Fencing Clothing Market Synopsis

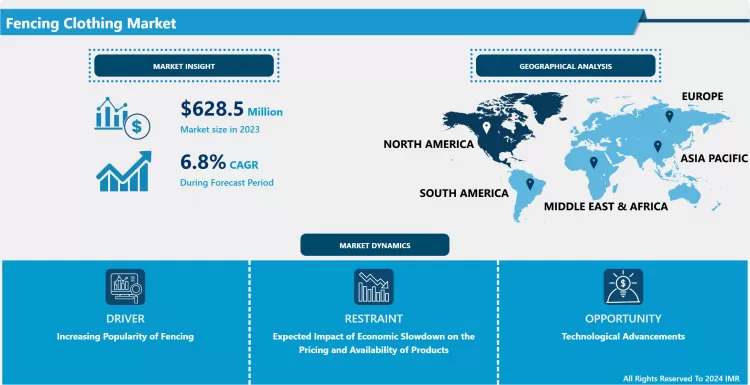

Fencing Clothing Market Size is Valued at USD 628.50 Million in 2023, and is Projected to Reach USD 1063.84 Billion by 2032, Growing at a CAGR of 6.80% From 2024-2032.

Global Fencing Clothing Market has shown modest growth owing to the rising appreciation of fencing as a competitive sport and a fitness activity. Fencing clothing includes jackets, breeches, plastrons, gloves and masks because it helps to protect athletes and improve their results. These garments contain some specific elements that will enable them to afford a protection on thrusts and strikes while at the same time enabling the wearer to move with ease. Current trends such as the establishment of fencing academies, the conduct of international competitions, and increasing interest to specific kinds of sports added to the growth of the market especially in Europe and North American countries where the sport of fencing is enjoyed.

- Technological changes that have occurred to the fabric and design of the fencing clothing are also influencing the fencing clothing market. Modern producers are paying attention to the application of rigid and aerated materials including Kevlar and Dyneema to boost the shield and flexibility of fencing equipment. Further, new concepts such as mobility, water resistance and ability to withstand shocks are seen in newer models to which athletes/novice players can easily relate to hence enhancing the product’s circulation. Other developments in the fencing clothing include the aspect of fit where the ready-made fencer wear can be tailored to fit individual body sizes and team logos where brands can further their identifications by the various fencer groups.

- However, e-commerce platforms and niche specialized sports clothing outlets have put fencing clothing squarely within the reach of most consumers in the world. It also states that there is sheer market potential in sunrise geographies, where demand for fencing too is gradually rising. However, some challenges may include; high cost of purchasing premium fencing gears and low perception of the sport in certain part of the globe. In summary, fencing clothing market is projected to remain amiably on the rise as long as there are new advanced materials to use in production and as the fencing fans base in the world increases.

Fencing Clothing Market Trend Analysis

Sustainable Materials

- The Fencing Clothing Market is also experiencing a trend toward using sustainable environmentally friendly products when it comes to fencing clothing. Recycled fabrics and organic materials are slowly being incorporated into production because consumers are becoming more sensitive to the environment and the product’s ability to protect them from danger.

- This shift is also particularly effective with appealing to a modern group of consumers actively pursuing environmentally friendly products and it also creates the impetus for the production of new materials that would offer better sturdiness and comfort to their owners. In the future some athletes may go with the green solution and therefore the firms that are capable of purchasing sustainability will be in great advantage.

Smart Technology Integration

- There is a growth to incorporating smart technology in fences clothing where aspects such as moisture control fabric, temperatures control and wearable are also added to the garments. Such development enhance the ability to track the performance and comfort in a training session and competitions or games.

- With the help of sensors and all the connected devices, athletes can monitor their movements and speed, and all other critical parameters of their working rates, which makes their training much more effective. It is a common knowledge that, with advancement in technologies, smart fencing clothing is likely to be demanded, thus creating producer services that target smart fencing wear to the tech-savvy users.

Fencing Clothing Market Segment Analysis:

Fencing Clothing Market Segmented on the basis of By Product Type, By Material , By Distribution Channel, By End-user

By Product Type, Jackets segment is expected to dominate the market during the forecast period

- The Fencing Clothing business is compounded by product type including jackets, Breeches, gloves, plastrons, chest protectors, masks & helmets, shoes, others. Jackets are necessary for upper body protection, constructed from strong fabrics to cushion the blow, breeches or trousers will allow the operator to move freely and comfortably. There are two major pieces of protective gear that are available to players which include gloves that improve hold and reducing injuries on hands besides plastrons which offer extra safety to the body’s trunk. Women and young men fencers should have chest protectors because they afford enough protection against thrusts.

- One piece, masks and helmets are crucial components because they protect the head and face and have mesh designed for vision but also for safety. Specialized footwear used in fencing affords stability that is needed to maneuver quickly during the duel. The “others” category includes other accessories such as socks and bags, which equally form part and parcel of fencing clothing. By offering such a wide choice of the products it addresses the increasing demand common among both beginners and professional fencers.

By End-User, Amateur Fencers segment held the largest share in 2024

- The Fencing Clothing Market caters to a broad cross-section of users such as professional fencers, amateur fencers, clubs and associations and schools and colleges etc. This sport entails that professional fencers use very robust modern advanced equipment, wearing safety equipped clothing that meets international ergonomics safety norms during competition while they prefer buying special clothing of their choices that fit them tightly. A similar case applies to amateur fencers who in addition to durability and safety want readily available protective gears at lower prices thus creating demand for entry level protective gears with safety features.

- Among other consumers, clubs and associations are a major market because they buy a lot of fencing clothing for their members; and schools and colleges that are gradually adopting fencing as part of their physical training programs equally create demand for fencing dress. Many of these learning institutions don’t fully understand where they can source cheap yet quality wears that could survive being washed and worn severally. In addition, non-athletes who partake in other professional events such as the art of fencing as fans, these group of people also help fuel the growth of the fencing clothing market.

Fencing Clothing Market Regional Insights:

North America dominates the fencing clothing market

- The Fencing Clothing Market is highly concentrated in North America, mainly due to the fact that sports are highly developed in the area and there is an increasing interest in fencing as a type of physical activity and sports game. The large number of fencing academies, clubs and organisations hence put pressure on athletes where specialized fencing apparels must be worn. The ready availability of a vast selection of outstanding fencing clothing because of North America’s greatly developed supply chains for both fencing and retail continues to enhance the unavailability of a great extent of fencing clothing including protective jackets, breeches, and other products.

- Apart from heightened activity in fencing events and competitions, the expansion of investments in sports at educational institutions contributes to market development. As the perception about fencing as a modern sport that requires discipline and physical endurance gains popularity, more people are being encouraged to take to the sport. These factors guarantee that North America continues to be a market for fencing clothing and shapes trends on aspects of designing and the materials used in production adopted across the world.

Active Key Players in the Fencing Clothing Market

- Leon Paul London (U.K.)

- Allstar Uhlmann (U.K.)

- PBT Hungary Kft (Hungary)

- ABSOLUTE FENCING GEAR (U.S.)

- Blue Gauntlet Fencing (U.S.)

- L. NEGRINI & F. snc. P. (Italy)

- Triplette Competition Arms (U.S.)

- others

|

Global Fencing Clothing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 628.50 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.80% |

Market Size in 2032: |

USD 1063.84 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fencing Clothing Market by Product Type (2018-2032)

4.1 Fencing Clothing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Jackets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Breeches

4.5 Gloves

4.6 Plastrons

4.7 Chest Protectors

4.8 Masks and Helmets

4.9 Shoes

4.10 Others

Chapter 5: Fencing Clothing Market by Material (2018-2032)

5.1 Fencing Clothing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 CottonNylon

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Polyester

5.5 Blended Fabrics

5.6 Kevlar

5.7 Others

Chapter 6: Fencing Clothing Market by Distribution Channel (2018-2032)

6.1 Fencing Clothing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Fencing Clothing Market by End-user (2018-2032)

7.1 Fencing Clothing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Professional Fencers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Amateur Fencers

7.5 Clubs and Associations

7.6 Schools and Colleges

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Fencing Clothing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LEON PAUL LONDON (U.K.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ALLSTAR UHLMANN (U.K.)

8.4 PBT HUNGARY KFT (HUNGARY)

8.5 ABSOLUTE FENCING GEAR (U.S.)

8.6 BLUE GAUNTLET FENCING (U.S.)

8.7 L. NEGRINI & F. SNC. P. (ITALY)

8.8 TRIPLETTE COMPETITION ARMS (U.S.)

8.9 OTHERS

8.10

Chapter 9: Global Fencing Clothing Market By Region

9.1 Overview

9.2. North America Fencing Clothing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Jackets

9.2.4.2 Breeches

9.2.4.3 Gloves

9.2.4.4 Plastrons

9.2.4.5 Chest Protectors

9.2.4.6 Masks and Helmets

9.2.4.7 Shoes

9.2.4.8 Others

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 CottonNylon

9.2.5.2 Polyester

9.2.5.3 Blended Fabrics

9.2.5.4 Kevlar

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Online

9.2.6.2 Offline

9.2.7 Historic and Forecasted Market Size by End-user

9.2.7.1 Professional Fencers

9.2.7.2 Amateur Fencers

9.2.7.3 Clubs and Associations

9.2.7.4 Schools and Colleges

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Fencing Clothing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Jackets

9.3.4.2 Breeches

9.3.4.3 Gloves

9.3.4.4 Plastrons

9.3.4.5 Chest Protectors

9.3.4.6 Masks and Helmets

9.3.4.7 Shoes

9.3.4.8 Others

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 CottonNylon

9.3.5.2 Polyester

9.3.5.3 Blended Fabrics

9.3.5.4 Kevlar

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Online

9.3.6.2 Offline

9.3.7 Historic and Forecasted Market Size by End-user

9.3.7.1 Professional Fencers

9.3.7.2 Amateur Fencers

9.3.7.3 Clubs and Associations

9.3.7.4 Schools and Colleges

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Fencing Clothing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Jackets

9.4.4.2 Breeches

9.4.4.3 Gloves

9.4.4.4 Plastrons

9.4.4.5 Chest Protectors

9.4.4.6 Masks and Helmets

9.4.4.7 Shoes

9.4.4.8 Others

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 CottonNylon

9.4.5.2 Polyester

9.4.5.3 Blended Fabrics

9.4.5.4 Kevlar

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Online

9.4.6.2 Offline

9.4.7 Historic and Forecasted Market Size by End-user

9.4.7.1 Professional Fencers

9.4.7.2 Amateur Fencers

9.4.7.3 Clubs and Associations

9.4.7.4 Schools and Colleges

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Fencing Clothing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Jackets

9.5.4.2 Breeches

9.5.4.3 Gloves

9.5.4.4 Plastrons

9.5.4.5 Chest Protectors

9.5.4.6 Masks and Helmets

9.5.4.7 Shoes

9.5.4.8 Others

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 CottonNylon

9.5.5.2 Polyester

9.5.5.3 Blended Fabrics

9.5.5.4 Kevlar

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Online

9.5.6.2 Offline

9.5.7 Historic and Forecasted Market Size by End-user

9.5.7.1 Professional Fencers

9.5.7.2 Amateur Fencers

9.5.7.3 Clubs and Associations

9.5.7.4 Schools and Colleges

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Fencing Clothing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Jackets

9.6.4.2 Breeches

9.6.4.3 Gloves

9.6.4.4 Plastrons

9.6.4.5 Chest Protectors

9.6.4.6 Masks and Helmets

9.6.4.7 Shoes

9.6.4.8 Others

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 CottonNylon

9.6.5.2 Polyester

9.6.5.3 Blended Fabrics

9.6.5.4 Kevlar

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Online

9.6.6.2 Offline

9.6.7 Historic and Forecasted Market Size by End-user

9.6.7.1 Professional Fencers

9.6.7.2 Amateur Fencers

9.6.7.3 Clubs and Associations

9.6.7.4 Schools and Colleges

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Fencing Clothing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Jackets

9.7.4.2 Breeches

9.7.4.3 Gloves

9.7.4.4 Plastrons

9.7.4.5 Chest Protectors

9.7.4.6 Masks and Helmets

9.7.4.7 Shoes

9.7.4.8 Others

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 CottonNylon

9.7.5.2 Polyester

9.7.5.3 Blended Fabrics

9.7.5.4 Kevlar

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Online

9.7.6.2 Offline

9.7.7 Historic and Forecasted Market Size by End-user

9.7.7.1 Professional Fencers

9.7.7.2 Amateur Fencers

9.7.7.3 Clubs and Associations

9.7.7.4 Schools and Colleges

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Fencing Clothing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 628.50 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.80% |

Market Size in 2032: |

USD 1063.84 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fencing Clothing Market research report is 2024-2032.

Leon Paul London (U.K.), Allstar Uhlmann (U.K.), PBT Hungary Kft (Hungary), ABSOLUTE FENCING GEAR (U.S.), Blue Gauntlet Fencing (U.S.), L. NEGRINI & F. snc. P. (Italy), Triplette Competition Arms (U.S.), others

The Fencing Clothing Market is segmented into By Product Type (Jackets, Breeches, Gloves, Plastrons, Chest Protectors, Masks and Helmets, Shoes, and Others), Material (CottonNylon, Polyester, Blended Fabrics, Kevlar, and Others), Distribution Channel (Online and Offline), End-user (Professional Fencers, Amateur Fencers, Clubs and Associations, Schools and Colleges, and Others).By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fencing clothing refers to the outfits worn by the Fencing athletes throughout the fencing activities with due consideration to suits that enhance good movements on the body. The information; concern this garb it will involve fencing jackets, breeches, plastrons, gloves, and masks; all made from products with enduring endurability, tenderness, flexibility and nimbleness for shield for strikes or thrusts. The clothing is manufactured with safety aspects taken into consideration, thus components such as padded regions and ventilated material is used to boost comfort and mobility. Furthermore, fencing clothes may have simple and sophisticated designs, the availability of which can be limited just to the preferences of the buyer as well as the specificities of certain contests. By and large, there is nothing more important than the fencing clothing in the sport since it is able to meet safety standards, functional requirement as well as an aesthetic consideration for the fencers.

Fencing Clothing Market Size is Valued at USD 628.50 Million in 2023, and is Projected to Reach USD 1063.84 Billion by 2032, Growing at a CAGR of 6.80% From 2024-2032.