Enterprise Search Market Synopsis

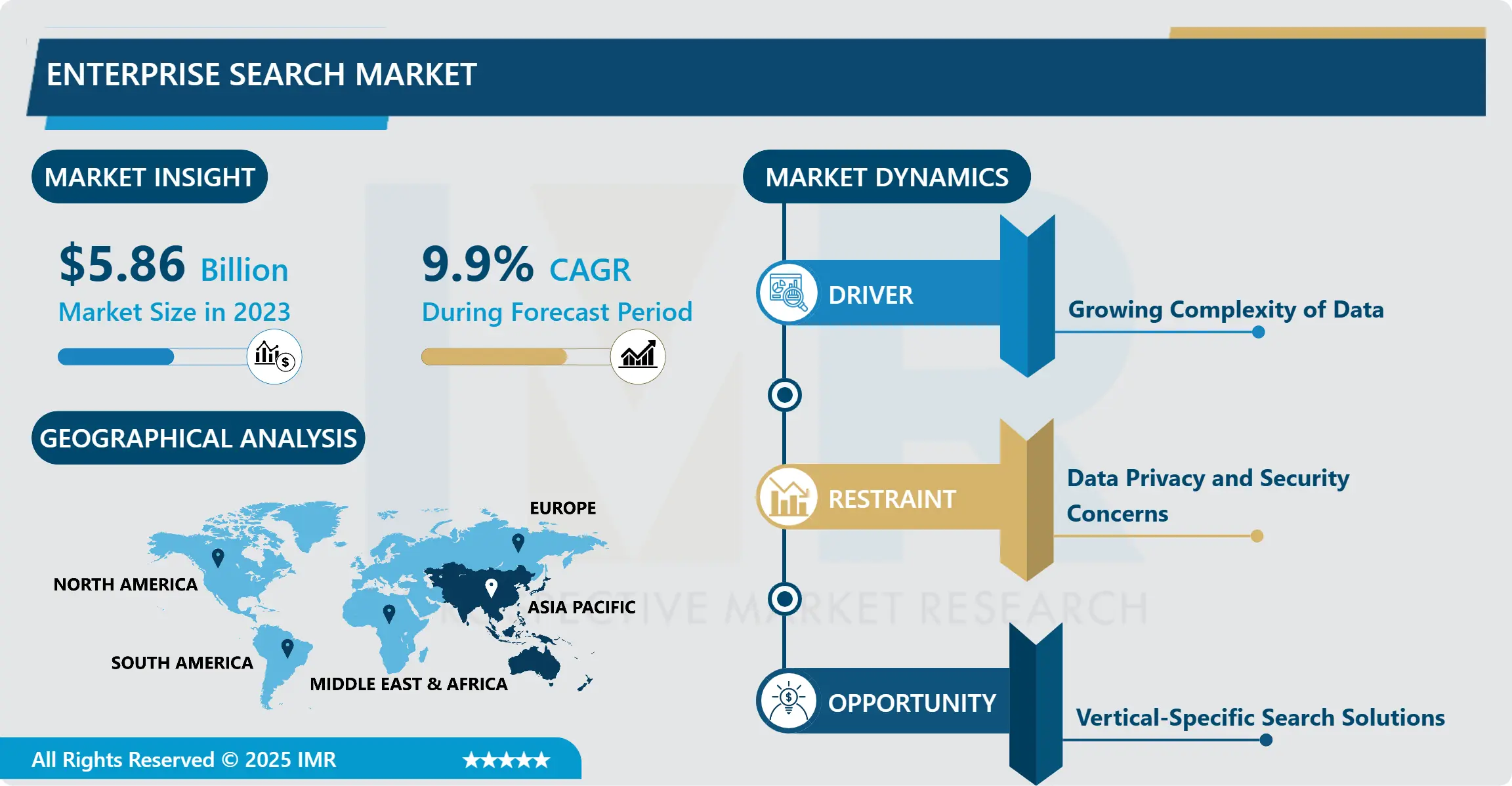

Enterprise Search Market Size Was Valued at USD 5.86 Billion in 2023 and is Projected to Reach USD 13.70 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.

Enterprise search means the capability of the company to search for information within the organization’s intranet or in other databases. It is commonly associated with indexing and searching of massive amounts of organized and unstructured information, documents, data bases, e-mails, and multimedia. Thus, the purpose of enterprise search is the effective integration of search tools and interfaces to help users identify the necessary data quickly and improve efficiency as well as decision making and collaboration in an organization.

The section explores that Enterprise Search Market has experienced constant growth and change over time because of the rising amount and diversification of information within companies. Enterprise search solutions are used for the identification and processing of data stored in different databases or information types, documents, emails, multimedia etc. This capability relates to the problem of information isolation and improves the efficiency of work since users can find information that is important to them.

Some of the trends likely to affect evolution of the market are: web-based and app-based search coupled with the application of artificial intelligence and machine learning algorithm that enhance search precision and reliability. These technologies add superior functionalities like NLP with semantic search, entity recognition, and sentiment analysis. They also improve the experience of the users by providing more relevant outcomes relative to specified parameters, thus increasing effectiveness.

Also, the migration to cloud enterprise search is visible, which means that businesses can obtain solutions with ease at a lower cost and scale them up when needed. Cloud deployment helps organisations deal with the increasing amounts of data and support remote workers. It also provides other enterprise applications and services interfaces to connect in order to enhance the continuity and operational efficiency of the organization’s multinational teams.

Privacy is still a critical factor of consideration in the enterprise search market due to the tough compliance requirements like GDPR and CCPA. The vendors have increased investment on security such as data encryption, access provisions and audit facilities as part of ensuring the customer’s data privacy is well upheld.

Hence, it is evident that the enterprise search market is evolving as organizations focus more on the way they manage data and search for it. AI, cloud computing, and cybersecurity have emerged as new major trends that are far from being marginal in the context of the postindustrial evolution of information environments, while providing rich opportunities for facilitating modern organizations’ decision-making processes by supplying them with sophisticated tools. As companies come to appreciate the importance of the outcomes and suggestions that may be obtained from the data, the need for advanced ES systems is projected to rise thus promoting innovation and market development.

Enterprise Search Market Trend Analysis

Enterprise Search Market Trend Analysis

Integration of Natural Language Processing (NLP)

- The use of Natural Language Processing in the Enterprise Search Market is the next revolutionary step in creating search functionality in organizations. The analysis of text, speech, and language processing help the systems in understanding, interpreting, and generating human language enhancing the results of the search. In an organization identification and extraction of information within large data sets become easier with the help of this technology stream. In this way, the enterprise search solutions may involve using more sophisticated features with the help of NLP, including semantic search, entity recognition, sentiment analysis, and contextual awareness all of which contribute to improving the users’ experience and their potential decisions. This integration is more important in sectors that involve a large number of data inputs and those which are complex as in the fields of finance, health, and legal.

- Also, the enterprise search engine based on NLP can help in the classification, summarization, and extraction of documents, which allows for faster work and less reliance on manual work. With the current emphasis by companies to use digital approaches and rely on real-time data, advanced NLP-based solutions that enhance the firm’s search processes are set to have crucial impact on enterprise information access and utilization, and thus organizational competitiveness.

Vertical-Specific Search Solutions

- The Enterprise Search Market is emerging specifically in the vertical-specific companies, where search technology by sector and type is getting popular among healthcare, finance, and manufacturing sectors as well as the retail chains. They include compliance requirements in healthcare, financial data and information retrieval and analysis in finance, product search and customers’ information in retail and manufacturing efficiency solutions. Businesses are continuing to purchase sophisticated solutions based on artificial intelligence for searching and integrating information from different sources including databases, documents and structured and unstructured information such as e-mails images and videos previously locked in enterprise systems.

- The market is growing strong on grounds of customers’ requirement of customized services, better administrative tools, and availability of cumulative information in the most effective way possible. The market has numerous stakeholders who are aiming at constructing search solutions that are flexible, secure, and easier to integrate with various firms and industries, resulting in the general growth of the enterprise search market.

Enterprise Search Market Segment Analysis:

Enterprise Search Market Segmented based on Type, End Use and Enterprise .

By Type, Hosted Search segment is expected to dominate the market during the forecast period

- The Enterprise Search Market can be segmented into three main types: Those are Local Search, Hosted Search, and Search Appliance solutions. Local Search is defined as the search capabilities incorporated in a specific firm’s local applications or in its internal data repositories to allow users to easily pull out relevant information from local desktops or servers. Hosted Search solutions are software that provides organizations with flexibly usability of highly efficient search options, hosted in third-party data centers, where the primary responsibility of setting up, improving, and maintaining the search function lies with the third-party providers.

- Search Appliance solutions in most cases encompass hardware or software based appliance that is installed inside a company’s network environment, and offers powerful search capabilities customized to suit the needs of large organizations and businesses with well-articulated search requirements, usually embeddable into the IT environment of the company. These types are designed to meet various organizational requirements, ranging from fast and effective data search and processing, cloud solutions for business growth, powerful on-premises search solutions, thus corresponding to the various approaches employed by enterprises to increase efficiency and information availability within their processes.

By End Use, Banking & Financial segment held the largest share in 2023

- The EM segmented by end-use applications like government and commercial offices, banks and financial segment, healthcare, retail, media, manufacturing, and others indicates a rising demand for the ES market due to progressing digitalization and necessity in the businesses to have efficient system for retrieving the necessary data. Businesses integrate enterprise search solutions into their governmental and commercial structures to improve data availability in decision-making mechanisms in different departments. In the banking and financial practices, these MEPs are invaluable in handling large amounts of financial information, meeting compliance, and swiftly delivering the sought data to employees for servicing clients and analysis.

- These solutions are implemented in healthcare organizations to optimise clinical operations, facilitate easy access to patients’ records and for research purposes. Retail industries use enterprise search to enhance the system by improving the stock system, the customer behavior trends and the different channels of e-commerce and physical stores. Media organizations stand to gain from these solutions as far as content management, as well as in the residual archiving and retrieval of digital assets, as well as extracting value from viewership or listenership data. Manufacturing benefits from enterprise search by improving supply chain transparency for suppliers and customers, improving product life cycle for manufacturers, and deploying data that helps in product quality assurance. In other fields, for instance education, transport, and energy, enterprises’ search solutions are incorporated to enhance performance, compliance to legal requirements, and decision-making, thus signifying a comprehensive and expanding market nourished by the need for adequate easy access to and management of information.

Enterprise Search Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region has stats to lead the Enterprise Search Market in the coming years due to the following factors. A rise in the implementation of digital transformation plans across different industries combined with the active use of technologies like artificial intelligence (AI) and machine learning (ML) in organizations is driving the adoption of enterprise search solutions in the region. Companies recognized the need to optimize operation and to examine large amounts of data to extract useful information, which stimulated the use of business search applications.

- Furthermore, the constantly rising(Client 2) implementation of it solutions and services and the development of cloud computing services enhance the adoption and expansion of enterprise search solutions among the Asia Pacific enterprises. Ongoing government campaigns regarding digitization and enhanced accessibility of Internet and mobile devices also help to drive the market for enterprise search by providing enabling conditions. In addition, the investment by dominant players in the growth of advanced technologies as well as the entrance of new start-ups dealing in AI technologies in different countries such as China, India, Japan, and South Korea are predicted to fuel the innovative element in the regional market. Therefore, the Asia Pacific becomes a critical zone for the enterprise search market growth; strong prognostications of constant development are expected in the subsequent years.

Active Key Players in the Enterprise Search Market

- Alphabet Inc (USA)

- Microsoft Corporation (USA)

- IBM Corporation (USA)

- SAP SE (Germany)

- Amazon Web Services, Inc. (USA)

- Salesforce.com, Inc.(USA)

- Oracle Corporation (USA)

- Dell Technologies Inc (USA)

- Micro Focus International plc (UK), Others Active Players

|

Enterprise Search Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 13.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Enterprise |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Enterprise Search Market by Type (2018-2032)

4.1 Enterprise Search Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Local Search

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hosted Search

4.5 Search Appliance

Chapter 5: Enterprise Search Market by End User (2018-2032)

5.1 Enterprise Search Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Government & Commercial Offices

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Banking & Financial

5.5 Healthcare

5.6 Retail

5.7 Media

5.8 Manufacturing

5.9 Others

Chapter 6: Enterprise Search Market by Enterprise (2018-2032)

6.1 Enterprise Search Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medium

6.5 Large

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Enterprise Search Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALPHABET INC (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT CORPORATION (USA)

7.4 IBM CORPORATION (USA)

7.5 SAP SE (GERMANY)

7.6 AMAZON WEB SERVICES INC. (USA)

7.7 SALESFORCE.COM INC.(USA)

7.8 ORACLE CORPORATION (USA)

7.9 DELL TECHNOLOGIES INC (USA)

7.10 MICRO FOCUS INTERNATIONAL PLC (UK)

7.11 OTHERS ACTIVE PLAYERS

7.12

Chapter 8: Global Enterprise Search Market By Region

8.1 Overview

8.2. North America Enterprise Search Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Local Search

8.2.4.2 Hosted Search

8.2.4.3 Search Appliance

8.2.5 Historic and Forecasted Market Size by End User

8.2.5.1 Government & Commercial Offices

8.2.5.2 Banking & Financial

8.2.5.3 Healthcare

8.2.5.4 Retail

8.2.5.5 Media

8.2.5.6 Manufacturing

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size by Enterprise

8.2.6.1 Small

8.2.6.2 Medium

8.2.6.3 Large

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Enterprise Search Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Local Search

8.3.4.2 Hosted Search

8.3.4.3 Search Appliance

8.3.5 Historic and Forecasted Market Size by End User

8.3.5.1 Government & Commercial Offices

8.3.5.2 Banking & Financial

8.3.5.3 Healthcare

8.3.5.4 Retail

8.3.5.5 Media

8.3.5.6 Manufacturing

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size by Enterprise

8.3.6.1 Small

8.3.6.2 Medium

8.3.6.3 Large

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Enterprise Search Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Local Search

8.4.4.2 Hosted Search

8.4.4.3 Search Appliance

8.4.5 Historic and Forecasted Market Size by End User

8.4.5.1 Government & Commercial Offices

8.4.5.2 Banking & Financial

8.4.5.3 Healthcare

8.4.5.4 Retail

8.4.5.5 Media

8.4.5.6 Manufacturing

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size by Enterprise

8.4.6.1 Small

8.4.6.2 Medium

8.4.6.3 Large

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Enterprise Search Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Local Search

8.5.4.2 Hosted Search

8.5.4.3 Search Appliance

8.5.5 Historic and Forecasted Market Size by End User

8.5.5.1 Government & Commercial Offices

8.5.5.2 Banking & Financial

8.5.5.3 Healthcare

8.5.5.4 Retail

8.5.5.5 Media

8.5.5.6 Manufacturing

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size by Enterprise

8.5.6.1 Small

8.5.6.2 Medium

8.5.6.3 Large

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Enterprise Search Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Local Search

8.6.4.2 Hosted Search

8.6.4.3 Search Appliance

8.6.5 Historic and Forecasted Market Size by End User

8.6.5.1 Government & Commercial Offices

8.6.5.2 Banking & Financial

8.6.5.3 Healthcare

8.6.5.4 Retail

8.6.5.5 Media

8.6.5.6 Manufacturing

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size by Enterprise

8.6.6.1 Small

8.6.6.2 Medium

8.6.6.3 Large

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Enterprise Search Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Local Search

8.7.4.2 Hosted Search

8.7.4.3 Search Appliance

8.7.5 Historic and Forecasted Market Size by End User

8.7.5.1 Government & Commercial Offices

8.7.5.2 Banking & Financial

8.7.5.3 Healthcare

8.7.5.4 Retail

8.7.5.5 Media

8.7.5.6 Manufacturing

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size by Enterprise

8.7.6.1 Small

8.7.6.2 Medium

8.7.6.3 Large

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Enterprise Search Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 13.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Enterprise |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||