Factory Automation and Industrial Control System Market Synopsis

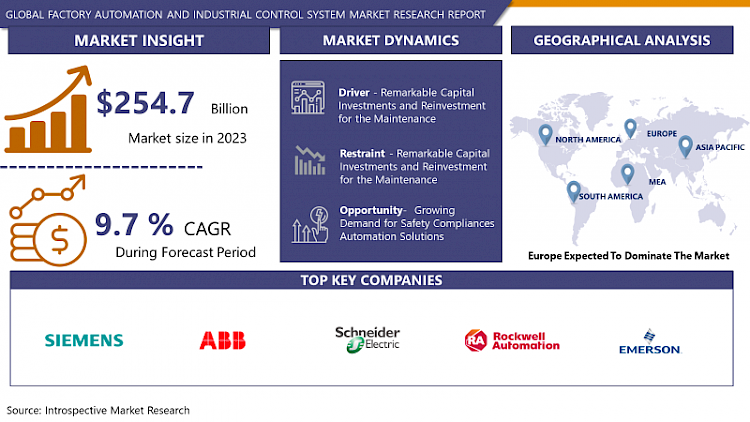

Factory Automation and Industrial Control System Market Size Was Valued at USD 254.7 Billion in 2023, and is Projected to Reach USD 585.99 Billion by 2032, Growing at a CAGR of 9.7% From 2024-2032.

The automation industry has been transformed by the combination of digital and physical aspects of manufacturing, aimed at delivering optimum performance. Furthermore, the target of reaching zero waste production and lesser time to gain the market has increased the growth of the market.

- The Factory Automation and Industrial Control System market have experienced significant growth and transformation, driven by advancements in technology and the need for enhanced efficiency in manufacturing processes. The adoption of automation solutions, such as robotics, programmable logic controllers (PLCs), and supervisory control and data acquisition (SCADA) systems, has been instrumental in streamlining production, reducing operational costs, and improving overall productivity.

- Key factors fuelling market expansion include the increasing demand for smart manufacturing, the integration of Internet of Things (IoT) in industrial processes, and the pursuit of Industry 4.0 initiatives. Manufacturers across various industries, including automotive, electronics, and pharmaceuticals, are investing heavily in these systems to gain a competitive edge and meet growing consumer expectations.

- The market landscape is characterized by a mix of established players and emerging technology providers, offering a wide range of automation solutions tailored to different industrial needs. However, challenges such as cybersecurity concerns and the initial high implementation costs remain considerations for businesses contemplating adoption.

Factory Automation and Industrial Control System Market Trend Analysis.

Growing Emphasis on Energy Efficiency and Cost Reduction

- The Factory Automation and Industrial Control System Market is witnessing a robust growth trajectory, primarily propelled by a growing emphasis on energy efficiency and cost reduction across industries. As businesses strive to optimize their operational processes, the adoption of automation and control systems has become integral. These systems streamline production, enhance overall efficiency, and reduce energy consumption, aligning with the global push for sustainable practices.

- Industries such as manufacturing, automotive, and electronics are increasingly investing in automation technologies to improve productivity and meet the rising demands of a competitive market. The integration of advanced technologies, including Industrial Internet of Things (IIoT) and Artificial Intelligence (AI), further enhances the capabilities of these systems, enabling real-time monitoring, predictive maintenance, and data-driven decision-making.

- In addition to energy efficiency, the focus on cost reduction is a key driving factor. Automation systems contribute to cost savings through minimized human intervention, reduced errors, and optimized resource utilization.

Growing Demand for Safety Compliances Automation Solutions creates an Opportunity

- The increasing emphasis on safety compliance in various industries has fueled a growing demand for automation solutions, creating a significant opportunity within the Factory Automation and Industrial Control System market. As industries strive to enhance workplace safety and adhere to stringent regulations, the adoption of automated systems becomes imperative.

- Factory automation involves the integration of control systems, machinery, and processes to streamline operations, reduce manual intervention, and ensure compliance with safety standards. This trend is particularly evident in sectors such as manufacturing, automotive, and chemicals, where precision and safety are paramount.

- Industrial control systems play a crucial role in this landscape by managing and regulating industrial processes. The market for these systems is expanding as companies seek to optimize production efficiency while maintaining a strong focus on safety protocols. Automation solutions not only enhance productivity but also contribute to risk mitigation and overall operational resilience.

Factory Automation and Industrial Control System Market Segment Analysis:

Factory Automation and Industrial Control System Market Segmented on the basis of Type, Component, End-User.

By Product Type, Industrial Control Systems segment is expected to dominate the market during the forecast period

- Factory Automation and Industrial Control Systems (ICS), the Industrial Control Systems segment is poised to exert dominance in the market. Characterized by its pivotal role in overseeing and managing industrial processes, the Industrial Control Systems segment is integral to the seamless functioning of diverse industries. These systems encompass a wide array of technologies, including programmable logic controllers (PLCs), distributed control systems (DCS), and supervisory control and data acquisition (SCADA) systems.

- The dominance of the Industrial Control Systems segment can be attributed to its ability to provide real-time monitoring, automation, and optimization of industrial processes. By enabling precise control over machinery and processes, these systems enhance operational efficiency, reduce downtime, and ensure optimal resource utilization. Additionally, the increasing adoption of Industry 4.0 practices, which emphasize the integration of digital technologies into industrial processes, further amplifies the significance of Industrial Control Systems in modern manufacturing environments.

By Industrial Control Systems, ERP segment held the largest share of xx% in 2022

- The Factory Automation and Industrial Control System Market is witnessing a significant dominance of the ERP (Enterprise Resource Planning) segment within the Industrial Control Systems (ICS) category. As industries increasingly prioritize operational efficiency, connectivity, and data-driven decision-making, ERP solutions have become integral components of modern industrial automation.

- ERP systems play a crucial role in streamlining and integrating various business processes, including manufacturing, supply chain management, finance, and human resources. In the context of industrial control systems, ERP solutions facilitate seamless communication and data exchange between different components of a manufacturing environment. This integration enhances overall operational visibility, efficiency, and responsiveness.

- The dominance of ERP in the Factory Automation and Industrial Control System Market can be attributed to its ability to provide a holistic approach to managing resources, optimizing production processes, and enabling real-time monitoring and control. By consolidating diverse functions into a unified platform, ERP solutions empower organizations to adapt to dynamic market conditions, reduce downtime, and make informed decisions.

Factory Automation and Industrial Control System Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is poised to assert dominance in the Factory Automation and Industrial Control System (IACS) market, reflecting the region's commitment to technological advancements and industrial innovation. With a strong emphasis on Industry 4.0, Europe is leading the integration of automation and control systems to enhance manufacturing efficiency and productivity.

- The robust industrial infrastructure, coupled with stringent regulations promoting automation for improved safety and precision, positions Europe as a key player in the global market. The region's manufacturers are increasingly adopting smart technologies, such as IoT-enabled devices and robotics, to streamline production processes and stay competitive on a global scale.

- Furthermore, Europe's proactive approach to sustainability and energy efficiency aligns with the goals of modern industrial automation. As industries embrace smart manufacturing practices, the demand for advanced factory automation and control systems is expected to surge.

Factory Automation and Industrial Control System Market Top Key Players:

- Siemens(Germany)

- ABB(Switzerland)

- Schneider Electric (France)

- Rockwell Automation (USA)

- Honeywell International (USA)

- Emerson Electric Co. (USA)

- Mitsubishi Electric (Japan)

- Fanuc (Japan)

- Yokogawa Electric Corporation (Japan)

- Omron Corporation (Japan)

- Bosch Rexroth AG (Germany)

- KUKA Robotics (Germany)

- Yaskawa Electric Corporation (Japan)

- Eaton Corporation (Ireland)

- Schneider Electric Industrial Automation (France)

- Beckhoff Automation GmbH (Germany)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Phoenix Contact Electronics GmbH (Germany)

- National Instruments (USA)

- Cognex Corporation (USA)

Key Industry Developments in the Factory Automation and Industrial Control System Market:

- In April 2023, Emerson acquired National Instruments (NI) for $8.2 billion. This strategic move aimed to combine Emerson's automation expertise with NI's test and measurement technology, creating a powerhouse in integrated automation solutions. It expands Emerson's reach into diverse markets and offers significant cost synergies.

- In September 2023, ATS Corporation acquired Avidity Science. This acquisition strengthened ATS' presence in the life sciences sector by adding Avidity's expertise in automated water purification solutions.

|

Global Factory Automation and Industrial Control System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 254.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 585.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY TYPE (2017-2032)

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SCADA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAM

- PLC

- DCS

- MES

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY COMPONENT (2017-2032)

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDUSTRIAL SENSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL ROBOTS

- INDUSTRIAL 3D PRINTERS

- MACHINE VISION SYSTEMS

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY END-USER (2017-2032)

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHEMICAL & PETROCHEMICAL

- PHARMACEUTICAL

- FOOD & BEVERAGE

- OIL & GAS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SIEMENS (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ABB (SWITZERLAND)

- SCHNEIDER ELECTRIC (FRANCE)

- ROCKWELL AUTOMATION (USA)

- HONEYWELL INTERNATIONAL (USA)

- EMERSON ELECTRIC CO. (USA)

- MITSUBISHI ELECTRIC (JAPAN)

- FANUC (JAPAN)

- YOKOGAWA ELECTRIC CORPORATION (JAPAN)

- OMRON CORPORATION (JAPAN)

- BOSCH REXROTH AG (GERMANY)

- KUKA ROBOTICS (GERMANY)

- YASKAWA ELECTRIC CORPORATION (JAPAN)

- EATON CORPORATION (IRELAND)

- SCHNEIDER ELECTRIC INDUSTRIAL AUTOMATION (FRANCE)

- BECKHOFF AUTOMATION GMBH (GERMANY)

- MITSUBISHI HEAVY INDUSTRIES, LTD. (JAPAN)

- PHOENIX CONTACT ELECTRONICS GMBH (GERMANY)

- NATIONAL INSTRUMENTS (USA)

- COGNEX CORPORATION (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Factory Automation and Industrial Control System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 254.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 585.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY TYPE

TABLE 008. SCADA MARKET OVERVIEW (2016-2028)

TABLE 009. PAM MARKET OVERVIEW (2016-2028)

TABLE 010. PLC MARKET OVERVIEW (2016-2028)

TABLE 011. DCS MARKET OVERVIEW (2016-2028)

TABLE 012. MES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY COMPONENT

TABLE 015. INDUSTRIAL SENSORS MARKET OVERVIEW (2016-2028)

TABLE 016. INDUSTRIAL ROBOTS MARKET OVERVIEW (2016-2028)

TABLE 017. INDUSTRIAL 3D PRINTERS MARKET OVERVIEW (2016-2028)

TABLE 018. MACHINE VISION SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET BY END-USER

TABLE 021. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 022. CHEMICAL & PETROCHEMICAL MARKET OVERVIEW (2016-2028)

TABLE 023. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 024. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 025. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 026. OTHER MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 028. NORTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 029. NORTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY END-USER (2016-2028)

TABLE 030. N FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 032. EUROPE FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 033. EUROPE FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY END-USER (2016-2028)

TABLE 034. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 036. ASIA PACIFIC FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 037. ASIA PACIFIC FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY END-USER (2016-2028)

TABLE 038. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY END-USER (2016-2028)

TABLE 042. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 044. SOUTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COMPONENT (2016-2028)

TABLE 045. SOUTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY END-USER (2016-2028)

TABLE 046. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 047. SCHNEIDER ELECTRIC SE: SNAPSHOT

TABLE 048. SCHNEIDER ELECTRIC SE: BUSINESS PERFORMANCE

TABLE 049. SCHNEIDER ELECTRIC SE: PRODUCT PORTFOLIO

TABLE 050. SCHNEIDER ELECTRIC SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ROCKWELL AUTOMATION INC.: SNAPSHOT

TABLE 051. ROCKWELL AUTOMATION INC.: BUSINESS PERFORMANCE

TABLE 052. ROCKWELL AUTOMATION INC.: PRODUCT PORTFOLIO

TABLE 053. ROCKWELL AUTOMATION INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 054. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 055. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 056. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. EMERSON ELECTRIC COMPANY: SNAPSHOT

TABLE 057. EMERSON ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 058. EMERSON ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 059. EMERSON ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ABB LTD: SNAPSHOT

TABLE 060. ABB LTD: BUSINESS PERFORMANCE

TABLE 061. ABB LTD: PRODUCT PORTFOLIO

TABLE 062. ABB LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MITSUBISHI ELECTRIC CORPORATION: SNAPSHOT

TABLE 063. MITSUBISHI ELECTRIC CORPORATION: BUSINESS PERFORMANCE

TABLE 064. MITSUBISHI ELECTRIC CORPORATION: PRODUCT PORTFOLIO

TABLE 065. MITSUBISHI ELECTRIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SIEMENS AG: SNAPSHOT

TABLE 066. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 067. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 068. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OMRON CORPORATION: SNAPSHOT

TABLE 069. OMRON CORPORATION: BUSINESS PERFORMANCE

TABLE 070. OMRON CORPORATION: PRODUCT PORTFOLIO

TABLE 071. OMRON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. YOKOGAWA ELECTRIC CORPORATION: SNAPSHOT

TABLE 072. YOKOGAWA ELECTRIC CORPORATION: BUSINESS PERFORMANCE

TABLE 073. YOKOGAWA ELECTRIC CORPORATION: PRODUCT PORTFOLIO

TABLE 074. YOKOGAWA ELECTRIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. GENERAL ELECTRIC CO.: SNAPSHOT

TABLE 075. GENERAL ELECTRIC CO.: BUSINESS PERFORMANCE

TABLE 076. GENERAL ELECTRIC CO.: PRODUCT PORTFOLIO

TABLE 077. GENERAL ELECTRIC CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. TEXAS INSTRUMENTS INC.: SNAPSHOT

TABLE 078. TEXAS INSTRUMENTS INC.: BUSINESS PERFORMANCE

TABLE 079. TEXAS INSTRUMENTS INC.: PRODUCT PORTFOLIO

TABLE 080. TEXAS INSTRUMENTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 081. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 082. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 083. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 084. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 085. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 086. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. SCADA MARKET OVERVIEW (2016-2028)

FIGURE 013. PAM MARKET OVERVIEW (2016-2028)

FIGURE 014. PLC MARKET OVERVIEW (2016-2028)

FIGURE 015. DCS MARKET OVERVIEW (2016-2028)

FIGURE 016. MES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COMPONENT

FIGURE 019. INDUSTRIAL SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 020. INDUSTRIAL ROBOTS MARKET OVERVIEW (2016-2028)

FIGURE 021. INDUSTRIAL 3D PRINTERS MARKET OVERVIEW (2016-2028)

FIGURE 022. MACHINE VISION SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY END-USER

FIGURE 025. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 026. CHEMICAL & PETROCHEMICAL MARKET OVERVIEW (2016-2028)

FIGURE 027. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 028. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 029. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 030. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA FACTORY AUTOMATION AND INDUSTRIAL CONTROL SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Factory Automation and Industrial Control System Market research report is 2024-2032.

Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Rockwell Automation (USA), Honeywell International (USA), Emerson Electric Co. (USA), Mitsubishi Electric (Japan), Fanuc (Japan), Yokogawa Electric Corporation (Japan), Omron Corporation (Japan), Bosch Rexroth AG (Germany), KUKA Robotics (Germany), Yaskawa Electric Corporation (Japan), Eaton Corporation (Ireland), Schneider Electric Industrial Automation (France), Beckhoff Automation GmbH (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Phoenix Contact Electronics GmbH (Germany), National Instruments (USA), Cognex Corporation (USA) and Other Major Players.

Factory Automation and Industrial Control System Market is segmented into Type, Component, End-User, and region. By Type, the market is categorized into SCADA, PAM, PLC, DCS, MES, Others. By Component the market is categorized into Industrial Sensors, Industrial Robots, Industrial 3D Printers, Machine Vision Systems, Others. By End-User, the market is categorized into Automotive, Chemical & Petrochemical, Pharmaceutical, Food & Beverage, Oil & Gas, Other. By Application, the market is categorized into XXX. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The automation industry has been transformed by the combination of digital and physical aspects of manufacturing, aimed at delivering optimum performance. Furthermore, the target of reaching zero waste production and lesser time to gain the market has increased the growth of the market

Factory Automation and Industrial Control System Market Size Was Valued at USD 254.7 Billion in 2023, and is Projected to Reach USD 585.99 Billion by 2032, Growing at a CAGR of 9.7% From 2024-2032.