Exemestane API Market Synopsis

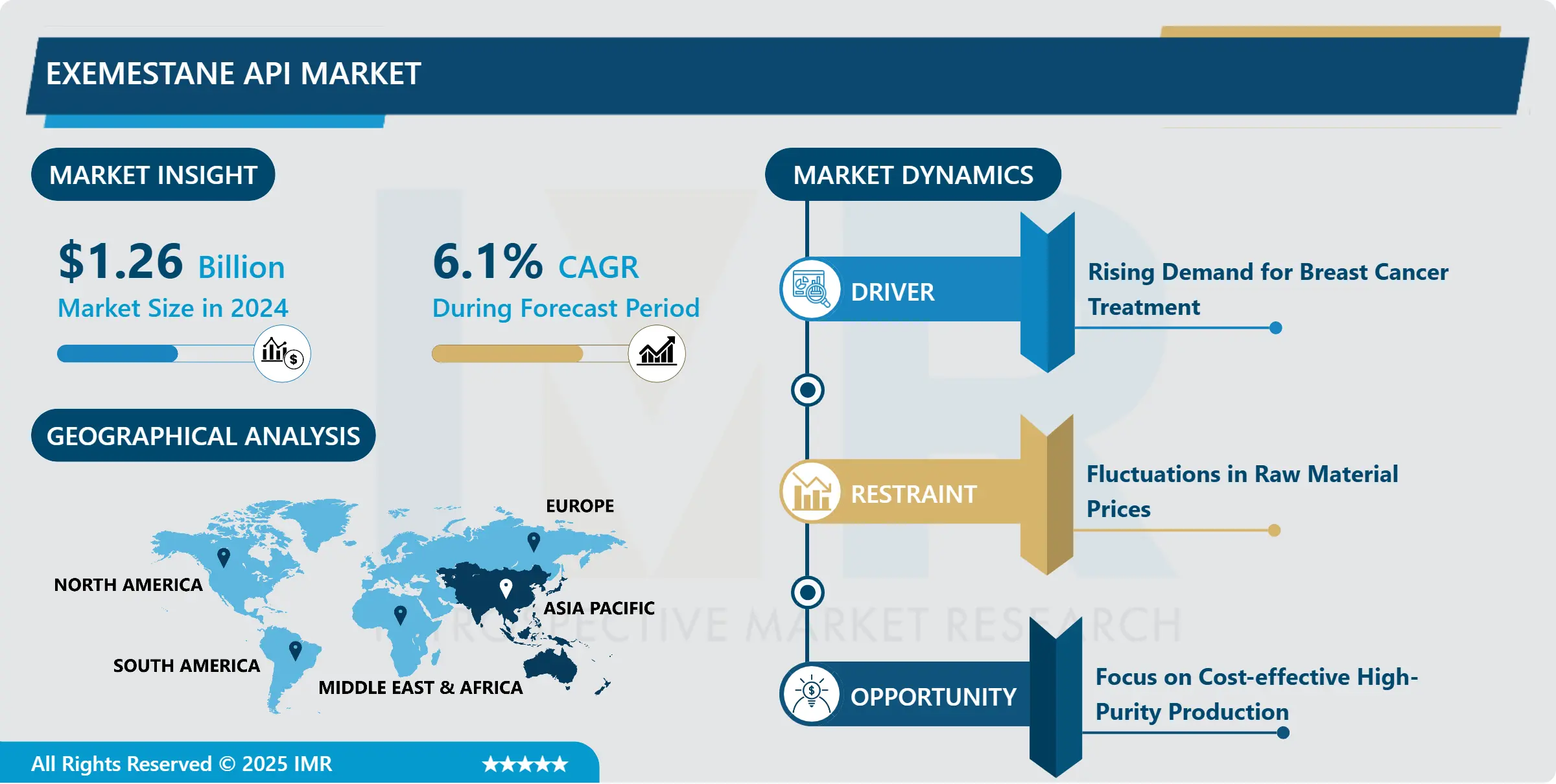

Exemestane API Market Size Was Valued at USD 1.26 Billion in 2024, and is Projected to Reach USD 2.42 Billion by 2035, Growing at a CAGR of 6.1 % From 2025-2035.

Exemestane API, also known as Aromasin, actively inhibits estrogen synthesis in postmenopausal women, playing a crucial role in treating estrogen receptor-positive breast cancer. It is characterized by its ability to block aromatase enzymes, contributing significantly to personalized cancer therapy.

Exemestane API, widely recognized as Aromasin, finds extensive application in the treatment of estrogen receptor-positive breast cancer among postmenopausal women. Its mechanism involves actively inhibiting estrogen synthesis by blocking aromatase enzymes, thus hindering tumor growth. This targeted approach minimizes cancer recurrence risks and enhances therapeutic outcomes, making it a pivotal component of personalized cancer treatment regimens.

Exemestane API lie in its efficacy and safety profile, offering a well-tolerated treatment option for patients. Its selective action on estrogen receptors ensures minimal side effects compared to traditional chemotherapy, leading to improved quality of life during cancer treatment. Furthermore, ongoing research and clinical trials continue to explore its potential benefits in other cancer types and medical conditions, expanding its application beyond breast cancer treatment.

Exemestane API is expected to remain robust, driven by several factors. These include rising cancer incidence rates globally, especially in aging populations, and advancements in healthcare infrastructure supporting early diagnosis and targeted therapies. Additionally, the shift towards personalized medicine and increasing awareness about the benefits of adjuvant therapies like Exemestane API are anticipated to fuel its demand in the coming years, creating opportunities for pharmaceutical companies and research institutions in oncology therapeutics.

Exemestane API Market Trend Analysis

Rising Demand for Breast Cancer Treatment

- The burgeoning demand for breast cancer treatment stands as a key driver propelling the growth of the Exemestane API market. This surge in demand is primarily fueled by the increasing prevalence of breast cancer cases worldwide, particularly among women. As awareness about breast cancer screening and early detection programs grows, more patients are diagnosed at earlier stages, leading to a higher demand for effective treatment options like Exemestane API.

- Advancements in medical technologies and therapeutic approaches have significantly improved the prognosis for breast cancer patients. As a result, there is a growing emphasis on personalized medicine, where treatments are tailored to individual patients based on genetic and molecular characteristics. Exemestane API plays a crucial role in this paradigm shift, offering targeted therapy that specifically inhibits estrogen synthesis in postmenopausal women with estrogen receptor-positive breast cancer.

- Furthermore, collaborations between pharmaceutical companies, research institutions, and healthcare providers are driving innovation in breast cancer treatment. These collaborations facilitate the development of new drugs, including Exemestane API, and ensure their accessibility to patients in need. With the rising demand for effective and personalized breast cancer therapies, the Exemestane API market is poised for continued growth in the foreseeable future, contributing significantly to advancements in oncology care.

Focus on Cost-effective High-Purity Production

- The Exemestane API market is strategically shifting its focus towards cost-effective and high-purity production methods to foster growth. This emphasis reflects the industry's commitment to meeting escalating demand while ensuring stringent quality standards and operational efficiencies. Companies are investing significantly in innovative production techniques and technologies aimed at enhancing the purity levels and yield of Exemestane API, thereby ensuring consistent supply and regulatory compliance.

- An essential opportunity within this landscape lies in optimizing production processes to achieve heightened purity levels at reduced costs. This optimization involves refining manufacturing workflows, implementing efficient purification methodologies, and harnessing automation and digital tools to augment production efficiency. By embracing such cost-effective strategies, manufacturers can offer competitive pricing for Exemestane API without compromising on product quality or regulatory adherence.

- Furthermore, there exists a burgeoning demand for high-purity Exemestane API across various sectors, including research and development, clinical trials, and commercial pharmaceutical production. This demand surge stems from the critical necessity for dependable and standardized raw materials in drug manufacturing processes. Companies capable of delivering cost-effective, high-purity Exemestane API stand poised to capitalize on this market opportunity, positioning themselves as key players in driving the growth trajectory of the pharmaceutical industry.

Exemestane API Market Segment Analysis:

Exemestane API Market Segmented on the basis of type, application, End-users and Region.

By Type, Purity 99% segment is expected to dominate the market with around 57.32% share during the forecast period.

- The segment focusing on Exemestane API with a purity level of ? 99% is poised to dominate and drive significant growth within the market. This segment's prominence is attributed to the increasing demand for high-quality and precisely formulated pharmaceutical products, particularly in oncology treatments such as breast cancer therapy. Patients and healthcare professionals prioritize medications with higher purity levels, as they are associated with enhanced efficacy and reduced risk of adverse effects.

- Moreover, advancements in manufacturing technologies and stringent quality control measures have facilitated the production of Exemestane API with purity levels exceeding 99%. This has bolstered the confidence of pharmaceutical companies, researchers, and healthcare providers in utilizing such high-purity APIs for drug development and clinical applications. As a result, the ? 99% purity segment is witnessing rapid adoption and is expected to continue its dominance, driven by the growing emphasis on precision medicine and the need for reliable and potent pharmaceutical ingredients in the global healthcare landscape.

By Application, Exemestane Tablets segment is likely to command almost 56.22% share during the upcoming years.

- The segment comprising Exemestane tablets emerged as the market leader, holding the largest share in driving the growth of the Exemestane API market. This dominance is primarily due to the widespread adoption of Exemestane tablets as a standard treatment option for postmenopausal women with estrogen receptor-positive breast cancer. Physicians often prescribe Exemestane tablets due to their convenience, accurate dosage delivery, and proven efficacy in hormone receptor-driven breast cancer cases.

- Furthermore, the Exemestane tablets segment benefits from ongoing advancements in tablet formulation technologies, leading to improved bioavailability and patient compliance. Pharmaceutical companies are continually innovating to enhance the therapeutic outcomes of Exemestane tablets, thus solidifying their position as the preferred choice in breast cancer treatment regimens. As the demand for targeted and personalized cancer therapies grows, the Exemestane tablets segment is expected to maintain its substantial market share and contribute significantly to the overall growth of the Exemestane API market.

Exemestane API Market Regional Insights:

By Region, Asia Pacific region is expected to continue leading the market, capturing nearly 32.44% of the overall share during the upcoming years.

- Asia Pacific is anticipated to emerge as the dominant region driving the growth of the Exemestane API market. This projection is underpinned by several factors, including the region's expanding healthcare infrastructure, increasing investments in oncology research and development, and rising awareness about breast cancer screening and treatment options. Countries within Asia Pacific, such as China, India, and Japan, are witnessing a surge in breast cancer cases, prompting a higher demand for effective therapies like Exemestane API.

- Moreover, regulatory initiatives aimed at accelerating drug approvals and enhancing access to innovative medicines further bolster the market outlook for Exemestane API in the Asia Pacific region. Pharmaceutical companies are also strategically expanding their presence in these markets, leveraging partnerships and collaborations to ensure product availability and market penetration. As a result, Asia Pacific is poised to dominate the Exemestane API market regionally, contributing significantly to the advancement of cancer care and treatment outcomes across the region.

Exemestane API Market Top Key Players:

- Pfizer Inc. (U.S.)

- Mylan N.V. (U.S.)

- Apotex Pharmachem (Canada)

- TRIFARMA S.p.A. (Italy)

- Novartis International AG (Switzerland)

- Qilu Pharmaceutial (China)

- Wuhan Dongkangyuan Technology (China)

- Coral Drugs (India)

- Glenmark Pharmaceuticals Ltd (India)

- Natco Pharma Limited (India)

- Hetero Drugs Ltd (India)

- Symbiotec (India)

- Cipla Ltd (India)

- Other Active Players

Key Industry Developments in the Exemestane API Market:

- In July 2025 - Aggregated DMF/generic supplier records (DrugPatentWatch summaries and public DMF snapshots) noted ~15 DMF entries and multiple branded/generic manufacturers for exemestane, reflecting mature generic sourcing options and multiple regulatory filings. This underscores the availability of alternate API sources for finished-dose manufacturers.

- In February 2024 - Novartis announced a voluntary public takeover bid for MorphoSys AG (a global biopharmaceutical firm specializing in oncology. The acquisition, contingent on customary closing conditions and regulatory approvals, aims to bolster Novartis' oncology pipeline and global presence in hematology. Upon completion, Novartis will gain access to pelabresib (CPI-0610) and tulmimetostat (CPI-0209), promising treatments for myelofibrosis and solid tumors/lymphomas respectively.

(Source: https://www.drugpatentwatch.com/)

|

Global Exemestane API Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 1.26 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.1 % |

Market Size in 2035 : |

USD 2.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution channel |

|

||

|

By Application |

|

||

| By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Exemestane API Market by Type (2018-2032)

4.1 Exemestane API Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Purity ≥ 98%

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Purity ≥ 99%

Chapter 5: Exemestane API Market by Application (2018-2032)

5.1 Exemestane API Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Exemestane Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Exemestane Capsules

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Exemestane API Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BOSCH (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DENSO CORPORATION (JAPAN)

6.4 MAGNA INTERNATIONAL INC. (CANADA)

6.5 MARTINREA INTERNATIONAL INC. (CANADA)

6.6 VALEO (FRANCE)

6.7 CONTINENTAL AG (GERMANY)

6.8 NTN CORPORATION (JAPAN)

6.9 HONEYWELL INTERNATIONAL INC. (USA)

6.10 ZF FRIEDRICHSHAFEN AG (GERMANY)

6.11 AISIN CORPORATION (JAPAN)

6.12 BARNES GROUP (USA)

6.13 NN INC. (USA)

6.14 LINAMAR INTERNATIONAL (CANADA)

6.15 WM BERG (USA)

6.16 RENISHAW GROUP (UK)

6.17 ARC GROUP WORLDWIDE (USA)

6.18 BEYONICS (SINGAPORE)

6.19 AND

Chapter 7: Global Exemestane API Market By Region

7.1 Overview

7.2. North America Exemestane API Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Purity ≥ 98%

7.2.4.2 Purity ≥ 99%

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Exemestane Tablets

7.2.5.2 Exemestane Capsules

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Exemestane API Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Purity ≥ 98%

7.3.4.2 Purity ≥ 99%

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Exemestane Tablets

7.3.5.2 Exemestane Capsules

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Exemestane API Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Purity ≥ 98%

7.4.4.2 Purity ≥ 99%

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Exemestane Tablets

7.4.5.2 Exemestane Capsules

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Exemestane API Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Purity ≥ 98%

7.5.4.2 Purity ≥ 99%

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Exemestane Tablets

7.5.5.2 Exemestane Capsules

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Exemestane API Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Purity ≥ 98%

7.6.4.2 Purity ≥ 99%

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Exemestane Tablets

7.6.5.2 Exemestane Capsules

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Exemestane API Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Purity ≥ 98%

7.7.4.2 Purity ≥ 99%

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Exemestane Tablets

7.7.5.2 Exemestane Capsules

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Exemestane API Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 1.26 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.1 % |

Market Size in 2035 : |

USD 2.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution channel |

|

||

|

By Application |

|

||

| By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||