Fall Detection Systems Market Synopsis:

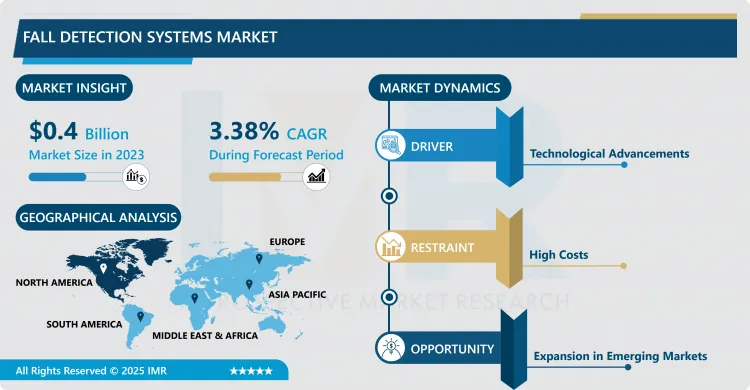

Fall Detection Systems Market Size Was Valued at USD 0.40 Billion in 2023, and is Projected to Reach USD 0.54 Billion by 2032, Growing at a CAGR of 3.38% From 2024-2032.

The Fall Detection Systems market captures the ability to monitor and identify a fall among an individual especially the elderly or chronically ill persons. These systems use a combination of accelerometers, gyroscopes and pressure sensors to observe movements and to look for sudden jerks that indicate a fall. If a fall is recognized, the system can issue signals to the caregiver or the emergency services and get a timely response. This market is largely fueled by the growth in the geriatric population, raising awareness of falls in homes and advancements in wearables and smart home technologies meant to make homes safer for frail people.

The global market for fall detection systems is rapidly growing due to improvements in technology for the elderly and patient with mobility issues. In light of the increasing population, especially the aging people worldwide, it is important to come up with a suitable way of detecting and preventing falls. These systems use sophisticated devices like sensors, artificial intelligence and machine learning to track people’s movement and to detect likely falls as they happen. This capability does not only aid in the responding to emergencies but more essentially in preventing falls, thereby minimizing the risks of falls related severe injuries.

Apart from demographic factors, there is other factors that drive the growth of the market such as smart home devices and wearable. Patients are moving towards solutions that require easy interoperability with care givers and other health care facilities. Such a trend is creating new product evolution that encompasses fall detection with other health tracking aspects, making them even more desirable. In addition onset of government policies and funding for elder care programs are encouraging usage of fall detection systems especially in the assisted living facilities and home care environments.

A cut-throat competition still defines the market which is occupied by established market players and start-ups who are in constant competition for market share through partnership, technology and customized solutions. Understanding and fulfilling the consumer needs and expectations must apply price convergence, marketing strength and innovative marketing communication. However, some issues like data privacy to customers, status of requisite regulatory requirements, can act as limitations for this market. However, the situations mentioned above are not very discouraging, as the market for fall detection systems has a great potential for further growth, with constant development and higher awareness of the need for better protection systems.

Fall Detection Systems Market Trend Analysis:

The Growing Demand for Fall Detection Solutions Amidst an Aging Population

- Falls are quite common among the elderly due to a growing elderly population as life expectancy increases and people age. Accidental falls are common in the elderly population and provoke severe health consequences, including fractures and head injuries; falls are also among the main causes of preventable death in the elderly according to WHO. With the increasing understanding of hazards resulting from falls it becomes apparent that there is demand for efficient solutions that can prevent these perils. On this basis, the need for falls prevention and detection systems that offer real-time alerting and support for the seniors within the family and caregivers, is felt more and more within the residential and healthcare sectors.

- The emerging emphasis on elder care has increased the need and utilization of new generation of fall detection technologies. These systems, which can recognize falls in real time and then alert caregivers or EMS to come to the elderly’s aid, are particularly useful in ensuring that the elderly receive required prompt support and leading to meaningful changes in this population. All these solutions involve wearable devices, smartphone application, and smart home systems not only providing security for seniors but also sharing key information with caregivers on their beloved one’s health condition and security. A constant increase in knowledge about potential fall risks augments the market for fall detection, which in turn, will propel new features integral to elderly care systems because of the high risk of accidents among this demographic.

Advancements in the Fall Detection Systems Market Amidst Demographic Shifts

- As the shifts in demography take place around the world and even more specifically in developed nations the need for better health monitoring systems is rising markedly. The elderly group is also experiencing high risk incidence of falls causing potential serious health implications such as fractures and head injuries thus becoming expensive to cater for in healthcare facilities. This trend is not good especially to older persons but also affects health care systems and caregivers so much. Therefore, there is a need for proper intervention in falls by the development of advanced systems that will improve safety while still offering seniors their liberty.

- This demographic change is beginning to put pressure on caregivers, health care professionals and families to search for practical and dependable fall detection systems that can provide assurance. An increased concern in the potential danger that encompasses falls has also emerged in technological products that encompasses individuals in real time and ability to identify a fall and respond to it. Thus, the potential for advances in the system’s design is significant, and the global market offers excellent opportunities for enhancing the identification of falls for companies specializing in wearable devices, artificial intelligence, and other smart home systems. All these enhancements are not only useful in reacting to fall accident risks but also in enhancing health and well-being of elderly populace.

Fall Detection Systems Market Segment Analysis:

Fall Detection Systems Market Segmented on the basis of Type, Technology, Component, End Use, and Region

By Type, Wearable segment is expected to dominate the market during the forecast period

- The use of wearable technology has grown dramatically because it is easy to use, portable, convenient, and offers accurate tracking of Health indicators. This segment is primarily categorized into four key types: wrist-wear, neck-wear, body-wear and others. Wearable gadgets that people wear on their wrists are by far the most popular and encompass such features as heart monitoring, exercising, and sleep tracking. Most of these devices have GPS and notification features; thus, they are not only the fitness gizmos but also are the remarkable additional tools that can be incorporated in the routine life. This is due to flexibility and immediate promotion of health status, making people healthier since it gives an instant report of health status.

- The available smart accessories can be named neckwear which includes stylish necklaces and pendants that are more appropriate for monitoring health condition with elegance. Initially developed to be worn with formal wear, these devices still offer the basic health reports needed in normal clothing Wearable Technology. Body-wear comprises smart wear like shirts and leggings with built-in sensors that allow the monitoring of certain parameters such as muscle activation and body temperature, thus increase the user’s experience in terms of self-health monitoring through the received data. The others category embraces a range of wearable devices that do not belong to any of more detailed categories outlined above, which include smart glasses and health measuring jewelries both of which provide features that add more functionality and value to wearable devices in health and wellness.

By End Use, Home-based users segment expected to held the largest share

- Home based users happen to be a key market in the health monitoring market primarily due to the rising need for personal health care gadgets from the comfort of one’s home. HIS devices come with a touch of usability to guarantee that differently abled people, people with different health complications such as old people or people with chronic diseases, can always monitor important health parameters without necessary technical help in monitoring the all important parameters such as the heart rate, blood pressure, and levels of activity. The ergonomics and interface have been simplified to ensure that managing health becomes an effortless task, and one which is well within the capabilities of users of all ages. Such an emphasis on simplicity does not only lead people to use the application on the frequent basis but also makes the activity personally engaging.

- However, the key feature, which embodies the novelty of using smartphones for HBM, is the integration of smartphone technology. Most gadgets integrate with mobile applications which enble users to have access to their health data irrespective of the time or place. This capability makes it possible to monitor a user remotely and allow caregivers and family members to receive status updates of the user’s condition. Therefore, through maintaining this connection, home based health monitoring devices not only enhance users independence but also make them to be under close supervision in case of any complications. Combined, convenience, accessibility, and connectivity are delivering a new paradigm for how people tend to personal health at home and setting the stage for a more preventive approach to health’s future.

Fall Detection Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, the fall detection systems market is thriving, primarily due to the region's advanced healthcare infrastructure and high adoption rates of smart technologies. As the population ages and the prevalence of chronic diseases increases, there is a heightened demand for reliable fall detection solutions in both residential and clinical environments. The growing awareness of the risks associated with falls among the elderly has prompted families and healthcare providers to seek effective systems that can enhance safety and ensure timely assistance. Moreover, the integration of fall detection technologies with smart home systems and wearable devices has made them increasingly appealing to consumers, further propelling market growth.

- Government initiatives aimed at improving elderly care and implementing safety measures in healthcare facilities have significantly contributed to the expansion of the fall detection systems market in North America. Programs designed to promote aging in place and improve healthcare accessibility are encouraging the adoption of these technologies. The United States stands out as the leader in market share, driven by substantial investments in healthcare technology and innovative product offerings. Companies are focusing on developing advanced features such as real-time monitoring, alert systems, and integration with telehealth services, ensuring that fall detection systems are not only effective but also user-friendly. This combination of factors positions North America as a key player in the global fall detection systems market, with strong growth prospects in the foreseeable future.

Active Key Players in the Fall Detection Systems Market:

- ADT

- Apple Inc.

- Connect America

- Koninklijke Philips N.V.

- MariCare

- Medical Guardian LLC

- MobileHelp

- SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches

- Semtech Corporation

- Tunstall Group

- Other Active Players

|

Fall Detection Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.40 Billion |

|

Forecast Period 2024-32 CAGR: |

3.38% |

Market Size in 2032: |

USD 0.54 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fall Detection Systems Market by Type (2018-2032)

4.1 Fall Detection Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wearable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wrist-Wear

4.5 Neckwear

4.6 Body-wear

4.7 Others

4.8 Non-Wearable

4.9 Camera

4.10 Floor Sensors

4.11 Wall Sensors

Chapter 5: Fall Detection Systems Market by Technology (2018-2032)

5.1 Fall Detection Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 GPS-Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mobile Phone-Based

5.5 Sensor-Based

Chapter 6: Fall Detection Systems Market by Component (2018-2032)

6.1 Fall Detection Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Accelerometers and Gyroscopes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Multimodal Sensors

6.5 Other Unimodal/Bimodal Sensors

Chapter 7: Fall Detection Systems Market by End Use (2018-2032)

7.1 Fall Detection Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Home-based users

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Nursing home

7.5 Hospices

7.6 Assisted Living Facilities

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Fall Detection Systems Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ADT (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 APPLE INC. (USA)

8.4 CONNECT AMERICA (USA)

8.5 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

8.6 MARICARE (FINLAND)

8.7 MEDICAL GUARDIAN LLC (USA)

8.8 MOBILEHELP (USA)

8.9 SAFEGUARDIAN SENIOR MEDICAL ALARM SOS PENDANTS & SMARTWATCHES (USA)

8.10 SEMTECH CORPORATION (USA)

8.11 TUNSTALL GROUP (UK)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Fall Detection Systems Market By Region

9.1 Overview

9.2. North America Fall Detection Systems Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Wearable

9.2.4.2 Wrist-Wear

9.2.4.3 Neckwear

9.2.4.4 Body-wear

9.2.4.5 Others

9.2.4.6 Non-Wearable

9.2.4.7 Camera

9.2.4.8 Floor Sensors

9.2.4.9 Wall Sensors

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 GPS-Based

9.2.5.2 Mobile Phone-Based

9.2.5.3 Sensor-Based

9.2.6 Historic and Forecasted Market Size by Component

9.2.6.1 Accelerometers and Gyroscopes

9.2.6.2 Multimodal Sensors

9.2.6.3 Other Unimodal/Bimodal Sensors

9.2.7 Historic and Forecasted Market Size by End Use

9.2.7.1 Home-based users

9.2.7.2 Nursing home

9.2.7.3 Hospices

9.2.7.4 Assisted Living Facilities

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Fall Detection Systems Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Wearable

9.3.4.2 Wrist-Wear

9.3.4.3 Neckwear

9.3.4.4 Body-wear

9.3.4.5 Others

9.3.4.6 Non-Wearable

9.3.4.7 Camera

9.3.4.8 Floor Sensors

9.3.4.9 Wall Sensors

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 GPS-Based

9.3.5.2 Mobile Phone-Based

9.3.5.3 Sensor-Based

9.3.6 Historic and Forecasted Market Size by Component

9.3.6.1 Accelerometers and Gyroscopes

9.3.6.2 Multimodal Sensors

9.3.6.3 Other Unimodal/Bimodal Sensors

9.3.7 Historic and Forecasted Market Size by End Use

9.3.7.1 Home-based users

9.3.7.2 Nursing home

9.3.7.3 Hospices

9.3.7.4 Assisted Living Facilities

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Fall Detection Systems Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Wearable

9.4.4.2 Wrist-Wear

9.4.4.3 Neckwear

9.4.4.4 Body-wear

9.4.4.5 Others

9.4.4.6 Non-Wearable

9.4.4.7 Camera

9.4.4.8 Floor Sensors

9.4.4.9 Wall Sensors

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 GPS-Based

9.4.5.2 Mobile Phone-Based

9.4.5.3 Sensor-Based

9.4.6 Historic and Forecasted Market Size by Component

9.4.6.1 Accelerometers and Gyroscopes

9.4.6.2 Multimodal Sensors

9.4.6.3 Other Unimodal/Bimodal Sensors

9.4.7 Historic and Forecasted Market Size by End Use

9.4.7.1 Home-based users

9.4.7.2 Nursing home

9.4.7.3 Hospices

9.4.7.4 Assisted Living Facilities

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Fall Detection Systems Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Wearable

9.5.4.2 Wrist-Wear

9.5.4.3 Neckwear

9.5.4.4 Body-wear

9.5.4.5 Others

9.5.4.6 Non-Wearable

9.5.4.7 Camera

9.5.4.8 Floor Sensors

9.5.4.9 Wall Sensors

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 GPS-Based

9.5.5.2 Mobile Phone-Based

9.5.5.3 Sensor-Based

9.5.6 Historic and Forecasted Market Size by Component

9.5.6.1 Accelerometers and Gyroscopes

9.5.6.2 Multimodal Sensors

9.5.6.3 Other Unimodal/Bimodal Sensors

9.5.7 Historic and Forecasted Market Size by End Use

9.5.7.1 Home-based users

9.5.7.2 Nursing home

9.5.7.3 Hospices

9.5.7.4 Assisted Living Facilities

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Fall Detection Systems Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Wearable

9.6.4.2 Wrist-Wear

9.6.4.3 Neckwear

9.6.4.4 Body-wear

9.6.4.5 Others

9.6.4.6 Non-Wearable

9.6.4.7 Camera

9.6.4.8 Floor Sensors

9.6.4.9 Wall Sensors

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 GPS-Based

9.6.5.2 Mobile Phone-Based

9.6.5.3 Sensor-Based

9.6.6 Historic and Forecasted Market Size by Component

9.6.6.1 Accelerometers and Gyroscopes

9.6.6.2 Multimodal Sensors

9.6.6.3 Other Unimodal/Bimodal Sensors

9.6.7 Historic and Forecasted Market Size by End Use

9.6.7.1 Home-based users

9.6.7.2 Nursing home

9.6.7.3 Hospices

9.6.7.4 Assisted Living Facilities

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Fall Detection Systems Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Wearable

9.7.4.2 Wrist-Wear

9.7.4.3 Neckwear

9.7.4.4 Body-wear

9.7.4.5 Others

9.7.4.6 Non-Wearable

9.7.4.7 Camera

9.7.4.8 Floor Sensors

9.7.4.9 Wall Sensors

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 GPS-Based

9.7.5.2 Mobile Phone-Based

9.7.5.3 Sensor-Based

9.7.6 Historic and Forecasted Market Size by Component

9.7.6.1 Accelerometers and Gyroscopes

9.7.6.2 Multimodal Sensors

9.7.6.3 Other Unimodal/Bimodal Sensors

9.7.7 Historic and Forecasted Market Size by End Use

9.7.7.1 Home-based users

9.7.7.2 Nursing home

9.7.7.3 Hospices

9.7.7.4 Assisted Living Facilities

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Fall Detection Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.40 Billion |

|

Forecast Period 2024-32 CAGR: |

3.38% |

Market Size in 2032: |

USD 0.54 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Fall Detection Systems Market research report is 2024-2032.

Koninklijke Philips N.V.; Tunstall Group; Apple Inc.; ADT; Medical Guardian LLC; MobileHelp; MariCare; Semtech Corporation; Connect America; SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches and Other Active Players.

The Fall Detection Systems Market is segmented into By Type, By Technology, By Component, By End Use and region. By Type, the market is categorized into Wearable and Non-Wearable.By Technology, the market is categorized into GPS-Based, Mobile Phone-Based and Sensor-Based. By Component, the market is categorized into Accelerometers and Gyroscopes, Multimodal Sensors and Other Unimodal/Bimodal Sensors. By End Use, the market is categorized into Home-based users, Nursing home, Hospices and Assisted Living Facilities. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

The Fall Detection Systems market encompasses technologies and devices designed to detect falls among individuals, particularly the elderly or those with health conditions that increase fall risk. These systems utilize various sensors, including accelerometers, gyroscopes, and pressure sensors, to monitor movements and identify abrupt changes indicative of a fall. Once a fall is detected, the system can trigger alerts to caregivers or emergency services, enabling timely intervention. The market is driven by the increasing aging population, rising awareness of fall-related injuries, and advancements in wearable technology and smart home solutions, aiming to enhance safety and improve the quality of life for vulnerable individuals.

Fall Detection Systems Market Size Was Valued at USD 0.40 Billion in 2023, and is Projected to Reach USD 0.54 Billion by 2032, Growing at a CAGR of 3.38% From 2024-2032.