Environment, Health, and Safety (EHS) Market Synopsis

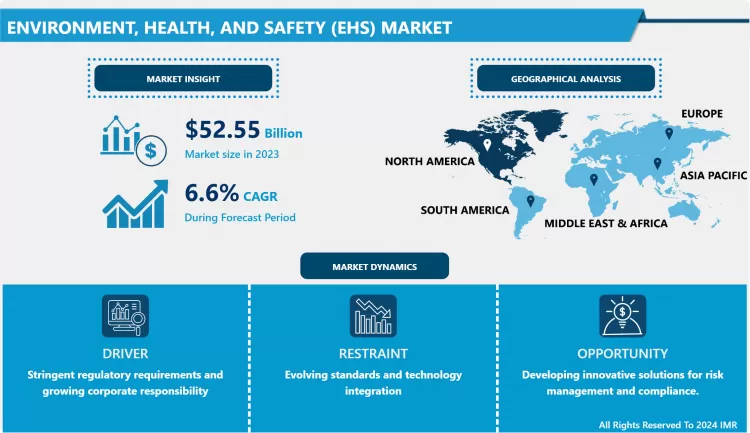

Environment, Health, and Safety (EHS) Market Size is Valued at USD 52.55 Billion in 2024, and is Projected to Reach USD 87.63 Billion by 2032, Growing at a CAGR of 6.60% From 2024-2032.

The Environment, Health, and Safety (EHS) market encompasses a wide variety of products and services aimed at ensuring adherence to environmental regulations, enhancing workplace safety, and promoting overall health. This market encompasses EHS software solutions for data management and compliance, consulting services for risk assessment and mitigation, and safety apparatus, including personal protective equipment. Increasing regulatory requirements, heightened awareness of environmental and health issues, and the necessity for businesses to manage risks and avoid liabilities are the primary factors driving the growth of the EHS market. The sector is undergoing a transformation as a result of technological advancements, such as IoT and AI, which enhance the efficacy and effectiveness of EHS programs.

- The Environment, Health, and Safety (EHS) market encompasses a range of solutions and services designed to mitigate and control risks related to environmental impact and worker health and safety regulations. The market has grown substantially as organizations place a greater emphasis on sustainable practices and adherence to rigorous regulatory compliance frameworks.

- A variety of factors, including a growing emphasis on corporate social responsibility, stricter regulations, and environmental concerns, influence the market. In order to enhance the overall safety of the workplace, ensure regulatory compliance, and improve their sustainability initiatives, companies are investing in EHS technologies and services.

- Key players in the EHS market provide a variety of solutions, such as environmental monitoring systems, health and safety consulting services, and software platforms for risk management. These solutions assist organizations in the proactive resolution of health and safety issues, the monitoring of workplace conditions, and the management of their environmental footprint.

- We anticipate the EHS market to continue its upward trajectory in the future due to the growing emphasis on sustainability and the pressures of regulatory compliance. Technological advancements and a greater emphasis on proactive risk management will further influence the market's future.

Environment, Health, and Safety (EHS) Market Trend Analysis

Increased Adoption of Digital Technologies

- The market for Environment, Health, and Safety (EHS) is undergoing a substantial transformation as a result of the growing prevalence of digital technologies. Digital solutions are becoming increasingly essential to EHS management as organizations prioritize regulatory compliance and sustainability. Technologies such as IoT sensors, AI, and data analytics are enabling real-time surveillance and more precise reporting of environmental impacts and safety conditions.

- By automating compliance processes, reducing manual errors, and offering actionable insights, digital platforms improve the efficacy of EHS operations. These developments improve the efficiency of reporting and documentation, as well as assist organizations in the proactive identification and mitigation of potential hazards. Consequently, businesses can enhance their environmental impact and guarantee a secure work environment.

- Additionally, the incorporation of digital tools facilitates a more proactive approach to environmental, health, and safety (EHS) management. Predictive analytics and machine learning models can anticipate potential issues, enabling the implementation of preventive measures that reduce risks and improve overall safety.

- The growing emphasis on digitalization in EHS is indicative of broader trends in technology adoption across various industries. As regulations become more stringent and sustainability objectives become more ambitious, we expect the role of digital solutions in EHS to expand, thereby driving further innovation and efficiency in the market.

Growing Focus on Sustainability and Corporate Responsibility

- The market for Environment, Health, and Safety (EHS) is undergoing a substantial transformation as a result of the growing prevalence of digital technologies. Digital solutions are becoming increasingly essential to EHS management as organizations prioritize regulatory compliance and sustainability. Technologies such as IoT sensors, AI, and data analytics are enabling real-time surveillance and more precise reporting of environmental impacts and safety conditions.

- By automating compliance processes, reducing manual errors, and offering actionable insights, digital platforms improve the efficacy of EHS operations. These developments improve the efficiency of reporting and documentation, as well as assist organizations in the proactive identification and mitigation of potential hazards. Consequently, businesses can enhance their environmental impact and guarantee a secure work environment.

- Additionally, the incorporation of digital tools facilitates a more proactive approach to environmental, health, and safety (EHS) management. Predictive analytics and machine learning models can anticipate potential issues, enabling the implementation of preventive measures that reduce risks and improve overall safety.

- The growing emphasis on digitalization in EHS is indicative of broader trends in technology adoption across various industries. As regulations become more stringent and sustainability objectives become more ambitious, we expect the role of digital solutions in EHS to expand, thereby driving further innovation and efficiency in the market.

Environment, Health, and Safety (EHS) Market Segment Analysis:

Environment, Health, and Safety (EHS) Market Segmented on the basis of by Component, Deployment Type, and Vertical.

by Component, Software segment is expected to dominate the market during the forecast period

- Advancements in both software and services are driving the significant growth of the Environment, Health, and Safety (EHS) market. EHS software encompasses a range of tools designed to enhance environmental and safety performance, mitigate risks, and accelerate compliance. Various industries are increasingly using this software to automate reporting, monitor regulatory changes, and ensure compliance with standards. Consequently, it reduces operational risks and enhances efficiency.

- Conversely, EHS services offer organizations customized solutions through expert consultation, training, and support. These services are essential for the implementation of best practices, the execution of audits, and the management of intricate EHS challenges. Companies frequently rely on these services to maintain a culture of environmental stewardship and safety and stay ahead of regulatory requirements.

- The integration of EHS software and services results in more comprehensive and effective EHS management systems. This collaboration enables organizations to not only adhere to regulations but also to anticipate and mitigate potential hazards.

- Organizations recognize the importance of effective EHS programs in safeguarding the environment and their operations, thereby positioning the EHS market for further growth. The combined value of software and services will primarily meet the evolving requirements.

By Vertical, Energy and Utilities segment held the largest share in 2024

- The Energy and Utilities, Chemicals and Materials, Healthcare, Construction and Engineering, Food and Beverage, Government and Defense, and other sectors comprise the Environment, Health, and Safety (EHS) market. These sectors prioritize environmental, health, and safety (EHS) to guarantee regulatory compliance, protect worker health, and reduce environmental impact.

- The energy and utilities sector centers EHS practices on managing environmental hazards and ensuring safety in hazardous operations. The chemical and materials industries place a high priority on responsible toxic substance management and environmental contamination prevention. Healthcare organizations implement stringent environmental health and safety (EHS) protocols to safeguard patient safety and refuse management.

- In order to guarantee environmental protection and safe working conditions during projects, construction and engineering firms must comply with EHS standards. The food and beverage industry prioritizes environmental sustainability, hygiene, and food safety.

- The government and defense sectors maintain stringent environmental, health, and safety (EHS) standards to oversee intricate and sensitive operations. In general, the EHS market is critical for environmental protection, individual well-being, and the advancement of sustainable practices in various sectors.

Environment, Health, and Safety (EHS) Market Regional Insights:

North America leads the market, accounting for the largest environment, health, and safety (EHS) market share

- North America dominates the Environment, Health, and Safety (EHS) market, holding the largest global share. The region's advanced infrastructure, stringent regulatory frameworks, and substantial investments in EHS technologies are all factors that contribute to its leadership position. Companies operating in North America must adhere to stringent environmental and safety regulations, which drives the demand for sophisticated EHS solutions.

- The increased emphasis on corporate responsibility and sustainable practices is accelerating the expansion of the EHS market in North America. Organizations in a variety of sectors are focusing on environmental, health, and safety (EHS) initiatives in order to reduce environmental impact, enhance workplace safety, and mitigate risks. This proactive approach is consistent with the region's dedication to upholding rigorous standards for employee well-being and environmental protection.

- Technological advancements also significantly influence the expansion of the EHS market in North America. Digital solutions, such as real-time monitoring systems and advanced data analytics, have transformed the management of environmental, health, and safety (EHS) challenges. These advancements can help businesses improve operational efficiency and streamline compliance processes.

- We anticipate that North America will maintain its dominant position in the EHS market in the future. We expect the demand for advanced EHS solutions to remain robust due to the ongoing evolution of regulatory requirements and the increasing emphasis on sustainability. We expect the EHS market in North America to continue growing and developing as companies strive to meet increasingly demanding standards.

Active Key Players in the Environment, Health, and Safety (EHS) Market

- Alcumus Group Limited (United Kingdom)

- Dakota Software Corporation (United States)

- Enhesa (Belgium)

- ETQ LLC (Hexagon AB) (United States - Hexagon AB is Swedish)

- Intelex Technologies ULC (Industrial Scientific Corporation) (Canada - Industrial Scientific Corporation is U.S.)

- ProcessMAP Corporation (United States)

- Pro-Sapien Software (United Kingdom)

- SafetyCulture Plus Pty Ltd. (Australia)

- SAP SE (Germany)

- Sphera Solutions Inc. (United States)

- UL LLC (United States)

- Verisk Analytics Inc. (United States) and Other Major Players

|

Environment, Health, and Safety (EHS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 52.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6 % |

Market Size in 2032: |

USD 87.63 Bn. |

|

Segments Covered: |

by Component |

|

|

|

By Deployment Type |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Environment, Health, and Safety (EHS) Market by Component (2018-2032)

4.1 Environment, Health, and Safety (EHS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Environment, Health, and Safety (EHS) Market by Deployment Type (2018-2032)

5.1 Environment, Health, and Safety (EHS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Environment, Health, and Safety (EHS) Market by Vertical (2018-2032)

6.1 Environment, Health, and Safety (EHS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Energy and Utilities

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Chemicals and Materials

6.5 Healthcare

6.6 Construction and Engineering

6.7 Food and Beverage

6.8 Government and Defense

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Environment, Health, and Safety (EHS) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PROVIDE A VARIETY OF SOLUTIONS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SUCH AS ENVIRONMENTAL MONITORING SYSTEMS

7.4 HEALTH AND SAFETY CONSULTING SERVICES

7.5 AND SOFTWARE PLATFORMS FOR RISK MANAGEMENT. THESE SOLUTIONS ASSIST ORGANIZATIONS IN THE PROACTIVE RESOLUTION OF HEALTH AND SAFETY ISSUES

7.6 THE MONITORING OF WORKPLACE CONDITIONS

7.7 AND THE MANAGEMENT OF THEIR ENVIRONMENTAL FOOTPRINTWE ANTICIPATE THE EHS MARKET TO CONTINUE ITS UPWARD TRAJECTORY IN THE FUTURE DUE TO THE GROWING EMPHASIS ON SUSTAINABILITY AND THE PRESSURES OF REGULATORY COMPLIANCE. TECHNOLOGICAL ADVANCEMENTS AND A GREATER EMPHASIS ON PROACTIVE RISK MANAGEMENT WILL FURTHER INFLUENCE THE MARKET'S FUTURE. ENVIRONMENT

7.8 HEALTH

7.9 AND SAFETY (EHS) MARKET TREND ANALYSIS INCREASED ADOPTION OF DIGITAL TECHNOLOGIESTHE MARKET FOR ENVIRONMENT

7.10 HEALTH

7.11 AND SAFETY (EHS) IS UNDERGOING A SUBSTANTIAL TRANSFORMATION AS A RESULT OF THE GROWING PREVALENCE OF DIGITAL TECHNOLOGIES. DIGITAL SOLUTIONS ARE BECOMING INCREASINGLY ESSENTIAL TO EHS MANAGEMENT AS ORGANIZATIONS PRIORITIZE REGULATORY COMPLIANCE AND SUSTAINABILITY. TECHNOLOGIES SUCH AS IOT SENSORS

7.12 AI

7.13 AND DATA ANALYTICS ARE ENABLING REAL-TIME SURVEILLANCE AND MORE PRECISE REPORTING OF ENVIRONMENTAL IMPACTS AND SAFETY CONDITIONSBY AUTOMATING COMPLIANCE PROCESSES

7.14 REDUCING MANUAL ERRORS

7.15 AND OFFERING ACTIONABLE INSIGHTS

7.16 DIGITAL PLATFORMS IMPROVE THE EFFICACY OF EHS OPERATIONS. THESE DEVELOPMENTS IMPROVE THE EFFICIENCY OF REPORTING AND DOCUMENTATION

7.17 AS WELL AS ASSIST ORGANIZATIONS IN THE PROACTIVE IDENTIFICATION AND MITIGATION OF POTENTIAL HAZARDS. CONSEQUENTLY

7.18 BUSINESSES CAN ENHANCE THEIR ENVIRONMENTAL IMPACT AND GUARANTEE A SECURE WORK ENVIRONMENTADDITIONALLY

7.19 THE INCORPORATION OF DIGITAL TOOLS FACILITATES A MORE PROACTIVE APPROACH TO ENVIRONMENTAL

7.20 HEALTH

7.21 AND SAFETY (EHS) MANAGEMENT. PREDICTIVE ANALYTICS AND MACHINE LEARNING MODELS CAN ANTICIPATE POTENTIAL ISSUES

7.22 ENABLING THE IMPLEMENTATION OF PREVENTIVE MEASURES THAT REDUCE RISKS AND IMPROVE OVERALL SAFETYTHE GROWING EMPHASIS ON DIGITALIZATION IN EHS IS INDICATIVE OF BROADER TRENDS IN TECHNOLOGY ADOPTION ACROSS VARIOUS INDUSTRIES. AS REGULATIONS BECOME MORE STRINGENT AND SUSTAINABILITY OBJECTIVES BECOME MORE AMBITIOUS

7.23 WE EXPECT THE ROLE OF DIGITAL SOLUTIONS IN EHS TO EXPAND

7.24 THEREBY DRIVING FURTHER INNOVATION AND EFFICIENCY IN THE MARKET.GROWING FOCUS ON SUSTAINABILITY AND CORPORATE RESPONSIBILITYTHE MARKET FOR ENVIRONMENT

7.25 HEALTH

7.26 AND SAFETY (EHS) IS UNDERGOING A SUBSTANTIAL TRANSFORMATION AS A RESULT OF THE GROWING PREVALENCE OF DIGITAL TECHNOLOGIES. DIGITAL SOLUTIONS ARE BECOMING INCREASINGLY ESSENTIAL TO EHS MANAGEMENT AS ORGANIZATIONS PRIORITIZE REGULATORY COMPLIANCE AND SUSTAINABILITY. TECHNOLOGIES SUCH AS IOT SENSORS

7.27 AI

7.28 AND DATA ANALYTICS ARE ENABLING REAL-TIME SURVEILLANCE AND MORE PRECISE REPORTING OF ENVIRONMENTAL IMPACTS AND SAFETY CONDITIONSBY AUTOMATING COMPLIANCE PROCESSES

7.29 REDUCING MANUAL ERRORS

7.30 AND OFFERING ACTIONABLE INSIGHTS

7.31 DIGITAL PLATFORMS IMPROVE THE EFFICACY OF EHS OPERATIONS. THESE DEVELOPMENTS IMPROVE THE EFFICIENCY OF REPORTING AND DOCUMENTATION

7.32 AS WELL AS ASSIST ORGANIZATIONS IN THE PROACTIVE IDENTIFICATION AND MITIGATION OF POTENTIAL HAZARDS. CONSEQUENTLY

7.33 BUSINESSES CAN ENHANCE THEIR ENVIRONMENTAL IMPACT AND GUARANTEE A SECURE WORK ENVIRONMENTADDITIONALLY

7.34 THE INCORPORATION OF DIGITAL TOOLS FACILITATES A MORE PROACTIVE APPROACH TO ENVIRONMENTAL

7.35 HEALTH

7.36 AND SAFETY (EHS) MANAGEMENT. PREDICTIVE ANALYTICS AND MACHINE LEARNING MODELS CAN ANTICIPATE POTENTIAL ISSUES

7.37 ENABLING THE IMPLEMENTATION OF PREVENTIVE MEASURES THAT REDUCE RISKS AND IMPROVE OVERALL SAFETYTHE GROWING EMPHASIS ON DIGITALIZATION IN EHS IS INDICATIVE OF BROADER TRENDS IN TECHNOLOGY ADOPTION ACROSS VARIOUS INDUSTRIES. AS REGULATIONS BECOME MORE STRINGENT AND SUSTAINABILITY OBJECTIVES BECOME MORE AMBITIOUS

7.38 WE EXPECT THE ROLE OF DIGITAL SOLUTIONS IN EHS TO EXPAND

7.39 THEREBY DRIVING FURTHER INNOVATION AND EFFICIENCY IN THE MARKET.ENVIRONMENT

7.40 HEALTH

7.41 AND SAFETY (EHS) MARKET SEGMENT ANALYSIS ENVIRONMENT

7.42 HEALTH

7.43 AND SAFETY (EHS) MARKET SEGMENTED ON THE BASIS OF BY COMPONENT

7.44 DEPLOYMENT TYPE

7.45 AND VERTICAL. BY COMPONENT

7.46 SOFTWARE SEGMENT IS EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIODADVANCEMENTS IN BOTH SOFTWARE AND SERVICES ARE DRIVING THE SIGNIFICANT GROWTH OF THE ENVIRONMENT

7.47 HEALTH

7.48 AND SAFETY (EHS) MARKET. EHS SOFTWARE ENCOMPASSES A RANGE OF TOOLS DESIGNED TO ENHANCE ENVIRONMENTAL AND SAFETY PERFORMANCE

7.49 MITIGATE RISKS

7.50 AND ACCELERATE COMPLIANCE. VARIOUS INDUSTRIES ARE INCREASINGLY USING THIS SOFTWARE TO AUTOMATE REPORTING

7.51 MONITOR REGULATORY CHANGES

7.52 AND ENSURE COMPLIANCE WITH STANDARDS. CONSEQUENTLY

7.53 IT REDUCES OPERATIONAL RISKS AND ENHANCES EFFICIENCYCONVERSELY

7.54 EHS SERVICES OFFER ORGANIZATIONS CUSTOMIZED SOLUTIONS THROUGH EXPERT CONSULTATION

7.55 TRAINING

7.56 AND SUPPORT. THESE SERVICES ARE ESSENTIAL FOR THE IMPLEMENTATION OF BEST PRACTICES

7.57 THE EXECUTION OF AUDITS

7.58 AND THE MANAGEMENT OF INTRICATE EHS CHALLENGES. COMPANIES FREQUENTLY RELY ON THESE SERVICES TO MAINTAIN A CULTURE OF ENVIRONMENTAL STEWARDSHIP AND SAFETY AND STAY AHEAD OF REGULATORY REQUIREMENTSTHE INTEGRATION OF EHS SOFTWARE AND SERVICES RESULTS IN MORE COMPREHENSIVE AND EFFECTIVE EHS MANAGEMENT SYSTEMS. THIS COLLABORATION ENABLES ORGANIZATIONS TO NOT ONLY ADHERE TO REGULATIONS BUT ALSO TO ANTICIPATE AND MITIGATE POTENTIAL HAZARDSORGANIZATIONS RECOGNIZE THE IMPORTANCE OF EFFECTIVE EHS PROGRAMS IN SAFEGUARDING THE ENVIRONMENT AND THEIR OPERATIONS

7.59 THEREBY POSITIONING THE EHS MARKET FOR FURTHER GROWTH. THE COMBINED VALUE OF SOFTWARE AND SERVICES WILL PRIMARILY MEET THE EVOLVING REQUIREMENTS.BY VERTICAL

7.60 ENERGY AND UTILITIES SEGMENT HELD THE LARGEST SHARE IN 2024THE ENERGY AND UTILITIES

7.61 CHEMICALS AND MATERIALS

7.62 HEALTHCARE

7.63 CONSTRUCTION AND ENGINEERING

7.64 FOOD AND BEVERAGE

7.65 GOVERNMENT AND DEFENSE

7.66 AND OTHER SECTORS COMPRISE THE ENVIRONMENT

7.67 HEALTH

7.68 AND SAFETY (EHS) MARKET. THESE SECTORS PRIORITIZE ENVIRONMENTAL

7.69 HEALTH

7.70 AND SAFETY (EHS) TO GUARANTEE REGULATORY COMPLIANCE

7.71 PROTECT WORKER HEALTH

7.72 AND REDUCE ENVIRONMENTAL IMPACTTHE ENERGY AND UTILITIES SECTOR CENTERS EHS PRACTICES ON MANAGING ENVIRONMENTAL HAZARDS AND ENSURING SAFETY IN HAZARDOUS OPERATIONS. THE CHEMICAL AND MATERIALS INDUSTRIES PLACE A HIGH PRIORITY ON RESPONSIBLE TOXIC SUBSTANCE MANAGEMENT AND ENVIRONMENTAL CONTAMINATION PREVENTION. HEALTHCARE ORGANIZATIONS IMPLEMENT STRINGENT ENVIRONMENTAL HEALTH AND SAFETY (EHS) PROTOCOLS TO SAFEGUARD PATIENT SAFETY AND REFUSE MANAGEMENTIN ORDER TO GUARANTEE ENVIRONMENTAL PROTECTION AND SAFE WORKING CONDITIONS DURING PROJECTS

7.73 CONSTRUCTION AND ENGINEERING FIRMS MUST COMPLY WITH EHS STANDARDS. THE FOOD AND BEVERAGE INDUSTRY PRIORITIZES ENVIRONMENTAL SUSTAINABILITY

7.74 HYGIENE

7.75 AND FOOD SAFETY.

7.76 THE GOVERNMENT AND DEFENSE SECTORS MAINTAIN STRINGENT ENVIRONMENTAL

7.77 HEALTH

7.78 AND SAFETY (EHS) STANDARDS TO OVERSEE INTRICATE AND SENSITIVE OPERATIONS. IN GENERAL

7.79 THE EHS MARKET IS CRITICAL FOR ENVIRONMENTAL PROTECTION

7.80 INDIVIDUAL WELL-BEING

7.81 AND THE ADVANCEMENT OF SUSTAINABLE PRACTICES IN VARIOUS SECTORS.ENVIRONMENT

7.82 HEALTH

7.83 AND SAFETY (EHS) MARKET REGIONAL INSIGHTS NORTH AMERICA LEADS THE MARKET

7.84 ACCOUNTING FOR THE LARGEST ENVIRONMENT

7.85 HEALTH

7.86 AND SAFETY (EHS) MARKET SHARENORTH AMERICA DOMINATES THE ENVIRONMENT

7.87 HEALTH

7.88 AND SAFETY (EHS) MARKET

7.89 HOLDING THE LARGEST GLOBAL SHARE. THE REGION'S ADVANCED INFRASTRUCTURE

7.90 STRINGENT REGULATORY FRAMEWORKS

7.91 AND SUBSTANTIAL INVESTMENTS IN EHS TECHNOLOGIES ARE ALL FACTORS THAT CONTRIBUTE TO ITS LEADERSHIP POSITION. COMPANIES OPERATING IN NORTH AMERICA MUST ADHERE TO STRINGENT ENVIRONMENTAL AND SAFETY REGULATIONS

7.92 WHICH DRIVES THE DEMAND FOR SOPHISTICATED EHS SOLUTIONSTHE INCREASED EMPHASIS ON CORPORATE RESPONSIBILITY AND SUSTAINABLE PRACTICES IS ACCELERATING THE EXPANSION OF THE EHS MARKET IN NORTH AMERICA. ORGANIZATIONS IN A VARIETY OF SECTORS ARE FOCUSING ON ENVIRONMENTAL

7.93 HEALTH

7.94 AND SAFETY (EHS) INITIATIVES IN ORDER TO REDUCE ENVIRONMENTAL IMPACT

7.95 ENHANCE WORKPLACE SAFETY

7.96 AND MITIGATE RISKS. THIS PROACTIVE APPROACH IS CONSISTENT WITH THE REGION'S DEDICATION TO UPHOLDING RIGOROUS STANDARDS FOR EMPLOYEE WELL-BEING AND ENVIRONMENTAL PROTECTIONTECHNOLOGICAL ADVANCEMENTS ALSO SIGNIFICANTLY INFLUENCE THE EXPANSION OF THE EHS MARKET IN NORTH AMERICA. DIGITAL SOLUTIONS

7.97 SUCH AS REAL-TIME MONITORING SYSTEMS AND ADVANCED DATA ANALYTICS

7.98 HAVE TRANSFORMED THE MANAGEMENT OF ENVIRONMENTAL

7.99 HEALTH

7.100 AND SAFETY (EHS) CHALLENGES. THESE ADVANCEMENTS CAN HELP BUSINESSES IMPROVE OPERATIONAL EFFICIENCY AND STREAMLINE COMPLIANCE PROCESSESWE ANTICIPATE THAT NORTH AMERICA WILL MAINTAIN ITS DOMINANT POSITION IN THE EHS MARKET IN THE FUTURE. WE EXPECT THE DEMAND FOR ADVANCED EHS SOLUTIONS TO REMAIN ROBUST DUE TO THE ONGOING EVOLUTION OF REGULATORY REQUIREMENTS AND THE INCREASING EMPHASIS ON SUSTAINABILITY. WE EXPECT THE EHS MARKET IN NORTH AMERICA TO CONTINUE GROWING AND DEVELOPING AS COMPANIES STRIVE TO MEET INCREASINGLY DEMANDING STANDARDS.ACTIVE KEY PLAYERS IN THE ENVIRONMENT

7.101 HEALTH

7.102 AND SAFETY (EHS) MARKETALCUMUS GROUP LIMITED (UNITED KINGDOM)

7.103 DAKOTA SOFTWARE CORPORATION (UNITED STATES)

7.104 ENHESA (BELGIUM)

7.105 ETQ LLC (HEXAGON AB) (UNITED STATES - HEXAGON AB IS SWEDISH)

7.106 INTELEX TECHNOLOGIES ULC (INDUSTRIAL SCIENTIFIC CORPORATION) (CANADA - INDUSTRIAL SCIENTIFIC CORPORATION IS U.S.)

7.107 PROCESSMAP CORPORATION (UNITED STATES)

7.108 PRO-SAPIEN SOFTWARE (UNITED KINGDOM)

7.109 SAFETYCULTURE PLUS PTY LTD. (AUSTRALIA)

7.110 SAP SE (GERMANY)

7.111 SPHERA SOLUTIONS INC. (UNITED STATES)

7.112 UL LLC (UNITED STATES)

7.113 VERISK ANALYTICS INC. (UNITED STATES)

Chapter 8: Global Environment, Health, and Safety (EHS) Market By Region

8.1 Overview

8.2. North America Environment, Health, and Safety (EHS) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Software

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size by Deployment Type

8.2.5.1 On-premises

8.2.5.2 Cloud-based

8.2.6 Historic and Forecasted Market Size by Vertical

8.2.6.1 Energy and Utilities

8.2.6.2 Chemicals and Materials

8.2.6.3 Healthcare

8.2.6.4 Construction and Engineering

8.2.6.5 Food and Beverage

8.2.6.6 Government and Defense

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Environment, Health, and Safety (EHS) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Software

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size by Deployment Type

8.3.5.1 On-premises

8.3.5.2 Cloud-based

8.3.6 Historic and Forecasted Market Size by Vertical

8.3.6.1 Energy and Utilities

8.3.6.2 Chemicals and Materials

8.3.6.3 Healthcare

8.3.6.4 Construction and Engineering

8.3.6.5 Food and Beverage

8.3.6.6 Government and Defense

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Environment, Health, and Safety (EHS) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Software

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size by Deployment Type

8.4.5.1 On-premises

8.4.5.2 Cloud-based

8.4.6 Historic and Forecasted Market Size by Vertical

8.4.6.1 Energy and Utilities

8.4.6.2 Chemicals and Materials

8.4.6.3 Healthcare

8.4.6.4 Construction and Engineering

8.4.6.5 Food and Beverage

8.4.6.6 Government and Defense

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Environment, Health, and Safety (EHS) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Software

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size by Deployment Type

8.5.5.1 On-premises

8.5.5.2 Cloud-based

8.5.6 Historic and Forecasted Market Size by Vertical

8.5.6.1 Energy and Utilities

8.5.6.2 Chemicals and Materials

8.5.6.3 Healthcare

8.5.6.4 Construction and Engineering

8.5.6.5 Food and Beverage

8.5.6.6 Government and Defense

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Environment, Health, and Safety (EHS) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Software

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size by Deployment Type

8.6.5.1 On-premises

8.6.5.2 Cloud-based

8.6.6 Historic and Forecasted Market Size by Vertical

8.6.6.1 Energy and Utilities

8.6.6.2 Chemicals and Materials

8.6.6.3 Healthcare

8.6.6.4 Construction and Engineering

8.6.6.5 Food and Beverage

8.6.6.6 Government and Defense

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Environment, Health, and Safety (EHS) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Software

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size by Deployment Type

8.7.5.1 On-premises

8.7.5.2 Cloud-based

8.7.6 Historic and Forecasted Market Size by Vertical

8.7.6.1 Energy and Utilities

8.7.6.2 Chemicals and Materials

8.7.6.3 Healthcare

8.7.6.4 Construction and Engineering

8.7.6.5 Food and Beverage

8.7.6.6 Government and Defense

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Environment, Health, and Safety (EHS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 52.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6 % |

Market Size in 2032: |

USD 87.63 Bn. |

|

Segments Covered: |

by Component |

|

|

|

By Deployment Type |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Environment, Health, and Safety (EHS) Market research report is 2024-2032.

Alcumus Group Limited (United Kingdom),Dakota Software Corporation (United States),Enhesa (Belgium),ETQ LLC (Hexagon AB) (United States - Hexagon AB is Swedish),Intelex Technologies ULC (Industrial Scientific Corporation) (Canada - Industrial Scientific Corporation is U.S.),ProcessMAP Corporation (United States), Pro-Sapien Software (United Kingdom), SafetyCulture Plus Pty Ltd. (Australia), SAP SE (Germany), Sphera Solutions Inc. (United States), UL LLC (United States), Verisk Analytics Inc. (United States) and others

The Environment, Health, and Safety (EHS) Market is segmented into by Component (Software, Services), Deployment Type (On-premises, Cloud-based), Vertical (Energy and Utilities, Chemicals and Materials, Healthcare, Construction and Engineering, Food and Beverage, Government and Defense, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Environment, Health, and Safety (EHS) refers to a set of practices and regulations designed to protect the environment, ensure the health and safety of individuals, and promote sustainable operations within organizations. EHS programs focus on reducing environmental impact by managing waste, emissions, and resource use, while also safeguarding workers and the public from hazards through safety protocols and health regulations. Effective EHS management not only complies with legal requirements but also enhances operational efficiency, reduces costs associated with accidents and environmental damage, and fosters a positive corporate reputation.

Environment, Health, and Safety (EHS) Market Size is Valued at USD 52.55 Billion in 2024, and is Projected to Reach USD 87.63 Billion by 2032, Growing at a CAGR of 6.60% From 2024-2032.