Exemestane API Market Synopsis

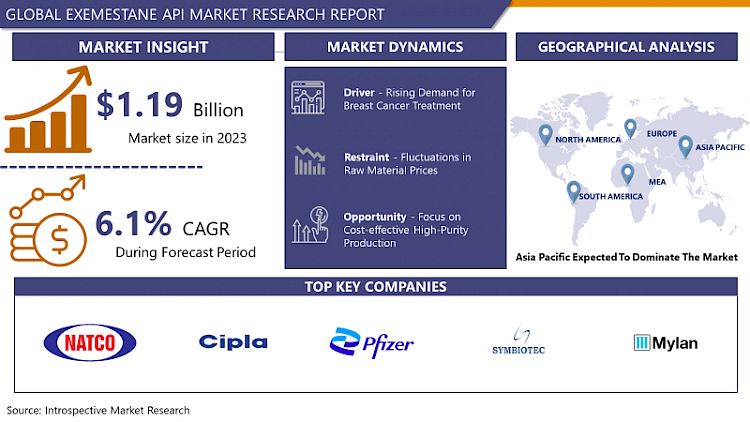

Exemestane API Market Size Was Valued at USD 1.19 Billion in 2023, and is Projected to Reach USD 2.03 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

Exemestane API, also known as Aromasin, actively inhibits estrogen synthesis in postmenopausal women, playing a crucial role in treating estrogen receptor-positive breast cancer. It is characterized by its ability to block aromatase enzymes, contributing significantly to personalized cancer therapy.

Exemestane API, widely recognized as Aromasin, finds extensive application in the treatment of estrogen receptor-positive breast cancer among postmenopausal women. Its mechanism involves actively inhibiting estrogen synthesis by blocking aromatase enzymes, thus hindering tumor growth. This targeted approach minimizes cancer recurrence risks and enhances therapeutic outcomes, making it a pivotal component of personalized cancer treatment regimens.

- Exemestane API lie in its efficacy and safety profile, offering a well-tolerated treatment option for patients. Its selective action on estrogen receptors ensures minimal side effects compared to traditional chemotherapy, leading to improved quality of life during cancer treatment. Furthermore, ongoing research and clinical trials continue to explore its potential benefits in other cancer types and medical conditions, expanding its application beyond breast cancer treatment.

- Exemestane API is expected to remain robust, driven by several factors. These include rising cancer incidence rates globally, especially in aging populations, and advancements in healthcare infrastructure supporting early diagnosis and targeted therapies. Additionally, the shift towards personalized medicine and increasing awareness about the benefits of adjuvant therapies like Exemestane API are anticipated to fuel its demand in the coming years, creating opportunities for pharmaceutical companies and research institutions in oncology therapeutics.

Exemestane API Market Trend Analysis

Rising Demand for Breast Cancer Treatment

- The burgeoning demand for breast cancer treatment stands as a key driver propelling the growth of the Exemestane API market. This surge in demand is primarily fueled by the increasing prevalence of breast cancer cases worldwide, particularly among women. As awareness about breast cancer screening and early detection programs grows, more patients are diagnosed at earlier stages, leading to a higher demand for effective treatment options like Exemestane API.

- Advancements in medical technologies and therapeutic approaches have significantly improved the prognosis for breast cancer patients. As a result, there is a growing emphasis on personalized medicine, where treatments are tailored to individual patients based on genetic and molecular characteristics. Exemestane API plays a crucial role in this paradigm shift, offering targeted therapy that specifically inhibits estrogen synthesis in postmenopausal women with estrogen receptor-positive breast cancer.

- Furthermore, collaborations between pharmaceutical companies, research institutions, and healthcare providers are driving innovation in breast cancer treatment. These collaborations facilitate the development of new drugs, including Exemestane API, and ensure their accessibility to patients in need. With the rising demand for effective and personalized breast cancer therapies, the Exemestane API market is poised for continued growth in the foreseeable future, contributing significantly to advancements in oncology care.

Focus on Cost-effective High-Purity Production

- The Exemestane API market is strategically shifting its focus towards cost-effective and high-purity production methods to foster growth. This emphasis reflects the industry's commitment to meeting escalating demand while ensuring stringent quality standards and operational efficiencies. Companies are investing significantly in innovative production techniques and technologies aimed at enhancing the purity levels and yield of Exemestane API, thereby ensuring consistent supply and regulatory compliance.

- An essential opportunity within this landscape lies in optimizing production processes to achieve heightened purity levels at reduced costs. This optimization involves refining manufacturing workflows, implementing efficient purification methodologies, and harnessing automation and digital tools to augment production efficiency. By embracing such cost-effective strategies, manufacturers can offer competitive pricing for Exemestane API without compromising on product quality or regulatory adherence.

- Furthermore, there exists a burgeoning demand for high-purity Exemestane API across various sectors, including research and development, clinical trials, and commercial pharmaceutical production. This demand surge stems from the critical necessity for dependable and standardized raw materials in drug manufacturing processes. Companies capable of delivering cost-effective, high-purity Exemestane API stand poised to capitalize on this market opportunity, positioning themselves as key players in driving the growth trajectory of the pharmaceutical industry.

Exemestane API Market Segment Analysis:

Exemestane API Market Segmented on the basis of type, application, and end-users.

By Type, Purity ≥ 99% segment is expected to dominate the market during the forecast period

- The segment focusing on Exemestane API with a purity level of ≥ 99% is poised to dominate and drive significant growth within the market. This segment's prominence is attributed to the increasing demand for high-quality and precisely formulated pharmaceutical products, particularly in oncology treatments such as breast cancer therapy. Patients and healthcare professionals prioritize medications with higher purity levels, as they are associated with enhanced efficacy and reduced risk of adverse effects.

- Moreover, advancements in manufacturing technologies and stringent quality control measures have facilitated the production of Exemestane API with purity levels exceeding 99%. This has bolstered the confidence of pharmaceutical companies, researchers, and healthcare providers in utilizing such high-purity APIs for drug development and clinical applications. As a result, the ≥ 99% purity segment is witnessing rapid adoption and is expected to continue its dominance, driven by the growing emphasis on precision medicine and the need for reliable and potent pharmaceutical ingredients in the global healthcare landscape.

By Application, Exemestane Tablets segment held the largest share of 73.12% in 2022

- The segment comprising Exemestane tablets emerged as the market leader, holding the largest share in driving the growth of the Exemestane API market. This dominance is primarily due to the widespread adoption of Exemestane tablets as a standard treatment option for postmenopausal women with estrogen receptor-positive breast cancer. Physicians often prescribe Exemestane tablets due to their convenience, accurate dosage delivery, and proven efficacy in hormone receptor-driven breast cancer cases.

- Furthermore, the Exemestane tablets segment benefits from ongoing advancements in tablet formulation technologies, leading to improved bioavailability and patient compliance. Pharmaceutical companies are continually innovating to enhance the therapeutic outcomes of Exemestane tablets, thus solidifying their position as the preferred choice in breast cancer treatment regimens. As the demand for targeted and personalized cancer therapies grows, the Exemestane tablets segment is expected to maintain its substantial market share and contribute significantly to the overall growth of the Exemestane API market.

Exemestane API Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is anticipated to emerge as the dominant region driving the growth of the Exemestane API market. This projection is underpinned by several factors, including the region's expanding healthcare infrastructure, increasing investments in oncology research and development, and rising awareness about breast cancer screening and treatment options. Countries within Asia Pacific, such as China, India, and Japan, are witnessing a surge in breast cancer cases, prompting a higher demand for effective therapies like Exemestane API.

- Moreover, regulatory initiatives aimed at accelerating drug approvals and enhancing access to innovative medicines further bolster the market outlook for Exemestane API in the Asia Pacific region. Pharmaceutical companies are also strategically expanding their presence in these markets, leveraging partnerships and collaborations to ensure product availability and market penetration. As a result, Asia Pacific is poised to dominate the Exemestane API market regionally, contributing significantly to the advancement of cancer care and treatment outcomes across the region.

Exemestane API Market Top Key Players:

- Pfizer Inc. (U.S.)

- Mylan N.V. (U.S.)

- Apotex Pharmachem (Canada)

- TRIFARMA S.p.A. (Italy)

- Novartis International AG (Switzerland)

- Qilu Pharmaceutial (China)

- Wuhan Dongkangyuan Technology (China)

- Coral Drugs (India)

- Glenmark Pharmaceuticals Ltd (India)

- Natco Pharma Limited (India)

- Hetero Drugs Ltd (India)

- Symbiotec (India)

- Cipla Ltd (India), and Other Major Players

Key Industry Developments in the Exemestane API Market:

- In February 2024 - Novartis announced a voluntary public takeover bid for MorphoSys AG (a global biopharmaceutical firm specializing in oncology. The acquisition, contingent on customary closing conditions and regulatory approvals, aims to bolster Novartis' oncology pipeline and global presence in hematology. Upon completion, Novartis will gain access to pelabresib (CPI-0610) and tulmimetostat (CPI-0209), promising treatments for myelofibrosis and solid tumors/lymphomas respectively.

- In December 2023: Pfizer Inc. completed its acquisition of Seagen Inc. for approximately $43 billion, solidifying its position as a key player in oncology. With a focus on pioneering cancer treatments, Pfizer aims to leverage Seagen's ADC technology to drive breakthroughs. To address regulatory concerns, Pfizer pledges royalties from Bavencio® sales in the U.S. to the American Association for Cancer Research (AACR).

- In April 2023: SK Capital Partners, LP, finalized the acquisition of Apotex Pharmaceutical Holdings Inc., a prominent player in affordable pharmaceuticals worldwide. Allan Oberman assumes the role of President and CEO, tasked with reshaping Apotex into a Canadian-based global health entity. The move marks a strategic shift under SK Capital's ownership, aiming to bolster Apotex's position in the pharmaceutical industry.

|

Global Exemestane API Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 1.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.1 % |

Market Size in 2032 : |

USD 2.03 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- EXEMESTANE API MARKET BY PURITY (2017-2030)

- EXEMESTANE API MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PURITY ≥ 98%

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PURITY ≥ 99%

- EXEMESTANE API MARKET BY APPLICATION (2017-2030)

- EXEMESTANE API MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXEMESTANE TABLETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EXEMESTANE CAPSULES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Exemestane API Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PFIZER INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MYLAN N.V. (U.S.)

- APOTEX PHARMACHEM (CANADA)

- TRIFARMA S.P.A. (ITALY)

- NOVARTIS INTERNATIONAL AG (SWITZERLAND)

- QILU PHARMACEUTIAL (CHINA)

- WUHAN DONGKANGYUAN TECHNOLOGY (CHINA)

- CORAL DRUGS (INDIA)

- GLENMARK PHARMACEUTICALS LTD (INDIA)

- NATCO PHARMA LIMITED (INDIA)

- HETERO DRUGS LTD (INDIA)

- SYMBIOTEC (INDIA)

- CIPLA LTD (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL EXEMESTANE API MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Purity

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Exemestane API Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 1.19 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.1 % |

Market Size in 2032 : |

USD 2.03 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EXEMESTANE API MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EXEMESTANE API MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EXEMESTANE API MARKET COMPETITIVE RIVALRY

TABLE 005. EXEMESTANE API MARKET THREAT OF NEW ENTRANTS

TABLE 006. EXEMESTANE API MARKET THREAT OF SUBSTITUTES

TABLE 007. EXEMESTANE API MARKET BY TYPE

TABLE 008. PURITY ? 98 % MARKET OVERVIEW (2016-2028)

TABLE 009. PURITY ? 99 % MARKET OVERVIEW (2016-2028)

TABLE 010. EXEMESTANE API MARKET BY APPLICATION

TABLE 011. EXEMESTANE TABLETS MARKET OVERVIEW (2016-2028)

TABLE 012. EXEMESTANE CAPSULES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA EXEMESTANE API MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA EXEMESTANE API MARKET, BY APPLICATION (2016-2028)

TABLE 016. N EXEMESTANE API MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE EXEMESTANE API MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE EXEMESTANE API MARKET, BY APPLICATION (2016-2028)

TABLE 019. EXEMESTANE API MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC EXEMESTANE API MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC EXEMESTANE API MARKET, BY APPLICATION (2016-2028)

TABLE 022. EXEMESTANE API MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA EXEMESTANE API MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA EXEMESTANE API MARKET, BY APPLICATION (2016-2028)

TABLE 025. EXEMESTANE API MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA EXEMESTANE API MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA EXEMESTANE API MARKET, BY APPLICATION (2016-2028)

TABLE 028. EXEMESTANE API MARKET, BY COUNTRY (2016-2028)

TABLE 029. FARMABIOS: SNAPSHOT

TABLE 030. FARMABIOS: BUSINESS PERFORMANCE

TABLE 031. FARMABIOS: PRODUCT PORTFOLIO

TABLE 032. FARMABIOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. APOTEX PHARMACHEM: SNAPSHOT

TABLE 033. APOTEX PHARMACHEM: BUSINESS PERFORMANCE

TABLE 034. APOTEX PHARMACHEM: PRODUCT PORTFOLIO

TABLE 035. APOTEX PHARMACHEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. CORAL DRUGS: SNAPSHOT

TABLE 036. CORAL DRUGS: BUSINESS PERFORMANCE

TABLE 037. CORAL DRUGS: PRODUCT PORTFOLIO

TABLE 038. CORAL DRUGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CIPLA: SNAPSHOT

TABLE 039. CIPLA: BUSINESS PERFORMANCE

TABLE 040. CIPLA: PRODUCT PORTFOLIO

TABLE 041. CIPLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. TRIFARMA: SNAPSHOT

TABLE 042. TRIFARMA: BUSINESS PERFORMANCE

TABLE 043. TRIFARMA: PRODUCT PORTFOLIO

TABLE 044. TRIFARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SCION PHARM TAIWAN: SNAPSHOT

TABLE 045. SCION PHARM TAIWAN: BUSINESS PERFORMANCE

TABLE 046. SCION PHARM TAIWAN: PRODUCT PORTFOLIO

TABLE 047. SCION PHARM TAIWAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SHANXI TOP PHARMA CHEMICAL: SNAPSHOT

TABLE 048. SHANXI TOP PHARMA CHEMICAL: BUSINESS PERFORMANCE

TABLE 049. SHANXI TOP PHARMA CHEMICAL: PRODUCT PORTFOLIO

TABLE 050. SHANXI TOP PHARMA CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. STERLING S.P.A. IT: SNAPSHOT

TABLE 051. STERLING S.P.A. IT: BUSINESS PERFORMANCE

TABLE 052. STERLING S.P.A. IT: PRODUCT PORTFOLIO

TABLE 053. STERLING S.P.A. IT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SYMBIOTEC: SNAPSHOT

TABLE 054. SYMBIOTEC: BUSINESS PERFORMANCE

TABLE 055. SYMBIOTEC: PRODUCT PORTFOLIO

TABLE 056. SYMBIOTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. QILU PHARMACEUTIAL: SNAPSHOT

TABLE 057. QILU PHARMACEUTIAL: BUSINESS PERFORMANCE

TABLE 058. QILU PHARMACEUTIAL: PRODUCT PORTFOLIO

TABLE 059. QILU PHARMACEUTIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. HUNAN YUXIN PHARMACEUTICAL: SNAPSHOT

TABLE 060. HUNAN YUXIN PHARMACEUTICAL: BUSINESS PERFORMANCE

TABLE 061. HUNAN YUXIN PHARMACEUTICAL: PRODUCT PORTFOLIO

TABLE 062. HUNAN YUXIN PHARMACEUTICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. WUHAN DONGKANGYUAN TECHNOLOGY: SNAPSHOT

TABLE 063. WUHAN DONGKANGYUAN TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 064. WUHAN DONGKANGYUAN TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 065. WUHAN DONGKANGYUAN TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EXEMESTANE API MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EXEMESTANE API MARKET OVERVIEW BY TYPE

FIGURE 012. PURITY ? 98 % MARKET OVERVIEW (2016-2028)

FIGURE 013. PURITY ? 99 % MARKET OVERVIEW (2016-2028)

FIGURE 014. EXEMESTANE API MARKET OVERVIEW BY APPLICATION

FIGURE 015. EXEMESTANE TABLETS MARKET OVERVIEW (2016-2028)

FIGURE 016. EXEMESTANE CAPSULES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA EXEMESTANE API MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE EXEMESTANE API MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC EXEMESTANE API MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA EXEMESTANE API MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA EXEMESTANE API MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Exemestane API Market research report is 2024-2032.

Pfizer Inc. (U.S.), Mylan N.V. (U.S.), Apotex Pharmachem (Canada), TRIFARMA S.p.A. (Italy), Novartis International AG (Switzerland), Qilu Pharmaceutial (China), Wuhan Dongkangyuan Technology (China), Coral Drugs (India), Glenmark Pharmaceuticals Ltd (India), Natco Pharma Limited (India), Hetero Drugs Ltd (India), Symbiotec (India), Cipla Ltd (India), and Other Major Players.

The Exemestane API Market is segmented into Type, Application, and region. By Type, the market is categorized into Purity ≥ 98% and Purity ≥ 99%. By Application, the market is categorized into Exemestane Tablets and Exemestane Capsules. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Exemestane API, also known as Aromasin, actively inhibits estrogen synthesis in postmenopausal women, playing a crucial role in treating estrogen receptor-positive breast cancer. It is characterized by its ability to block aromatase enzymes, contributing significantly to personalized cancer therapy.

Exemestane API Market Size Was Valued at USD 1.19 Billion in 2023, and is Projected to Reach USD 2.03 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.