eSports Market Synopsis

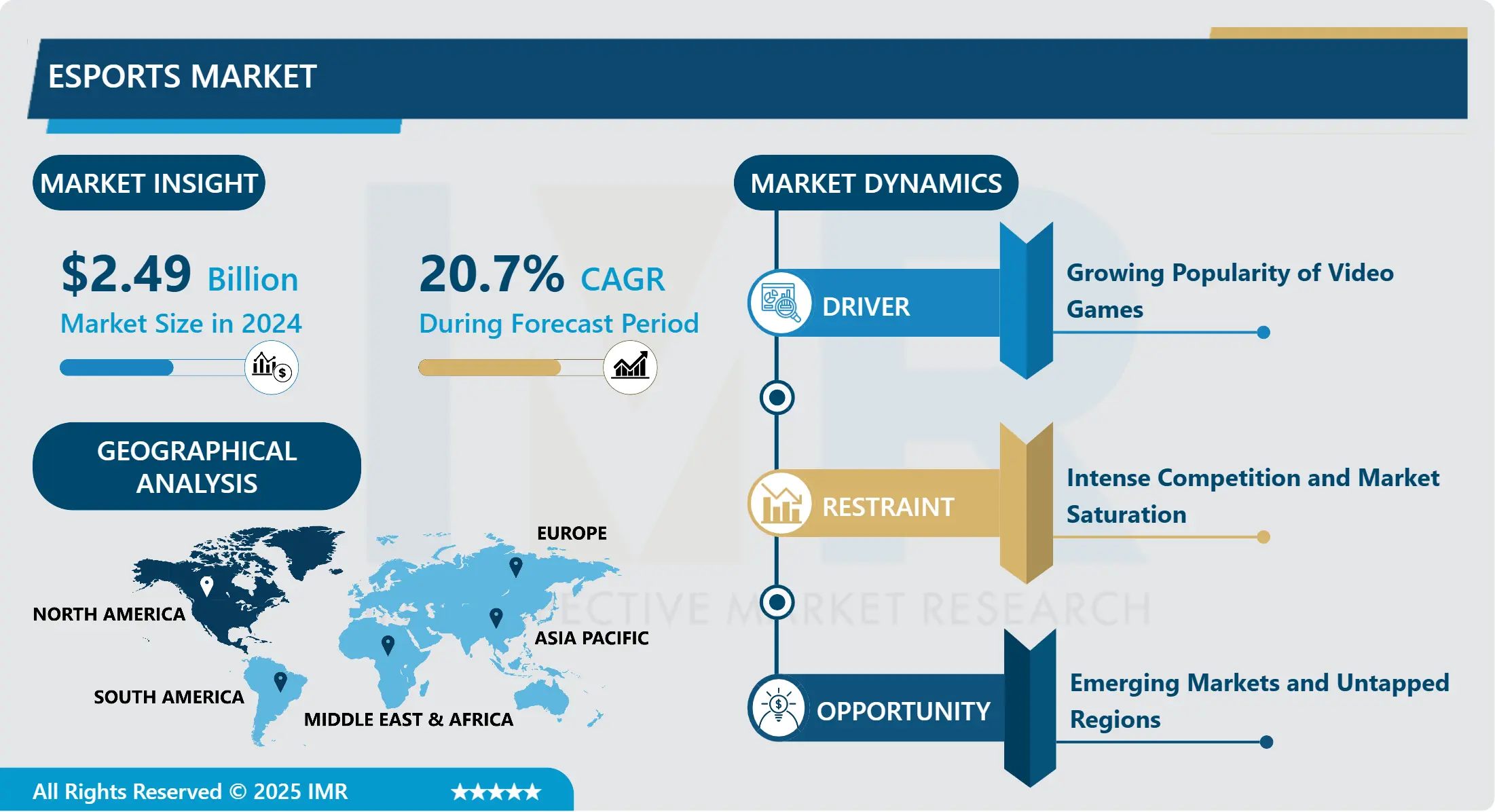

eSports Market Size is Valued at USD 2.49 Billion in 2024 and is Projected to Reach USD 11.22 Billion by 2032, Growing at a CAGR of 20.7% From 2025-2032.

The eSports market has witnessed rapid growth, propelled by increasing internet penetration, technological advancements in gaming hardware and software, and rising viewership across global platforms like Twitch and YouTube Gaming. This sector encompasses competitive gaming across various genres, including multiplayer online battle arenas (MOBAs), first-person shooters (FPS), and real-time strategy (RTS) games. Revenue streams primarily derive from sponsorships, advertising, media rights, and merchandise sales, with major tournaments drawing substantial live and online audiences. Key stakeholders include game publishers, tournament organizers, teams, and streaming platforms, collectively contributing to the industry's dynamic expansion and the mainstream recognition of eSports as a significant entertainment and business sector globally.

In recent years, the eSports market has undergone a rapid expansion, transitioning from a niche hobby to a global phenomenon. Professional-level competitive video games, such as Fortnite, Dota 2, and League of Legends, characterize eSports and attract millions of spectators and participants worldwide. The proliferation of the internet, the development of gaming technology, and the emergence of streaming platforms such as Twitch and YouTube Gaming have facilitated the expansion of this industry.

Sponsorships, advertising, media rights, merchandise sales, and tournament prize pools are the primary sources of revenue in the eSports market. Intel, Coca-Cola, and Red Bull are among the major corporations that have made substantial investments in eSports sponsorships. They have taken advantage of the vast and engaged audience to advertise their brands. Media rights agreements with platforms like ESPN and BBC, which provide broadcast rights for significant tournaments that rival traditional sports events in terms of viewership, further emphasize the market's mainstream integration.

North America and the Asia-Pacific region primarily dominate the eSports landscape, with large-scale tournaments drawing millions of online viewers and filling arenas. Adolescents, young adults, and even older generations make up the diverse global eSports audience, united by a shared passion for gaming and competition. This demographic diversity has attracted advertisers who are interested in reaching enigmatic audiences through digital platforms, thereby driving further revenue growth and market expansion.

eSports Market Trend Analysis

eSports Market Growth Driver- Growing Viewership and Audience Engagement

- eSports have become more accessible to a global audience as a result of the proliferation of platforms such as Twitch, YouTube Gaming, and Facebook Gaming. These platforms offer interactive features, highlights, and live streams, which enable viewers to interact with content in real time.

- From MOBAs such as "League of Legends" to battle royales like "Fortnite," the eSports arena offers a diverse selection of games that appeal to a wide range of audiences. This diversity attracts a diverse audience, thereby cultivating a more extensive and inclusive viewership.

- Professional divisions, including the Overwatch League and the Call of Duty League, offer consistent, high-quality content and structured competition. Major tournaments with considerable prize pools, such as "The International" for Dota 2, attract significant media attention and viewership.

- Innovations like virtual reality (VR), augmented reality (AR), and advanced analytics enhance the observing experience. Live chats, fan polls, and behind-the-scenes content are interactive elements that enhance spectator engagement and provide a more immersive experience.

eSports Market Expansion Opportunity- Expansion of Mobile eSports

- In comparison to conventional PC and console gaming, mobile eSports have substantially lower entry barriers. The increased affordability and accessibility of mobile devices have made it possible for a broader audience to engage in eSports. This democratization has resulted in a significant increase in the number of players and observers from a variety of demographics, particularly in areas with restricted access to high-end gaming equipment.

- Advancements in mobile hardware and network infrastructure, including 5G technology, have improved the gaming experience on mobile devices. These advancements enhance the competitiveness and appeal of mobile games for eSports by enabling real-time multiplayer interactions, smoother gameplay, and high-quality graphics.

- Mobile games like Call of Duty Mobile, Free Fire, and PUBG Mobile have attracted massive audiences. Major eSports organizations and game developers are further legitimizing and expanding the mobile eSports scene by investing in tournaments with substantial prize pools and sponsorships.

- Sponsors, advertisers, and media corporations have made substantial investments in mobile eSports due to their increasing popularity. This influx of funds facilitates the growth and professionalization of the mobile eSports industry by supporting the development of professional divisions, player salaries, and global events.

eSports Market Segment Analysis:

eSports Market Segmented on the basis of Streaming Type, Revenue Streaming, Gaming Genre, and Region.

By Streaming Type, Live segment is expected to dominate the market during the forecast period

- On-demand streaming and live streaming make up the two segments of the eSports market. Real-time broadcasting of events, known as live streaming, is a method of capturing the immediacy and intensity of the competition. Flexibility is provided by on-demand streaming, which enables viewers to view recorded matches and highlights at their convenience.

- The demand for real-time interaction and engagement drives live broadcasting as the most dominant segment in the eSports market. Platforms like Twitch and YouTube Gaming facilitate live chat conversations, fostering a sense of community among observers. The excitement of watching competitions unfold draws large, engaged audiences to this segment.

- On-demand streaming is surging in popularity, particularly among viewers who prefer to consume eSports content at their own leisure. This segment is able to appeal to both casual viewers and hardcore aficionados due to the growing availability of recorded matches, tutorials, and highlights. It offers opportunities for spectatorship that extend beyond live events.

- Both forms of streaming contribute significantly to the eSports market's revenue. Income is generated through advertising, sponsorships, and subscriptions in live streaming, while on-demand streaming increases the longevity of content and increases ad revenues. When combined, they cultivate a robust eSports ecosystem and ensure continuous viewer interest, thereby enhancing audience engagement.

By Gaming Genre, Real-Time Strategy Games segment held the largest share in 2024

- The eSports market is dominated by FPS games, which are characterized by their large, dedicated fanbase and intense, action-packed gameplay. Titles such as "Counter-Strike: Global Offensive" and "Call of Duty" are significant contributors, drawing millions of viewers to their tournaments.

- "League of Legends" and "Dota 2" are cornerstones of the eSports industry. They are distinguished by their intricate strategies and team-based combat, which have resulted in extensive international tournaments with substantial prize pools and viewership.

- While their popularity has declined in comparison to other categories, real-time strategy games such as "StarCraft II" continue to attract a dedicated audience. They are renowned for their strategic profundity and are particularly popular in regions such as South Korea.

- "World of Warcraft" and "Final Fantasy XIV" are MMORPGs that have a significant presence in eSports, although they are not as dominant as FPS or MOBA games. The dedicated player and viewer base of these games is a result of their extensive worlds and long-term engagement.

eSports Market Regional Insights:

North America accounted for the largest market share in 2024

- Major corporations and venture capitalists have made substantial investments in North America, resulting in well-funded teams and divisions. Coca-Cola, Intel, and Red Bull have made substantial investments in the region, thereby increasing its market share.

- A vibrant eSports ecosystem is supported by the region's state-of-the-art gaming facilities and arenas. Global audiences have been drawn to cities such as Los Angeles and New York, which have become the sites of significant tournaments and events.

- In North America, there is a substantial following for popular eSports titles, including Fortnite, League of Legends, and Call of Duty. The wide audience base is guaranteed by the diverse selection of games, which in turn contributes to increased market engagement.

- Streaming platforms and television networks have granted lucrative media rights agreements to North American eSports leagues. The region's market dominance has been further enhanced by partnerships with platforms such as Twitch, YouTube, and ESPN, which have increased viewership.

Active Key Players in the eSports Market

- Twitch Interactive, Inc. (U.S.)

- Activision Blizzard, Inc. (U.S.)

- Tencent Holdings Limited (China)

- Riot Games, Inc. (U.S.)

- Gfinity plc (U.K.)

- X1 Esports and Entertainment Ltd. (U.S.)

- Loco (Stoughton Street Tech Labs Private Limited) (India)

- Caffeine (U.S.)

- DLive Entertainment Pte. Ltd. (U.S.)

- Sony Corporation (Japan)

- Other Active Players

|

Global eSports Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.49 Bn. |

|

Forecast Period 2025-32 CAGR: |

20.7% |

Market Size in 2032: |

USD 11.22 Bn. |

|

Segments Covered: |

By Streaming Type |

|

|

|

By Revenue Streaming |

|

||

|

By Gaming Genre |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: eSports Market by Streaming Type (2018-2032)

4.1 eSports Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Live

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-demand

Chapter 5: eSports Market by Revenue Streaming (2018-2032)

5.1 eSports Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Media Rights

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Advertisement

5.5 Sponsorship

5.6 Ticket & Merchandise

5.7 Game Publisher Fees

5.8 Others

Chapter 6: eSports Market by Gaming Genre (2018-2032)

6.1 eSports Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Real-Time Strategy Games

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 First Person Shooter Games

6.5 Fighting Games

6.6 Multiplayer Online Battle Arena Games

6.7 Mass Multiplayer Online Role-Playing Games

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 eSports Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TWITCH INTERACTIVE INC. (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ACTIVISION BLIZZARD INC. (U.S.)

7.4 TENCENT HOLDINGS LIMITED (CHINA)

7.5 RIOT GAMES INC. (U.S.)

7.6 GFINITY PLC (U.K.)

7.7 X1 ESPORTS AND ENTERTAINMENT LTD. (U.S.)

7.8 LOCO (STOUGHTON STREET TECH LABS PRIVATE LIMITED) (INDIA)

7.9 CAFFEINE (U.S.)

7.10 DLIVE ENTERTAINMENT PTE. LTD. (U.S.)

7.11 SONY CORPORATION (JAPAN)

7.12

Chapter 8: Global eSports Market By Region

8.1 Overview

8.2. North America eSports Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Streaming Type

8.2.4.1 Live

8.2.4.2 On-demand

8.2.5 Historic and Forecasted Market Size by Revenue Streaming

8.2.5.1 Media Rights

8.2.5.2 Advertisement

8.2.5.3 Sponsorship

8.2.5.4 Ticket & Merchandise

8.2.5.5 Game Publisher Fees

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Gaming Genre

8.2.6.1 Real-Time Strategy Games

8.2.6.2 First Person Shooter Games

8.2.6.3 Fighting Games

8.2.6.4 Multiplayer Online Battle Arena Games

8.2.6.5 Mass Multiplayer Online Role-Playing Games

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe eSports Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Streaming Type

8.3.4.1 Live

8.3.4.2 On-demand

8.3.5 Historic and Forecasted Market Size by Revenue Streaming

8.3.5.1 Media Rights

8.3.5.2 Advertisement

8.3.5.3 Sponsorship

8.3.5.4 Ticket & Merchandise

8.3.5.5 Game Publisher Fees

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Gaming Genre

8.3.6.1 Real-Time Strategy Games

8.3.6.2 First Person Shooter Games

8.3.6.3 Fighting Games

8.3.6.4 Multiplayer Online Battle Arena Games

8.3.6.5 Mass Multiplayer Online Role-Playing Games

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe eSports Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Streaming Type

8.4.4.1 Live

8.4.4.2 On-demand

8.4.5 Historic and Forecasted Market Size by Revenue Streaming

8.4.5.1 Media Rights

8.4.5.2 Advertisement

8.4.5.3 Sponsorship

8.4.5.4 Ticket & Merchandise

8.4.5.5 Game Publisher Fees

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Gaming Genre

8.4.6.1 Real-Time Strategy Games

8.4.6.2 First Person Shooter Games

8.4.6.3 Fighting Games

8.4.6.4 Multiplayer Online Battle Arena Games

8.4.6.5 Mass Multiplayer Online Role-Playing Games

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific eSports Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Streaming Type

8.5.4.1 Live

8.5.4.2 On-demand

8.5.5 Historic and Forecasted Market Size by Revenue Streaming

8.5.5.1 Media Rights

8.5.5.2 Advertisement

8.5.5.3 Sponsorship

8.5.5.4 Ticket & Merchandise

8.5.5.5 Game Publisher Fees

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Gaming Genre

8.5.6.1 Real-Time Strategy Games

8.5.6.2 First Person Shooter Games

8.5.6.3 Fighting Games

8.5.6.4 Multiplayer Online Battle Arena Games

8.5.6.5 Mass Multiplayer Online Role-Playing Games

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa eSports Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Streaming Type

8.6.4.1 Live

8.6.4.2 On-demand

8.6.5 Historic and Forecasted Market Size by Revenue Streaming

8.6.5.1 Media Rights

8.6.5.2 Advertisement

8.6.5.3 Sponsorship

8.6.5.4 Ticket & Merchandise

8.6.5.5 Game Publisher Fees

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Gaming Genre

8.6.6.1 Real-Time Strategy Games

8.6.6.2 First Person Shooter Games

8.6.6.3 Fighting Games

8.6.6.4 Multiplayer Online Battle Arena Games

8.6.6.5 Mass Multiplayer Online Role-Playing Games

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America eSports Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Streaming Type

8.7.4.1 Live

8.7.4.2 On-demand

8.7.5 Historic and Forecasted Market Size by Revenue Streaming

8.7.5.1 Media Rights

8.7.5.2 Advertisement

8.7.5.3 Sponsorship

8.7.5.4 Ticket & Merchandise

8.7.5.5 Game Publisher Fees

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Gaming Genre

8.7.6.1 Real-Time Strategy Games

8.7.6.2 First Person Shooter Games

8.7.6.3 Fighting Games

8.7.6.4 Multiplayer Online Battle Arena Games

8.7.6.5 Mass Multiplayer Online Role-Playing Games

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global eSports Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.49 Bn. |

|

Forecast Period 2025-32 CAGR: |

20.7% |

Market Size in 2032: |

USD 11.22 Bn. |

|

Segments Covered: |

By Streaming Type |

|

|

|

By Revenue Streaming |

|

||

|

By Gaming Genre |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||