Global Farm Management Software Market Overview

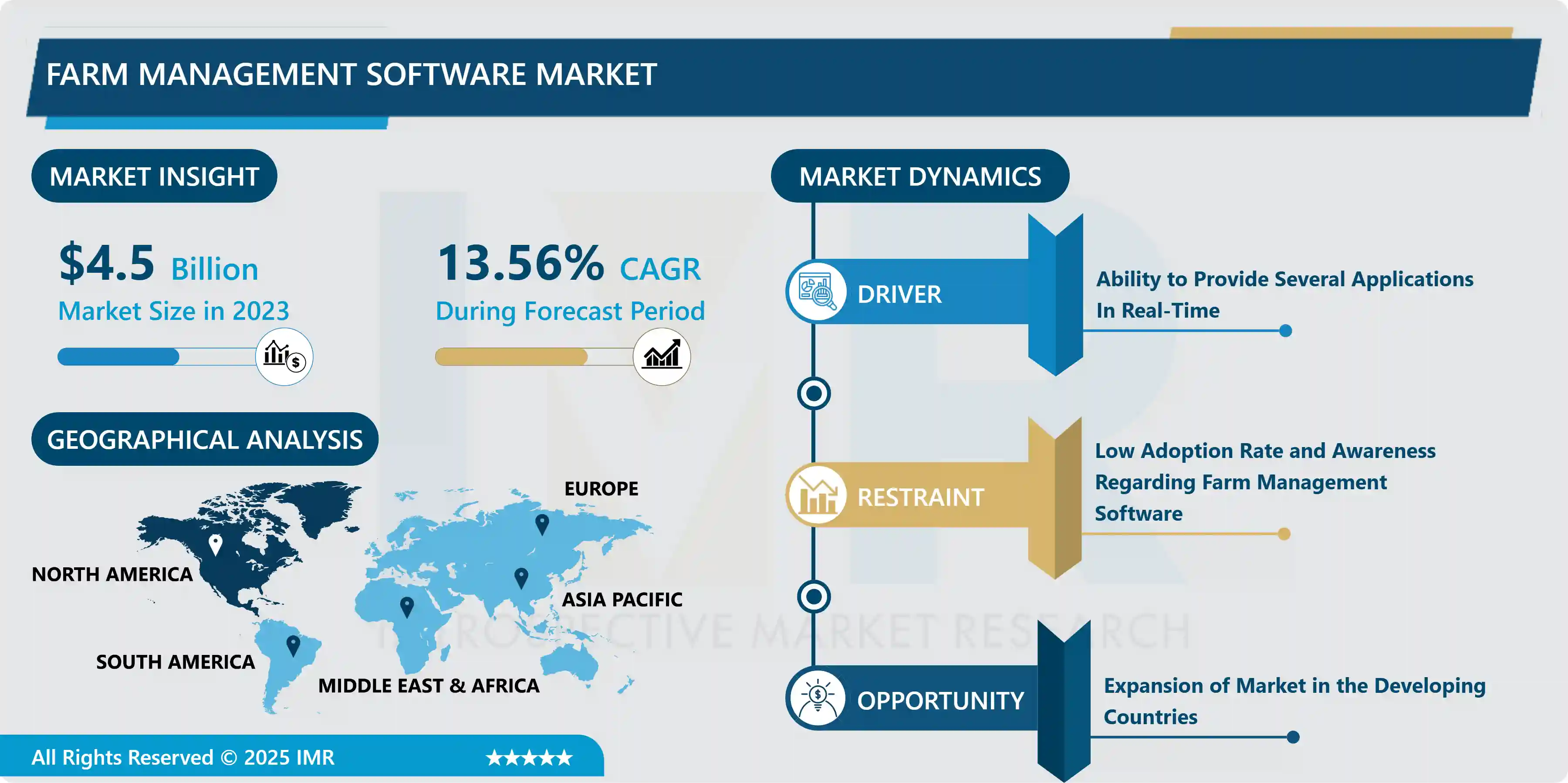

Farm Management Software Market is estimated to grow from USD 4.50 Billion in 2023 to USD 14.13 Billion by 2032 at a CAGR of 13.56 % during the forecast period 2024-2032.

Farm management software is a technological development of a system to help farmers by updating the timely status of regular practices and providing them a holistic view of all farm-related activities and inputs. Farm management software is a mobile application, website, and computer program that helps to take accurate and effective farm-related decisions. This software allows solutions for planning, assessment, implementation, and optimization of agricultural tasks, ultimately increasing productivity. The major benefit of farm management software is it performs and manages many farm-related activities and operations in real-time. This software helps with better risk management, improved planning, and tracking, easy and accurate traceability, reduction of input and labor costs, and provides better regulatory compliance which helps to fills the technical gap in farming. As a result of this applications leads to growth of the market during the forecast period.

Market Dynamics of Farm Management Software Market

Drivers:

Ability to Provide Several Applications In Real-Time

- The farm management software market is largely expanding due to its ability to provide several applications in real-time to the user. This application improves the overall farm efficiency and helps to generate better yield. Additionally, farm management software works on mobile devices due to this it is easily accessible to everyone. Moreover, farm management software helps to manage several advanced farming activities such as fish farming, smart greenhouse farming, precision farming, and livestock monitoring. This versatile use of one software application is propelling the growth of the farm management software market during the projected period.

Restraints:

Low Adoption Rate and Awareness Regarding Farm Management Software

- The smartphone and internet penetration is providing a huge customer base that helps to expand the farm management software. But in most regions, people are managing their farming activities based on experience and took decisions according to the traditional way of farming. Farmers are carrying out farming practices in the traditional way due to less awareness about technology and less knowledge of advanced framing practices which may hamper the growth of the Farm Management Software Market during the projected period.

Opportunities:

Expansion of Market in the Developing Countries

- Farm management software manages various farming-related activities and is show real-time data analysis of those activities to increase profits and reduce loss. In agriculture management, the use of farm management software solutions requires technical knowledge. The expansion of this software market in developing countries provides greater opportunities to enhance the growth of the market. Developing regions are mainly based on the agriculture sector and large land under agricultural business provides a large customer base to the farm management market. Additionally, the farmers having small farm sizes are seen in developing countries and they are also potential users of this software. This expansion of farm management software in developing regions supports the growth of the market.

Market Segmentation Analysis of Farm Management Software Market

- By Deployment Type, on-premise is the segment that dominates the market growth of farm management software over the forecast period. On-premises farm management software is mostly preferred by users. It is simple and easy to use. It is readily available on smartphones, computers, and tablets. Additionally, the huge advantage of on-premise software is data security because the data is stored locally on particular premises, and individuals have full control over this data and its security. Also, it cost a lesser initial installation amount than cloud-based devices. This segment is providing high growth to the farm management market.

- By Application, the precision farming segment anticipated the highest growth in the farm management software market during the forecasted period. Precision agriculture is important in farm management by its way of approach to words farm management software. This segment is used to provide information technology to ensure the fixed amount of ingredients goes into crops through the soil. Soil and crop can exactly receive what they want for maximum health and productivity. In Farm management software precision farming ensures profitability, sustainability, and protection of the soil and environment. The advances provided by this segment propel the growth of the farm management software market.

- By Farm Size, the large farm size segment is expected to dominate the farm management software market share during the forecast period. The large size of the farm requires more manpower, management skill, Analysis, and high decision-making capacity. It is very hard for the individual to record and maintain different tasks in real-time because of this large size farm owners are preferred to invest in farm management software. This software manages and maintains all the farming processes and activities and gives suggestions accordingly. This segment helps to increase the growth of the farm management software market during the analysis period.

Regional Analysis of Farm Management Software Market:

- Asia-Pacific is dominating region for farm management software market during the projected period. Most of the people live in countries of Asia-Pacific regions are commonly depended on farming. Farming is the primary source of living in Asia Pacific region. Asia-Pacific region is dominating in the land under agricultural practices. This region includes countries like India, china, japan. India consist most arable land in the world, and then China. Additionally, Digitalization in India is increasing in recent years, leading to the development of the Agri-tech, smart farming, and agricultural e-commerce. Increasing digitalization helps to enhance the adoption of new technology in this region such as farm management software. Rising applications of smart irrigation to conserve water and surging investments towards the development of IT infrastructure is propelling the growth of farm management software during the analysis period.

- The North American region is the dominant and fast-growing region for farm management software market during the forecasted period. The North America has environmental conditions that support the higher growth of agricultural practises. US are always destined to be one of the world’s leading agricultural product producers and suppliers. US are at second position for containing most arable land in the world after India. According to statista, in 2019, the U.S. farming industry employed more than 960 thousand people around the country. In 2020, the total number of farms in the countries is just over two million. This shows the larger size of land is under control of a particular individual. For Instance, on average, in the U.S. farm sizes are around 444 acres in size and in total there are nearly 896 million acres of farmland across the country. This huge number shows the volume of total land under the farming practices. To manage the large size of farm land most of the farmer are using farm management software’s in this region that supports the growth of market during the upcoming analysis period.

- Europe is the leading region in the farm management software market during the forecasted period. The region includes developed countries so high and early adoption of technology is helping the growth of farm management software market in this region. This region exports some agricultural commodities to the countries like China, Canada, and Mexico. This shows the large scale and high end agricultural practices in this region. As a result, due to the technical knowledge having by farmer to use the farm management software is providing growth to the farm management software market.

- Middle East and Africa region is also experiencing growth in the farm management software market during the analysis period. Digitalization in Africa increasing in recent years, results in the adaption of software in agricultural sector. According to Statista, in 2020, Kenya the Sub-Saharan African country had the highest number of active digital agriculture services, amounting to 95. Nigeria and Ghana followed with 47 and 45 services related to digital agriculture.

Top Key Players Covered In Farm Management Software Market:

- Deere & Company (US)

- Trimble Inc. (US)

- Agjunction Inc. (Canada)

- Raven Industries Inc. (US)

- Iteris Inc. (US)

- AG Leader Technology (Iowa)

- Dickey-John Corporation (US)

- Sst Development Group (California)

- Topcon Positioning Systems Inc (US)

- The Climate Corporation (US)

- Conservis Corporation (US)

- Farmers Edge Inc. (US)

- Delaval (Sweden)

- Gea Group AG (Germany)

- Boumatic LLC (US) and other major players.

Key Industry Development In The Farm Management Software Market

- In May 2024, Cooperative Ventures announced its investment in Traction Ag, Inc., a provider of agricultural accounting technology serving farmers across the United States. A joint venture between prominent agricultural cooperatives GROWMARK and CHS, Cooperative Ventures is focused on fostering mutually beneficial partnerships between cooperatives and startups. The investment led Traction Ag's Series A funding round, which raised USD 10 million, with additional participation from Plymouth Development and existing investors.

- In September 2023, John Deere and DeLaval formed a strategic alliance to promote sustainable milk production by launching the Milk Sustainability Center (MSC). This digital platform is designed to help dairy farmers enhance the efficiency and sustainability of their operations. By offering a holistic view of dairy operations, MSC addresses the challenges of integrating crop and animal performance data. As many dairy farmers currently use various disconnected software solutions, MSC aims to simplify and streamline this process.

|

Global Farm Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2023: |

USD 4.50 Bn. |

|

Forecast Period 2023-32 CAGR: |

13.56% |

Market Size in 2032: |

USD 14.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Farm Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Farm Management Software Market by Type (2018-2032)

4.1 Farm Management Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud Based

Chapter 5: Farm Management Software Market by Application (2018-2032)

5.1 Farm Management Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Precision Farming

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Livestock Monitoring

5.5 Aquaculture Monitoring

5.6 Other

Chapter 6: Farm Management Software Market by Farm Size (2018-2032)

6.1 Farm Management Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Large

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Farm Management Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ORACLE (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT (US)

7.4 GOOGLE (US)

7.5 AMAZON (US)

7.6 IBM (US)

7.7 MONGODB (US)

7.8 REDIS LTD. (US)

7.9 ENTERPRISEDB (US)

7.10 COUCHBASE INC. (US)

7.11 DATASTAX (US)

7.12 RACKSPACE TECHNOLOGY (US)

7.13 COCKROACH LABS (US)

7.14 YUGABYTE (US)

7.15 FAUNA (US)

7.16 DIGITALOCEAN (US)

7.17 LINODE (US)

7.18 SCALEGRID (US)

7.19 INFLUXDATA (US)

7.20 SALESFORCE (US)

7.21 TIMESCALE (US)

7.22 ARANGODB (US)

7.23 SAP (GERMANY)

7.24 ALIBABA (CHINA)

7.25

Chapter 8: Global Farm Management Software Market By Region

8.1 Overview

8.2. North America Farm Management Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 On-Premises

8.2.4.2 Cloud Based

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Precision Farming

8.2.5.2 Livestock Monitoring

8.2.5.3 Aquaculture Monitoring

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size by Farm Size

8.2.6.1 Large

8.2.6.2 Small

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Farm Management Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 On-Premises

8.3.4.2 Cloud Based

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Precision Farming

8.3.5.2 Livestock Monitoring

8.3.5.3 Aquaculture Monitoring

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size by Farm Size

8.3.6.1 Large

8.3.6.2 Small

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Farm Management Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 On-Premises

8.4.4.2 Cloud Based

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Precision Farming

8.4.5.2 Livestock Monitoring

8.4.5.3 Aquaculture Monitoring

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size by Farm Size

8.4.6.1 Large

8.4.6.2 Small

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Farm Management Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 On-Premises

8.5.4.2 Cloud Based

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Precision Farming

8.5.5.2 Livestock Monitoring

8.5.5.3 Aquaculture Monitoring

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size by Farm Size

8.5.6.1 Large

8.5.6.2 Small

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Farm Management Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 On-Premises

8.6.4.2 Cloud Based

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Precision Farming

8.6.5.2 Livestock Monitoring

8.6.5.3 Aquaculture Monitoring

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size by Farm Size

8.6.6.1 Large

8.6.6.2 Small

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Farm Management Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 On-Premises

8.7.4.2 Cloud Based

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Precision Farming

8.7.5.2 Livestock Monitoring

8.7.5.3 Aquaculture Monitoring

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size by Farm Size

8.7.6.1 Large

8.7.6.2 Small

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Farm Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2023: |

USD 4.50 Bn. |

|

Forecast Period 2023-32 CAGR: |

13.56% |

Market Size in 2032: |

USD 14.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Farm Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The key players mentioned are Deere & Company, Trimble Inc., Agjunction Inc., Raven Industries Inc., Iteris Inc., AG Leader Technology, Dickey-John Corporation, Sst Development Group Inc., Topcon Positioning Systems Inc, The Climate Corporation, Conservis Corporation, Farmers Edge Inc., Delaval, Gea Group AG, Boumatic LLC, Start-Up Ecosystem, and other major players.

It is used for the preparation, execution, evaluation, and optimization of tasks performed on farms. Better preparation and monitoring, lower input and labor costs, better risk management, compliance with regulatory requirements, and simple and reliable traceability are only a few of the advantages of farm management software.