Energy Drinks Market Synopsis

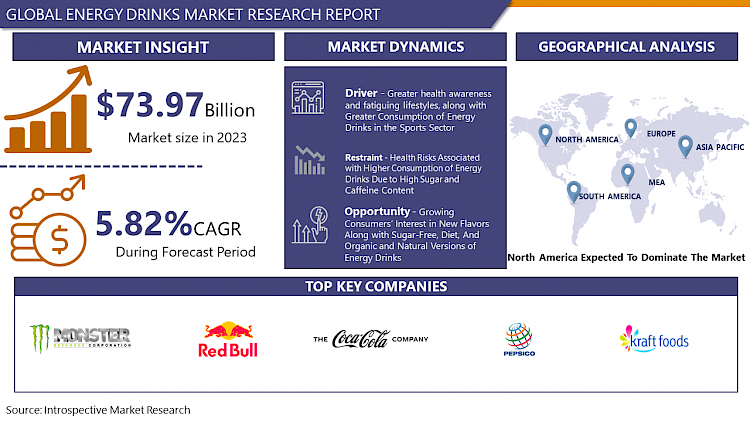

The Energy Drinks Market size is estimated at 73.97 billion USD in 2023 and is expected to reach 130.24 billion USD by 2032, growing at a CAGR of 5.82% during the forecast period (2024-2032).

Energy Drink is a beverage that contains high levels of stimulant ingredients like caffeine, as well as sugar, it often is packed with supplements, such as vitamins or carnitine. Energy Drinks are widely known and advertised as beverage products capable of enhancing mental alertness and physical performance. Energy drinks are the fastest-growing sector in the beverage industry of now. These drinks are known to enhance performance as it contains five times the amount of caffeine as soft drinks and also some other derivatives such as taurine, riboflavin, pyridoxine, etc.

- Today, the consumption of energy drinks is expeditiously increasing as compared to other beverage categories. Various modifications are also made in the combination of ingredients by keeping in mind the needs and preferences of the targeted demographic groups, which are teenagers, young adults, and 18 to 34 y old.

- Along with the great taste and flavors offered by energy drinks, many research studies also show that energy drink formulations, in addition to increasing energy utilization, may also aid in improving mood, enhancing physical endurance, reducing mental fatigue, and increasing reaction time. Further, it is also claimed that energy drinks can offer an increased energy boost as per their ingredient profile and amounts of caffeine, taurine, herbal extracts, and vitamins.

- Moreover, the market for energy drinks is experiencing elevated growth with its expansion into non-traditional markets also and this expansion is evidently a result of rising incomes, urbanization, and an increase in the health and wellness consciousness of the population worldwide. Many adult and adolescent populations are continuously consuming energy drinks to support their busy and active lifestyles, most consumption is seen among people engaged in athletics and sports to achieve improved performance, endurance, and alertness.

The Energy Drinks Market Trend Analysis

Greater health awareness and fatiguing lifestyles, along with Greater Consumption of Energy Drinks in the Sports Sector

- Fatigue has become one of the fundamental features of today’s modern life. The way in which cities and economies work today indicates that fatigue is not a temporary symptom but it has a much greater picture to show. Today with more than four decades of neoliberalism and urbanization, exhaustion has become an inevitable part of people’s life.

- Many people suffer stressful situations throughout the day, and many on the sufferers have now moved beyond coffee to energy drinks, which have seen their popularity grow steadily each year from 2008 to 2013, such drive for energy drinks to curb stress is forming great area for the development of the Market.

- Along with the increased sales of Energy Drinks to stay active throughout work, frequent consumption of energy drinks by athletes and sports players is also helping the market with higher sales. Energy drinks contain chlorides, calcium, sodium, magnesium, and potassium due to content athletes consume energy drinks frequently before, during, or after exercise, not only adult players but the consumption of sports and energy drinks in adolescents is also pretty high with 61.7%, of them consuming on practicing the sport and in leisure time

- Further, the rising positive correlation between energy drink consumption and improved sporting performance has also been observed in the sports which has boosted the energy drink sales in the sports sectors with the revenue generated through sales of energy and sports drinks worldwide amounted to 159 billion U.S. dollars in 2021.

Growing Consumers’ Interest in New Flavors Along with Sugar-Free, Diet, And Organic and Natural Versions of Energy Drinks

- Several energy drink manufacturers are shifting their focus on natural ingredients these days, the reason behind such business acts is the growing consumer awareness regarding their health and their knowledge about how regular energy drinks containing artificial ingredients might harm their health.

- Recently, the market has experienced a push towards natural energy drink ingredients that manufacturers says can enhance energy and immunity. Such ingredients include coconut water, adaptogens, and mushrooms among other healthy ingredients. Such a surge of health and wellness in the arena of Energy Drinks is serving the market players with great opportunities to develop healthy options in the product.

- Moreover, the development of such healthy organic product lines is aiding in the expansion of the markets even more rapidly than their traditional versions. Also, the appealing promotion and branding of these products is been enticing consumers who are looking for wellness in their diet and hence the companies who are trying to provide clean and natural energy drinks for health-conscious consumers are estimated to boost the market growth by achieving greater sales.

Segmentation Analysis Of The Energy Drinks Market

Energy Drinks market segments cover the Product Type, Nature, Age Group and Distribution Channel. By Product Type, the Drinks segment is Anticipated to Dominate the Market Over the Forecast period.

- Energy Drinks are easily available to People these days. People now are able to get energy drinks everywhere may it be on the way to the gym, at any store or shop, or at the work. Many people choose energy drinks as an enjoyable beverage to maintain consistent activity throughout their fatiguing day.

- Moreover, an array of options is available for consumers when it comes to energy drinks, energy drinks are available in a variety of packaging such as cans, bottles, etc. Also, the convenience offered by the ready-to-drink energy drinks over the energy powder and shots is the reason behind the success of the Drinks Product Type in the Energy Drink Market.

- The convenience and availability of Energy Drinks in the soft drink category are responsible for yielding 42% of the soft drinks category’s growth last year. Such RTD Energy Drinks have also led to an extra 400,000 consumers. Because of such Ease of offering, the Drinks segment remains the favorite option in the global Energy Drinks Market.

Regional Analysis of The Energy Drinks Market

North America Dominates the Global Energy Drinks Market, While the Asia Pacific Is Expected to Experience the Fastest Growth in the Market Over the Forecast period.

- North America in the last few years has experienced massive consumption of energy drinks due to the growing party and pub culture, also the massive coffee culture in North American Countries such as the United States has pushed the energy drinks beverage category in terms of growth, to be explained the total sales revenue generated in the United States alone last year was around USD 13.97 billion and hence, owning to such major factor driving the sales of energy drinks, the region is leading the market globally

- Further, Energy drinks are emerging as an integral part of celebrations, social meets, and parties, and celebrations in modern countries such as the United States and Canada, which is offering greater sales opportunities for regional Manufacturers to sell their wide range of energy drinks, which can come in multiple flavors, and attractive and functional packaging.

- Being the largest consumer of packaged beverages and energy drinks, the United States also benefits from the presence of mixed and modern communities, the adoption of energy drinks is quite high in the US as compared to other parts. For instance, in 2022 the per capita volume consumption of energy drinks was at an average of 28.4 liters per person which was the highest worldwide. The US was followed by the United Kingdom, Japan, and Spain with approximately 12, 10.5, and 8.8 liters per person. Such high consumption along with the elevated and innovated products from the market players are going to fuel the regional Energy Drinks Market in North America.

Top Key Players Covered in The Energy Drinks Market

- Monster Beverage Corporation (US)

- Red Bull GmbH (Austria)

- Coca-Cola Co. (US)

- PepsiCo Inc. (US)

- Kraft Foods Inc. (US)

- National Beverage Corp. (US)

- The Gatorade Company Inc. (US)

- Nestlé S.A.(Switzerland)

- Carlsberg A/S (Denmark)

- LT Group Inc (Philippines)

- Suntory Holdings Ltd. (Japan)

- Living Essentials LLC (US)

- Kabisa B.V. (Netherlands)

- Asia Brewery Incorporated (Philippines)

- Eastroc Beverage Co Ltd (China)

- Taisho Pharmaceutical Co. Ltd. (Japan) and Other Major Players

Key Industry Developments in the Energy Drinks Market

- In January 2023, Monster Energy, a subsidiary of Monster Beverage Corporation launched its new variant of Lewis Hamilton zero-sugar energy drink. The company launches its full line in the first quarter of 2023. This new Lewis Hamilton Zero Sugar edition has a completely new formula with a peach nectarine flavor described as “stone fruits” and is made from vegan ingredients. With the launch consumers can finally enjoy the amazing taste of the flagship original Monster Energy Green but without sugar.

- In January 2022, PepsiCo and Starbucks announced a partnership to launch energy drink BAYA Energy. With the launch Starbucks is entering the energy category for the first time, this new ready-to-drink (RTD) beverage from the company is crafted from caffeine naturally found in coffee fruit as well as antioxidant vitamin C for immune support and it was developed through the North American Coffee Partnership (NACP), a joint venture between Starbucks and PepsiCo to create ready-to-drink coffee and energy products.

|

Global Energy Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73. 97Bn. |

|

Forecast Period 2024-2032 CAGR: |

5.82 % |

Market Size in 2032: |

USD 130.24 Bn |

|

Segments Covered: |

By Soft Drink Type |

|

|

|

By Packaging Type |

|

||

|

by Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Nature

3.3 By Age Group

3.4 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Energy Drinks Market by Product Type

5.1 Energy Drinks Market Overview Snapshot and Growth Engine

5.2 Energy Drinks Market Overview

5.3 Shots

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Shots: Geographic Segmentation

5.4 Drinks

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Drinks: Geographic Segmentation

5.5 Drink Mixes

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Drink Mixes: Geographic Segmentation

Chapter 6: Energy Drinks Market by Nature

6.1 Energy Drinks Market Overview Snapshot and Growth Engine

6.2 Energy Drinks Market Overview

6.3 Organic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Organic: Geographic Segmentation

6.4 Conventional

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Conventional: Geographic Segmentation

Chapter 7: Energy Drinks Market by Age Group

7.1 Energy Drinks Market Overview Snapshot and Growth Engine

7.2 Energy Drinks Market Overview

7.3 Teenagers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Teenagers: Geographic Segmentation

7.4 Adults

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Adults: Geographic Segmentation

Chapter 8: Energy Drinks Market by Distribution Channel

8.1 Energy Drinks Market Overview Snapshot and Growth Engine

8.2 Energy Drinks Market Overview

8.3 Supermarkets & Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Supermarkets & Hypermarkets: Geographic Segmentation

8.4 Specialty Stores

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Specialty Stores: Geographic Segmentation

8.5 Convenience Stores

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Convenience Stores: Geographic Segmentation

8.6 Online Retail Stores

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Online Retail Stores: Geographic Segmentation

8.7 Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Others: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Energy Drinks Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Energy Drinks Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Energy Drinks Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 MONSTER BEVERAGE CORPORATION (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 RED BULL GMBH (AUSTRIA)

9.4 COCA-COLA CO. (US)

9.5 PEPSICO INC. (US)

9.6 KRAFT FOODS INC. (US)

9.7 NATIONAL BEVERAGE CORP. (US)

9.8 THE GATORADE COMPANY INC. (US)

9.9 NESTLÉ S.A. (SWITZERLAND)

9.10 CARLSBERG A/S (DENMARK)

9.11 LT GROUP INC (PHILIPPINES)

9.12 SUNTORY HOLDINGS LTD. (JAPAN)

9.13 LIVING ESSENTIALS LLC (US)

9.14 KABISA B.V. (NETHERLANDS)

9.15 ASIA BREWERY INCORPORATED (PHILIPPINES)

9.16 EASTROC BEVERAGE CO LTD (CHINA)

9.17 TAISHO PHARMACEUTICAL CO. LTD. (JAPAN)

9.18 OTHER MAJOR PLAYERS

Chapter 10: Global Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Product Type

10.2.1 Shots

10.2.2 Drinks

10.2.3 Drink Mixes

10.3 Historic and Forecasted Market Size By Nature

10.3.1 Organic

10.3.2 Conventional

10.4 Historic and Forecasted Market Size By Age Group

10.4.1 Teenagers

10.4.2 Adults

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Supermarkets & Hypermarkets

10.5.2 Specialty Stores

10.5.3 Convenience Stores

10.5.4 Online Retail Stores

10.5.5 Others

Chapter 11: North America Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Shots

11.4.2 Drinks

11.4.3 Drink Mixes

11.5 Historic and Forecasted Market Size By Nature

11.5.1 Organic

11.5.2 Conventional

11.6 Historic and Forecasted Market Size By Age Group

11.6.1 Teenagers

11.6.2 Adults

11.7 Historic and Forecasted Market Size By Distribution Channel

11.7.1 Supermarkets & Hypermarkets

11.7.2 Specialty Stores

11.7.3 Convenience Stores

11.7.4 Online Retail Stores

11.7.5 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Shots

12.4.2 Drinks

12.4.3 Drink Mixes

12.5 Historic and Forecasted Market Size By Nature

12.5.1 Organic

12.5.2 Conventional

12.6 Historic and Forecasted Market Size By Age Group

12.6.1 Teenagers

12.6.2 Adults

12.7 Historic and Forecasted Market Size By Distribution Channel

12.7.1 Supermarkets & Hypermarkets

12.7.2 Specialty Stores

12.7.3 Convenience Stores

12.7.4 Online Retail Stores

12.7.5 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Shots

13.4.2 Drinks

13.4.3 Drink Mixes

13.5 Historic and Forecasted Market Size By Nature

13.5.1 Organic

13.5.2 Conventional

13.6 Historic and Forecasted Market Size By Age Group

13.6.1 Teenagers

13.6.2 Adults

13.7 Historic and Forecasted Market Size By Distribution Channel

13.7.1 Supermarkets & Hypermarkets

13.7.2 Specialty Stores

13.7.3 Convenience Stores

13.7.4 Online Retail Stores

13.7.5 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Shots

14.4.2 Drinks

14.4.3 Drink Mixes

14.5 Historic and Forecasted Market Size By Nature

14.5.1 Organic

14.5.2 Conventional

14.6 Historic and Forecasted Market Size By Age Group

14.6.1 Teenagers

14.6.2 Adults

14.7 Historic and Forecasted Market Size By Distribution Channel

14.7.1 Supermarkets & Hypermarkets

14.7.2 Specialty Stores

14.7.3 Convenience Stores

14.7.4 Online Retail Stores

14.7.5 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Energy Drinks Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Product Type

15.4.1 Shots

15.4.2 Drinks

15.4.3 Drink Mixes

15.5 Historic and Forecasted Market Size By Nature

15.5.1 Organic

15.5.2 Conventional

15.6 Historic and Forecasted Market Size By Age Group

15.6.1 Teenagers

15.6.2 Adults

15.7 Historic and Forecasted Market Size By Distribution Channel

15.7.1 Supermarkets & Hypermarkets

15.7.2 Specialty Stores

15.7.3 Convenience Stores

15.7.4 Online Retail Stores

15.7.5 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Energy Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73. 97Bn. |

|

Forecast Period 2024-2032 CAGR: |

5.82 % |

Market Size in 2032: |

USD 130.24 Bn |

|

Segments Covered: |

By Soft Drink Type |

|

|

|

By Packaging Type |

|

||

|

by Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ENERGY DRINKS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ENERGY DRINKS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ENERGY DRINKS MARKET COMPETITIVE RIVALRY

TABLE 005. ENERGY DRINKS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ENERGY DRINKS MARKET THREAT OF SUBSTITUTES

TABLE 007. ENERGY DRINKS MARKET BY PRODUCT TYPE

TABLE 008. SHOTS MARKET OVERVIEW (2016-2028)

TABLE 009. DRINKS MARKET OVERVIEW (2016-2028)

TABLE 010. DRINK MIXES MARKET OVERVIEW (2016-2028)

TABLE 011. ENERGY DRINKS MARKET BY NATURE

TABLE 012. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 013. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 014. ENERGY DRINKS MARKET BY AGE GROUP

TABLE 015. TEENAGERS MARKET OVERVIEW (2016-2028)

TABLE 016. ADULTS MARKET OVERVIEW (2016-2028)

TABLE 017. ENERGY DRINKS MARKET BY DISTRIBUTION CHANNEL

TABLE 018. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 019. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 020. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 021. ONLINE RETAIL STORES MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA ENERGY DRINKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. NORTH AMERICA ENERGY DRINKS MARKET, BY NATURE (2016-2028)

TABLE 025. NORTH AMERICA ENERGY DRINKS MARKET, BY AGE GROUP (2016-2028)

TABLE 026. NORTH AMERICA ENERGY DRINKS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. N ENERGY DRINKS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE ENERGY DRINKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. EUROPE ENERGY DRINKS MARKET, BY NATURE (2016-2028)

TABLE 030. EUROPE ENERGY DRINKS MARKET, BY AGE GROUP (2016-2028)

TABLE 031. EUROPE ENERGY DRINKS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. ENERGY DRINKS MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC ENERGY DRINKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 034. ASIA PACIFIC ENERGY DRINKS MARKET, BY NATURE (2016-2028)

TABLE 035. ASIA PACIFIC ENERGY DRINKS MARKET, BY AGE GROUP (2016-2028)

TABLE 036. ASIA PACIFIC ENERGY DRINKS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. ENERGY DRINKS MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA ENERGY DRINKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA ENERGY DRINKS MARKET, BY NATURE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA ENERGY DRINKS MARKET, BY AGE GROUP (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA ENERGY DRINKS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 042. ENERGY DRINKS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA ENERGY DRINKS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 044. SOUTH AMERICA ENERGY DRINKS MARKET, BY NATURE (2016-2028)

TABLE 045. SOUTH AMERICA ENERGY DRINKS MARKET, BY AGE GROUP (2016-2028)

TABLE 046. SOUTH AMERICA ENERGY DRINKS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 047. ENERGY DRINKS MARKET, BY COUNTRY (2016-2028)

TABLE 048. MONSTER BEVERAGE CORPORATION (US): SNAPSHOT

TABLE 049. MONSTER BEVERAGE CORPORATION (US): BUSINESS PERFORMANCE

TABLE 050. MONSTER BEVERAGE CORPORATION (US): PRODUCT PORTFOLIO

TABLE 051. MONSTER BEVERAGE CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. RED BULL GMBH (AUSTRIA): SNAPSHOT

TABLE 052. RED BULL GMBH (AUSTRIA): BUSINESS PERFORMANCE

TABLE 053. RED BULL GMBH (AUSTRIA): PRODUCT PORTFOLIO

TABLE 054. RED BULL GMBH (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. COCA-COLA CO. (US): SNAPSHOT

TABLE 055. COCA-COLA CO. (US): BUSINESS PERFORMANCE

TABLE 056. COCA-COLA CO. (US): PRODUCT PORTFOLIO

TABLE 057. COCA-COLA CO. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PEPSICO INC. (US): SNAPSHOT

TABLE 058. PEPSICO INC. (US): BUSINESS PERFORMANCE

TABLE 059. PEPSICO INC. (US): PRODUCT PORTFOLIO

TABLE 060. PEPSICO INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KRAFT FOODS INC. (US): SNAPSHOT

TABLE 061. KRAFT FOODS INC. (US): BUSINESS PERFORMANCE

TABLE 062. KRAFT FOODS INC. (US): PRODUCT PORTFOLIO

TABLE 063. KRAFT FOODS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. NATIONAL BEVERAGE CORP. (US): SNAPSHOT

TABLE 064. NATIONAL BEVERAGE CORP. (US): BUSINESS PERFORMANCE

TABLE 065. NATIONAL BEVERAGE CORP. (US): PRODUCT PORTFOLIO

TABLE 066. NATIONAL BEVERAGE CORP. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. THE GATORADE COMPANY INC. (US): SNAPSHOT

TABLE 067. THE GATORADE COMPANY INC. (US): BUSINESS PERFORMANCE

TABLE 068. THE GATORADE COMPANY INC. (US): PRODUCT PORTFOLIO

TABLE 069. THE GATORADE COMPANY INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. NESTLÉ S.A. (SWITZERLAND): SNAPSHOT

TABLE 070. NESTLÉ S.A. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 071. NESTLÉ S.A. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 072. NESTLÉ S.A. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CARLSBERG A/S (DENMARK): SNAPSHOT

TABLE 073. CARLSBERG A/S (DENMARK): BUSINESS PERFORMANCE

TABLE 074. CARLSBERG A/S (DENMARK): PRODUCT PORTFOLIO

TABLE 075. CARLSBERG A/S (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. LT GROUP INC (PHILIPPINES): SNAPSHOT

TABLE 076. LT GROUP INC (PHILIPPINES): BUSINESS PERFORMANCE

TABLE 077. LT GROUP INC (PHILIPPINES): PRODUCT PORTFOLIO

TABLE 078. LT GROUP INC (PHILIPPINES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SUNTORY HOLDINGS LTD. (JAPAN): SNAPSHOT

TABLE 079. SUNTORY HOLDINGS LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 080. SUNTORY HOLDINGS LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 081. SUNTORY HOLDINGS LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. LIVING ESSENTIALS LLC (US): SNAPSHOT

TABLE 082. LIVING ESSENTIALS LLC (US): BUSINESS PERFORMANCE

TABLE 083. LIVING ESSENTIALS LLC (US): PRODUCT PORTFOLIO

TABLE 084. LIVING ESSENTIALS LLC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. KABISA B.V. (NETHERLANDS): SNAPSHOT

TABLE 085. KABISA B.V. (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 086. KABISA B.V. (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 087. KABISA B.V. (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. ASIA BREWERY INCORPORATED (PHILIPPINES): SNAPSHOT

TABLE 088. ASIA BREWERY INCORPORATED (PHILIPPINES): BUSINESS PERFORMANCE

TABLE 089. ASIA BREWERY INCORPORATED (PHILIPPINES): PRODUCT PORTFOLIO

TABLE 090. ASIA BREWERY INCORPORATED (PHILIPPINES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. EASTROC BEVERAGE CO LTD (CHINA): SNAPSHOT

TABLE 091. EASTROC BEVERAGE CO LTD (CHINA): BUSINESS PERFORMANCE

TABLE 092. EASTROC BEVERAGE CO LTD (CHINA): PRODUCT PORTFOLIO

TABLE 093. EASTROC BEVERAGE CO LTD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. TAISHO PHARMACEUTICAL CO. LTD. (JAPAN): SNAPSHOT

TABLE 094. TAISHO PHARMACEUTICAL CO. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 095. TAISHO PHARMACEUTICAL CO. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 096. TAISHO PHARMACEUTICAL CO. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 097. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 098. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 099. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ENERGY DRINKS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ENERGY DRINKS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. SHOTS MARKET OVERVIEW (2016-2028)

FIGURE 013. DRINKS MARKET OVERVIEW (2016-2028)

FIGURE 014. DRINK MIXES MARKET OVERVIEW (2016-2028)

FIGURE 015. ENERGY DRINKS MARKET OVERVIEW BY NATURE

FIGURE 016. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 017. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 018. ENERGY DRINKS MARKET OVERVIEW BY AGE GROUP

FIGURE 019. TEENAGERS MARKET OVERVIEW (2016-2028)

FIGURE 020. ADULTS MARKET OVERVIEW (2016-2028)

FIGURE 021. ENERGY DRINKS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 022. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 023. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 024. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 025. ONLINE RETAIL STORES MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA ENERGY DRINKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE ENERGY DRINKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC ENERGY DRINKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA ENERGY DRINKS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA ENERGY DRINKS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Energy Drinks Market research report is 2024-2032.

Monster Beverage Corporation (US), Red Bull GmbH (Austria), Coca-Cola Co. (US), PepsiCo Inc. (US), Kraft Foods Inc. (US), National Beverage Corp. (US), The Gatorade Company Inc. (US), Nestlé S.A. (Switzerland), Carlsberg A/S (Denmark), LT Group Inc (Philippines), Suntory Holdings Ltd. (Japan), Living Essentials LLC (US), Kabisa B.V. (Netherlands), Asia Brewery Incorporated (Philippines), Eastroc Beverage Co Ltd (China), Taisho Pharmaceutical Co. Ltd. (Japan) and Other Major Players

The Energy Drinks Market is segmented into Product Type, Nature, Distribution Channel, and region. By Product Type, the market is categorized into Shots, Drinks, and Drink Mixes. By Nature, the market is categorized into Organic and Conventional. By Age Group, the market is categorized into Teenagers and Adults. By Distribution Channel, the market is categorized into Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Energy Drink is a beverage that contains high levels of stimulant ingredients like caffeine, as well as sugar, it often is packed with supplements, such as vitamins or carnitine. Energy Drinks are widely known and advertised as beverage products capable of enhancing mental alertness and physical performance. Energy drinks are the fastest-growing sector in the beverage industry of now. These drinks are known to enhance performance as it contains five times the amount of caffeine as soft drinks and also some other derivatives such as taurine, riboflavin, pyridoxine, etc.

The Energy Drinks Market size is estimated at 73.97 billion USD in 2023 and is expected to reach 130.24 billion USD by 2032, growing at a CAGR of 5.82% during the forecast period (2024-2032).