is a major driver of the fermented drinks market.

- Probiotic beverages, which are fermented drinks containing beneficial live bacteria for gut health, are experiencing a surge in popularity across North America. This trend is driven by the growing health consciousness of individuals who are actively seeking natural methods to enhance their well-being. These fermented beverages are seen as a wholesome substitute for sugary drinks, gaining traction among health-aware consumers.

- The fermented drinks market in Europe holds the second-largest market. The increasing recognition of the positive health effects associated with consuming fermented vegetables, along with advancements in food fermentation technology, and a rising consumer preference for plant-based snacks, are all factors projected to drive the demand for fermented food and beverage items within the region.

Fermented Drinks Market Key player

- Yakult Honsha (Japan)

- Nestlé (Switzerland)

- Danone (France)

- Anheuser-Busch (US)

- Suja Life (US)

- PepsiCo (US)

- Bright Food (China)

- Hain Celestial (US)

- Kraft Heinz (US)

- Coca-Cola (US)

- Red Bull (Austria)

- Bionade (Germany)

- Living Essentials (US)

- KEVITA (California)

- Kombucha Brewers (INDIA)

- Synergy Drinks (US)

- Health-Ade Kombucha (US)

- Kefirly (Russia)

- Goodbelly (US)

- Sula Vineyards (INDIA) and Other Major Player.

Key Industry Developments in the Fermented Drinks Market

- In May 2024, Yakult Honsha Co., Ltd. announced that its overseas subsidiaries, Yakult (China) Corporation and Guangzhou Yakult Co., Ltd., began selling Yakult Peach Flavor (Iron Plus) in stages starting from May 9, 2024. In recent years, there had been growing health awareness among consumers in China, and the demand for products containing nutritional ingredients had been increasing in the lactic acid bacteria beverage market. In response, the subsidiaries introduced Yakult Peach Flavor (Iron Plus), which contains 10 billion of Yakult’s proprietary Lactobacillus casei strain Shirota as well as iron. The Yakult Group aimed to expand sales by stimulating demand with the peach flavor, which is popular in China.

- In January 2024, Kraft Heinz and TGI Fridays announced an exclusive, perpetual extension of their existing licensing deal, under which Kraft Heinz produces restaurant-inspired, TGI Fridays® branded frozen appetizers for retail across North America. Kraft Heinz and TGI Fridays have maintained a successful licensing partnership since 2001. With the new perpetual licensing deal, which superseded the most recent agreement signed in 2015, Kraft Heinz continued to develop and sell delicious TGI Fridays frozen appetizers and snacks.

|

Fermented Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.15 Tn. |

|

Forecast Period 2024-32 CAGR: |

6.47% |

Market Size in 2032: |

USD 3.78 Tn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fermented Drinks Market by Type (2018-2032)

4.1 Fermented Drinks Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alcoholic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Alcoholic Beverages

Chapter 5: Fermented Drinks Market by Application (2018-2032)

5.1 Fermented Drinks Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Alcoholic Biofuels

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverages

Chapter 6: Fermented Drinks Market by Distribution Channel (2018-2032)

6.1 Fermented Drinks Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-Trade

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Off-Trade

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fermented Drinks Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AH BEARD (ENGLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SEALY (INDIA)

7.4 COMFORT SLEEP BEDDING (IRELAND)

7.5 SLEEPEEZEE (ENGLAND)

7.6 CASPER SLEEP INC (UNITED STATES)

7.7 CORSICANA BEDDING INC (UNITED STATES)

7.8 INNOCOR INC (UNITED STATES)

7.9 KING KOIL (UNITED STATES)

7.10 KINGSDOWN INC (UNITED STATES)

7.11 PARAMOUNT BED CO. LTD (JAPAN)

7.12 RELYON LIMITED (UNITED KINGDOM)

7.13 RESTONIC MATTRESS CORPORATION (UNITED STATES)

7.14 SERTA SIMMONS BEDDING LLC (UNITED STATES)

7.15 SILENTNIGHT GROUP LTD (UNITED KINGDOM)

7.16 SLEEP NUMBER CORPORATION (UNITED STATES)

7.17 SPRING AIR INTERNATIONAL (UNITED STATES)

7.18 TEMPUR SEALY INTERNATIONAL INC (UNITED STATES)

7.19 SLUMBERCORP (AUSTRALIA )

Chapter 8: Global Fermented Drinks Market By Region

8.1 Overview

8.2. North America Fermented Drinks Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Alcoholic

8.2.4.2 Non-Alcoholic Beverages

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Alcoholic Biofuels

8.2.5.2 Beverages

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 On-Trade

8.2.6.2 Off-Trade

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fermented Drinks Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Alcoholic

8.3.4.2 Non-Alcoholic Beverages

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Alcoholic Biofuels

8.3.5.2 Beverages

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 On-Trade

8.3.6.2 Off-Trade

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fermented Drinks Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Alcoholic

8.4.4.2 Non-Alcoholic Beverages

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Alcoholic Biofuels

8.4.5.2 Beverages

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 On-Trade

8.4.6.2 Off-Trade

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fermented Drinks Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Alcoholic

8.5.4.2 Non-Alcoholic Beverages

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Alcoholic Biofuels

8.5.5.2 Beverages

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 On-Trade

8.5.6.2 Off-Trade

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fermented Drinks Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Alcoholic

8.6.4.2 Non-Alcoholic Beverages

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Alcoholic Biofuels

8.6.5.2 Beverages

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 On-Trade

8.6.6.2 Off-Trade

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fermented Drinks Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Alcoholic

8.7.4.2 Non-Alcoholic Beverages

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Alcoholic Biofuels

8.7.5.2 Beverages

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 On-Trade

8.7.6.2 Off-Trade

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Fermented Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.15 Tn. |

|

Forecast Period 2024-32 CAGR: |

6.47% |

Market Size in 2032: |

USD 3.78 Tn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||