Eye Health Ingredients Market Synopsis

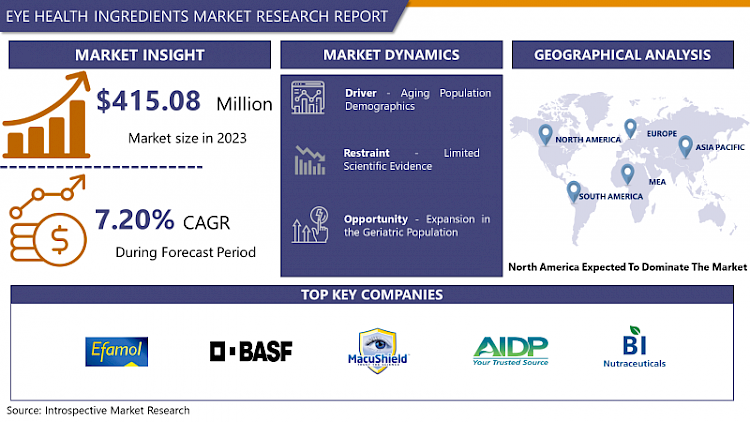

Eye Health Ingredients Market Size Was Valued at USD 415.08 Million in 2023, and is Projected to Reach USD 776.04 Million by 2032, Growing at a CAGR of 7.20% From 2024-2032.

Eye health ingredients are nutrients and compounds that support and maintain vision and overall eye health. Key ingredients include vitamins A, C, and E, which act as antioxidants to protect eye cells; lutein and zeaxanthin, which filter harmful blue light and improve visual function; omega-3 fatty acids, which support retinal health and reduce the risk of dry eyes; and zinc, which aids in the metabolism of essential eye nutrients. These ingredients are found in various foods and supplements and are crucial for preventing age-related eye conditions like macular degeneration and cataracts.

- The eye health ingredients market has been on the rise with label intel tising of eye health and the growing instances of ocul pathology including AMD, cataracts, and glaucoma. These category encompasses various ingredients such as vitamins (A, C, E), carotenoids (Lutien & Zeaxanthin), Omega 3 fatty acids, minerals, and herb extracts. These are utilized in nutraceuticals, nutriceuticals as well as functional foods and drinks used to enhance eye performance and alleviate other vision related issues.

- Various dynamics are now leading to the expansion of the demand for eye health ingredients. On the same note, demographic trends such as the increasing ageing population across the globe, are also a major driving force behind the increased demand for eye care since elderly people are more likely to suffer from eye related complications. As according to the World Health Organization, it is estimated that by year 2050, one in every six people will be aged 60-year and above and therefore population will definitely yearn for the products which support eye health. Also, increased screen time evidenced from the enhanced use of gadgets to access the internet has enhanced the use of the device, contributing to digital eye strain thereby progressing the market. People are getting more conscious about how to protect their eyes hence are willing to take precautions rather than suffer from high risks for a long time.

- The market is also able to benefit from scientific shifts and technological improvements and the resultant research in the effectivity of specific inoculations for the sustenance of eye health. For instance, it is now known that lutein and zeaxanthin in particular play the role of allowing only beneficial wavelengths of light to enter the eye, thus preventing the development of the various chronic eye diseases that are associated with aging. Since the human body cannot synthesize Omega-3 fatty acids, it is necessary to obtain it through diet and some of the important fatty acids such as DHA are significant for the proper functioning of the retina and vision development. It is due to these findings that the consumers have been led into embracing and trusting the products concerning eye health.

- Region-wise, North America currently holds the largest share of the eye health ingredients market due to consumer consciousness complemented by well-developed healthcare and sound R&D expenditure. Europe is the second region; there is also an increase in the percentage of elderly people and the trend in preventive measures. According to a recent market review based on the most recent research conducted on the nutraceutical industry, Asia-Pacific is likely to exhibit the highest growth in the near future for reasons such as increasing disposable income, increasing population trend toward urbanization, and peculiar emphasis placed on health and wellness in the region.

- Dominate market players such as DSM, BASF, and Kemin Industries engaged in research and development for its efficacious product offerings and strategic joints ventures aiming at the development of new product portfolio to consolidate their position in the competitive market. It is also notable that these companies are placing more attention to sustainability on natural sources of ingredients as the consumers lean towards aspects of clean-label products

- However, some threats are present too: regulations, For instance, are still an issue in the industry and high costs of the superior quality ingredients. It is noteworthy that various administrative agencies in regulatory regions have different requirements for d-slists, which makes it difficult to gain approval and enter the market. However, the price of such precious nutrients such as omega-3 fatty acids and carotenoids may be very expensive since they significantly influence the pricing of the products hence reduces access to the end consumers.

- In sum, there are certain opportunities and prospects associated with the consumption of eye health ingredients, which is likely to grow due to several factors such as demographic shifts, increasing incidence of lifestyle-related diseases and or advances in scientific research. This is another strong indication that the desire for good health and regular eye care puts a substantial market for quality and unique ingredients in this area to rise in the future. There are many facets of the market that need to be addressed that include regulatory factors as well as the increased costs in order to grab the new opportunities the sector has to offer.

Eye Health Ingredients Market Trend Analysis

Increasing Popularity of Plant-Based and Natural Ingredient

It should be noted that the market for the study of eye health ingredients has gone through some dynamic changes in the more recent past, with an emphasis being placed on plant-based and natural solutions. This has been on a rise for several reasons; rise in the awareness of population on the health of their eyes and their inclination to healthier products that are eco friendly. The plant derivative substances, for example lutein, zeaxanthin as well as astaxanthin have been embraced due to their antioxidant qualities and research verified effects in ocular health/medical. In addition, natural products are widely considered to elicit fewer side effects and provide less risk for adverse reactions and are, therefore, more attractive to consumers looking to avoid synthetic components. Consequently, the producers are gradually using plant derivatives and natural additives in eye health products, which are supplements, functional foods, and beverages, to address the changing needs of customers seeking healthy products. These dynamics of this current trend of going green and adopting organic plant-based formulations for their products shall go on fueling the growth of the eye health ingredients market in the future.

Expansion in the Geriatric Population

- Aging is another factor that has affected the world population in that there is an increase in the number of elderly people across the globe since; there has been an improvement in the health facilities, qualities of life, and low birth rate. It is for this reason that this demographic shift is viewed as offering both the social progression and the problems for societies all across the globe. In that perspective, the longer life expectancy is beneficial in terms of having more years of work and the elderly population may also provide the society with a means of volunteering their time and wisdom. But it also requires significant changes in public policy, especially in terms of address healthcare, social security and pension to meet and face an aging society.

- The increasing number of citizens aged 65 years and above presents a significant effect, that is economic, to the economy and the job market. This knowledge directly relates to an emerging need for the healthcare workers qualified for working with elderly population, as well as for advancements in health technologies and medicine for the elderly. This demographic shift will also have an impact on the housing markets, urban development, and transportation infrastructure, this will call for infrastructural changes to facilitate elderly status provision. There is a challenge for the government and other businesses to come up with the inclusive health, social, and economic approaches that can be used to meet the needs of the ageing population so that society can afford the costs and continue productive despite the changes.

Eye Health Ingredients Market Segment Analysis:

3d Printed Wearables Market Segmented based on By Type, By Application , By Source and By Form.

By Type, Vitamin A segment is expected to dominate the market during the forecast period

- The market for Eye Health Ingredients is vast and multi-faceted as it consists of various substances regarded as essential for the health of eyes and enhancement of vision. Beta carotene, a readily converted substance into vitamin A, is an essential nutrient that contributes to this formula due to it importance in the prevention of night blindness and good vision. Many of these micronutrients have specific importance, and vitamin A is in particular vital for vision, perhaps due to its function in the production of rhodopsin – important pigment that is located in the retina and used in low light and colour perception. Lutein and zeaxanthin, two carotene molecules, are present in high amounts in the macula of the eye and are acknowledged for influencing out the squinting blue high-energy wavelengths of light to preserve as well as rejuvenate the healthy cells in eyes. These antioxidant nutrients have been linked to the decreased probability of contracting chronic eye ailments including the AMD and cataracts.

- Besides, there are other constituents that exist in the market for Luka, including omega-3 fatty acids (DHA and EPA), which are vitally important to the functioning of the retina and vision development. Among those vitamins and minerals, the vitamins C and E, with the addition of zinc and copper are particularly important for eye health because of their antioxidant properties that helps in the protection of damage from free radicals. The addition of these ingredients in the eye health supplements and in the food that is enriched is as a result of increased uptake of health foods and knowledge on preventive medicine and the people today are aging and hence are more vulnerable to eye related complications. This combination of components not only enjoys ample proofs in various scientific sources but also corresponds to market tendencies caused by increased interest in solutions for the problems of eye health.

By Form, Capsule & Tablets segment held the largest share in 2023

- Caplets and liquid supplements are popular in the eye health ingredients market since they bring different benefits as well as accommodate for the various consumers understanding of forms of supplementation. Coated soft gels, capsules, and tablets are versatile and easy to measure, and that is why those consumers, who value simplicity and convenience opt for them. These forms also provide increased stability so that the delicate ingredients that are ingredients for health of eyes such as affordable antioxidants and vitamins remain potent over time. While encapsulated products are easy to swallow and give long term results, liquid products have the advantage of faster rate of absorption perfect for people who cannot swallow pills or those who would want quick effect. Furthermore, as liquid forms offer bulk volumes and doses, it becomes easier to develop unit specific for general or individual eye health problems.

- The solid direct compressed eye health supplements that are easy to use due to their portable and Versatile nature of the powdered eye health supplements. They come in the form of capsules, tablets, and powders, which can dissolve in drinks or foods which is good for those who do not actually like taking supplements in tablets or capsules. In addition, drinks in powder form contain a wider list of components, such as superfoods and herbal drugs that are helpful when it comes to the health of the eyes, and helps the consumer get a whole range of nutrients in one glass. In detail, the freeness in the choice of forms of eye health ingredients available in the market guarantee that every person is able to access a product that is fitting for them depending on their personal preference while making it easier for them to manage the health of their eyes.

Eye Health Ingredients Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- As far as the regional segmentation of the eye health ingredients market is concerned, North America is expected to continue to reign supreme in the market throughout the forecast period. This can be pinned on several factors such as the availability of effective health care facilities in the region, awareness of people on preventive health measures, and estimated rise in population of the world’s elderly who are prone to vision complications including macular degeneration and cataracts. In addition, increased awareness among consumers and reliance on nutritional supplements for better health and rejuvenation of the eye muscles, as well as on functional foods enriched with ingredients for eye health, all support this market in the region. Also, further development through R&D along with partnerships between main market participants and research organizations ensures the constant assembling in new technologies and new innovations of eye health ingredients to introduce them to the market, which ensures North America’s leadership in the global market.

- Second, there are increased access to products along the eye health value chain through various distribution channels, improved regulatory environment, and third is higher disposable income, all of which bolster the development of this market in North America. The increasing evidence of the governments within the region stressing on healthcare and wellness coupled up with the growing concept of nutraceuticals or customized nutrition has made the consumers run towards making more purchases from the products that contain eye health elements. Moreover, the increasing trend in development in healthcare and a shift towards promotional health consciousness by the customers as well as the practitioners are some of the factors that enable the North America to again maintain the continued supremacy in the eye health ingredients market over the predicted forecast period. These trends keep on highlighting the point that the region has a great prospect for eye health ingredients market and manufacturers, suppliers, and other relevant players from the sector should tap in it as soon as possible..

Active Key Players in the Eye Health Ingredients Market

- Efamol (UK)

- MacuShield (UK)

- BASF SE (Germany)

- AIDP Inc. (U.S.)

- BI Nutraceuticals (U.S.)

- BLUE CALIFORNIA (U.S.)

- Amway (US)

- DSM (The Netherlands)

- Alcon(US)

- Solgar(US)

- Swanson(UKS)

- Other Key Players

Global Eye Health Ingredients Market Scope:

|

Global Eye Health Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 444.96 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.20%

|

Market Size in 2032: |

USD 776.04 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- EYE HEALTH INGREDIENTS MARKET BY TYPE (2017-2032)

- EYE HEALTH INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BETA CAROTENE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VITAMIN A

- LUTEIN

- ZEAXANTHIN

- OTHERS

- EYE HEALTH INGREDIENTS MARKET BY APPLICATION (2017-2032)

- EYE HEALTH INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HUMAN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMAL

- EYE HEALTH INGREDIENTS MARKET BY SOURCE (2017-2032)

- EYE HEALTH INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATURAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SYNTHETIC

- EYE HEALTH INGREDIENTS MARKET BY FORM (2017-2032)

- EYE HEALTH INGREDIENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFT GEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CAPSULE & TABLETS

- LIQUID

- POWDER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Eye Health Ingredients Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- EFAMOL (UK)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MACUSHIELD (UK)

- BASF SE (GERMANY)

- AIDP INC. (U.S.)

- BI NUTRACEUTICALS (U.S.)

- BLUE CALIFORNIA (U.S.)

- AMWAY (US)

- DSM (THE NETHERLANDS)

- ALCON(US)

- SOLGAR(US)

- SWANSON(UKS)

- COMPETITIVE LANDSCAPE

- GLOBAL EYE HEALTH INGREDIENTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Eye Health Ingredients Market Scope:

|

Global Eye Health Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 444.96 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.20%

|

Market Size in 2032: |

USD 776.04 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EYE HEALTH INGREDIENTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EYE HEALTH INGREDIENTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EYE HEALTH INGREDIENTS MARKET COMPETITIVE RIVALRY

TABLE 005. EYE HEALTH INGREDIENTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. EYE HEALTH INGREDIENTS MARKET THREAT OF SUBSTITUTES

TABLE 007. EYE HEALTH INGREDIENTS MARKET BY TYPE

TABLE 008. BETA CAROTENE MARKET OVERVIEW (2016-2028)

TABLE 009. VITAMIN A MARKET OVERVIEW (2016-2028)

TABLE 010. LUTEIN MARKET OVERVIEW (2016-2028)

TABLE 011. ZEAXANTHIN MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. EYE HEALTH INGREDIENTS MARKET BY APPLICATION

TABLE 014. HUMAN MARKET OVERVIEW (2016-2028)

TABLE 015. ANIMAL MARKET OVERVIEW (2016-2028)

TABLE 016. EYE HEALTH INGREDIENTS MARKET BY SOURCE

TABLE 017. NATURAL MARKET OVERVIEW (2016-2028)

TABLE 018. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 019. EYE HEALTH INGREDIENTS MARKET BY FORM

TABLE 020. SOFT GEL MARKET OVERVIEW (2016-2028)

TABLE 021. CAPSULE & TABLETS MARKET OVERVIEW (2016-2028)

TABLE 022. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 023. POWDER MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY SOURCE (2016-2028)

TABLE 027. NORTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY FORM (2016-2028)

TABLE 028. N EYE HEALTH INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE EYE HEALTH INGREDIENTS MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE EYE HEALTH INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 031. EUROPE EYE HEALTH INGREDIENTS MARKET, BY SOURCE (2016-2028)

TABLE 032. EUROPE EYE HEALTH INGREDIENTS MARKET, BY FORM (2016-2028)

TABLE 033. EYE HEALTH INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC EYE HEALTH INGREDIENTS MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC EYE HEALTH INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 036. ASIA PACIFIC EYE HEALTH INGREDIENTS MARKET, BY SOURCE (2016-2028)

TABLE 037. ASIA PACIFIC EYE HEALTH INGREDIENTS MARKET, BY FORM (2016-2028)

TABLE 038. EYE HEALTH INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA EYE HEALTH INGREDIENTS MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA EYE HEALTH INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA EYE HEALTH INGREDIENTS MARKET, BY SOURCE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA EYE HEALTH INGREDIENTS MARKET, BY FORM (2016-2028)

TABLE 043. EYE HEALTH INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY APPLICATION (2016-2028)

TABLE 046. SOUTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY SOURCE (2016-2028)

TABLE 047. SOUTH AMERICA EYE HEALTH INGREDIENTS MARKET, BY FORM (2016-2028)

TABLE 048. EYE HEALTH INGREDIENTS MARKET, BY COUNTRY (2016-2028)

TABLE 049. ALLIED BIOTECH CORPORATION: SNAPSHOT

TABLE 050. ALLIED BIOTECH CORPORATION: BUSINESS PERFORMANCE

TABLE 051. ALLIED BIOTECH CORPORATION: PRODUCT PORTFOLIO

TABLE 052. ALLIED BIOTECH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. EFAMOL: SNAPSHOT

TABLE 053. EFAMOL: BUSINESS PERFORMANCE

TABLE 054. EFAMOL: PRODUCT PORTFOLIO

TABLE 055. EFAMOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. MACUSHIELD: SNAPSHOT

TABLE 056. MACUSHIELD: BUSINESS PERFORMANCE

TABLE 057. MACUSHIELD: PRODUCT PORTFOLIO

TABLE 058. MACUSHIELD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BASF SE: SNAPSHOT

TABLE 059. BASF SE: BUSINESS PERFORMANCE

TABLE 060. BASF SE: PRODUCT PORTFOLIO

TABLE 061. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. AIDP INC.: SNAPSHOT

TABLE 062. AIDP INC.: BUSINESS PERFORMANCE

TABLE 063. AIDP INC.: PRODUCT PORTFOLIO

TABLE 064. AIDP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BI NUTRACEUTICALS: SNAPSHOT

TABLE 065. BI NUTRACEUTICALS: BUSINESS PERFORMANCE

TABLE 066. BI NUTRACEUTICALS: PRODUCT PORTFOLIO

TABLE 067. BI NUTRACEUTICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BLUE CALIFORNIA: SNAPSHOT

TABLE 068. BLUE CALIFORNIA: BUSINESS PERFORMANCE

TABLE 069. BLUE CALIFORNIA: PRODUCT PORTFOLIO

TABLE 070. BLUE CALIFORNIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. AMWAY: SNAPSHOT

TABLE 071. AMWAY: BUSINESS PERFORMANCE

TABLE 072. AMWAY: PRODUCT PORTFOLIO

TABLE 073. AMWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. DSM: SNAPSHOT

TABLE 074. DSM: BUSINESS PERFORMANCE

TABLE 075. DSM: PRODUCT PORTFOLIO

TABLE 076. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. ALCON: SNAPSHOT

TABLE 077. ALCON: BUSINESS PERFORMANCE

TABLE 078. ALCON: PRODUCT PORTFOLIO

TABLE 079. ALCON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. SOLGAR: SNAPSHOT

TABLE 080. SOLGAR: BUSINESS PERFORMANCE

TABLE 081. SOLGAR: PRODUCT PORTFOLIO

TABLE 082. SOLGAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. SWANSON: SNAPSHOT

TABLE 083. SWANSON: BUSINESS PERFORMANCE

TABLE 084. SWANSON: PRODUCT PORTFOLIO

TABLE 085. SWANSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 086. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 087. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 088. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EYE HEALTH INGREDIENTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EYE HEALTH INGREDIENTS MARKET OVERVIEW BY TYPE

FIGURE 012. BETA CAROTENE MARKET OVERVIEW (2016-2028)

FIGURE 013. VITAMIN A MARKET OVERVIEW (2016-2028)

FIGURE 014. LUTEIN MARKET OVERVIEW (2016-2028)

FIGURE 015. ZEAXANTHIN MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. EYE HEALTH INGREDIENTS MARKET OVERVIEW BY APPLICATION

FIGURE 018. HUMAN MARKET OVERVIEW (2016-2028)

FIGURE 019. ANIMAL MARKET OVERVIEW (2016-2028)

FIGURE 020. EYE HEALTH INGREDIENTS MARKET OVERVIEW BY SOURCE

FIGURE 021. NATURAL MARKET OVERVIEW (2016-2028)

FIGURE 022. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 023. EYE HEALTH INGREDIENTS MARKET OVERVIEW BY FORM

FIGURE 024. SOFT GEL MARKET OVERVIEW (2016-2028)

FIGURE 025. CAPSULE & TABLETS MARKET OVERVIEW (2016-2028)

FIGURE 026. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 027. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA EYE HEALTH INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE EYE HEALTH INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC EYE HEALTH INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA EYE HEALTH INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA EYE HEALTH INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Eye Health Ingredients Market research report is 2024-2032.

New Balance (US), Under Armour (US), Adidas America Inc. (US), 3D Systems Inc. (US), Shapeways Inc. (US), Formlabs (US), Materialise (Belgium), and Other Major Players.

The Eye Health Ingredients Market Market is segmented into Type , Application , Source,Form and Region. By Product Type, the market is categorized into Footwea, Prosthetics, Orthopedic Implants, Surgical Instruments, Smart Watches, Fitness Trackers. By Type the market is categorized into Beta Carotene, Vitamin A, Lutein, Zeaxanthin, Others. By Application the market is categorized into Human, Animal. By Source the market is categorized into Natural, Synthetic), Form (Soft Gel, Capsule & Tablets, Liquid, Powder. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Eye health ingredients are nutrients and compounds that support and maintain vision and overall eye health. Key ingredients include vitamins A, C, and E, which act as antioxidants to protect eye cells; lutein and zeaxanthin, which filter harmful blue light and improve visual function; omega-3 fatty acids, which support retinal health and reduce the risk of dry eyes; and zinc, which aids in the metabolism of essential eye nutrients. These ingredients are found in various foods and supplements and are crucial for preventing age-related eye conditions like macular degeneration and cataracts.

Eye Health Ingredients Market Size Was Valued at USD 415.08 Million in 2023, and is Projected to Reach USD 776.04 Million by 2032, Growing at a CAGR of 7.20% From 2024-2032.